Who inherits property after the death of a spouse?

In the absence of an order from the deceased owner, receipt of inherited property is formalized according to the law (Article 1141 of the Civil Code of the Russian Federation). This option is based on family ties.

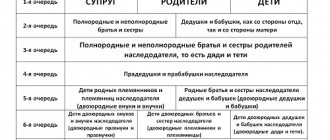

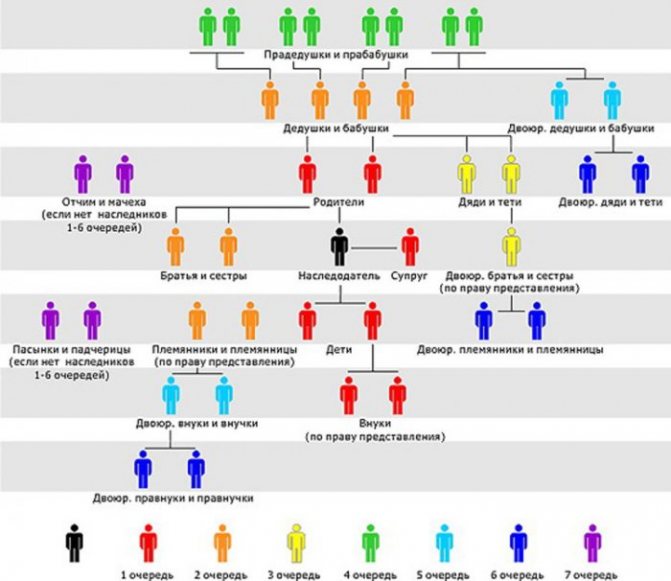

Priority for applicants for a share in the property of a deceased relative

| Queue no. | List of relatives |

| 1 | Biological children, spouse, mother and father |

| 2 | Grandparents, brothers and sisters |

| 3 | Aunts and uncles |

The law provides for 7 stages. The last to inherit are nominal relatives (stepmother, stepfather of the deceased). If they are absent, then the property can be received by the owner’s dependents who are not his relatives.

You can change the established order using a will. The testator has the right to assign his assets to legal heirs or distant relatives. If the order concerns part of the property, then the list of applicants is determined based on the actual circumstances of the case.

The testator can draw up a will and designate a specific heir. The administrative document allows you to exclude any relative from inheriting property. The exceptions are persons who are entitled to a mandatory share in the inheritance:

- disabled parents or dependents;

- young children.

A disabled spouse has similar rights. Therefore, even if the testator assigned all of his property to one or more heirs, the spouse retains the right to an obligatory part. Its size is at least half of the share that is due to the heir by law (Article 1149 of the Civil Code of the Russian Federation).

Who will get the inheritance after the death of the parents (father/mother)?

Heirs of the first stage

The owner of the property can write a will before his death. Sometimes children are not indicated in such documents. As a result, they are left with nothing unless they contest the will.

Meanwhile, the law clearly defined the circle of priority heirs, these are:

- surviving spouse;

- children (including those born out of wedlock);

- parents of the deceased.

Winning an inheritance case in court is very problematic if you do not belong to the category of obligatory heirs.

Mandatory shares

If, according to the will, the rights of the direct heirs were violated, they can be restored.

There is a category of compulsory heirs, these are:

- legal spouses (their age, state of health, time spent in marriage is not taken into account);

- children under 16 or under 18 years of age (pupils, students);

- disabled people of groups 1,2,3;

- pensioners, disabled family members;

- dependents whom the deceased supported for a year (minimum period).

By will

If the testator does not mention compulsory heirs in his will, then they receive only 1/2 of the share that is due to them by law. The document can be challenged.

This challenge to a will should be taken up only when it is possible to prove that the will is the result of pressure on the testator from interested parties.

Rights of the surviving spouse during inheritance

The Family Code divides the property of spouses into personal and joint. The following applies to personal matters (Article 36 of the RF IC):

- premarital property and bank deposits;

- inherited property;

- property received as a gift;

- personal items;

- property rights (copyright).

Property acquired during the marriage is considered joint property. This includes:

- jewelry and luxury items;

- spouses' income;

- property acquired during marriage;

- funds in the accounts, regardless of whose name the deposit is opened.

Consequently, each of them has the right to a share of the common property. The exception is the situation when the spouses have drawn up a marriage contract or an agreement on the allocation of shares in joint property. In this case, inheritance is carried out in accordance with the document.

If such a document is missing, then the general order of inheritance applies. The husband/wife's share is separated from the inheritance mass, and the second half is distributed among the heirs who submitted an application to the notary.

The personal property of a spouse can be bequeathed to him in full. The second spouse has no rights to it. The identified property is divided among the heirs.

Documentation for a notary office

If the entire inheritance of the spouses was indicated in the will, then the marital share can be determined through the court. A person has the right to protect his interests, since only the property of the testator can be indicated in a will. A person cannot indicate the entire list of property, since 50% belongs to the spouses. In such a situation, as a rule, part of the will is revoked.

During the marriage, an apartment was purchased for which two apartments belonging to each of the spouses were sold in turn. The husband's apartment was sold a week before the purchase of the common living space, the wife's apartment only six months later, since the husband's apartment had to be checked out of somewhere before the sale.

The mandatory spousal share of the inheritance is 50%. However, it can be reduced for certain reasons. Inheritance relations between spouses are regulated by the norms of the Civil Code, as well as the Insurance Code. The reduction in the share is prescribed in Article 39 of the Family Code.

The spouse is the primary legal successor and, under certain conditions, the legal holder of a mandatory share of the inheritance. But besides this, he is the owner of a significant part of the property acquired jointly with the testator, which is essential in determining the composition of the inheritance mass and the total amount of assets received by the widower.

The obligatory spousal share can be considered the part of the inheritance to which the legal companion of the testator has the right to claim. It can be obtained either from the personal property of the deceased or from assets acquired jointly during the marriage.

This is important to know: Agreement on termination of shared ownership

I ask you not to allocate the spousal share from the property acquired during the registration of marriage relations with gr.________________ (full name), who died on ______________ (date). I am familiar with the norms of current legislation.

Ilya Vladimirovich contacted our agency. His wife died in a car accident a few months ago. This was her second marriage; from her first marriage she has a 15-year-old daughter. They were married for three years.

In standard order this is:. The only exception to this rule is a concluded marriage contract with other conditions for the allocation of property in various situations. Moreover, there is no difference between the acquirer of property and objects. It doesn’t matter who specifically contributed the money for the purchase or to whom it was registered.

Now let’s change the conditions a little: the wife has died, and her son and husband are claiming her share. In this case, both of them are considered heirs of the first stage. If, before his death, by his decision he deprived the second spouse of the right to inherit his part of the property, he will still receive the obligatory spousal share.

The inheritance opens with the death of the testator, that is, the day of his death is the moment the inheritance is opened, and not the moment when the notary opens (starts) the inheritance case, as many people think. These two concepts should not be confused.

Half of the property acquired during the marriage must go to the widow(er) as the marital share.

The notary who is in charge of the inheritance case can separate the surviving spouse's spousal share from the inherited property and exclude it from the inheritance mass.

The statement of claim has individual characteristics. Unlike a settlement agreement, it is necessary to comply with the requirements of the civil process, otherwise the court has the right to reject acceptance for consideration.

The statement of claim is in the following form:

- In the right-left corner there is a “header”: the name of the court, details of the parties to the lawsuit, the price of the claim.

- Below in the center is the name of the document.

- Statement of information relevant to the case:

Even if the deceased deprived his other half of the inheritance by his last will, the allocation of the obligatory part of the property will still occur.

Rozhdestvensky S.N. Once again on the issue of allocating the “spousal share” // Russian Justice. 2003. N 9. September. Thus, the wife will own her legal half, and with her son they will share in equal shares half of the house belonging to the deceased spouse, that is, the child is entitled to ¼ of the house or apartment.

Heirs of the second and third orders, and even more so heirs of subsequent orders, do not have the right to claim an inheritance in the presence of first-priority heirs, with the exception of the disabled dependents of the testator, who have the right to inherit on an equal basis with the called heirs, regardless of which order of inheritance they themselves belong to.

Since you and your husband were divorced at the time of his death, you are not an heir. You can contact a notary with an application for the allocation of your marital share if any of your husband’s property was acquired by him during his marriage to you. After the death of one of the spouses, according to the provisions of Art. 244 of the Civil Code of the Russian Federation, his share in joint property is subject to allocation for further inheritance.

It is worth distinguishing joint property from personal property, the right to which is assigned exclusively to the spouse indicated in the title documents for it.

This also applies to things for individual use, except for luxury items and jewelry, according to Art. 36 IC RF.

The spouse who legally receives a certificate for half of the property becomes its sole owner. The received objects are not included in the general inheritance mass and are not subject to distribution among successors. This algorithm is preserved in the absence of an application for the allocation of the spouse’s share.

How is property divided upon the death of one of the spouses?

Thus, for inheritance, the volume of property that belongs exclusively to the deceased owner is determined. The spouse's share is not included in the inherited property.

How is the deceased spouse's property divided?

| By will | |

| Second spouse | Share established by the deceased owner |

| Dependents | ½ part of the share provided by law |

| Other heirs | Share established by the deceased owner |

In the absence of a will, the inherited property is divided among all recipients entering into the inheritance in equal shares.

In addition, the law provides for the possibility of heirs to independently divide the inheritance. To do this, you need to draw up an agreement. The document can be certified by a notary. However, if all heirs agree with its terms, then the inherited property is simply re-registered as property in accordance with the terms of the agreement.

If the recipient does not agree with the share that is due to him by law, then he has the right to go to court for the division of the inherited property. To do this, you must file a claim with a judicial authority. If the object of the dispute is an apartment, then the claim is filed at the location of the apartment. The applicant bears the burden of proof, the cost of assessing the property and paying the state fee to the court.

General rules for inheriting property of spouses (including former spouses)

The law establishes the basic principles of inheritance after the death of one of the spouses. Knowledge of basic rules and concepts is required to have a general understanding of such a very complex procedure.

What applies to common and jointly acquired property?

Property acquired during marriage is considered joint property. It makes no difference to which spouse the property is registered or the monetary deposit is opened.

We are talking about citizens who have officially registered their marriage with the civil registry office.

The list of jointly acquired property is indicated in the Family Code of the Russian Federation:

- Income received by spouses from any type of activity (including pensions and benefits).

Lack of income for a good reason during marriage (illness, caring for common children) does not deprive the right to joint property.

- Real estate and movable things that are purchased with funds from income.

Movable property also includes luxury items, that is, everything that is not essential (valuable furs, jewelry, etc.)

- Securities, deposits, shares, shares in capital.

If the actions and investments of one of the spouses have significantly increased the value of the personal property of the other, it is recognized as common property.

What is the significance of the fact of divorce in posthumous division?

The division of property after the death of one of the spouses is required so that the half of the common property due by law does not go to the heirs of the deceased. Additionally, the widow (widower) has the right to count on part of the deceased’s inheritance, which will include his share of the joint property.

If at the time of the death of one of the spouses they were already divorced, the following consequences may occur:

- in the absence of a will in favor of the former spouse, the latter has no right to inherit from the deceased;

- property can be divided between the heirs and the former spouse by drawing up an agreement or in court, if at the time of the death of the testator the property had not been divided and the statute of limitations (3 years) had not expired.

The new marriage of the deceased ex-spouse cannot influence the order of division of joint property.

Who are considered the heirs of the first stage?

If there is no will, first of all the testator’s property is claimed by:

- Children.

All children of the deceased (including officially adopted ones) can count on the property, even if the parents are deprived of their rights or are divorced.

If there is an unborn heir, division of property is possible only after the birth of such a child.

- Spouse.

Inheritance is possible only in the case of an official marriage.

In the event of a divorce, the former spouse cannot claim the estate of the deceased.

- Parents.

They are not deprived of parental rights:

- native father and mother;

- adoptive parents.

Based on the legislation of the Russian Federation, the inheritance mass is divided equally between all the children of the deceased, his wife (husband), and parents.

Children's rights in inheritance

The right to receive the property of a deceased parent is granted to the children of the owner who meet the following conditions:

- information about the parent is included in the children’s documents based on his application or court decision;

- information about the parent is included in the children’s documents if there is a marriage between the mother and father;

- The data was entered on the basis of a court decision on adoption.

Important! All official children of the deceased have equal rights to their father's property. Thus, the inheritance is divided among all children from all marital unions and those born out of wedlock.

The possibility of receiving the property of a deceased parent depends on the presence/absence of a will. If there is a document, the child will receive a share in the property in the following cases if:

- included by the owner in the will;

- has not reached the age of majority;

- is undergoing full-time education and is under 23 years of age;

- has a disability.

In the absence of a will, children inherit property after their parents as first-degree heirs. In the absence of a will, all children of the deceased and his legal spouse will receive equal shares in the property.

Is it possible to increase or decrease the spousal share?

The size of the marital share directly depends on the content and size of the inheritance mass and is exactly half of it. But it can be changed in the following cases:

- The existence of a marriage contract between the testator and the surviving spouse.

- The widow or widower has a minor child in common with the deceased.

- The deceased squandered family property or did not bring income to the family without good reason.

It is important to know that the spousal part of the property rights is also accompanied by responsibilities in the form of repaying the common debts of the husband and wife or debts registered in the name of the testator, but spent on the general needs of the family.

Features of determining the size of the share of the surviving spouse can be traced using the following examples.

Example 1. Before the official marriage, the future husband initiated the conclusion of a marriage contract that defined the scope of his personal income and his wife’s income. According to the agreement, in the event of a divorce or after the death of one of the spouses, the division of joint property will not be carried out due to its absence. The husband and wife will have separate bank accounts and a register of acquisitions. And during pregnancy and childcare, the spouse will contribute funds to support his wife, which will also be recorded.

After the death of her husband, his wife received part of his property under the will. Her personal property remained with her unchanged, just as the material assets of the late spouse did not pass into the widow’s marital share.

Example 2. During the marriage, the duties of the “breadwinner” were performed by the wife. The husband did not take on any other responsibilities. He led an asocial lifestyle: he did not work, abused alcohol, received bank loans to meet his personal needs and took money from his wife to repay them. After three years of marriage, the wife left her husband, but the divorce was not officially filed.

Two years later, the spouse dies and after her the inheritance opens. The widower turns to the notary for the allocation of the marital share and acceptance of the inheritance. The mother of the deceased tries to challenge the legitimacy of his claims and she is only partially successful. The court, based on the testimony of witnesses and material evidence of the absence of a contribution from the surviving spouse to the family budget, refused to receive the spousal share. However, his inheritance rights remained in force (the deceased was not considered in need and did not sue her husband for alimony).

This is important to know: Voluntary abandonment of a land plot in shared ownership

What is inherited, what is included in inheritance

The estate usually includes movable and immovable property. Less commonly, the object of inheritance is the corporate and/or exclusive rights of the testator.

What is inherited:

- Apartment or house.

- Land plot.

- Industrial equipment.

- Vehicle.

- Enterprise securities.

- Bank deposit.

- Jewelry.

- The harvest of any crop.

- Copyright.

Sometimes the object of inheritance is unregistered property. For example, a non-privatized apartment. The inclusion of such property in the inheritance mass occurs by court decision.

You can win the case provided that the testator began privatizing housing during his lifetime.

In addition to property, the obligations of the deceased citizen are inherited. For example, if an apartment or car was purchased on credit. Such property is pledged to the bank until the debt is fully repaid. However, successors in title are not required to accept the property. If the debts exceed the value of the property, then they have the right to refuse the inheritance.

How is the spousal share in common property allocated?

The allocation of the spousal share is guaranteed to the widower (widow) by force of law. However, an indisputable procedure for such a procedure is not always possible.

Voluntary procedure for registration with a notary

When the husband and wife did not draw up agreements regarding their property during the marriage, the latter is considered joint (that is, specific shares in it are not determined). In the event of the death of one of the spouses, the widower or widow has the right to claim a share equal to half of the jointly acquired property.

The allocation of the share of the surviving spouse (including the former) is carried out on the basis of an application submitted to the notary. Actions of a notary:

- allocation of a share from the total inheritance mass;

- recording the consent or refusal of the widower (widow) to accept his share.

Division of property in court if there are disputes

The allocation of the marital share in court may be required, for example, in the following cases:

- lack of documents for the disputed property;

- Missing the deadline for submitting an application to a notary;

- the drafting of a will by the deceased spouse in which the share of the widower is not taken into account.

Such disputes are subject to consideration by district courts:

- at the location of the defendant;

- at the location of the property, if the dispute concerns it.

Documents for the court:

- lawsuit;

- confirmation of payment of state duty;

- Marriage certificate;

- death certificate;

- property papers;

- substantiation of the applicant's arguments.

If the court rules in favor of the surviving spouse, the latter will only have to draw up documents for the property based on the ruling that has entered into force.

The procedure for dividing property in the event of the death of a spouse between heirs

Entering into inheritance for a spouse includes the following steps:

- Identification of a will . The spouse may not know about the existence of the document. Although, as of September 1, 2018, the law provides for the possibility of drawing up a joint will of spouses. Moreover, even when a husband or wife issues a personal order, the second spouse has the right to be present at the notary at the time of signing. If a citizen does not have the information, then it is necessary to contact a notary office to search for the document.

- Submit an application to a notary to enter into an inheritance . Regardless of the basis of the inheritance, the recipient must submit an application to the notary's office to accept/refuse to accept the inheritance. In the absence of a will, the document is drawn up by a notary at the place of last registration of the deceased. If there is an order, the application is submitted to the notary who kept the will.

- Select the marital share . When inheriting without a will, it is advisable for the spouse to submit an application for the allocation of the marital share. The issued certificate will protect the property interests of the citizen. Other heirs will not be able to claim the allocated property.

- Conduct a property assessment. The spouse is required to pay a fee upon entering into an inheritance. To calculate it, it is necessary to evaluate the property of the deceased. The assessment is carried out by public and private organizations. When concluding a contract, it is necessary to clarify the availability of a license for the type of service provided.

- Prepare documents . To register property, it is necessary to prepare title documents for the property, a will or marriage certificate, and children’s documents.

- Obtain a certificate of inheritance rights . The document is issued by a notary 6 months after the death of the owner. If there are no other applicants, the spouse may request the issuance of a certificate earlier than the established deadline.

- Re-register property. A certificate of inheritance rights is a document of title. Based on it, the heir needs to re-register the objects as ownership. Re-registration is necessary for property that is subject to state registration (vehicles, real estate, shares, deposits).

What is the wife's share in the apartment after the death of her husband?

It happens that property (this mainly applies to real estate and vehicles, bank deposits, shares and other securities) is registered in the name of one of the spouses. Let's look at how a share is allocated:

- Option one is when the property is registered in the name of the deceased spouse. In this situation, the “surviving” spouse must contact a notary, who has the right to allocate to him a spousal share in the property and register only the half of the deceased spouse included in the estate as the property of the heirs. This is possible, as a rule, in the case when the “community” of the property is beyond doubt and from the documents presented to the notary, the right of the “surviving” spouse to a share in this property is indisputably discerned. But it also happens that the ex-spouse has to prove his right to a share of property and demand exclusion of “his half” from the inheritance. Documents evidencing the joint acquisition of property must be submitted to the court. The fact of being married can be confirmed by a certificate from the registry office on marriage registration, or a certificate of divorce.

The date of acquisition of property is determined from sales contracts, which always have such a date in the preamble of the contract. As for movable property (for example, household appliances, furniture, television and video equipment, etc.) - the dates of purchase may be indicated in sales receipts and warranty cards. There are no particular problems with proving rights to securities, shares, cash deposits in credit institutions - all the necessary dates are available and stored in the relevant documents in banking institutions or depositories. The heirs of the deceased have the right in court to raise objections to the claims of the former spouse, including on the grounds that the statute of limitations has passed.

Option two: all property is registered in the name of the “surviving” spouse, and the allocation of the “married half” from this property is required by the heirs of the deceased former spouse. In such a situation, the dispute is most often resolved in court. And in this case the heirs will have to prove the “commonality” of the property. The documents submitted to the court are the same as in the first case, which we discussed above.

The former spouse has the right to raise his objections to the “division” of property and the allocation of a “matrimonial” share for the heirs of the deceased. For example, he may claim that the statute of limitations has passed if a sufficiently long period has passed between the divorce and the death of the former spouse.

Whether or not the statute of limitations has been missed is determined directly in court in each specific case. The three-year period established by law begins to run not from the date of divorce, but according to the general rule for calculating the beginning of the limitation period, that is, “from the day when the person learned or should have learned about the violation of his right.”

This is important to know: How to exchange an apartment in shared ownership

In this case, a violation of the spouse’s right to common property may be the commission of administrative actions in relation to this property by one of the spouses (for example, sale or donation). It is also a violation to interfere with the use of common property (for example, a spouse is not allowed to use a common garage or plot of land, or other real estate, and so on).

ATTENTION!

Due to recent changes in legislation, the information in this article may be out of date!

Our lawyer will advise you free of charge - write in the form below.

Time limits for challenging a refusal

If there are conditions that provide grounds for going to court, the failed heir must do this no later than two months from the date of registration of the “renunciation” application with the notary. If such grounds arose later (for example, a relative did not accept the inheritance because he was misled, which became known three months later), the two-month statute of limitations is calculated from the moment when the heir was notified of these circumstances.

Is it possible to accept an inheritance and then refuse it? You can read about it here.