In 2020, my husband and I bought an apartment. We were missing 1.4 million rubles, and that’s what we borrowed from the bank at 10% per annum for eight years. On August 14, the institution transferred the money to the former owners of the apartment. If everything had gone according to the bank’s plan, we would have paid it off in full in August 2026 and overpaid 639.5 thousand rubles.

We made the last payment in October 2020 and overpaid 91.5 thousand - seven times less. At the same time, we did not win the lottery or receive an inheritance, but simply zealously saved, worked hard and calculated everything at every stage. There are many articles on Lifehacker that tell you how to do this, and they work - it’s been tested.

This is not my first text in which I share personal experience, so I will immediately clarify one point. If you divide 1.4 million (and with interest - 1.5 million) by 14 months, you get a fairly large amount. Someone may not finish reading the text, but immediately write in the comments about low salaries in the regions and that half the country lives on 15 thousand per month per family. This is a fair point, but for my husband and I, the primary goal was to pay off the debt, and not to conduct an experiment under conditions that were fair for someone else. Therefore, we proceeded from our own income, which, by the way, was very average. Results of the socio-economic development of St. Petersburg for January-August 2020 for St. Petersburg for St. Petersburg.

Luckily, financial advice is highly scalable. If you are thinking about a mortgage and you have the money for it, these recommendations will suit you. You may not be able to pay off the debt in a year, but you can do it faster if you consider it appropriate.

Decided whether to take out a mortgage

Many people have a negative attitude towards mortgages and believe that it is easier to save up or live in a rented apartment for the rest of their lives, just so as not to fall into “slavery to the bank.” Of course, everyone makes their own choice here. But it’s good when it is based on calculations and supported by common sense, and not just baseless hatred of credit products.

For us, mortgage has become the most profitable strategy. This was clear before purchasing the apartment and became even more obvious after. Here are some thoughts:

- Before buying, we rented an apartment for almost three years for 22 thousand rubles a month and managed to pay 748 thousand. The required monthly mortgage payment was almost the same, which means we didn’t lose anything.

- We could continue to live in a rented apartment and put the down payment money into a deposit. As a result, we would have collected the amount for which we bought the house only after five years. True, there is practically no chance that we would later find a similar apartment for that kind of money.

- The motivation to save and save without a mortgage would be much lower. It’s one thing when you pay off debts, and another thing when you save for the future. This may not apply to you, but it worked great for us.

- In terms of housing, mortgages have greatly improved our quality of life. For 22 thousand rubles we rented housing on the outskirts, although close to the metro. Sleeping areas have their advantages, but for us it was not the best option. With the same mortgage payment, we settled in the center. All your favorite places, establishments, institutions are within walking distance. You practically don’t waste time on the road, and if you do spend it, you walk, and don’t hang on the handrail in the subway.

So for us the decision was obvious.

If you are wondering whether to take out a mortgage, consider all factors, not just material ones. Maybe you live well in a rented room not far from work, and with a mortgage you can afford a one-room apartment, but on the outskirts, and the argument “but you have your own” is an empty phrase for you. How will buying a home affect your quality of life? Will it protect against problems or, on the contrary, create new ones? These are important questions that need to be answered.

Deposit instead of loan

Let's say the borrower has problems at work and expects to be fired in the coming months. The loss of wages will pose a big problem for him to pay his current loan debt. In this case, it is better to put the extra money on deposit in Sberbank than to repay the loan obligations ahead of schedule.

If you save at home in the form of cash, then a person will lose a certain amount monthly on overpayments of interest. For example, the borrower put aside 90,000 rubles at home just in case. Loan rate 12% (1% per month). As a result, a person will overpay monthly by 35,000 * 1% / 100 = 900 rubles.

If these funds are deposited with the bank at 7% per annum, then losses will decrease to 12% -7% = 5% per annum. Based on our example, we get a saving of 900/12*7=525 rubles. Now the losses from storing money will be only 375 rubles.

The described scheme is used by people who are characterized by a high level of self-discipline, long-term life planning and fear of becoming an unscrupulous borrower. If the risk of losing income disappears, then you can withdraw money from the deposit and pay off the loan debt in full.

Monitored the actions of the bank

Once you sign a loan agreement, both you and the bank will be bound by its terms. Therefore, in order not to get into a disadvantageous position, you need to follow literally every step of the credit manager and every line in the documents.

Of course, before you decide to enter into an alliance with any financial institution, you need to compare all offers on the market, reading every letter. Let's say one bank issues a mortgage loan at 9.5%, and another at 10.5%. It seems that the choice is obvious. But it turns out that the interest rate in the first bank is valid only when taking out title insurance for the transaction. In the end, a higher percentage may be more profitable.

Our house was built in 1904, so the choice of banks was small: most often, mortgages are issued for apartments in buildings no earlier than the 60s–70s. The list was reduced to one institution, but there were still enough problems there.

In short, initially we were considered an unreasonably high rate, although we collected the entire package of documents. I had to fight back every half a percent. As a result, the manager still managed to ignore the 2‑NDFL certificate, although the fact that it was attached was easily confirmed thanks to electronic document management. However, we no longer had time to make a scandal: the deal was scheduled for tomorrow, so we had to stop at 10% instead of 9.5%. Initially, they were talking about a figure close to 12% (yes, in 2020).

So keep in mind: the percentage that the bank has previously calculated for your mortgage is not necessarily final. You can fight for it.

Find out if there are special conditions and what documents need to be submitted to influence the percentage. And carefully read the papers you sign. For example, we were given the wrong date for the purchase and sale transaction in the contract and made several minor errors, but we managed to catch them in time.

Types of payments

Different banks use different types of interest calculations, and, as a result, different monthly payments. Somewhere they use the annuity method of calculating interest, and somewhere else they use a differentiated method. When repaying your mortgage debt with Sberbank ahead of schedule, you need to take this fact into account. You can find out the type of your payments in the agreement or accompanying papers.

Annuity

With the annuity method of calculating interest, the amount of monthly payments is the same, and interest is accrued mainly in the first half of the loan term. Then they decline and most of the payment is made up of repayment of the loan principal. For banks, this method is more convenient and profitable, since at first the client pays more interest, and the principal debt remains practically unchanged. In this case, it is beneficial for borrowers to repay the loan early, in full or partially ahead of schedule, in order to avoid overpaying interest.

Differentiated

In this case, interest is distributed evenly across all monthly payments. If the client deposits a larger amount, then the interest and subsequent monthly payments are reduced. Repaying a mortgage loan with differentiated payments is equally beneficial for the borrower at any stage. With a large payment, both the principal debt and the interest on it are repaid at once, which leads to a reduction in the overpayment on subsequent payments.

Chose the optimal payment

Our monthly payment was 21,243 rubles. We could have contributed more, but we settled on this figure as the most comfortable one. We paid almost the same amount - 22 thousand rubles - for a rented apartment, which means that these expenses would have been easy for us. If one of us lost our job, the other's income would be enough for a mortgage and food. So we simply insured ourselves in case of force majeure.

The thesis about the need to choose a comfortable payment would be excellent to illustrate with a real-life situation. Fortunately, this didn’t happen during the year. Over a longer period of time, 8, 10, 15 years, this will be very useful.

Be sure to take care of safety. Comfortable payment, reserve fund, insurance in case of death or disability - these are important things. You don’t want to think about them when everything is fine. But if one day the situation changes, then you will not regret that you foresaw this.

Step-by-step scheme for early closure of a mortgage at Sberbank

The step-by-step scheme for early closure of a mortgage loan consists of the following steps:

- Making the final payment to repay the entire principal balance. The borrower is required to be attentive: the money must be paid down to the penny (the main thing is not less than necessary). It would also be a good idea to check your credit account after writing off a large amount;

- Upon closing the account, you need to check with Sberbank: is it necessary to write an application and, if so, do so. At the same stage, a certificate is taken confirming the absence of debt and its full repayment. It is recommended to keep it for 3 years (to avoid disputes with the bank). The same applies to all other mortgage documents;

- Applying to Rosreestr to remove the encumbrance from the collateral. You need to pay a state fee and take a mortgage from Sberbank. As a result, the former borrower will receive a certificate from the register confirming the absence of debt (previously, a Certificate of State Registration was issued without a note on the pledge);

- After the second stage, you can go to the insurance company to cancel the insurance policy. The client will be refunded the balance of funds for the unused insurance period (most often the policy is issued for 1 year). Unless, of course, the early repayment coincides with the expiration of the insurance.

Only after going through all these stages can the client “exhale calmly” and become a full-fledged homeowner. A competent and thoughtful approach to early repayment of a mortgage will ensure the borrower has a painless loan repayment.

Chose a strategy to pay off your mortgage early

Good intentions to repay the loan as quickly as possible are not enough—you need a plan. Even several are better. Firstly, it will help you evaluate what you are actually going to work so hard for. When you see the amounts saved on interest and the shortened time frame, motivation is much higher. Secondly, calculations will show how hard it is worth pushing on the path to early repayment.

We were going to pay early every month and reduce the payment amount. But at the same time, the difference between the down payment and the current one would also go toward paying off the mortgage. In fact, for us the payment would still remain fixed. Next, I made two plans (they are both in Google Sheets):

- The monthly payment amount is 21,243 rubles plus 20 thousand. In this case, we would pay off the mortgage in 3 years and 6 months with an overpayment of 253 thousand.

- The monthly payment amount is 21,243 rubles plus 40 thousand. We would have paid off the loan in 2 years and 2 months with an overpayment of 169 thousand.

Such calculations show everything clearly: when you pay, how much you will save. Even if you cannot make advance payments every month and plan to do it once a quarter, a year, the numbers will put everything in its place.

Separately, it is worth noting the small difference between these two plans - just over a year and 84 thousand rubles. And if 20 thousand really radically changes the situation, then at 40 thousand the changes are not so impressive. At the same time, 20 thousand per month (the difference between these two strategies) is a lot of money that can provide a higher standard of living.

If, in any case, a mortgage takes several years, it is better to choose a more gentle option and live fully than to tighten your belt for many, many months.

It is worth choosing the path of total deprivation and restrictions only if we are talking about a very short distance. Or if you came up with a beautiful title for yourself, “How I paid off an eight-year mortgage in a year and a half,” like I did.

In fact, it turned out even faster, and this is how it all turned out. In the first month, we gave away ahead of schedule everything that we had left after the transaction from what was allocated just in case. Then they paid regularly for three months according to the second plan. And then I sat down and drew up a third schedule, in which I calculated ahead of schedule the maximum amounts that we could give away without dying of hunger. This is what we stuck to until the very end, making adjustments along the way.

How to pay off a mortgage faster if payments are annuity?

Sberbank does not please borrowers with its choice of mortgage repayment schemes, offering only an annuity repayment scheme. But this is not the worst option if you skillfully use all the opportunities provided.

If you repay your mortgage early at Sberbank, the loan term does not change, but the monthly payment amount is recalculated.

Example. Mortgage loan amount - 450,000 rubles, rate - 12.4% per annum, term - 1 year, extraordinary payment - 40,000 rubles. Repayment options with and without early repayment are shown in the graphs below.

The example shows that early repayment reduced the total amount of interest by 1247.80 rubles. The loan term has not changed, but after the extraordinary payment the required annuity amount has decreased from 40,066.21 rubles to 31,790.64 rubles.

It is clearly seen that paying the next payment is always profitable. Regular early repayment sharply reduces the amount of the monthly planned contribution, which actually makes each subsequent payment early. In such a situation, it will be convenient for the borrower to pay payments from his card without visiting a branch and without filling out an application form for early repayment of the loan each time.

They paid the mortgage with fanaticism

There is no secret here. To free up more money, you need to:

- earn more;

- spend less.

Both strategies were used.

How we made money

Most banks issue a mortgage if the borrower has been working in his last job for more than four months, so that there is confidence that he has passed the probationary period. Therefore, we simply waited until the agreement was signed. Within a month after this, the husband took another job and increased his income by 1.5 times. There are certain risks here: if you are not confident in your abilities, you may be left without work during the probationary period. Therefore, it is important to adequately understand your value in the labor market. My husband had several proposals at the same time, and they kept coming periodically all this time, so we weren’t worried about it.

Since I was a student, the strategy hasn’t let me down: if you feel like you don’t have enough money, start working more.

Over the years, I have become wiser and realized that ideally one should not work more, but get more for the same amount of work done, but that’s how it works out.

I cooperate with several companies, some pay me fixed amounts, others on an itemized basis. So in my case, both strategies are effective - work more and get more. So I wrote a lot, talked to experts, did interviews, read research and documentation, and then wrote again - including at night and on weekends.

If you are worried about how your husband will be without my care, then there is no need. He was also at work: he heroically transcribed the interview for me, looked for and cut out pictures, cut gifs - in general, he helped in any way he could.

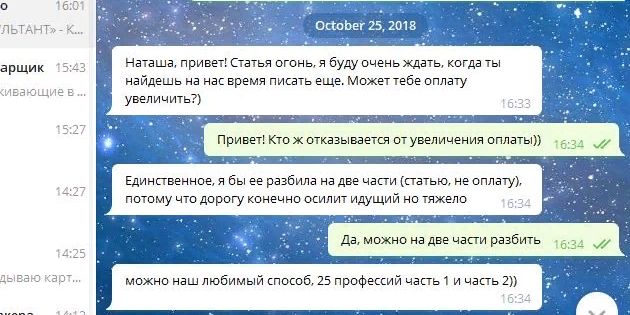

In the process, we had to abandon lower-paying projects in favor of higher-paying ones in order to work not only a lot, but also effectively. Although sometimes miracles happened and the customers themselves offered more.

So if you work hard and diligently, it will be rewarded. If not, try working hard and hard for someone else.

How we spent

For all the remaining months, I gave away every penny of my salary, and “to the penny” is not a metaphorical expression here. The husband initially had only the amount of the mandatory payment, but then he increased his contribution.

For several months we tried to live on 18 thousand, but it was really sad, so we increased our expenses to 22 thousand. We used them to eat, travel on public transport, buy household chemicals, and have fun. The last item of expenditure was hit the hardest. Before the mortgage, we went to the theater at least once a month, and often went to the cinema or museum, or to festivals. We visited the theater twice this year. But they began to go to cinemas more often for cheap morning shows. We didn’t buy clothes (and I also didn’t buy cosmetics) for almost the entire year, with the exception of a short shopping break (I wrote about this in detail).

We decided to save wisely on food, because it is one of our basic needs. You still can’t make millions out of this, but it’s easy to make life unbearable. Let’s say, I wasn’t ready to give up cucumbers, even if we are talking about January cotton ones.

All this was more unusual than terrible.

And here again it’s worth returning to the conversation that was at the beginning. Probably, in the opinion of a family living on 15 thousand, we were even chic. But compared to our usual way of life, it was a bit difficult. It’s difficult to explain to yourself why you can’t buy some crap for 100 rubles, although it’s obvious what you’re fighting for (for a beautiful headline, as we understood above).

And here we get to the main thing: 100 rubles. They really make a difference if you want to pay off your loan faster. Literally every thing you don't buy is important. There is no expense item within which you can mindlessly rush to the checkout. Each potential acquisition must be assessed three times: is it really necessary? It infuriates, frustrates, confuses. But the result is worth it, even without any headlines.

Other ways to pay off your mortgage quickly

If the client does not have enough money to pay off the mortgage early, then he can use other ways to quickly pay off his home loan. These include reducing the size of monthly payments, reducing the loan period and receiving support from the state. Let's look at each of these methods in more detail. All of them are quite real and help to achieve good results.

Reduced payment amount

To pay off your mortgage profitably, you can reduce the size of your payments. This can be done as part of restructuring. This is a procedure by which you can change the parameters of an existing loan. The reduction in monthly payments will occur due to an increase in the loan term. Keep in mind that this action will ultimately result in you overpaying more than originally expected. But the payment will be more convenient if it was difficult for the borrower to pay it off.

Reducing the loan term

This procedure can also be carried out as part of a mortgage restructuring. It is the complete opposite of the previous option. Here, the monthly payment increases due to a decrease in the loan term. Overpayment, accordingly, is also reduced. The interest rate here remains unchanged.

All unexpected money was given to pay off the mortgage

Finally, we come to the point that will reveal all the cards: we are not so great. We paid off approximately 150 thousand mortgages thanks to gifts. With the exception of the money allocated for the purchase of clothes in the spring, we deposited everything that was transferred and transferred to us on our birthdays, New Year and gender holidays into the mortgage account. Tax deductions went there too.

And this is also an important point. You weren't counting on the random money anyway, so spend it on your mortgage, it won't cost you anything.

conclusions

To pay off your mortgage quickly, have a repayment strategy in place before you go to the bank. Weigh all your options, assess your financial situation and consider any available ways to earn extra income.

Ideally, the step-by-step diagram should be like this:

- Save up funds for a down payment.

- Find great deals from lenders with the lowest interest rates.

- Use all available social programs and subsidies, including maternity capital.

- Choose a loan program with a shorter repayment period.

- Maintain your family budget economically.

- Follow the 10% principle - set aside a tenth of each salary to accumulate an amount for early repayment.

- Consider possible options for part-time work.

- Find a better-paying day job or develop professional skills for a promotion.

- Monetize your hobby - bake cakes to order, sew, knit, sell handmade souvenirs through social networks, create and promote websites, etc.

- Rent out your home if it is not your only one. Another option is to rent out one room or half of the house.

- Monitor the lending market to find better offers to refinance your current loan.

- File a tax deduction and use the funds received to close the mortgage.

Follow this plan to get rid of your mortgage as quickly as possible. But don’t get hung up on this goal, and don’t cut yourself off in everything, act wisely and thoughtfully.

Draw conclusions

One mortgage didn’t scare us; in the future we want to take out a second one one day. During the break between loans, we think this:

- The reputation of mortgages is much worse than itself. Jokes about the Doshirak diet and the like also work to create a negative image. We joked that way ourselves. But this is practically not true.

- To prevent jokes about a pre-pregnancy diet from becoming a reality, you need to calculate everything in advance and take care of financial security. There can be no “maybe” or “oh well” here.

- You should focus on earning more rather than saving.

- Over long distances, it is necessary to maintain a normal lifestyle, including going on vacation and having fun. Because money can be earned, but time can no longer be earned.

Basic conditions for early payments at Sberbank

- To close your mortgage early, be sure to notify your lender of your intention 30 days before making the payment. To write a corresponding application, visit the bank branch where you signed the mortgage agreement.

- You can pay off your mortgage early immediately after you have signed the contract.

- You can make early contributions - in such cases the bank does not charge a commission.

- The agreement specifies the amount for the minimum mortgage payment. As for the maximum amount, it is not set, which means that you can pay off the debt in a single payment.

To calculate your mortgage payments yourself, read our mini-instructions.

Full early repayment

To pay off your mortgage loan in full, you must:

- Contact a bank specialist and ask him for instructions on what you should follow. You must have a loan agreement and a passport with you.

- Find out the exact amount that needs to be paid to fully repay the loan - you can do this by calling the contact center or by visiting a bank branch.

- Pay the entire amount in a single payment (it must completely cover the amount of debt) - this must be done before the next payment date.

- Go to your bank branch and close your credit account.

- Request that the bank employee give you a certificate stating that there is no mortgage debt. This is necessary in order to avoid charges and delays in the future that may arise due to a few kopecks not paid by you.

Partial early repayment

To pay off your mortgage early, increase your regular payment amount each month. At the branch you can write the appropriate application, and only then deposit money into the cash register. The lender will take this document into account and prepare a new mortgage payment schedule for you. The new conditions will provide for either a reduction in the monthly payment amount or a shortening of the loan term. You may wish to use the loan refinancing service. It will allow you to reduce your existing credit load, which will lead to quick loan repayment.