Buying a home is a joyful, exciting and long-awaited event for many. And when buying an apartment at the construction stage, it is also accompanied by worries about the successful completion of construction within the specified time frame. There are hundreds of shareholders who entered into an agreement to purchase real estate in a project under construction from unscrupulous developers and ultimately lost their financial resources without waiting for the completion of construction. In order to gain peace of mind and not worry about your hard-earned money, the law provides for the protection of the interests of shareholders, which is called insurance of new buildings. Let's take a closer look at the most frequently asked questions regarding insurance of new buildings, how this program works, how to apply for it and other aspects of protecting the interests of shareholders.

Why insure an apartment in a new building

Trusting the developer or taking out an insurance contract for an apartment in a new building under construction is a voluntary decision of every citizen, the future owner of the home. Considering the large number of construction projects frozen at the construction stage and, as a result, many dissatisfied shareholders, insurance of shared construction against unfinished construction is the protection of one’s own material assets. And given the cost of housing, even in a small city, a loss can be very expensive. However, if real estate is purchased through mortgage lending, then insurance is a prerequisite for loan approval. These measures help the bank to insure itself and not lose its funds if the construction of the facility is not completed on time, or if the developer’s company goes bankrupt. If such a situation arises, the remaining debt will be paid off by the insurance company.

Insurance programs for new buildings may differ in their content of risks and the ability to include additional risks. A standard policy includes protection for the following risks:

- delay in delivery of housing or delay in completion of construction;

- destruction of a new building for reasons beyond the control of the developer (natural disasters, terrorism);

- bankruptcy of the developer company;

- resale of an apartment through fraudulent actions.

In addition, many insurance companies offer to include additional risks in the insurance contract, which may include:

- insurance of home interior decoration;

- protection of property rights;

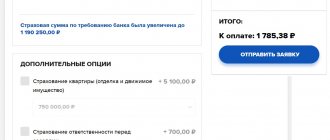

- increase in the franchise amount, etc.

ATTENTION! Adding additional insurance risks increases the cost of the policy.

When choosing an insurance company, it is important to find a reliable, time-tested company with a large number of clients. Factors such as:

- high rating from the RA rating agency;

- long period of work in the Russian insurance market;

- positive customer reviews;

- ratio of insurance claims and payments for them.

Some developers offer shareholders a supposedly reliable insurance company. You should not blindly trust this offer, since the insurance company and the developer may be in cahoots, and then in the event of an insured event, problems may arise with receiving compensation payments.

Who insures what?

The insurance contract for an apartment in a new building is concluded between the insurance company and the shareholder. In this case, the insurance company assumes responsibility for the financial risks of the policyholder, and he, in turn, is obliged to transfer the insurance premium to the insurance company’s account.

The risks that the company undertakes to compensate include failure to fulfill the developer’s obligations to the equity holder:

- delay in completion of construction;

- delay in delivery of housing;

- refusal to return invested funds;

- bankruptcy or liquidation of a construction company;

- fraudulent actions on the part of the developer with the fact of double resale of unfinished housing;

- destruction of housing for reasons beyond the control of the construction organization.

Article on the topic: Features of insurance of a private house and cottage, its cost and registration

When concluding an insurance contract, it is important to pay attention to the list of insurance risks that will be compensated, since many insurance companies assume responsibility and obligations for compensation only in the event of bankruptcy or liquidation of a construction company .

What is property insurance for individuals can be found here.

More details about insurance of developers under 214-FZ

The construction sector is one of the engines of the economy: every year, millions of square meters of residential real estate of various classes are leased in different regions. The activity of developers is largely explained by the mechanism of equity participation, which allows shareholders to reduce the cost of purchasing housing, and developers to avoid the need to obtain a loan at a high interest rate.

However, shared construction has a big drawback - the risk that the developer will not fulfill his obligations. To reduce this risk, amendments to Law 214 were adopted at the legislative level. The essence of these amendments is that the developer is now obliged to provide security for its obligations. Two documents can serve as collateral - a bank guarantee or a civil liability insurance policy.

The choice of security option is entirely up to the developer, but due to the unstable economic situation, obtaining each type of security may be difficult.

You can avoid these difficulties by using. Our clients can obtain insurance under 214-FZ in record time and on the most favorable terms.

What to watch out for

Despite the big advantage of insuring your home against unfinished construction, if certain safety measures are not followed, you can not only overpay for the policy, but as a result of an insured event you will not receive payment. To avoid this, it is recommended:

- Do not agree to cooperate with the insurance company recommended by the developer, since there is a high probability that an unscrupulous developer may be in collusion with the insurance company. And this may ultimately lead to refusal of payment. You need to choose a proven and reliable insurer, preferably with a high reliability rating of A+;

- Pay special attention to the reputation of the developer. If the developer has a dubious reputation or the object he is building has a high risk of risky events, a reliable insurance company may refuse to enter into an agreement with the shareholder.

In addition, it should be remembered that if the property was purchased through mortgage lending, the insurance rate will be higher than if you buy an apartment with your own funds.

Legislative changes

In 2014, Federal Law No. 294 was amended, according to which liability insurance for the developer of equity participation in construction is now mandatory. The developers themselves are involved in drawing up contracts. They choose with whom to sign contracts: with a company, a bank, a specialized company.

All participants of the compulsory insurance company bear joint liability. If a transaction is concluded with a bank, then a lot of time is spent collecting papers. A 30% deposit of the cost of the property must be paid, which serves as a guarantee for the financial institution. In addition, the Central Bank sets its own requirements for such banks:

— minimum term of work – 5 years;

— authorized capital 200 million;

— property value — 1 billion rubles.

It is more profitable for developers to obtain a loan than to issue a guarantee. Financial institutions also do not classify insurance for equity participation agreements in construction as profitable products.

It is better to enter into an agreement with the company. In conditions of strong competition, insurers are trying to attract customers with low rates and prices. The rate for such transactions remains fixed throughout the entire term of the contract. Developer liability insurance for shared construction is paid after the work is completed. Another advantage is the speed of processing documents. The insured is the developer himself, the beneficiary is the shareholder. The security method is selected for each residential premises separately.

Shareholders' insurance

The acquisition of an insurance policy for housing under construction occurs through the conclusion of an agreement between the insurance company and the shareholder. The interests of the shareholder in the event of failure by the developer to fulfill obligations under the contract are protected by the Federal Law “On Participation in Shared Construction” No. 214. On the basis of this law, an insurance contract is drawn up, as well as upon the application of the insured and upon provision of the necessary package of documents.

If an insured event occurs, the amount of compensation is commensurate with the amount of investment that the shareholder made in the construction. Compensation is only possible in the form of cash, and not in the form of new housing.

The insurance period is set individually depending on the date of completion of construction. Typically, the insurance period and the completion date of the object are one date. If for some reason the housing delivery date is delayed, an additional agreement is concluded between the policyholder and the insurer, which specifies a new date, which is taken from the updated share participation agreement or the developer’s constituent documents.

ATTENTION! When drawing up an agreement with an insurance company, it is recommended to choose a contract duration that is several months longer than the object’s delivery date.

An effective protection mechanism in shared construction

The most common scheme for acquiring primary housing is participation in shared construction.

In addition, this transaction format is the most protected for the buyer from a legal point of view.

Alternative methods of acquiring real estate (such as, for example, housing cooperatives or purchasing under a preliminary sales agreement)

cannot ensure the protection of his interests.

Actually, civil liability insurance of the developer to shareholders is one of a number of mechanisms through which the buyer has the opportunity to get back the invested funds if something goes wrong. In the case of alternative methods of acquiring real estate, such a mechanism is not provided, so the buyer who transfers money against promises (albeit recorded on paper)

, there is no guarantee that he will be able to get an apartment or get his money back.

Of course, in the event of a trial, the court will side with the buyer and oblige the development company to return the amount paid.

But what to do if by the time of the court decision the company simply ceases to exist or the management disappears in an unknown direction, wiping out the accounts?

The procedure for obtaining real estate insurance against unfinished construction

To conclude a real estate insurance contract against unfinished construction, you need to go through several stages:

- Firstly, as mentioned earlier, you need to choose a reliable company that offers services to protect real estate under construction.

- Secondly, you need to choose an insurance program.

- The next step is to establish insurance coverage, which is commensurate with the amount of investment in the property being purchased or the cost of a bank loan to purchase a home.

- If an insured event occurs, this exact amount will be compensated.

Related article: Features of title insurance when purchasing real estate

One of the main conditions for concluding an agreement with an insurance company is the provision of a full package of documents required by the policyholder. The standard package of documents includes:

- agreement between the construction organization and the shareholder;

- permission from local government for the construction of the facility;

- lease agreement for the land plot on which the house will be built;

- receipt or check for payment of the investment contribution;

- constituent documents of the developer.

The insurance company carefully checks all documents relating to the activities of the developer in order to ensure its reliability. The check is carried out by a special expert and the result of this check is valid for 2 months. If the contract is not signed within this period, you will need to go through the entire procedure again. These actions are for the benefit of both the policyholder and the shareholder.

You can learn about the features of insurance for developers here.

Equity insurance

Construction equity insurance was previously a right, not an obligation, of developers. But since 2014, everything has changed, and now they are required to carry out this procedure. Otherwise, it is a violation of the law. The norm is contained in Federal Law No. 214.

Full liability insurance for the developer during shared construction is carried out as follows:

- with the help of a mutual insurance company;

- with the participation of a credit institution;

- with the help of an insurance company.

If the developer provides insurance with the help of the society, he is forced to pay membership fees.

Participants bear collective responsibility. Insurance from a bank is rarely used, as it requires compliance with more serious conditions from both parties. For example, the applicant will need a lot of documents and payment of a security deposit. Insurance by a developer of shared construction with the help of a financial institution implies the presence of additional restrictions. First of all, they concern the bank.

- The institution must operate for at least 5 years.

- The bank's capital is no less than a fixed amount (200 million rubles).

- The value of the institution’s total property is at least 1 billion rubles.

Finding a bank that meets the legal requirements is not easy. Many construction companies prefer to issue loans that automatically come with insurance. But then it is difficult for shareholders to receive compensation when an insured event occurs.

Construction insurance by a company is most often carried out with the help of licensed firms. There is no need to pay a deposit, the interest rate does not change throughout the entire period. If an insured event occurs, shareholders have the right to receive funds.

Information: the developer bears all costs for registration and payment of insurance. But shareholders have the right to demand information about the terms of the insurance agreement.

Ensuring payments is also carried out with the help of Rosreestr, because the relationship between the developer and the insurer must be registered. The agreement is registered as an official document containing the conditions necessary for cooperation. The rule also applies to preschool education. Without this, further relationships are impossible, as stated in Federal Law No. 214.

Shareholders themselves can take out insurance. This is permitted by law, but such a procedure is voluntary and not mandatory. In this case, the participant acts as a beneficiary and policyholder at the same time. And the construction company, that is, the developer, acts as the insurer.

Cost of insurance

The cost of a policy for real estate under construction depends on what insurance rate will be applied. The size of the tariff is influenced by the results of checking the developer’s documentation (about the construction project, constituent documents, various types of permits, etc.) and assessing the risks of insured events. Also, the price of insurance compensation is affected by the value of the property, what stage of construction the property is currently at and the timing of the commissioning of the property.

The tariff percentage is also affected by the amount of investment. The value of the property paid by the equity holder is usually equal to the amount of the insurance coverage. Usually 2% of the investment amount per year is taken. If there is a high risk of an insured event, the percentage may increase to 6% per year.

Insurance payments

The main rule for receiving insurance payment is timely submission of a claim to compensate for damage within the time limits legally specified in the contract. The law establishes two periods for filing an application, which depend on the cause of the insured event. So this is:

- 24 months from the date of the court decision to foreclose on the collateral;

- until the end of the date when bankruptcy proceedings were completed in relation to the bankrupt construction organization.

Compensation is paid in full if the cause of the risk event is recognized as bankruptcy of the organization. This amount cannot be recovered from a bankrupt company, so it is strongly recommended to insure the property, since compensation in this case will be paid by the insurance company.

The application for compensation for damage must be accompanied by evidence - a package of documents:

- a document confirming that the shareholder has not received a refund from the developer;

- a document confirming that the housing was not transferred to the developer;

- insurer's passport;

- receipts for payment of insurance premium;

- documents confirming ownership;

- a document confirming that there was an insured event;

- the result of the examination and the estimated amount of damage.

The exact list of required documents can be clarified with the insurance company employees.

Changes in law and compensation fund

The compensation fund for shared construction (a fund for the protection of the rights of shareholders) was created by the state in order to protect shareholders from financial losses as a result of the developer’s failure to fulfill his direct responsibilities. The main task of the fund is to compensate for damage to shareholders under an equity participation agreement (SPA). The protection fund appeared in 2020 to replace the developer's liability insurance, which had existed since 2014, but showed its ineffectiveness. The essence of the fund’s work, as in the developer’s liability insurance, is to protect the rights of shareholders, but with a different mechanism of action.

Article on the topic: Features of real estate insurance in Sberbank Insurance

After October 20, 2017, for all new construction projects, the developer is required to transfer a certain percentage of the contribution to the account of the shared construction fund. The amount of the contribution is established by law, which is the same for everyone - 1.2% of the value of each agreement with the shareholder. The amount accumulated in the fund account is a source for compensation of damage or as financial support for the completion of construction of the project.

In addition, in June 2020, amendments were made to the law and now the shared construction fund is obliged to compensate for damage even if the shared construction agreement was drawn up before October 20, 2020.

What are the consequences of the adoption of the law on compulsory insurance?

Once a law is passed and officially introduced obliging all construction companies to insure the activities they currently conduct, the following changes and reactions to such a reform are expected:

- Law firms, which are the mainstay and support of developers, will once again begin to dig and look for loopholes in the new law. As a rule, experienced people who are professionals in their field find them and subsequently use them in unauthorized financial schemes.

- All housing in newly constructed buildings will increase in value exactly by the amount that construction companies will pay as insurance.

- Those people who have entered into a shared participation agreement, in connection with the newly used so-called “gray schemes,” may generally lose the opportunity to get their own housing. This can happen even if the building is successfully completed and the construction company does not go bankrupt.

- If we talk about corruption, then most likely, when the new law on compulsory insurance is introduced, construction will be covered by a new wave of crime on this basis. Moreover, the matter will affect specifically new buildings, since it is for them that insurance will be issued.

It should not be forgotten that construction companies must have certain financial assets that will be used to pay the insurance amount for a new home. Currently, to insure a newly constructed building, it takes about 300 million rubles, which is an unbearable burden for many companies. If construction companies try to resort to the help of banks, which will calculate all possible risks, then this will cost them another three percent of the insurance amount. This is exactly the amount that the developers will need to pay to the bank for all the analytical work they have carried out. In this case, banks may also require collateral, which, as a rule, is land that belongs to local authorities.

However, the municipal organization will never agree to leave the land as collateral. It is much easier to offer the bank some equipment or something even simpler instead of a plot of land. However, this scenario is also unlikely, since most of the equipment used in the construction process is used on the basis of a leasing agreement. That is, in fact, the equipment is also rented.

For this reason, such an approach to business also complicates the process of selling apartments in a new building. Since it will be impossible to carry out such activities without insurance, the developer must:

- join the corresponding company, in which the lump sum payment is 500 thousand rubles;

- in this case, it is necessary to pay an insurance premium equal to 1.2% -1.6%;

- the construction company must have an authorized capital of at least 120 million rubles;

- the amount of own available funds must be at least 400 million rubles.

If the developer does not have insurance for the new building, as well as guarantees issued exclusively by the bank, then he will be strictly prohibited from selling apartments under an equity participation agreement.

In what cases can payment be refused?

Insurance of new buildings contains many pitfalls, which at first glance may seem unremarkable, but become the reason for refusal of payments. Even before signing the agreement, you must carefully read the contract, paying special attention to the chapter concerning clauses related to insured events. Often, companies can very cleverly disguise risks and subsequently refuse compensation. Each specific case of insurance risk must be specified separately. For example, the term “fire” in a contract may not include the concept of “arson,” which means that if the property was damaged by the actions of third parties, compensation will be denied.

In addition, the following situations may include uninsured events:

- if the damage was caused by the fault of the shareholder himself;

- if there was a fire in the apartment due to improper operation of the equipment (they didn’t turn off the gas, forgot to turn off the iron, etc.);

- in case of an insured event arising as a result of military actions.

Payment may also be refused if the shareholder:

- provided incorrect or knowingly false information about himself;

- did not pay the insurance premium.

To avoid problems with receiving payment, it is recommended to seek advice from a competent lawyer before signing the contract.

Developer liability insurance forms

In 2014, civil liability insurance for the developer became mandatory (Federal Law No. 214-F3, Article 15.2). The insurance itself assumes that the developer is unable to complete the construction of the property for one reason or another; in this case, the insurance will compensate for all “lost” funds of the shareholders.

Currently, only two fundamentally different forms of such insurance are provided: compulsory and voluntary insurance by the developer. The difference between them is quite noticeable:

In the case of voluntary insurance, the amount of funds received under insurance depends only on the amount of contribution from shareholders (the more shareholders invest in construction, the greater the insurance payments will be, if necessary). With compulsory insurance, the amount of payments will not directly depend on the percentage of financing of shareholders.- Voluntary insurance presupposes the presence of bankruptcy management if the developer refuses to continue work. With compulsory insurance, shareholders receive compensation from the insurance fund;

- Voluntary insurance in certain situations may imply a waiver of compensation and payments, while compulsory insurance cannot be terminated.

- The voluntary insurance agreement can be changed during construction; compulsory insurance has permanent rules that cannot be changed from the moment of signing.

Also, insurance may vary depending on the insurance provider. This can be non-commercial risk insurance. The guarantor can be an insurance company providing such a service and a bank.

The significant difference is that the insurance company pays the amount specified in the policy, and in the vast majority of cases reserves the right to refuse payment after it assesses the developer as “unscrupulous” and notifies the shareholder of the risks. A similar mechanism applies to banks. In the case of non-commercial insurance, we are talking about the mechanisms of the Mutual Insurance Society, whose actions are regulated by Federal laws.

What to do if a construction company goes bankrupt

If a construction organization has been declared bankrupt and documents confirming this fact have been provided, the insurance company is obliged to pay 100% compensation to the insured shareholder. To receive this payment, you must inform the insurance company about this within the specified time frame, submit an application and provide the required documents.

Each company establishes its own list of required documentation, but the standard package includes:

- a document confirming that the shareholder has not received a refund from the developer;

- a document confirming that the housing was not transferred to the developer;

- insurer's passport;

- receipts for payment of insurance premium;

- documents confirming ownership;

- a document confirming that there was an insured event;

- the result of the examination and the estimated amount of damage.

After reviewing all the documentation, if the insurance company does not require additional documents, an approving decision will be made and the payment will be transferred to the client’s account.

When taking out any insurance, you should weigh the pros and cons, make sure the insurance company is reliable and carefully read the terms of the contract. This also applies to property insurance in a new building. But when it comes to buying real estate, large financial resources are always involved, which means there is a high risk of losing a large amount. If the developer goes bankrupt, it is impossible to demand that he return the money invested; only the insurance company can compensate for the damage. Therefore, although this is a voluntary purchase, it is strongly recommended that you take out insurance.