VTB mortgage lending conditions

VTB Bank is the largest Russian bank, which has a large customer base from different regions of the country. Potential borrowers are attracted by favorable mortgage terms, namely loyal interest rates and long loan terms.

In 2020, mortgages at VTB became even more accessible. The Bank has introduced a number of changes regarding the issuance of targeted loans. The main one is the reduction of the minimum interest rate, which is now 9.5%. The reformations also affected the loan term; according to them, the borrower can repay the loan for 50 years.

VTB has developed several mortgage programs for its clients. Each borrower can choose the most optimal mortgage option based on their capabilities. You can buy housing as a share, that is, register common ownership, for example, with a close relative.

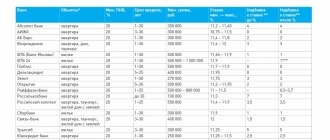

| Name of the mortgage program | Annual percentage | Down payment amount | Loan amount | Property | Loan terms |

| Buying ready-made housing | 0.131 | 0.15 | From 1.5 million to 90 million rubles | An apartment from the secondary real estate market, a room in a communal apartment (the room must be in good, habitable condition) | Duration up to 30 years |

| Apartment in a new building | 0.131 | 0.15 | From 1.5 million to 90 million rubles | Apartment from the primary real estate market | Duration up to 30 years |

| Mortgaged property | 0.12 | 0.2 | From 1.5 million to 90 million rubles | Resale or new building, which are pledged to the bank | Duration up to 30 years |

| Mortgage for the military | 0.125 | 0.2 | Up to 1.93 million rubles | Housing from both the primary and secondary real estate markets | Duration up to 14 years |

| Victory over formalities | 0.141 | 0.4 | From 1.5 million to 30 million rubles | Housing in a building under construction or finished | Duration up to 20 years |

| Young family | 0.11 | 0.1 | From 500 thousand rubles to 8 million rubles | New building, which is included in the list of the state corporation "Rosstroy" | From 5 to 30 years |

| Refinancing | 0.107 | Not required | From 1.5 million to 90 million rubles | Primary or secondary market real estate, mortgaged from another lender | Duration up to 50 years |

At the same time, today there is an opportunity not to make a down payment. But it is available only to corporate and salary clients, as well as participants in government programs.

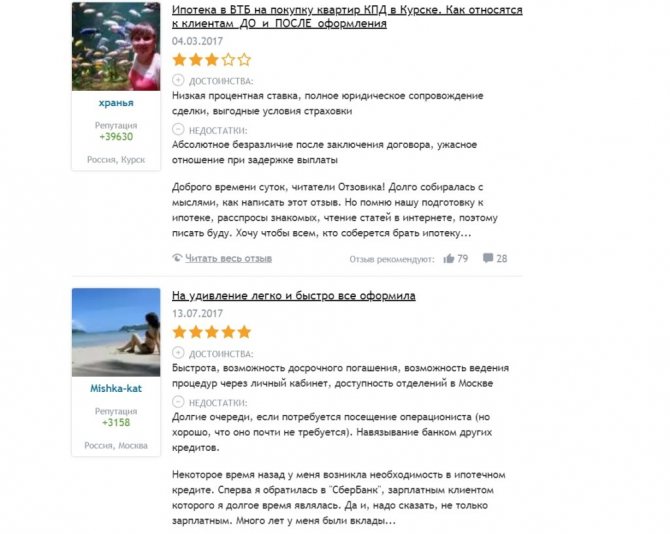

Mortgage in VTB 24 – customer reviews

According to feedback from a bank client, it is important to clearly understand the financial burden that the borrower imposes on himself. According to the majority of clients, it is important to calculate your own solvency.

Hundreds of clients, dreaming of their own home, do not calculate their ability to fulfill their obligations. According to client reviews, the work is carried out by high-class specialists, all questions are explained by competent employees.

Positive feedback about the state of the interest rate and insurance. Borrowers are pleased with the free expert assessment of property organized by the bank.

Video “VTB 24 reduced the mortgage rate”

Useful articles:

Procedure for obtaining a mortgage

To obtain a mortgage, the borrower must go through several successive stages and important steps, each of which is mandatory. Applying for a mortgage at VTB involves collecting various documentation, searching for suitable housing and, finally, concluding an agreement.

First stage: submitting an application

After the borrower has decided on the most optimal mortgage program, he must provide the VTB branch with a complete list of requested documents and write the appropriate application (this could be a passport, income certificate, education diploma). Within 3 days, the bank makes a decision regarding the advisability of providing a loan, assessing the client’s solvency and reliability, after which the loan specialist tells him the answer over the phone.

Stage two: searching for real estate

Once the application is approved, you can proceed to the second stage of applying for a mortgage - searching for housing, and the borrower must do so within two months. The purchased housing must fully comply with the requirements put forward by VTB. In particular, to have good repairs, legalized redevelopment and the necessary utilities. In this way, VTB is trying to protect itself from possible financial risks, because if the borrower turns out to be insolvent, it can quickly sell the property at market value. You can search for suitable real estate either independently or with the involvement of a bank or realtor.

Third stage: real estate valuation

The lender must know the appraised value of the property to apply for a mortgage, since the loan amount should not exceed 85-100% of its value. For this purpose, the borrower must call an independent appraiser, whose services cost money. The lending procedure provides for the preparation of two assessment reports (one is sent to the bank, the second remains with the borrower). The cost of an appraiser’s services directly depends on the type of housing and can vary from 3 to 25 thousand rubles.

Stage four: insurance

VTB imposes a mandatory condition on its clients - insurance. In this case, lending programs will be more loyal, since the financial institution can reduce the interest rate on the loan or cancel the requirement for a down payment. Experts recommend taking out comprehensive insurance, which includes insurance of the purchased property, your own life and health, as well as title insurance. At the same time, at this stage, an insurance tariff is issued - a letter confirming that the insurance company is ready to provide its services, and insurance is carried out after the final decision is made by the bank, but before the mortgage agreement is signed.

Fifth stage: making a final decision

At this stage, the client must take a complete package of documents to the bank. It includes personal papers, documents for the purchased property, as well as an insurance rate. Within 3-7 days, VTB will make its final verdict and determine the size of the loan.

Stage six: conclusion of an agreement

There are two types of mortgage transactions possible at VTB. The most widespread transaction is using a deposit. The client opens an account with VTB, after which he signs a loan agreement and completes a purchase and sale transaction. The bank issues money, which is placed in the cell. After successful registration of the transaction in Rosreestr, the real estate seller receives access to the cell. The second possible option for concluding a transaction is using a letter of credit, that is, transferring funds to the seller’s bank account and blocking them. To unblock funds, you need to obtain documents confirming ownership from Rossestr and take them to the VTB branch.

Mortgage programs

Since the bank issues credit mortgages to individuals depending on the type of employment and citizenship (or registration), the VTB mortgage option is the most optimal.

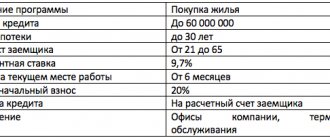

Mortgage for housing in a new building

The purpose of this program is to provide a mortgage for the purchase of already built housing in a new house or living space under construction. The main condition for this is that the housing has not yet acquired an owner and has not been registered.

The bank dictates the conditions for issuing a mortgage for living space in a new house.

- The amount that a bank can issue under the terms of a loan cannot be less than 600,000 rubles and cannot exceed 60 million rubles.

- The mortgage payment period is 30 years.

- The first payment is 10% of the cost of housing.

- Type of insurance – comprehensive.

Interest rates are presented in the table.

| Starting rates: | For physical persons – from 10.6%. |

| For salary card holders – from 10.3%. | |

| For persons participating in the “People of Action” program (employees of government agencies) – from 10.3%. | |

| For persons participating in the “People of Action” program and who are owners of salary cards – 10.2%. | |

| Special conditions: | For persons participating in the “Victory over formalities” program, where the provision of an income certificate is not required - from 11.1%. |

| For persons who own an apartment with an area < 65 square meters - 10.1%. | |

| For persons who own an apartment with an area < 65 square meters and do not confirm their income - 10.6%. |

Mortgage “Victory over formalities”

The “Victory over formalities” program allows you to obtain an approved mortgage with a minimum of documents. It is enough to leave an application online, attaching copies of 2 documents (passport and SNILS) confirming the identity of the borrower. And within 24 hours the bank will report the result of acceptance or refusal of a mortgage loan.

This program is an excellent opportunity to get a mortgage for both the unemployed and those on maternity leave. It is enough to have some simple knowledge.

The interest rate is 11.5% per annum.

The downside of the program is the fact that the first payment (unlike the secondary and subsequent ones) is quite high and requires repaying 40% of the full cost of the living space, and the borrower cannot be younger than 25 years.

For residents of Moscow and St. Petersburg, it is possible to take out a mortgage of up to 30 million rubles, and for residents of other regions - up to 15 million rubles. In this case, the mortgage loan agreement is concluded for a period of 20 years.

Mortgage for military personnel

The program applies to participants in the mortgage accumulation system (NIS) for the purchase of housing that is still under construction or has already been built.

Its features are as follows.

- The maximum mortgage loan amount is 2.435 million rubles.

- The period determined by the bank and the terms of the program is up to 20 years.

- The age limit for the borrower is not older than 45 years at the time of the last loan payment.

- Down payment – 15%.

- 8% per annum.

Mortgage on secured real estate

The program allows you to purchase housing that is currently under collateral and has been put up for auction by the owner.

The terms of the mortgage loan are very good - from 10.6% per annum, for a period of 30 years, down payment 20%.

The disadvantage of this program for collateralized real estate is obvious - the borrower will have to solve the legal problems that arise on his own.

Mortgage for secondary real estate

Under the terms of this program, a loan is issued for the purchase of secondary living space on the real estate market. As an alternative, you can get a mortgage for a new home, with the title to it already registered.

The conditions are as follows.

- The minimum size of a mortgage loan is 600,000 rubles, and the maximum is 60 million rubles.

- Down payment – 10% or more.

- Type of insurance – comprehensive.

Refinancing

Refinancing a loan allows you to slightly reduce the interest rate for it at the moment. Monthly repayments become a tangible problem for any borrower. In pursuit of reducing them, the borrower turns to another bank, which provides a reduced refinancing rate. But sometimes you just need to extend your mortgage repayment period.

It is capable of:

- reduce the rate as much as possible,

- reduce payments each month,

- reduce overpayments,

- adjust the loan repayment period.

VTB 24 provides refinancing to both individuals and their salary card holders.

Photo: https://pixabay.com/photos/house-money-euro-calculator-366927/

A mortgage loan can only be issued in rubles, for a period of either 30 years or 20 years (if the borrower has provided only two documents).

Amounts vary by region:

- capital - up to 30 million rubles,

- large cities of Russia – up to 15 million rubles,

- other regions – up to 10 million rubles.

Risks in mortgage lending

A mortgage is inextricably linked with great risks for a credit institution. Actually, this is why VTB insists on real estate insurance. The main sources of risks are the economic situation in the country, the standard of living of the population, the domestic and foreign policies of the state, the dynamics of rising real estate prices and much more.

All mortgage risks can be divided into three groups:

- credit - the risk of illegal actions, such as the borrower’s evasion from fulfilling its financial obligations. It is almost impossible to avoid it completely. To protect itself as much as possible, VTB requests a large amount of documentation confirming the client’s solvency;

- interest rate - the risk of losses due to the excess of annual rates that are paid to financial organizations on borrowed funds over the rates on loans provided. It is quite difficult to predict the occurrence of interest rate risk;

- liquid - the risk of changes in real estate market conditions, exchange rates, and stock markets. These are factors that the bank cannot control. To reduce risk, banks must develop a resource mobilization plan that identifies sources and costs.

Requirements for borrowers

In order to protect itself from financial losses, VTB Bank puts forward a number of requirements for borrowers. To get a mortgage you must fully comply with them:

- have Russian citizenship and registration in the region where the VTB branch is located;

- have at least a minimum work experience (from one year), and the borrower must have worked at his last place of work for at least 6 months;

- have at least secondary education;

- the age of the borrower can vary from 21 years to 60/65 years for women and men, respectively;

- have a good credit history, that is, at the time of applying for a mortgage, the borrower should not have overdue payments to other financial organizations.

In addition, it is very important that the client is solvent. He must prove his financial solvency with relevant documents, for example, a certificate of income or a bank account statement.

Required documents

To apply for a mortgage at VTB, you must provide a standard package of primary documents. It includes the following papers:

- application for a mortgage loan;

- Russian passport;

- marriage registration certificate;

- children's birth certificate;

- education document;

- another document that confirms the identity of the borrower;

- employment contract;

- employment history;

- certificate from the place of work about the amount of income;

- a certificate indicating the presence of additional sources of income.

As mentioned above, this is a standard set of papers. But you need to be prepared for the fact that the bank may request other documentation. For example, a certificate of ownership of real estate or an extract from the borrower’s account.

After purchasing a mortgaged home, you need to provide a secondary package of documents to the VTB branch. It includes title documents (transfer and acceptance certificate, contract, checks), technical documents, insurance letter, photocopy of the seller’s passport (if we are talking about housing from the secondary market). In this case, the title documentation is subject to mandatory notarization.

Pros and cons of mortgages at VTB

According to statistics, the majority of Russians choose VTB Bank to obtain a mortgage. Among its main advantages it is worth noting the following:

- a large selection of mortgage programs for various categories of citizens;

- low interest rates;

- long loan term;

- prompt decision-making on the application;

- possibility of early repayment of the loan.

Of course, there are also disadvantages. Perhaps the most significant of them is the stringent requirements for potential borrowers, which not everyone can meet. Also, if you refuse to insure your own life and health, the mortgage rate increases by several percent. After registering a mortgage and concluding an agreement, the borrower must pay a commission to the bank of several thousand rubles.

[shortkod477-28-02-2019-11:54:50]

Every person should understand that purchasing a mortgage property is a heavy financial burden. Moreover, difficulties arise already at the stage of its registration. Thus, it is necessary to collect a large number of documents, find real estate that fully meets the bank’s requirements, evaluate it and insure it against risks. This also entails additional expense transactions. But at the end of the journey, a worthy reward awaits you - purchased your own home.

Mortgage loan agreement at VTB: what you need to pay attention to

Focus on some details:

Insurance

Mortgage products at VTB 24 Bank are provided with an encumbrance - insurance of the collateral property and the life of the borrower. By law, lenders cannot insist on life insurance, but without it they will most often refuse a loan. Read more about the list of force majeure situations, study the points about what is covered by insurance and what you can count on if an insured event occurs.

Other requirements

Suppose you know that you can pay off your mortgage faster than stated in the contract, you should study in more detail the procedure for this procedure. VTB 24 establishes certain deadlines within which the borrower is obliged to notify the lender of his desire to repay the loan early.

Borrower Responsibilities

The most important section of the form, the one you need to spend the most time reading, because it spells out the procedure for interacting with the lender for the entire “credit” period. Failure to comply with just one condition may result in the imposition of penalties.