Mortgage conditions for Sberbank employees

Sberbank employees can get a mortgage at a reduced rate (by 1 - 2%), and you will not need 2-NDFL to apply for it. Moreover, a decision on the application will be made in a couple of hours, and no commission will be charged for issuing money.

The collateral for the mortgage can be the security of the purchased home or garage. In this case, the down payment will be 15%. If the collateral is existing real estate, then there is no need for a down payment. Insurance of the mortgaged property is a mandatory condition of the mortgage, and life insurance is taken out voluntarily.

Also read: Is it necessary to insure property, life and health when obtaining a mortgage from Sberbank

Mortgage conditions in Sberbank without down payment

You can get a loan without a down payment for housing only if you meet the basic requirements of the bank and government subsidizing conditions.

Requirements for borrowers

General requirements for applicants:

- Citizenship of the Russian Federation and permanent residence in the country.

- Age restrictions are from 21 years to 70 years at the time of the last payment. For benefit programs, the age range may vary.

- At least six months of work experience in the current position. Total labor period - more than 1 year.

- Income level meets requirements. It is officially confirmed by a certificate in the form of a bank or 2-NDFL.

- The client has a co-borrower and a guarantor. They increase the lender's confidence because their income is also taken into account.

For a military mortgage, the borrower must be a military personnel and a participant in the savings mortgage system.

To apply for a non-targeted loan, the applicant must provide real estate (house, apartment, plot, garage, etc.) as collateral.

Requirements for the Young Family program:

- apartment area for two is 42 m2, for three - 18 m2 each;

- living conditions do not meet sanitary and technical standards;

- a family lives with a seriously ill person;

- applicants under 35 years of age.

To receive maternity capital, you must give birth to your second baby after January 2007.

Documents for obtaining a mortgage without initial payments for each of the available programs

Standard package of documents for a mortgage loan without a down payment:

- Passport of a citizen of the Russian Federation and a co-borrower.

- Driver's license, SNILS, foreign passport. For men under 27 years old, a military ID is required.

- Borrower questionnaire.

- Marriage certificate.

- Pensioner's ID.

- A copy of the work book.

- If you have additional income - any document confirming the fact of receipt of profit (lease agreement, deposit statement).

- Certificate in the form of a bank or 2-NDFL to confirm the income of the borrower/co-borrower.

For individual entrepreneurs - tax return.

Additional package of documents for state subsidies:

- children's birth certificates;

- marriage contract (if any).

To apply for a loan with maternity capital you will need:

- state certificate for maternity capital;

- a certificate from the territorial body of the Pension Fund of the Russian Federation about the balance of subsidy funds.

Under the non-targeted lending program, it is necessary to provide collateral documents.

To the standard package of certificates, the military personnel will need to add a certificate of rights as a participant in the savings-mortgage housing system for military personnel.

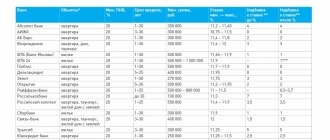

Interest rates and maximum amounts issued under Sberbank mortgage programs

Mortgage rates and maximum loan amounts for an apartment without a down payment for 2020

| Maximum amount (RUB) | Term | Bid | |

| Mortgages with state support for families and children | 12 million | Up to 30 years old | 6 % |

| Mortgage with maternity capital | 70 million | Up to 30 years old | From 8.5% |

| Military mortgage | 2.502 million | Up to 20 years | 9,5 % |

| Non-targeted loan secured by real estate | 10 million | Up to 20 years | From 13% |

Programs and conditions

Sberbank employees can take advantage of seven mortgage programs:

| The name of the program | Term | Sum | Bid |

| Housing under construction | up to 360 months | up to 85% of the collateral price | from 7.1% |

| Ready housing | from 8.6% | ||

| Mortgage with state support | up to 8 million rubles in Moscow and St. Petersburg, up to 3 million rubles. — in other regions | from 6% | |

| Home construction | up to 75% of the collateral price | from 10% | |

| country estate | from 9.5% | ||

| Garage or parking space | from 10% | ||

| Non-target mortgage | up to 240 months | up to 12 million rubles | from 12% |

If you do not take out life insurance, the rate for any program will increase by 1%.

Who can apply for a mortgage without a down payment?

In 2020, the recipient of a Sberbank mortgage without a down payment is subject to separate requirements.

Recommended article: Preferential mortgage Dom.rf with state support at 6.5 percent - conditions and list of documents

When approving a loan, holders of salary cards of this bank will have an advantage. Holders of deposit accounts also have a greater chance of receiving funds. You can also apply for a mortgage:

- citizens of the Russian Federation under the age of 75;

- officially employed citizens;

- persons whose work experience is more than 5 years and 6 months in the last place.

The terms of a standard (targeted) mortgage from Sberbank without a down payment in 2020 assume that the borrower has certain benefits. Funds are issued under state programs that provide subsidies to military personnel, upon refinancing or in the presence of maternity capital. To get a loan, you need to collect a package of documentation, which includes certificates confirming the availability of benefits (if the loan is taken by a person entitled to subsidies from the state).

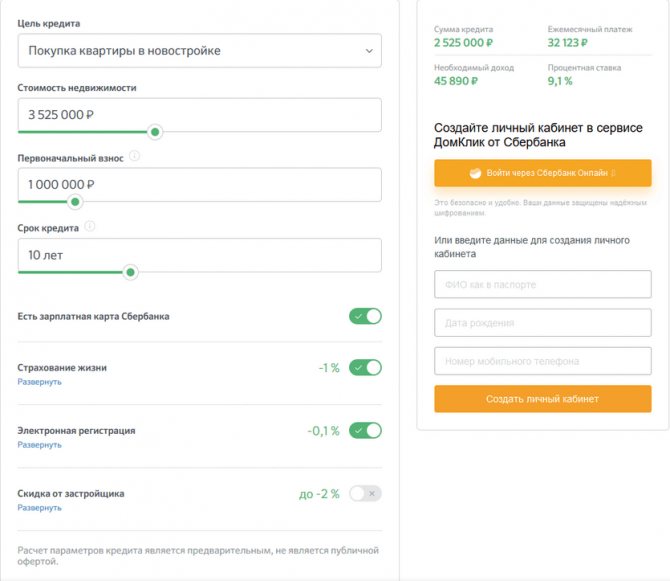

Mortgage calculator

The Sberbank website has a calculator with which you can calculate the monthly mortgage payment and the income required for its approval.

In the calculator you must indicate:

- price of an apartment (or other real estate);

- the amount of the first payment;

- desired loan term;

Example . A mortgage is issued for an apartment for RUB 3,525,000. The loan term is 10 years. If you are a salary client of Sberbank and take out life insurance, then every month you will need to pay 32,123 rubles, and the rate will be 9.1%. The bank will approve such a mortgage with an income of 45,890 rubles.

How to calculate a loan without a down payment

To calculate the loan size, overpayment and other loan features, use Sberbank's mortgage calculator without a down payment in 2020. You will find it on the company’s website in the appropriate section.

- In the calculator, select the purpose of the loan (building a house, buying a finished apartment, cash secured by real estate, etc.).

- Indicate the full cost of the purchased object and the amount of the down payment. The down payment here will be maternity capital funds or other preferential deductions. If the loan does not provide one, leave the field blank.

- Enter the desired loan term. The range between the minimum and maximum period will be indicated in the calculator.

- Set additional parameters and click the “Calculate” button. Then the program will display the amount of payment, overpayments and other details of the loan.

Recommended article: Rosselkhozbank mortgage without down payment

To calculate a Sberbank mortgage without a down payment in 2020, you will need to specify additional values. These include:

- availability of a salary card;

- desire to obtain an insurance policy;

- discount from the developer;

- participation in a preferential program, etc.

Such nuances will affect the speed of consideration of the application and the interest rate on the loan. The likelihood of loan approval will also increase or decrease. For example, salary card holders have a greater chance of receiving a higher amount. When all calculations have been completed, you can proceed to applying for a loan. This can be done through the company's website.

How can Sberbank employees get a mortgage?

Once the mortgage is approved, you can begin choosing a suitable property. It needs to be assessed by a specialized company, and then a report on the assessment must be submitted to Sberbank.

Now you can negotiate with the home seller and carry out the transaction. To do this, prepare a purchase and sale agreement and a mortgage agreement, hand them over to the MFC employees, and then to the Sberbank credit manager.

Secure payment service and electronic transaction registration

To register a transaction, it is not necessary to contact Rosreestr or the MFC. Sberbank offers to sign all documents at the branch using an electronic digital signature and send them to Rosreestr electronically. In this case, you will receive an extract from the Unified State Register and a registered purchase and sale agreement by email.

Using the secure payment service, you can conduct a transaction with the seller without fear of possible problems.

Funds are credited to a special Sberbank account and transferred to the seller only after successful registration of the property as your property. When using the service, the seller also receives a security guarantee, since you will not be able to withdraw money from the account without the bank’s consent. The cost of such a service is 2,000 rubles.

How to get a mortgage without a down payment at Sberbank

Applying for a mortgage without a down payment online is possible, but one personal visit is still required to sign the documents.

Stages of the registration procedure:

- calculate preliminary payments using a mortgage calculator;

- consult with specialists by phone;

- submit an application for the value of the selected property;

- wait for the bank's decision;

- send the apartment for approval and order an assessment;

- come to sign the agreement at a branch of Sberbank of Russia;

- register rights through the electronic document submission form;

- transfer funds to the seller’s account through a secure payment service.

How to apply for a mortgage online

Applying for a mortgage:

- Log in to your DomClick personal account through Sberbank Online.

- Enter all the characteristics of the future mortgage in the calculator. Calculate several convenient options and choose one. Pay special attention to services that reduce interest rates.

- Click on “Submit Application”.

- A borrower's questionnaire will appear in a new window, which must be filled out in accordance with reality.

- At the last stage, you need to upload scans of all documents and submit your application.

The bank considers the application within 5 days, but in most cases the decision comes within 24 hours. After approval, the borrower is given 90 days to find an apartment and complete the transaction.

Requirements for borrowers

Bank employees must meet basic requirements for borrowers.

- Age from 21 to 75 years at the time of loan repayment. Since a Sberbank employee confirms his official income by working in the same bank, the upper age limit is not 65 years, but more.

- At least 6 months of work before the loan is issued at the lender’s bank branch.

See on the same topic: 13 percent refund from the purchase of an apartment in [y] year

The requirement for most clients to have at least one year of total experience over the last five years does not apply to Sberbank’s salary clients, including its employees.

The presence of Russian citizenship as a mandatory requirement for a borrower for employees of a financial and credit organization of the Russian Federation is clarified even when applying for a job.

How to apply for a mortgage at Sberbank

A Sberbank employee, as well as another client, has two ways to complete an application:

- By hand by entering information into the application form;

- Online on the Sberbank website.

The employee will pick up the application form at work. Filling out an application online is also easy: the “Submit Application” button on the bank’s website is located opposite the description of each mortgage product.

See this same topic: Is it possible to take out a mortgage in another city without registration in your passport?

When filling out the application, the applicant must indicate in it the following information:

- Personal, passport, contact;

- About employment;

- About marital status and family ties;

- About official income and available assets;

- About the employing organization (its organizational and legal form, staff);

- About the presence of other unclosed loans;

- About the planned loan (mortgage program, amount and term of the loan, nature of the collateral).

The application will be reviewed within the day of its submission. A quick decision on an application is an advantage for Sberbank employees planning a mortgage.