What is required for a mortgage loan?

The list of documents that will need to be presented to the bank may differ depending on where exactly you will apply, as well as on the mortgage program. Below is a sample list of what you will need to prepare.

- A written application for a mortgage loan, which must be completed at a bank branch. It is in the form of a questionnaire.

- Passport of a citizen of the Russian Federation.

- Certificate of pension insurance.

- TIN.

- Military ID (for men of military age).

- Documents evidencing education (certificates, diplomas).

- A work record book, as well as a certificate of income, which must be certified by the chief accountant.

- Certificate of marriage or divorce.

- Birth certificates of children, if available.

The bank will need to provide not only the originals of the above documents, but also their copies.

Some banks allow you to fill out an application for a mortgage online.

We talked in detail about how to apply for a mortgage online at Sberbank of Russia in a separate article.

Particular attention must be paid to ensure that all documents are completed correctly. False information may cause the bank to refuse to provide a loan. This will affect your credit history, which may make it difficult to obtain a mortgage from other banks.

In addition to the required documents, the bank may require additional information from you, which includes :

- information about immediate relatives - photocopies of their passports;

- certificate of registration, which can be obtained at the passport office;

- certificates proving that the borrower has property, for example, an apartment, land, car, etc.;

- a certificate from the EIRC confirming that the borrower has no debt on utility bills;

- certificates from a psychiatrist and narcologist;

- information about unemployed close relatives.

If a guarantor is required for the loan, then he will also have to provide the above list of documents to the bank. Do we need a guarantor for a mortgage at Sberbank, what responsibility is assigned to him, and whether it is possible to get a mortgage without guarantees from a third party? We discussed here.

If you are going to take out a mortgage for housing construction, the bank will require you:

- design documentation related to the construction project;

- ownership of the site;

- documentation showing the expenditure of funds.

You can find out the conditions, as well as the pros and cons of a mortgage from Sberbank for the construction of a private house here.

Factors influencing the amount

The minimum amount provided for a mortgage at Sberbank will depend on many factors, and only the bank itself knows how exactly it is calculated. It seems that the approach of each specific office and the mood of its employees play an important role, because their evaluative opinion regarding the solvency and reliability of the client, and, consequently, the prospects of issuing a loan to him, is also given space. But we can identify the main factors that influence what the minimum mortgage size will be. And this:

Borrower's income

A key factor, although first of all, based on it, the maximum loan size that the bank is ready to provide is determined, and whether it will be ready to provide a loan at all.

It is clear that if the client's income is too low to pay the mortgage, then it will be denied.

When making calculations at the bank, it is assumed that the client can spend approximately 30-60% of his regular monthly income on repaying the loan, while the rest of the income must cover the basic needs of all family members. This means that income is calculated for the entire family, as are expenses.

Property value

Inviting an appraiser is required to take out a mortgage - this way the bank will be able to obtain accurate data on the value of the property for which the mortgage is being taken out. If the sale price is higher than, in the opinion of the appraiser, the bank will not provide a mortgage based on a percentage of the sale price, but will do so based on the price indicated by the appraiser. If the property is sold for less than it is worth, in the opinion of the appraiser, the same thing applies. This is important for us, first of all, because the minimum mortgage size will directly depend on the valuation of the property.

Requirements for the recipient

Sberbank can provide mortgages to persons over 21 years of age. The income of the person planning to apply for a loan has a great influence on the approval of the application.

The following factors can increase the chances of your application being approved::

- work experience from 1 to 3 years;

- salary, the amount of which must be at least twice the monthly loan payment;

- official work with the conclusion of an employment contract.

If you have changed jobs, your mortgage application must be approved for at least six months.

Credit history also plays a big role. The bank may refuse to provide a mortgage not only to persons with a bad credit history, but also to those who do not have one.

Existing restrictions

All restrictions on obtaining a mortgage loan are specified in the banking conditions. To find out more about them, you can contact a bank employee.

Before applying for a loan, you need to realistically assess your capabilities. You cannot get a mortgage for several reasons:

- Age. Most banks refuse to provide mortgage loans to young and elderly people. The fact is that the loan is issued for a very long period, and the person is given a large amount, and in both the first and second cases, the risk of non-repayment of the money to the bank increases (what is the minimum mortgage term at Sberbank?).

- Place of registration. Often people do not pay due attention to this point. Many families living in one area purchase an apartment or plot of land in another area or city. The fact is that there must be a branch of the bank chosen by the borrower in the same area as the apartment. If it is not there, then most likely you will receive a refusal from the bank in a short time. What to do if you were denied a mortgage at Sberbank and how long after you can apply again, read here.

- Place of work. Here the bank pays attention primarily to the length of service and the official salary of the borrower. Work experience is of greater importance, since it determines what the borrower’s financial situation will be in the future.

- Real estate. Before concluding a loan agreement with a bank, the property must be carefully checked. The borrower is obliged to provide the bank with information with which it will be possible to determine the market value of the apartment in advance.

Minimum mortgage amount

There is no one, strictly agreed upon minimum amount for everyone - neither fixed nor as a percentage.

Most often, this role is played by a threshold of 30% of the value of the purchased property, but in some cases the threshold can be reduced to 20%, or even 10%. Based on what bank employees decide on the possibility or impossibility of lowering this threshold is a big question.

Sberbank used to have a firmly established minimum amount of 45,000 rubles, but now it is no longer valid. For some proposals, a new minimum level has been established - 300,000 rubles, while for others, as already mentioned, there are no strict limits, and the calculation takes place as a percentage of the value of the property. What can clearly be said is that the bank calculates the ratio of possible income and risk, and reduces the amount only to the point where the risk no longer pays off the income. In addition, it is simply not very profitable to draw up a contract for a small amount, because it takes a lot of time, but the return is relatively small.

Where there is a minimum amount, there is a minimum term, and therefore the same people who are interested in what the minimum amount of a mortgage loan can be are also interested in what the minimum term of a mortgage at Sberbank is. After all, the overpayment directly depends on the term, and even though it is easier to pay over ten years, interest is charged for each year, and you will have to pay much more. To avoid this, the minimum amount can be borrowed for the minimum period, which, according to Sberbank’s main mortgage programs, is one year.

Speaking about the minimum size and term of the mortgage, let’s say a few words about the maximum: as a rule, it is equal to 80% of the amount of the purchased property, on the basis that by paying the remaining 20% the client will confirm his solvency. But in some cases, usually through special promotions, you can get a mortgage that covers 100% of the cost of the purchased property. However, if you take out such a mortgage not from Sberbank, pay great attention to the agreement - it may contain many subtle, at first glance, not the most pleasant conditions.

What should be the minimum work experience?

If the work experience is less than six months, then, in most cases, the person will receive a refusal from the bank, since this indicator raises doubts about the borrower’s solvency. However, this is not the only thing that determines whether your mortgage application will be approved or not.

Often, the borrower is required to present a work record book. Sometimes the information contained in this document may influence the bank's decision not in your favor.

Why is this happening? The bank may be alerted by information that a person worked at different enterprises for 6 months to a year. Also, the bank’s decision may be influenced by information that a person was fired from a previous position due to violations of the Labor Code of the Russian Federation.

A few more reasons when the bank most likely will not give a mortgage after reviewing the work record:

- Inconsistency of education with the position held.

- At the time of submitting an application to the bank, the person is unemployed.

- Long gaps in the borrower's work experience.

- If a person works, but is not officially employed and, accordingly, there are no necessary entries in the work book.

Minimum and maximum age

In accordance with the legislation of the Russian Federation, persons over 18 years of age can obtain a mortgage loan from a bank. However, in most cases, banks only approve applications for those over 21 years of age.

Each bank sets the minimum and maximum age independently.

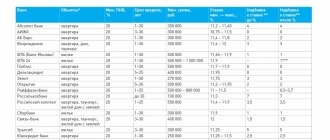

Therefore, before contacting the nearest branch, it is better to find out this information on the official website . For example, in Sberbank and VTB24 the age limit for obtaining a mortgage is from 21 to 75 years.

Read more about up to what age they can give a loan at Sberbank and at what age you can become a borrower here.

How to check the status of a loan application at a Sberbank branch?

The most complete way to clarify the results and complete information on the status of the application and the stages of loan consideration, including mortgage loans, is to visit the Sberbank branch, the specialist from whom the documents were drawn up. Specialists work according to their own schedule. But another employee also has access to the same information base to be able to fully inform the client about the status of the loan or answer his questions.

Recommended article: Mortgage with maternity capital in Rosselkhozbank

Will the bank give money if the borrower has a loan?

Sberbank is the most widespread bank in the Russian Federation. The organization offers its clients various mortgage programs suitable for different segments of the population.

But if a person already has a loan, can he get a mortgage from Sberbank? To do this, the borrower must do the following :

- Receive salary certificates.

- From the bank where the loan was previously issued, obtain the necessary certificates indicating the existence of existing loans and their repayment.

- Decide on a mortgage program that will match your income and social status.

- If possible, add another payment person to the list of borrowers.

What are the alternatives?

It is not always profitable for banking organizations to cooperate with clients who wish to borrow a minimum amount. A mortgage loan is a rather complex agreement that requires the interaction of many departments of the bank. Such agreements, in addition to being high risk, are also very costly for the bank.

Therefore, it is rare to find a reliable organization that would offer a mortgage of less than 300,000 rubles. And in modern economic conditions, this amount is often many times less than the cost of real estate, so except for suspicion from the security service when asking for a small amount, you are unlikely to achieve anything.

If you don’t have enough money to buy an apartment: from 50,000 to 300,000 rubles, you can use alternative options.

Consumer loan

You can take out a consumer loan. Apply for a loan from Sberbank or another commercial organization. What is the minimum amount for a consumer loan? Banks offer consumer loans from 30,000 to 500,000 rubles. The interest rate will be higher than on a mortgage from Sberbank or another bank: about 15–30%. But at the same time, drawing up such an agreement is much simpler.

It is possible to obtain a loan without proof of employment and income. Funds are issued within 3 business days from the date of application. Therefore, if a small amount is not enough to buy an apartment, then the option of borrowing cash from a bank may be quite attractive.

Save on your own

If the question of an apartment is not so urgent, and you can wait a little, then in order to save money, you can save money yourself. A smart financial decision would not be to draw up a mortgage agreement and pay interest to a commercial organization, but to open a deposit. Many banks are ready to open deposits from 10,000 rubles at 10% annually with interest capitalization. With the rate of growth in real estate slowing down, this could be a great decision to buy your own apartment.