Cost of assessment in “INNOVATIONS” under the “MORTGAGE Lite” program:

- Collective assessment - from 1800 rubles .

- Individual visit of an expert - from 3,500 rubles .

The service includes the production of two copies of the report (one for the bank, the second for the MFC), as well as free delivery of reports to the bank (more about delivery).

The service completion period is 1-3 business days from the date of provision of all documents and photographing of the apartment.

Why do clients choose INNOVATION Center?

- Your personal account is convenient and safe.

- Under the MORTGAGE Lite program, the service is integrated with Rosreestr.

- There is a mobile application.

SIGN UP FOR AN INNOVATION ASSESSMENT

More information about conducting an independent assessment for banks:

Accreditation in banks Cost of assessment Procedure for assessment List of required documents Payment, delivery, report in PDF,... Mandatory insurance (On-Line)

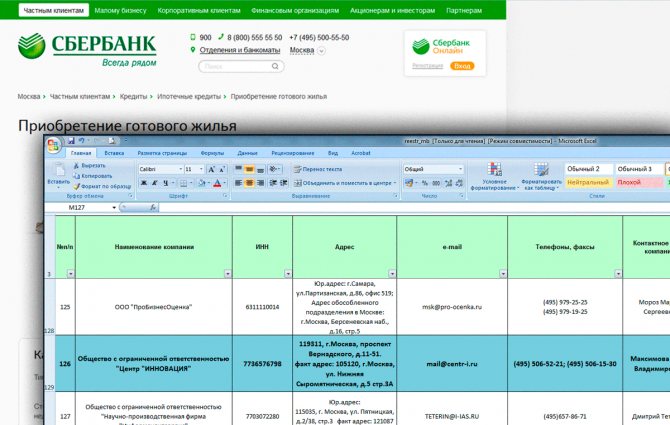

— accredited partner of Sberbank of Russia since 2012.

| List of appraisal organizations of the Central Russian Bank of Sberbank of Russia: | List of appraisal organizations accredited by SBERBANK (Moscow): |

|

BACK TO MENU

Our reports are accepted by all banks without exception.

. In some we have official accreditation, but this has absolutely no meaning, because all banks are obliged to work within the framework of the law, and not violate it in relation to an independent assessment. Learn more about accreditation. In 2020, we completed more than 23,000 assessments for a variety of banks in the country:

| Bank's name | Number of reports completed in 2020, pcs. |

| Sberbank of Russia | 8758 |

| VTB 24 | 2114 |

| Gazprombank | 1878 |

| Raiffeisen Bank | 874 |

| UniCredit Bank | 216 |

| Metallinvest bank | 175 |

| Credit Bank of Moscow | 44 |

| Uralsib | 44 |

| Promsvyazbank | 37 |

| Transcapital Bank | 34 |

| Svyaz Bank | 32 |

| Renaissance | 30 |

BACK TO MENU

Collective assessment

To evaluate an apartment in a new building, you can use either an individual service (individual visit by an expert) or a collective one, with significant savings in money.

Collective assessment

- this is an opportunity to get a ready-made report for

1800 rubles.

, that is, save more than 50%.

The principle of pricing during collective assessment:

| Bank reporting | number of apartments for inspection | |||||

| 1 | 2-4 | 5-7 | 8-10 | 11-39 | 40 or more | |

| Sberbank, VTB (watch out for promotions!) | 3800 | 3500 | 3000 | 2500 | 2000 | 1800 |

| Delta Credit, Gazprombank, Metallinvest, Otkritie, Zenit | 4500 | 4000 | 3500 | 3000 | 2500 | 2300 |

| assessment according to the Bank-Appraiser system | 4500 | 4500 | 3000 | 3000 | 3000 | 3000 |

| all other banks | 3800 | 3500 | 3000 | 2500 | 2000 | 1800 |

When the keys are issued, 99% of new buildings already have people willing to be appraised. Just leave a request!

We ourselves are gathering a group of people interested in your residential complex, but if you have a desire to help us with this, we will only be glad and grateful to you personally. Read about how to organize a collective assessment yourself here.

To join a collective assessment, call us (or leave a request), provide the address and desired date. We will immediately inform you about planned departures, and if necessary, we will jointly adjust the date.

Most often we plan a trip on the weekend!

Approximately one day before the assessment day, our manager will contact you and agree on an acceptable time for visiting your apartment. Then you will receive an SMS with the date, time of the inspection, name and telephone number of the expert at the inspection.

Inspecting and photographing the apartment will take no more than 15 minutes.

You can join the collective assessment at any time, even on the day of the assessment!

REFERRAL SYSTEM “MORTGAGE Lite”

Do you want to make money by attracting clients? It's very simple: share the referral link on your page, in the LCD chat... anywhere. Everyone who follows the link and orders the service will become your referrals, and for the services they paid for, the Program Partners will pay you a reward of up to 10% of the cost of the service.

Example: when refinancing a mortgage lender you referred through MORTGAGE Lite, the amount of your remuneration can reach 20 thousand rubles. And this despite the fact that the conditions for refinancing in MORTGAGE Lite are better than directly at the bank!

The situation is similar with insurance. Share the link, help people save and receive rewards from banks, insurance and appraisal companies!

More details in your personal account, section “REFERRAL SYSTEM”

Individual assessment

If you do not have the opportunity to adapt to the conditions of a collective assessment, order an individual visit from an expert. A specialist will come to you at the agreed time and carry out all the necessary actions within 5 minutes.

Individual departure

costs

3800 rubles.

If you are far from the Moscow Ring Road, the cost may increase slightly (to be agreed with the manager).

Good news!

From January 2020, when ordering an individual assessment, your MORTGAGE Lite account automatically switches to VIP status. The status provides a number of advantages, and the most important of them is the opportunity to conduct a mortgage loan audit by a program expert, with detailed consultation. The goal is to reduce the cost of servicing a mortgage (loan interest, insurance, taxes,...). Read more...

Who is eligible for a Sberbank mortgage for secondary housing in 2020?

The list of requirements for the recipient of a mortgage loan at Sberbank is constantly changing and some requirements “disappear” from the list, but this does not apply to such parameters as:

- Russian citizenship;

- registration at the location of the Sberbank branch;

- fixed income;

- certain work experience.

The age of the applicant matters. Getting a mortgage for secondary housing at Sberbank is available from the age of 21, and at the time of repayment of the mortgage loan, the age should not exceed 70 years.

The implementation of a number of programs jointly with the state makes it possible to obtain a mortgage for secondary housing on preferential terms. A large or young family can contribute maternity capital to repay part of the loan or make a down payment on a mortgage. At Sberbank, the terms of mortgages for secondary housing for other categories of beneficiaries (military personnel, families with disabled children, combatants, and others) have also been simplified by the bank and the state as part of the implementation of state programs.

Appraisal for Mortgage Refinance

Such an assessment is practically no different from the assessment for registration of property, but it is worth paying attention to one feature: when submitting an application for refinancing to the bank through our personal account, you have the opportunity to get back up to 100% of the funds spent on the assessment ( CashBack

), in case of concluding a mortgage agreement.

Not all banks have joined this program, so check your bank for presence in the CashBack program of the INNOVATION Center

(MORTGAGE Lite), and apply through us!

sign up for an assessment

Office phones are open Monday to Saturday, from 10 to 19:00. But you can sign up for an assessment any day!

Telephone

BACK TO MENU

Features of the building's location

First of all, you should know the location requirements:

- An apartment building must be in acceptable sanitary and technical condition and not subject to demolition. You can find out whether a house will be subject to resettlement or demolition by contacting the administration of a given territorial entity;

- An apartment located in a private house (barracks) without central heating and sewerage is not subject to consideration only if, according to the documents, it is a share or has more than 50% wear and tear on the building;

- The apartment or house must be located on the territory of the Russian Federation, with the exception of the Crimean peninsula and the city of Sevastopol, since Sberbank does not have offices in these territories;

- The seller must submit an application having owned the apartment or house for at least three years. Otherwise, problems may arise in the future if the seller’s relatives begin to claim part or all of the housing;

- Dormitories and hotel-type premises are quite suitable for Sberbank;

- Lenders have a negative attitude towards apartments located in the basement, on the lower or top floor;

- The property must be located in developed areas, there must be hospitals, schools and kindergartens;

- They rarely lend to “Stalin” buildings - because of the wooden interfloor ceilings and “Khrushchev” buildings.

Recommended article: Underfunded mortgage or risks of purchasing real estate at a reduced price

These restrictions are due to the liquidity requirement of the premises, which must be presented to the bank as a guarantee for the return of funds. A collateral that does not meet at least one of the conditions will be extremely difficult to sell.

WHEN REFINANCING A MORTGAGE:

If you have already ordered an assessment from us, and now to refinance the loan you need a new report (according to the requirements of the new bank, taking into account changes in ownership,...) - we will definitely give you a good discount.

Moreover, if less than 3 months have passed since the assessment, you will save time and money on repeat photography.

Call us and we will advise you and immediately decide how to make a report quickly and inexpensively.

sign up for an assessment

BACK TO MENU

To evaluate an apartment when registering ownership (for a bank mortgage), the following copies of documents are required:

- An equity participation agreement, or an agreement on the assignment of rights, if available, instead of the DDU.

- Certificate of acceptance and transfer of the apartment (on the fulfillment of obligations under the DDU).

- Civil passport of the shareholder, double page with photo and registration. If there is more than one shareholder, then the passports of everyone listed in the DDU will be required.

- Extract from the Unified State Register of Real Estate (required by banks: Vozrozhdenie, Transcapital, Metallinvest, but it’s better to check with your bank manager). You can order an extract through us, it is done within 2 hours.

- Registration certificate for the apartment *

*You do not need to specially order a technical passport; your developer already has it. When the house was handed over to the state commission, the developer, together with BTI employees, measured all the constructed apartments and prepared a registration certificate for the house. From this document we will receive the parameters of your apartment for registration of a mortgage. That is, from a multi-page technical passport, we will cut out only the fragment we need for your apartment.

Options for obtaining a technical passport from the developer (only the developer himself will tell you the required option, by phone, and if you can’t get it from the developer, our manager will advise you):

- Download from the developer’s website (in this case, the developer will tell you in which section of the site the documents for downloading are located).

- Receive from the Management Company of your home, or from the developer’s office when signing the deed.

- Receive upon request, to the email address that you provide to the developer via SMS or by phone.

Attention! We only need copies of documents, and in electronic form (just upload in your personal account)

In most cases, an explanation and a floor plan can be obtained from the office of the developer or management company, when signing the apartment acceptance certificate.

sign up for an assessment

BACK TO MENU

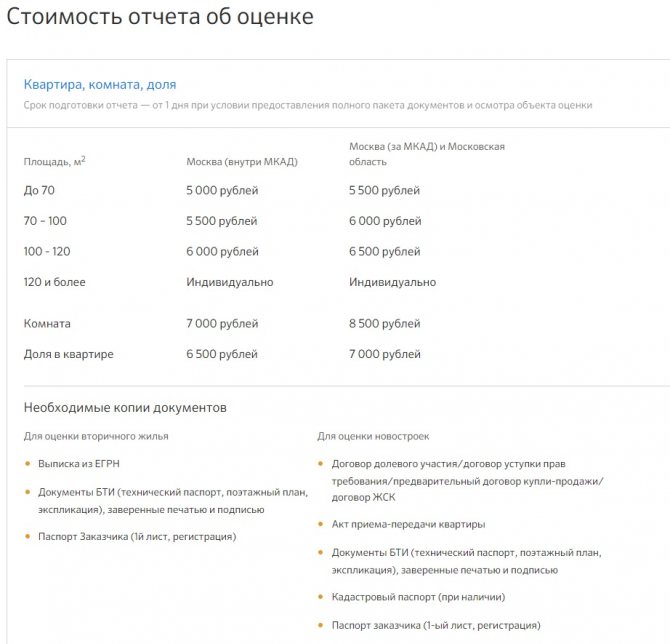

The cost of appraising an apartment in Sberbank

The premium paid by the borrower for appraising an apartment with a Sberbank mortgage depends on factors such as:

- the region in which the collateral is located;

- the pricing policy of the appraiser (price levels for a large company and a private appraiser can be very different);

- area and type of housing;

- the day on which the specialist is scheduled to visit (weekends are usually more expensive than weekdays).

It is logical that the cost of the assessment is 1-k. apartments for a mortgage and houses with a plot in an elite village outside the city will have a significant gap.

As for territorial differences, in Moscow and St. Petersburg prices will be maximum - from 5 thousand rubles. Prices vary in the region, the starting price is from 2 thousand rubles. Registration of real estate valuation by a Sberbank employee - from 3,000 rubles.

The cost of an assessment report for a Sberbank mortgage in Moscow and Moscow Region:

Delivery of reports

Delivery of reports (as a rule, the result of our work is two copies of one report) is made from Monday to Saturday.

In order to order delivery of the report “tomorrow”, we kindly ask you to arrange and pay the delivery cost in your personal account no later than 15:00.

The easiest way to order delivery is in your personal account.

You can also use the service of delivering reports directly to your bank branch, within the Moscow Ring Road. Read more about the procedure for delivering reports to Sberbank here.

Providing a report in PDF and scanned printed pages to the bank manager

From his personal account, the client can send an SMS with a link to the finished report in PDF and scanned pages of the report, which contain a signature and seal. The SMS can be forwarded to the mortgage manager.

(service in accordance with the requirements of 152-FZ on the protection of personal data)

sign up for an assessment

BACK TO MENU

Structural insurance is a mandatory condition of any mortgage loan agreement

Since August 2020, all our clients can independently (on-line) arrange their insurance (constructive) in our personal account.

Moreover, for such banks as Sberbank, Gazprombank, Svyazbank and Uralsib, with our help you will receive a policy in electronic form. That is, you don’t even have to go to the insurance company.

Why is insuring through us the most profitable option?

It would seem that calling several insurance companies and finding the cheapest one is the most correct option. However, it is not. As a result of the call, it turns out that even the lowest rate offered to you “directly from the insurance company” will be higher than the rate at which you would issue the same policy through us. The secret lies in the fact that the insurance company does not have such volumes of mortgages as we have, and it is profitable for the insurance company to give us a rate lower than its own minimum, only so that the clients ultimately end up with this insurance company. Two reasons why you should take out insurance with us: 1. The rate for insurance through our system is the lowest on the market!

Example: for Sberbank, constructive insurance in our system will be 0.08% of the loan balance.

For all other banks - 0.1%! Compare these numbers with other insurance offers. 2. Quick and easy

You no longer need to travel anywhere or coordinate a bunch of paperwork with the insurance company. We have almost all the necessary documents for your mortgage, and have agreements with several insurance companies. Together with you, we create a policy, electronically approve it with the insurance company that is most profitable for your bank, you pay for the policy by card and a few hours later download the finished policy in electronic form (Note: the electronic policy is not suitable for all banks).

In addition to the policy, download a payment confirmation receipt with a verification code on the Federal Tax Service website.

Legal nuances

Housing undergoes a two-level inspection in accordance with all the above requirements, the possibility of maintaining the value of this housing throughout the entire mortgage period is considered. After these operations, the time comes for a legal audit, during which the following occurs:

- Assessment of the cost of residential space on the market, which is carried out with the participation of an independent expert selected by Sberbank;

- Monitoring the legal purity of a future transaction, in which potential candidates for property will be identified, taking into account minors, incompetents or those serving a sentence, discharged due to violation of legal requirements;

- Checking the full compliance of the technical characteristics of the property and the information contained in the documents.

However, many owners of residential space, usually involved in repurchasing real estate, seek to reduce the amount in the purchase and sale agreement. When concluding a transaction with the participation of any financial organization, this opportunity appears only when the client pays the entire remaining cost himself. This happens due to taxation; in accordance with the relevant legal requirement, the amount of funds from the sale of residential space that has been in the seller’s possession for less than five years is subject to taxation on that part of the property whose price exceeds 1 million rubles. At the same time, the bank usually enters into transactions with owners who have owned real estate for more than five years.

Recommended article: How to calculate a mortgage online?

Even if the owner of the property considers its inflated price to be justified, he will need to reduce the value to the level determined as a result of an independent examination during a legal audit. The bank will give approval only if the seller approves the discount and the cost of the living space does not exceed the amount specified by the expert. However, if the client expresses a willingness to bear all additional costs, the seller can negotiate with the buyer, which will serve as an alternative solution to the cost issue.