Features of the mortgage “Victory over formalities”

A mortgage is a type of loan issued by a bank for the purchase of housing. A mortgage is more profitable than a consumer loan, as it has lower interest rates and favorable conditions. But VTB does not issue mortgage loans to all clients. Reasons for refusal may include:

- Insufficient wages of the borrower.

- Lack of collateral.

- Client unreliability.

- Availability of current debt obligations.

There can be many reasons, but most often people are refused due to a lack of documents confirming their solvency. With the “Victory over formalities” program from VTB, difficulties in this regard will not arise, because a person is required to provide only the following documents:

- Passport with Russian citizenship.

- SNILS.

- For men aged 21 to 27 years - military ID.

Just two basic documents and a mortgage is already in a person’s pocket. VTB issues a mortgage loan without formalities, since people who apply to this bank are most often already its paid clients and have a good status. But this does not mean that a complete stranger cannot apply for a mortgage at VTB.

If the client really wants to get borrowed funds to purchase a home, then he must try to prove to the bank his solvency.

Requirements for the borrower

The fact that VTB asks to provide only two documents does not mean that other parameters will not influence the bank’s decision. VTB will definitely check on its own how the person is employed and what his income is. The latter must be at least twice the expected monthly mortgage payment.

If a person does not have enough finances to receive the necessary amount to buy a home, then you can slightly increase your chances by going to the bank with a co-borrower or guarantor. VTB allows up to 5 such persons.

A person must have continuous work experience at one place of work for 1 year before submitting an application for a mortgage to the bank. And at the time of application, be employed, albeit not quite officially. VTB will check absolutely all of its client’s employment to ensure his solvency for the entire loan period.

Another standard requirement is the age of the borrower - 21-70 years. A VTB client is required to repay the mortgage before the age limit.

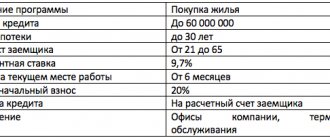

Mortgage terms

Mortgages under the “Victory over formalities” program have quite attractive conditions for bank clients:

| Interest rate | From 10.7% |

| Loan terms | Up to 20 years |

| Minimum mortgage amount | 600 thousand rubles. |

| Maximum mortgage amount | 5 million rub. for residents of Moscow, St. Petersburg and these regions, and for other citizens - 15 million rubles. |

| Down payment amount | At least 30% of the cost of purchased housing |

| Participation in the property insurance program | Necessarily |

Each borrower must understand that the conditions for providing a mortgage are standard under the “Victory over formalities” program, and for each specific client the bank will select the most acceptable conditions for both parties. The more opportunities the borrower wants to have (large amount, long period, low interest rate), the more guarantees of his responsibility and solvency he must provide to VTB.

Lending terms

So, the lending conditions according to two documents provide:

- Purchase of both finished and under construction housing (including from a VTB-accredited developer), as well as refinancing of an existing mortgage;

- Approval of a loan from 600,000 to 30 million rubles;

- Lending period for a period not exceeding 20 years;

- Making a down payment of at least 30%;

- Comprehensive insurance;

- Applying for a loan under the “finished housing” and “housing under construction” programs at 8.4% per annum, subject to making a down payment of more than half the cost of housing;

- Loan refinancing at a rate of 9%;

- Lending at a rate of 9.4%, provided that the area of the purchased residential premises exceeds 100 square meters.

It is important to note that the simplified version of applying for a mortgage loan at VTB prohibits the borrower from choosing a program that provides for the use of state support funds, including the contribution of maternity capital to repay the down payment.

It might be interesting!

What is a non-target mortgage, what is it, what are the requirements and conditions

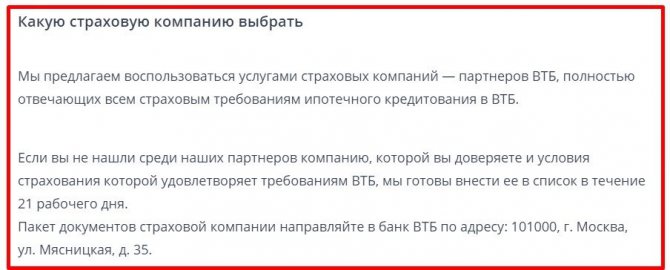

Mortgage insurance

VTB can offer the borrower two types of insurance:

- Insurance of property pledged (purchased real estate) against the risk of loss or damage. It is mandatory and if insurance is refused, the borrower will be denied a mortgage.

- Personal insurance of the borrower against various risks such as disability, life, restrictions on ownership of property, etc.

If a person refuses any form of personal insurance, then VTB automatically increases the mortgage interest rate by one point.

The interest rate may increase for other reasons (large amount, but short term, low salary, etc.), but these are special cases.

Mortgage insurance

VTB’s mortgage insurance proposal “Victory over formalities” sets a loan rate of 13.6%. The borrower will receive a loan at this percentage by agreeing to comprehensive insurance. It includes insurance:

- life, ability to work of the borrower;

- damage to the subject of the mortgage;

- loss of purchased home;

- termination/restriction of ownership of purchased real estate in the first three years of home ownership.

Insurance of the apartment is mandatory, but the borrower insures himself at will. If you refuse comprehensive insurance, the loan interest increases to 14.6%.

VTB 24 prefers to cooperate with insurance companies that are its partners. When a borrower wishes to use the services of his insurer, the lender is ready to consider this option.

The list of requirements that the bank imposes on insurance organizations can be found on the official website of VTB 24.

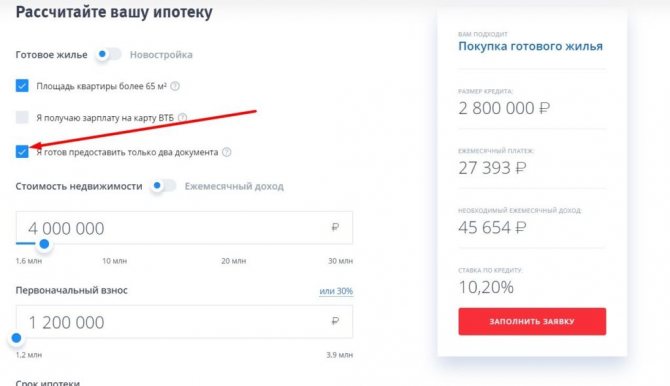

Mortgage calculator

On the official VTB website in the “Mortgage” section, subsection “Victory over formalities” you can find a loan calculator. You need to check the box next to the item “I am ready to provide only two documents” and move the cursors by amount, term and down payment to see the calculations:

- Total mortgage amount.

- Monthly payment and minimum income.

- Interest rate.

Using this data, a person will be able to determine how convenient and realistic a mortgage loan will be for him under the “Victory over formalities” program.

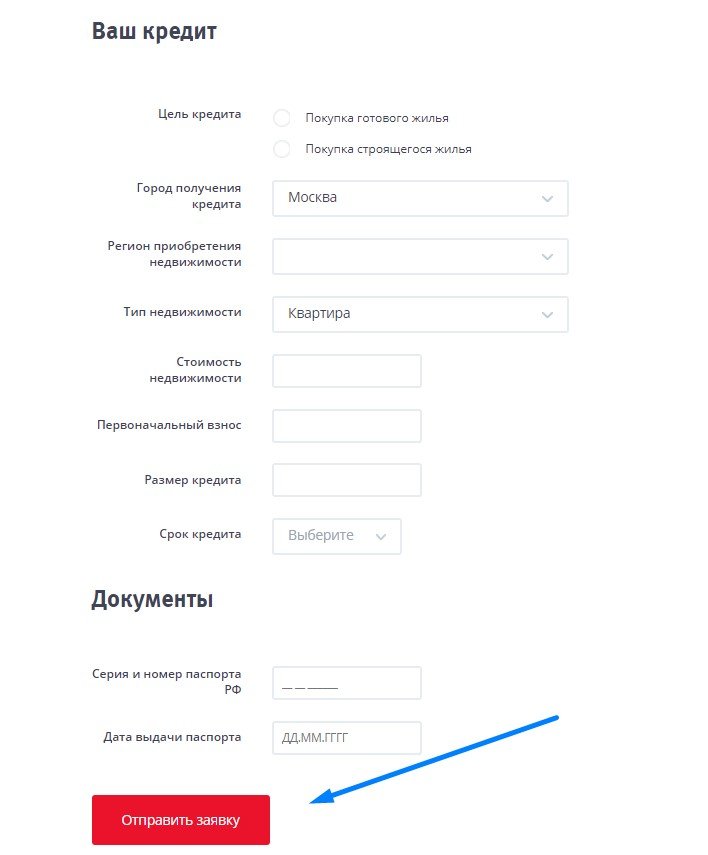

How to apply for a mortgage using 2 documents?

On the official website of VTB 24 you can fill out an application for a loan for a mortgage. The website has offers for CHL. There is a column “Victory over formality” - go to it and fill out the required fields in the form. Then you need to send it to the credit institution.

The bank reviews your application within 24 hours. He will provide you with his solution by sending an SMS, an email or calling you on your cell phone.

If you are approved for a loan, then at the appointed time you meet with the manager with the necessary documents in hand and discuss all the details of the transaction. The bank's consent is valid for 4 months, during which you can apply for a loan.

What documents may be needed?

VTB will actually issue the mortgage itself using two documents. But he will formalize it - this means he will agree to the issuance of funds. But for the further process you cannot do without:

- Cadastral and technical passport for the purchased housing.

- Extracts from Rosreestr confirming the absence of debts on utility bills.

- Extracts from the same register about the ownership of this property.

- A document confirming the transfer of ownership of housing to the borrower.

- Purchase and sale agreements.

- Specialist estimates of housing costs.

All these documents will definitely be needed when VTB begins to calculate the possible amount of the mortgage. It will also be mandatory to fill out a mortgage application form. It is in it that you will need to indicate all the information about your place of work and earnings. You should not think that VTB does not check this information - it focuses on it when making a decision on issuing a loan.

The advantage of the “Victory over formalities” program is that you do not need to provide a certificate of income and employment, which is good, because this is not always possible. But you still have to indicate your income and place of work.

What do you need to provide?

The future borrower is required, first of all, to provide identification documents . These include the original and a copy of the passport, as well as the number of the compulsory pension insurance certificate (SNILS).

The most important document – a certificate of income from your place of work – is not required when choosing the “Victory over formalities” program.

For personal identification, you can also provide:

- pensioner's ID;

- military ID for men under 27 years of age;

- driver's license;

- TIN.

If 30-40% of the cost of housing has already been placed on a current or deposit account, then this can be confirmed by an appropriate agreement or statement. However, this document does not appear in the list of bank documents.

The loan applicant must fill out a very detailed application form . If the bank is convinced that the client has the funds for the down payment and finds out that he has a good credit history, then most likely the application will be approved. The absence of a certificate of income does not lead to significant risks for the bank, since all information about its income and expenses will be presented in the borrower’s application form.

When applying for a mortgage using two documents, the borrower does not have to bring a work certificate or tax return to the bank. But he is obliged to pay at least 30-40% of the cost of the apartment himself.

Procedure for obtaining a mortgage

Getting a mortgage under the “Victory over formalities” program from VTB is no more difficult than any other type of loan. The scheme will be built as follows:

- Come to the VTB branch with your passport and SNILS and write an application (you can submit an application online on the website).

- Submit the documents and wait for the preliminary decision.

- Having received a positive answer, start looking for an apartment. The bank's decision is valid for 4 months and it is during this period that a person must find housing and collect all the papers.

- Collect a complete package of documents for the purchased housing and bring it to the bank.

- Discuss the terms of the mortgage and sign the agreement (at the same time, issue an insurance agreement for the collateral and personal insurance if desired).

- Make a down payment on your mortgage.

- Wait for the transfer from VTB in favor of the buyer and pledge the apartment to the bank.

After the mortgage is paid in full, the apartment will fully belong to the former borrower, and until then the bank has the right to take it back if the terms of the mortgage are not met. No borrower wants to lose an apartment or other housing, and therefore, in the process of drawing up a mortgage agreement, you should carefully read all the clauses of the agreement and do not forget to comply with them.

How can I repay the loan?

Most often, VTB offers clients an annuity scheme for repaying mortgage debt. The entire loan amount, together with interest, is divided into equal parts over the entire loan period.

This scheme is convenient, since there is no need to monitor the payment amount and you can set up automatic payment in your VTB personal account. But the overpayment of interest is a significant part, which would not be the case in a differentiated payment scheme. It involves unequal but pre-agreed payments on set dates.

When signing a mortgage agreement, a person must pay utmost attention to this point and choose the most convenient scheme for himself.

VTB allows early repayment of a mortgage without sanctions or penalties for the borrower. You just need to write an application to the bank a month in advance and indicate the amount and date of payment.

You can repay your mortgage at VTB in many convenient ways:

- Transfers from other banks and accounts.

- Top up your account through VTB payment terminals.

- Using Russian Post.

- Through your VTB personal account from a computer or mobile phone with the VTB Online application installed.

- Through a bank cash desk.

There are many options, and therefore a person can easily and without delay transfer funds to pay off the debt. It is necessary to do this at least five days before the appointed date and always take checks, so that in case of a bank delay in the transfer, you can prove that the payment was made on time and the bank did not charge a penalty for late payment.