At what age can you take out a mortgage for an apartment?

A housing loan is a priori considered by banks to be a risky enterprise. Even the presence of such a factor as collateral does not completely secure the loan, because if friction arises with the debtors, the collateral property will still need to be sold. This, in turn, means spending on maintenance, the work of lawyers, appraisers, insurers, etc.

Therefore, the bank simply physically cannot issue a mortgage to anyone, as long as the client has an income. Getting such a large loan is sometimes difficult even for those clients who already have a good credit history, but what about young people, whose solvency and integrity the bank can only guess at? And yet, it is impossible to determine a clear limit for how many years a mortgage can be given.

The bank always tries to take into account all the circumstances: not only the age and income of the client, but also the integrity and income of his guarantors and co-borrowers; the amount of expected collateral; the amount of the down payment, which reduces the bank’s risks; availability of completed education, its quality and other factors.

We can safely say only one thing: if the borrower is under 21 years old, his chances of getting a mortgage drop catastrophically.

Formally, you can get a loan from the age of 18, because According to the legislation of the Russian Federation, it is from the age of majority that a citizen becomes fully capable in all respects. But banks, not unreasonably, believe that legal age alone is not enough. The client must have at least some stable income that is sufficient to pay the loan.

The bank's management calculates the optimal age depending on gender: for men the most convenient interval is between 27 and 45 years, for women - between 25 and 40 years . If the client is in this age category, and at the same time he has an income, we can assume that the mortgage is already “in his pocket”.

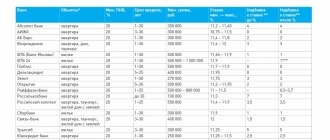

Attention: the age limit of 21 is arbitrary. Each bank, depending on its policy, may have less or, conversely, more stringent rules. For example, AK Bars does not provide loans to persons under 25 years of age, and UralSib does not provide loans to persons under 18 years of age.

Commercial real estate

Commercial real estate differs from residential real estate in the narrow specificity of the market, large loan amounts and, most importantly, a low degree of liquidity. Therefore, this type of real estate is given on loan only to businessmen with good financial performance.

Age will not be of particular importance: if the client was able to build a strong and profitable business at the age of 21, he will be given a loan. But in practice this rarely happens, so the average level is 25-60 years .

Military mortgage

According to Federal Law No. 117 of August 20, 2004, you can only receive money under the NIS for mortgaged housing. To receive such a loan, the client must be within the working age, i.e. from 21 to 41 years .

Young family

Basically, under this program, subsidized by the state, loans are provided by Sberbank. He also set a lower limit for the application: both spouses must be at least 21 years old at the time of application. The upper limit is already indicated by the relevant federal law: no more than 35 years for each spouse (inclusive).

Pension programs

The upper limit of the age category is closely related to the policy of the bank itself. In very rare organizations you can see programs where lending is allowed up to 80 years of age; in some it is possible to obtain a loan up to 75 years of age. Finally, in the vast majority of organizations you can get a mortgage up to 65 years of age.

Attention: the agreement specifically states that the upper limit is tied to the end of the loan term. That is, if the maximum age is 65 years, and the client came at the age of 55, he will be given a mortgage for a period of no more than ten years.

Programs without down payment

For young girls and boys, getting a mortgage without a down payment is almost impossible. Before reaching the age of 25, the chances of obtaining a loan under such a program leave much to be desired.

This is explained simply: the first payment, if the collateral is sold, will allow the bank to recoup expenses. If you issue a loan for the entire property, then no profits will be received from the sale of the property; on the contrary, there will be only expenses.

Up to what age do banks provide a mortgage for housing?

Mortgage lending appeared on the domestic banking services market relatively recently, but has already become popular among the population. This is no coincidence, because attracting bank borrowing resources is the only way for many families to purchase residential real estate. Such a loan differs not only in the large amount, but also in the duration of repayment. Up to what age do banks give mortgages for housing is a pressing issue, since credit institutions set additional requirements for their potential clients.

This is important to know: Who should pay for the appraisal of an apartment with a mortgage?

Where can a young person get a mortgage?

It is already clear at what age you can take out a mortgage for an apartment. But there are exceptions to all rules. Which banks can a young man contact?

Sberbank. The loan is possible after the 21st year . In addition, men under the age of 27 must provide a military ID. The maximum loan term is 30 years, the maximum upper limit is 75 years.

VTB. The second bank in Russia after Sberbank practically copies the conditions of its “big brother”, with the exception of the upper lending limit: the borrower’s age must be no more than 65 years at the end of the loan agreement.

Rosselkhozbank. Standard programs: age from 21 to 65 years . In practice, the bank treats with certain caution all persons under 25 years of age.

Gazprombank. This organization has relatively unusual conditions: age must be between 22-60 years . In exceptional cases, if the client’s solvency is proven, the upper limit can be increased to 65 years.

What’s even more curious is that the bank allows that the young man will take out the loan without involving co-borrowers or even guarantors - such an outcome is quite possible if the borrower’s stable income is proven.

Alfa Bank. Interval - from 20 years to 75 years . At the same time, young borrowers whose age has not exceeded 23 years will be given a loan only if they have official employment with at least a year of experience in this job.

Who can take out a loan?

Banks put forward the following requirements for those who can take out a mortgage for an apartment:

- Having Russian citizenship. Some banks also provide the opportunity to obtain a loan for foreign citizens who are in the Russian Federation legally. This means that he must have registration at the place of stay or permanent registration at the place of residence. In addition, he must have permission to work in the Russian Federation.

- Permanent registration at the bank's location is required . Not all credit institutions make such a requirement, but some of them have it.

- Those who can get a loan must have worked for at least six months at their last place of work Attention is also paid to how long the borrower worked in previous places and how often he changes jobs. If the period of employment at previous places of work is short and the client often moves to a new employer, his candidacy may not be approved by the bank. The only exception is a change of job through transfer.

- Income level. When calculating solvency, all documented income is taken into account. The standard confirmation form is 2-NDFL certificate. The monthly payment should not exceed half of the total family income. Payments on existing debts are deducted from income.

- The client should not have problems with credit history. Bad credit history also includes fines and claims on the bailiffs’ website. If a potential borrower has many existing loans and credit cards, this may also be grounds for refusing to issue a loan. Even if the client does not use cards, the fact of their availability will affect the calculation of his solvency. Therefore, it makes more sense to take your credit cards to the bank and close the account.

Factors that are determined by the category of the borrower:

- Age. Young people are given mortgages for a longer period.

- Income level.

- Family status. People who are married will be given a loan more readily.

- Availability of co-borrowers or other housing that can be used as collateral.

From what age and until what age is a loan given?

Mortgage loans can be obtained by persons from 21 years of age, in some banks from 23 years of age. Before this age, a person does not yet have his own finances and does not stand firmly on his feet.

The maximum age for obtaining a mortgage loan is 55 years. Moreover, banks also set the maximum age that a citizen can reach to repay a mortgage. Basically it's 75 years old. Those. If a person takes out a mortgage at age 55, he cannot take it out for more than 20 years.

This is important to know: Section of a mortgage apartment with maternity capital

How else can you get a mortgage and how to increase your chances of approval?

There is a small list of life hacks that significantly increase the chances of your application being approved:

- You need to work for at least 6 months at your last job, or better yet, at least a year;

- Employment must be official;

- The estimated monthly payment should be no more than 35% of income minus all other debt load (third-party loans, for example);

- It is necessary to attract adult guarantors, or better yet, co-borrowers. The higher their income, the higher their chances of approval;

- Build at least a minimum credit history. To do this, six months to a year before applying to the bank for a mortgage, take out a loan and/or credit card, and then repay the debt exactly according to schedule. The bank is much more willing to give loans to those who have already proven their reliability than to people about whom the bank knows absolutely nothing;

- A significant advantage for men will be the receipt of a military ID; for both sexes, having a completed education - higher or secondary specialized education - will be a plus;

- The larger the down payment, the higher the chances of getting a loan;

- Provide the bank with information about all income received on a regular basis. Even a scholarship from the university, financial assistance from the university, financial support from parents - in a word, convey information about all sources of income in documented form.

These generally simple recommendations, if fully or at least partially followed, significantly increase the chance of getting a loan. The effectiveness of all the tips above can be explained simply: the bank is more willing to give loans when it can be sure that the money issued will not “burn out.”

Is it possible to get a mortgage after retirement?

Just recently, getting a mortgage for a pensioner was an almost impossible dream. For banks, retirement was tantamount to a loss of income for the borrower and led to a sharp increase in risks (including possible loss of work or health).

Recent changes in legislation related to increasing the retirement age have corrected this situation. Now there are banks that are ready to give mortgages to citizens up to 75, and even up to 85 years old (meaning the age at the time of full planned repayment of the loan).

Not every pensioner will be able to get a mortgage loan; it is almost impossible for:

- a non-working pensioner with an average pension;

- older borrowers without collateral, such as no collateral or co-borrowers;

- a pensioner with dependents - minors or elderly;

- borrowers with serious health problems.

Important! The loyalty of banks is guaranteed to pensioners who have the right to retire before 55 (60) years of age, but who decide to continue working. In this case, the pension is considered additional income.

A pensioner who wants to get a mortgage should take into account that the permissible age limit may vary depending on the terms of the loan. For example, in some banks the age threshold may be reduced by 5–10 years if:

- refusal of a comprehensive insurance program;

- mortgage under two documents;

- insufficient number of co-borrowers (guarantors) and in other cases.

Recommended article: How to get VTB mortgage insurance online

Where will they give a mortgage to a pensioner?

A short review of banks indicating age limits will allow you to find out which banks provide mortgages up to 75 years of age and will help an elderly borrower choose the right bank.