Main features of providing mortgages by Sberbank

As a bank included in the Top 10 Russian banking organizations in terms of assets and reliability, Sberbank provides clients with a variety of mortgage products.

At Sberbank you can get a mortgage for:

- Housing construction;

- Purchase of finished housing;

- Individual construction of a residential building;

- Construction of a wooden residential building (in Moscow, Moscow and Lipetsk regions);

- Construction of a country house.

Sberbank provides mortgage loans under preferential lending programs with government support, making it possible to implement Maternity Capital as part of improving housing conditions. He is one of the few Russian banks that are ready to issue non-targeted loans secured by real estate (i.e., practicing mortgages by virtue of an agreement).

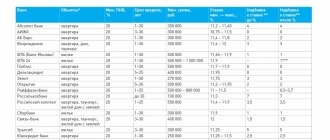

Sberbank interest rates on mortgages today

Most of Sberbank's mortgage products are characterized by favorable interest rates, ongoing discounts, promotions and special offers from the lender's leading partners. The level of loan rates for mortgage programs is presented in the table below.

| Programs | Maximum amount, thousand rubles. | Bid, % | Duration, years | Down payment | Note |

| Ready housing | 15 000 | 9,2 | 30 | 15 | +0.3% if PV is from 15-20%, + 0.5% if there is no Sberbank salary card, + 1% if insurance is refused; +0.6% on a mortgage according to two documents: + 0.3% if you refuse to purchase an apartment through the domclick website; Young family promotion - base rate 8.8% |

| Construction | up to 85% of the property value | 9,3 | 30 | 15 | +0.3% if PV is from 15-20%, + 0.5% if there is no Sberbank salary card, + 1% if insurance is refused; +0.5% on mortgages according to two documents: |

| Construction of a residential building | up to 75% of the value of the collateral | 10 | 30 | 25 | +0.5% if the borrower does not receive salary on a Sberbank card; +1% in the absence of a life insurance policy; +1% if the mortgage is issued after registration of the property with the Rosreestr authorities |

| country estate | up to 75% of the value of the collateral | 9,5 | 30 | 25 | +0.5% if the borrower does not receive salary on a Sberbank card; +1% in the absence of a life insurance policy; +1% if the mortgage is issued after registration of the property with the Rosreestr authorities |

| Military mortgage | 2 502 | 9,2 | 20 | 20 | |

| Non-targeted loan secured by real estate | up to 60% of the cost | 11,6 | 20 | + 0.5% - if not a salary employee; + 1% - if you refuse life insurance. | |

| Mortgage for garage and parking space | 10 | 30 | 25 | + 0.5% if not a salary project, + 1% if insurance is refused. | |

| Family mortgage | up to 6 million in the regions and up to 12 million in Moscow, Moscow Region, St. Petersburg and Leningrad Region. | 5 | 30 | 20 | |

| Mortgage refinancing | 9,5 | 30 | |||

| Promotion “Your turnkey home” | up to 8,000,000 ₽ for properties in Moscow and the Moscow region up to 5,000,000 ₽ for properties in the Lipetsk region | 10,9 | 30 | 20 | Before registering a mortgage, the rate is 12.9% |

The table shows that the minimum interest (from 8.5) can be obtained as part of the program for purchasing housing in new buildings taking into account government subsidies, in individual residential complexes from Sberbank partner developers, or by obtaining a family mortgage.

The following surcharges may apply to base rates:

- +0.5 p.p. – for clients who do not receive their salary to a Sberbank account/card;

- + 0.2 p.p. — for a mortgage payment of less than 20%;

- + 0.3 p.p. — for refusing the “Showcase” campaign;

- +1 p.p. – when taking out only property insurance;

- +1 p.p. – until the property is encumbered in favor of the bank.

- Moscow

- For private clients

- Loans

- Samples of filling out the Questionnaire

© 1997—2019 PJSC Sberbank.

General license for banking operations dated August 11, 2020. Registration number - 1481.

Features of the questionnaire in Sberbank

The application form for obtaining a mortgage at Sberbank has a single form, regardless of which mortgage program the client has chosen.

The application form includes seven pages, six of which (p. 1-5.1) are filled out by the borrower, and the seventh (p. 6) is used to put official marks on the application form and is filled out by bank employees.

Another important feature of the application form for a home loan at Sberbank is the requirement for the person filling it out to provide detailed information. So, when filling out the fields relating to the personal data of a potential borrower, it is necessary to indicate in them his family connections, and when submitting information about employment, you must indicate:

- Organizational and legal form of the employing organization;

- Approximate total number of employees;

- TIN of the organization;

- Type of activity of the employing organization;

- The applicant's length of service there;

- The applicant's total work experience;

- Monthly income and expenses.

All these details are necessary for the bank to get a complete picture of the borrower’s personality and financial solvency.

Sberbank mortgage application form 2020

Sberbank's mortgage application form is characterized by the following criteria:

- reliability and relevance of the information filled in;

- accuracy regarding the parameters of the requested loan;

- honesty on the part of the client;

- willingness to provide information about the employer and immediate family.

Each client applying for a mortgage fills out a unique form consisting of several blocks. You can receive the form in two ways: print it yourself from the official Sberbank website or contact the nearest service office.

Let's look at a sample form and an example of filling it out in detail.

Download a blank form in Word

The application form for a Sberbank mortgage in Word format allows you to fill out the required data and, if necessary, make prompt adjustments.

You can download a blank form from this link.

Sample and example of filling

The application form for a Sberbank mortgage is filled out:

- with your own hand with a blue/black pen – carefully, without errors or corrections;

- in printed format.

The borrower will need to indicate:

- personal data (full name (if changing surname, indicate the previous surname and reason), date of birth, TIN);

- passport information;

- Family status;

- contacts (current phone number);

- education;

- registration address (there must be a corresponding mark in the passport) + actual location address;

- information about the work (name of the employing company, its details, number of employees, type of activity, position, length of service);

- level of monthly income and expenses (both documented and unofficial income of the client are indicated);

- information about the client’s own property (real estate, transport);

- information about the requested loan (amount, term, purpose of lending, parameters of a potential property, availability of special conditions/promotions, cost of housing, method of issuing a loan);

- SNILS;

- presence/absence of a salary card or other Sberbank accounts.

IMPORTANT! It is recommended to indicate in the application the amount of the loan (mortgage) that is slightly more than required, since there is a tendency for it to decrease slightly after approval of the mortgage application by Sberbank.

After filling out, the client puts the date, his signature and agrees to the processing of personal data.

NOTE! It is possible for a third party to fill out the form with the consent of the potential borrower, but the signature must be affixed exclusively by the client himself.

In order to avoid mistakes, typos and not get confused when filling out a rather lengthy application, you should carefully study the sample application form and all the available nuances.

You can download the completed application form here.

Sample form

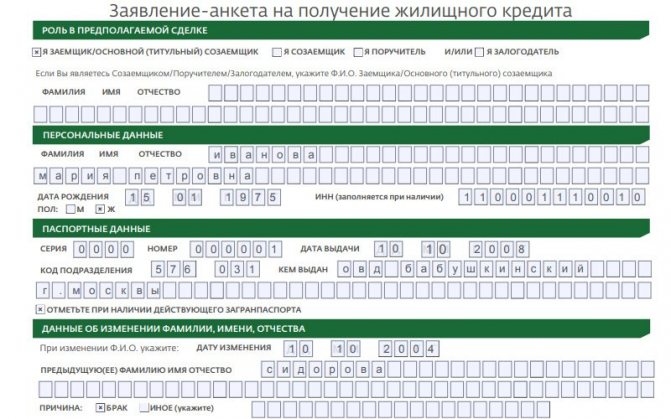

Page 1 of the questionnaire includes information about the applicant’s role in the proposed transaction, personal and passport data, information about the applicant’s marital status, changes in his last name, first name, patronymic and contact information.

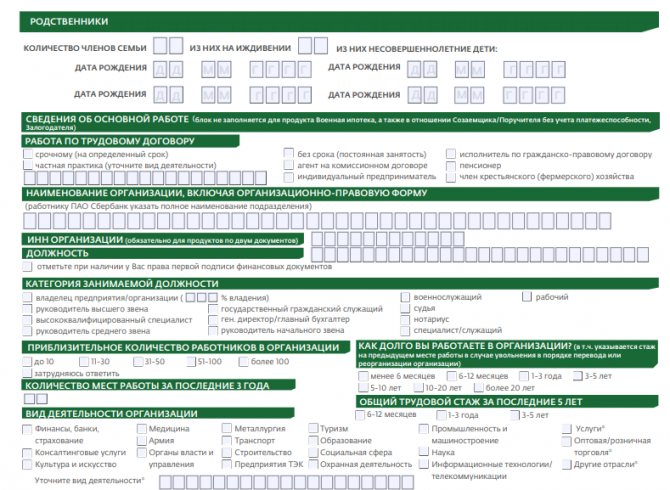

On page 2 of the application form, you are required to provide information about the applicant’s relatives, the nature of his employment and his existing assets.

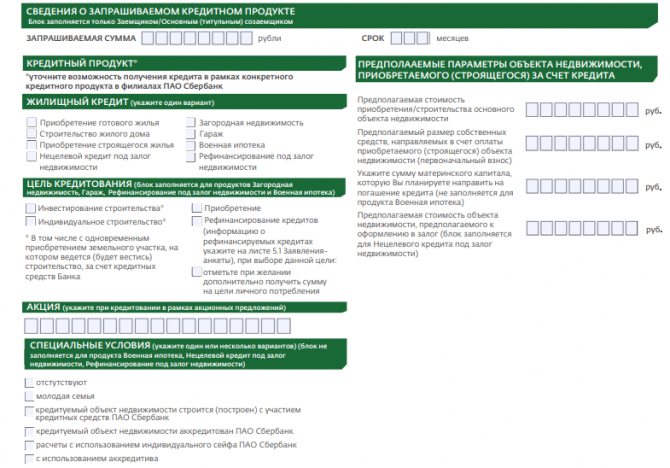

Page 3 is devoted to information about the requested loan product: the required amount, the mortgage program, the nature of the collateral, preferential lending conditions.

Since banks often underestimate the loan amount compared to the planned one, you can try to slightly overestimate it when filling out the application form.

Additional page 5.1 is filled out only when refinancing is secured by real estate and contains information about loans previously taken from Sberbank or third-party banks that are subject to refinancing.

Sample of filling out a mortgage application form at Sberbank

The application form for obtaining a mortgage contains 6 A4 pages and consists of several sections. Conventionally, they can be divided into:

- Personal data, starting from full name and ending with data of immediate relatives;

- Information about the financial condition of the borrower (indicate place of work, income level, availability of property);

- Information about the requested loan (how much you need, for how long);

- Block of consent to the processing of personal data.

Sample form

filling out a loan application form

In order to write an application correctly and not get confused when answering this or that question, study in advance the sample form, which can be downloaded on our website, and the main points of what and how to indicate. Also, carefully read the tips written in small print to avoid mistakes.

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

- Role in the proposed transaction. If you are the borrower yourself, check the appropriate box in the left column. There is no need to fill in your full name in the right column; other participants in the transaction (co-borrowers, guarantors) must write their data there. There is a separate column for your data.

- Personal Information. Here indicate your full name, date and place of birth. Please note that the place of birth must be written as indicated in the passport.

IMPORTANT: If you do not have a TIN, it is advisable to first create one so that you have a number, since this is an important document that is used to verify you through the tax authorities.

- Fill out your passport information carefully and without errors, especially the name of the authority that issued the document. If you have a valid foreign passport, check the box next to it.

- Data on changes in full name are important, as they allow you to check a person’s credit history or criminal record before changing their last name. Therefore, be sure to indicate your previous full name, if you changed it, as well as the reason for the change (most often it is marriage).

- Contact information is telephone numbers where you can be reached. The more you include, the better. You will look like an honest borrower in the eyes of the bank if you provide many ways to communicate, because phone numbers may change, get lost, be transferred to third parties, or become unavailable.

IMPORTANT: Having landline phone numbers significantly increases your chances of success.

- Addresses. The application form requires full indication of the addresses of actual residence, registration or temporary registration. The very first and most important thing is the permanent registration address. Before you start applying for a mortgage, you must take care of its availability. If the place of actual residence coincides with the registration address, then this block does not need to be filled in. You just need to indicate the timing of how long you live in a particular place. If you have a temporary registration, then an important point is its validity period, since a mortgage loan is issued only until it expires.

- Education and marital status are indicated by ticking the appropriate box. If there is a marriage contract, we note its existence. You also need to indicate whether you have children.

- The “Relatives” section has more significance than it seems at first glance. Here you do not need to indicate the details of all relatives, but the closest ones are required. If you are married, then your spouse’s details must be entered, since he or she is automatically a co-borrower in this transaction (in the absence of a marriage contract). If you have children, you must indicate their details without hiding the number of children. The presence or absence of a child is an important criterion when making a decision by the bank. For example, if there are many children, then the income should be significant. Or another case: a young family who does not yet have children applies for a mortgage. In this case, the bank considers them as risky clients for itself, since there is a high probability of having a child, which means an increase in expenses. In addition, such clients will probably ask for a deferment on their mortgage, since they have a legal right to do so. If the family already has one or two children, then the situation is likely to remain stable throughout the loan repayment period. In addition to children, the questionnaire must indicate the details of parents or adult sisters and brothers.

- Information about the main work. Here you will need to indicate the details of the company where you are currently employed. Fill out the information as detailed and accurately as possible. If you don’t know something (for example, the organization’s tax identification number, the exact name of your company, how many people work here), clarify this in advance. Fill out information about how long you have been working at your current place, how many times you have changed jobs over the past three years and your total length of service as accurately and truthfully as possible, since the bank will still check and verify this data.

- The monthly income section is the main section, because it is based on the specified data that the bank will judge your solvency. The main point is the amount of income, which you can officially confirm (this could be a personal income tax certificate from your place of work, an extract from a salary card, a statement of receipts to a bank account, etc.). If you have personal other sources of income, feel free to indicate them, but do not exaggerate their size. Write it as it is. If not, leave the field blank. Filling out the “recurring expenses” field may cause some difficulties. Here you need to be as honest as possible, and first of all with yourself, because you will then pay the monthly loan fee and manage the remaining amount of your monthly income. If a mortgage is purchased for a young couple or family, indicate the amount of your monthly expenses. The calculation needs to include payment for renting an apartment, rent, payment for telephone, Internet, school or kindergarten, and so on. This does not take into account taxes, current loan payments (the bank will check them itself), and expenses for food, clothing, etc. If you are purchasing a mortgage for yourself and live with your parents, you must indicate your share in the periodic expenses column. In the “family income” column, indicate the total amount of monthly income, taking into account all sources. You need to write a reasonable amount (we take into account all sources of official and unofficial income of all family members), avoiding inadequate exaggerations.

- Information about existing property. Based on the data specified in this column, bank employees will analyze your overall financial condition and solvency (after all, maintaining property sometimes requires a lot of money). In addition, property can to some extent act as a guarantor for the repayment of borrowed funds.

- A block confirming your consent to the processing of personal data. Here, having studied everything that is written in small print, you need to put your signature. According to the law, a citizen has the right to give or not give his consent to a data check regarding himself. But in this case, you will have to sign your consent in any case, because without verification the bank will not issue you a loan. But before you sign, you must know what you are agreeing to. The last section is information about the loan you are requesting. Here you indicate the amount and term of the loan.

- in the “Additional information” section you must indicate information about bank cards or accounts opened only with Sberbank, if you have them. There is no need to indicate data on products from other organizations;

- you confirm the accuracy of the information provided and agree to its processing and verification;

- confirm that you have been notified of the bank’s right to refuse to issue a loan without giving a reason, understand and accept the risks associated with the mortgage loan if it is approved;

- give permission to Sberbank to request information about you from the Pension Fund, indicating your insurance number;

- you consent to the transfer of your data to cellular operators for additional verification;

- you allow the bank to check your credit history by indicating the Code of the subject of the credit history (find out in advance) and checking the appropriate boxes.

- At the end, we write the date and exact time of handing over the questionnaire to the bank employee, write our full name and sign. The manager who accepted your application also writes your full name and signs the document.

- The last section is information about the requested loan. Here you indicate the amount and term of the loan.

IMPORTANT: based on practice, it is recommended to indicate an amount slightly larger than you need, since Sberbank, based on the results of reviewing the questionnaire, almost always underestimates the requested loan amount.

Next, we select the type of “housing loan”, that is, do you want to buy housing in a new building, on the secondary market, etc. (this needs to be decided in advance). We indicate the purpose and special conditions of the loan, if any (promotions, programs, etc.). We provide a bank account number for transferring credit funds (if the account is not yet opened, please open a new account in your name). We complete filling out the form by indicating your full name and personal signature.

statements

The application form can be downloaded directly from the Sberbank website and filled out by hand at home. To do this, you need to follow the link: https://www.sberbank.ru/common/img/uploaded/files/pdf/person/credits/kf-anketa.pdf and print the document that opens.

The questionnaire should be easy to read by a bank employee. Therefore, you need to enter information into it with a bright pen (black or blue) in block letters, placing no more than one graphic character (letter, number, etc.) in the cell intended for filling.

Questionnaire for title co-borrower, co-borrower, guarantor

Sberbank offers a unified questionnaire form that is equally suitable for filling out by the borrower (if the mortgage is issued by one person), the co-borrower (if several people are involved in the mortgage on the part of the borrower), the mortgagor or the guarantor. All fields of the form, if filled out by a co-borrower or guarantor, remain mandatory.

Look at the same topic: How to apply online for a mortgage at VTB 24 Bank?

When filling out the first field of the form, “Role in the proposed transaction,” you should check the box next to the options offered in the form:

- Title co-borrower;

- Co-borrower;

- Guarantor;

- And/or pledgor.

You are also required to provide the full name of the borrower (title co-borrower).

Next, you just need to carefully read the application form, which states which fields need to be filled out by the co-borrower or guarantor, and which are addressed only to the borrower (title co-borrower). The information required to fill out the form is clear and it is easy to understand how to fill out the form.

If the client still experiences difficulties when filling out the application, he can make a request to a Sberbank employee: he will fill out all the fields of the application according to the applicant.

A mandatory condition for filling out the form is consent to the processing of personal data. Its validity period is by default 5 years from the date of signing. However, the applicant can withdraw consent by writing an application to the bank. This is relevant if the applicant’s application form has not been approved, and he does not want to receive advertising notifications from Sberbank about financial services, new offers and promotions.

How to fill out the Sberbank application form for a mortgage

Anyone who wants to get a loan, especially a mortgage loan designed for a long period and a large amount, thinks about how to fill out an application in order to receive bank approval.

Recommendations for filling out the applicant’s application form are the same regardless of the client’s choice of financial institution and mainly relate to the veracity of the information reflected in the application.

The information provided by the applicant in the application form must be different:

- Objectivity;

- Truthfulness;

- Accuracy;

- Completeness.

Often, an applicant, aware that he does not meet the bank’s requirements for a borrower, mistakenly decides that by distorting the information in the application form, he will achieve its approval. This is not true: any information about the applicant can be easily verified.

Therefore, adjusting the age to the limits set by the bank, overstating income, or providing incorrect information about the place of work or collateral by an unscrupulous applicant does not make sense.

Don’t forget that Sberbank’s initial verification of the borrower’s identity is carried out automatically. Bank employees working with the software set up stop filters that immediately eliminate unsuitable candidates.

No borrower can know exactly what stop filters are used at Sberbank, especially since they are changed from time to time for a number of objective reasons.

The borrower should be honest with himself. Filling out a mortgage application form is an opportunity for the applicant to see how ready he is to take out a long-term loan secured by real estate. This is a serious step that requires large expenses for more than one year (and often even more than a dozen years). A questionnaire helps you assess your readiness to take out such a loan.

Look at the same topic: How is real estate insured with a mortgage? Cost of property insurance in [y] year

You should not submit a half-empty application form to Sberbank: it will definitely not be approved by the bank. An applicant interested in a mortgage will try to provide all the information required by the banking organization in as much detail as possible.

How to fill out the application form?

Each financial institution develops its own sample form, which a potential borrower is asked to fill out. To answer all the questions, you can come to the office and seek the help of an employee, or go to the website and do the paperwork yourself. The application must be filled out in block letters in blue or black ink.

How to fill out a mortgage application form

Marks are unacceptable; present information carefully and legibly. Corrections, if any, must be certified by the signature of the person in respect of whom they were made. Keep in mind that a bank employee can fill out the form, but only the borrower can sign it. Therefore, read the document carefully before you endorse it.

What other documents will be needed?

The applicant's questionnaire is the main, but not the only document required to obtain a mortgage at Sberbank. The contents of the package of documents partly depend on the mortgage program, and should be clarified with a bank employee.

The following documents are required for consideration:

- Russian Federation passport with mandatory registration;

- Documents confirming the financial solvency of the borrower (2-NDFL certificate, salary account statement, etc.);

- Documents confirming the borrower’s employment (a copy of the work record book certified by an employee of the HR department, an employment contract, etc.);

- Documents for the property that is planned to be purchased with a mortgage and/or which acts as collateral.

Sberbank has the right to require additional documents from the borrower, co-borrower or guarantor confirming the information provided in the application form. These documents are also required when applying for mortgages with government support.

Sberbank also offers simplified mortgage registration using two documents - a passport and SNILS. However, in this case the interest rate will be increased. Salary clients of Sberbank can do without an income certificate in Form 2-NDFL, since information about their permanent income is known to the bank.

What other documents will be needed for a Sberbank mortgage?

In order to obtain a mortgage through Sberbank, in addition to the application form, you must provide other documents:

- passport;

- a copy of the completed pages of the work book or an extract from this book (with the signature of the manager), a certificate from the management at the place of work or a photocopied employment contract;

- a bank or 2-NDFL certificate to confirm income;

- documentation for the loaned or pledged property: purchase and sale agreement (exchange, deed of gift), certificate of registered property rights, extract from the Unified State Register of Real Estate and others;

- documentation to confirm the availability of funds for the entry fee.

If you have any problems applying for a mortgage at Sberbank PJSC, then contact the DomBudet.ru broker: the company will select a suitable program, submit an application on your behalf, help collect documents and conclude a deal, and also advise on any requests.

After studying the information from the article, you will be able to correctly submit an application for a mortgage to Sberbank.

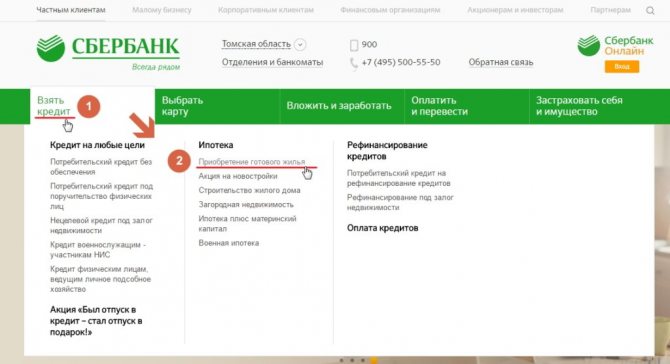

How to apply online

Filling out an application online has certain features at Sberbank. Having selected a mortgage program on the bank’s website, the user clicks on the “Fill out an application” button, after which he is automatically redirected to the DomClick portal from Sberbank, which specializes in transactions with the purchase and sale of real estate, including mortgage loans.

Here the applicant is asked to compare mortgage programs, calculate approximate loan costs and enter information about:

- Date of birth;

- Marital status;

- Any number of minor children;

- Nature of employment;

- Purposes of the loan.

After entering information and receiving a calculation for the selected mortgage program, the applicant is asked to create a personal account for further filling out the application and, if approved, obtaining a mortgage.

DomClick contains information about developers and agencies for the purchase and sale of real estate accredited by Sberbank, which may be useful for the borrower.

A correctly completed Sberbank mortgage application form influences a positive decision on granting a home loan. Therefore, after filling it out, it is recommended to check the correctness of the information provided in it. The questionnaire should not contain corrections, so it is recommended to fill it out slowly and preferably at home, in order to spend the required amount of time on it.

What documents are needed for submission?

The main borrower must provide along with the application form:

- a passport with a registration mark (if there is no permanent residence permit in the Russian Federation, then you additionally need a document confirming temporary registration);

- 2NDFL certificate or certificate in the bank form;

- a copy of the work book (instead, you can submit an extract from the book or a certificate from the place of work with information about the position held and length of service);

- a certificate of receipt of an old-age pension, disability pension, or long service pension (if the borrower receives these payments);

- tax return (if the applicant is an individual entrepreneur).

The co-borrower is required to have the same list of documents:

- passport;

- employment history;

- income document.

The main recipient of funds may ask the bank not to take into account the income of the co-borrower when calculating the loan.

In this case, the additional participant in the transaction does not need to provide a work book or confirm the salary. If the co-borrower is a family member, then a document is required confirming his relationship with the loan recipient.

The list may be supplemented depending on the selected program:

- To apply for a mortgage under the “Young Family” program, you additionally need a marriage certificate (if the borrower is married) and a child’s birth certificate.

- If the borrower wants to pay the first installment using maternity capital, then the bank must provide a certificate and a certificate from the Pension Fund about the availability of funds in the account.

- Those wishing to purchase real estate under the Military Mortgage program require a certificate of NIS participant. No proof of income is required.

You can study an overview of Sberbank's mortgage programs, learn about their advantages and disadvantages, as well as interest rates here.

REFERENCE: If the borrower has several sources of income, he can provide documents confirming the receipt of funds in addition to salary from the main place of work: a rental or rental agreement, an income statement for individuals, a contract for the provision of services. This will increase the chances of approval of the desired amount.

You will find a complete list of documents for a mortgage at Sberbank in a separate article.