A mortgage for a room in a communal apartment is a good, and often the only option for people moving to another city who cannot afford to purchase full-fledged housing.

Many banks are wary of this type of mortgage, but there are conditions under which a mortgage loan will be guaranteed.

Today we will tell you about the conditions for purchasing a room in a communal apartment and the banks that establish them

Is it possible to buy a room with a mortgage?

A mortgage in many banks can be taken out not only for separate housing, but also for part of it, which includes a room in a communal apartment.

The most common option for such an acquisition is the purchase of part of the property from other owners in order to own the apartment completely (most often this happens if the last room remains, and the rest of the housing already belongs to the borrower).

In this case, banking institutions willingly issue mortgage loans to clients, and the amount required is quite small.

However, it should be remembered that the bank pledges the entire apartment, not part of it.

Banks can issue a mortgage loan secured by a room that is not necessarily purchased in accordance with Article 6 of Federal Law No. 102.

Another mortgage lending option is to purchase one room (or a certain part) in a communal apartment.

Banks are quite wary of issuing mortgages to such clients, since the liquidity of the collateral is called into question, and they additionally check the borrower’s solvency, as well as the availability of permission to buy out part of the property from other co-owners.

Is such a purchase possible?

Not every bank likes such objects when drawing up contracts. Only a few organizations consider a mortgage for a room, and then only when the owner of the remaining part of the communal apartment buys the last part into ownership.

Making such transactions is important for participants in programs like “Affordable Housing”. This means that the contract is drawn up with government support.

But ordinary borrowers can also count on approval of applications for similar types of loans. When the last room is purchased, the entire apartment will become the property of the citizen, but will become collateral for the bank while the debt is being repaid. From now on, even a room will be considered liquid real estate, the sale of which does not cause much trouble.

Requirements

Since buying part of an apartment is quite a risky undertaking for banks, they set increased liquidity requirements for real estate so that it can cover all the costs of a mortgage loan in the event of the borrower’s non-payment of debt.

The client’s solvency and the purpose of his purchase of the room are also carefully checked.

The requirements of banking institutions can be identified as conditions for the candidacy of the borrower and directly for the purchased property.

Requirements for the borrower

In order to issue a mortgage to a borrower to purchase part of a home, the bank checks his candidacy for compliance with the following requirements:

- By age - reaching 21 years of age at the time of registration of the mortgage and no more than 65-70 years of age to fully repay the mortgage debt;

- For length of service - having at least six months of experience at the last place of work, and total experience - 1.5-3 years;

- To attract co-borrowers or guarantors - a guarantee may be required in case of low income; spouses are required to act as co-borrowers under some programs, regardless of their desire.

Room requirements

A room in a communal apartment must meet the bank's requirements and general living conditions so that the bank can approve the issuance of a mortgage.

Requirements include:

- Suitability for habitation and good condition;

- Availability of amenities (bathroom, sewerage, other communications);

- Availability of heating and electrical wiring;

- The area size is at least 12 square meters;

- The house was built later than in the 70s, there are no wooden connections.

Depending on the procedure for assessing conditions and cost, other housing nuances may also be taken into account when approving housing by a banking institution.

Requirements for the borrower

When applying for a mortgage loan, it is important to assess compliance with the requirements of the lending institution. A mortgage on an apartment carries increased risks for the lender, which explains the strict requirements for potential clients:

- Being of working age. By the time the contract is completed, the borrower’s age should not exceed 65-75 years (depending on the credit institution). Some financial institutions limit this parameter to 50 years.

- The lower age limit is 21 years old.

- The duration of employment is one year or more. It is important that the borrower has worked in the last place for at least six months. Sometimes a banking institution requires an experience of three years or more.

- Connecting co-borrowers and guarantors. The requirement is explained by the risks of the credit institution mentioned above. Involving solvent people in obtaining a mortgage for a room increases the chances of receiving the service. But it is worth considering that involving a spouse (if there is a marriage contract) as a co-borrower or guarantor is not allowed.

Where can I buy a room?

The type of housing for this type of lending is determined only by the type of property in which there is the possibility of purchasing one room.

Among these are dormitories and communal apartments, as well as parts of an ordinary apartment in which there is more than one owner.

In dorm

A mortgage for the purchase of a dorm room is quite a risky undertaking for banks, since the liquidity of such real estate is very questionable.

Therefore, the borrower may be required to provide a document confirming the availability of additional real estate that can be considered by the bank as collateral.

Also, the possibility of opening a mortgage increases if the borrower wants to buy the last room in the hostel in order to become the full owner of the entire complex.

In a communal apartment

For communal apartments, as well as dormitories, banking institutions set increased requirements.

The object must not be demolished, nor be unfit for habitation.

You will also need written confirmation of the consent of other owners to buy out part of the communal apartment.

You can also significantly increase your chances of successfully obtaining a mortgage loan by purchasing additional real estate or purchasing the last part of the apartment.

Requirements for the borrower

Applying for a mortgage loan for a room in 2020 is available only to citizens who meet the bank’s criteria. Among the standard conditions are:

- minimum age – 21 years;

- the maximum age at the end of making payments is 65-70 years;

- presence of Russian citizenship;

- current official place of employment where the person has been working for at least six months;

- total work experience of 1 year;

- income level that allows you to pay the amount required for the loan.

Please note:

Age criteria are averaged. Typically, banks issue mortgages to persons who will not be 65 years old at the time of full repayment.

Often banks require the involvement of co-borrowers or citizens who are ready to guarantee the repayment of the loan. In the absence of payments from the borrower, they are obligated to deposit funds.

They check banks and credit history. The institution must be sure that it is issuing a loan to a reliable person. Even if there is no credit history, either negative or positive, this may be grounds for refusal. Banks are not ready to trust newcomers whose first loan is a mortgage for a room.

Which banks are ready to provide a mortgage?

Many banking institutions are afraid to work with communal housing and issue a mortgage for the purchase of a room.

But you can still find conditions in the largest and regional banks that allow you to become the owner of a room in a communal apartment.

You can find recommendations for choosing a mortgage bank here.

Sberbank

Sberbank has been successfully offering mortgage lending for the purchase of a room in a communal apartment for many years, as it became one of the first in this business.

Interest rates will range from 9.5% to 14% per annum with a down payment of 10%.

The maximum amount you can receive is from 45,000 rubles to 15,000,000 rubles for a period of up to 30 years, and a deposit is also issued for the purchased housing.

Documents that may be needed:

Certificate of income in the form of Sberbank;

Sample of filling out an application form for a housing loan at Sberbank;

Application form for obtaining a mortgage loan from Sberbank;

General conditions for housing loans at Sberbank.

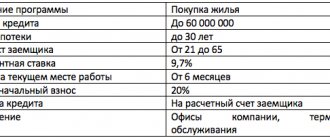

VTB 24

VTB 24 is more willing to issue a mortgage for a room in a communal apartment if the borrower buys the last part of such real estate.

The loan term reaches 20 years, and the maximum amount and interest rates depend on the amount of the down payment, which is set at 20% of the cost of the collateral housing.

A sample application form for VTB 24 can be found in this attachment.

Rosevrobank

At Rosevrobank you can get a mortgage for a fairly large amount from 350,000 rubles to 20,000,000 rubles for a period of up to 20 years.

Interest rates depend on the amount of the down payment, which ranges from 15-20%.

Useful video:

Gazprombank

Gazprombank offers fairly small sums of up to 5,000,000 rubles for the purchase of part of an apartment.

The down payment amount will be from 20% with interest rates from 11.75% per annum.

Tinkoff

Tinkoff Bank offers to save up to 0.8% of banks' rates, offering its own from 10.5%.

The loan term and down payment depend on the chosen banking institution and its conditions. Read about what the down payment on a mortgage is here.

Video on the topic:

Deltacredit

Deltacredit has developed an entire mortgage program for a room. Interest rates on it range from 11.25% with a down payment of 25%.

The term of the mortgage loan reaches 25 years.

Mortgage for a room in Sberbank

A possible option for obtaining a mortgage for a room in Sberbank is available under the “Ready Housing” program. It provides for the purchase of objects on the secondary market under the following conditions:

- interest rate within 11.1-11.4%;

- the loan agreement is drawn up for a period from 1 year to 30 years;

- there is no maximum allowable amount;

- the starting payment is at least 20%.

The requirements for the loan recipient are standard. The set of documents submitted to the bank also does not have any special features.

Comparative characteristics of banks

Table characterizing the conditions of banks that issue loans for a room:

| Bank's name | Bank logo | Interest rate | An initial fee |

| Sberbank | from 9.5% | from 10% | |

| VTB 24 | from 11.25% | from 10% | |

| Rosevrobank | from 9.75% | from 15% | |

| Gazprombank | from 11.75% | from 20% | |

| Tinkoff Bank | from 10.5% | — | |

| Deltacredit | from 11.25% | from 25% | |

| SKB bank | from 12% | from 12% | |

| AK Bars | from 13.5% | from 0% |

Which Russian banks issue a mortgage for a room?

Finding a bank that provides this form of lending is not so easy. The reason for this situation is great risks.

A room purchased with a mortgage will be the subject of collateral; if the borrower does not pay the debt, it will be very difficult for the bank to sell this property. The benefit for the bank is also minimal.

With a huge number of required documents, the interest received will be minimal, and if the loan is repaid early with the help of maternity capital, for example, there is almost no benefit left for the bank at all.

The list of banks due to the above circumstances will not be large:

- Sberbank. It was this bank that first began issuing loans for the purchase of a room. The maximum loan term is 30 years.

- Bank of Moscow. The exception is housing in dormitories. Loan term up to 30 years, down payment from 20%.

- SKB bank. The minimum loan amount is 350 thousand rubles, the loan term is 12, 20, 30 years.

- MTS bank. The minimum loan is 300 thousand rubles. The size of the down payment is from 10 to 85%.

- TransCapitalBank. The loan term is up to 25 years, the minimum amount is 500 thousand rubles.

Can I take advantage of a preferential mortgage?

A mortgage for the purchase of part of the housing in a communal apartment can be obtained using preferential programs, since they do not prohibit the purchase of this type of real estate.

You just have to find a suitable bank that cooperates with programs and this type of housing.

Is it possible to buy a room with a military mortgage?

A military mortgage provides for payments under the mortgage-savings system to the military personnel participating in it.

Quite large amounts of these savings, as well as the period for starting to use them after 3 years of participation, allow you to purchase separate housing, but to buy out the last part of a communal apartment in order to become its sole owner, you can obtain this right quite profitably without your own investments.

Is it possible to buy a room with a mortgage using maternity capital?

Maternity capital is provided to families after the birth of two or more children.

This amount is enough to buy out a room, but banking institutions are more willing to agree to buy out the last part of the apartment if the client is already the owner.

A little about bank risks

Banks are reluctant to agree to issue a mortgage loan for the purchase of a room in a communal apartment or dormitory, since the liquidity of such housing is called into question.

Even if, when assessing the real estate, compliance with all conditions is established, the bank is unlikely to receive much benefit from such a transaction.

And if the borrower fails to repay the loan, the sale of such real estate will be quite difficult.

Therefore, banks often dissuade clients from purchasing part of the housing in a communal apartment, even if they have such a right and meet all the requirements.

In the case of a communal apartment

Banks are likely to give a positive answer to those who want to finance the purchase of their last room. Having given a small amount, the bank receives an entire apartment as additional collateral.

The likelihood of refusal increases if the property has several potential or current owners. There is only one way to get out of this situation - make a down payment as early as possible and offer high-quality security.

Differences for dormitories

Only a few banks are willing to consider the rooms themselves as collateral.

Such housing has a low level of liquidity, which is due to several factors:

- The presence of a large number of violations in the preparation of accompanying documents.

- Doubts about the legal purity of individual rooms.

What are the differences from regular apartment loans?

More information about a room mortgage

The difference is due to the fact that work is carried out only with the secondary market. In new buildings, selling apartments in separate rooms is not possible.

Owners most often become co-borrowers if a shared ownership scheme is used.

The second difference lies in the fact that all other owners with preferential rights must give their official refusal in this regard.

For the written form of this document, notarization is required.

Registration of a mortgage

After choosing a banking institution that is ready to provide a mortgage for the purchase of part of the housing in a communal apartment, the potential borrower must submit an application form.

After approval of the client’s candidacy and approval of the mortgage loan, the borrower selects a room and provides all the necessary documents for this property.

The bank carries out the assessment at the borrower's expense. If it is planned to pledge not only the purchased housing, but also existing property, then it is also assessed by a professional appraiser.

Requirements for living space

Not every room in a communal apartment or dormitory will be approved by the bank when issuing a mortgage. The bank must see its benefit from the transaction, which is why it provides its demands. Moreover, they concern not only the room, but the entire apartment and house.

Bank requirements may vary, but in general they are as follows:

- The room must be completely suitable for living.

- There should be no signs of emergency condition of the house, or prerequisites for demolition.

- The room must be properly heated.

- The apartment must have working electrical wiring, running water, a bathroom and a sewerage system.

- The building should not have wooden floors, and its construction date should not be earlier than 1970.

In a communal apartment

The room must be privatized, otherwise it will not be subject to sale. Also, when taking out a mortgage, the bank will check who owns the other rooms of the apartment. If a borrower plans to purchase his first room in an apartment, then he will have to prepare for stricter requirements from the bank, since the risks in this situation increase.

In addition, neighbors have a priority right to purchase a room, so they must be notified and their opinion must be sought. The bank will give the go-ahead for a mortgage only if none of the neighbors planned to purchase this room, and they wrote a refusal or ignored the seller’s offer.

In dorm

In the case of a hostel, there are no such difficulties, because here all buyers will have equal rights. This means that it will be easier for the bank to issue a mortgage. However, a dorm room has its own requirements.

- Banks will require a document from the owner of the hostel, which will confirm his right to this living space. The owner can be either an individual or a legal entity, but it is worth considering that in the second case, banks are not very fond of issuing mortgages.

- The room must be registered as a separate piece of real estate.

Advantages and disadvantages

It seems that it is better to purchase a full-fledged apartment with a mortgage instead of a room, but for some this is the only opportunity to stay in the city or find housing after a divorce.

The advantages and disadvantages of mortgage lending for such real estate are shown in the table:

| Advantages | Flaws |

| High availability due to low prices. | You should always take into account the fact that you are close to other people. |

| A good opportunity to buy the last room from your neighbors to own a large communal apartment alone. | The liquidity of such real estate is often questioned by tanks and does not always withstand the assessment procedure. |

| Short payment period in case of a small mortgage amount. | The acquisition is complicated by the need to collect signatures from other registered parties. |

| — | It is necessary to take into account your solvency so that the bank does not have a reason to seize the collateral. |