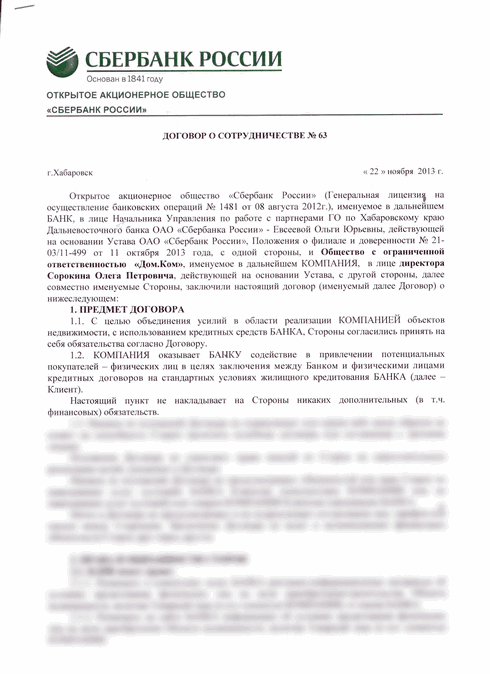

Applying for a mortgage at Sberbank is a complex, time-consuming process that consists of many stages. At the same time, clients at each of them need to comply with a large number of conditions, requirements and nuances in order to ultimately become the owner of their own apartment. To begin with, clients select the optimal lending program, then submit an application and then decide what to do after the mortgage is approved .

What is required for a positive decision by the bank

If a person decides to apply for a mortgage through Sberbank , then he will have to carefully study all the requirements that apply to borrowers and then provide the necessary documents, certificates, statements, etc. Among the requirements is the age of the citizen. must not be under 21 years of age at the time of receiving a mortgage At the time of repayment of the full debt, his age should not exceed 75 years. You will also need to provide papers confirming official employment and certificates confirming the level of income of the client who is receiving a mortgage from Sberbank . Taking into account the individual characteristics of the client and his income, the size of the loan amount and the interest rate will be determined.

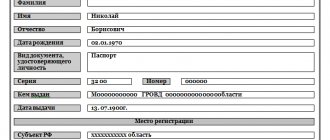

What documents are needed to obtain a mortgage from Sberbank

When applying for a mortgage, a banking organization is required to submit the following documents for consideration. They must be prepared at the time of consideration of the application, since the bank makes its decisions based on many of them. The package of papers should contain the following:

- Russian citizen passport;

- Confirmation of registration;

- Another document proving the identity of the borrower, which can be represented by a driver's license, military ID, pension card and many other types of documents;

- Work record book or extract from the enterprise where the citizen is employed. The document must reflect the borrower's work experience over the past five years;

- Certificate confirming the client’s monthly income;

- Paper on the collateral, if it will be used when a person decides to take out a mortgage . This type of document will increase the amount that can be issued to a citizen as a loan for the purchase of housing;

- Papers that can be used to obtain a mortgage loan on preferential terms. This could be a maternal certificate, birth certificates for all children, or a marriage certificate.

Along with the transfer of these documents to Sberbank , the client also submits a questionnaire for consideration. After that, he can only wait for approval or refusal. Once your mortgage is approved by Sberbank, you can begin further steps towards owning your own home.

The bank’s official Internet portal indicates that mortgage are processed on average within 8 days.

But taking into account holidays or weekends, this period may vary.

What should the borrower do after approval?

So, the long-awaited decision on your home loan application has been received. Let's briefly consider the borrower's further actions.

Selection of real estate

Ideally, the choice of an apartment for a mortgage should be made before submitting an application to the bank, or at least the selection should be carried out in parallel with this process. This will speed up the transaction once initial approval has been received. On the other hand, selecting a banking solution after the fact has its advantages:

- you know with great accuracy what price of housing you can expect;

- It will be easier for you to negotiate with the seller if you have a certificate of approval in hand;

- By clarifying bank requirements for collateral, you can avoid wasting time considering unsuitable options.

Advice: Try to choose housing where the owners are only adults. The presence of children among the owners will greatly delay the registration; there is a risk of not meeting the deadline allotted by the bank.

Portfolio of documents

Once an apartment has been found, it is necessary to submit it to the bank for consideration. To do this you will need to collect a certain set of papers:

- title documents;

- legal documents;

- extract from the house register;

- cadastral passport;

- explication (technical passport);

- extract from the Unified State Register.

This is the minimum set that will be required at Sberbank. Depending on the type of property, as well as the family situation of its sellers, other documents may be required.

By the way! The paperwork required for a mortgage is usually at the buyer's expense, unless otherwise specified in the earnest money agreement.

Property valuation

One of the mandatory stages of preparing housing for consideration by the bank is appraisal. To carry it out, you should contact one of the appraisal companies with which Sber has an agreement. To compile the report you will need:

- provide the specialist with copies of the documents listed above;

- provide him with access to the apartment;

- pay for his work.

The assessment typically takes approximately three business days. After receiving the report, it will need to be sent to the bank along with the rest of the documents for the apartment. Only after this Sber will begin reviewing the collateral and will be able to make a final decision on lending to a specific transaction. Usually it takes no more than 5 days.

Registration of an insurance policy

What to do after the mortgage is approved by Sberbank and the collateral is approved? The next step will be signing a loan agreement. At the same time, as a rule, insurance is taken out. The following are subject to insurance:

- borrower's life;

- the borrower's ability to work;

- apartment title;

- integrity of the purchased housing.

In principle, it is not necessary to insure life and health. But the absence of this policy usually leads to an increase in the interest rate on the loan.

Important! Mortgage title insurance is required by mortgage law. But it will be valid for only three years. Then contributions under this policy article will be eliminated.

Making a down payment

The down payment for the purchased home can be made by the buyer in a variety of forms:

- in cash to the seller (at the bank this is confirmed by a deposit agreement);

- in the form of a state certificate (military, maternal, etc.);

- through a letter of credit;

- through a bank account;

- using a safe deposit box.

What are the steps to take when an application is approved?

After approval of an application for mortgage lending, clients have to complete a large amount of work, for which Sberbank allocates only three months. This period is quite enough to cope with all the nuances. It is installed for a reason. This is due to the fact that many documents become invalid after 3 months, which may result in them being reissued.

Once approval , the borrower needs to do the following:

- Find suitable housing to purchase;

- Conduct a housing assessment;

- Insure the property that is planned to be used as collateral;

- Prepare a complete package of documents to complete the transaction with the bank;

- Signing a real estate purchase and sale agreement with the participation of a credit institution;

- Transfer of the required amount to the seller of the residential property;

- Registration of an apartment on the same terms as the mortgage ;

- Make a down payment under an agreement concluded with a credit institution;

- Making mortgage payments on time. Sberbank the client with a payment schedule, which is used for timely repayment of debt.

Mortgage approved by Sberbank - scheme of further actions

If a person has not previously used a mortgage loan, he may have the impression that after approval of the application, Sberbank will provide the requested amount, and the borrower will be able to enter into a purchase and sale agreement with the owner of the property. However, in practice, the scheme is much more complicated, because the client has to go through a whole list of stages before receiving the loan.

Searching for an apartment

When choosing a room for subsequent residence, citizens are usually guided by the external attractiveness of an apartment or house, its location and the functionality of the layout. If you are taking out a mortgage at Sberbank, it is important to take into account the quality components and technical characteristics. The financial institution puts forward a number of requirements for the premises being financed, which must be met without fail.

Violation of the rule entails the institution’s refusal to continue cooperation. When searching for an apartment, you need to take into account the cost of the property and the amount of money that a person plans to provide as a starting payment. Sberbank will agree to provide no more than 80-85% of the market value of the premises. The borrower must independently provide at least 15-20% of the housing price. Requirements may vary depending on the specifics of the selected tariff plan.

Examination of a mortgaged apartment

The procedure requires additional financial costs imposed on the potential borrower. The expert will conduct an inspection of the property and draw up an official conclusion, which records the market value, which often differs from the actual one.

The procedure is required to identify the true price of real estate. Based on the document, a decision is made on the required amount of funds for its purchase. The following parameters are taken into account:

- the amount of the down payment;

- client's solvency;

- calculation period;

- assessed value.

Apartment inspection by an expert

Collection of documents for obtaining a mortgage at Sberbank

An expert opinion is not enough to complete the registration procedure. If the application is approved, the person must prepare the following papers:

- technical documentation for real estate;

- title documents and original extract from the Unified State Register;

- passport of the property owner - a photocopy is enough;

- official registration of the relationship, if the person is married, and notarized permission of the spouse to sell the apartment;

- a certificate of persons registered in the premises;

- documents confirming the absence of debt and other encumbrances on the purchased property.

The financial institution has the right to consider the package provided insufficient and request other documents, which the borrower will be informed about personally. The documentation is carefully checked by Sberbank lawyers, who determine the authenticity of the papers and the reliability of the data presented in them.

Conclusion of a mortgage agreement

If the submitted documentation does not raise any complaints, a day is set for signing the contract. Usually insurance is taken out at the same time. The borrower has the right to refuse it, but in this case the interest rate will increase significantly. Protection of property from risks is a mandatory condition that must be observed throughout the entire loan period.

The organization puts forward special requirements for the insurer, so experts advise choosing in advance a company for cooperation that meets the established criteria.

Signing an agreement at Sberbank

Drawing up a mortgage

If a mortgage agreement is concluded, the citizen is obliged to provide collateral, because its presence presupposes the very essence of the service. The purchased real estate or housing owned by the borrower can be considered as collateral.

In the first situation, registration of a mortgage is possible only after the purchased apartment has been re-registered as a citizen and the transaction has been registered with the state. The encumbrance is removed when the person makes a full settlement with the financial organization, having fulfilled his obligations.

When a person is the owner of another property, the mortgage is issued at the time of signing the contract, if a package of documentation is provided. Having received the paper, the financial institution will reduce the rate.

Search for residential properties

Before finalizing , you will first need to select a home to purchase. How long this will take depends on the borrower. He can immediately decide on an apartment option, or he can look at several of them and then choose the one that best suits his selection criteria. Also, when choosing housing, you need to focus on banking requirements. Taking them into account, the procedure for choosing an apartment becomes more complicated. Sberbank has the following requirements for housing that is used for purchase with a mortgage :

- Housing must be located in a building that does not require major repairs;

- The purchased residential property should not have the status of a communal apartment;

- The object must have all communications necessary for living;

- Illegal alterations should not be carried out in housing;

- The apartment should not be registered or owned by persons who are in prison or missing.

Clients can take these parameters into account and then choose housing based on the availability of communications, the area where the residential property is located, and other parameters and criteria.

Real estate valuation

Further actions include having an expert assessment of the value of the property. The client is required to carry out this procedure The expert's opinion allows you to determine the size of the mortgage loan. But it is worth remembering that to conduct such an assessment you must contact agencies that are accredited by Sberbank . Thanks to this, it is possible to save time on drawing up an expert opinion on the estimated value of the selected property. It is issued after week .

If you contact bank-accredited companies to evaluate your home, you can avoid disagreements in terms of cost. All costs for obtaining such a conclusion are borne by the person purchasing the property. On average, obtaining an expert assessment of the cost of an apartment will cost from 3,000 to 5,000 rubles. The report contains the following data:

- The market value of a residential property that is purchased with a mortgage ;

- Liquid price of a residential property;

- Description of the main characteristics of housing that was subject to the valuation procedure.

What to do after receiving the keys in a new building

Legal entities know the laws better and are more willing to cooperate with lending organizations. They have no worries about payment/non-payment. Especially if the construction company is on the list of accredited ones.

Note! Large financial institutions always carefully check the developer. Therefore, the risk for the buyer is minimized. And for force majeure situations, an insurance procedure is provided. In addition, if you choose an apartment from a developer-partner of the bank, you can save on interest, avoid unnecessary costs, paperwork and wasted time checking the property.

So, the acceptance certificate has been signed. But the title documents are not ready yet (the apartment does not yet belong to the borrower). What to do in this case? Prepare a package of documents so that you can register ownership of square meters.

Recommended article: How to sell a house bought with maternity capital

You will need:

- agreement with a construction company;

- act of acceptance and transfer;

- mortgage;

- loan agreement;

- receipt of payment of state duty;

- permission from the guardianship authorities (if there are minor children in the family);

- a copy of the permit to put a residential building into operation (sometimes).

Important! You can carry out registration yourself, or you can entrust it to a developer or a bank representative. More information about what to do after accepting an apartment with a mortgage in a new building is written in another article.

Registration of insurance for real estate

After searching for suitable housing and reporting its estimated value, clients think about what actions to take next on the way to their cherished dream of owning their own apartment. And here you can’t do without taking out insurance. Current legislation requires compulsory insurance of real estate, which is purchased with a mortgage .

For insurance, you should contact companies that are accredited by a credit institution. Thanks to this, you can insure your residential property in just a few days. The document is completed very quickly, and it will definitely meet banking requirements.

If desired, the client can also take out insurance for his life and health. This procedure is not mandatory, but if it is carried out, the bank will welcome it. The client gets the opportunity to obtain a mortgage loan on more favorable terms. The process is paid separately.

Collection of documents

A mortgage in the country's largest banking institution is issued only if a complete package of documents is available. It is recommended to prepare and complete them at the stage of selecting a property suitable for purchase. This is due to the fact that the preparation of certificates, statements and other papers may require quite a long period of time. In order for a deal with Sberbank to be concluded, you will need to provide credit specialists with the following documents:

- Documents that are used to confirm the identity of the borrower, as well as his social status;

- Certificates and statements that are used to confirm the income level of the loan recipient;

- A set of additional papers that are needed in cases of using various property as collateral or if there is a co-borrower on a mortgage ;

- An application that must be completed in the correct manner.

But this set of documents may vary. The bank takes an individual approach to each client, which determines their list. You also need to provide Sberbank with documents on the real estate purchased with borrowed funds.

Actions of the buyer after approval of the mortgage in Sberbank

Once the client has seen that the mortgage application has been approved, he should rush through the remaining stages of preparing documents and complete the transaction before the 90 days expire. In this case, the borrower will need:

- Select or finally approve the purchase object. Agree with the owner of the living space and draw up a purchase and sale agreement. If you have concerns about your own skills in choosing housing, then it is more advisable to hire a realtor. It is enough for the agent to indicate the requirements for living space and the amount that the buyer expects.

- Collect documents. If an agent takes part in the transaction, he will help collect papers for the purchase object and draw them up in accordance with the requirements of Sberbank. If the transaction is carried out independently, then all responsibilities will fall on the seller and buyer. A package of documents for housing is provided to the bank to verify the legal purity of the transaction object and the possibility of transferring ownership of the property.

- Conduct a housing assessment. The examination is carried out only by agencies accredited by Sberbank. The assessment is made only for finished housing or land. When taking a mortgage on a property under construction, an examination is scheduled at the time of commissioning.

- Get insurance. The insurance procedure for mortgage lending at Sberbank goes through both the object of sale and purchase and the borrower. You can refuse personal insurance, but the bank reserves the right to increase the mortgage interest rate.

- Make a down payment. This can be done in several ways: by transfer to the seller's personal bank account, through a bank letter of credit, or by transfer of cash. They also use the method of jointly renting a safe deposit box. At the same time, the contract stipulates that the right to the stored money passes to the seller after the real estate is re-registered to the buyer. In a number of situations, maternity capital or other government subsidies can be used as a down payment. But this is determined in advance when the lending program is approved.