How to become a member of NIS

Every Russian citizen who performs military service on a contract basis has the right to join the NIS. Under the terms of this state program, after three years, each participant receives accumulated funds in the form of a cash loan, which can be used to pay the down payment on a military mortgage, or to pay off monthly payments on this loan.

Attention! NIS participants cannot receive CZH funds in their hands, since they are transferred by bank transfer to the accounts of banking organizations in which military mortgage programs are issued. It is also worth noting that they can only be used when purchasing specific real estate items on credit, specified in the CRL agreements.

Every serviceman who seeks to purchase mortgage housing on preferential terms must join the register of the special state NIS program. After concluding the relevant agreement, the accumulation of funds will begin the next month, and after three years of participation in the program, the serviceman can use the accumulated funds to pay the down payment for a country house or city apartment purchased on credit.

To become a participant in the savings and mortgage program, a serviceman must contact his superiors and submit a properly completed report. After this, an entry is made about the applicant in the appropriate accounting register. At the next stage, a card is issued for the serviceman, which will serve as confirmation of his participation in the NIS.

The serviceman's leadership transmits information about him to the relevant military authorities, after which the data is entered into a special register, which is maintained in accordance with the regulations of Federal legislation. The Ministry will check the received documents, after which they are registered, and the participant is assigned a unique twenty-digit number, valid throughout the entire period of military service. After this, the authorized government body will open a savings account for an individual, to which funds will be credited.

Attention! Each participant in the state program is personally informed about the entry of his data into the register. Military personnel receive appropriate notifications against receipt.

Bank selection

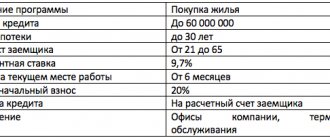

The bank must write an application, having previously clarified the fact of its participation in the state program. We can confidently say about the work of some banks in the field of military mortgages - many people turn to Sberbank and AHML to apply for one.

This is important to know: The standard for providing living space for military personnel

VTB can also offer interesting conditions. The list of banks working with military mortgages in 2020 is quite extensive.

The package of documents for each bank may vary in composition, so you need to call in advance, clarify whether the institution works with a military program, and find out what papers are needed. Approval of a mortgage by a bank is only a formality, since it is guaranteed by the Ministry of Defense, and funds are provided by the state.

Stages of obtaining a military mortgage

The procedure for obtaining a military mortgage involves several stages:

- First of all, an individual must become a participant in the state NIS program, receive a unique number and a Certificate giving the right to enter into an agreement with Rosvoenipoteka.

- At the next stage, the serviceman needs to select a property. He should hurry up, since the received Certificate has a limited validity period - only six months.

- The third stage is collecting documentation. It must be started in advance, since this will require contacting various departments and government agencies, which may delay the issuance of certificates.

- After the documentation package has been compiled, an individual must contact the bank and submit an application for a mortgage product. The applicant's application will be received by the bank within 2-5 business days, after which he will be informed of the decision made.

- The bank opens a special account in the name of an individual to which the funds of the Central Life Insurance Fund will be transferred.

- After receiving a positive decision from the bank, the serviceman needs to contact a specialized company and conduct an assessment of the property. Next, a mortgage agreement is signed with a financial institution.

- The last stage involves the preparation of documents for real estate in Rosreestr and the signing of a purchase and sale agreement.

Attention! The seller of real estate must be notified of the specifics of the upcoming transaction, as well as that funds will arrive in his bank account within a certain period of time after the registration of ownership by a military personnel (approximately 1.5 - two months). A participant in the state program should know that he will have to insure the housing purchased with a mortgage.

List of required documents for various procedures

Main list of documents

An application form for obtaining a loan in the form established by the bank, a copy of all pages of the passport, a certificate of a NIS participant, and the military personnel’s written consent to the processing of personal data by the lender.

Additional list of documents for married military personnel:

Passport and copies of passport pages of your spouse; a copy of the marriage contract (if available) and a copy of the marriage certificate, as well as the notarized consent of the spouse to participate in the Military Mortgage program. If the serviceman is not currently married, but was previously married, he must provide a certificate of divorce.

This is important to know: Monthly amount for a military mortgage in 2020

Documents for the bank:

Information from the registration certificate for the house in which the housing is located; documents from the developer on the ownership of housing; certificates about the absence of residents and registered in the housing, and the absence of debts for utility services; cadastral passport and certificate of title to housing. The bank specialist may also request documents about what kind of property the applicant has, what his education is, and whether there are additional sources of income.

List of documents for a military mortgage submitted to the Federal State Institution "Rosvoenipoteka"

A certified copy of the account opening agreement; statement; a copy of the loan agreement certified by the bank; a copy of all pages of the passport, a draft targeted housing loan agreement in triplicate and information about the assessment of housing.

List of documents for a military mortgage for concluding a housing purchase and sale agreement

Originals and copies of the loan agreement, targeted housing loan agreement (CHL) and real estate mortgage; an agreement for the services of an agent for state registration in two copies, a contract for the purchase and sale of housing and an act of acceptance and transfer of real estate in three copies.

List of documents for military mortgages for state registration of housing

Notarized consent of the spouse for the purchase of housing or a statement about the absence of the spouse (you must also provide a marriage contract if available), a check for payment of the state fee (its amount will be found out during registration), documents signed at the Federal State Institution "Rosvoenipoteka" and jar - in one copy. The following documents must be provided in triplicate: originals of the housing acceptance certificate and the purchase and sale agreement.

Originals and copies of the mortgage, loan agreement, targeted housing loan agreement and power of attorney for registration (if the serviceman acts through an agent).

List of documents for a military mortgage required by Rosvoenipoteka and the bank after registration

Originals of the certificate of ownership of housing (for a military man) and extracts from the Unified State Register, copies of a check for payment of insurance, an insurance agreement and a registered purchase and sale agreement. The mortgage must be kept in the bank.

List of documents for a military mortgage to obtain keys to housing

Acceptance and transfer certificate of housing, purchase and sale agreement, certificate of owner and notification to receive keys.

The preparation and collection of documents must be treated very carefully and responsibly. After all, if there is any error or absence of any document, you may not be given a loan. At the same time, the validity of all documents has a limited period and therefore it is best to complete all legal formalities as quickly as possible.

What documents need to be collected for a military mortgage?

Documents for registration:

- Certificate issued by Rosvoenipoteka.

- Application form for participation in the mortgage program.

- Written consent of an individual to the processing of his personal data.

- Passport.

- Tax identification number.

- If an individual is legally married, then a notarized consent to purchase an apartment will be required.

- Marriage certificate, marriage contract.

- Birth certificates of children.

- Documents for the property.

- Valuation report for purchased housing.

- Contract of sale.

- If you are purchasing housing from the secondary real estate market, you must obtain a certificate from the BTI, documents confirming the ownership of the individual seller to the apartment, as well as copies of his personal documents. If the seller of a secondary home is legally married and has minor children, then the notarized consent of the spouse for the sale, a document from the guardianship authorities, etc. will be required.

You should know that most banks do not check credit history for military mortgages and do not require documents confirming income, which allows you to receive a positive decision on applications in almost 100% of cases.

What documents are needed for a military mortgage?

Stage 1 of preparing military mortgage documents: obtaining a central mortgage agreement

After 3 years of participation in the savings-mortgage system (NIS), a serviceman has the right to receive a targeted housing loan (CHL) for a down payment on an apartment. To do this, you need to submit a report addressed to the commander of the military unit. The application will be reviewed, and after a couple of months the serviceman will receive a Certificate.

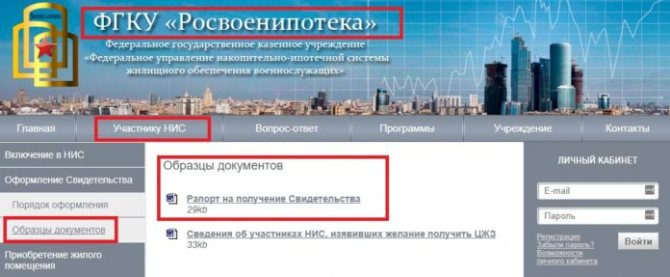

A current sample (only this one is suitable) of this and other documents is presented on the official website of the Federal State Institution “Rosvoenipoteka”:

The issued certificate has a validity period of 6 months . During this time, the program participant must have time to choose an apartment and conclude an agreement with the bank to receive a loan.

Stage 2 of preparing military mortgage documents: package for applying to a bank for a loan

- Passport plus its full copy (all pages with numbering);

- CZHZ certificate;

- Military ID plus its full copy;

- Marriage contract (if any) indicating the size of shares. If there is no contract, then you need to notarize the consent of the husband/wife to purchase housing under a mortgage agreement (plus a copy);

- Marriage certificate and, if the serviceman is divorced, then the divorce certificate. If the NIS participant is single, then you need to make a certificate of marital status and have it notarized (plus a copy);

- A copy of the birth certificate of the child (children, if there are several);

- When purchasing a home under a power of attorney, you must provide 2 notarized copies of this power of attorney . You will also need passport and a copy of it.

Stage 3 of preparing military mortgage documents: documents from the seller

When purchasing housing secured under the Military Mortgage program, it is imperative to use the standard form of the preliminary purchase and sale agreement, which is available only on the official website of the Federal State Institution Rosvoenipoteka. Also on this page, military personnel will find samples of other necessary documents:

To complete a transaction for the purchase and sale of an apartment, NIS participants, together with the housing seller, need to prepare the following package of documents:

- ownership of housing (purchase and sale agreement, privatization, exchange, donation, inheritance or others);

- Certificate of state registration of the seller’s right to housing;

- Technical passport and cadastral passport for housing;

- A report on the assessment of the market value of the apartment, compiled in accordance with the law;

- Certificate (with a copy) about the non-emergency condition of housing older than 1970 (not subject to demolition, reconstruction, resettlement, major repairs). The document can be obtained from the municipal property management committee of the locality administration;

- Extract from the Unified State Register of Encumbrances confirming the absence of encumbrances (valid for no longer than 30 days );

- Certificate (with a copy) about the absence of debt for utility and other payments;

- Certificate from the tax office confirming that there are no property tax debts;

- Passport (plus a full copy) of the seller or sellers (when selling shared ownership);

- Certificate (with a copy from a notary) of the seller’s marriage;

- Consent (notarized) of the seller’s wife/husband to sell the home;

- A document from the guardianship authorities authorizing the sale of housing in which minors or other incapacitated persons are registered;

- Certificate of mental health status of the seller (from a mental health clinic and a drug treatment center). It is not required if the seller has a driver's license (plus a copy).

Important:

- In assessing the market value of housing, its value cannot be less than the total amount of CZHZ funds and a bank loan;

- The loan amount from the mortgage loan agreement and in the payment schedule must match;

- The account number for transferring money in the loan agreement and in the bank account agreement must match.

Banks that are partners of the Federal State Institution "Rosvoenipoteka" have their own housing bases for NIS participants. All apartment owners and developers are already aware of what documents they must provide to formalize a purchase and sale agreement with military personnel. If a military man wants to buy another home, he must notify the seller himself about the required package of documents.

Apartment for a family of a military man

After receiving a package of documents, the bank reviews them and makes a decision to issue a loan or refuse.

The final stage: military mortgage and documents for an apartment

If the mortgage is approved, the bank opens an account for the borrower. A copy of the agreement on opening this account, a copy of the preliminary loan agreement, the draft CZHZ agreement and a certificate from the apartment appraiser must be given to the Federal State Institution "Rosvoenipoteka". The organization must transfer the amount of the down payment according to the agreement to the account opened for the borrower.

After receiving the money, the bank settles with the seller, and the serviceman receives a housing purchase and sale agreement. To draw up its final version, you need to collect a loan agreement with the bank, a housing contract and a mortgage for the apartment, an agreement for the services of an agent for state registration, a purchase and sale agreement and an acceptance certificate in 3 copies.

Now the serviceman only has to go through the procedure of state registration of housing in his own name.

NIS

Svetlana Yurina

November 15, 2017

Loans secured by real estate

3 120

Instructions for obtaining a military mortgage

The first thing you should start with is to obtain a Certificate of the right of a participant in the savings-mortgage system to receive a housing loan, which can be issued at the Federal State Institution “Rosvoenzhilye”. It will calculate the conditions for obtaining a loan, which are calculated based on the savings in the personal account, since the funds from it will be used to pay the down payment for the purchased housing. The Certificate also indicates the amount of monthly charges to the account during the validity period of the certificate, as well as the maximum period for which a military mortgage loan can be obtained.

Next, you can start choosing the housing you want to buy , while you are not limited by the area of purchase and can independently look for an option that you will like, regardless of your place of work. The main thing is that the property fits into the loan amount. This amount is constantly growing, so in 2012 it increased by 30%. You can improve the quality of housing by increasing the down payment using your own funds.

Next, you need to select a bank from among the partners of the Agency for Mortgage and Housing Lending in which you want to apply for a mortgage loan. After this is done, you need to prepare a package of documents.

What documents are needed to obtain a military mortgage?

To obtain a military mortgage, it is necessary to interact with the command of a military unit, a bank, a real estate agency, and Rosvoenipoteka. Each of these organizations will require a separate package of documents:

Basic documents for obtaining a loan:

- A loan application form drawn up in accordance with the bank’s requirements.

- Copies of all pages of the passport.

- Certificate of participant of the NIS system.

- The applicant's consent to the processing of personal data (in writing).

Additional documents (for married persons):

- Spouse's passport and copies of all pages.

- Marriage agreement (copy), if available.

- Marriage certificate (copy).

- Consent of the spouse to join the Military Mortgage project, certified by a notary.

- Certificate of divorce (if the applicant was previously married).