The decline in demand in the real estate market prompted lending organizations to create special programs for preferential lending for young married couples. Youth mortgage provides for the purchase of housing (apartment, cottage, private house) on favorable terms and conditions.

In 2020, interest rates are decreasing, the down payment may be minimal or completely absent. Today, obtaining a mortgage to improve living conditions for young families is becoming a feasible task.

Legislative regulation of the issue

The legislation clearly states which family is considered young and has the right to take out a loan under a special offer. Social lending takes into account the presence of young children and parents as co-borrowers. To study the sequence of paperwork for this type of loan, consumers can familiarize themselves with Federal Law No. 122 and find detailed information in the Civil Code. Issues about collateral and property secured are covered in Federal Law No. 102.

Regulatory documents clearly state which newlyweds can qualify for a preferential mortgage:

- spouses under 35 years of age (including families with children or one parent);

- couples without children living in an official marriage for 1 year (age restrictions are the same - no older than 35).

Important!

If a family has been on the housing register since March 2005, it has the right to apply for a social loan with a reduction in the value of real estate. The program is aimed at attracting young couples to purchase living space. It was this target audience that caused the biggest decline in the real estate market. The lack of savings for the down payment, insurance and registration of purchase and sale creates difficult conditions for such families in purchasing apartments.

Social loans are a separate, priority queue for mortgages with a quick decision on applications to banks. The first to be served are young families with two or three children, categories of citizens with living conditions that do not meet sanitary and social standards.

The mortgage under the “Young Family” program provides for the calculation of living space for each person, taking into account the property owned. Standard option - 1 room is allocated for each family member (with a housing standard of 18 sq. m.).

What does the bank require?

A mortgage from Sberbank with two young children is issued if the requirements for the applicant are met:

- presence of Russian citizenship and permanent registration in the region of residence;

- age - from 21 years old, up to 75 years old at the end of the mortgage repayment;

- work experience - at least 1 year total of the last five years and 6 months at the current place of employment;

- documentary evidence of work activity and income received.

At the same time, you need to know that the second spouse will necessarily act as the title co-borrower for the loan, and the bank will make similar demands on him.

To increase the chances of getting a mortgage from Sberbank after the birth of a second child, the applicant can also involve close relatives as co-borrowers.

Recommended article: Is it possible to get a mortgage to buy and renovate an apartment?

Which banks can I apply for?

When selecting a financial institution, consumers study social program offerings. Banks may use your data for lending under other programs. It is necessary to clearly indicate in the online application or other types of contact that the client wishes to participate in a social mortgage for young spouses.

Mortgages for young people are issued by large and developing lending organizations under certain conditions. The comparison table* will tell you more:

| Bank | Annual rate | PV (down payment) in%. | Special conditions |

| Sberbank | 10,2% | From 20 for families without children, from 15 for couples with children | No compulsory insurance |

| Rosselkhozbank | 9,7% | From 30 | Personal, property insurance |

| DVB (Far Eastern Bank) | 9,5% | From 15 | Raising maternity capital funds |

| VTB 24** | 11% | From 20 | Minimum borrower age – 18 years |

*The information provided is current as of December 2020. **In the VTB 24 institution, young families with living space restrictions - no more than 14 sq.m. can get a mortgage under special conditions. per person. In other cases, social credit is not available.

Basic conditions for issuing funds

The “Young Family” program is the availability of free subsidies from the state for partial repayment of debt obligations (depending on the individual characteristics of the couple). The federal benefits clearly state the amount of compensation: 30% for childless couples, 5% of the established thirty for each child.

The package of documents is submitted to the Housing Department at the registered address of one or both spouses. The terms of the mortgage presuppose the availability of status for citizens in need of improved living space. It is confirmed by a special certificate for preferential lending.

In the list of other basic requirements for borrowers:

- selection of primary housing with a loan repayment period of up to 30 years;

- a minimum PV is required (from 15%);

- execution of an agreement for collateral property (which is owned or new real estate);

- at least one year of work experience in the last place;

- 2-NDFL and other certificates about additional sources of financing for a young family;

- permanent registration of young spouses (or one of them) in the region of appeal.

A youth mortgage is available to one parent who is not officially married but is raising children. The main age requirement remains – no older than 35.

Important! The state benefit also applies to plots of land purchased for private development or the construction of a residential building on one’s own.

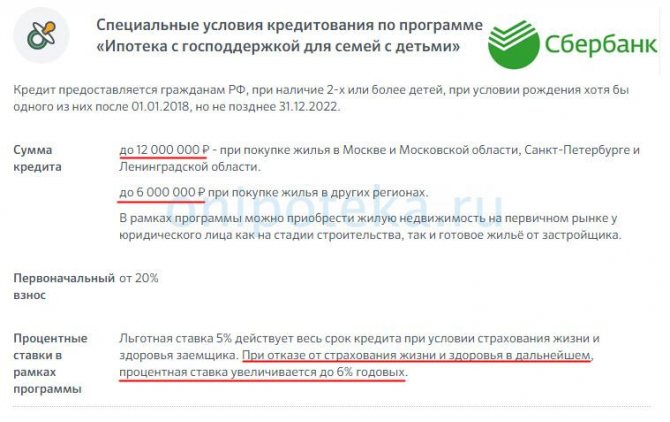

Conditions for providing a family mortgage by Sberbank in 2020

Lending is provided to families with 2 or more children, provided that the second and subsequent children were born between 01/01/2018 and 12/31/2022.

This program is valid until December 31, 2022, but there are conditions under which it is possible to obtain a mortgage later than this period:

- if the second and subsequent children were born after 07/01/2022, then the mortgage can be issued until March 1, 2023;

- if the second child was assigned disability later than December 31, 2022, then for such families the period is extended until December 31, 2027.

Family mortgages from Sberbank in 2020 are issued at 5% per annum for the entire loan term, subject to life and health insurance of the borrower; in case of refusal of insurance, the interest rate increases by 1 point.

Lending is carried out with a down payment of 20%, in the amount from 300,000 to 12,000,000 rubles for properties in St. Petersburg, Moscow and Moscow Region, for other regions the maximum amount is 6,000,000 rubles.

Recommended article: Mortgage in Gazprombank for salary card holders

The mortgage is issued for a period from 1 year to 30 years.

Who is considered a young family for mortgage purposes?

By viewing real estate loans through the prism of savings, young families with three children receive the most favorable conditions. If a social mortgage is issued to spouses without a child at a higher annual rate, then young parents with many children have the right to count on a minimum percentage, which gives a small overpayment.

An apartment subsidy is allocated for the following categories of citizens:

- young couples living in rented apartments;

- spouses with children in conditions that violate social norms of living space (less than 18 sq.m. per person);

- parents of children of different sexes who need separate rooms;

- father or mother raising a child on their own (without legal marriage);

- young spouses without children, whose age is over 21 years old, but not more than 35.

Regarding credit history, checks are more loyal with preferential subsidies. Purchasing real estate with partial repayment under a social program requires a thorough check of solvency. Mortgages for young people in most cases are approved if loan payments do not exceed 50% of the total income of the young family.

General requirements for borrowers and purchased housing

Citizens whose living space does not have family members over 35 years of age can receive a preferential mortgage. Only young married couples and young children (if any) are taken into account. Some financial structures allow you to choose secondary market housing. But special conditions apply here: in worn-out multi-storey buildings (more than 60%) the apartments have a low assessed value and do not cover the loan amount.

The main requirements for real estate:

- after moving to the purchased housing, all members of the young family must be socially settled (at least 18 sq.m. per person);

- in purchasing an apartment under the DDU, an additional document is required, which specifies the shares of each resident (including children);

- the purchase of a land plot requires a full package of documents confirming the legality of the transaction and ownership rights.

Important! Citizens with maternal (family) capital can receive benefits for an apartment. Banks recalculate the amount of monthly payments and present a new repayment schedule.

How to apply

A family mortgage from Sberbank in 2020 can be applied for online or at a bank branch. For this you will need the following documents:

- passports of the borrower and co-borrower;

- for temporary registration - documents confirming it;

- employment history;

- confirmation of income in a certificate or in a certificate filled out in a bank form;

- if there is collateral real estate - documents confirming ownership;

- confirmation of the availability of the down payment.

The loan application is reviewed within 3-5 business days.

After approval of the application, it is necessary to provide documents on the loaned object and set a date for the transaction. On the appointed day the transaction is executed:

- online, through the DomClick service: the Sberbank manager sends an electronic package of documents to Rosreestr, after registration with Rosreestr, the finished documents are sent to you by email. Such a transaction is safe, and the finished documents received by mail will have the same legal force as ordinary ones. The pros and cons of electronic transaction registration in Sberbank are described in another article.

- at the bank’s office: documents are signed with the developer, then the transaction is registered in Rosreestr, the finished documents will be received there in 10 days.

Recommended article: Mortgage subsidy: who is eligible and how to get it

Important to know: Buying and selling an apartment through Sberbank - sample documents and step-by-step instructions

Buying a new building with a mortgage: instructions

What to do after accepting an apartment with a mortgage in a new building

What documents will be required?

If you don’t have the social benefit certificate on hand, first obtain the document from the department. Another option is to use maternity capital, but here real estate at a discount is available only to families with children (more than two).

A mortgage for a young family with a child extends to lending to military personnel. Regardless of their length of service, contract employees can apply to financial organizations if their living conditions are inadequate (in a dormitory, communal apartment, rented house).

Important! If parents accept the obligations of co-borrowers, a document on relationship is presented. The banking organization must check the CI of all clients, their solvency and the absence of violations of credit discipline.

Calculation rules

The decision on the direction of the state subsidy is made by the borrower. Young families prefer to use the benefit as an advance payment. If funds for the contribution are collected, the accrued amount may go towards a one-time partial repayment or a residual payment. After receiving funds to the current account, the preferential mortgage is recalculated and a new schedule is drawn up.

Examples of overpayments under different conditions:

| Cost of housing/plot | Down payment (RUB) | Annual interest (in rub.) | Mortgage term | Total amount of payments (RUB) |

| 3 million rub. | 800 000 | 12% | 30 years | 4 945 276 |

| 7 million rub. | 500 000 | 8,9% | 20 years | 13 504 261 |

If you buy an apartment for a young family under a gift agreement (for example, working parents buy it for their son/daughter), participation in social lending is excluded.

Having a down payment is a kind of insurance against refusals of financial institutions to provide a loan. Compensation from the state is an excellent option to improve your living space without having a large sum on hand.

State mortgages apply exclusively to young people planning to have children or who have already given birth to a child.

Important! To ensure that obtaining a loan against real estate does not take many weeks, obtain a certificate from the housing fund in advance indicating the availability of housing benefits.

No down payment

Mortgage discounts are provided for those borrowers who pay the loan in full. That is why it is better to use preferential funds to pay it off. Otherwise, you need to pay in full from your personal savings. The same question applies to insurance contracts and expenses for re-registration of property. If clients wish, banks include these items in the mortgage loan amount.

Attention: there are special offers from lending institutions that do not require a large package of documents (passport and license or military ID). In the case of social loans, the shortened version is not suitable.

The sequence of obtaining a mortgage and how much it costs

Sberbank mortgages for families with two children are issued in the following sequence:

- get acquainted with the bank’s requirements and the list of documents, and preliminarily calculate their own solvency. If necessary, contact the office for advice;

- collect a package of documents and submit an application;

- await the decision of the credit committee, and if the application is approved, they select a property;

- The purchase and sale transaction is concluded and registered, after which the funds are transferred to the seller.

It is safe for the borrower to electronically register the purchase and sale transaction, which is offered by Sberbank.

Most related services when applying for a mortgage with Sberbank with 2 children are free. But, nevertheless, there are costs. What you will have to pay one-time:

- when purchasing finished housing, an apartment appraisal service;

- for registration of a transaction - the state duty established by law. If a client registers a purchase and sale through the Sberbank service, this is also a paid service;

- notary expenses are also associated with the purchase of real estate;

- intermediary services - real estate companies, mortgage brokers. You can save money on this article if you choose an apartment using DomClick and arrange a mortgage yourself;

- payment for the rental of a safe deposit box, if a letter of credit form of payment is provided.

Recommended article: Is it possible to gift an apartment with a mortgage to a relative or co-borrower?

There will also be systematic (annual) expenses for a mortgage loan:

- collateral insurance and personal insurance. The amount of the insurance premium for a property is set as a percentage of its value. Life and health insurance of the borrower - in a fixed amount. Costs can be significant, but taking out insurance contributes to a percentage reduction on a Sberbank mortgage with 2 children;

- If you purchase housing under construction, bank specialists conduct an annual inspection of the collateral, for which you will have to pay a commission.

How to apply online for a mortgage?

Before submitting an application to a financial institution, make sure that a federal program is included in the offerings. When filling out the form on the website, be sure to indicate participation in preferential mortgages for young couples. The calculator for 2020 will help you pre-calculate all payments and the amount of overpayment on interest.

Important! Do not submit several applications to different lending organizations, wait for the final response from one bank, and if rejected, visit another. Otherwise, the Credit History Bureau will record many requests, and the mortgage may be denied.

Credit calculator

If you are just thinking about mortgage lending, you can use the calculator on the bank’s website to obtain preliminary information and assess your capabilities.

Recommended article: Mortgage conditions at 2 percent for Far Eastern residents

Sberbank's 2020 family mortgage calculator does not require entering personal data. Using a simple menu, you enter your indicators: what you want to purchase, under what program and for how long. The computer immediately calculates monthly payments and indicates the minimum income at which this offer is available. Additionally, you can familiarize yourself with the payment schedule and the amount of overpayment.

Mortgage program for young families

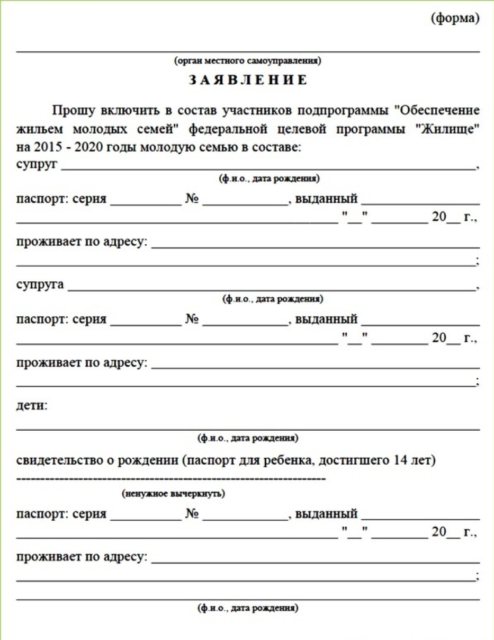

Real estate collateral, purchase and sale agreement, life or property insurance are included in the social lending program for young families. After collecting documents, the following sample application is submitted to the financial institution:

Borrowers should carefully study contracts with participation in the social program - some banks do not provide funds for the purchase of secondary housing or for families with conditions that meet the living space standards.

Sberbank

A well-known Russian bank offers clients a special lending offer under a preferential program at 12.5%. Knowing how old you can apply for this type of mortgage, newlyweds have the right to apply for the purchase of any type of housing.

Sberbank does not limit the choice of real estate; loans are received by buyers of apartments in new buildings or “Khrushchev” buildings, cottages on the secondary market, and land plots for building a house.

Attention: a borrower who cancels an insurance contract receives plus 1% to the annual rate. The organization does not charge fees for issuing and servicing a loan; funds are issued in cash or by transfer to the applicant’s account.

In case of early repayment, the remaining debt must be recalculated on the date of payment (specify the full amount at closing, request the issuance of a certificate of full repayment of the mortgage).

Rosselkhozbank

The lending institution operates the “Housing (new building apartments)” program. In addition to the standard set of documents, clients under 27 years of age are required to provide a military ID. Rosselkhozbank conditions:

- loan amount up to 60 million rubles;

- terms – up to 30 years;

- property insurance, life insurance;

- 9.7% per year;

- annuity repayment scheme (in equal parts).

Preference is given to salary project participants who are reliable, proven clients.