What does it mean to transfer a mortgage to another bank?

The procedure is called refinancing or refinancing. It is represented in many leading banks. A borrower has a mortgage at a certain rate and sees that another bank is offering a lower rate. He can submit an application and conclude an agreement with a new creditor without the consent of the first bank. Thus, transfer the mortgage to the new company.

Refinancing is similar to taking out a new mortgage. You need to submit an application, get a decision, collect documents for the property and re-evaluate its value. But details about the registration procedure are in the corresponding section.

Next, it’s worth considering the banks that offer to transfer the loan under the new program, as well as their conditions and nuances.

Banks to which you can profitably transfer your mortgage

List of banks whose conditions will be discussed in the review:

- Sberbank.

- Gazprombank.

- VTB.

- Rosselkhozbank.

- Opening.

In addition to them, you can transfer a loan to Alfa-Bank, Raiffeisenbank, and other companies. From the banks on the list, the borrower can receive an additional amount for personal purposes and reduce the total overpayment on the mortgage.

Conditions for transferring a mortgage to Sberbank

General conditions at Sberbank:

- registration of a mortgage in rubles;

- interest rate from 10.1% per year;

- minimum loan size 0.3 million rubles;

- repayment from 12 to 360 months;

- no commission for issuing funds.

The maximum loan amount depends on the region. In Moscow and Moscow region up to 7 million rubles. In other regions, you can transfer a loan in the amount of up to 5 million rubles. Life and health insurance of the client on a voluntary basis.

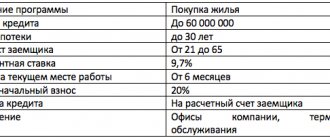

Transfer of mortgage to Gazprombank

Gazprombank offers 3 different programs: refinancing for the military, according to two documents, and a standard program for mortgages. Its terms include:

- Loan size from 0.1 to 45 million rubles. The minimum loan size cannot be less than 15% of the cost of housing.

- The minimum repayment period is 3.5 years for the secondary market and 1 year for housing under construction.

- The maximum payment term is 30 years.

- Interest from 10.2% per year.

The bank provides funds in a one-time transfer. It does not charge any commissions and processes the application within 1 to 10 business days.

Nuance! From the date the client applies for refinancing, at least 3.5 years must remain until the loan is fully repaid.

The bank warns that in the last year before submitting the application, the borrower should have no more than two overdue payments lasting up to 29 days.

Conditions for transferring a mortgage loan from VTB Bank

VTB offer:

- includes a fixed rate for the entire period of fulfillment of obligations;

- rate from 9.6% per year;

- registration in rubles;

- payment up to 360 months, but for two documents up to 240 months;

- issue a loan of no more than 90% of the value of the property;

- maximum amount in rubles – 30 million.

The borrower can take out a loan without commission, repay it, or transfer funds to another lender.

Special condition: if the loan amount to the cost of housing is more than 80%, then the bank increases the interest rate by 0.5% per year.

Terms of restructuring at Rosselkhoz Bank

You can transfer to Rosselkhozbank under the following conditions:

- Rate from 10.15% per year.

- In rubles.

- From 100 thousand rubles The maximum loan size depends on the city. In Moscow – up to 20 million rubles, in St. Petersburg – up to 15 million rubles, in the Moscow region – up to 10 million rubles. In the regions up to 5 million rubles.

- Repayment up to 360 months.

- No commissions.

The company provides no more than 80% of the cost of an apartment or townhouse with land. If a residential building with a plot of land, then up to 75% of the cost of the property.

The application is processed within 5 working days. It is allowed to involve up to three co-borrowers in the transaction and it is possible to change the list of co-borrowers during refinancing.

On-lending from Otkritie Bank

The last refinancing option in the review is from Otkritie Bank. He proposes to transfer the mortgage under the following conditions:

- transfer with co-borrowers up to three people;

- no fees for processing and issuing money;

- in rubles;

- repayment 3-30 years;

- loan size from 500 thousand rubles to 30 million rubles;

- interest from 9.6% per year;

- They issue loans from 20 to 85% of the cost of housing.

In some regions, the maximum loan size is limited. You can transfer a mortgage in St. Petersburg and the Leningrad region for an amount of up to 15 million rubles, and for other regions the loan amount should not exceed the balance in the previous bank.

How to transfer a mortgage to another bank: conditions, procedure and reviews

Nowadays, most apartments are purchased with a mortgage loan, and not from their own savings, and after a while many people wonder how to transfer the mortgage on an apartment to another bank with a more favorable interest rate.

It could turn out that the person had not thought about this issue before and took out a loan from the most popular bank. Perhaps, over time, more favorable conditions appeared in another organization. In any case, the reasons are not that important.

Anyone can refinance at a lower interest rate, which is what will be discussed in the article.

What it is

What does it mean to re-register a mortgage on a house or apartment to another bank? A person receives a loan from another organization and, with the help of these funds, pays off the mortgage in the first one. As a result, he becomes a client of a new bank that offers more favorable conditions.

It is beneficial for the bank you want to switch to to get a new client. If the citizen meets the conditions, then refinancing the mortgage is not difficult. The company in which you are a borrower cannot interfere with this, which must be taken into account without fear of starting to cooperate with a new organization.

However, if the agreement states that you cannot repay the loan early, then switching to another bank is impossible. Many banks began to reinsure themselves and stipulate this in their contracts. If you pay off your mortgage early, the bank loses income because interest accrues every year. The sooner you pay off your mortgage, the less income the organization will receive.

You must be prepared for the fact that in the future this credit institution will not allow you to take out another loan - a car loan, a mortgage or a consumer loan. This is due to the fact that banks do not like early repayment of loans.

It’s easier for them to play it safe and not cooperate with you again. If you decide to refinance the loan, you must be prepared for the fact that you will not remain friends with this bank.

Consider whether it really pays to switch to a different mortgage lender.

Refinancing conditions

Transferring a mortgage to another bank is not always possible. You should prepare for the fact that the credit institution will refuse you. You can refinance your mortgage in the following cases.

- The property is housing on the secondary market. Banks are not interested in other options. If you bought an apartment in a new building, then you are unlikely to be able to refinance the mortgage.

- You must faithfully pay your mortgage for at least one year. If you took out a mortgage just a couple of months ago, you won’t be able to transfer. This period is set for the credit institution to see how you are paying off your mortgage. It is important for them that the client does not have any delays.

- Each company has its own requirements for the apartments they finance. Not all cases are refinanced. You can find out which banks provide the service and what conditions they have on the Internet or at a personal reception at the organization. You should find out in advance whether you can get a new mortgage from the bank you like.

- Borrower's passport.

- A certificate confirming official income. Without it, no bank will provide you with a loan.

- Loan agreement with the previous bank.

- You must not have any loan debt. Renegotiating your mortgage should not be a way to get out of debt. It is not profitable for lenders to work with clients who have an unstable financial situation.

- You must make the first payment in the very next few days. Prepare money in advance, as this condition occurs in many organizations.

- There are a huge number of banks and each of them has dozens of loan offers with different conditions.

- Consumer loans take first place in terms of quantity, and mortgage loans take first place in terms of amounts received.

- The fundamental difference between them can be seen in several points:

The new bank has the right to re-request documents that confirm solvency. If something has changed for the worse in your finances, then it is better not to try to ask for a mortgage transfer, as you will most likely be refused.

Important! The bank where you currently have a mortgage cannot refuse to transfer you. Some organizations tell their clients that they cannot give permission because they do not want to lose paying clients and revenue. By refinancing, you deprive the bank of its interest payments.

Decor

If you decide that you want to get a mortgage from another bank that offers you more favorable conditions, you should prepare for the fact that they will require the entire package of documents in order to complete the transaction. They will refinance you only if the bank receives all the necessary papers.

Usually the decision is made within one hour, but in most cases it depends on the bank (sometimes it considers the application within several days). If you decide to transfer your loan, then it is better to start doing this in advance.

The organization may require the following.

To avoid any problems with the procedure, you should know about all this in advance. First you need to make inquiries and only then contact the bank you like. The decision must be balanced and deliberate. A completed transaction cannot be cancelled.

Read the agreement carefully: the bank that refinanced you may not be the most profitable solution. With transferred mortgages, the first terms and conditions are not kept together. The new lender may have its own requirements, which many are not prepared for.

You should not count on the bank employees themselves to warn you about everything.

Many banks offer refinancing, because it is profitable for them to get a new client who will bring them profit. To reissue a mortgage, you can contact, for example, Sberbank or VTB 24. These organizations offer favorable conditions, and Sberbank is located in any locality, and there will be no problems with obtaining a loan. Other banks also carry out such transactions.

Now you know how to renew your mortgage. You cannot be prohibited from doing this unless additional conditions are specified in the contract. It is advisable not to sign loan agreements and not to cooperate with banks that prohibit early repayment of mortgages.

Over the course of a few years, life may change - for example, your financial capabilities will improve, and you will want to get rid of all your loans. It is better to take a loan from a bank with more flexible terms so that you have the right to choose.

When moving to a new, refinancing bank, it is also worth thinking about all these nuances.

The procedure for transferring a mortgage to another bank with a more favorable interest rate Link to the main publication

How to convert a consumer loan into a mortgage?

Living on credit has become common and common today. Most working citizens regularly use credit, including mortgages, consumer loans and credit card funds. Different rates, payment terms and repayment durations make you want to optimize payments and solve the problem of how to convert a consumer loan into a mortgage loan.

Main differences in terms of consumer and mortgage loans

In both types of loans, bank clients indicate the purpose for using the funds, but in a mortgage this purpose is documented and verified by the bank. In a consumer loan, the loan is simply declared and the direction of use of funds is not subsequently monitored, especially if the loan is repaid on time.

In consumer contracts, the presence of collateral depends on the amount being lent; small loans are issued without collateral. For a mortgage, collateral is required and its object is most often the purchased property.

If a consumption loan is issued for a period of 1 to 5 years, then the mortgage is repaid within 15-25 years.

If there are several loans, the mortgage terms are more favorable for borrowers and it is not surprising that the question arises of how to convert a consumer loan into a mortgage loan.

Possibility of changing loan terms

Just a few years ago there was no talk of the bank agreeing to change the initial lending terms to be more lenient for the client.

In recent years, a refinancing mechanism has emerged that can be used by all citizens. This possibility began to be widely used as a result of the gradual but steady reduction of the discount rate by the Bank of Russia.

We advise you to read: How to get a loan without income?

The meaning of refinancing or refinancing is that a citizen transfers his loan from one bank to another.

As a result:

- the borrower switches to more favorable lending terms,

- the bank that offered favorable conditions receives new clients.

Today, many banks offer refinancing or refinancing services. Among them are Sberbank of the Russian Federation, VTB 24, Gazprombank, Promsvyazbank, Vozrozhdenie and others.

Conditions for refinancing

Refinancing is a complex process that is strictly controlled by bank employees and requires the fulfillment of a number of conditions.

An approximate list of requirements that most banks impose:

- absence of loan debt, both current and overdue;

- loan duration – at least a certain period (from 3 months or more)

- the loan is issued in rubles;

- having a positive credit history;

- There is collateral securing the entire amount of the pooled loans.

- When considering an application for refinancing, all conditions are taken into account and various refinancing schemes are applied.

- If a citizen only has a consumer loan, even if it was taken out for the construction of a house, then it will be almost impossible for him to conclude an agreement with a new bank on mortgage terms.

- The issue of refinancing is considered completely differently if the bank client already has a mortgage and additionally opens one or more consumer loans.

- In this case, it is possible to join them and include them in the mortgage on the terms offered by the bank providing the refinancing service.

- For example, if a consumer loan was taken to pay a down payment or repair a home, and the main cost of the apartment is paid through a mortgage.

Refinancing procedure

If in order to initially obtain a loan it is necessary to collect a lot of documents, then the procedure for refinancing is even more complicated and consists of many stages and sequential actions.

The procedure for agreeing on refinancing and transferring loans to another bank is as follows:

- the borrower collects documents and writes an application to the bank for on-lending (the list of required documents can be obtained from a banking institution);

- receives a positive decision to provide a loan on the bank’s terms;

- writes an application to the bank that issued the primary loan about early payment (a copy of the application certified by the bank is given to the future creditor);

- a new loan and insurance agreement is concluded;

- the new lender transfers funds to the previous bank, which are used to repay previously taken loans;

- the real estate pledge is re-registered from one bank to another.

As a result, the borrower continues to repay the loan, but at new interest rates.

The need to convert a consumer loan into a mortgage

Despite the fact that a mortgage is issued with lower interest rates, transferring a consumer loan to new terms is not always profitable, since a significant part of the savings is eaten up by the payment that the client pays to the bank for the refinancing service.

There are cases when transferring a consumer loan to mortgage terms leads to significant savings. We are talking about paying off the mortgage using maternity capital.

We advise you to read: Is it profitable to take out an apartment with a mortgage?

This program does not provide funds for consumer loans, and transferring amounts to mortgage terms allows you to take advantage of government assistance funds.

It is necessary to first check with bank employees whether it is possible to repay a new mortgage loan by transferring maternity capital.

Conclusion : There is no clear answer to the question of how to convert a consumer loan into a mortgage loan. This possibility exists, but it requires a coincidence of proposals from the bank and the interests of the borrower.

Source: https://bankingsite.ru/kak-perevesti-ipoteky-v-drygoi-bank-ysloviia-poriadok-i-otzyvy/

How to apply online for a mortgage?

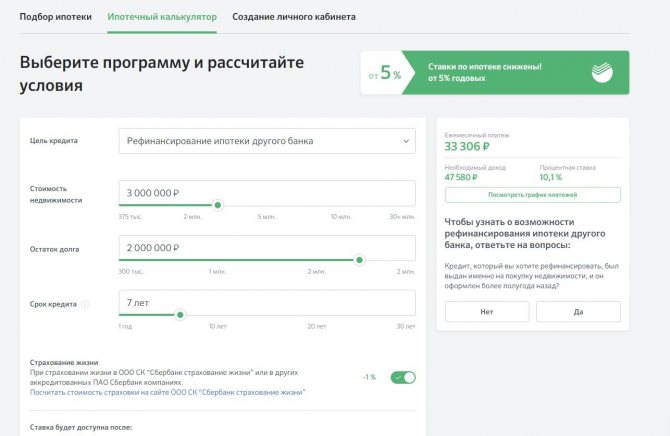

Many borrowers are wondering whether it is possible to transfer a mortgage to another bank by arranging everything online, or whether they need to go to a mortgage center.

The answer is yes, you can. To do this, the borrower chooses a bank with a favorable rate. Goes to the official website and selects a refinancing program - standard, based on two documents, etc.

Then he calculates the conditions on the calculator or immediately presses the “submit an application” or “fill out an application” button. Using the example of Sberbank, the screenshot shows that completing an application is available immediately upon switching to the program.

After clicking, the user is transferred to the DomClick page, a Sberbank service, from where they can send the application form for consideration to the bank. The client is asked to calculate the conditions using a calculator, fill out personal data and create a personal account on the website.

Uploading documents is also available online. The interest rate offered will be available upon registration, agreement to obtain life and health insurance, and confirmation of payment of the refinanced mortgage with the current company.

Is it possible to transfer a mortgage to another bank?

The question of transferring a mortgage to another bank may arise for a number of reasons. Before starting such a procedure, the borrower should carefully study all its advantages and disadvantages.

Reasons for transferring a mortgage to another bank (refinancing)

Most often, a borrower thinks about refinancing when lending conditions appear on the market that are significantly more favorable than those in the current agreement. It is not surprising that over such a long period, the conditions for newly issued loans manage to change more than once.

At the same time, if a borrower turns to his lender to reduce the rate, then, with a high probability, he will be refused. But competing banks are ready to refinance credit to solvent borrowers. Moreover, they have already shown their good faith by paying monthly payments.

The issue of refinancing may also arise if the borrower’s financial condition worsens. One of the ways to solve the problem of “unbearable mandatory payment” is to increase the loan term .

The current lender may not always be able or willing to provide such a program. It is most difficult for such borrowers to resolve their issue, since not every bank is ready to issue funds to a client whose financial condition is deteriorating.

Borrowers sometimes use refinancing to resolve the issue by increasing the loan amount. This is possible when a significant part of the debt has already been paid, and the client needs loan funds for some other needs.

When is refinancing beneficial?

Before you decide to transfer your mortgage to another bank, you need to carefully calculate the profitability of this operation. The interest rate must be at least 2% less than the current one.

Now such offers can be found if the initial loan was issued before 2006. Do not forget that you will need to pay again for the services of the appraiser, insurance payments, commissions, etc.

d.

The clauses in the contract regarding the early repayment procedure also deserve special attention. Although current legislation does not allow a ban on early closure of a loan, banks can include various special conditions for such repayment in the loan agreement.

Paperwork

At the new bank, the client will be checked in the same way as during a regular mortgage application.

- Firstly, you need to carefully study its requirements for potential borrowers and the mortgaged property. The fact that one bank issued a loan without a certificate of income or for the purchase of an apartment in an old building does not mean that another lender will issue the funds.

- Secondly, all papers must be collected again. We are talking not only about documents confirming the financial status, but also about a certificate of registration, technical passport, title documents, etc.

Procedure

It is a mistaken belief that the borrower is required to obtain permission to refinance from the current lender. His task is only to inform him of his intentions.

Next , you need to agree on the refinancing procedure . This can be done in several ways.

The simplest, in terms of documentation, is to repay the loan from the first bank and take out a mortgage from another lender secured by real estate that is already owned.

But this method has a very significant drawback: the borrower needs to get a sum of money from somewhere to pay off the entire loan balance.

Refinancing in its purest form is the transfer of a mortgage . It confirms the rights of the mortgagor and contains basic information about the loan transaction. Its registration when receiving the first loan greatly simplifies the transfer of the mortgage to another bank.

When applying for refinancing, it is enough to make an endorsement on the mortgage. After this, the second creditor transfers the money to the original one. The risks for all three parties during such an operation are minimal.

The legislation also allows the so-called subsequent mortgage . This means that real estate with a valid bank lien can be pledged to another lender.

The main condition is that the value of the collateral should not be less than the debt under two loan agreements.

In case of forced sale of the pledge, first of all, the debt under the agreement that was executed earlier is repaid.

These two methods are interesting, first of all, to the borrower, since he does not need to look for funds to repay the balance, but only needs to pay the associated expenses.

As you can see, the process of transferring a mortgage to another bank is accompanied by considerable paperwork and additional costs. Therefore, before contacting another bank, you should inform your current lender about your needs (reduce payment, increase amount, etc.). Perhaps the bank will not want to lose the client and will be offered convenient ways to resolve the issue.

Source: https://law03.ru/finance/article/perevod-ipoteki-v-drugoj-bank

Requirements for the borrower

Basic requirements for the candidate if he is applying for a mortgage transfer to another bank:

- Having Russian citizenship.

- Registration is permanent or temporary. The Passport must have a registration stamp. If it is not there, then you must provide a registration document.

- Positive credit history.

- Age from 20 to 65 years.

- Work experience at last place was six months. Total work experience over the last 5-6 years from one year.

If this is the first job for a young person, where he has been employed for six months, then many banks require at least a year of experience. Provided that the candidate is under 25 years of age.

At Sberbank, the age requirements are softer. You can get a mortgage from 21 to 75 years of age.

Refinancing conditions

Transferring a mortgage to another bank is not always possible. You should prepare for the fact that the credit institution will refuse you. You can refinance your mortgage in the following cases.

- The property is housing on the secondary market. Banks are not interested in other options. If you bought an apartment in a new building, then you are unlikely to be able to refinance the mortgage.

- You must faithfully pay your mortgage for at least one year. If you took out a mortgage just a couple of months ago, you won’t be able to transfer. This period is set for the credit institution to see how you are paying off your mortgage. It is important for them that the client does not have any delays.

- Each company has its own requirements for the apartments they finance. Not all cases are refinanced. You can find out which banks provide the service and what conditions they have on the Internet or at a personal reception at the organization. You should find out in advance whether you can get a new mortgage from the bank you like.

The new bank has the right to re-request documents that confirm solvency. If something has changed for the worse in your finances, then it is better not to try to ask for a mortgage transfer, as you will most likely be refused.

Important! The bank where you currently have a mortgage cannot refuse to transfer you. Some organizations tell their clients that they cannot give permission because they do not want to lose paying clients and revenue. By refinancing, you deprive the bank of its interest payments.

List of required documents

Transferring a mortgage to another bank requires the provision of the following list of documents:

- passport – original and copies of pages;

- insurance number of an individual personal account (IPA);

- registration document, if it is temporary;

- solvency papers. Banks accept 2-NDFL certificates in the established form or in free form, 3-NDFL;

- employment documents; various forms of confirmation are also accepted: copies of the employment contract, work book or extract from it, fixed-term contract, etc.

For refinancing, a copy of the loan agreement and a certificate of the amount owed to the current creditor are provided. It must be valid, since its validity is limited to 30 calendar days.

Later, when the application is approved, collateral documents are provided. Typically, the applicant must submit them within 90-120 days.

Documentation

The bank requires the following documentation:

- Passport.

- Work book confirming employment.

- Certificate of permanent income.

- Application (questionnaire).

The lender may request additional documents: TIN, SNILS, marriage certificate of a potential client, military ID and others. The package of documents depends on the specific bank. All you need from the previous mortgage loan payer is a passport and an application.

The package of required documents may vary from bank to bank, so this information will need to be clarified with a loan specialist.

As a rule, the future borrower must provide:

- passport;

- a copy of the work book;

- certificate in form 2-NDFL;

- loan application;

- a statement to remove obligations from an existing client and assign them to oneself.

The procedure for re-registration of a mortgage

Key steps when transferring a mortgage to another bank:

- Look at the best offers on the market, choose a lender.

- Fill out an application on the website of the company you are interested in. Wait for the initial decision on the mortgage transfer.

- Receive notification of the bank's consent and begin collecting documents for the property.

- Contact an appraisal company and request a report on the value of the property.

- Give the documents to the lender and sign the documentation on the new conditions.

- The bank transfers funds to the previous creditor to repay the debt.

- The borrower registers the encumbrance on the property in Rosreestr. He also transfers the rights to the collateral from the previous bank to the new one.

For refinancing and any other mortgage, it is recommended to submit one application to the company. This is due to the fact that specialists see the borrower’s activity in the credit history bureau. If he contacts a dozen banks at once, the company will decide that the person has a problem loan or a difficult financial situation. Most banks will refuse to transfer the loan.

But you can increase your chances of getting a more favorable loan by contacting a credit broker. He cooperates with banks and can send several applications at once, inviting the client to transfer the mortgage under optimal conditions.

Important! The mortgage broker saves the borrower money.

Mortgage broker dom-bydet.ru helps borrowers in obtaining mortgages, refinancing, and also negotiates with banks on a lower interest rate, which saves the client’s money.

Borrower's costs when transferring a mortgage

Despite the benefits of a new mortgage loan, the borrower will have to spend his own funds during the renewal.

To transfer a loan, you will have to pay the following procedures:

- expenses for collecting a set of documents;

- payment for real estate valuation;

- new design of an insurance policy for property, life and health;

- commission for opening an account, in some cases a one-time payment for reducing the rate, issuing money;

- payment for the transfer of funds to the former creditor;

- removal of the former bank's encumbrance on the property;

- registration of the mortgage in the cadastral chamber.

Services for an estimated cost may cost the borrower no expense, since some banks offer to carry out the procedure at their own expense.

Payment for an insurance policy also has its own nuances. Typically, banks require that the insurance firm be accredited. If the primary company is accredited with the new bank, the insurance premium can be offset.

Nuance! The insurance company may require the contract to be reissued or refuse to renew it.

When taking out a mortgage in a currency and subsequently changing it, there may be costs during conversion.

Reasons for refusal of another bank

Transferring your mortgage to a new bank may not be so easy. Here are some of the common reasons why lenders reject borrowers:

- Bad credit history.

- Low solvency.

- Property values have dropped.

- The person committed illegal redevelopment while paying off the mortgage.

- No insurance policy.

- The difference between interest rates is less than 1%.

Not all banks may have the reasons listed for refusal. It is possible to transfer your mortgage to another bank, but you need to find an organization that will agree to reduce the rate for the current loan and the conditions specified in the agreement.

The main reasons for transferring a mortgage to another bank

Typically, mortgage loans in Russia are issued for 15 years. During this time, the bank manages to change its interest rates and lending conditions more than once. More favorable conditions are not the only reason why it is necessary to transfer a mortgage to another bank: sometimes there is a need to change the currency, and for those borrowers who have taken out several home loans, it is wiser to combine them.

But the main reason for searching for refinancing opportunities is the emergence of more convenient and advantageous lending conditions than in the current agreement. A mortgage is a long-term project, and loan terms can change many times.

However, rates, as a rule, are not reduced, and even if the borrower contacts his bank with a corresponding request, he will almost certainly be refused. Fortunately, there are many banking organizations present in the domestic credit services market today. Competitors always accommodate solvent borrowers who accurately make payments every month and offer them mortgage refinancing.

The need for refinancing also arises when the recipient of a mortgage loan is doing poorly, income falls, and the monthly obligatory payment becomes an unbearable burden. In this case, the optimal solution is to extend the mortgage term. However, lenders are usually not interested in this, so they are in no hurry to offer clients new conditions. This category of borrowers has the hardest time: not all banks want to lend to a client whose financial condition is not very reliable and is constantly deteriorating.

In some cases, refinancing a mortgage involves increasing the loan amount. The bank may take such a measure if the main part of the debt has already been repaid, and the client needs another loan to meet some other needs.

Why don’t borrowers from the banks themselves receive offers to refinance on more convenient terms if the interest rates on mortgage loans change in a direction favorable to clients? Yes, because banks do not want to lose part of their profits due to rate cuts. However, a home loan recipient can always transfer his mortgage to another bank if it is beneficial to him. Although, of course, it would be easier to refinance with the organization with which you already have an agreement: there is no need to re-register the collateral, collect documents again, etc.