Early repayment of the mortgage will not only speed up the payment of debt, but will also help reduce costs, since as a result of recalculation, the amount of accrued interest will decrease. And you can calculate the possible benefit using a special mortgage calculator with early repayment. It differs from the usual ones by the presence of additional items that allow you to add information about additional contributions and payments to the calculations. As a result, debtors have the opportunity to find out in advance how profitable their actions will be and calculate the amount they will be able to save. At the same time, using a calculator is no more difficult than entering data into Excel. Borrowers simply need to indicate the required amounts and data and start the calculation process. The rest will happen automatically, without their active participation.

Instructions for using the calculator

The process of using the mortgage calculator is extremely simple.

Borrowers will have to:

- enter the loan amount, term and interest rate;

- indicate the date the loan was issued and specify the type of payments (annuity or differentiated);

- add information about all planned and made early contributions;

- start the calculation process;

- wait for the result.

As mentioned above, a minimum of actions will be required from debtors. They are required to accurately fill out all the required fields and click the calculation button. If the debtor has doubts about future payments, it is worth carrying out several calculations, successively replacing additional data (about early payments). If you need to compare several options, it's worth opening a couple of additional tabs and repeating the process. This seems a little inconvenient, but it will allow you to get an accurate result and calculate the potential benefits in advance.

VTB Bank: exploring the online calculator

By opening the appropriate menu tab on the bank’s website, you can calculate a VTB mortgage with a payment schedule. What points the user should pay attention to:

- it is required to establish the region of location of the purchased property;

- choose the purpose of lending - for new construction or the purchase of finished housing;

- enter the parameters of the future obligation - the cost of an apartment or house, down payment, monthly income;

- set “flags” to note the advantages of the loaned object and the characteristics of the borrower. For example, if the apartment being purchased exceeds 100 sq.m or the recipient belongs to the category of business people, it is assumed that two documents will be issued, the loan is planned for a salary client;

- The checkbox next to the maternity capital item will make adjustments to the VTB mortgage payment schedule. Read more about how to calculate a mortgage with maternity capital in VTB using an online calculator in another article.

If the purchase option is not selected and the applicant doubts the availability of borrowed funds, you must select the switch on the right - calculate from income. Then the calculator will determine the loan amount recommended for the income side of the family. After all the actions, select the Calculate button, and the following information will appear on the right side of the screen:

- the loan amount that the borrower can service;

- monthly payment calculated according to the annuity;

- final interest rate.

Recommended article: What will happen to the mortgage if the bank goes bankrupt, do I have to pay

You can print a document with the click of a button. The calculation looks simple - the text that is already on the screen is printed. Calculator and mortgage payment schedule VTB takes into account maternity capital in a simplified manner - state support is deducted from the available loan.

Features of early mortgage repayment

Despite the apparent simplicity of early repayment, even such a simple procedure has rules. The best way to become familiar with them is to read the loan agreement.

But in general terms the conditions are as follows:

- the debtor is obliged to notify the bank of the desire to increase the contribution and pay an additional amount;

- the warning may even be verbal, but it is recommended to submit a written application;

- By submitting an application, the client undertakes the obligation to pay;

- Waiver requires you to withdraw your application by submitting a second application with the appropriate information;

- the deadline for submitting an application is strictly defined (specified in the contract);

- after payment of the debt, a recalculation is made;

- As a result, either the period for complete closure of the loan or the amount of monthly payments is reduced.

Sometimes the contract also specifies other features that depend on the credit institution issuing the money. That is why, before concluding an agreement, you must carefully read each section of the agreement, without neglecting any point.

What are the terms for early repayment of a mortgage?

After calculating the early repayment of the mortgage, you can submit an application. It is drawn up in free form, but must clearly indicate:

- the amount of additional payment that is planned to be made;

- date of payment.

Moreover, most organizations in 2020 require that the application be submitted 15 days before the payment date, but some credit companies increase this period to a month or 45 days.

It is also important that many establishments accept as an application a regular telephone call to the contact center, during which the client declares his desire to repay part of the debt. But it is more reliable to visit the bank in person and submit a written application to eliminate inaccuracies.

Minimum payment

There are usually no limits on the amount, so debtors are able to make both a small contribution and a substantial payment to the credit account. The main thing is that it is appropriate. That is, it is difficult to imagine that it makes sense to waste time writing an application for a few rubles. But contributing an additional thousand can be a significant help in paying off the debt.

Some people round up the payment amount for their own convenience. In such a case, a statement is also required. In this case, the amount by which the monthly contribution increases can be any.

Recalculation of interest

The recalculation of interest deserves special attention. After making payment, borrowers can request a reduction in the amount of monthly payments or the repayment period of the debt. In the second case, the bank will have to additionally recalculate the amount of overpayment. That is, with annuity payments, interest is accrued immediately for the entire loan term. When the term is reduced, the excess accrued interest disappears. As a result, debt is reduced.

With differentiated payments, the overpayment is reduced in any case, no matter which recalculation option the client chooses, since in this case the interest depends solely on the loan balance.

Description of the procedure for early repayment of a mortgage

It is not enough to simply deposit funds into an account and expect that the financial structure will independently write off and take into account the payment outside the schedule.

By following the following 3-step algorithm, the borrower safely gets rid of mortgage debt:

- Preliminary notification to the bank of the planned repayment. Most organizations require reporting of the planned contribution 30 days before the date of deposit and debit of funds.

- Together with a bank employee, a day and time are set, and the amount to be paid is agreed upon. If the payment does not lead to final repayment, the bank officer will need to prepare new documents with a payment schedule.

- On the set date, the borrower pays the agreed amount and receives new payment estimates. In the event of complete liquidation of the mortgage debt, it is necessary to request a certificate confirming the absence of financial claims against the client from the creditor organization.

When it comes to early termination of the contract and full payment to the bank, it is necessary to ensure that the mortgage account is reset to zero and the bank provides a certificate of zero debt. In the future, this document will make it possible to prove the inconsistency of all possible claims of the bank and attempts to collect additional fines and penalties.

In addition, a certificate of absence of debt will become the main document that will give the right to re-register real estate with the removal of the encumbrance mark.

Each credit structure has its own characteristics of off-schedule payments.

- For example, Sberbank successfully uses convenient Internet banking for repayment. A user registered with Sberbank Online can settle a mortgage debt remotely.

- VTB 24 clients have the opportunity to make repayments by calling the hotline.

- Rosselkhozbank , when implementing state mortgage lending programs, can take into account the amount of subsidies towards early repayment.

Refund of insurance in case of early repayment of mortgage

Another advantage of quickly closing the debt is the ability to return part of the insurance fee. The size of the benefit obtained from this cannot be calculated in any calculator for early repayment of a mortgage, but it is significant.

To receive money you need:

- close the debt early;

- make sure your insurance is still valid;

- write a statement to the insurance company demanding compensation for the remaining unused amount.

It is important to emphasize that they will not be able to refuse the client, since the beneficiary of insured events is the bank. But, since the debt is paid, such a situation becomes meaningless, and the insurance itself loses its meaning.

You can get more detailed advice at the office of the insurance company or from its official representatives (all modern insurers provide clients with a free contact number where they can contact them with any questions).

Mortgage repayment schedule: how much and when to pay

There are two ways to find out your mortgage payment schedule:

- by opening an agreement with the bank, where the transaction table is drawn up as an application and signed by the parties;

- in your online bank account.

An SMS notification function is also provided: a notification about the upcoming payment and deadlines is sent to your mobile phone. The borrower can independently call the bank’s hotline and receive information from an operator or automatic information service.

You can view the mortgage payment schedule and get a detailed breakdown online. For this:

- log into your personal online banking account;

- select the Loans tab, if there are several agreements, set the pointer to the mortgage one you are interested in;

- By default, detailed information on the loan appears on the monitor: amount, terms, accrual scheme - differentiated or annuity, next installment and when to pay, remaining debt to be repaid.

Recommended article: Subsequent mortgage - what it is and the terms of the conclusion.

In this case, a Payment Schedule button will be placed next to it. By selecting it, you can not only view, but also print the mortgage payment schedule.

Conditions for early repayment of mortgages in large banks

The rules and procedure for servicing early repayment of a loan in large banks do not differ from those described above. There may be only a few features that will be reflected in the loan agreement (the importance of reading it in a timely manner has already been discussed). That is, clients should remember to comply with the application deadlines and fully comply with the conditions specified in the application (including the amount of payment). There are no other important features and distinctive features of service in reputable organizations.

Universal calculator: do the calculations yourself

A simpler form of solvency analysis is offered by universal services. One of them is an online mortgage calculator with a payment schedule. The program is developed for the annuity lending scheme and provides for entering a minimum of data:

- mortgage loan amount;

- the period during which the loan is expected to be used;

- interest rates.

As a result, the user receives an online mortgage payment schedule, in which the monthly payment is broken down into principal and interest on the loan. Here the applicant will be able to submit an online application to several banks.

There are other calculator programs online that can help you roughly calculate your mortgage payment schedule. And only then make a decision about applying for a loan and preparing a package of documents.

Recommended article: Requirements for online mortgage documents

Features of a mortgage at VTB 24 with early repayment

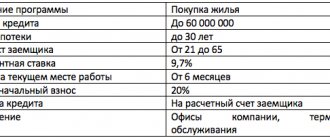

Today VTB 24 offers its clients several mortgage products, within which they can purchase primary and secondary housing. Among them there are socially oriented proposals, including those involving maternity and housing certificates. If desired, the borrower has the right to decide to repay the loan early. This situation is often due to the emergence of an additional source of income and free funds that can be used to pay off debt.

At VTB 24 there is no restriction on early repayment of a loan, and the client has the right to make a payment beyond the schedule or completely close the loan.

The advantages of servicing an organization include the following:

- Receiving a free card for the convenience of making payments, which can be topped up without commissions, including using the VTB Online service or at bank ATMs;

- Using a mechanism for setting up automatic payment processing in accordance with the calculated schedule;

- Engaging an online service or mobile application to transfer payments and control their write-off, obtain reliable information regarding the loan and its repayment;

- Prompt problem solving by calling the hotline and obtaining advice if necessary.

When using a special card for payments, it is important to take into account that the money is credited to the payment instrument instantly, but the money must be deposited before 19:00 on the scheduled payment date. You can clarify information about the payment details using the VTB Online service or an ATM, at any of the bank’s branches or by calling the customer service center.

It might be interesting!

Is it possible to take out 2 mortgages in parallel in 2020?

Early repayment: use Excel spreadsheet

The electronic mortgage payment schedule in Excel works correctly, even if you plan to pay the bank early. Since the borrower can use one of the alternatives to repay the loan before the due date, it is proposed to consider two options.

- Early payment is used to reduce monthly repayments. Then, according to the annuity payment scheme, transactions each month are reduced, but the lending terms remain unchanged. In such a situation, a differentiated accrual model looks more profitable - interest is reduced by paying part of the loan body, and the duration of the loan is reduced.

In our example, you can look in more detail at the payment schedule for a mortgage with early repayment. Let maternity capital for the first child be issued in the amount of 466,617 rubles by January 2021. Then the next payment will be:

- for annuity - 2694.99 rubles, but the terms will remain unchanged - 20 years;

- according to a differentiated scheme - the monthly repayment of the principal debt will remain the same, but the schedule will show a decrease in the percentage payment and credit terms.

- Early repayment should be used to shorten the credit period. The alternative is beneficial for the annuity, since both the loan term and the overpayment of interest will be reduced. Let's transfer the value of maternity capital to the column for reducing the term and note how much more profitable it has become to lend: the monthly payment remained the same, but the terms were reduced, as was the overpayment to the bank.

Payment schedule: what is it?

A payment schedule is a document that contains information about the timing and amount of loan repayments. When concluding a mortgage agreement, the borrower familiarizes himself with the rules for debt repayment and confirms his agreement with the terms proposed by the bank at the time of signing the documents. The payment schedule looks like a table that indicates the frequency of loan payments.

The following columns are considered mandatory:

- date of next payment;

- amount to be transferred to the account for repayment;

- the amount of interest and principal payments;

- balance of credit debt after making payment.

Some banks supplement the table with columns about the amount of deposit for early repayment of the loan. Having a payment schedule at hand allows borrowers to always know what amount is due and on what date. Such a document reduces the risk of delays due to incorrect calculations by the client or simple forgetfulness. The absence of such circumstances allows you to avoid fines and maintain a good quality of credit history.

What options are there for early mortgage repayment?

As it turns out, paying off your mortgage early does not mean that if you bring one hundred thousand rubles to the cash desk of a financial institution, your debt will decrease by exactly that amount. Banks wouldn't be banks if they didn't try to make a profit out of your every move. Therefore, when you bring a certain amount to pay off a debt, only part of it (and not always the majority) goes towards these needs. An impressive amount can pay off the interest debt, for example. Or it is charged as a fee for using a loan, or something else that is completely legal, but terribly unpleasant for the borrower. Therefore, as soon as you come to your bank branch with such a request, the operator will offer you two ways to repay the loan early:

- With a reduction in payment terms. That is, by depositing the amount, you do not repay the loan body (this is the amount that you owe the bank without taking into account interest), but “cut off” the number of months that you must make payments. Thus, by regularly making contributions more than the established ones, you can completely repay the loan not in 15 years, but in 10. At the same time, the monthly payment amount will not change for the entire term of the loan agreement.

- With a decrease in the loan amount. In this case, everything acquired through back-breaking labor goes towards repaying the debt and interest on it (it varies from bank to bank, but on average the amount deposited is split in half for both of these purposes). By repaying the loan early in this way, you will also make monthly payments for the agreed fifteen years, but the amount will be less and less with each payment.

And how to choose? What are the advantages of each method? Nothing. One hundred and one early loan repayment calculators on the Internet show that no matter which scheme you choose, the savings (read: reduction in overpayments) will be the same. “Then what’s the point?” - the discouraged reader will exclaim. And the meaning depends on how confident you are in yourself and in the future, forgive the advertising. In other words, if your financial condition is rock-solid, you are an important employee, adored by your superiors, and you will not be fired from your position at any price. You can choose to reduce payment terms. Then you will quickly get rid of your debts without fear of worsening your financial situation.

If your well-being is like a circus stuntman who rides a circus unicycle on a high-tensioned rope and at the same time juggles monkeys (read - there is no confidence in the future), then it is best for you to repay the loan amount so that the monthly payment quickly decreases to the amount that you would be comfortable paying even with the loss of your job and financial well-being.