When is a debt considered common?

There is no specific law that defines the concept of common debt for spouses.

Fortunately, the court considers each situation separately. There are things in which the loan will absolutely be considered general:

- If the second spouse is indicated as a guarantor or co-borrower.

- If written consent of the second spouse to the loan is received.

- The loan money went to the general needs of the family.

As you know, completely different situations can arise in court.

And sometimes the spouse for whom the loan is issued must present some documents in order to prove that the loan should still be recognized as joint:

- Checks

- Treaty

- Acts

- Witness testimony

- Account statements

If none of these documents are provided to the court, then the loan may not be recognized as common and it will have to be paid to the spouse for whom it was officially issued.

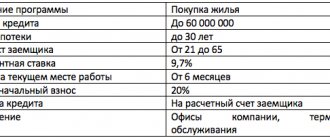

Procedure for drawing up a mortgage agreement

Since there are two borrowers on a mortgage, a set of documents is submitted to the bank for two. The same applies to personal insurance - the policy is purchased and regularly renewed by each spouse. Involving a wife or husband as a guarantor is very rare and is possible only if the bank provides for this method of purchasing real estate.

It is worth noting that a decision on the procedure for obtaining a loan and real estate should be made before submitting the papers. Subsequently, changing the terms of the agreement, changing the status of a co-borrower to a guarantor will be quite difficult. It is unlikely that the bank will agree.

In general, the procedure for applying for a mortgage by spouses will be standard:

- Submission of applications and questionnaires from two.

- Selecting real estate, concluding a mortgage agreement.

- Signing a loan agreement.

- Registration of insurance.

- Pay.

Both spouses can return the overpaid personal income tax; free use of maternity capital funds for partial or early repayment is allowed.

It is worth considering some nuances regarding the choice of the main borrower. Despite the complete equality of men and women, there is a certain difference in who exactly to take out a loan for. For example, the bank will take into account that a woman retires earlier, and accordingly, her working life may be shorter. That is, the mortgage agreement may have a shorter term.

What is mortgage consent?

All property acquired during marriage will be divided in half in the event of a divorce. This also applies to debts. Accordingly, if one of the spouses takes out a mortgage, and then a divorce occurs, then the second spouse will need to pay half of the debt.

That is why the notarized consent of the spouse to purchase real estate with a mortgage must be formalized . This form provides an additional guarantee to the bank. The transaction becomes safer, since there is confirmation of the absence of fraudulent actions on the part of one of the spouses.

With a mortgage, persons who are officially married become co-borrowers. That is, the bank has a guarantee that the debt will be repaid. But in the absence of consent from the second spouse, such a transaction may be declared invalid. Then the bank will not be able to demand repayment of the debt from the other party.

Consent is required for both the purchase and sale of housing . The document must be certified by a notary. Forms that are simply signed by both parties have no legal significance. Lawyer's notes are required.

What points does it consist of?

The form can be obtained from any notary office or from a lawyer. You can also fill it out yourself by downloading a sample from open sources. The main thing is to reassure him later.

The form must contain information:

- About spouses. Their passport details, registration, date of birth.

- About the object of lending and collateral. It is mandatory to indicate the address of the apartment being purchased. If the collateral is other property, then it must be indicated that the second spouse is not against such collateral.

- About the loan agreement. Its number, date of signing.

- About what consent is given. That is, the form must clearly indicate a phrase that confirms the consent of the second spouse.

- About the notary. Marks always come after the main “body” of the document.

There are no special requirements for content. The lawyer will check the data and put his signature and seal. Then the responsibility for writing the form correctly falls on his shoulders.

The lawyer will need:

- Passports of both spouses.

- Marriage certificate.

Where can I get a notarized document?

You can fill out this form yourself or contact a notary. When filling it out yourself, you must carefully enter your passport details, addresses and dates. After filling out, you need to contact a notary company to certify the form .

If you contact a notary directly, he will take care of the filling. At the same time, the client has a guarantee of a correctly completed document. In case of an error, the lawyer will bear responsibility independently. Will reissue the document free of charge.

Uncertified forms have no legal force.

In what cases may it be necessary?

Legal consent is always required when taking out a mortgage . Article 35 of the Family Code states that all transactions requiring state registration must be notarized.

Reference! A mortgage loan falls into the category of procedures that require registration. Accordingly, it is necessary to provide notarized consent to complete the transaction.

In addition, Article 7 of the Law “On Mortgage” states that the consent of all owners is required to complete a transaction.

Thus, the document is required in all cases when taking out a mortgage.

There is one exception. If the spouses have a prenuptial agreement that specifies cases in which consent is not required, then it is not necessary to provide it. A prenuptial agreement can be drawn up before marriage or during cohabitation.

When is consent not required?

The law describes cases in which you can buy or otherwise acquire an apartment without asking the consent of your legal half. Such cases include the following:

- The couple entered into a marriage contract. It does not matter when exactly the contract was concluded: before marriage or after, its execution is mandatory for both parties. In it, the parties can agree on all aspects of the disposal of existing and acquired real estate. Moreover, these provisions of the agreement may differ from the norms of the Family Code. For example, spouses can stipulate that all acquired real estate becomes the property of one of them, and after a divorce it will not be divided. This clause of the agreement does not comply with the RF IC, but is quite legal, since the parties agreed among themselves and voluntarily entered into a marriage contract. In the same way, it is fashionable to indicate in the contract that it is not necessary to obtain the consent of the second spouse in real estate transactions.

- The apartment is given to one of the spouses as a gift.

- The apartment is part of the inheritance estate, which comes under a will or by law at the disposal of one of the spouses.

- Consent is not required even when the second spouse has issued a power of attorney on his own behalf in the name of the first spouse to complete a purchase and sale transaction.

If, for any reason, one of the spouses cannot be a party to the purchase and sale transaction, then he can issue a power of attorney in the name of the other. For example, a wife can put her signature on a bill of sale if her husband has issued a corresponding power of attorney in her name. In this case, it is the husband who will become the owner of the apartment. In this case, the power of attorney acquires exactly the same legal force as a notarized consent.

If one of the spouses, on the basis of a power of attorney, acts in the interests of a third party and buys an apartment specifically for him, then the consent of the second spouse is also not required for this kind of transaction, since after registration the apartment will become the property of the third party.

Is the consent of the spouse required for the loan?

The Family Code of the Russian Federation in Article 33 defines the regime of joint ownership. This implies that all the property of the marriage partners, which is acquired during the period of marriage, will be community property. This category also includes everything that was given to one of the spouses or received as an inheritance. However, the distribution of property rights can be specifically stipulated in an agreement between spouses.

Spouses may use property on the terms of mutual consent. And therefore, both spouses should decide how to dispose of the property, not just one. So now the spouse’s written consent is required every time? No, only when required by law.

If the client takes out a regular consumer loan, then there is no need to have the spouse’s consent to receive the loan in writing. Only when receiving a mortgage will the spouse be a co-borrower.

However, the very question of who owns the loan, whether it is personal or general, arises when a loan debt arises. Another situation could be the divorce of spouses and the subsequent division of property between them, because debts must also be divided.

However, divorce is not necessary; division of debts can also arise while the spouses are married. The process goes through the court after an application from one of the spouses or a creditor. The reason for such consequences may be the lack of personal property of the spouse to pay off the debt that has arisen.

Change and termination of the marriage contract

In accordance with Art.

43 of the Family Code, the parties, if there is mutual consent, have the right to amend the marriage contract or terminate it. Also in the event of the death of one of the parties (one of the spouses). If the parties decide to end the marriage, then after the divorce the marriage contract is automatically dissolved, but the spouses are not released from the obligations that were provided for by the parties in this case. If one of the spouses does not agree with the changes or termination, then the contract cannot be unilaterally adjusted or terminated. If there is mutual agreement, the parties are required to contact a notary office, attaching the established package of documentation, which includes:

- An application filled out in the prescribed form (a sample can be viewed directly from a notary when applying).

- The original document - the marriage contract.

- Passports of both spouses (originals and copies).

- Original certificate of marriage.

The notary charges a fee for providing services - its amount must be clarified on an individual basis. Payment for notary services can be made on the spot - upon application - documents will be issued there proving the fact of depositing funds. As part of the provision of the service, an authorized representative of the notary's office will check the authenticity of the provided documentation, after which an agreement will be concluded between the parties (spouses), and the notary will certify it.

It is important to take into account that if it is necessary to terminate a contract, it is not necessary to contact the notary office where it was previously certified - it is possible to use the services of any notary. .

The agreement to terminate the marriage contract must contain the following set of information:

- The name of the document being drawn up.

- Place and date of execution of the agreement to terminate the contract.

- Information about the parties to the marriage contract.

- Information about the marriage contract.

- Details and signatures.

At the end of the agreement, the notary puts his mark.

There is also the possibility of canceling the marriage contract in court. For this purpose, the spouse interested in terminating the transaction must draw up a statement of claim, which will need to include:

- The name of the judicial authority to which the appeal is made.

- Information about the plaintiff (full name, residential address, contact phone number).

- Information about the defendant (full name, residential address, telephone number).

- Information about the marriage contract that the person acting as the plaintiff wants to terminate (date of execution and other details).

- Indication of the reasons due to which the plaintiff had the need to terminate the marriage contract.

Most often, a marriage contract is terminated if the following reasons occur:

- One of the spouses (no matter - husband or wife) violated the terms of the contract.

- Circumstances have changed so significantly that the agreement previously drawn up between the spouses has lost its original meaning.

In addition, the claim will need to indicate a list of attached documentation, the date of its preparation and the signature of the plaintiff. In this case, the list of attached documentation usually includes:

- A copy of the plaintiff's passport.

- A copy of the marriage contract.

- Original document confirming payment of the state duty.

- Documents confirming the circumstances indicated by the person that served as the reason for applying to the court for termination of the contract.

After the claim is received, the judge will consider it and, if all the required documents are submitted, a time is set for its consideration with the parties summoned to the trial. During the process, each spouse defends their point of view, after which the judge makes a decision whether to satisfy the claims and annul the contract or not.

Loan without the consent of the wife or husband: prospects and consequences

In the case where there was no formal agreement between the spouses, all property will be subject to the law described above, that is, it will be considered common. According to the Civil Code of the Russian Federation, a credit transaction carried out at a bank may not be accepted by the other half within one year, provided that everything happened without its introduction. However, a year has passed, and no applications have been received from the second half, so no one is against it. And if he didn’t mind, then he agreed.

Consider the following situation. If there is no document confirming the consent of the spouse to receive the loan, then the resulting amount of the loan debt will not be recognized by the court as common, and it will not be distributed between the spouses. This situation is possible if the spouse says: “I didn’t know/didn’t know about my other half getting a loan. And I didn’t see/didn’t see the money either, he/she spent it only on himself.”

If, during the trial, it is confirmed that all borrowed funds were entirely spent on the needs of the family, then the debt will be recognized as common, so it will be divided between husband and wife.

There are situations when the court recognized the debt as general, but the creditor banks themselves refer to Articles 307 and 391 of the Civil Code of the Russian Federation, and appeal the decisions of the court of first instance in the courts of the district or city level.

Loan taken without the consent of the second spouse

An excellent option for dividing the debt would be either unanimity between husband and wife on this issue, or solving this problem with the bank to a large extent. This will help avoid subsequent litigation. What does that require? On your part you will need:

- invite the bank in writing to come to an agreement on the issue of recognizing the resulting debt as general.

- obtain the consent (in writing) of the creditor bank so that in the future you will have a chance to confirm the consent of the banking institution during the trial if the latter goes to court.

When the creditor does not have the consent of the second spouse to receive the creditor, he can collect the debt from part of the property owned by the borrower, but in no case to his other half.

Therefore, the lender sometimes takes care of the consent of the spouse, so that in the future there will be no problems with the property that is subject to sale in the event of failure to fulfill the borrower’s obligations.

If the consent of the spouse is available, then the creditor bank will be able to collect the entire debt with interest from the common property, even from the property that was acquired or received before the marriage.

Sometimes not only the written consent of the second spouse is required, but also his personal presence at the banking institution when an application for a loan is submitted, or when a Loan Agreement or a car loan agreement is signed.

A loan taken without the consent of the wife or husband: prospects and consequences

Let's consider the question of how debts are divided after a divorce. Let's imagine this situation. During the marriage, the husband took out a consumer loan; his main goal was to develop the business. After some time, the couple were officially divorced. One day, employees of the banking institution where the ex-husband took out a loan began calling his wife, moreover, now even bailiffs are calling and demanding that the wife pay her ex-husband’s debt. after all, he stopped making payments.

What to do? Don't get lost! Here are some important points:

- Report to the local branch of the Federal Bailiff Service that your ex-husband took out the loan for himself and did not receive your consent for this loan.

- Find and prepare all your existing contracts, receipts, etc., which confirms the apartment’s belongings, furniture, and so on, in the case where the apartment was purchased jointly by the spouses in the past. For what? So that if the bailiffs come to seize the property, you have documents confirming your ownership.

- What if the husband took out millions as a loan? Try to sell your existing property as soon as possible and find other housing. Otherwise, a penalty will be imposed on the husband’s share.

However, the last point does not happen often.

List of required documents for obtaining a consumer loan

If you wish to receive a consumer loan, you must provide the following documents. Among them:

- application in the form of a questionnaire;

- a passport confirming citizenship of the Russian Federation (a registration mark is required);

- if there is temporary registration, then a document confirming registration at your place of residence;

- a set of documents that will confirm your solvency, employment, and so on.

If the borrower is over 18 years old but under 20 years old, then additional documents will be required to confirm family ties with the guarantors. Among them: birth certificate, etc.

So, when you take out a loan, think about the possible consequences and your other halves. And if your other half took out a loan, then be careful and prudent.

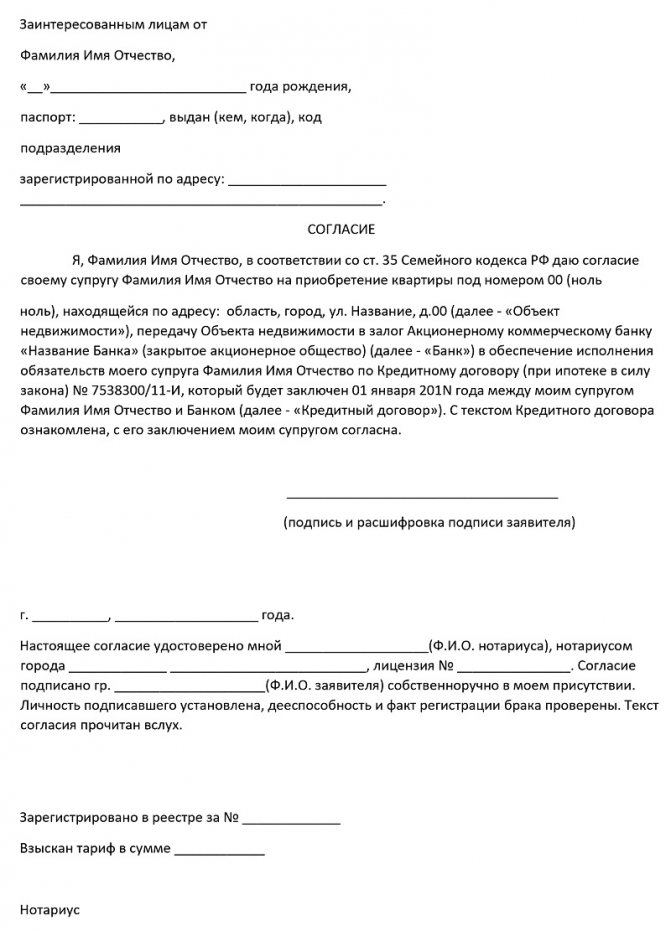

Notarial consent

When applying for a loan for an apartment, it is required to take the notarized consent of the spouse to purchase real estate with a mortgage. You can contact any notary office; you should have a passport and a certificate of official marriage with you, even if there is a corresponding stamp in the passport of both spouses. The certificate must be readable, despite the age of the document, without typos or other inconsistencies with the main document - the passport.

Consent is of a one-time nature . In this regard, the document must indicate the address of the exact property being purchased with a mortgage.

The cost of a written document certifying a spouse’s consent to the other spouse taking out a mortgage will consist of:

- the tariff established by the notary chamber on the day of execution of the document;

- tariff for related technical services.

Sample agreement

A document expressing the spouse’s permission to purchase real estate with a mortgage must contain the following mandatory components:

- Date/place of document preparation.

- Full name, place of registration, passport details of the person giving consent.

- Full name, place of registration, passport details of the person receiving consent.

- Information from the marriage certificate.

- Data on real estate purchased as collateral.

- Details of the notary who issued the consent.

- Registration number.

- Notarized consent of the spouse to purchase real estate with a mortgage.

Sample of a notarial consent of a spouse for the purchase of an apartment with a mortgage

There is no strictly mandatory form of notarial consent of a spouse to purchase an apartment on a mortgage, however, based on established practice, in almost all cases they use approximately the following type of document:

Spouses do not have to compile it themselves. It is enough to entrust this moment to a notary and then simply carefully check all the points.

Depending on the situation, the procedure for obtaining consent from a spouse for a mortgage loan may be associated with a number of problems. They can be resolved with the help of an experienced lawyer. At a free consultation, specialists clarify frequently arising controversial issues, and they can also act as client representatives, accompanying the entire process of applying for a loan.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

3

Agreement for the purchase and sale of an apartment using a mortgage and credit funds

The apartment purchase and sale agreement is the main document when concluding a transaction. Especially…

15

How to check an apartment for cleanliness before buying it yourself

A transaction involving the alienation of housing for a fee always involves certain risks...

12

How does the purchase and sale of an apartment through a safe deposit box work?

The purchase and sale transaction of an apartment involves many risks, one of which is...

35

What expenses do the buyer and seller bear when buying or selling an apartment?

Purchasing an apartment is associated with high costs. The lion's share of the buyer's expenses...

2

Buying an apartment with a mortgage encumbrance

When applying for a mortgage loan, the bank requests collateral. They can perform...

6

Termination of the preliminary agreement for the purchase and sale of an apartment

In case of expropriation of an apartment for compensation, the Seller and the Buyer may not…

Disagreement of the second spouse to issue a loan and judicial practice

In practice, courts do not always consider the disagreement of the second spouse to issue a loan as a basis for recognizing the debt as a personal loan of one spouse. At the same time, recently banks have often, on their own initiative, challenged decisions on the division of the common debt between spouses, citing Articles 307 and 391 of the Civil Code of the Russian Federation. As a result, the demand for recognition of the debt is appealed and its satisfaction is canceled by the regional courts. Thus, even recognition of a loan as a general debt in the courts of first instance (in district or city courts) does not guarantee that such a decision will not later be appealed by the bank itself.

What should the injured party do in such a situation?

Have you acted as a guarantor for your spouse?YesNo

First of all you need to:

- Contact the bailiffs for help, notify them that the loan was taken without consent, and also provide the name of the bank where the loan was taken.

- Since bailiffs can describe personal property, you need to prepare all documents to prove ownership.

- If the loan amount is several million, then it is worth selling the shared housing in advance (if available) and purchasing a separate one so that the bank can collect only the share of the spouse for whom the loan is issued.

Debt section: communication with the bank

The ideal option for dividing the debt is not only to reach an agreement on this matter between the spouses, but also to agree on the issue with the creditor bank. This will help avoid further appeals, as well as the cancellation of a court decision or agreement on the division of property. To achieve this goal it is necessary:

- contact the bank with a written proposal to agree on the issue of recognizing the loan debt as general.

- obtain bank approval in writing in order to then be able to prove the bank’s consent in court if the financial organization challenges the actions of the borrower or co-borrower to recognize the loan debt as common.

Who pays the mortgage in a divorce?

Consent to purchase real estate on credit and under its security is necessary if the property becomes the common property of the spouses. Accordingly, the responsibility to repay the debt falls on the shoulders of both the husband and wife.

This rule is reflected in Part 2 of Art. 45 of the Family Code of the Russian Federation. We are talking about joint and several liability. If, for example, the husband paid the mortgage after the divorce, then he has the right to demand compensation for half the amount of money spent. This is a general rule to which there are exceptions.

Some banks take a different route: they require the spouses to enter into a prenuptial agreement, which would indicate that the property will belong only to the husband or exclusively to the wife. This simplifies the procedure for collecting overdue debt and foreclosure on the collateral.

If there is a prenuptial agreement, then the property is no longer considered joint property, but personal property. Accordingly, there is no need to seek money from the second spouse, especially since he may be insolvent. There will be no problems with the division of real estate - the bank simply takes away the personal property of the husband or wife in full.

Sources

- https://otkazanet.ru/credits/kredit-bez-soglasiya-supruga-chto-nuzhno-znat.html

- https://svoe.guru/ipoteka/dokumentatsiya/ip-soglasie.html

- https://law03.ru/finance/article/soglasie-supruga-na-pokupku-kvartiry

- https://TemaBankov.ru/bankovskie-uslugi/kredity/nuzhno-li-soglasie-supruga-na-kredit.html

- https://ahrfn.com/ipoteka/nuzhno-li-soglasie-supruga-na-ipoteku.html

- https://101.credit/articles/kredity/kredit-bez-soglasija-supruga/

- https://mylawyer.club/nedvizhimost/kvartira/kuplya-prodazha/pokupka/pok-v-ipoteku/notarialnoe-soglasie-supruga.html

[collapse]