What is a 3‑NDFL income tax return

3‑NDFL - a declaration form with which those who pay tax to the Tax Code of the Russian Federation report to the Federal Tax Service Article 229. Tax return on personal income. It needs to be served in two cases.

You have income on which tax has not been paid

If you are employed, your employer reports your income. He also calculates and pays taxes on them. In this case, you don't need to do anything. The declaration is completed if you have additional income. This may be the case if you:

- You are not working under an employment contract, and the employer has not assumed the function of your tax agent. In this case, you will have to resolve issues with the state yourself.

- You sold an apartment that you owned for less than three years (or less than five if you own several properties).

- We sold a car that we had owned for less than three years.

- They rented out something (an apartment, land, etc.) and received income.

- You received real estate, a car, or securities as a gift from a person who is not your close relative.

- Won up to 15 thousand rubles in the lottery - if more, the organizer deals with tax issues.

- Received income abroad.

- You work as an individual entrepreneur on the general taxation system.

Keep in mind that not all money that comes into your hands is subject to personal income tax. This means there is no need to declare them. These are, for example, pensions and scholarships, debt repayment, government benefits.

In some cases, you do not need to pay tax, but will have to file a return. For example, if you sold an apartment a year after purchase, but received less for it than you spent (how this works is in Lifehacker’s special material).

Do you want to receive a tax deduction?

The state gives you the opportunity to return part of the taxes paid if you bought a home, received treatment or studied for a fee, donated to charity, and so on. To apply for it, you need to submit a 3‑NDFL declaration.

Types of tax return

The form of a tax return can vary significantly. It depends on what type of income is declared. In this case, the scheme for filling out reporting is identical. All forms have a similar structure. Tax returns are always approved by government agencies. The document consists of 2 sections - the title page and appendices. They are all connected. The person independently decides in what form he wants to provide the document. This may be a paper form or an electronic medium. You can obtain a declaration for entering information by contacting the Federal Tax Service. It is provided without paying a fee. The citizen himself or his authorized representative can provide the document to the authorized representative.

It is acceptable to file a tax return in 2020 via the Internet or other means of telecommunications. An alternative is to mail documents 2-NDFL or 3-NDFL by letter with a list of attachments. A classic personal visit to the organization’s office is also acceptable.

When filling out the form, it is recommended to rely on the finished sample. It can be found on the Internet or at the Federal Tax Service on the information board. It is permissible to use a specialized accounting program when filling out the declaration. New forms of documents appear periodically. They are published on the official websites of tax authorities.

If the document is provided in person, a reminder about receipt and registration date is placed on its copy. The document is kept for 5 years. The period is calculated from the end of the tax period. In practice, a person may encounter a situation where he needs a copy of the declaration. If the paper version is lost, you can contact the Federal Tax Service.

| Variety | Explanation |

| According to VAT | The form contains information about the amount of revenue received, indicating the amount of accrued tax. The declaration is submitted quarterly. The document must be submitted by the 20th day of the month following the reporting period. Tax must be paid within the same period. |

| Income tax | The amounts that the institution was able to receive from the sale of products are reflected. Cost is also included in the indicator. The deadline for submitting the document is the 28th day of the month following the last one in the quarter. |

| About the income of an individual | Sometimes the document is called a 3-personal income tax declaration. The form records information about the profit received, the benefits that a citizen is entitled to, as well as deductions. The report is provided annually. The declaration must be submitted to the authorized body no later than April 30. The tax is due by July 30. |

| Simplified form | Filled out in several cases at once. Provision is carried out if there is an object of taxation. It's easiest to understand with an example. A single simplified form is used if you need to transfer information about land tax to the Federal Tax Service. So, if there is no site, the need to provide a declaration disappears. In this situation, the company is not required to report to the authorized body. A simplified form for personal income tax is not provided. In this case, the citizen is required to fill out a standard declaration. It does not matter whether the company operated during the specified period. Consists of two pages. The second of them is filled out only by individuals who are not engaged in entrepreneurial activities and do not have a tax number. |

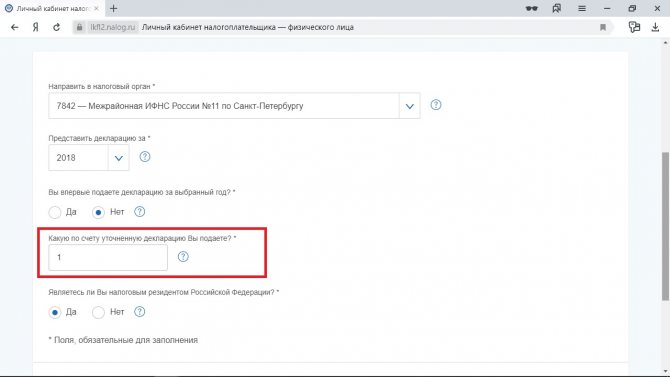

| Clarifying | Used if an error was made during the process of drawing up the primary document. As a result, this led to an understatement of the tax amount. The clarifying declaration must reflect the same information as in the primary declaration. However, the information is recorded in a corrected form. Externally, the document form is similar to the one used for the initial application. However, there are a number of nuances. They focus on the title page. There are fields for the correction number. If a clarifying declaration is being filled out, the number one is entered. When it comes to the primary document, zero is reflected. The possibility of drawing up a document is provided for in Article 81 of the Labor Code of the Russian Federation. But the regulatory legal act states that if the primary documentation was provided on time, and the clarifying documentation was submitted after its completion, no violation occurs. |

| Unified agricultural tax | The taxation system can be used by legal entities and entrepreneurs engaged in the production of agricultural products. This allows you to get rid of the provision of a number of fees to the budget. Obligations to the state are repaid using a single payment. The declaration must be completed at the end of the year. The report must be submitted at the place of registration. The rate is 6%. It is calculated from net profit. |

| MET | Charged to legal entities and entrepreneurs engaged in mining. Taxes are calculated monthly. The declaration must be submitted at the payer's location. The procedure is performed once a month. It is entered at the location of the mining site. |

| Excise | The declaration is provided by entrepreneurs and companies engaged in the manufacture and sale of excisable goods. The declaration must be submitted at the place of residence of the payer or the location of the unit. The document is provided at the end of the month. Real trade turnover is taken into account. The type of declaration directly depends on the product. So, if you need to provide a declaration for alcoholic beverages, it will differ from the one that needs to be filled out in case of selling gasoline. |

| For property | Filled out by companies that have fixed assets on their balance sheet. The list includes real estate, cars, things in temporary use, property contributed by the founder or transferred to trust management. Reporting is provided at the location of the organization. If there is a separate division, they are required to provide a separate declaration. The taxable base is the average annual cost of the property. The rate is set by local authorities. The fact is that the tax is recognized as regional. |

| For transport tax | Legal entities are required to provide documents. Entrepreneurs report to the state as an individual. As a result, they no longer need to file a declaration. Transport tax is considered a regional fee. The provision of reporting and deadlines are regulated by local authorities. The document must be provided at the location of the vehicle, which is registered to the company. The rate depends on the engine power. |

Where to file a tax return 3‑NDFL

The declaration is submitted to the tax office at the place of permanent registration of the Federal Tax Service of the Russian Federation dated 06/02/2006 N GI-6-04/ [email protected] “On the direction of information” href=”https://www.consultant.ru/document/cons_doc_LAW_60810/c1b8be8ab11626a8435ecb996e2ab6a3cfce8001 /» target=»_blank» rel=»noopener noreferrer»><Letter> Federal Tax Service of the Russian Federation dated 06/02/2006 N GI‑6‑04/ [email protected] “On the direction of information”. This can be done at the place of temporary registration only if you do not have a permanent one. Luckily, you don't have to plan to travel to file your declaration—more on that in the next paragraph.

You can find out which inspection is yours on the Federal Tax Service website.

How to fill out and submit the 3‑NDFL declaration

There are several ways to submit documents to the inspector.

Electronic

Through your personal account on the Federal Tax Service website

This is the simplest option with minimal labor costs.

1. Log in to the site. There are three ways to do this:

- Using your login and password from Gosuslug.

- Using the login and password from your personal account, which were issued by the tax office. To receive them, you need to come to the department with a passport.

- Using a qualified electronic signature (ES).

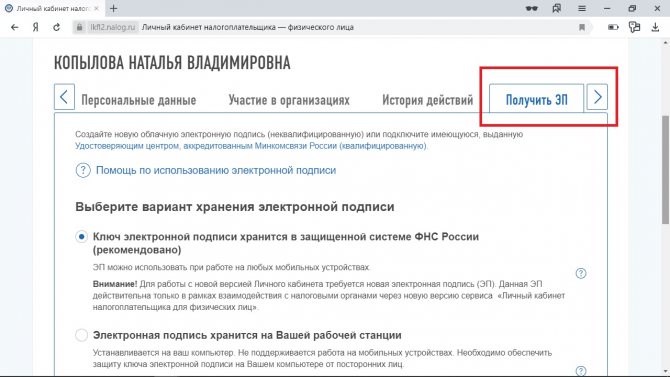

2. Create an enhanced non-qualified electronic signature if you have not already done so. Click on your last name, first name and patronymic to go to your profile page. Select "Get EP". Decide where you will store the electronic signature key: on your computer or in the secure system of the Federal Tax Service of Russia. Create a password and submit your application.

The signature will be registered in a few days.

If you have a qualified electronic signature, simply register it on the site. This will be more than enough to fill out the declaration.

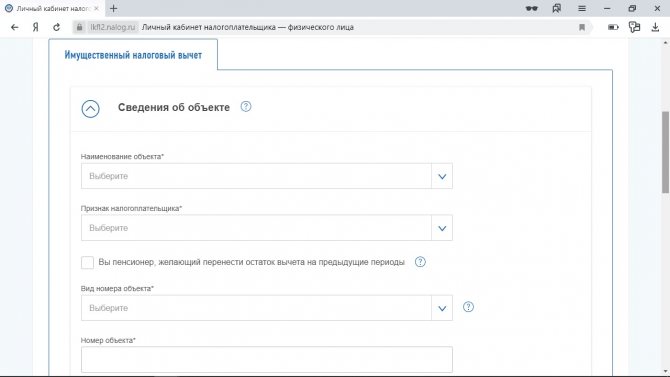

3. Select the items “Life situations” → “Submit 3‑NDFL declaration” → “Fill out online”.

4. Enter your personal information. Specify the inspection office where you are sending the documents. Usually the system offers the correct option, but it wouldn’t hurt to double-check. Mark the year for which you are filing a return (usually the previous one). Exceptions are possible if you apply for a tax deduction. Please indicate whether this is your first return this year or whether you are filing an amended document.

5. Report your income. Click on the “Add income source” button and enter the data. Feel free to hover your cursor over the question mark icon: there are very smart tips from the tax office hidden there.

Information on income on which taxes are paid by the employer will appear in your personal account after March 1. If it is not there, you will have to get a 2‑NDFL certificate from the accounting department and also add this source of income manually.

6. Select a deduction. You can read more about them in a separate Lifehacker article.

If you are reporting your income rather than filing a tax deduction, continue to the next step.

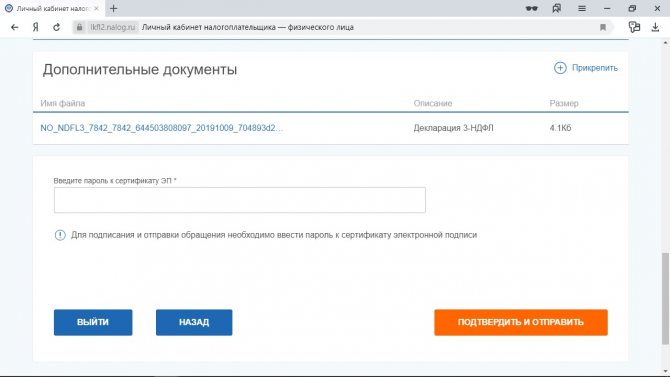

Enter details about the circumstances that qualify you for the deduction. Attach documents confirming this. You will have this opportunity before submitting your declaration.

7. Prepare the declaration for sending. Make sure that you have specified everything correctly, enter the password for the electronic signature certificate and send the document.

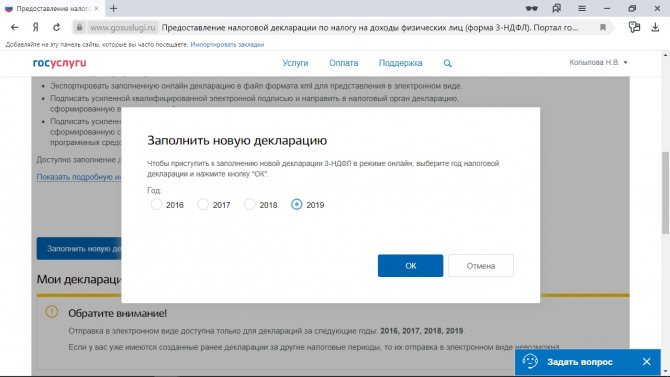

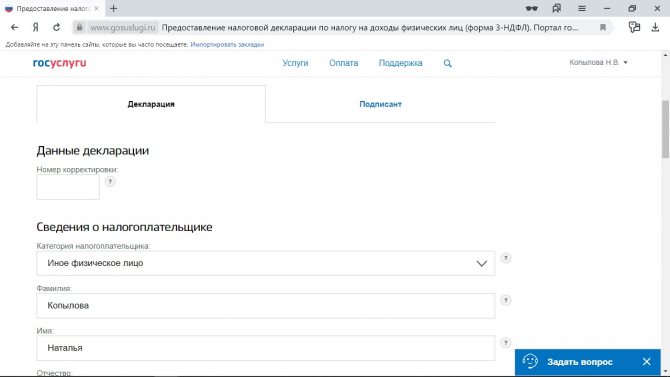

Through "State Services"

You will need the same information as when sending through the Federal Tax Service. The algorithm is similar, so when filling out, follow the previous instructions.

1. Log in to the site. Select “→ “Acceptance of tax returns (calculations)” → “Acceptance of tax returns of individuals” (3‑NDFL) → “Receive.

2. Select the year for which you are filing a return.

3. Fill out the declaration.

On paper

The declaration is ready to be accepted directly at the tax and multifunctional centers. The documents are filled out in the same way, but this must be done through the “Declaration” program. You can download it on the tax website. But even there they advise not to suffer and submit documents electronically.

Declaration 3-NDFL: how to fill out and within what time frame to submit for a tax refund

Who submits the 3-NDFL declaration for 2020?

A declaration in form 3-NDFL for 2020 is submitted in three situations.

Firstly, 3-NDFL is filed by special groups of individuals, for example, entrepreneurs on the general taxation system, lawyers, and so on. Secondly, these are those who received income in 2020 on which tax was not withheld (but the income is taxed). Third, these are those who are claiming a 2020 tax refund. Most often, income that entails the need to report arises in the following situations: the sale of property (for example, a car, apartment, house, garage) that you owned for less than 3 years (or less than 5 years for real estate acquired after 01/01/2016 year, except for those received under a privatization agreement, lifelong maintenance with a dependent, as well as as a gift or inheritance from a close relative - for the listed types the minimum tenure is 3 years), sale of securities, receipt of gifts in some situations (when the gift is, for example, real estate, and the one who gave it is not a close relative). At the same time, a common mistake in such a situation is not to file a declaration if the property was sold for less than 1 million rubles, and the car for less than 250 thousand rubles. In such situations, you will have no tax due. But the obligation to file a declaration (the so-called “zero”) remains. These are two different responsibilities - filing a return and paying taxes.

Also, a declaration in 2020 is submitted by those who apply for a personal income tax refund for 2020. For example, if you bought or built housing in 2020, or you had expenses for education, medicine, or charity in 2020, you can submit a declaration, attach documents confirming your right to deduction, and return taxes. Here you can read more about the property tax deduction.

When is 3-NDFL submitted?

Those who are required to report income by filing a declaration are required to submit it during the so-called declaration campaign - the first four months of the year following the reporting year. That is, no later than April 30, 2020. For those who file a return only for a tax refund, there is no such time limit, meaning they can file a return at any time of the year. But it is important for them to remember another deadline - only taxes paid no earlier than 3 years ago can be returned.

Forms for 2020 (for 2020)

The form (form) of the declaration for 2020 has changed compared to last year. In order not to get confused by changes when filling it out, it is recommended to use a special program or Internet service that will take care of everything. Here you can see samples of filling out 3-NDFL.

How to fill out a declaration correctly and quickly?

You can quickly and easily fill out the declaration in the Taxation online service. This service will generate the required form, enter the correct codes and calculate the results. And it will give you a ready-made declaration in a convenient PDF format.

Where should the declaration be submitted?

The declaration is usually submitted to your registered address (“registration”). Exactly at the time of filing the declaration. If, for example, you changed your registration address in 2020 or after its end, in any case, only the address at the time of filing the declaration is important. Data about your address should be sent to your “new” inspection (at the new address) automatically.