- Marina Diskova

- 2 496

It will be useful for holders of impersonal metal accounts (OMA), savings accounts and deposits in Sberbank to find out as much detailed information as possible about the conditions for inheriting such property. According to Russian legislation, the opportunity to receive a deposit under a will is provided to citizens who have assumed the rights to inherit deposits after the death of its owner. The laws of the Russian Federation allow leaving accounts for legal entities and individuals. Let's talk about the specifics of preparing such testamentary dispositions for Sberbank clients.

Receiving a deposit in Sberbank according to a will

The owner has the right to independently dispose of his contribution in the event of death, together with other property. To do this, you need to draw up a will. This is a document that contains the owner's instructions in the event of death. It is subject to mandatory notarization.

If it is not possible to contact a notary, a citizen can have the will certified by the head physician of a hospital or nursing home, the captain of a ship, or the leader of an expedition. In an emergency, you can bring in 2 witnesses to certify the document.

The document regulates the procedure for dividing inherited property in the event of the death of the owner. The recipient of the property can be any individual or legal entity, as well as the state. The will may contain information about the division of the contribution, as well as any other property of the deceased.

To receive a deposit, you must issue a certificate of inheritance rights. To do this, you will need to enter into inheritance in the general manner.

When registering a will and a testamentary disposition for the same contribution, the date of execution matters. The property will be transferred according to a document drawn up later.

Registration process

According to the Civil Code of the Russian Federation (Chapter 62, Article 1128), a testamentary disposition for a deposit can be drawn up at a notary or at a bank branch.

Through a notary office

Like a regular will, the form of a testamentary disposition for a deposit in Sberbank can be certified by a notary. The procedure is as follows:

- fill out the form according to the provided sample;

- together with the order, identification card and passbook, go to the notary;

- pay for his certification services;

- receive a certified order;

- take the document to the Sberbank office.

The cost of the procedure will be 700-1000 rubles per order.

But keep in mind that when drawing up a document independently, the testator may make a mistake, in which case Sberbank may refuse to accept it. Therefore, it is better to contact the department directly and perform the operation there.

Through the bank office

You will need a standard set of documents:

- passport;

- data of the heir (or several heirs);

- account (deposit) details.

The owner of the deposit just needs to come to Sberbank and declare that he wants to leave a testamentary disposition. The specialist will provide a ready-made form and help you compose the text on the spot.

Then the order is signed and endorsed by a bank specialist and remains in the branch. From a legal point of view, a Sberbank employee visa is equivalent to a notarization.

The entire operation is completely free.

Testamentary disposition for a deposit in Sberbank

To dispose of his contribution in the event of death, a citizen can draw up a testamentary disposition. This option saves time and money.

Important! The disposition document allows the owner of the deposit to transfer funds to a specific person. If there are several heirs, then the investor can determine the size of the share of each of them. The remaining applicants are excluded from the inheritance.

Testamentary disposition according to Art. 1128 of the Civil Code of the Russian Federation is drawn up free of charge in the credit institution in which the deposit is opened. It differs from a will in that the document is executed solely in relation to the contribution. It is impossible to provide for the disposal of other property with its help.

A will may set restrictions on the use of funds. For example, if the heir is a minor child, then his parents or guardians act in his interests. But they do not have the right to spend the minor’s funds in their own interests. To remove it, you must obtain permission from the district guardianship department.

Expert opinion

Noskov Georgy

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

To eliminate the possibility of abuse, the testator can provide a withdrawal schedule. Also, the order may contain a clause on withdrawal of the deposit when the heir reaches 18 years of age.

If the document was executed before 2002, then the heir should not receive a certificate of inheritance rights. Funds are issued on the basis of the death certificate of the depositor.

What is a bank deposit

A bank deposit or deposit is money that was transferred by the depositor to a credit institution (bank) for storage with the aim of making a profit. The income on the deposit consists of the accrual of interest on its amount and depends on the rate established in accordance with the deposit opening agreement.

Interest on the deposit can be received along with the original amount of funds only if pre-agreed conditions are met, and they, in turn, depend on the type of investment chosen. Sberbank of Russia, like most other credit institutions, offers its clients to deposit money on fixed-term and permanent deposits.

Urgent is divided into three types:

- Savings (“Save”) - funds are deposited for a period of one month to three years without the possibility of partial withdrawal* and replenishment, the interest rate on it is higher than on the deposits listed below.

- Cumulative (“Replenish”) – the deposit period is from three months to three years, you can top up, but you cannot withdraw*.

- Settlement (“Manage”) - the lowest interest rate for a time deposit, the account is opened for a period from three months to three years, it can be replenished and withdrawn within the permissible amount (up to the minimum minimum balance).

* - waiver of the right to receive funds from the deposit upon first demand (even if it is specified in the agreement) is void - the depositor has the right to withdraw money at any time, but in most cases the interest on it will be lost.

Keeping money on a fixed-term deposit can be extended and this is done automatically. If the recipient does not withdraw the funds upon expiration, the deposit is considered renewed under the same conditions as before.

A minimum interest is accrued on a permanent deposit (on demand), but the depositor (his representative, heir) has the right to withdraw money or replenish the account at any time without losing the already accrued profit.

At Sberbank, permanent deposits are represented by the following offers:

- "Poste restante";

- "Universal";

- nominal account for crediting social benefits.

Each of the listed deposits can be received by the heirs of the investor if they have documentary evidence of their rights and belonging to the priority successors of the current order of inheritance.

How to receive money from Sberbank by inheritance without a will

In the absence of administrative documents, inheritance of such property occurs in the general manner. If the account owner did not have time to sign off the property, then the contribution will be included in the inheritance along with other property.

In this situation, inheritance of the deposit will occur according to law. When receiving the property of the deceased according to the law in accordance with Art. 1142 of the Civil Code of the Russian Federation, the parents, children and spouse of the deceased investor have priority rights.

The procedure for inheritance is the same as in the case of a will. Relatives of a deceased citizen need to contact a notary. The key point is the deadline for filing papers - 6 months. If applicants do not submit documents, then relatives of the next line are called upon to inherit. This includes siblings and grandparents of the deceased subject.

After receiving the inheritance certificate, the recipients must contact the bank. Money is issued upon application. If the heir recognized the ownership of the deposit through the court, then when submitting the application it will be necessary to provide a court decision.

Procedure for receiving a deposit from a deceased relative in Sberbank

Procedure for receiving a deposit:

- Contacting a notary.

- Search for contributions.

- Registration of a certificate of inheritance rights.

- Receiving funds from Sberbank.

Important! The amount does not exceed 100,000 rubles. heirs can withdraw from the deposit without a certificate of inheritance rights in order to organize the funeral of the depositor.

Contacting a notary

The testator has the right to assign his property to any person. Having a will greatly simplifies the procedure for registering an inheritance. However, withdrawal of funds from a bank account is preceded by registration of documents with a notary.

An inheritance case is opened upon the application of the heir. Documents are submitted at the place of registration of the deceased citizen.

List of documents for registration of inheritance in the form of a deposit

| No. | Title of the document |

| 1 | Civil passport of the heir |

| 2 | Original testamentary disposition or will |

| 3 | Owner's death certificate |

| 4 | Agreement with the bank (if any) |

| 5 | Passbook (if available) |

| 6 | Certificate about the last place of registration of the deceased |

After the expiration of the deadline ( 6 months ) for accepting the inheritance, the recipient is issued a certificate.

Important! The state duty when registering an inheritance in this case is not withheld (Article 333.38 of the Tax Code of the Russian Federation). Other services (request to search for a deposit) of a notary are paid by the heirs in full.

Sample application for inheritance

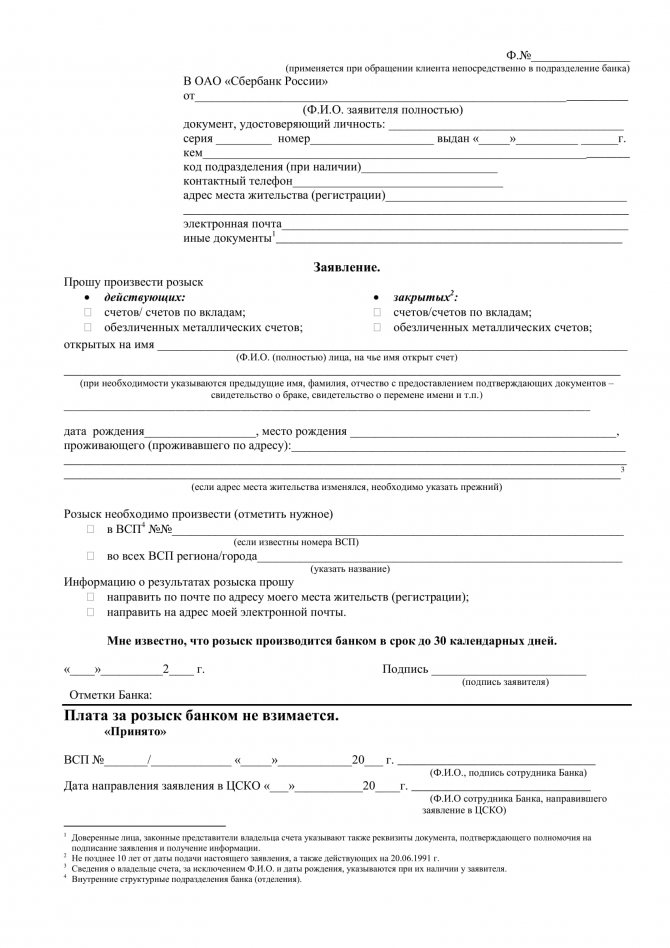

Search for contributions

A testamentary disposition and a will are documents confirming the presence of money in the bank. Quite often, citizens are unaware of the existence of deposits registered in the name of deceased relatives.

Important! If the recipients of the deceased's property do not know about the presence of the deposit, then the bank is not obliged to look for them. The unreceived contribution becomes the property of the state.

If the testator did not leave behind a will or did not transfer the document to the heir for any reason, then finding the bank in which the money is located becomes somewhat more complicated. The key document is the bank deposit agreement or passbook.

They display information about the presence of a deposit, the amount of funds and the name of a specific bank. Usually such documents are kept at home. Therefore, it is necessary to look through the personal belongings of the deceased.

The heir can make a request to Sberbank independently. Below is a sample application for seeking a deposit:

Application for the issuance of money

After receiving the inheritance certificate, the applicant will need to contact the bank. To withdraw money from your account, you must write an application. There is usually a sample included in the jar.

The heir must have with him:

- passport of a citizen of the Russian Federation;

- death certificate of the investor;

- a document confirming the heir's rights to the deposit;

- agreement or passbook.

A bank employee will identify the applicant and check the documents provided. If there are no comments to the heir, then he will be given a date to receive the money. If desired, the recipient can re-register the contract in his name without withdrawing money.

In some cases, a document confirming the citizenship of the testator may be required. Among them:

- Extract from the house register. The document confirms not only the place of residence of the testator, but also contains records of registration/extract as of 1991.

- USSR passport insert.

- Certificate from the Federal Migration Service.

If the specified documents are available, the heirs can receive deposits opened by the testator back in 1991. Heirs born between 1946 and 1991 can expect a doubling of the balance. Persons born after 1991 are not entitled to monetary compensation.

Grounds for inheriting a deposit

The area of inheritance law, including issues of transfer and receipt of bank deposits, is regulated by the third part of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). It establishes three grounds for transferring funds from a deposit:

- Will.

- Testamentary disposition.

- Belonging to the priority queue of the legal inheritance regime.

A will is a notarized posthumous disposition of the testator. Through their preparation, a depositor of sound mind and good memory has the right to determine the recipient of the money or distribute funds from the account (accounts) among several successors. In this case, the heirs can be:

- any individuals alive at the time of the death of the testator and not considered unworthy or conceived during his lifetime;

- legal entities (organizations) officially existing on the day of opening of the inheritance;

- international organizations;

- foreign state;

- Russian Federation (its administrative-territorial unit).

A testamentary disposition is an action similar to a will of property, and the legal force of the resulting document is equal to the significance of a will, but only regarding a bank deposit. The circle of potential heirs is also chosen by the investor independently.

The legal regime of inheritance becomes relevant in the event that a will or testamentary disposition was not drawn up or was declared invalid after the death of the testator.

Applicants for inheritance and the order of their calling are determined by Ch. 63 Civil Code of the Russian Federation. Inheritance by law can be characterized as follows:

- Only officially recognized relatives, family members and dependents of the deceased can be successors.

- Potential heirs are divided into seven groups, which are called queues.

- Immediately after the death of the testator, applicants of the first stage are called upon to receive funds from the account, and, if there are none or they did not want to accept the inheritance, the second or third, and so on until the seventh. If there are no heirs, the property of the deceased goes to the state.

- Each of the successors in one line receives the property of the testator in equal shares.

- Along with relatives from the group of heirs, the material assets of the deceased can be accepted by dependents who were supported by him for more than a year and were disabled for good reasons (due to disability, serious illness, etc.). This condition is relevant for dependents who are listed in one of the queues of heirs by law. For other persons, in addition to being a dependent, they also had to live with him for at least one year.

- Unworthy successors are excluded from the circle of applicants for inheritance.

- If one of the heirs dies before completing the deposit, the right to it passes to his children or heirs.

Potential heirs by law (in order):

- First. Parents, children, husband/wife.

- Second. Grandmothers, grandfathers, brothers, sisters.

- Third. Aunts, uncles.

- Fourth. Great-grandparents.

- Fifth. Children of nephews, brothers and sisters of grandparents.

- Sixth. Great-great-grandchildren, great-great-great-grandchildren, great-nephews, great-uncles and aunts.

- Seventh. Stepfather, stepmother, stepdaughters and stepsons.

Even if the testator disposed of his property through a will and did not mention/disinherit his close relatives, they do not lose the right to receive his property. In the event of inability to work (due to age or health), the mother, father, spouse and children of the deceased receive exactly half of what they could receive under the law. In legal terminology, this is called a compulsory share of inheritance.

Who is entitled to the obligatory share?

When drawing up a will, the testator must take into account the interests of socially vulnerable persons. A similar rule applies to a testamentary disposition, which is drawn up in the bank where the deposit is located.

Mandatory heirs include:

- disabled children/parents;

- disabled spouse/dependents.

These citizens are entitled to at least half of the share that they could count on by law. If the will does not take into account their interests, then the notary is obliged to take the necessary actions to allocate a share of the property. The contents of the will are not important. If a dispute arises between the heirs, it is resolved in court.

Reducing the share of the inheritance or refusing to award it is permitted only by a court decision. The initiator of the legal proceedings is usually the heir, whose rights are significantly limited in the event of the allocation of a mandatory share to the applicant.

Waiver of the obligatory share in accordance with Art. 1149 of the Civil Code of the Russian Federation is drawn up in writing and submitted to a notary.

Marital share

If the testator was married at the time of opening the deposit, then such property is the common property of the spouses. Therefore, after the death of one, half of the property belongs to the living spouse.

Allocation of the marital share in accordance with Art. 1150 of the Civil Code of the Russian Federation occurs at the request of the husband/wife. Documents are submitted to the notary within 6 months. Missing deadlines can result in lengthy legal proceedings.

Important! Having received ½ of the contribution as a spousal share, the spouse has the right to claim the share as an heir.