Today, purchasing housing in most cases is necessary only for young families. For young people, this issue is relevant, which is associated with the beginning of a family and the birth of children. For such cases, the largest Russian bank offers to use one of the suitable mortgage lending programs that are valid from 2010 to 2020 inclusive. VTB 24 - young family mortgage is a type of loan.

Loans for the purchase of real estate are provided for long terms. A down payment is required. The financial institution offers various mortgage lending programs. This allows you to choose the most suitable option for each family. Mortgages are issued to those married couples who are just starting their family life.

VTB 24 provides a certain amount, and borrowers dispose of funds at their own discretion:

- Purchase of primary or secondary real estate.

- Payment of 10% of the down payment amount.

- Construction of a residential building (you must provide a full estimate).

- Payment of the value of part of the real estate upon the birth of a child.

This type of lending is the most optimal when compared with analogues in the financial market. In order to use this service, borrowers must meet certain criteria, otherwise a mortgage will not be provided.

Mortgage for a young family VTB 24: conditions 2020

Married couples can expect to purchase a home of 42 square meters. When a cell of a society includes more than 3 members, then 18 square meters are added for each of them. m.

Mortgage young family VTB 24 conditions:

- There is a justified reason for the provision of living space (unsuitable living conditions, the need to increase living space).

- One of the family members is under 35 years old.

- Citizenship in the Russian Federation.

A prerequisite is the availability of documentary evidence of solvency and registration in the queue for housing. For example, in order for an application to be approved for a family of 2 people, the income must be at least 23 thousand rubles/month, of 3 members - 32 thousand rubles/month, of 4 - 48 thousand rubles/month.

After receiving the certificate, the borrower must go to a financial institution to assess the value of the apartment. After this, specialists make a decision on the maximum possible loan amount if the client fully meets all the requirements.

Real estate purchased with a mortgage must be insured. This increases the overall cost of the loan. In order to independently calculate your capabilities before contacting the bank, you can first use the VTB mortgage young family calculator to calculate 2020, which is located on the official website of the financial company. Using this service, you can pre-assess your capabilities. To obtain more accurate information, you should contact a specialist from a financial institution.

Program conditions

Parents who had a second child and subsequent children between January 1, 2020 and the end of December 2022 can apply for a primary loan or refinancing.

Look at the same topic: What are the alternatives to mortgages in Russia in [y] year? Overview of all options

Coverage areas: the entire country with the exception of the Far Eastern Federal District. Here the upper limit is the same - December 2022, the lower - January 1, 2020. In the first case, the rate is 6%, in the second - 5%, subject to the conclusion of insurance contracts: illness, accident, property, etc.

Approved amounts:

- Residential premises in the country with the exception of Moscow, St. Petersburg and their regions - no more than 6 million rubles;

- Real estate objects for living in the territories of the above cities and regions - 12 million rubles.

If the borrower refuses to enter into insurance contracts or violates the conditions specified in them, the loan rate may be increased.

List of documents

To apply for a mortgage for a young family in 2020 VTB 24, you must present:

- Application for participation in the program from one of the family members.

- Identity documents.

- Work records of able-bodied family members (certified copies).

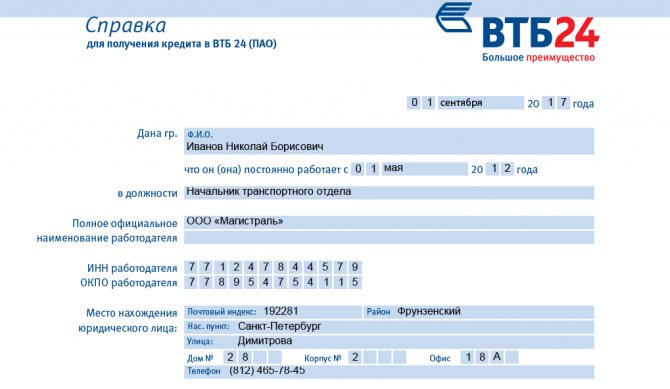

- Income certificates, sample 2NDFL.

- When staying on the condition of social security. hiring, providing documentary evidence.

Before contacting a financial institution with documents to obtain a mortgage, you should inquire in advance about the availability of such an opportunity in the municipality. This is due to the fact that conditions may differ in different regions.

Requirements

Requirements for the borrower. Since VTB does not provide a special product for young families, all families with a second child can take advantage of a mortgage taking into account maternal capital. The standard requirements for obtaining a mortgage loan apply:

- age from 18 years;

- official employment in Russia;

- total work experience of at least one year;

- The place of registration does not have to be in the same city where the housing is purchased.

Required documents. First of all, fill out an application, which can be downloaded on the bank’s website. It must be filled out by hand in block letters or sent online. In addition to the application, provide the following documents:

- Russian passport;

- SNILS (pension insurance certificate);

- TIN;

- certificate confirming income;

- photocopy of work record book or extract;

- military ID (men under 27 years old);

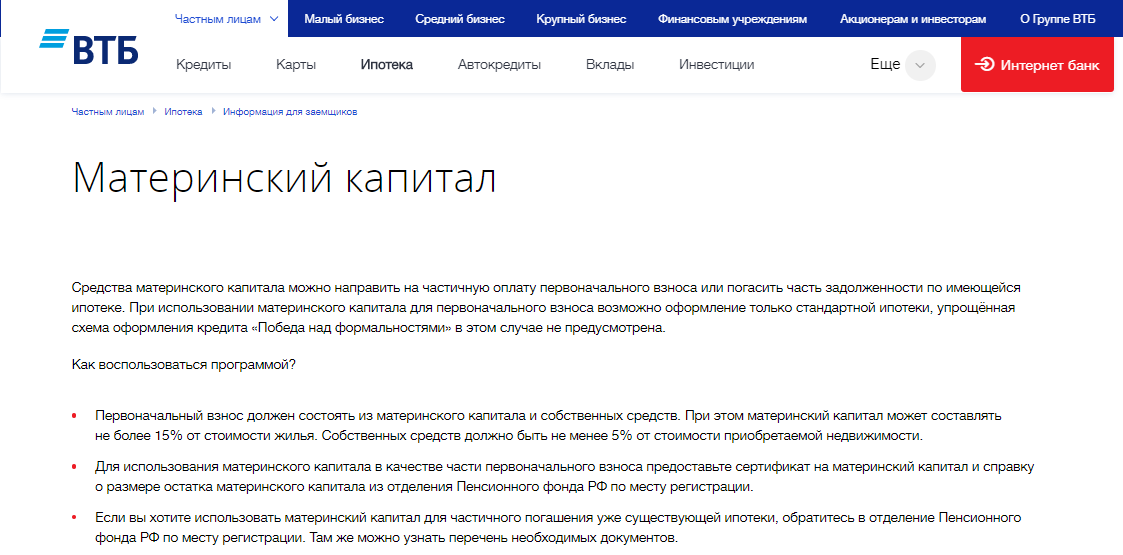

If you plan to use maternity capital, provide the bank with a certificate and a document from the Pension Fund, which will confirm information about the balance of funds. After approval, do not forget to contact the Pension Fund so that the funds from the certificate can be used to pay off the mortgage.

To use a housing certificate under any current government support program, attach it to the package of documents for the bank. Once your application is approved, you can begin searching for suitable real estate.

To confirm income, you can provide a certificate in form 2-NDFL or in the form of a bank. A tax return for the most recent year may also be provided. You can take into account wages from two places of work: main and part-time.

Certificates on the bank form can be found on the official VTB website. Persons participating in the VTB salary project do not need to confirm income. If you attract guarantors to increase the available amount, they also need to provide a full package of the documents listed above.

The bank may ask you to provide additional certificates and documents (about marital status, education, work activity, credit history).

Sample certificate of income according to the bank form.

Features of issuing a mortgage

VTB mortgage for a young family is issued to persons who provide all the necessary documentation. Please note that you need not to miss even the little things by carefully collecting all the necessary papers. Otherwise, you will need to collect additional documents for mortgage lending, which takes quite a lot of time.

The VTB 24 mortgage young family program has the following features:

- Allocation of funds only to persons who have provided confirmation of a permanent income corresponding to the declared level.

- An increase in the queue due to new participants joining the program.

- The amount of mortgage lending does not exceed 30% of the value of the property.

- The maximum mortgage size is 2.2 million rubles.

The terms of the mortgage also stipulate that until the entire debt is paid in full, the spouses will not be the direct owners of the property.

If there are frequent delays in payments, then such a scenario as resolving the rights to the acquired property is considered. It is permissible to rent out an apartment only after concluding an appropriate agreement with the bank.

Advantages and disadvantages of VTB 24

The advantages and disadvantages of obtaining a mortgage at VTB 24 for young families are presented in the table:

| Advantages | Flaws |

| Support for all government programs for young families and the opportunity to use suitable benefits and choose any type of housing. | The collateral remains the theoretical property of the bank until the mortgage debt is fully repaid. |

| Apartments in new buildings are recommended by the state, which means they have a fairly high level of conditions. | Interest payments must be closely monitored. |

| Reduced mortgage interest rates compared to other banks and for other categories of the population. | The assessment and insurance of the collateral is the responsibility of the borrower. |

| Possibility of issuing a long-term mortgage without a down payment. | — |

| Accessibility to bank branches in almost all cities of Russia. | — |

Video on the topic:

Current programs

The financial institution offers clients 3 main mortgage lending programs:

- Maternal capital. The first deposit must be 10%. In this case, the interest rate must be paid at 9.9% per year, while the loan terms vary within 50 years. If a woman is on maternity leave, and the head of the family’s income does not cover mortgage costs, then there is a need to find co-borrowers.

- Government support. In this case, you can purchase an apartment (primary or secondary market) or a share in construction. In 2020, married couples were given the opportunity to get a mortgage at 11% per annum. The down payment is at least 20% of the total amount for periods from 5 to 30 years. You can pay off your loan debt using cash certificates, which greatly simplifies your life.

- Housing certificates. Provides fairly favorable conditions for borrowers. Payments can be made through GHS. The amount varies from 500 thousand rubles. mortgages are issued for terms of up to 50 years at 9.9% per annum. The initial contribution is 10% of the amount. This type of mortgage can only be obtained using certificates that serve as confirmation of participation in the program. The acquired real estate must be included in the list of apartments approved by the construction corporation of the Russian Federation.

Please note that reviews of bank clients who have obtained mortgage loans from VTB confirm the high level of service. The financial institution takes care of each client, providing the most favorable conditions for cooperation. Penalties apply only to those borrowers who do not pay their debt on time.

Mortgage products for young families

The main preferential program is “Mortgage with state support.” According to it, participants receive a reduced rate. The rest of the loans are standard with the possibility of using maternity capital or a housing certificate.

With government support

The state is interested in increasing the birth rate, therefore it allocates part of the budget funds to support families with two or more children. We will describe this program in detail below. VTB Bank’s rate on it is the lowest as of 2020. You can calculate your mortgage on the website using the built-in calculator.

Using maternity capital funds

Maternity capital can be used to partially or fully cover debt or as a down payment, but only in conjunction with your own savings. The amount of the certificate funds should cover no more than 15% of the cost of the object. The minimum amount of your money is at least 10%.

To make an initial contribution, in addition to the standard package of documents, you must provide the bank with a certificate and a certificate from the Pension Fund of the Russian Federation about the amount of funds on it. If partial repayment is planned, submit an application to the Pension Fund.

Mortgage on a housing certificate

The subsidy is targeted assistance. Citizens in need of improved housing conditions can count on receiving it. As in the case of maternal capital, the money can be used to partially cover the debt or used as a down payment (10% for secondary housing, 20% for new construction).

To keep the certificate accounted for, include it with all documents when you apply for your mortgage. The rest of the procedure is no different.

Please note that when using housing construction as a PE, the bank will provide a loan only after paying for part of the purchased apartment with subsidy funds.

Why mortgage programs attract young families

A mortgage is a long-term loan that requires an initial payment of 10-20% of the total amount. Debt repayment can stretch up to several decades with mandatory life insurance of the client and the purchased home.

A mortgage for a young family is good because citizens can not only buy an apartment in a new building with the amount received, but also:

- Invest in the construction of your home;

- Expand your property after having children;

- Buy secondary housing.

Despite the fact that VTB does not offer loans directly aimed at the “young family” category, unlike other credit institutions, in few other banks you can find more suitable conditions in terms of terms and rates. Each client is free to choose what suits him with maximum benefit.