Applying for a mortgage with maternity capital in Sberbank Applying for a mortgage in Sberbank is very pleasant, because this banking organization provides the comfort and safety of all funds. These are the main criteria that you should pay attention to before taking out a mortgage . Sberbank has several types of mortgages, including for families who have received maternity capital from the state. This is very convenient, because when applying for such a mortgage there are a huge number of advantages that are so important for those in need of improving their living conditions.

What are the advantages of a loan from Sberbank

When choosing a lender to obtain a mortgage, many young families choose Sberbank. Firstly, this bank is the most stable; all financial actions are insured there. In addition, Sberbank offers its clients the following advantages:

- favorable loan interest rates;

- no commissions or other security fees;

- loan benefits for young families;

- individual conditions for each client (review of applications and service);

- special conditions for clients who receive salaries on Sberbank cards or work in organizations accredited by the bank;

- possibility of increasing the loan amount by attracting co-borrowers.

Which loans are available and which are not?

It is legal to use maternity capital to purchase real estate, improve living conditions, and build a house. It is allowed to take out a mortgage loan and make the amount specified in the certificate as a down payment. You can pay off your existing mortgage debt or part of it.

However, the certificate cannot pay for other needs:

- consumer credit;

- commodity loans;

- loans to pensioners, students, military;

- credit cards;

- car loans;

- microloans.

It is believed that a person must find money for such needs on his own, since he has taken upon himself the responsibility for purchasing certain goods and services.

What is maternity capital today?

Maternity capital is state support for all Russian families who decide not to limit themselves to one child and have a second child. The state has provided a minimum list of options on which the amount can be spent.

One of the items on this list is improving the living conditions of the family. This does not only mean renovations and exchanges of living space. The issue of purchasing new apartments and houses is also being considered.

Naturally, for 453 thousand rubles (which is exactly what the state is currently paying), even in the outback it is difficult to find housing with normal conditions. However, the amount may become part of the funds invested in solving the housing issue.

Using it, you can make a down payment to buy a house or pay off part of your mortgage debt.

Regarding a loan, most citizens of the Russian Federation turn to the Savings Bank of Russia, as the most rated and reliable financial institution in the country.

Programs and interest rates

You can use maternity capital when applying for the following mortgage programs:

| The name of the program | An initial fee | Bid | Term |

| New building | from 15% | from 6.7% | up to 30 years old |

| Ready housing | from 8.6% |

The rate may be increased in the following cases:

- if you purchase housing under construction from a developer who is not a partner of the bank - by 2%;

- when purchasing a finished apartment not through the Sberbank DomClick service - by 0.3%;

- if you receive your salary in cash or from another bank - by 0.3-0.5%;

- when applying without proof of income and employment - by 0.8-1%;

- if you register a transaction through the MFC or a branch of Rosreestr, and not online - by 0.1%;

- upon refusal of life insurance - by 1%;

- if you purchase a ready-made apartment, but do not belong to the “Young Family” category - by 0.5%.

Young family

Married couples where the spouses are between 21 and 35 years old, without children or with at least one child, may have the right to improve their living conditions under the state’s “Young Family” mortgage subsidy program. The amount of subsidies can vary from 30% of the price of the loaned property + 5% for each child born in the family. If the application is submitted on time, the subsidy can serve as a down payment on the requested mortgage loan.

Under the terms of the special offer for young families, even families with only one parent can apply for a loan. The main conditions, in addition to the age of the borrowers, are that they must be on the list of those who need to improve their living conditions and the size of their existing property.

Subsidies transferred to young families are received within a certain period of time as a payment on a loan aimed at the purchase of secondary housing or housing under construction, or for the construction of real estate in the territory of the region of the Russian Federation that issued the assistance program.

The possible amount of the minimum down payment (in combination with the amount of the allocated subsidy or paid separately) ranges from 15% for couples with children and 20% for a family without children. The purchased housing will be in common family ownership between the spouses and their children.

Mortgage with capital

In contrast to centralized assistance to young families, a certificate is issued only after the birth of a second child (full or partial) in the family, regardless of whether it is in line to improve the quality and size of real estate.

A family certificate can partially or fully repay the mortgage that the family has, or serve as a down payment on the loaned property. The bank allows it to be spent within the framework of lending programs for housing under construction and secondary market objects. That is, it will not be possible to build your own house or purchase a plot for construction using maternity capital from Sberbank, but you can purchase an individual residential building.

If the family already has a mortgage that they want to pay off with family capital, then they need to do the following:

- Obtain a certificate from the bank about the type of lending and the balance of debt obligations on the mortgage.

- Provide this certificate to the Pension Fund office.

- Fill out an application for the transfer of maternity capital funds to repay the balance of the debt on the mortgage loan that you have (the transfer will be carried out within 40 days).

Mortgage conditions in Sberbank under mother capital:

- Depending on the chosen lending program and the home purchased, the mortgage interest will vary. If a family decides to invest in housing under construction, the down payment will be equal to 15% of the cost of housing. When purchasing a ready-made apartment, the contribution is 20%.

- The bank allows the use of maternity capital as a down payment if the amount of capital is equal to or exceeds the specified minimum of 15-20%, depending on the selected object. Thus, the amount of your own contributed funds is zero.

Existing types of real estate for which the attraction of maternity capital for a down payment has been approved.

- Secondary:

- the loan amount ranges from 300 thousand rubles - up to 80% of the value of the property for which the mortgage loan is issued (up to 15 million for housing in the Moscow and Leningrad regions and up to 8 million for other regions);

- the size of the PV is determined accordingly to be at least 15% of the value of the property;

- the period for which the loan is issued is up to 30 years, but no later than the moment when the borrower turns 75 years old;

- mandatory registration of insurance for the purchased object; in the absence of a policy, the rate may increase by 1 percent (registration of insurance is an important point in lending in leading banks).

- New building:

- the size of the PV has been reduced – 15% of the cost of the purchased housing;

- the loan amount ranges from 300,000 rubles to 85% of the price of the purchased new building;

- payment can be made in several parts (mortgage in installments) - the first part after registering the property in Rosreestr, the second - before putting the house into operation;

- for the period of construction (before registering the object with the Rosreestr authorities, and not the right to it), additional guarantees from third parties are possible.

When applying for a mortgage loan against maternity capital at Sberbank, the first thing the bank will do is check the borrower’s identity for compliance with the requirements.

- At the time of purchasing the loan, the borrower must be at least 21 years old and not older than 75 years at the time of its repayment; when lending without proof of income and from a place of work, no older than 65 years.

- Confirmation of income and employment. The period of service in the current place is at least six months, for the last 5 years - at least 12 months.

- It is possible to attract up to three co-borrowers, whose income can be taken into account when determining the maximum mortgage loan amount. The spouse must become a co-borrower and owner of the property; this requirement does not apply to children.

There is an additional discount for all programs for salary earners of 0.5% for the first payment of more than 20% and 0.1% if you register an apartment from the DomClick website from Sberbank.

Mandatory conditions for a mortgage with maternity capital

There is one unusual feature of a mortgage that is combined with maternity capital . Since maternity capital is issued specifically for children, this means that the interests of each child in the family must be taken into account when drawing up this type of loan agreement.

Once the entire mortgage amount is paid, the homeowner is required to divide it among all of his children, regardless of how old they are at the moment.

In this way, the personal interests of children who were born during the execution of the mortgage agreement and after it are taken into account. The share that will be allocated to each person is determined by the owner of the apartment/house.

Applying for a mortgage with maternity capital will not be difficult, but they will still have to tinker with documents.

How to pay off a mortgage with maternity capital at Sberbank?

In order to fully or partially repay an already issued home mortgage loan with matkapital from Sberbank, you first need to submit an application for early repayment (can be sent online), attaching to it:

- a certificate of the balance of the certificate issued by the Pension Fund of Russia branch;

- certificate for maternal capital.

According to clause 3.9.1. Part 3 of the “General Conditions for Providing, Servicing and Repaying Loans”, effective from 12/09/2013, the borrower must submit an application no later than the repayment day, indicating the date, amount and account. In addition, the certificate holder must take a certificate of the amount of the unpaid balance and confirmation of non-cash crediting of the loan to his account (the spouse’s account).

The exact period during which it is necessary to notify about early repayment must be clarified with a bank employee, since in a particular case additional conditions may be imposed. In addition, Sberbank has the right to additionally request other documents confirming the actual amount of maternal capital at the disposal of the borrower (co-borrower).

After contacting the bank, the owner of the certificate must submit an application for the order to the Pension Fund of Russia , providing the following documents:

- Russian passport with a registration mark;

- marriage certificate and passport of the spouse with a registration mark, if he is the title borrower or co-borrower;

- a copy of the loan agreement;

- a copy of the mortgage agreement registered in Rosreestr;

- title documents for residential premises; extract of ownership from the Unified State Register of Real Estate;

- if the premises have not been put into operation - a copy of the registered share participation agreement ;

- if loan funds were used to pay the entrance (share) contribution - an extract from the register of members of the housing cooperative .

The application is considered by the Pension Fund for a month . If satisfied, maternity capital will be transferred to Sberbank within 10 working days .

If the loan has been partially repaid, then the owner of the certificate will be issued a new payment schedule with a reduced monthly payment - Sberbank does not provide for .

How to get a mortgage with maternity capital from Sberbank?

You can take out a mortgage loan using maternity capital funds in several steps .

Step 1. Submit an application form and the documents necessary for its consideration to the bank.

Step 2. After approval, select residential premises and provide documents for it - can be provided within 90 days .

Step 3. Sign the loan agreement.

Step 4. Contact the Pension Fund with an application for disposal of maternity capital.

Step. 5. Receive funds non-cash (will be transferred to the bank).

Along with the application form to Sberbank, you must provide:

- passports of the borrower and co-borrowers (if any) with a registration mark;

- documents confirming employment and income;

- maternity capital certificate;

- a certificate of capital balance issued by the Pension Fund of Russia can be provided within 90 days, but the document is valid for 30 days from the date of issue.

can be provided as proof of income

- certificate of income for the last 6 months from the place of work - for employed persons;

- on the right about the amount of pension for the last month - for pensioners;

- tax return for the last tax period - for individual entrepreneurs.

Proof of employment can be:

- a copy of the work record book, an extract or certificate from the employer with information about the position and length of service - for the main place of work;

- a copy of the employment agreement (contract), certified page by page or bound (certified on the last page - the employer must indicate the number of sheets) - for part-time work;

- certificate of registration of individual entrepreneurs (notarized copy, if there is no original), certificate of entry into the Unified Register of Individual Entrepreneurs, entry sheet of the Unified Register of Individual Entrepreneurs - for entrepreneurs.

Documentary evidence of employment and receipt of income is valid for 30 days from the date of issue. In some cases, additional documents may be required, so the exact list must be checked with a Sberbank employee.

To manage maternity capital to the Pension Fund , along with the application, you must provide:

- Russian passport of the certificate owner with a registration mark;

- marriage certificate and passport of the spouse with a registration mark, if he is the title borrower or co-borrower;

- a copy of the loan agreement;

- a copy of the mortgage agreement registered in Rosreestr;

- an obligation to allocate shares to the spouse and children, certified by a notary.

Maternity capital will be transferred to Sberbank within 1 month and 10 working days from the date of registration of the application, if the Pension Fund of the Russian Federation allows the disposal of funds.

Program “Mortgage with state support for families with children”

In accordance with the provisions of the Federal Law “On Mortgages”, this program is designed for the period from January 1, 2020 to December 31, 2022. The state budget has allocated 600 billion rubles to support Russian citizens. Support measures are aimed at increasing the birth rate in the Russian Federation. Only those families that plan to give birth to a second or third child during the program period can count on receiving a benefit (reduced interest rate on a mortgage loan):

- At the birth of a second child, the benefit is issued for 3 years from the date of issuance of the mortgage loan.

- At the birth of a third child, the benefit is issued for years from the date of issuance of the mortgage loan.

- At the birth of the second and third children, the benefit is issued for 3 years, after which the subsidy period is extended for 5 years.

The minimum down payment is set at 20% of the cost of the purchased home. In this case, the down payment can be made using maternity capital and other government subsidies.

Please note : the interest rate here is lower than under the “Mortgage plus maternity capital” program - it is 6% during the grace period and 9.5% at the end of its validity period. Important: only families where the age of both or at least one (single) parent does not exceed 35 years can become a participant in the program.

This program is beneficial not only due to the reduced interest rate. Young people with children can also apply for a state subsidy for the purchase of housing from the state:

- for families with children – 35% of the value of the purchased property;

- for single parents with children – 35%.

Social mortgage lending is a government program, which is implemented at the subject level. Therefore, in each region it has its own characteristics, which can be found out in the local authorities at the place of residence, or in the AHML. To take advantage of the opportunities of targeted social mortgages aimed at improving the lives of citizens, it is enough to contact the Housing and Communal Services Department or the local administration.

Please note : Mortgage lending using subsidies and subsidies from the state is available only to certain categories of citizens and is aimed at improving their living conditions. At the same time, with the help of a social mortgage, housing conditions can be improved only within the established standards, which are established in each region separately. For example, the current norm in St. Petersburg is 33 square meters for citizens living alone and 18 square meters for each family member if several people live in an apartment.

Conditions for construction with maternity capital

The main conditions for obtaining a targeted loan with the participation of maternity capital are:

- the recipient of the funds must have citizenship and permanently reside in the territory of the Russian Federation;

- the age of the recipient of the funds must be at least 21 years old and no more than 75 years old at the time of full repayment of the loan;

- The borrower’s work experience at the last job must be at least 6 months, the total period of employment must be at least 1 year;

- the recipient of the funds is the owner of the collateral property;

- Collateral property must be insured, with the exception of land.

It is also useful to read: Maternity capital for the rehabilitation of a disabled child

Can I get it in cash?

This is one of the most common questions regarding the use of funds under an already issued certificate. Many people would like to cash out the subsidy itself. Not everyone has enough money for a mortgage: some understand in advance that they won’t be able to afford it, but real money would be useful for more pressing needs. They could be used to make repairs in the apartment, to improve something. But such payments are not provided by the state.

Important! This money cannot be obtained in cash. Firstly, according to current legislation, you can only get a mortgage or a loan for building a house. Secondly, the transfer of money between the Pension Fund of the Russian Federation and the bank always occurs in non-cash form.

Requirements for the borrower

To use maternity capital to obtain a loan from Sberbank, the borrower must:

- Be at least 21 years of age.

- Reach the maximum age of 75 years at the time of making the last payment on the loan taken, the age may be less.

- Work for a total of at least six months consecutively at one place of work.

- Be officially employed at the time of applying for a loan.

- Have a second child aged three years or older.

- Have a valid certificate for maternity capital (it does not matter whether the money has already been withdrawn or the original amount is there).

- Provide a certificate of income if he is not a salary client, and even more so if he does not work officially.

These requirements are standard for all Sberbank borrowers. It does not matter who wants to use maternal capital to take out a loan - mother or father. But if the income of this family member is not enough, then he can involve his spouse as a co-borrower in order to obtain a loan for the required amount.

How to get a mortgage with maternity capital

Maternity capital in Sberbank helps families get their own housing, which is extremely difficult and sometimes even impossible to buy on their own. Currently, the conditions for obtaining a mortgage with maternity capital have been much simplified, so no problems arise during the application process.

According to the established law of the Russian Federation, maternity capital can be used immediately after the birth of a child. There are two main goals for its implementation: to pay off part of an already issued mortgage or to apply for a mortgage immediately with maternity capital . It all depends on individual capabilities.

In order for a mortgage to be issued against maternity capital , you must follow several simple rules:

- Be over 21 years of age.

- Have a permanent job (at least six months).

- The total work experience must be at least five years.

- Be a citizen of the Russian Federation.

- Do not have any debts on other loans.

If you take out a loan for real estate with maternity capital , then it will be issued to a person who has received the appropriate certificate from the state. However, the spouse’s salary will be taken into account without fail.

Real estate requirement

Real estate requirements when receiving a loan for maternity capital from Rosselkhozbank:

- you can buy both a new building and secondary housing, and also get a loan to build a house

- secondary housing should not be dilapidated

- manufacturing material – concrete, brick, monolith (wood excluded)

- not older than 69 years of construction

- wear should be no more than 71%

- without encumbrance

- not to be under arrest

- minimum requirements for living space (1-room apartment from 32 meters, 2-room apartment from 41 meters, 3-room apartment from 55 meters)

- availability of all communications

- availability of a separate bathroom and toilet

Is it worth using maternity capital for a mortgage?

If you decide to take out a mortgage, be prepared for the fact that you will need to insure the selected property with your own personal money. But if you close a housing loan with Sberbank before the time specified in the contract, you will be able to return unused insurance premiums. Usually there are no difficulties in obtaining them. If difficulties still arise, contact a lawyer.

Some Russians are confident that by paying off their mortgage in advance with maternity capital from Sberbank, they will ruin their credit history. However, this is a common misconception - there are no adverse consequences from such an action. And there are currently thousands of examples of this.

Moreover, according to statistics, the majority of maternity capital owners have already decided to improve their living conditions by paying off their mortgage early with Sberbank. There are no fewer of those who are just planning to turn to Sberbank in order to improve their living conditions on more attractive terms with the help of maternity capital finance.

Stages of registration

To use maternity capital as a down payment on a housing loan, you must:

- 1. Contact the Pension Fund to receive a maternity capital certificate. The waiting period for a decision regarding the issuance of funds for these purposes in this case is 1 month.

- Submit an application for loan approval to the bank. At the same time, in addition to the maternity capital certificate, you will need to provide:

- Passport, SNILS, INN.

Certificate of income of an individual (form 2-NDFL).

- A copy of the work record certified by the employer.

- Marriage certificate, as well as the original and a copy of the spouse’s passport.

- A completed application form from the bank

- If the loan amount is approved, it is necessary to collect and prepare all the necessary documents for the housing being financed, and draw up a preliminary purchase and sale agreement.

- The next stage is concluding agreements (loan and collateral) with the bank; the collateral must be insured.

- The final stage is to contact the Pension Fund with an application for the disposal of maternity capital funds and wait for them to be transferred to the bank.

After receiving approval of the preliminary application, the bank is provided with general data on the property being purchased, including an assessment of its market value.

The process of repaying an existing mortgage using maternity capital funds is somewhat different from making a down payment and consists of the following steps:

- Issuance by the bank, at the request of the borrower, of a certificate indicating the amount of the current debt on the mortgage loan.

- The borrower’s application with the specified certificate and the necessary package of documents to the Pension Fund branch in order to submit an application for the disposal of maternity capital funds.

- The pension fund is given a month to review the application. If approved, the funds will be transferred to Sberbank within the next 30 days.

- Immediately after receiving funds, the bank recalculates and approves a new loan payment schedule.

- Full ownership of the purchased housing and its release from collateral becomes possible only after final settlement with the bank for the fulfillment of all loan obligations. The loan agreement is considered fulfilled.

Documentation

The documents required for a loan using maternity capital to purchase a home at Sberbank are the same as for all other borrowers, with only one difference - you will have to provide two more papers. Namely, a maternal certificate and an extract from the Pension Fund of the Russian Federation on the balance of funds allocated by the state for this subsidy.

Standard set of documents:

- application form for a loan

- copies of the passport, including a double page with registration

- any other document capable of confirming identity

- 2NDFL certificate from the place of work about the amount of income from all participants in the transaction (borrower, co-borrower, guarantor)

- copies of the work book

- 3NDFL certificate for persons receiving additional income

- an extract from a current account for pensioners receiving a pension and for other persons who have deposits and intend to use them in a transaction

- certificate of ownership of the property being purchased (provided after successfully obtaining a mortgage)

- evidence of the emergence of grounds for ownership of the object (purchase and sale agreement)

- cadastral passport

- consent of the spouse to conduct the transaction, notarized

- an extract from the Unified State Register confirming the absence of debt encumbrances or seizure of the purchased property

- permission from guardianship authorities

- marriage contract

- plus maternity capital certificate

- an extract from the Russian Pension Fund about the balance of funds in the accounts of the recipient of the maternity capital

How to apply?

A convenient option is to collect all the documents and come to Sberbank with them. Get advice from a loan specialist at the bank and calculate your options. If everything goes well and the person is able to handle the loan, then you can write an application and attach documents to it. The bank will notify the potential borrower of the decision within 5 business days. After this, you need to come to the branch and sign a loan agreement.

The second option allows the borrower to save money. The application form can be submitted online on the bank’s website and then the interest rate on the loan will drop by 0.1-0.5%. Sberbank will review the application and make a preliminary decision on issuing a loan. Next, the person must go to the bank branch within the specified period and bring documents. The bank will review the borrower’s case again and will give a final answer. A preliminary decision is made very quickly - within a day, maximum three. The final response will need to wait a maximum of five days from the date of submission of documents.

At Sberbank you can choose a loan for maternity capital that meets the needs of any person.

Mortgage loans are especially popular, especially for young families, as they have the most favorable lending conditions in Russia. Other bank offers also have certain advantages, you just have to consider the matter from all sides.

Video

Electronic registration of a transaction without visiting Sberbank

Using electronic transaction registration, you can register real estate without visiting the MFC. The Sberbank manager will send all documents to Rosreestr and will monitor the transaction process. Upon completion, you will receive an extract from the Unified State Register and a purchase and sale agreement in electronic form.

You can get another one at Sberbank. When ordering it, after signing the loan agreement, the money is credited to the account of the Sberbank Real Estate Center, and the seller receives it into his account after registering the transaction in Rosreestr. In this way, you can avoid being deceived by an unscrupulous seller.

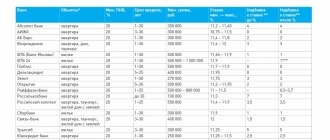

Which banks provide loans for construction using maternity capital?

It must be emphasized that the construction of residential premises is a fairly long-term, labor- and financially-intensive project. The construction of a residential building falls into the category of loans with high risks; the liquidity of this object reaches average market indicators only at the last stage of construction.

Reference! Leading banking organizations offer Russians many mortgage lending programs with the participation of a family certificate on attractive terms.

It is thanks to the high demand that the prevalence of these programs is growing, but in reality there are a limited number of suitable offers that will not force borrowers to languish in line for a long time, waiting for a response from the bank or that do not inflate the already high lending interest rate. Let's look at a few of them in detail.

Sberbank programs

It is important that it has several advantageous positions, compared to many other banks in Russia. Sberbank is one of the reliable banks in Russia; moreover, it is one of the few banks that works with these types of government subsidies on terms that are friendly to the consumer.

Sberbank has two programs that provide for the use of maternity capital for lending: “for the construction of a house using maternity capital” and “purchase of finished housing.” Let's take a closer look at one of the programs.

The conditions for lending with the participation of a family certificate at Sberbank are as follows: a loan for 300 thousand rubles or more is provided for a period of up to 30 years with an initial payment of 25% and an interest rate of 9.5%. This bank also offers loyal conditions, for example, you can get a credit card up to 200 thousand rubles and a reduced interest rate for the bank’s salary clients.

The requirements for the borrower are typical, distinguished by only a few criteria: if there is a marriage certificate or a valid marriage contract, the spouse automatically becomes co-borrowers if the property is not divided under the terms of the marriage contract. The presence of borrowers, the maximum number of which is 3, increases the loan amount.

To obtain a loan against a family certificate, standard documents are required , but in addition two more documents must be attached: a certificate of maternity capital and a certificate from the Pension Fund of Russia on the balance of funds in the accounts of the copyright holder of maternity capital.

Rosselkhozbank programs

With the help of the “Young Family and Maternity Capital” mortgage loan from Rosselkhozbank, it is possible to buy a country house, an apartment or a plot of land for the construction of residential premises.

Conditions for this program:

- The minimum loan amount is from 100 thousand rubles

- the maximum allowable is 20 million rubles

- down payment from 15%

- interest rate starts from 11.5%

- compulsory insurance of loan collateral

- voluntary registration of a life and health insurance policy (if you refuse this type of insurance, the bank has the right to increase the interest rate by 1.5-2%)

- Availability is limited to 3 co-borrowers (not necessarily close relatives; spouse automatically becomes borrowers).

Additional documents required to obtain a loan: a certificate for receiving maternity capital and a certificate from the Russian Pension Fund about the balance in the accounts of the owner of the maternity capital.

Let's also consider equally popular banks in order to obtain a mortgage loan for building a house: Otkritie Bank, Alfa-Bank, Sovcombank

The main feature of Otkritie Bank in providing a loan with the participation of a maternal certificate is the lowest interest rate - only 8.4% per annum, but this rate is counterbalanced by an increased minimum loan size of 500 thousand rubles.

It should also be noted that the maximum loan amount limit for residents of the central regions of Russia is 30 million rubles, and for residents of other regions of the Russian Federation - only 15 million rubles. If there is no life and disability insurance policy, +2% will be added to the current rate.

At Alfa Bank it is possible to obtain a mortgage loan for the purpose of building a house for a period of up to thirty years in the amount of up to 50 million rubles. Of course, borrowers from this bank are very pleased with the interest rate of only 8.09% and the low down payment of 10%. Additionally, the bank provides favorable conditions for its salary clients in the form of a reduction in the lending interest rate by 0.3%. An undoubted advantage is submitting an application online and a quick decision within 3 business days.

Sovcombank does not lag behind its partners and offers consumers a loan for housing construction of up to 30 million rubles, regardless of the region of residence of the borrower.

The conditions for this program are quite flexible: the initial payment is from 10%, and the bank also offers a high approval rate for clients over 35 years of age. The only significant criterion that reduces consumer demand for the program is the maximum loan term, which does not exceed 10 years.

Advantages and disadvantages of a mortgage at Sberbank

Why is it profitable to contact Sberbank to get a mortgage using maternity capital in 2020? Among the advantages:

- The most favorable interest rates on the Russian lending market - you can purchase your own real estate with a rate of 8.5% per annum.

- The bank does not charge any commission for granting or issuing a loan.

- The bank provides preferential conditions for young families. In addition, within the framework of mortgage lending, it is possible to combine maternity capital with the state subsidy program.

- You can purchase your own home without a down payment.

- Loyalty to customers: Sberbank provides a unique opportunity to take into account not only the borrower’s regular income, but also three co-borrowers, which significantly increases the likelihood of approval of a loan application.

- There are special favorable conditions for salary clients, as well as for employees of affiliated companies.

- After signing a mortgage agreement, you can apply for a credit card with a limit of up to 200,000 rubles.

- By giving preference to mortgage lending from Sberbank, you can qualify for a subsequent tax deduction not only based on the amount of housing purchased, but also the interest paid.

And these are not all the advantages: for example, in 2020, depending on the type of property, the borrower may also qualify for discounts on the rate:

- up to 2% when purchasing real estate from a partner developer;

- 1% – upon concluding an insurance contract;

- 0.3% when purchasing an apartment through the DomClick service.

- Please note : families in which one or both spouses are under 35 years of age may qualify for an additional 0.5% discount. In addition, when registering a transaction electronically (without visiting Rosreestr and the MFC), you can qualify for a rate reduction of 0.1%. Thus, loyalty programs allow you to purchase your own real estate in Sberbank on the most favorable terms.

Important: if you not only have maternity capital, but also gave birth to a 2nd or 3rd child between January 1, 2020 and December 31, 2022, you can take part in the state program “Mortgages with state support for young families”: here the rate is more favorable: 6% per annum.

Required documents

To apply for a mortgage using maternity capital, the borrower and co-borrower should provide a package of documents, namely:

- passport (the bank will need a copy of it);

- second document of your choice (SNILS, driver's license, international passport, military ID);

- a certificate of income from the place of work, as well as a copy of the work book, certified by the enterprise, and for Sberbank clients it is enough to present a salary card;

- a certificate from the Pension Fund about the balance of maternity capital (valid for 30 days from the date of receipt);

- application for a mortgage;

- children's birth certificates;

- for a mortgage at 6%, you must provide proof of citizenship for the child(ren) born after January 1, 2018;

- certificate for family capital (more information: about obtaining a certificate);

- documents on the collateral object (if it is not housing purchased with a mortgage);

- Marriage certificate.

How can you get preferential conditions?

Using the Sberbank calculator, we change the conditions for construction using bank credit funds - and we receive an overpayment of 2 million 158 thousand.

We change the category to salary recipient in Sberbank and do not see any change after recalculation. How so? It's simple, if you are a salary recipient from Sberbank, then this gives you the same 0.5% discount as purchasing a house built using borrowed funds from the bank, however, alas, these benefits do not add up.

Finally, if the registration of the property is carried out not before, but after the registration of the mortgage, you can win a whole percentage, as a result of which the overpayment will be equal to 1 million 985 thousand rubles - another 173 thousand won.

What documents need to be submitted to the Pension Fund?

No less significant will be the package of documents that you must bring to the branch of the Pension Fund of the Russian Federation, which is done after concluding an agreement with the Savings Bank.

Without a positive response from the Pension Fund of Russia, the bank will not transfer you the amount necessary to purchase housing.

To obtain approval, you must first bring the main document to the Pension Fund - a certificate.

It includes everything related to the purchased property and relations with the bank. This:

- a copy of the agreement with the financial institution;

- documents confirming that you have a debt to the bank;

- a copy of the agreement stating that you took out a mortgage;

- extract from the house register;

- the borrower’s obligation to allocate a share of property to all family members (children and second spouse) within the period established by law;

- official title and your bank account information.

As soon as your application is approved, which may take about 2 months, you will be transferred the funds required under the contract.

How to calculate a mortgage at Sberbank?

To roughly calculate the size of the monthly payment and interest rate, you can use Sberbank's mortgage calculator. Loan terms are determined based on analysis:

- lending purposes;

- cost of living space;

- loan amount;

- the amount of the down payment;

- loan term;

- interest rate.

All calculations made in the calculator are preliminary . The loan amount, repayment period and monthly payment amount (including maternity capital) are determined individually for each borrower based on his income (co-borrower’s income).

The interest rate is set not only in accordance with the mortgage program, but also with a system of increasing and decreasing interest :

- + 0.1% - if the borrower refuses the “Electronic Registration Service”;

- + 0.2% - for a down payment of 15% to 20% (not including the upper limit);

- + 0.3% - if the salary is not transferred to a Sberbank card;

- + 1% - if the borrower refuses to insure his life and health in accordance with the requirements;

- + 0.3% - if the borrower has not confirmed income and employment, but has made a down payment of 50% (when purchasing a primary apartment);

- — 0.5% — under the “Young Family” program (for the purchase of secondary housing);

- — 0.3% — when using the DomClick service (when purchasing a secondary apartment);

- — 2% — when purchasing a primary home under a subsidy program with a loan term of up to 12 years (when purchasing a new apartment).

Sources

- https://creditvsbervbanke.ru/credits/ipoteka-materinskij-kapital-sberbank

- https://kapital.expert/banks/loans/kredit-pod-materinskiy-kapital-v-sberbanke.html

- https://kredit-online.ru/ipoteka/ipoteka-pod-materinskij-kapital-v-sberbanke.html

- https://ipotekaved.ru/sberbank/ipoteka-plus-materinskij-kapital.html

- https://dom-click.ru/oformit-ipoteku-s-materinskim-kapitalom-v-sberbanke/

- https://materinskij-kapital.ru/ipoteka/banki/sberbank/

- https://sovet-bankira.ru/ipoteka-pod-materinskijj-kapital-v-2019-godu-ot-sberbanka/

- https://CreditSoviets.com/banki/sberbank/kredit-pod-meterinskij-kapital/

- https://creditoshka.ru/kredit-pod-materinskiy-kapital-v-sber/

- https://sber-info.ru/ispolzovat-materinskij-kapital/

- https://www.vbr.ru/banki/sberbank-rossii/ipoteka/kalkulator/ipoteka_s_materinskim_kapitalom/

- https://sbotvet.com/ipoteka/materinskim-kapitalom/

Lending terms

Lending conditions will differ for different families, depending on the chosen program, the age of the borrower, the amount of the down payment in relation to the total mortgage loan, and the possibilities of paying it off. When purchasing real estate on the secondary housing market, citizens should know that the down payment must be more than 15% of the cost of housing, and the loan rate will be approximately 10.2%.

Using the DomClick service from Sberbank, the borrower can count on a discount on the loan interest rate, which is 0.3% for all clients.

Real estate on the primary market is usually more in demand. However, the requirements for purchasing it are slightly different. The down payment must be at least 15% of the price of the selected apartment, and the maximum period for which a loan can be obtained is 30 years. The base rate is 10.5%, but do not forget about various subsidy programs, for example, when you can get a mortgage for 7 years at 8.5%.

For clarity, lending conditions for various programs are summarized in a table.

| Program | Bid | Sum | Term | An initial fee |

| Ready housing | 11% - basic | From 300 thousand rubles to 85% of the value of the collateral | 1-30 years | From 15% |

| 10.5% - for young families | ||||

| 11.3% - with a mortgage on 2 documents | ||||

| 10.8% - according to 2 documents for young families | ||||

| Housing under construction | 10.8% - basic | From 300 thousand rubles to 85% of the value of the collateral | 1-30 years | From 15% (from 50% without proof of income) |

| Subsidized housing under construction | 8,5% | Up to 7 years | From 15% (from 50% without proof of income) | |

| 9% | From 7 to 12 years | |||

| With the state support | 6% during the grace period (3-5 years) 9.5% after the grace period | Up to 8,000,000 rubles for Moscow and Moscow Region, St. Petersburg and Leningrad region. Up to 3,000,000 for other regions | 1-30 years | From 20% |

The following surcharges are also possible to the indicated rates:

- +0.2% for down payment less than 20%;

- +0.1% if you refuse electronic registration;

- +0.3% for borrowers who are not payroll clients;

- +1% when canceling life and health insurance.

Thus, a mortgage with maternity capital is provided under the terms of standard banking programs with the only difference being that certificate funds can be used as a down payment. However, there must be enough of them (at least 15% of the housing price), otherwise you will have to add the rest with your own money.