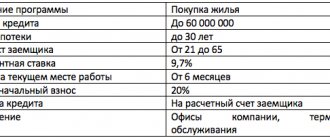

Types of mortgage insurance at VTB 24

Without a special policy, no bank will provide mortgage funds. It is a kind of protection of a financial organization from possible risks associated with non-repayment of funds. In addition, VTB 24 mortgage insurance will also be useful to the borrower, as it can protect against significant costs in the event of damage or destruction of a real estate property. Thanks to it, banks cover their basic costs, and the client receives security guarantees in the event of an insured event.

ATTENTION! Compulsory mortgage insurance may only affect purchased residential real estate. The borrower can voluntarily insure his life or purchase comprehensive services.

There are several types of mortgage insurance available. This:

- Protection of the borrower’s life and loss of his ability to work. It is not a mandatory type, but has a lot of undeniable advantages, such as the use of a reduced mortgage rate, exemption from obligations to compensate debt upon the death of the policyholder, as well as payment of the remaining loan amount in the event of the borrower’s illness or disability.

- Property insurance. It is a prerequisite for obtaining a mortgage. This is a kind of financial protection of a residential property from various cases when natural disasters occur, for example, fires or floods, or the commission of illegal actions leading to damage or loss of property.

- Title insurance. Aimed at preventing the main risks associated with the loss or restriction of the owner’s rights to housing. As a rule, this service is in demand when purchasing residential premises on the secondary market, providing buyers with legal guarantees when making an invalid or illegal transaction.

Is it possible to refuse mortgage insurance at VTB?

Legislation regulating the sphere of credit relationships prohibits a bank from issuing a mortgage if the borrower refuses to purchase an insurance policy that protects property risks. An agreement must be concluded between the buyer and the insurance company, providing protection against loss by the owner of the mortgaged property or damage to it.

In this case, it is possible not to pay for life insurance or restrictions on property rights. If these types of risks are not paid. The responsibility for their occurrence falls on the borrower.

Title protection is required in the first three years after the transaction, after which the statute of limitations period provided for by law expires.

If a client refuses to conclude an agreement on life insurance, then the interest rate on the loan increases. This is due to the compensation of existing risks.

If the borrower has purchased a policy, he has the right to subsequently terminate it due to:

- No payments for the first thirty days. It is canceled automatically.

- The policyholder's request for termination within the first 14 days from the date of signing the agreement.

But before making such a decision, it is necessary to assess the emerging risks to the applicant’s life or his rights as an owner.

BY THE WAY! If you purchase a comprehensive mortgage policy that includes several types of insurance, it cannot be cancelled. It is possible to terminate the contract only if the life and health of the subject or title are protected separately. VTB usually does not conduct a transaction without insuring these risks, so VTB insurance is voluntary and compulsory for all risks.

Is it possible to refuse VTB mortgage insurance?

The Federal Mortgage Law prohibits borrowers from refusing to purchase an insurance policy that protects the risks of their mortgaged property. It is necessary to follow the mandatory principles for issuing a policy. A prerequisite is the procedure for concluding an agreement between the citizen and the insurance company, providing protection in the event of loss of property or damage to the object of the loan agreement.

It is allowed not to pay for life insurance for a mortgage from VTB and protection for situations of loss, restriction of the right of ownership (title). In the absence of this extension in the policy, responsibility is transferred to the shoulders of the borrower. Title protection is considered valid for the first three years of ownership. The statute of limitations subsequently expires.

When a life insurance contract is not concluded, the mortgage interest rate increases. This action is related to risk compensation.

If a person has already taken out insurance, then in accordance with the law, you can terminate the contract in the future:

- Automatic cancellation if there are no payments for the first month (30 days) of the mortgage agreement;

- When applying in the first two weeks (14 days “cooling off period”) after signing the insurance.

All details about refusal of insurance for a VTB 24 loan - refund, sample application.

But first, it is worth assessing the possibility of risks to the borrower’s life or property rights.

Please note: When you sign an insurance policy that includes comprehensive protection, you cannot cancel the contract. This procedure is feasible only for policies that provide protection for a subject or property.

There is no need to sign a policy to protect life and health, as many credit inspectors assure when reviewing applications. The refusal does not affect the quality of the credit history, since the situation described is not indicated in the data submitted to the bureau.

How much does a mortgage insurance policy cost and where can you buy it cheaper in 2020?

The cost of the policy will depend on certain conditions, including:

- the price of the purchased property and its location;

- the amount of the down payment that the client can provide;

- loan amount;

- expert assessment of the property;

- a list of risks that will be included in the agreement.

To evaluate the proposals of the insurance company, you can contact their offices directly. Very often they hold promotions that reduce the cost of popular programs issued when providing a home loan. Among the proposals, the following companies stand out for their cost-effectiveness:

- JSC IC "Alliance" The company offers policies starting from 0.34% of the mortgage amount.

- VTB Insurance. It is one of the leading insurers and offers to make a lump sum insurance premium for 3 or 5 years, but at the same time take advantage of a discount of several thousand rubles.

- VSK. Provides a flexible system for calculating the cost of the policy depending on the age and gender of the client, high-quality service and fast payment of compensation.

IMPORTANT! When selecting an insurance company, you need to pay attention not only to the low cost of the service, but also to the company’s reputation in the market. In the future, if an insured event occurs, compensation may be required to be paid, which must be issued within the time limits established by law.

Cost of insurance for a mortgage at VTB 24

Each borrower has its own price for the policy, since it depends on a number of factors that will be taken into account when calculating the final cost of insurance services.

Insurance rates are distributed as follows:

- financial protection of the property – 0.33%;

- life and health of the applicant – 0.33%;

- deprivation of property rights – 0.33%.

On average, the price of the policy will be 1% of the amount of the mortgage loan, and every year 1% will be charged on the remaining debt.

How much does life and health insurance cost?

When calculating the cost of a life and health insurance policy, the characteristics of the applicant are taken into account. Such indicators as the borrower’s age, weight, gender, lifestyle, social status, place of work, etc. will be considered.

The average price for life and health insurance for a client in the first years will cost about 8,000-15,000 rubles, or 650-1,250 rubles monthly. Over the entire lending period, the total overpayment for the financial protection service will cost 80,000-200,000 rubles.

How much does apartment insurance cost?

To obtain the final price, the features and characteristics of the premises will be taken into account, such as the price of the apartment, the insurance risks covered by the policy, the size of the down payment on the mortgage, the condition of the premises and the territorial location of the residential property.

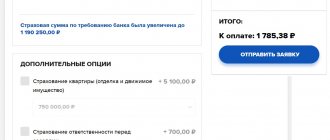

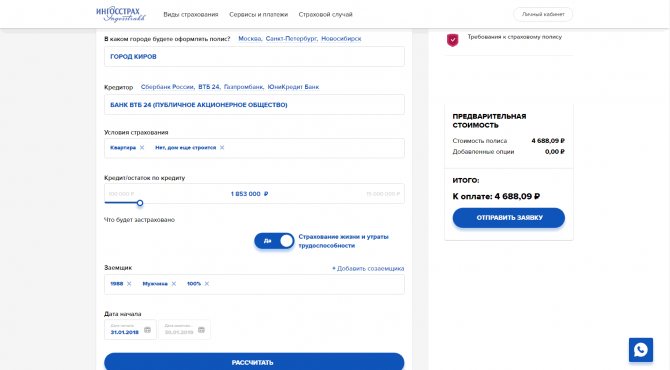

There is no mortgage insurance calculator on the official page of the financial company, but the borrower can use the website of one of the accredited organizations, for example, ingos.ru. Let’s say the principal amount is 1,853,000 rubles, then the cost of the policy will be 4,699.09 rubles.

Online calculator

Internet users can pre-calculate the cost of mortgage insurance before purchasing a policy directly on our portal. To calculate the amount, you need to enter the following data into the calculator form:

- city of insurance;

- name of the banking institution;

- Terms of agreement;

- mortgage loan amount;

- name of the insured property;

- personal information about the borrower;

- insurance situations.

Important point! You can apply for an insurance policy for a VTB mortgage immediately after making the calculation online. The electronic policy can be printed and submitted to the bank.

Registration procedure

The procedure for obtaining an insurance policy consists of the following steps:

- Filing a Mortgage Insurance Application. This can be done by visiting the insurance company office in person or on the VTB 24 website.

- Submission of required papers. The list includes information about real estate to confirm the transaction.

- Conclusion of an insurance agreement.

- Payment for the policy and its receipt.

Important! To submit an application electronically, you will need to make a calculation using a calculator on our website, and then pay for it online. After this, the policy can be printed and submitted to the bank. Typically, the cost of a policy via the Internet is approximately 10-15% cheaper than a similar one in a bank or insurance office.

Sberbank mortgage insurance calculator online

Accessibility is a distinctive feature of the subsidiary of Sberbank PJSC. You can insure your mortgage property at the office of a bank or insurance company. But it’s faster and easier to do it online. The application form is available at:

- Internet resource of the bank;

- official website of Sberbank Insurance;

- DomClick service.

Using the calculator on our website, you can pre-calculate the cost of insurance online.

There are several ways to pay for the policy:

cash at a bank or ATM;

- by card;

- online on the website.

After payment, an electronic copy of the insurance document is sent by email, and the original is sent by registered mail to the address of the insured property.

Required documents

To conclude a contract you will need to bring:

- civil passports of borrowers;

- SNILS;

- a certificate of the person’s income for the last six months;

- work book;

- medical certificate confirming the absence of chronic serious diseases;

- background information on existing debts on financial obligations, including alimony, tax payments, etc.;

- cadastral and technical documentation for the facility, extract from the Unified State Register;

- VTB 24 mortgage agreement.

There are cases when additional documentation may be requested, for example, when the number of owners increases or their age exceeds the permissible limit.

List of accredited insurance companies VTB 24 for mortgages for 2020

A list of accredited companies has been published on the VTB portal. You can take out an insurance policy at one of these institutions.

| No. | Listing date | Name of insurance company |

| 1 | 09/08/2009 | LLC IC "VTB Insurance" |

| 2 | 09/08/2009 | OJSC "AlfaStrakhovanie" |

| 3 | 09/08/2009 | JSC "SOGAZ" |

| 4 | 09/11/2009 | JSC "MAX" |

| 5 | 01.12.2009 | SPJSC "RESO - Guarantee" |

| 6 | 03/29/2010 | Insurance public joint stock company "Ingosstrakh" |

| 7 | 09/07/2009 | Insurance Joint Stock Company "VSK" |

| 8 | 04/25/2014 | Closed Joint Stock Company "Insurance |

| 9 | 09.12.2014 | Public Joint Stock Company "Insurance Joint Stock Company" |

| 10 | 06/05/2017 | JSC "Insurance |

| 11 | 01/01/2018 | LLC "Insurance Company "Surgutneftegaz" |

| 12 | 01/01/2018 | Zetta Insurance LLC |

| 13 | 01/01/2018 | Limited Liability Company "Insurance Company CARDIF" / LLC "SK CARDIF" |

| 14 | 01/01/2018 | Insurance Joint Stock Company ERGO / SAO ERGO |

| 15 | 01/01/2018 | JSC State Insurance / JSC GSK Yugoria |

| 16 | 01/01/2018 | Joint Stock Company "Insurance / JSC "SK PARI" |

| 17 | 01/01/2018 | Insurance LLC / SF Adonis LLC |

| 18 | 01/01/2018 | Renaissance Insurance Group LLC |

| 19 | 01/01/2018 | Liberty Insurance (JSC) |

| 20 | 01/01/2018 | Absolut Insurance LLC |

| 21 | 01/01/2018 | JSC IC "Chulpan" |

| 22 | 01/01/2018 | JSC Tinkoff Insurance |

| 23 | 01/01/2018 | PJSC IC "Rosgosstrakh" |

| 24 25 26 | 01/01/2018 08/24/2018 09/28/2018 | LLC SK Soglasie LLC "SK Ekaterinburg" JSC SG "Spassky Gate" |

Accredited mortgage insurance companies VTB 24

You can obtain mortgage insurance from any of the following institutions. The list approved by the bank includes 19 insurance companies:

- VTB insurance,

- Alfa insurance;

- Sogaz;

- MAX;

- Reso-Garantiya;

- Ingosstrakh;

- VSK;

- Energy guarantor;

- Alliance;

- Surgutneftgaz;

- ERGO;

- Yugoria;

- Zetta insurance;

- Renaissance Insurance;

- BET;

- Liberty;

- Absolute;

- Rosgosstrakh;

- Agreement.

When operating, these insurance companies comply with the requirements of VTB, which has maintained a partnership with them for several years. But this list has been expanded by other insurers, whose policies are accepted by the bank when concluding a mortgage agreement.

Additionally, borrowers can use the services of RSHB-Insurance, Cardiff, Adonis, Chulpan, Tinkoff.

Procedure in the event of an insured event

If a situation occurs under the terms of the insurance agreement, the following steps must be taken:

- It is necessary to minimize the damage as much as possible and report the incident to the appropriate authorities.

- Contact the insurance company via the hotline or call the toll-free number.

- Determine the time for a meeting with a company employee to inspect the property and carry out assessment actions. In this case, you should not touch the damaged object, except in cases of preventing its further destruction.

- Prepare the necessary documentation, including reports from the relevant authorities about the incident, an expert’s opinion on the amount of damage, bank account details, and an application form.

What to do if an insured event occurs

If something that the borrower was insured against does happen, it is necessary to immediately notify both the bank and the insurance company. After all, further communication will take place mainly between them.

After this, the borrower must do everything in his power to save the property or reduce the extent of the damage. If third-party organizations are involved for this, then contracts with them are required, as well as documents confirming expenses.

The borrower needs to ensure that the damage to the property is not intentional. A representative of the insurance company will assess the amount of damage, after which a decision on compensation will be made.