Few people know that family capital can be used to pay off a home loan. In VTB 24, as in many other financial and credit organizations, this opportunity is available.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Next, we will look at the conditions under which it is possible to obtain a housing loan using maternal capital, how the mortgage is repaid in these cases, and other issues.

Conditions

Mortgages secured by capital can be obtained through two products:

- “Purchase of finished housing”;

- “Purchasing housing on the primary market.”

Accordingly, upon presentation of maternity capital, the conditions of the above-mentioned products will apply.

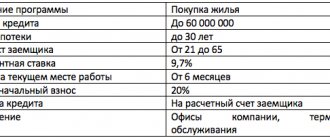

Conditions of a housing loan when purchasing housing on the secondary market:

- amount – from 500,000 to 60,000,000 rubles;

- term – up to 30 years;

- down payment – from 15%;

- This housing loan is issued only with compulsory insurance against the risks of loss or damage to real estate;

- the minimum possible interest rate is 13.1%, if the client is not a salaried person, then the rate is increased by 0.5%, if the borrower refuses comprehensive insurance, then the rate will be increased by 1%.

A mortgage for the purchase of real estate on the primary market can be obtained under the following conditions:

- the purpose of lending is the purchase of new apartments in apartment buildings under construction;

- loan size – from 500,000 to 60,000,000 rubles;

- term – up to 30 years;

- down payment – from 15%;

- compulsory property insurance against risks of loss or damage;

- interest rate – from 13.1%.

Repaying a mortgage with maternity capital at VTB 24

Funds from maternal capital can be used to repay part of the mortgage debt to VTB 24 Bank. In this case, the procedure for this procedure will be similar to early repayment.

In other words, after the mortgage is issued, maternity capital funds will be used to pay off the debt.

In this case, at the request of the borrower, the following will be done:

- or reducing the term of the mortgage loan;

- or a reduction in monthly payment.

Unless otherwise specified in the mortgage agreement, the default monthly payment amount will be recalculated. Thus, with the help of maternal capital funds, it is possible to reduce the payment paid in future periods on a housing loan.

How to get a mortgage with maternity capital

After receiving final approval from VTB, you need to select an apartment, have it assessed by an independent expert and coordinate your choice with the bank. If credit specialists are satisfied with such housing as collateral, you can negotiate with the seller and carry out the transaction. It must be registered with Rosreestr by preparing a purchase and sale agreement and a mortgage agreement.

Also read: Mortgages with state support at VTB: conditions and rates, documents and reviews

As a down payment

In addition to the possibility of repaying a home loan using maternal capital, funds can also be used to repay the down payment, both partially and completely.

The procedure for submitting documents and completing this procedure will be the same as for repaying a mortgage with maternal capital.

If the first installment is paid only partially with capital funds, for example, if there are not enough funds to fully cover the installment, then the borrower will have to pay the remaining amount from his own funds.

Increasing the loan amount

With the help of a maternity capital certificate, you can increase the amount of your housing loan. How does this happen? It should be said that VTB 24 Bank calculates the maximum amount of a housing loan based on the borrower’s income.

But in some cases, the amount provided is not enough to purchase the property you like. In these cases, matkapital will help increase the loan amount, and, at the same time, reduce the size of the down payment.

Let's give a simple example. Income allows you to apply for a loan in the amount of 5,000,000 rubles. The amount of maternity capital in 2020 is 453,026 rubles.

Accordingly, the maximum mortgage amount, taking into account maternal capital, will be 5,453,026 rubles. In this case, the down payment, for example, is 10%. Total contribution amount: 545302 – 453026 = 92276 rubles.

How to fill out an application for a mortgage in VTB 24 is described in the article: VTB 24 application for a mortgage. Mortgages for railway workers at VTB 24 are discussed on this page.

How to spend maternity capital on a mortgage

If the pension fund refuses to transfer funds, the decision can be appealed. You must also file a complaint with the Pension Fund of Russia - it will be reviewed by the head of the department or a special department. If the problem is with the paperwork, the answer will come in five days. If something is wrong with the maternity capital - in 15.

We recommend reading: Benefit for 3 Children in 2020 in the Chelyabinsk Region

How to repay a mortgage loan with maternity capital

- Maternity capital certificate or its duplicate.

- Borrower's passport.

- SNILS of the borrower.

- Marriage certificate.

- A copy of the loan agreement.

- Certificate from the bank confirming the issuance of a loan.

- A copy of the real estate purchase and sale agreement.

- An extract from the Unified State Register of Real Estate, which confirms the borrower’s right to housing.

- A copy of the registered agreement for participation in shared construction or a copy of the permit for the construction of your house, if it has not yet been put into operation.

- Notarial obligation to re-register housing as the common property of mom, dad and children.

- A document that confirms that the bank paid for the purchase of a home, for example, a statement of account from the seller.

Absolutely any family with more than one child has the right to receive maternity capital. Thanks to a certain package of documents, you can purchase real estate or make an extension to your house. Our bank created this offer six years ago. At VTB 24, a mortgage and maternity capital, as a down payment, can be issued subject to certain conditions.

How to register

Registration takes place in almost the same mode as a regular mortgage loan, for example, under the “Purchase of Finished Housing” program.

The procedure looks like this:

- the borrower leaves an online application on the VTB 24 website for the selected mortgage product;

- within a short time, a consultant from the bank will call back and provide a preliminary decision on the application;

- during the telephone conversation, the borrower will also be asked to collect a package of required documentation and visit the bank office at the agreed time;

- the borrower provides a package of documents for the client and waits 4-5 business days to make a final decision;

- after receiving the final decision, the borrower submits to VTB 24 documentation on the selected property and documents on maternal capital;

- After concluding a mortgage transaction, the borrower applies to the territorial office of the Pension Fund of the Russian Federation to claim maternity capital funds to repay the first installment or debt.

The procedure for repaying a mortgage with maternity capital

Banks are required to accept maternity capital as payment for part of the mortgage. But in practice, refusals are possible, since most financial institutions do not position their mortgage “products” as a public offer. This means that the bank itself has the right to choose who to give a mortgage to and who to refuse due to various circumstances.

Contacting the Pension Fund

- Paying off the mortgage in full is important when the loan was issued before the birth of the 2nd or next child, or when the mortgage amount was initially small.

- Reduce the size of monthly payments (this is possible with annuity payments). The mortgage term will remain at the same level.

- Reduce the loan payment period while maintaining the same monthly amount.

We recommend reading: Regional payments for the birth of 3 children in 2020 in the Moscow region

Transferring capital to form your future pension is also the height of frivolity, since the Pension Fund manages contributions ineffectively, as a result of which they depreciate under the influence of inflation.

It is a state benefit paid from the country's federal budget to families with two or more children. This amount can only be used for the intended purpose: for pensions, for improving living conditions, for education. The right to receive family capital arises immediately after the birth of the mother’s second child. However, according to the law, a man can also receive capital in certain cases prescribed by law, for example, if the mother died or was deprived of parental rights, or the man is the sole adoptive parent of a second and subsequent child. You cannot receive matkapital in cash, since it cannot be transferred to a specific person. The fund directs it exclusively to company accounts, depending on how the owner decides to use it. To obtain a certificate you need:

Loan from VTB 24 with participation of maternity capital.

- Give birth to (adopt) a second child.

- Contact the territorial body of the Pension Fund of the Russian Federation

- Present a passport, birth (adoption) certificate, documents confirming the citizenship of the newborn and his registration, and write an application for the issuance of a state certificate.

- A decision is made within a month to grant or refuse benefits.

- online application involves submitting an application via the Internet and receiving a bank decision online;

- Online registration of an appointment for a consultation. The questionnaire will be filled out at the bank office with the help of a loan specialist;

- filling out an application at a bank branch.

Required documents

You will need a standard package of mortgage documents + documentation on the transfer of maternity capital funds.

The standard list of documents is as follows:

- statement;

- general passport;

- SNILS;

- certificate 2-NDFL for the last calendar year (not required if the client is a salary earner);

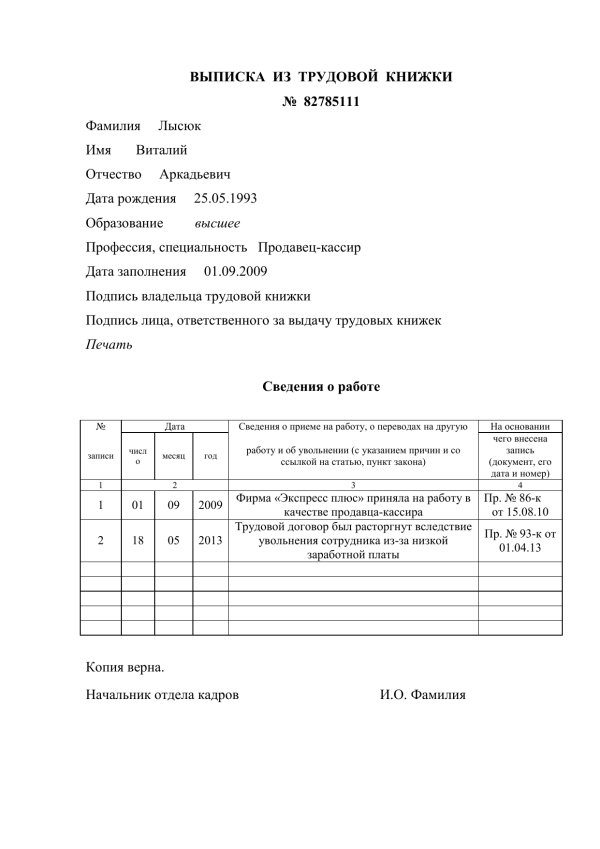

- a photocopy or extract of a work record book, certified at the place of employment;

- military ID - for males under 27 years of age.

The bank may also require other documentation not specified in this list.

Regarding maternity capital, the following documents will be required:

- certificate for maternal capital;

- certificate from the Pension Fund about the balance of funds in maternal capital.

Advantages

Matkapital provides borrowers who have the appropriate certificate with a huge list of advantages.

Here are just a few of them:

- capital funds can be used for various purposes - to pay off the down payment, debt or increase the loan amount;

- capital allows you to legally improve your living conditions, while allowing you to significantly reduce your credit burden;

- matkapital is an excellent opportunity to purchase expensive housing if there are no funds available for a down payment;

- With the help of maternity capital, you can reduce the monthly payment for the entire further loan term.

Advantages of using maternity capital

Maternity capital is provided to owners in the form of a certificate, which can be spent on purposes established by the state. It cannot be cashed legally. This action is punishable in accordance with the Criminal Code of the Russian Federation.

The presence of capital gives its owners a number of advantages. On their list:

- Using a certificate for various purposes, from paying off the down payment on a mortgage to increasing its overall size.

- Capital can be an excellent help for families wishing to improve their living conditions without getting into long-term credit bondage.

- Mat. capital allows you to purchase more expensive real estate, without using an additional loan as a mandatory contribution.

- The certificate can be used if you already have an open mortgage with VTB. The capital will be able to cover the remaining debt or serve as part of it.

Important! VTB invites potential borrowers to pre-assess the acquired financial burden by calculating the minimum mortgage payment in an online calculator. Using the filter, it is necessary to establish that the client plans to take out a loan using a government support certificate.

How to repay

The borrower has the opportunity to repay a housing loan obtained using funds from maternal capital using any convenient method:

- through the VTB 24-Online remote banking system;

- by paying in cash through any VTB 24 ATM in the Russian Federation;

- at the cash desks of branches and representative offices of VTB 24 Bank;

- by making a non-cash transfer of funds from another bank;

- at Russian Post offices.

In addition, clients who have received a mortgage using maternity capital have access to both partial and full repayment ahead of schedule.

To carry out such a procedure, an application is submitted to the nearest VTB 24 office in the prescribed form. The bank does not impose any restrictions on the amount of early repayment. There are no fees.

Insurance

Just like with a regular housing loan, when using maternity capital funds, it is necessary to obtain insurance. One thing is mandatory - insurance against the risk of damage or loss of the pledged real estate.

Other types of insurance, such as title, life and health insurance of the borrower, are optional and can be carried out at will.

It is recommended to insure yourself in organizations approved by VTB 24 Bank. Such companies have all the conditions necessary for high-quality and quick registration of an insurance policy. The list of accredited insurers can be found here.

A mortgage obtained using maternal capital funds is a unique opportunity for a family to improve their living situation. With the help of the certificate, it is possible to both pay the down payment and partially repay the housing loan. In addition, the size of the mortgage loan can be increased by the amount of maternity capital.

Find out the conditions for a mortgage in VTB 24 without a down payment in the article: VTB 24 mortgage without a down payment. Read the rules for partial mortgage repayment at VTB 24 here.

The assessment of housing with a mortgage in Sberbank is described in this article.

Requirements

The down payment is partially paid by maternity capital, subject to:

- its size is no more than 15% of the cost of the object, and

- the borrower's personal funds are at least 5% of its price;

- availability of a certificate from the Pension Fund indicating the amount of maternity capital available in the account at the place of registration of the borrower.

If it is used to partially repay an existing mortgage, you need to contact the Pension Fund branch, having previously obtained documents from the bank indicating:

- balance of debt;

- monthly payment amount,

- no delays;

- account number for transferring maternity capital funds.

Complete information is reflected in a single certificate on the bank’s letterhead with a seal.