Home » Division of property » Division of an apartment under a military mortgage during divorce

8

Any family can divorce, including the family of a military personnel; separation is usually followed by division of property. And if in ordinary families the division of real estate is complex and unpredictable, then in families where a military mortgage is issued this fact aggravates the problem many times over.

What is the difference between a military mortgage and a simple mortgage loan?

A military mortgage differs from a simple civil mortgage. Its peculiarity is as follows: the loan debt is repaid not by the serviceman himself, but by the Ministry of Defense of the Russian Federation. This program allows military personnel to purchase housing on preferential terms.

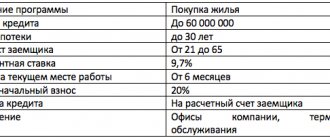

To apply for a preferential loan, several conditions must be met:

- The applicant must be an active military member. The remaining household members do not take any part in the program, but also do not bear any responsibility if the loan conditions are not met.

- An apartment purchased with a military mortgage is pledged to the Ministry of Defense until the entire loan is repaid. No transactions with the apartment are possible during this period.

- It is impossible to renew such a loan agreement. Only the serviceman himself, for whom the military mortgage was issued, is responsible for the fulfillment of the contract; accordingly, only he becomes the sole owner of the apartment, regardless of whether he is married or divorced.

- In cases where a serviceman is discharged (with the exception of transfer to the reserve), the entire remaining unpaid amount must be repaid by him independently.

- If the residential premises were purchased exclusively using military mortgage funds, all property disputes regarding the apartment are futile.

- The maximum allowable loan amount is 2.4 million rubles. In addition to this amount, it is allowed to use other funds, both by the borrower himself and his family members, if the designated amount is not enough to purchase a home.

Typical questions

Let's look at some common questions related to military mortgages and the rights of spouses during divorce.

Who divides property during a divorce?

Spouses have the right, through an amicable agreement, preferably notarized, to decide who will get what from the property during a divorce. If the peaceful method is unacceptable, then you should go to court.

As a rule, the claim is filed by women who do not agree that they do not have rights to an apartment purchased under the NIS. As noted above, there are cases when there really are no rights, but situations are possible in which appealing to a judicial authority will provide the opportunity to live in an apartment.

Read also: How to switch to homeschooling?

Is an apartment purchased with a military mortgage a common property?

An apartment purchased with a military mortgage can be recognized as common property only if the spouses additionally took out a loan from the bank and both participated in its repayment.

If all obligations were solely on the husband and were financed by the Ministry of Defense, then this is the personal property of the serviceman.

Is it possible to divide an apartment purchased with a military mortgage during a divorce?

The money transferred to pay off a military mortgage has a designated purpose and is provided only to the serviceman himself. In cases where spouses divorce, real estate is not subject to division; it remains the personal property of the serviceman. The question arises: is it possible to somehow divide “military” housing?

When concluding an agreement on a military mortgage, the general principles of division of property during a divorce do not have legal force, but, in some circumstances, the second spouse may qualify for monetary compensation.

Features of a military mortgage

In order to better understand the specifics of military personnel exercising their rights to improve their living conditions, it is necessary to briefly examine the mechanism for obtaining a military mortgage.

Conventionally, it can be shown like this:

- Registration in NIS.

- Annual receipt of a targeted payment to your personal account.

- Serving the required period of service to apply for a military mortgage.

- Contact the appropriate bank that provides this service.

- Transfer of accumulated funds to an account in a given bank in order to make them as a down payment.

- Search for real estate.

- Applying for a loan on special terms for military mortgage lending for the missing part of the payment.

- Making a deal.

In fact, the longer a soldier serves, the higher the amount in his NIS participant account. In 2020, the target annual payment to the NIS participant’s account amounted to more than 200 thousand rubles. After a certain period of time and taking into account the characteristics of a particular area, a serviceman can even take out a purely symbolic loan amount, almost completely covering the cost of housing using the savings of an NIS participant.

Taking into account the above circumstances, taking out a military mortgage allows you to get housing without investing your own money. All transfers, both savings and credit, are strictly targeted in nature and are aimed only at the purchase of residential premises for a serviceman serving under a contract.

The fact that at the same time as the military man the right to an apartment is acquired by his family members has no legal significance. The proper debtor under the loan agreement and the owner under the purchase and sale agreement is the military personnel. Moreover, if the contract is terminated for culpable reasons, he loses the right to a preferential mortgage and may be forcibly deprived of his housing through the court.

Housing purchased under the military mortgage program is the personal property of the military personnel and is not included in the general list of property assets during a divorce. However, there are a number of circumstances in which a spouse will be able to claim a forced division of an apartment under a military mortgage.

How is an apartment divided under a military mortgage during a divorce?

Disputes regarding the division of real estate may arise before or after the military mortgage is fully repaid.

In the first case, the prospects of seizing some part of the apartment from the spouse are practically zero. Until the mortgage is paid in full, the apartment is pledged and any actions with it are unacceptable. The serviceman will become the full owner only after the loan has been fully repaid.

In such a situation, it is impossible to divide the apartment; the court will reject all claims regarding the division of real estate, and the spouse who executed the mortgage agreement will be recognized as the owner.

After repaying the loan, the second spouse has the opportunity to receive a share of the living space. This may happen under the following circumstances:

- If, in addition to the target program funds, general money was used. Since the size of a military mortgage is limited to no more than 2.4 million rubles, and normal housing costs much more, most families buy more expensive apartments, and pay off the difference in their cost with joint money. In this case, the second spouse can lay claim to half the amount that was invested from the general budget or to a share of the apartment proportional to this amount.

- If a military mortgage participant retires early from the ranks of the RF Armed Forces, he cannot subsequently count on the target program. Naturally, further payments in the vast majority of cases will be made from joint money, and in the event of a divorce, the second spouse has the right to part of the property (see paragraph 1)

- In addition to the two situations described above, the family can repay the loan with the personal funds of the second spouse (received as a gift, proceeds from the sale of other personal property). In this case, he has the right to claim a share of the apartment commensurate with the invested funds.

- Maternity capital can be used to pay off the mortgage. In such cases, both mother and children can also claim a share in the apartment.

Thus, if in addition to the money under the target loan, other funds are invested in a mortgaged apartment, then the share of real estate commensurate with the additional investments is considered joint property and is subject to division on generally accepted grounds.

Judicial practice of division in military mortgages

Very often, the issue of a military mortgage during a divorce is considered in court, since prenuptial agreements are an unusual practice, as is the voluntary renunciation of the spouse’s claim to the apartment. Therefore, it is useful to consider specific cases from judicial practice. This is also important because the law and the NIS program itself do not describe specific actions in case of divorce.

Borrowed funds + NIS

Situation: The head of the family is a military man, the wife is officially employed. According to the NIS program, we purchased housing. The amount used for military savings amounted to 2.3 million rubles. The loan was received for 4 million, that is, they had to pay another 1.7 million from the family budget. 5 years after receiving the loan, the couple decided to divorce. The mortgage has not yet been paid off.

Resolution of the situation: Due to the fact that the wife officially worked, that is, took part in the formation of the family budget, payments to repay the loan were made by both. They failed to resolve their relationship peacefully, so they went to court. The division was made in the amount of 1.7 million, and not in the total cost of housing. As a result of the trial, it was decided that the remaining debt should be paid 50%/50% by both spouses. As a result, the apartment became their joint property, which in the future they could already divide by law.

Marriage contract

Situation: A serviceman and his wife decided to purchase an apartment with a mortgage using funds accumulated under the NIS program. When applying for a loan, the bank set conditions regarding the execution of a marriage contract. Repayment of the loan went according to plan, with the help of the wife’s relatives.

Resolution: When the decision to divorce was made, the wife naturally went to court and was able to prove that part of the funds were received from relatives. The spouse was ordered to pay compensation in the amount of funds contributed by relatives. But due to the bank’s foresight, the ex-wife was unable to prove her rights to the property; even the presence of two minor children could not influence the decision.

Persistent ex-wife

Situation: A couple took out a loan using NIS funds. Additionally, a mortgage loan was obtained to pay off the cost. We decided to get a divorce, the loan was not repaid, there was no prenuptial agreement.

Resolution: The first instance left all rights to the spouse; naturally, he had to repay the loan on his own. The wife was not satisfied with this decision - she appealed to higher authorities. For the next trial, she collected a massive evidence base. As a result, the spouses divorced, she became a co-borrower, that is, after repaying the loan, she had equal rights with her husband in relation to this property.

How to divide property received under a military mortgage through the court

In case of divorce and subsequent division of property, if the residential premises were purchased under the military mortgage lending program, the following is decisive:

- the entire loan was repaid using targeted funds;

- part of the loan was repaid from the general family budget.

In the first case, the second spouse has no judicial prospects, since:

- the loan agreement is signed only with the military personnel, all responsibilities for the loan are assigned only to him;

- renewing the contract for the second spouse is impossible;

- neither the conclusion, nor the dissolution of a marriage, nor the birth of children makes any adjustments.

If joint funds were used to repay the loan in addition to funds under the program, then in this case the legal proceedings in the vast majority of cases end in favor of the plaintiff.

In order to receive a share in the residential premises or monetary compensation, the second spouse must write a statement of claim to the district court of general jurisdiction at the location of the apartment. The application must be accompanied by documents indicating that part of the mortgage was repaid with joint funds, these could be:

- receipts proving that other amounts of money were deposited into the loan account in addition to funds under the program;

- documents on inheritance;

- gift agreement;

- bank statements;

- other documents that will confirm joint expenses for housing.

In addition to these documents, you will need to attach to the claim:

- title documents for residential premises (photocopies);

- registration certificate;

- photocopy of passport;

- a copy of the marriage or divorce certificate;

- receipt for payment of state duty.

When making a decision, the court is guided by circumstances that are confirmed either by documents or by testimony. Therefore, the more evidence of joint participation in the purchase of an apartment is presented, the more likely it is that the court will meet the plaintiff’s demands.

The following circumstances must be kept in mind:

- Until the loan is fully repaid, the other party has no legal prospects.

- Only after the loan is fully repaid and all encumbrances are removed does the serviceman become the owner of the apartment and the possibility of any real estate transaction arises, including by court decision.

- The claims of the second party to the process are possible only in the amount of funds invested by him (personal or general).

Rights and obligations of a military personnel

Both single and married military personnel can become a participant in the program. An important aspect is that when applying for a military mortgage, the consent of a military spouse is not required, unlike standard lending for the purchase of real estate.

The fact is that the main and only borrower in this case is the military - a participant in the NIS. His or her significant other does not have any rights to housing, as well as obligations regarding payments.

Read also: Children's rights when parents divorce

In the event of a divorce, the apartment cannot be re-registered to a spouse who is not in the military; the apartment must remain the property of the person to whom the loan was issued. This is due to the fact that payments are made by the Ministry of Defense, which is only interested in helping military personnel.

Attention! When applying for a military mortgage, banking organizations insist on concluding a marriage contract between spouses, according to which, in the event of a serviceman’s dismissal, the family is excluded from the NIS, which means that rights and responsibilities are distributed between the spouses. This can be done, but is not necessary.

Arbitrage practice

In any case, a military spouse with a military mortgage cannot count on receiving an apartment purchased on credit; at best, she will receive either a share of the living space commensurate with her personal investments, or monetary compensation. But all this is possible only if she proves her participation in the costs of purchasing the apartment, namely:

- any loan agreement that specifies the purpose of receiving funds (for the purchase of housing);

- receipt for borrowing money from private individuals;

- documents according to which it will be proven that the plaintiff participated in the payment of the military loan.

The court's decision will be made taking into account all the evidence presented; the amount of monetary compensation determined by the court will depend on its completeness.

Important. Regardless of the outcome of the case, payment of the balance of the debt on the military mortgage is assigned only to the serviceman who received the military mortgage; all other current or former members of his family do not bear any responsibility for the fulfillment of the loan agreement.

The division of any property during a divorce is a rather complex and confusing procedure, especially the division of property under a military mortgage, where the parties to the process, in addition to the spouses, are often credit institutions and the Ministry of Defense of the Russian Federation. The law determines that the only owner of an apartment purchased with a military mortgage is the serviceman himself, and in the absence of compelling evidence of the other party’s participation in the purchase of the residential premises, one cannot count on a positive court decision.

It is possible to win the process only with the help of a competent, highly qualified lawyer who:

- at the first stage, he will conduct a free consultation and tell you what evidence will be required for the trial;

- will help you write a statement of claim;

- if necessary, act as a legal representative in court.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

4

Statement of claim for divorce and division of property

If, upon divorce, the former spouses cannot agree on...

2

How to properly divide a non-privatized apartment between relatives

Non-privatized housing is not subject to direct division, since it is not...

How to divide a one-room apartment during a divorce

The division of a one-room apartment during a divorce can be voluntary or forced...

1

Valuation of property when dividing marital property

When dividing property, spouses are often faced with the fact that they...

2

Division of business, LLC in case of divorce between spouses

Upon divorce, each of the former spouses is interested in fair...

Division of property of an individual entrepreneur during divorce

An individual entrepreneur (IP) is an individual who runs his own...

Snags according to the NIS program

The essence of lending for the military is that for a serviceman who expresses a desire to take part in the program, an account is opened to which a certain amount is transferred from the state budget annually. After just 3 years, these funds can be used to make the first mortgage payment. If you wait a little longer, it is quite possible to buy the entire apartment with the accumulated funds. Although it is not prohibited to take out a loan to repay the remaining balance, including applying for it for two spouses as co-borrowers.

The process of dividing property during a divorce is complex, especially if you have such a large loan, such a division has its own characteristics. According to the law, all property received during marriage is considered common, but the property remains the property of the borrower, since he was the one who was allocated the targeted loan.

Some more difficulties:

- An apartment purchased on credit is in any case collateral for the bank, and such property is not subject to division.

- A mortgage issued under the NIS cannot be renegotiated.

- The loan is paid to those for whom the loan agreement is drawn up.

- Responsibility for payment cannot be transferred to your spouse.

Important! A military member can take part in the military mortgage loan program regardless of whether he has a family or not. Moreover, permission to purchase and apply for a loan if you still have a spouse is not necessary.

Difficulties in dividing property under a military mortgage, and what will the creditor bank say?

Do not forget that the bank is directly involved in the military mortgage program.

Therefore, the division of an apartment received under a military mortgage must take place with the consent of the financial institution. Moreover, the bank will take part in the upcoming trial as a third party.

Before dividing an apartment purchased with a military mortgage during a divorce, you should study the loan agreement. Most banks already include instructions in loan agreements on how to act in such situations.

Typically, loan repayments during a divorce are distributed between spouses in equal shares. However, a military mortgage is a special case. And after the divorce, the serviceman will pay the mortgage.

But, as we have already said, he can legally demand compensation from his wife.

It also happens that some banks require early repayment of the loan during a divorce. And the motivation is very simple - divorce reduces the guarantee of repayment of the mortgage loan.

This is important to know: Certificate of ownership of a house: sample