Mortgage is a targeted credit banking product that is firmly entrenched in the real estate market.

Based on his organizational and financial capabilities, each borrower himself determines for how long to borrow a loan.

The minimum and maximum mortgage term depend on the bank’s conditions, the age of the borrower, the loan program and the amount of payments. There are other factors that determine loan terms.

A mortgage with a minimum time frame has a lower overpayment amount. A mortgage for a maximum period reduces the burden on the family budget and allows you to count on inflation.

Let's look at different options and determine for what period is most profitable for you.

Mortgage terms

The mortgage can be issued for a period from 1 year to 30 years . Russian banks offer minimum and maximum terms for repayment of funds.

The term of a mortgage loan is determined not only by the age of the borrower and the level of his solvency. The state has the right to limit the period of use of loan funds within the framework of special programs.

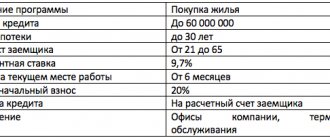

The main conditions for granting a mortgage are the term, interest rate and loan size . Separate bank requirements relate to age, length of service, income of the borrower and collateral.

The minimum lending term starts from 1, 2,3 or even 5 years, but the maximum term, designed for more than 30 years, is unlikely to be found in Russian banks.

One of the most important conditions for obtaining a mortgage is obtaining compulsory insurance for the collateralized property. This cannot be refused, since the requirement is determined at the federal level.

Interest rates on mortgages are significantly lower than on consumer loans, and they also tend to decrease.

By June 2020, Sberbank offered mortgages for young families at 8.6% per annum, and with state support for families with 2 or more children - even at 6%. Otkritie banks, Gazprombank and Alfa-Bank also offer favorable offers.

If you have already taken out a mortgage with a higher interest rate, contact the refinancing program and re-issue your loan obligations with another bank.

Amount Options

The size of the loan that the bank is willing to make available to the borrower is determined by the following parameters:

- restrictions on the minimum and maximum amount for the target program - for example, at Sberbank you can get from 300 thousand to 30 million rubles;

- the value of the property - the bank issues a loan up to 90% of the appraised value;

- income of the borrower - the amount of monthly payments should not exceed 30-40% of total income.

When determining the amount, the bank also takes into account the age of the borrower, family expenses, including other loan obligations, a list of documents, and the presence of guarantors.

Minor Conditions

Banks tend to use reinsurance, so when issuing long-term loans they impose additional requirements that are not defined at the legislative level, but if they are not met, you will be given a loan on unfavorable terms or even denied.

One of these conditions is life and health insurance . You don’t have to agree to it, but if you refuse, the annual interest rate will increase from 0.5 to 1%. A more reasonable decision would be to accept the bank’s terms and take out personal insurance.

Another important condition is the down payment. You can choose a mortgage program without it, but the conditions are unlikely to be very favorable. By paying the down payment, the borrower demonstrates to the bank his solvency and responsibility.

Typically, the contribution is from 15 to 25% of the cost of housing, and this is a considerable amount. You can pay more, then the bank will offer a more favorable interest rate, but not necessarily.

The standard borrower age requirement is 1 year . There is no upper limit, but there are restrictions on the age of the borrower at the time of retirement.

You should also pay attention to the conditions for early repayment . Even if you did not immediately plan for such an item, circumstances may change after a few years, and you will benefit from early repayment. Not all banks provide the opportunity to repay a loan earlier than the due date without charging commissions.

You may also need mortgage holidays - it is also better to find out the conditions for their provision in advance.

Optimal terms of mortgage lending

The average loan period is 15 years. This period is the most acceptable for the distribution of funds without any special burden for the citizen.

However, depending on a number of conditions, it varies from 1 year to 30 years, and in exceptional cases up to half a century.

There are 3 options for determining a mortgage loan according to its terms:

- short-term (1–10 years);

- medium-term (10–20 years);

- long-term (20 years or more).

Of course, a number of banks are interested in fixed lending periods. Meanwhile, most factors influence the ability to issue a loan within the time frame established by the financial institution.

That is why the time period is so widely stretched both to the upper boundaries and to the lower ones.

Maximum mortgage term

Most banks make it possible to take out a mortgage on an apartment for a maximum period of 30 years. However, many financial institutions seek to protect themselves from all sorts of risks by offering lending terms of up to 25 years and even less than 20 years.

It should also be understood that the longer the mortgage, the higher the overpayment on it will be. But the amount of monthly payments will allow you to repay the loan without much effort, without causing significant blows to the family budget.

Minimum mortgage term

The shortest mortgage period is 1 year. However, some financial institutions have set the lower limit at 3 years or even 5 years, since it is extremely unprofitable for banks to issue loans on a short-term basis.

As a result, there are extremely few approvals for minimum mortgage terms. Most often, in this case, the interest rate is inflated so that the financial institution receives a decent profit from the transaction.

Length of mortgage and age of borrower

The average term for which a mortgage is usually granted is 15 years. During this time, most borrowers manage to pay the bank.

Debt obligations based on the maturity of the loan are divided into three types:

- short-term mortgage - up to 10 years;

- medium-term - from 10 to 20 years;

- long-term - from 20 to 30 years.

Most Russian banks set minimum and maximum age thresholds for borrowers. The requirements are determined by taking into account solvency and reducing the number of risks.

The standard age limit is from 21 to 65 years - the start and end of working age . For a 47-year-old woman, the maximum permitted loan period will be 18 years. A man aged 23 to 35 has the opportunity to apply for a loan for a maximum period.

Pensioners can increase the mortgage term if they have a stable income and pledge their existing real estate.

Some banks are moving away from standard requirements and issuing mortgages with completely different approaches to age. Otkritie Bank and Ak Bars Bank issue mortgage loans from the age of 18. Transcapitalbank and Sberbank lend to non-working pensioners and provide mortgages up to 75 years of age.

This approach allows you to get a mortgage loan for the maximum term, reduce your monthly payment and increase your chances of approval on a modest income.

Validity periods of mortgage loans under special programs

Mortgage for young families

A certificate for a certain amount is provided to one of the spouses aged 21 to 35 years . The document can be issued as a down payment. Determining the loan term depends on the conditions of a particular bank.

Military mortgage

The savings mortgage system in accordance with Federal Law No. 117 allows military personnel to accumulate funds in a special account.

The total amount will be used to purchase housing.

The activities of military personnel are dangerous, and retirement occurs earlier than for other categories of citizens.

The upper age limit for borrowers has been reduced to 45 years.

Military mortgages are available from 22 to 45 years of age. The maximum loan term is 23 years.

What is the minimum and maximum loan period?

Attention! The minimum length of the mortgage is one year. In this case, the person must be at least 21 years old. The maximum loan duration is 30 years. At the time of repayment of the loan, the person must be no older than 75 years.

When receiving a loan without proof of income and work activity, the age limit is no more than 65 years. You can find out more about age restrictions here.

Repayment can be early and has no restrictions . Some Sberbank mortgage programs have their own peculiarities. The duration of the loan for the purchase of housing under construction or housing in a finished new building in accordance with the program for subsidizing the rate by developers is up to 7 years.

A loan for country real estate involves the possibility of obtaining a deferment for making payments or increasing the loan term in the presence of acts certifying an increase in the cost of construction, but no more than 2 years from the date of receipt of the loan. The maximum time to repay a military mortgage is limited to 20 years, this is due to early retirement.

For what period is it more profitable to take out a mortgage loan?

In 2020, Sberbank occupies a leading position in the mortgage lending market. The minimum mortgage term in Sberbank starts from 1 year, and the maximum mortgage term in Sberbank is 30 years.

At the same time, interest rates and the total amount of overpayments have more advantageous positions than in other financial organizations.

If you are wondering what is the minimum term for which you can take out a mortgage, it is usually 1 year. However, a very small number of citizens, who have their own reasons for this, enjoy this right.

For example, in a year you are expected to receive an inheritance, transfer funds, receive financial assistance from relatives, and pay off a debt. Not everyone will be able to obtain the minimum mortgage term for a large amount .

If the age limits and monthly income do not meet, you will most likely be refused, but may be offered a mortgage for a longer period.

If you are still confident in your capabilities, choose a bank with the possibility of early repayment without paying commissions and agree to the loan term that they offer you. And you will make the decision on when to pay off the debt yourself.

How to increase the duration of a mortgage loan?

In certain situations, the borrower needs to increase the duration of the mortgage loan specified in the loan agreement. To do this, you can try to negotiate with the bank on debt restructuring. This step should be taken only as a last resort, since a request to defer payment is actually a default by the counterparty. The delay will be recorded in the stop list and the credit history bureau. If the application for loan restructuring is approved, the person will be able to receive a “mortgage holiday.” The monthly payment amount may also be reduced.

To restructure a loan you must provide:

- A copy of your passport;

- Documents confirming employment and stable financial position (2-NDFL certificate and work book);

- A copy of the order of the head of the company to change the terms of the employment agreement (reduction of wages or provision of unscheduled unpaid leave);

- A paper confirming registration with the employment center (for unemployed citizens);

- A copy of the notice of upcoming dismissal (if available);

- Documents confirming the loss of ability to work or death of the co-borrower (certificate of incapacity for work, certificate of death, etc.).

If a person has a high debt load, then he must provide the appropriate contracts and agreements. If necessary, the bank may request additional documentation confirming the difficult financial situation of the citizen.

The term of your mortgage can be extended through mortgage refinancing. The client can apply for a new loan at a reduced interest rate, which allows reducing financial costs. The new loan involves the provision of liquid collateral that meets the bank's requirements.