The legislative framework

Employees of the Federal Tax Service often refer to Law No. 2003-1, adopted in 1991 to regulate the taxation of property of individuals. However, it does not apply to the current ones. Therefore, we rely on Chapter 32 of the Tax Code of the Russian Federation, the subject of which is the property tax of individuals. As well as Chapter 30, which regulates the collection of fees from the property of organizations. The Tax Code defines federal tax benefits and is intended to indicate the maximum level that tax interest rates can reach.

Representative bodies of municipal associations (MO) have the right to differentiate tax rates for property fees. And also provide preferences to certain categories of individuals and organizations.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(the call is free for all regions of Russia)

For individuals, property taxes are calculated by the local Federal Tax Service. And organizations do this on their own, according to Art. 52 NK. And the local Federal Tax Service does not tell them about this.

Property tax and types of property on which it is levied

Before claiming tax breaks on apartments or other housing and land, it is worth understanding the objects of taxation.

In relation to organizations, such objects are recognized as objects related to real estate as fixed assets on the balance sheet. The legal entity is obligated to pay the filing fee:

- owning real estate;

- those who received it for use or disposal;

- receiving objects under the concession agreement.

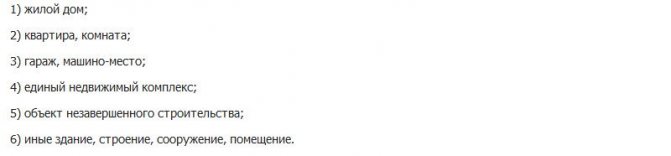

As for individuals, real estate related to the collection received by the budgets of the Moscow Region was divided into several categories in paragraph 1 of Art. 401 NK.

Clause 2 contains an important clarification regarding the land plot used by an individual, which was once intended for private plots, individual housing construction, a dacha, a garden or a vegetable garden. Housing built there is also considered a residential building. And the local Federal Tax Service, taking advantage of this norm of the Tax Code, will apply to it the appropriate requirements for taxation.

If you, as a payer, have not submitted an application to the local Federal Tax Service regarding which of the objects related to different types of real estate the existing benefit should apply, then the employees will choose the one with the largest tax base.

Procedure for obtaining a privilege

Property tax benefits are provided exclusively to certain categories of citizens. At the same time, the applicant must document his preferential right. To apply for tax benefits for personal property tax, you must adhere to the following procedure:

- Collecting a package of papers. What documents are needed to receive the benefit: Application on the inspection form for individuals to receive a tax benefit. The application for property tax relief can be filled out on site under the supervision of a specialist or brought in ready-made.

- Identification.

- Property documentation. To do this, it is necessary to obtain a certificate of property registration, since the certificate is not currently issued.

- Papers that serve as the basis for granting benefits.

The right to a property tax benefit arises after a positive decision is made by the inspectorate. If the documents are not fully collected, taxes will be sent to the beneficiary in full.

When a person who pays property tax is sure that he is entitled to a benefit, he needs to contact the specialists of the Federal Tax Service with documents. In other words, a benefit recipient who owns property fills out an application for a benefit with the tax authority and submits the required package of documentation. From this moment on, he has the right to count on tax privileges.

Interesting information: How to get a tax deduction when buying an apartment

Property tax benefit: general information

Property fees are regulated at two levels:

- federal - reflected in the norms of the Tax Code of the Russian Federation, on the basis of which the beneficiary can apply for the corresponding status;

- local - a representative body of the Moscow Region can supplement a benefit existing at the federal level or introduce a new one.

The representative body of the Moscow Region has the right to:

- differentiate the rate;

- establish a deduction from the tax base;

- offer a property tax benefit to certain categories of payers.

When applying for preferences, you should immediately figure out who established them. A benefit valid in the territory of one municipality may not apply in the territory of another if it was established at the local level.

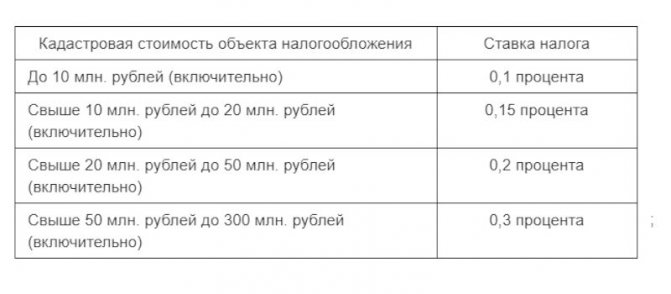

Tax rates

In Art. 380 rate for organizations was set at 2%. This does not prevent us from taking a differentiated approach to payers at the local level by offering preferential tax treatment to some. By differentiating the rate for legal entities, municipalities can raise it, but not above the level of 2.2%.

In paragraph 2 of Art. 406 proposed three levels of cadastral value rates for individuals. The minimum, 0.1%, is supposed to apply to:

- residential real estate;

- unfinished residential buildings;

- single complexes, including residential buildings;

- garages;

- outbuildings, structures with an area of up to 50 square meters. m. on plots allocated for private plots, individual housing construction, cottages, vegetable gardens or gardens.

The maximum 2% is set for buildings:

- used as administrative, commercial, office;

- isolated from some taxable object until it is included in another list.

For other objects, a level of 0.5% is proposed.

In 2020, tax rates based on inventory value will end. Its value must be multiplied by the deflator coefficient of 1.518 - established in 2020. The reduction coefficient was initially planned to be 0.8, but now it has been revised downward and returned to the level of 2018, when it was 0.6.

Based on this level, the cadastral value will no longer be raised annually by more than 10%.

Tax terms and periods

The real estate tax is due annually. You need to pay:

- for individuals – by December 1. Local INS make calculations in April-September, after which they send out notifications;

- organizations, the amount remaining after making advance payments - by February 1 after the reporting year.

The taxation period is usually equal to a calendar year. Exceptions are possible for objects:

- registered during the year;

- inherited;

- recently built;

- changed hands or ceased to exist.

For them, taxes are paid for the period of actual ownership in the current year, and for recently erected ones - from the next year after commissioning.

Property tax deductions this year

The cadastral value of the property when determining the tax base Art. 403 of the Tax Code proposes to reduce. Homeowners are given a deduction in the amount of:

- cost 10 sq. m – per room or part of the apartment;

- 20 sq. m – for an apartment, part of a residential building;

- 50 sq. m – for a residential building;

- 1,000,000 rubles – for a single complex, including residential buildings.

Applying a deduction may result in a negative value for the amount of accrued tax. They will not pay extra from the local budget to the property owner; they will simply equate the tax rate to zero.

Who is entitled to tax benefits and in what amount?

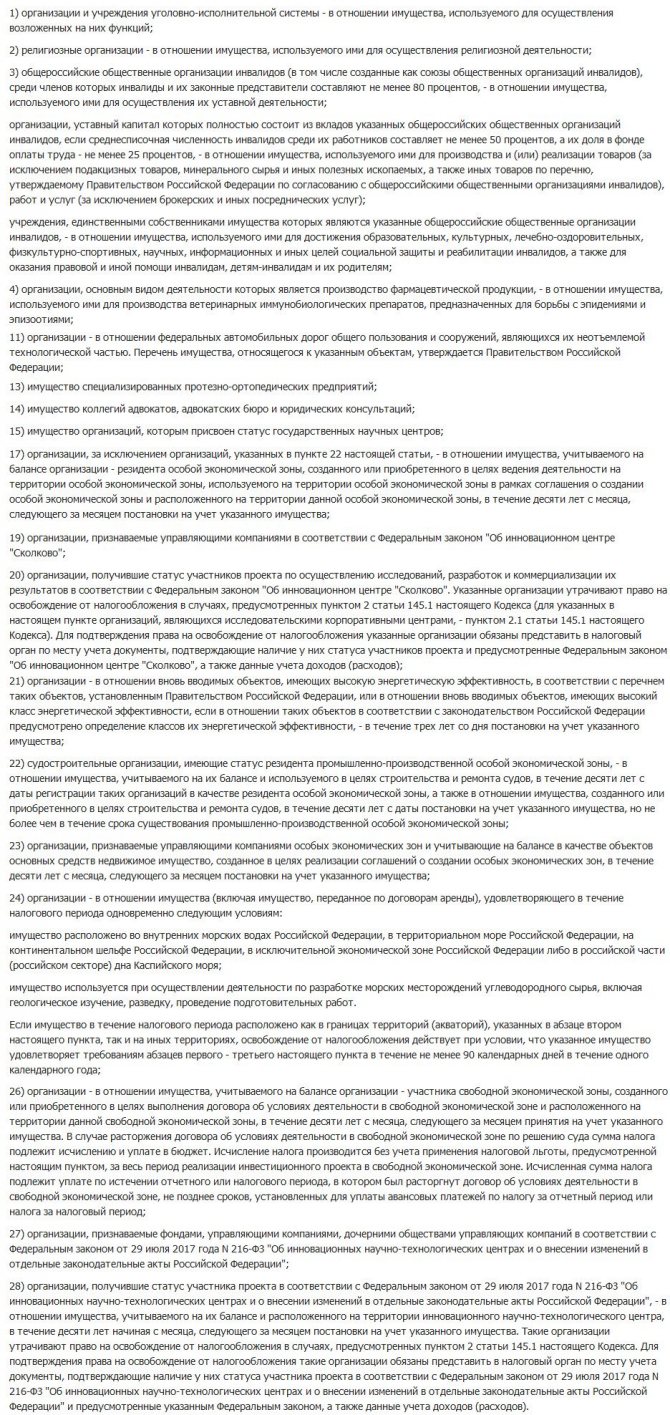

The list of legal entities who are entitled to property tax benefits in the form of a complete exemption from payments is given in Art. 381 NK.

The emphasis is clearly on organizations that contribute to the introduction of technological innovation into the Russian economy.

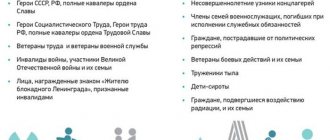

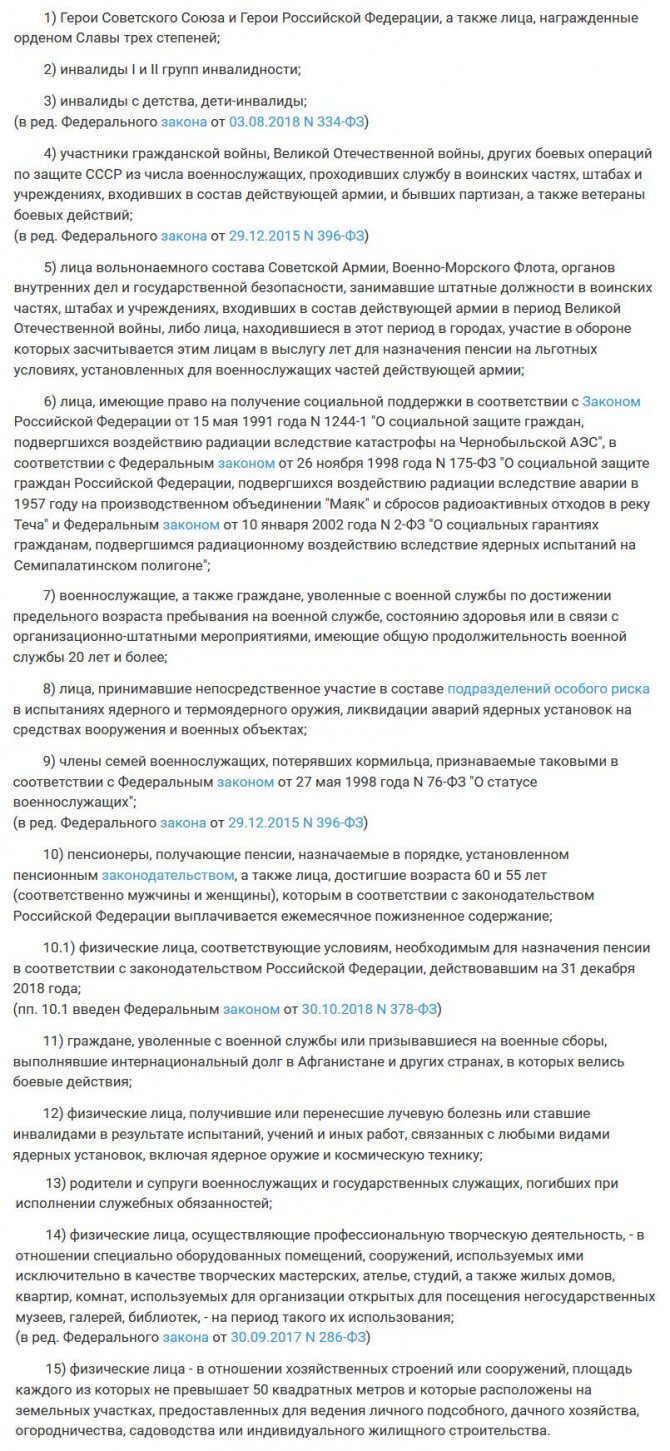

In Art. 407 of the Tax Code lists the categories of individuals who are entitled to benefits.

The right to use the due preferences is given not only to home owners, but also to owners:

- outbuildings and ancillary buildings with an area of up to 50 square meters. m, located on the territory of land plots issued for private plots, private housing construction, cottages, vegetable gardens, gardening;

- creative workshops, studios;

- objects located on the territory of the library, museum.

A relatively new category in the list of beneficiaries, and the most widespread one, is pensioners.

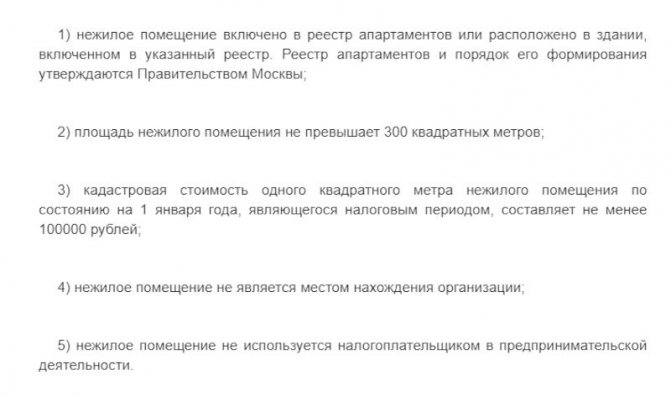

The list of categories of recipients of federal benefits can be expanded by representative bodies of the Moscow Region. For example, Law No. 51 of the city of Moscow, adopted in 2014 and regulating the property tax of individuals. This regulatory act significantly reduced the tax rates on residential real estate in force on the territory of the Moscow Region.

And the provision of preferences for non-residential premises was conditional on compliance with a number of conditions.

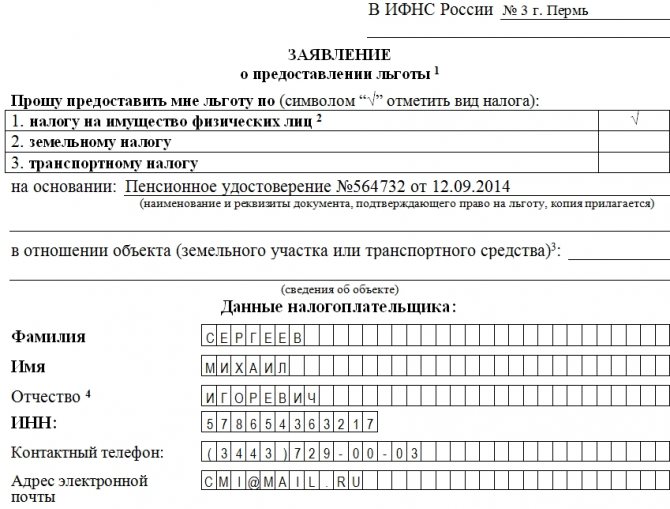

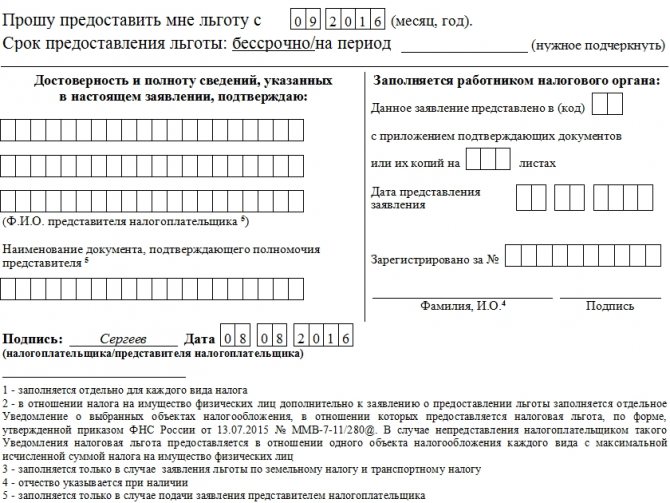

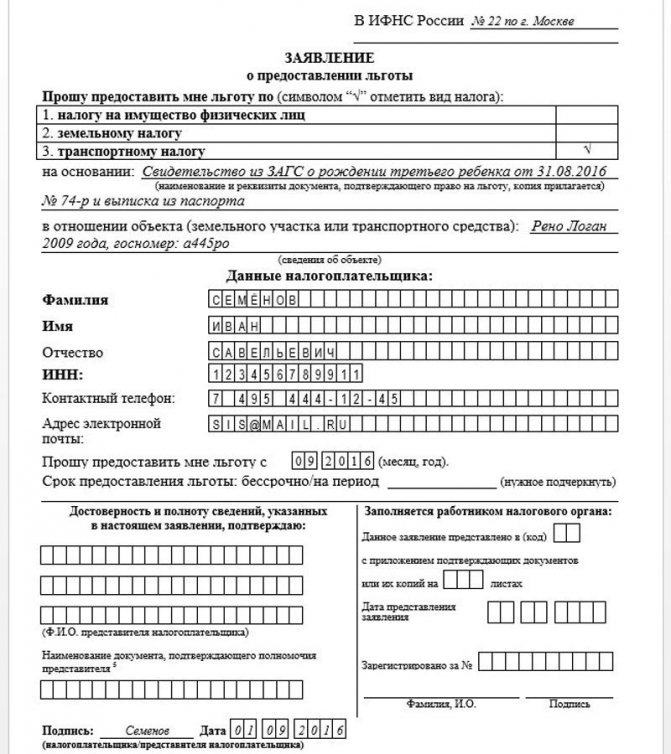

How to write an application for property tax relief

This example considers applications from a pensioner who wants to take advantage of property benefits.

- At the beginning of the application, you must indicate the number of the tax service to which the taxpayer belongs at the place of residence and the locality in which it is located.

- Next, in the appropriate sign, you should check the type of tax, and here, too, everything is quite clear - the icon is placed opposite the line “personal property tax.”

- After this, the basis is entered that gives the right to receive relief, i.e. the name and number of the supporting document are indicated.

- Below is a table in which information about the taxpayer is entered. Here, in capital block letters, you must enter your last name, first name, patronymic, telephone number and, if available, an email address for communication (in case the tax specialist has any questions).

- In the second part of the document, enter the date (only month and year) from which the taxpayer would like to receive the benefit, and in the next line the period for its provision (if it is limited for some reason, here you need to enter the period during which the taxpayer has the right to it receive).

- Next comes the part that is filled out on the left by the taxpayer’s representative acting on his behalf on the basis of a power of attorney (if any), and on the right by the tax specialist accepting the document. In other words, the applicant himself does not have to enter anything here.

- At the very bottom, the taxpayer must put his signature and the date the document was completed.

If any questions arise during the registration process, you should pay attention to the explanations written in small print and located under the document.

Benefits for property tax for individuals

At the federal level, a list of categories of beneficiaries is given in the Tax Code. When starting to solve the problem of how to apply for property tax benefits, we check the data from the electronic service of the Federal Tax Service. It contains information about tax benefits and rates for the constituent entities of the Russian Federation.

If you find out that you are entitled to preferences, apply for real estate tax at a discount or a reduced interest rate.

You can request discounts for one object. But not in general, but for each type of real estate that is owned. Let us recall that they are given in paragraph 1 of Art. 401 NK.

Grounds for providing tax benefits

The basis is, as a rule, the presence of documents confirming that their owner belongs to one of the categories mentioned in Art. 407 NK. Or you will need to collect documents demonstrating compliance with the conditions for receiving preferences specified in the regulatory act of the representative body of the Moscow Region.

Procedure for granting tax benefits

There can be no question of providing a property tax benefit to the local Federal Tax Service if it has not been provided with an application supported by supporting documentation.

The beneficiary has the right to choose the way to receive the benefits due to him when paying the real estate tax. The benefit has a declarative nature, so you need to take the initiative and act. Otherwise, you will not take advantage of the discounts provided.

To ensure that everything is completed properly, an application is submitted with a package of supporting documentation. It:

- awarded to the local Federal Tax Service;

- addressed there by mail. You will need to notarize copies of the attached documents;

- submitted online through Internet portals of government services or the Federal Tax Service, where the user has a personal account.

When the notification received from the local Federal Tax Service does not reveal your right to preferences, you will have to go to the tax authorities to find out how this could happen. Let them figure it out and correct the mistake so that you can get a property tax benefit.

There is no other option for providing tax benefits. Unless the employees of the Federal Tax Service already have the necessary information.

How to fill out an application

In 2014, the Federal Tax Service adopted Order No. ММВ-7-21/ [email protected] , which established for individuals how to submit a request for a property tax benefit. This document approves:

- document form;

- how it should be filled out;

- How to submit a request in electronic format.

All these features are reflected in three appendices to the order.

The application form (Appendix 1 to order No. ММВ-7-21/ [email protected] ) can be:

- download on page;

- obtain directly from the local Federal Tax Service.

Instructions for filling out (Appendix 1 to order No. ММВ-7-21/ [email protected] ).

The completed first sheet of the four-page form will appear as follows.

Here's what you need to know:

- passport details;

- TIN;

- the grounds for taking advantage of the benefit;

- contact details;

- from what time and for what period to provide.

On the second sheet, marks are placed for transport tax, on the third - for land tax. But the fourth will require close attention, as it relates to collection from real estate. Here you need to indicate by setting the codes:

- for what types of real estate the benefit is requested;

- What are the numbers of the corresponding real estate objects?

What needs to be attached to the application

It is not enough to simply submit an application to take advantage of the property tax benefit. You will need to attach copies of the following documents:

- passports;

- TIN;

- titleholder - for the property included in the request for preferences;

- others mentioned in the statement.

When transferring via e-mail (via government services or the Federal Tax Service), an electronic signature is placed and sent by mail; it is advisable to have the copies notarized.

How to get a tax benefit

The property tax benefit is declarative. To obtain it you will need to fill out an application. If this is not done, the tax will be calculated for the individual in full.

The application for a discount has a prescribed form and is filled out on a special form. You can submit a document:

- when visiting a tax office;

- through the taxpayer’s personal account electronically by filling out an application on the website: you are required to register on the portal;

- by letter by Russian post: all documents confirming benefits must be notarized.

The application consists of 4 sheets:

- The title page is always filled out. It contains information about the taxpayer: full name, passport details, place and date of birth. The TIN must be indicated.

- The 2nd sheet is used only if you own a vehicle.

- The third one must be issued when paying the tax fee on the land plot. If there is no land owned, then the sheet remains blank.

- To receive property tax benefits, you must fill out the 4th sheet. A note must be made about the type of property for which the discount is issued (house, room, apartment, garage). Its cadastral number is entered. Enter the name, number and date of the document providing the tax benefit. The period for which the discount applies is recorded.

To receive a tax benefit you will need to fill out an application

A copy of the document specified in it must be provided with the application. The following papers will also be required:

- passport;

- TIN certificate;

- document of ownership.

After receiving and checking the documents by the tax inspector, the citizen will be informed about the method of notification of the decision made.

There are time limits. To obtain tax discounts, you must submit an application before November 1 of the same tax year. For example, to receive a property tax benefit in 2020, a citizen must submit an application and documents before 01/11/2017.

How to get a tax benefit

Useful video

What new approaches in state tax policy should be taken into account by accountants of organizations is outlined in a 19-minute lecture.

In a more condensed three-minute presentation, you can get acquainted with the innovations for legal entities by watching another video.

The two-minute episode of the popular legal aid blog examines what discount pensioners are now entitled to when paying property taxes, and how the benefits provided should be formalized.

When referring to video materials for tips on property tax benefits, do not forget to look at the date of posting. The most significant changes, mostly positive for payers, have occurred in recent years.