Social mortgage is state assistance to preferential categories of citizens. It consists in the fact that they are given money to buy their own home. How to get a social mortgage, what subsidy program to apply in your region is decided by local authorities.

This assistance is provided in the form of:

1. Compensation for part of the cost of an apartment purchased with a mortgage.

2. Purchasing housing from the state at a low interest rate.

3. Reimbursement of part of the interest on the mortgage loan.

Social mortgage in 2020

In 2020, the subsidy amount should be at least 30% of the price of an apartment purchased with a mortgage, and for families with children - at least 35% of the cost of housing.

The final amount is set by local authorities. It depends on the region of the country, the cost per square meter of housing and the number of children in the family.

The minimum interest rate on social mortgages in 2020 is 9.9% per year. Although even in Sberbank, under the mortgage program with state support, the percentage does not fall below 11.5%. Moreover, at the Mortgage Lending Agency (AHML), the down payment is only 10% of the housing price. Compare with 20% in Sberbank.

Let us note that many commercial banks provide their own preferential lending programs for public sector employees. They offer lower mortgage rates and lend money for a longer period.

How to get in line

The procedure will vary depending on the social group to which you are assigned. But the standard scheme is as follows:

- First, you should make sure that you belong to a specific category of beneficiaries.

- Then a package of papers is formed and an appeal is submitted to the authorities or to the bank.

- After generating lists for receiving social mortgages for public sector employees, apply for a loan.

- Before receiving money from the state, you must submit a loan agreement to the municipality.

Military personnel will be able to take out a public sector mortgage after joining the NIS (Savings System) program. From it, funds are transferred to the bank.

Successful completion of the initial check means entry into the queue. But it may take several years. Based on the results, you will receive a certificate of participation in the program. You need to come with it to AHML, where they will provide a list of financial organizations working under the social mortgage program. The decision to be included in the lists is made on the basis of the papers provided by the applicant.

Recommended article: How to pay for Sberbank mortgage insurance - online, in Domklik

Who is entitled to a social mortgage?

According to the law, they can count on it:

- State employees who are supported by the state.

- Poor citizens who do not have decent living conditions.

- Young families in which the spouses have not yet turned 35 years old.

But they have the right to count on benefits if the following conditions of a social mortgage are additionally met:

- State employees have worked for at least three years in state or municipal authorities, medical or educational institutions; serve in the Armed Forces, police, customs, rescue and fire-fighting structures.

- They do not have their own housing, or it does not meet the requirements of the law on minimum space and sanitary standards.

- One of the spouses has not yet turned 35 years old.

Providing state support to doctors and teachers

The issuance of a social mortgage to a doctor is carried out on lenient terms. It is usually provided when moving to a rural area. Subsidies are provided:

- in-demand specialists under 35 years of age;

- employed and living in the village;

- who have concluded a contract for at least 5 years of work.

Teachers who have just begun to perform their duties are also included in this category of beneficiaries. They are provided with support under the state Housing program, one of the regional programs, or corporate lending conditions.

Social mortgages for teachers include a reduced loan rate or reimbursement of up to 40% of the cost of the property. Funds are also allocated from the budget for the first payment (10-15%). You can register both secondary housing and a facility under construction. An apartment or house can be provided from a special fund of affordable real estate. Plots are also allocated for the construction of houses.

Additional requirements are imposed on teachers: minimum work experience is one year, and the position is in a general education institution. The conditions of a social mortgage for doctors are standard, although the place of work must be specialized, as in the case of teachers. If we are talking about researchers working in this field, you will have to additionally confirm the availability of an academic degree.

List of documents

To apply for a preferential mortgage in 2020, the borrower will need the following documents:

- statement;

- passports of all family members;

- children's birth certificates;

- tax registration document;

- extract from the house register;

- certificate of family composition;

- document from the place of work about length of service and salary;

- a copy of the work book;

- extract from the Unified State Register for the purchased housing;

- title documents for the apartment;

- certificate of registration of ownership of real estate;

- bank account details.

You can count on a social mortgage if the applicant does not have his own home, lives in a hostel or communal apartment, or rents an apartment. State employees living in the same area with relatives or in cramped conditions (less than 14 square meters per family member) are also entitled to preferential mortgages.

How does the transaction and settlements with the seller proceed?

The family meets the criteria for the preferential category of citizens - you need to find real estate that meets the requirements of the law. Then begins the lengthy procedure of collecting documents and obtaining consent to register the apartment or house as property. Further, everything depends on the type of state support and the category of the applicant.

- If mortgage rates for public sector employees are reduced, an agreement is drawn up with the bank on lenient terms, and the funds are transferred to the property owner.

- When it comes to military personnel, after receiving permission to use the funds, the money is sent to a bank account to repay the loan or as a down payment.

- A young family (spouses under 35 years of age) receive funds from the state free of charge. But they can only pay off 30-40% of the cost of housing. The rest is purchased at your own expense.

The collected documents for a social mortgage must be sent to a financial institution that has preferential loan programs. Among the papers there must be a certificate of allocation of funds or other confirmation of the need for favorable conditions. After receiving consent from the bank, all that remains is to take the details for transferring budget money, handing them over to the official. After paying the first installment, the property is registered with the buyer.

Important to know: How does a mortgage transaction work - frequently asked questions

Purchase and sale agreement with a mortgage - important points for the seller and buyer

Mortgage programs for special categories of beneficiaries

Social mortgage for young teachers

The right to receive a loan on preferential terms is recorded in the certificate. Lists of program participants are formed by local authorities together with the regional education department. The candidate must meet the following requirements:

- be under 35 years of age;

- work in a government agency;

- have a working experience of at least three years.

For such young specialists, the state significantly reduces rates and reduces the down payment. Only one spouse can participate in the program. The maximum subsidy amount in 2020 is 11 million rubles.

Social mortgage for young scientists

To become a participant in the program, a candidate only needs to write an application at his place of work. To obtain a certificate, a scientist must work in a scientific organization for at least five years . The presence of a family and children does not affect the terms of the loan in any way. The list of applicants is sent to the Academy of Sciences and beneficiaries are already approved there to receive government support.

Mortgage for military personnel and doctors

A serviceman can receive a social mortgage within the framework of the NIS (savings-mortgage system), in which he must participate for at least three years. The funds from this fund are used to make a down payment on housing.

To receive benefits, a special certificate is issued, which is presented to the credit institution. To obtain such a certificate, a serviceman only needs to write a report to his unit commander.

Medical workers will receive a preferential mortgage only if they do not have their own housing and the medical institution really needs them.

State support for young professionals

Young professionals can also count on preferential lending terms. However, they must work for a certain time in the company, need housing and have the appropriate status. In addition to the reduced rate, state social mortgages are issued with a reduced down payment. It is formalized at the employer’s partner banks.

In the process, you need to find a suitable property, conclude a loan and purchase agreement, and contact the company management with it. Managers either issue a subsidy to repay part of the debt, or preferential conditions are provided at the stage of drawing up a loan agreement.

Why do commercial banks offer special conditions to public sector employees?

Private credit organizations willingly give mortgage loans to public sector employees and provide them with significant benefits. There is an explanation for this:

- Everyone knows the discipline of public sector workers. They are more responsible in fulfilling their obligations. This quality is highly valued by banks because it guarantees timely repayment of the loan.

- They can be influenced through leadership. Such employees value their position and are easily influenced through their superiors. In extreme cases, the debt will be forcibly written off from the debtor’s wages.

- The earnings of public sector employees are relatively stable. Although they receive little, their salary is always transparent and is not divided into “black” and “white”. State institutions are less likely than others to undergo staff reductions, reorganizations and liquidation of branches. Therefore, there is a high probability that the debtor will work at one job while paying off the loan.

Mortgage benefits are established for defense industry workers and pensioners. You need to find out exactly their size from local authorities.

Video: Mortgage experts on social mortgages

Are there preferential mortgages for public sector employees in banks?

Many financial organizations actually offer their own programs to support preferential categories of citizens. The provision of a social mortgage is carried out after submitting documentation and an application to the bank office. However, the conditions for its execution and the package of papers may differ from the requirements imposed by the state. Banks often offer reduced interest rates, a smaller down payment and no need for guarantors.

Recommended article: How to transfer a mortgage to another person: procedure and conditions

Which banks issue loans to beneficiaries, and on what terms?

In addition to government agencies, you can apply for a social mortgage at a regular bank. The list of institutions involved in issuing such loans includes:

- VTB – from 5% per annum and down payment from 20% ();

- Rosselkhozbank - rate from 4.75% and 20% down payment ();

- Sberbank – under the Young Family and Social Mortgage program, the rate is reduced by 0.4% ();

- AK Bars - the use of maternity capital is allowed ().

Also on the list of organizations offering social mortgages is Rosbank. Rosselkhozbank and Sberbank have provided separate programs. In the first you can get a Young Family loan, and in the second you can get a military mortgage.

In addition to their own developments, such banks allow the issuance of funds under the state. social mortgage programs and subprograms. In this case, they receive part of the funds from the budget of the country or region, and part of the money is contributed by the borrower himself. At Rosselkhozbank you can receive funds under the Young Family and Maternity Capital program ():

- at 9.75% per annum;

- down payment from 10%;

- up to 60,000,000 rubles;

- from one year to 30 years;

- without guarantors.

The same bank operates a state program to support families where a second and/or third child was born from 01/01/2018 to 12/31/2022). The rate for the entire term is minimal - 4.7%, subject to insurance of real estate, life and health of the borrower.

Although the conditions for providing funds may vary depending on the region where the application is submitted. Thus, social mortgages under the Housing program in some areas are provided at 10% per annum. If you purchase real estate in a new building, you will have to pay 20% of the cost.

To understand how to apply for a social mortgage through a bank, you need to contact the financial institution directly. Here you will find the conditions for providing funds, a list of documents and requirements for the borrower. General rules are standard:

- presence of Russian citizenship;

- official employment;

- age from 21 years;

- work experience and so on.

If a social mortgage is issued to disabled people, you will need to enter into a compulsory insurance agreement. When all the conditions have been clarified, you need to send an application to the bank (if you want to get a loan under company programs) or to the municipality (if you need a government benefit). The documentation package differs insignificantly. When applying through the administration, you will have to provide a decision confirming that the benefit has been approved.

There is another option for young professionals to get a social mortgage. The government of the country assigned the responsibility for the implementation of this program to Domklik.

- The annual rate here starts at 7.6%, and the down payment is 20%.

- There is no need to take out insurance for the borrower; a real estate insurance contract is sufficient.

- Also, the law on social mortgages provides for the opportunity to buy housing through Domklik using maternity capital.

- If the payer encounters financial difficulties, a reduction in the payment amount is allowed.

In addition to favorable lending conditions, the state provides tax breaks. But the scheme for providing them is somewhat different from the standard one.

The procedure for obtaining and the social mortgage agreement

The procedure for obtaining a mortgage is not an easy process. If we are talking about social mortgages, then things are even more complicated. The applicant will have to prove that he really belongs to the low-income category of citizens and has the right to receive this type of lending. This process is step-by-step, and each step will be discussed in detail below:

- The first and most important step is to apply for a social mortgage. This application is usually submitted to the city administration or to your immediate superiors (depending on the social group you belong to). You are now in line to receive a social mortgage.

- Next, you need to find out the nuances of this loan. This is done in a bank that cooperates with government agencies under this program. First, we find out which bank will provide you with a loan (this can be done at the city administration), and then we contact the bank. This stage will allow you to find out the interest rate, payment details, maximum terms and the most important point - the package of documents required for registration.

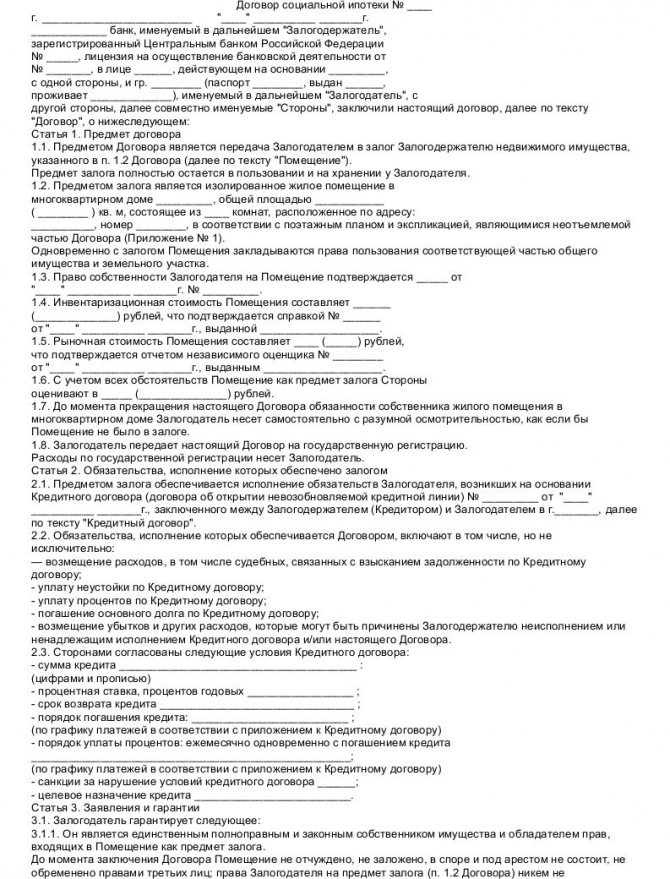

- When it’s finally your turn, a social mortgage agreement is drawn up, and you receive the coveted apartment as a mortgage. A sample document looks like this:

Please note that the mortgage process outlined above may vary in your area. It may also be different for certain categories of citizens. Please consider this in advance to act in accordance with the law.

Who can receive

The following categories of citizens can apply for participation in the housing program:

| Having housing | the area of which is less than 18 square meters per family member, or 32 square meters per citizen living alone |

| Living in a building that is unsuitable for living (in dilapidated, disrepair) | the house is included in the corresponding demolition plan |

| With 2 or more children | Who have received a certificate for targeted financial assistance from the state - maternity (family) capital |

| Young families | participants of the mortgage program for young families |

| Military families | Participating in the savings-mortgage system (NIS) program |

| State employees | Employees in government agencies Authorities or local governments with more than 3 years of service |

| Combat Veterans (CV) | The size of existing housing is not taken into account |

| Researchers from scientific institutions | With 3 years of experience in the industry |

| Employees of city-forming organizations | With over 3 years of experience in an organization |

| Workers of the military-industrial complex | With 3 years of experience in the industry |

| Disabled people and families with a disabled child | The size of existing housing is not taken into account |

Some citizens, before applying for participation in the social mortgage program, participate in other housing programs, for example, in the Young Family program or in the NIS program for military personnel.

The purchased support funds can be used together with borrowed funds to purchase housing or pay off a mortgage loan.