A mortgage for an apartment under a mortgage from Sberbank is a document necessary for the subsequent removal of the encumbrance from the mortgaged apartment. It is drawn up by bank employees after signing the transfer and acceptance agreement. Production time varies, with an average of 14 days.

However, today, when making a mortgage loan, there is no longer a need to issue a paper mortgage. It is enough to submit an application online, and we will tell you what you need to do for this in the article.

What is a mortgage on an apartment

A mortgage for a bank is a security that gives the lender the right to recover costs associated with the borrower's insolvency by reselling the mortgaged property. In Russia, this registration procedure is optional only when working with banks that have good financial reserves.

The credit institution is interested in drawing up the document, because it serves as a guarantee of the return of funds on the housing loan. The borrower must be extremely careful when signing, because the collateral, in most cases, becomes the only home. In the event of a conflict between the parties, the court considers a case based not on the mortgage agreement, but on the mortgage.

| Mortgage debt, rub. | Monthly savings, rub. | Refinancing costs | ||

| — 1% | — 2% | — 3% | ||

| 1 million | 500 | 1000 | 1500 | 15500 |

| 1.5 million | 800 | 1600 | 2400 | 21000 |

| 2 million | 1050 | 1600 | 3100 | 26500 |

| 3 million | 1600 | 3200 | 4600 | 37500 |

| 4 million | 2150 | 4250 | 6300 | 48500 |

| 5 million | 2825 | 5560 | 8250 | 59500 |

| 6 million | 3500 | 6870 | 10200 | 70500 |

The mortgage comes in several forms:

- in the form of a paper document;

- electronic.

The document is valid only until the payer repays the loan in full. Before this, the lender does not have the right to sell the mortgage for his own purposes without the client’s permission.

Description of the document

Expert opinion

Sergey Bogdanov

Work experience at Sberbank for 12 years.

The requirements, registration and form of the mortgage note are set out in Federal Law No. 102-FZ dated July 16, 1998. The third chapter of the law is devoted to the execution of the document, its issuance, registration and restoration.

Functions

Main functions:

- The mortgage allows the borrower to live in the mortgaged apartment, but prohibits its sale, gift or exchange.

- The document confirms that after full payment of the debt, the payer becomes its full owner.

- The paper protects the rights of the mortgagor when it is resold to another beneficiary, since he cannot change the terms of the mortgage loan.

A mortgage is given legal force only after registration with Rosreestr; until this moment it is not considered an official document.

Requisites

List of details required by law:

- Information about the bank. It is important to indicate the name, payment details, contact information and license number.

- Payer information. The document contains the borrower’s personal data and email address for sending the web version of the mortgage.

- Information about the subject of the pledge. A complete description of the object, its estimated value, and all registration documents are indicated.

- Lending terms. It is important to specify the full loan amount, repayment period, payment procedure and interest rate.

- Date of execution and signature of the parties to the transaction.

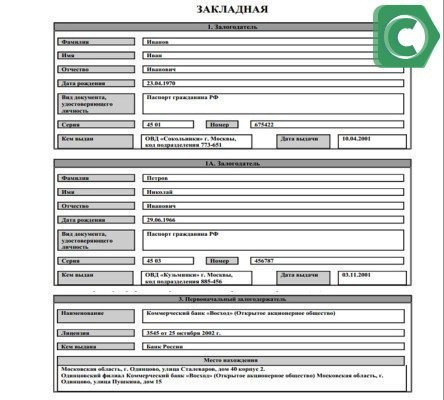

Example document:

Since the beginning of last year, the state has obliged Sberbank to issue electronic mortgages through the Rosreestr portal.

What does a mortgage look like?

A sample mortgage for an apartment under a Sberbank mortgage is a form divided into 10 points:

- Pledger. This section is devoted to the borrower’s personal data.

- Debtor. The information is duplicated from the first paragraph if it is the same person. Otherwise, a separate form is drawn up for each debtor.

- Initial mortgagee. In most cases, it is a legal entity, so all the details and contact information of the company are written down.

- An obligation secured by a mortgage. This section includes mortgage loan information.

- Subject of mortgage. The paragraph is devoted to collateral and its description.

- Information about the time and place of notarization of the contract.

- Information about the right by virtue of which the subject of the mortgage belongs to the mortgagor. The block reveals the legal side of the transaction and explains why the borrower cannot dispose of the property until the mortgage is paid in full.

- Mortgage Loan Data. Information from the loan agreement is written down: payment, payment deadline, conditions for NPV and RAP.

- Information about the state registration of the mortgage in Rosreestr.

- The date a mortgage is issued to the primary mortgagee.

You can obtain a sample mortgage note from your bank for review.

You can study the first pages of the document from the photo:

What is a mortgage note in Sberbank?

A mortgage refers to registered securities. It certifies the right of pledge, and the one who owns it has the right to receive the property pledged under the mortgage agreement. The paper is kept in the financial institution until the debt is fully repaid. Moreover, it acquires legal force only if the terms of debt repayment are violated. If you comply with your obligations, there is no need to worry about the property left as collateral.

A mortgage note from Sberbank (a sample photo can be seen in the figure) is allowed for registration for the following type of property:

- Plot. At the same time, the presence of buildings and houses on it is not a prerequisite.

- Non-residential buildings. Often these are a country house or a garage.

- Real estate: house, apartment. If the subject is a private house, then the land on which it stands (plot) also acts as collateral.

- Buildings registered in the name of legal entities.

- Some other objects. For example, the subject could be a rented apartment. In this case, the right to long-term lease is transferred.

This is what the document for registration of collateral on a loaned property looks like

How to apply for a mortgage at Sberbank

In most cases, the registration of a mortgage at Sberbank is entrusted to bank employees. Documentation is prepared after signing the transfer and acceptance agreement.

Documents for mortgage note

It is necessary to prepare the following documents for registration of a mortgage note:

- borrower's passport;

- act of acceptance and transfer of future collateral real estate;

- an extract from the Unified State Register for this house;

- registration certificate;

- mortgage agreement;

- appraiser's report on the purchased apartment;

- insurance contract;

- receipt for payment of state duty.

Based on the assessment results, in order to obtain a mortgage from Sberbank, the authorized person issues the borrower 2 copies of the report: the first remains with the credit manager for registration of the security, and the second is sent to Rosreestr.

Payment of state duty and signing of the contract

The mortgage is issued together with the title to the property. Therefore, the state duty depends on the form of the person receiving the title:

- For citizens – 2 thousand rubles.

- For legal entities persons – 220 thousand rubles.

After payment, you must hand over the receipt to the lender, and then sign the executed mortgage.

Mortgage registration

Having collected all the documents for registering a mortgage, you need to visit the territorial representative office of Rosreestr. Since 2020, borrowers have access to online registration using an electronic signature. The mortgage is drawn up in a special form and registered automatically.

List of documents for a mortgage note in Sberbank

To be able to draw up a mortgage, the person being credited is required to submit a list of documents that must certify the existence of the mortgaged object and the completion of the transaction with the seller. The list of documents for registration of a mortgage is as follows:

- passport of the buyer, as well as other owners of the apartment or house, if we are talking about joint ownership;

- original extract from the Unified State Register, which confirms the technical data of the property and ownership rights;

- evidence that the borrower has full ownership rights;

- documents of title that indicate the legality of ownership, for example, a contract of sale, exchange, deed of gift or deed of gift;

- a document confirming the assessment of property and its results;

- registration certificate of the property being mortgaged;

- the spouse’s consent to the pledge, certified by a notary, but if the apartment belongs to one of them, a marriage document or a marriage contract will be needed;

- permission from the guardianship authorities to make the apartment collateral if the owner of the home is a child or he owns part of the premises.

READ The procedure for deleting templates in Sberbank Online

Mortgage after debt repayment

Each borrower, after paying off the home loan in full, is required to withdraw the mortgage from Sberbank. The document can be obtained at the branch where the payer took out the mortgage.

How to get a mortgage from Sberbank after repaying the mortgage

The mortgage can only be returned when the final payment is made and the mortgage is closed. After this, the payer must contact the credit institution with an application to issue the document. The return period can take up to 30 days; the bank is obliged to check all receipts and mark the absence of claims.

To obtain a mortgage from Sberbank, you do not need to present an equity participation agreement, a loan contract or collect documents from the list. The bank will independently send the necessary documents to Rosreestr.

What to do with the mortgage after paying off the mortgage loan

As soon as the borrower receives a mortgage with a mark, he is obliged to visit Rosreestr to remove the encumbrance from his own home. The following documents must be collected:

- Payer's passport.

- Application for removal of encumbrance.

- Mortgage agreement.

- Mortgage note with a no-claims note.

- Document of ownership.

Removal of the encumbrance is carried out within 3 working days.

What operations can Sberbank perform with a mortgage?

Legal powers of the lender after receiving the mortgage:

- Assignment of rights to another bank. In this case, the terms of payment for the borrower remain the same, only the current account number changes.

- Mortgage exchange. The bank has the right to exchange the mortgage for a security of another bank with an additional payment.

- Partial implementation. For some time, the bank may transfer the right to receive monthly payments to another credit institution. In this case, the current account number does not change.

In rare situations, Sberbank uses mortgages to replenish working capital. It issues mortgage-backed securities and markets them as an investment product with good returns.

Can Sber sell a mortgage?

Based on the Civil Code of the Russian Federation, the bank is not obliged to agree with the borrower on the transfer/assignment of the right to claim the debt. The lender may notify the client of the upcoming mortgage sale. A banking organization has the right to resell the security of even the most disciplined payer.

Mortgage on an apartment under a mortgage - what is it?

Not every borrower can find guarantors, but a loan is not only a risk for the borrower, it is also a risk for the bank: what if the borrower does not repay the money? Therefore, a mortgage is a kind of guarantor to the bank that the funds ( a large amount and for a long period) taken for the purchase of housing will be returned. And if it turns out that the money is not returned, the bank will still own the property, which Sberbank will then have the right to sell.

Registration of a mortgage usually occurs simultaneously with the signing of lending papers, so you need to carefully check all the data on these papers so that there are no contradictions in them. The mortgage contains all the main provisions of the loan agreement and the main characteristics of the property that is pledged as collateral.

According to their classification, secured mortgages are classified as registered securities. The owner of the mortgage (in this case, Sberbank) can transfer it to another legal entity or remortgage. It is precisely this right to transfer rights under the mortgage that the bank receives when drawing up this document.

According to the law, the lender issues funds at interest, which is the bank’s profit. If the bank urgently needs funds, Sberbank will have the right to resell the mortgage. In addition, on the basis of the mortgage, the bank has the right to issue a series of issue-grade securities - this will be its additional income.

The term of the mortgage ends at the time of the borrower's last payment of the loan amount.

What to do if you lose your mortgage

If a mortgage on a home was issued only in paper form, then there is a risk of losing it. There is no way to protect yourself from this, since the borrower does not have the right to keep the original.

If you are lost

In fact, it is impossible to lose the mortgage, since it is deposited with the bank, i.e., loss is possible only on the part of the creditor who received it. If an electronic version of the document was issued, then its loss is also unrealistic.

If you lost the bank

The fact that there is no mortgage on a mortgage with Sberbank is revealed after the debt has been fully repaid. Most often, a document is lost during interbank movements between departments and offices.

If the lender independently notices the loss of the document, then he is immediately obliged to inform the borrower about this, issue a duplicate and register it with Rosreestr.

The electronic form was created specifically for the bank in order to eliminate the possibility of loss of the document.

Rules for registering a mortgage for an apartment

An apartment is the property that is most often used as collateral. Sberbank always accepts this type of property as collateral because it is valuable. When a citizen takes out a mortgage for this type of property, then it is necessary to pay attention to the following sections:

- Personal information of the owner of the collateral. This section contains information from the passport or other identification document of the mortgagee;

- Basic mortgage . This paragraph indicates the terms of mortgage lending, the loan amount, parameters for repaying debt obligations, interest rates on the mortgage loan, the amount of the down payment and many other types of information that are reflected in the mortgage agreement;

- Apartment parameters . This section requires you to indicate the exact address of the location of the object, what it is called, its technical parameters, the collateral price, who carried out the assessment of the property, what document was issued and when;

- Information about the owners. This type of mortgage is required to reflect the circumstances under which ownership is transferred if someone else previously owned the property.

After completion, all mortgages are carefully checked. Only after verification is a bank stamp placed. This type of document is subject to sale or donation procedure.

conclusions

A mortgage is a document that guarantees the bank that if the borrower fails to repay the housing loan, he will be able to sell the mortgaged property and cover his own costs. This security has priority over the mortgage agreement.

A mortgage on an apartment is issued in the bank that issued the housing loan, and is registered in Rosreestr. Afterwards it is transferred for storage to a credit institution or electronic depository.

You can make a mortgage at Sberbank in two weeks by paying the state fee.