After a person passes away, his property is transferred to his successors.

The heirs receive both the rights and obligations of the deceased, which is the main thesis in the field of inheritance by law.

The realization of rights occurs in compliance with the rules of law and on legal terms. The topic under discussion has certain circumstances:

- the testator transfers his rights to his successors (heirs) in full (with the exception of those that cannot pass into inheritance under Russian law);

- rights of inheritance by law are transferred simultaneously and as a whole (universal succession is carried out).

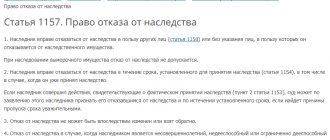

Reasons for transferring rights as part of inheritance

The transfer of rights within the framework of inheritance by law comes into force for a number of the following reasons:

- There is no order from the deceased regarding the property (it was not drawn up or was destroyed).

- The existing indication covers only part of the property in question, while the other part will be inherited by law.

- The citizen's successor receives a mandatory share.

- The order was drawn up, but later this document was declared invalid.

- There is no order from the deceased regarding his bank account and the money available there.

- The citizen canceled the will created earlier, but did not have time to formulate a new one.

- The indication of the deceased is unenforceable due to the fact that the successor did not accept the inheritance, does not have the opportunity to inherit it, or the candidate died before the opening of the inheritance, as well as if there is no other designated successor.

- The deceased, while still alive, ordered that his successors be deprived of their inheritance; there is no testamentary refusal.

Order of succession by law

The following categories of citizens claim the property of the deceased:

- relatives;

- spouse;

- dependents who are disabled and lived with him;

- adopted (adoptive parents);

- persons who had a relationship with the deceased.

The irreducible principle of priority is that in the absence of candidates from the 1st round, applicants from the next round will be considered. If a representative of the previous circle of heirs is found and he does not refuse the property, then candidates of the next sequence are not allowed to inherit.

Sequence is an important rule according to which property is inherited by law. The law defines eight lines of heirs. An equal division of the inherited property occurs between the heirs of the same line. The order does not apply to the obligatory share.

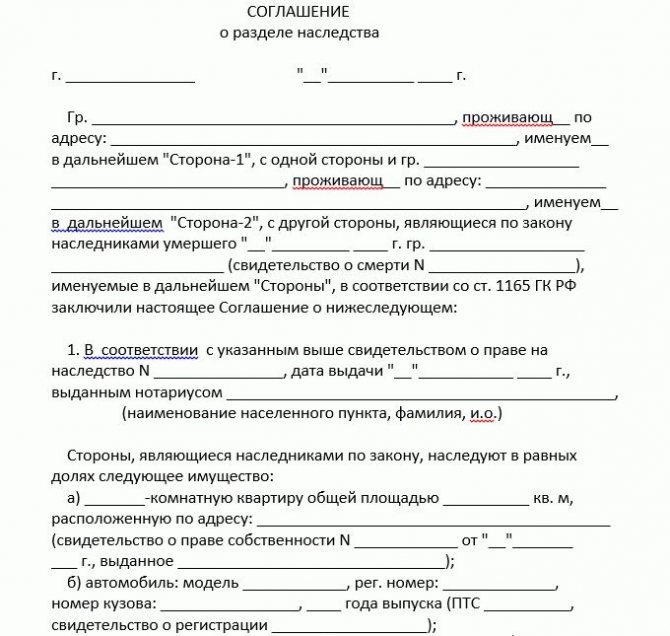

How to draw up an agreement correctly

- date and place of compilation;

- information about the parties involved in the agreement - surname and initials, date of registration of heirs;

- the name of the document is “Agreement...”;

- a list of inherited material and other property subject to division between heirs (information specified in the cadastral, registration or technical documentation);

- procedure for dividing inherited property;

- the value of the property for each item;

- additional provisions;

- details of the parties, certified by personal signatures.

This is important to know: Driving without a license: what the risks are, liability and the amount of the fine in 2020

When drawing up an agreement, the heirs have the right to indicate in it the issues that, in their opinion, are the most important. An example of such an interest of the parties is the clause on compensation payments or refusal of them. The above question is not mandatory when drawing up an agreement, but if the parties wish, it is included in the document.

Mandatory share

This part is allocated from the property for the obligatory and least protected heirs, even if the owner of the property himself is against it.

This provision limits the freedom of will in Russian law. If it is absent, then the person’s property passes to the inheriting citizens in the order of inheritance according to the law of succession of heirs.

If there is a will, then not only the persons indicated in it, but also citizens who have a legal right to the property of the deceased become heirs.

In addition to candidates claiming the inheritance in the first place, among the successors there may be persons who have the right to an obligatory share. In this case, it does not matter how the inheritance property is accepted: by will or by law. This right is available to minor children and disabled citizens (children, spouse, parents, dependents).

Inheritance by will

Most people, when the word “inheritance” is mentioned, imagine an elderly relative distributing property using a special document. And this is not surprising - the distribution of property using a document drawn up in advance by the deceased is a very popular procedure. Such a paper is called a will, and in it the testator is free to indicate who, what and how can receive from his property. To register an inheritance in this way, you will need the help of a qualified notary.

Inheritance by will has one unique feature - anyone can act as an heir: an ex-wife, an old friend, a neighbor, a nurse, his own company or even some kind of shelter. In world practice, it is not uncommon for cases when, according to a will, a decent part of the property went even to pets. Thus, absolutely any person or legal entity specified in the will as an heir automatically receives the opportunity to inherit by law. The only restriction is for legal entities - at the time of opening the inheritance, the organization must be active.

Information!

However, it should be remembered that a will can be revoked or challenged in court. If it is cancelled, the procedure for entering into an inheritance according to the specified instructions will become impossible, and the property will be transferred back to the notary for further distribution in the order of priority.

How does the transfer of property occur by right of representation?

The form of the right of representation is one of the ways of transferring powers from the deceased to his relatives.

This scenario occurs if the death of the heir was earlier or simultaneously with the death of the main owner of the property.

The successors of the property of the deceased can be considered people who are alive at the time of opening of the inheritance, as well as persons conceived by the testator during his lifetime and born alive after the opening of the inheritance. If before the acceptance of the property the recipient died, his powers are transferred in a special manner to certain citizens.

Inheritance by right of representation is carried out in order of priority under Russian law, as is the main transfer of property rights. The law recognizes the date of death as an essential circumstance. If the death of two citizens occurred on the same day, but at different times, then they are considered dead at the same time. If these citizens are relatives and one was the heir of the other, then the inheritance passes by right of representation.

The order of inheritance of property is determined according to the following scheme. The sons and daughters of the representative of the 1st stage will have a priority right to receive the property of the deceased. Along with other first-line applicants, they have a chance to receive the property. The remaining citizens - representatives of further queues - do not receive this opportunity.

If there are no candidates of the 1st line, also by right of representation, then the opportunity to inherit is given to persons included in the 2nd line. Further, together with the third-line applicants, persons who inherit by nomination have their rights to inheritance. These are the sisters and brothers of his parents, that is, his cousins. Children of heirs of subsequent orders (4, 5, etc.) cannot follow this principle.

Conditions for division of property by agreement

An agreement on the division of property by heirs is concluded after six months from the date of opening of the inheritance (death of the testator), provided that the number of heirs is precisely determined. The conclusion of this document is possible both in case of inheritance by law and by will.

When making a division by agreement, the shares of the heirs may be disproportionate to each other.

The law establishes a preferential right of inheritance in situations:

- the right to inherit household furnishings and household items has the person who lived with the testator at the time of death (Article 1169 of the Civil Code of the Russian Federation),

- when inheriting rights related to participation in a consumer cooperative (Article 1177 of the Civil Code of the Russian Federation), inheriting an enterprise (Article 1178 of the Civil Code of the Russian Federation), inheriting the property of a member of a peasant (farm) enterprise (Article 1179 of the Civil Code of the Russian Federation),

- when inheriting an indivisible thing, the advantage goes to the person who: had common ownership of it, and others did not use it and are not co-owners,

- used the item, but other heirs did not use it and are not the owners,

- lived in a residential building or apartment on the day of death and has no other home, and other heirs do not have ownership rights to it.

Division of inherited property is permissible within three years from the date of death of the testator (Article 1164 of the Civil Code of the Russian Federation). If the specified period is missed, the heirs lose the benefits granted to them in inheritance of its individual types.

Peculiarities of inheritance by adopted children and adoptive parents

The most vulnerable categories of heirs are protected by Russian laws.

This ensures the safety of the property interests of the family of the deceased.

Adopted children are equal in all rights to the natural offspring of their adoptive parent (clause 1 of Article 1147 of the Civil Code).

Therefore, they are equal to blood relatives in the categories of inheritance law.

An adopted person is a successor among the first-line candidates. His relatives and descendants acquire the same rights that blood relatives have. All this equally applies to the right of representation.

According to the Family Code, after adoption, a minor ends all relations with his blood relatives. Therefore, he has no right to receive property after the death of his parents by blood, since he is not considered their successor. The same rule applies to all other blood relatives. However, this norm has its exceptions. If a person was taken into a family after the death of his blood father and mother, then he retains the possibility of inheritance.

FOR FREE

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

An agreement on the division of the inheritance and on the allocation of a certain share of one or a number of heirs from the inheritance must be concluded by the heirs after they receive a certificate confirming the right to inheritance, if this concerns real estate. The existing division agreement, as well as a certificate of inheritance rights, allow the heirs to register their own right to property, including real estate, in the manner established by law.

Property that is in common shared ownership of a certain number of heirs is divided by their agreement in accordance with paragraph 1 of Art. 252, paragraph 1, art. 1165 of the Civil Code of the Russian Federation, and if an agreement is not reached - in the manner determined by the court (clause 3 of Article 252 of the Civil Code of the Russian Federation).

Inheritance by surviving spouse

After the death of the spouse, the wife (husband) acts as the heir of the first priority.

The disabled spouse is left with a mandatory share. The rights of the surviving spouse are affected by circumstances such as the will left by the deceased.

Much is determined by the content of this document.

If it is not there, then the inheritance depends on the availability and number of applicants of the 1st stage. If the surviving spouse is the only heir of the 1st stage, and there are no other candidates, then he receives all the property by will.

In some cases, the other half has minimal rights to the inherited property, for example, when the able-bodied surviving spouse is completely deprived of the inheritance by the testator. But in any case, the surviving spouse is entitled to receive his part of the property, which was the common property of the husband and wife.

The surviving spouse inherits by will or by law. He also has the right to part of the property that he acquired together with his life partner during the period of marriage.

The law protects the rights of the surviving spouse in relation to part of the property that was acquired by him together with the testator during their marriage.

What is an inheritance agreement

An inheritance contract is an agreement between two parties, according to which one party (the acquirer) undertakes to carry out, at the order of the other party (the alienator), a certain action(s) of a property or non-property nature and in the event of his death (declaring him deceased) acquires the right of ownership of the property. the property of the alienator specified in this agreement.

The inheritance agreement includes elements of a will and a gift, while supplementing them with some completely new provisions, which we will consider below.

The testator, by signing the specified agreement with potential heirs, may impose on them additional obligations of a property or non-property nature. These obligations can be both in favor of the testator himself and in favor of other persons specified by the testator.

Distinctive features of an inheritance agreement

The ownership of real estate under an inheritance agreement passes to the acquirer immediately after the death of the alienator. In this case, the acquirer is not required to perform any additional actions that the law associates with the acceptance of the inheritance.

This agreement differs from inheritance by will or law.

The timing of inheritance by law and by will, the list of documents required for this, as well as the cost of the procedure for accepting an inheritance are discussed in this article.

Unlike a gift agreement, the right of ownership of the property specified in the inheritance agreement does not pass to the heir immediately after signing the agreement, but remains with the testator until his death.

In this case, both the owner of the residential premises, who after signing the donation agreement may find himself without housing, and the heir, who is guaranteed to receive this residential premises after the death of the owner, are protected.

The testator can stipulate in the contract the obligation of the heirs to provide him with any material benefits during his life, for example: care, material support.

This is the similarity of the agreement in question with a lifelong maintenance agreement with dependency; however, there is a significant difference between them.

After signing the inheritance agreement, ownership of the property remains with its owner and does not pass to the rent payer.

The conditions for concluding a lifelong maintenance agreement, the advantages and disadvantages for each of its parties, as well as other issues related to the execution of this agreement are discussed in this article; the main differences between a lifelong maintenance agreement with a dependency and a life annuity are discussed in this article.

Peculiarities of inheritance by disabled dependents of the testator

If disabled citizens act as a person’s successors by law, but they are not included in the circle of heirs of the line that is currently called for inheritance, then by law they inherit equally and together with representatives of this group, provided that they are at least 1 year old, before death of the testator, were on his support.

It does not matter whether they lived separately or together with the deceased. Such disabled people are also considered successors in law.

Heirs of a special category - receive a mandatory share in the property, regardless of whether the testator made a will and also regardless of the contents of the will.

Division of inherited property

The easiest way to resolve issues is with the division of funds in accounts. But most inherited property refers to indivisible objects.

An indivisible object is understood as an object that cannot be divided in kind, without losing its qualities or the threat of losing the thing.

Such objects include:

- real estate;

- vehicles;

- enterprises;

- share packages and others.

The law provides for the following division options:

- By agreement. Recipients of the deceased's property independently distribute property objects and formalize the decision in writing. The agreement is submitted to the notary. The specialist issues certificates of inheritance rights in accordance with the agreement of the parties.

- Judicially. If the heirs cannot come to an agreement, the disputed issue will be resolved in court. An heir whose rights are violated may initiate legal proceedings.

Escheat

Property becomes escheatable if the following circumstances exist:

- There are no heirs by will or by law, or none of them has the right to inherit, or all candidates are excluded from succession (Article 1117 of the Civil Code of the Russian Federation).

- The inheritance was not accepted by any of the applicants, or they all refused the inheritance, but none of them indicated that the refusal was made in favor of another relative.

In such cases, the testator's property becomes escheated.

Escheat is sometimes associated with circumstances that are not tragic. For example: all the heirs refused to accept the inheritance. Then the Russian Federation acts as the legal heir.

Transaction objects

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

Property that is not affected by the will can be divided by agreement. The certificate of inheritance always indicates on what basis the share is transferred to use: by law or in accordance with the will of the deceased.

Important! Bequeathed items may become the object of a division agreement if there is a need to allocate an obligatory part.

For example, the future owner of the property under this agreement may agree to pay monetary compensation. Or if all the property was bequeathed to several persons, but the author did not indicate the ratio of shares.

Other objects can participate in the agreement all, or only some part. For example, if three heirs received documents for three objects: an apartment and two plots of land, then they can conclude any of the contract options:

- allocate objects in kind, that is, each of the heirs will receive one entire object;

- leave the apartment in shared ownership, and distribute the land plots between two heirs;

- transfer all objects into the ownership of one heir, who will pay monetary compensation to others;

- other options that suit all participants.

This is important to know: How to restore a military ID: what documents are needed, how to restore a ticket if lost, cost

When drawing up a contract, you can focus on the market, cadastral value of objects or completely neglect this indicator. It all depends on how willing the relatives are to negotiate.

There is only one condition for concluding a deal: all participants must agree with the division. If someone does not give consent (intentionally or is simply indifferent to the property received), then the issue will have to be resolved through the court.

The order of succession by law - scheme

The sequence of calling citizens to inheritance is determined by law. There are 7 lines of heirs. Relatives of the deceased form separate groups. Degrees of relationship take precedence. Queue No. 1 consists of direct relatives, followed by the rest depending on the number of tribes separating them from the deceased.

In this case, the inheritance rights of children born in a marriage that was later declared invalid (as well as within 300 days from the date of recognition of the marriage as such) are equal to the rights of those offspring who were born in a valid marriage.

How to find out the degree of relationship

The order of inheritance by law is usually determined by the number of births that separate relatives from each other. This number does not include the birth of the citizen-testator. If there are no candidates of the 1st, 2nd and 3rd stages, then the right of inheritance is given to the next successors. These are citizens who are considered relatives of the third, fourth and fifth degrees of kinship.

Top contenders

The testator's child, born after his death, is also included in the circle of priority candidates.

By right of representation, the grandchildren of the deceased, as well as their descendants, receive their share.

The first line of inheritance by law is formed by the closest relatives (children, parents).

The heir of the 1st priority is the spouse, but his connection with the testator is based on legal marriage. Children born in an official marriage receive property after the death of their parents.

If the marriage was not registered, then after the mother, the children in any case are her successors. If paternity has been confirmed by law, then they are the successors of the father. The civil registry office can confirm this fact if there is a joint statement from the mother and father.

The application can be unilateral, from the child’s father, if his mother is deceased, incapacitated or it is impossible to find out her place of residence. Having secured the consent of the guardianship and trusteeship authorities, the father can submit a unilateral application to the registry office. If a citizen refuses to acknowledge his paternity voluntarily in the registry office, then it can be established in court.

If the marriage is declared invalid, then this fact does not affect the child’s right to inherit after his parents. After the father and mother are deprived of parental rights, the children remain their successors.

Distribution of inheritance in the absence of first-line applicants

If there are no applicants of the 1st stage or they have not accepted the inheritance or are deprived of the right to inherit, then candidates of the 2nd stage are considered (Article 1143 of the Civil Code of the Russian Federation): grandparents, brothers and sisters.

If there are children of both full and half brothers and sisters of the deceased, then they inherit by right of representation.

The 3rd stage includes the aunts and uncles of the deceased. First cousins are considered by right of representation.

The legal candidates of the 4th stage are great-grandparents. Cousins and granddaughters, as well as great-uncles and grandmothers, make up the 5th circle (relatives having the fourth degree of relationship). Heirs of the 6th stage include applicants who had the fifth degree of relationship with the deceased. Queue No. 7 – these are stepdaughters, stepsons, stepmother and stepfather.

The law allocates the eighth line in the circle of heirs. It includes disabled dependents of the deceased, whom he provided for at least 1 year before his death, living together. This applies only to those citizens who are not included in the circle of the above-mentioned heirs by law (turn from the first to the seventh).

Division of inheritance in court

» Documents for receiving inheritance October 10, 2020

How to divide an inheritance in court?

When resolving the issue of inheritance, quite a few controversial issues arise, the resolution of which is possible only in court. This may be a notarial refusal to accept an application from an applicant for an inheritance or to issue a certificate of inheritance. On the part of interested parties, the need for judicial review arises when they disagree with the shared division of property or the determination of the inheritance mass. Any controversial issue or conflict situation is resolved by the court, whose decision is the basis for continuing the notarial registration or refusing it.

Judicial situations

The notary may refuse to accept an application if it is not supported by sufficient grounds. For example, a specialist expressed doubt about the authenticity of the will or the evidence of kinship provided. The notary will refuse the applicant if there are facts of intentional harm to the health or death of the testator, resulting in imprisonment of the heir.

Interested persons can report to the notary about existing facts of coercion to draw up a will, unworthy behavior of one of the applicants, or other emergency circumstances. Such information obliges the specialist to transfer the consideration to the court, on the basis of whose decision to continue considering the inheritance rights of the applicants.

The court has the right to extend the six-month period for consideration established by law if this is required for the interests of the case or due to a missed deadline. An heir who is late in claiming his rights or any interested person can apply for such a resolution. The establishment and confirmation of family ties during inheritance should not raise doubts. Therefore, in difficult situations, additional confirmation and examinations will be required, for example, when establishing paternity.

An heir who actually accepted the property before receiving a certificate of inheritance is sometimes faced with demands from the opposing party to review the division. These are the most common reasons for turning to justice; consideration is opened at the request of other heirs.

Questions about inheritance of unregistered property are complex.

Real estate in the form of living space or land must have the status of ownership, that is, a state-issued certificate.

To be included in the estate, you will have to obtain a decree that allows you to register ownership of the property to the approved heirs.

For example, the owner collected a package of documents for the privatization of an apartment and submitted it to the privatization department, where the review period is more than a month. In this way, the person expressed his will to become the owner of the apartment, but due to his death he did not have time to complete the procedure. A court decision will be required to divide the estate between several heirs. For example, determining the share ratio between applicants of the same line of kinship in indivisible property, for example, an apartment.

The mandatory share of minors, disabled people and dependents is determined during inheritance by court. If there are several heirs and disputes between them, in order to allocate the obligatory marital share in the jointly acquired property, the notary will require a decree to be provided to him.

Challenging a will and removing the heir from accepting property is carried out only through a court decision. You can challenge certificates of rights previously issued by a notary within the prescribed period, no later than three years after issue. If the plaintiff receives a ruling to satisfy his demands, the notary revokes the previously issued certificates and the process of establishing inheritance rights is resumed.

Determination of jurisdiction of inheritance cases

An applicant who has received a notarial refusal to formalize his rights to inheritance, as well as to resolve controversial issues in this case, must determine which court to apply to. At the place of registration of the defendant, they are contacted to determine inheritance legal relations. At the place of residence of the plaintiff, claims are accepted to establish and confirm certain circumstances of the case, for example, kinship or actual acceptance of property.

The issue of ownership is decided by the location of the object. If the estate includes several pieces of property, the plaintiff has the right to choose one of them at his discretion or according to its significance. After determining jurisdiction, the applicant must formulate a demand, attach documentary evidence of his case and indicate witnesses who can clarify the circumstances. When filing a claim, you must pay a state fee, the amount of which depends on the price of the issue.

Rules for the division of inheritance in court

Inheritance in court is carried out according to strict regulations. The statement of claim may be rejected or returned for revision if the applicant has not provided compelling evidence of his claims, and legal standards have not been met. After the claim is accepted, a process opens, at the meetings of which the plaintiff and the opposing party are present and speak. The defendant has the right to put forward counterclaims supported by arguments. Expertise may be assigned in various areas, from biology to handwriting.

The verdict must indicate the composition of the disputed inheritance property, determine the essence of ownership, that is, whether it is divisible or not, the possibility and size of the shared division. The document must justify the possibility or impermissibility of sharing, the possibility, consent and amount of compensation for the participants in the process.

If agreement between the participants in the process is not reached or there are certain difficulties in the division, then the property is put up for auction by a court decision.

The procedure for dividing the inheritance

When inheriting by law, if the inherited property passes to two or more heirs, and when inheriting by will, if it is bequeathed to two or more heirs without each of them indicating the specific property to be inherited, the inherited property comes from the date of opening of the inheritance into the common shared ownership of the heirs. Until the inheritance is divided among the heirs, the procedure for their exercise of the powers of the owners of this property will be determined in accordance with the provisions of Chapter 16 of the Civil Code of the Russian Federation on common shared ownership, taking into account the rules of Art. 1165-1170 Civil Code of the Russian Federation.

According to Art. 1165 of the Civil Code of the Russian Federation, the division of inherited property is carried out by agreement of the heirs, into whose common shared ownership this property has passed, in accordance with the shares due to them, indicated in the certificates of inheritance rights they received. The rules of the Civil Code of the Russian Federation on the Form of transactions and the form of contracts are applied to the agreement on the division of inheritance according to the types of property subject to division. At the same time, it seems correct to continue the established practice of notarizing agreements on the division of inheritance, regardless of whether the notarial form is required by law for a transaction (agreement) with a specific type of property. Since the agreement is of a legal nature and is most often concluded when dividing particularly valuable property of the testator (a residential building, apartment, car, etc.), qualified assistance from a notary in this case would help protect the rights and legitimate interests of the heirs, preventing their violation and protecting the heirs from the need for judicial restoration of rights.

When inheriting by law, unless otherwise established by agreement between the heirs, the shares of the heirs in accordance with Art. 245 and paragraph 2 of Art. 1141 of the Civil Code of the Russian Federation are considered equal, with the exception of the shares of the heirs who have inherited the right of representation. The division of property that is in the common shared ownership of heirs under a will, in which the inheritance mass is distributed among several heirs in shared proportions, is carried out by them in accordance with the shares determined by the testator. It is also possible to divide an inheritance bequeathed to one person if there are heirs entitled to an obligatory share. However, an agreement on the division of property in kind cannot be concluded if the testator specifically distributes the property to one or another heir and each of them, by will, becomes the owner of a separate thing.

The rule on the division of inheritance in accordance with the shares due to the heirs should be understood as the right of the heir to demand, during the division, the allocation of property equal to the value of his inherited share in kind or the payment of an amount of money corresponding to his share, if the allocation of a share in kind is not permitted by law or is impossible without disproportionate damage to property, for example an apartment, a residential building, a car (Part 2, Clause 3, Article 252 of the Civil Code of the Russian Federation). At the same time, according to paragraph 4 of Art. 252 of the Civil Code of the Russian Federation, the disproportion between the property allocated in kind to the heir and his share is eliminated by payment of the appropriate amount of money or other compensation by the remaining heirs.

Replacing the allocation of the heir's share in kind with the payment of appropriate compensation is permitted only with the consent of this heir. In cases where the share is insignificant, cannot be actually allocated and the heir does not have a significant interest in the use of the common property, the court may, even in the absence of his consent, oblige the remaining heirs of the shared property to pay him compensation, upon receipt of which the heir loses the right to a share in the common property . If the heirs cannot come to a consensus on the procedure for dividing the inheritance, or at least one of them objects to the procedure for allocating the inheritance share to him proposed by other heirs, or when a dispute between the heirs regarding the division of the inheritance arises for any other reason, the division of the inheritance is carried out only in court. Under these circumstances, the notary also cannot certify the agreement on the division of the inheritance, since, according to Art. 41 of the Fundamentals, the performance of notarial acts is postponed if there is an objection from any interested person and is suspended when the relevant dispute is considered by the court.

Any agreement on the division of inheritance concluded in conflict with these provisions is invalid.

5.105.95.87 studopedia.ru Is not the author of the materials posted. But it provides the opportunity to use it for free. Is there a copyright violation? Write to us.

Dividing the inheritance into parts between the heirs

Inheritance is a complex process. Difficulties sometimes arise due to the presence of several heirs and the uncertainty of the division of inherited property. Often it is not possible to reach an agreement peacefully, which makes the inheritance case much more complicated and falls under the jurisdiction of the court.

Division of property by inheritance: rules and procedure

Sometimes inheritance occurs in favor of not one, but several persons. This order of things creates the need to divide the received inheritance between the heirs. Sometimes, if a will has been drawn up that specifies the exact shares due to each heir, there will be no problems with the division.

If there is no will, then the property of the testator becomes the property of the heirs, and joint property. In this case, certain difficulties arise with its division:

- impossibility of peacefully agreeing on partition in some cases

- impossibility of equally dividing property in kind

- dispute between heirs over the right to a specific piece of property, etc.

- Is it possible to divide property actually in kind?

- whether it is the individual property of the deceased

- whether it is in joint or shared ownership, etc.

- in the text of this document the testator can himself determine the shares or parts of the inheritance for each heir

- If a will has not been drawn up, the heirs by law receive the property in equal shares.

- if one of the heirs has a share in property that includes another - an inherited share that belonged to the testator, he has a priority right to the inherited share

- if one of the heirs constantly used an indivisible thing during the life of the testator, then he has a priority inheritance right to it

- if one of the heirs lived together with the testator in an apartment that belonged to him, then after his death this heir has a preferential right to this object of inheritance. However, the right is exercised only if the heir has no other housing, and other heirs are not the owners of the property.

- about the parts or exact name of the inheritance for each participant

- on payment of compensation for the transfer of property to another heir

- on the division of expenses arising as a result of the agreement

- any other items that the heirs deem important.

- not to violate or infringe on the rights and interests of heirs who do not participate in the agreement

- do not violate or contradict the provisions of the law.

- the deceased person did not leave a will

- the will was declared invalid

- among the heirs there are persons who are entitled to a share of the inheritance without fail

- the heirs specified in the will renounced the right to inherit the property of the deceased

- In the will, the deceased did not dispose of part of the property.

Some of its characteristics are important when dividing property:

In many ways, the division of property after the death of the testator depends on the presence of a will:

The rules of inheritance by law require the division of property between heirs of only one line called for inheritance. This is determined by the provisions of the Civil Code of the Russian Federation, according to which each queue inherits at the same time.

If, in addition to other heirs, there is a conceived but not yet born child who is related to the inheritance, the division should be made only after his birth and taking into account his interests.

Who has the advantage in the division?

If there is a need to divide the testator's property, certain categories of heirs have a priority position. This right is especially important when the inheritance is indivisible:

An indivisible thing is one that cannot be divided without changing its essence and direct purpose.

Division of inheritance between heirs: agreement

How exactly can property be divided if the shares are not determined in advance? An excellent way to negotiate and document the agreement reached is to conclude a special document. It reflects the shares of the heirs, which they determined independently, and is called an inheritance division agreement.

Such a paper can be drawn up either by all heirs within the framework of one inheritance case, or by several. The meaning of its conclusion is the voluntary division of property between the heirs as they wish, and not as the inheritance was originally transferred.

An agreement on the division of inheritance may include the following points:

The conclusion of an agreement must necessarily comply with certain rules:

If the agreement concerns the division of real estate, then its conclusion is legal only after the heirs receive certificates of inheritance.

After the agreement is concluded, the heirs can present it when registering the right to the property, however, the certificates issued by the notary should be preserved.

Thus, the division of inheritance is an issue that will never cease to be relevant. Often, heirs resort to dishonest methods of division or cannot reach an agreement at all. This is unacceptable, especially since there are legal ways to resolve conflicts.

Share this article with your friends:

Is inherited property subject to division?

Each person acquires certain property during his life. When a person dies, all property owned by him is inherited by certain persons from the close circle of the deceased person.

The inheritance procedure is strictly regulated by law.

Moreover, if a deceased person has several heirs, then the inherited property must be divided between them.

Next, we will consider in more detail whether property received by inheritance is subject to division, as well as how this procedure occurs.

What it is?

The distribution of the deceased's property among the heirs must be carried out on the basis of a will. In a will, a person has the right to dispose of his own property after death at his own discretion, distributing its shares among his heirs.

If there is a will, then disputes regarding the division of property should not arise, but sometimes situations arise when this procedure takes place not on the basis of a will, but according to the procedure established by law.

The need to divide inherited property may arise in the following situations:

The legislative framework

The procedure for inheritance and division of property between heirs is regulated by law by Article 1141 of the Civil Procedure Code of the Russian Federation.

The Civil Code also specifies the inheritance order, which determines the priority of the right of inheritance between relatives.

Preemptive right

The law has the concept of a preferential right to inheritance, which can be given to a person in the following situations:

- The heir is given a preferential right to inherit the apartment if he lived in it together with the deceased person. In such a situation, a preemptive right is given if the heir does not have his own living space, and other heirs are not co-owners of the real estate.

- If the heir has his own legal share in the property of the deceased, then the priority right is given to him.

- Persons who, during a person’s lifetime, regularly used certain of his property, then they receive a priority right of inheritance.

The concept of pre-emptive right is used in situations where the division of so-called indivisible property is carried out.

Division of inherited property

Heirs can divide the property of the deceased, as on the basis of a voluntary agreement. and in court.

If applicants for inheritance find a compromise solution, then a specialized agreement on the division of inherited property is concluded between them. Inheritance disputes must be resolved in court.

The property of the deceased person becomes the property of the heirs according to a certain order.

In this case, all property, as a rule, is divided between representatives of the same category. When there are no heirs in the highest category, the right of inheritance passes to representatives of the next category.

There is a strictly established by law sequence of heirs:

If in a certain category of heirs there are no direct claimants to the inheritance, but there are their children, then they can also receive the right of inheritance. In law there is a concept of representative inheritance for such situations.

Agreement

Quite often, a deceased person may have several heirs from the same line; in such a situation, the inherited property is divided between them on the basis of a concluded agreement on the division of inherited property, which is an official document.

In this agreement, the relatives indicate to which of the heirs each part of the inheritance goes.

The law establishes that an agreement on the division of property may be declared invalid if it violates the rights of one of the heirs.

A sample application for division of property upon divorce will help in drawing up the document.

Is it possible to divide property without divorce? See here.

Indivisible things

In matters of inheritance, the concept of an indivisible thing is often used. Such things include the property of the deceased, which will lose its properties and purpose in the event of division. In other words, an indivisible thing can be called an object that cannot be divided among several heirs.

In such situations, the preemptive right may be used to determine the heir of the property.

Also, indivisible things can be sold to divide the proceeds between heirs in equal parts.

Going to court

Any disputes related to the division of inheritance can be resolved in court. Quite often, heirs cannot find a compromise for dividing the inheritance based on an agreement.

If one of the heirs believes that his rights have been violated, he can go to court.

Division of inherited property in court is a fairly common procedure.

The period of claim for cases related to the division of inheritance is 3 years.

Procedure

To divide inherited property through the court in 2020, you need to prepare all documents and a statement of claim to submit to the court in advance.

You need to contact the court that is registered in the territory in which the case about the division of inheritance was opened.

Documentation

To divide the inheritance through the court, the plaintiff must provide the court with the following mandatory package of documents:

Sample statement of claim

The main document on the basis of which the case of division of inheritance is considered in court is the statement of claim.

The plaintiff in court proceedings is a person who believes that his rights were violated during the division of property.

A sample statement of claim for division of inherited property is here.

An agreement on the division of jointly acquired property between spouses can be concluded voluntarily.

Do you need a sample settlement agreement on the division of marital property? Read here.

What is the period for dividing property after divorce? Details in this article.

Arbitrage practice

If you study the judicial practice on issues of division of property, you can see a tendency that, most often, the court does not particularly take into account the interests of the heirs, distributing the inheritance in equal parts among all applicants.

When dividing property through the court, during the hearing the total value of all the property of the deceased is assessed.

Based on the total value, a division is made between the heirs in such a way that each of them receives an equal part of the inheritance.

Video about dividing inheritance

Division of housing between heirs

Inheritance

The basis for the emergence of inheritance rights to the property of deceased citizens in the Russian Federation can be a will and a court decision. Section 5 of the third part of the Civil Code of the Russian Federation is devoted to the regulation of inheritance rights. and their consolidation is Article 35 of the Constitution. When determining inheritance rights in court, other normative and legislative acts that are not in conflict with the Civil Code and are directly related to the issue under consideration can be used.

The object of inheritance can be property, real estate, money, as well as various intangible assets and copyrights to intellectual property.

The procedure for dividing inherited housing

Practice shows that issues related to inheritance of property are most often resolved by the courts, and not by notaries. This is due to the reluctance of many citizens to make a will during their lifetime. which leads to legal disputes between heirs.

Dear visitors to the “Inheritance Expert” project!

When faced with problems regarding entry, registration of inheritance, donation, will, we recommend that you contact qualified practicing lawyers on donation and will issues:

+7

+7

+7 ext. 107

Applications and calls are accepted around the clock and seven days a week.

Thank you for visiting our Inheritance Expert resource.

Regardless of the presence or absence of a will, all applicants for inheritance must declare their rights to the notary at the place where the inheritance case was opened within six months from the date of death of the testator. Current legislation provides for the voluntary division of inheritance between claimants. In this case, the parties draw up and sign a contract or agreement on the division of inheritance. If the heir was conceived but not born at the time of entry into inheritance rights, the inheritance process is postponed until his birth. All disputes arising between the parties are resolved through court.

Particular difficulties in dividing inheritance are associated with housing. Legislators did not allocate real estate as a separate article and did not develop clear rules for its division. An agreement on the division of property between heirs is often impossible to draw up for a number of objective reasons that are difficult to resolve without the help of a professional lawyer. Particularly difficult in inheriting real estate are apartments that are in the process of privatization. As with the division of a house and a plot of land, issues related to the inheritance of housing should take into account the current legislation regulating the legal aspects of the formalization and registration of citizens' property rights to real estate.

Preferential rights to inheritance

When dividing real estate between heirs, preferential rights may arise. They are disclosed in Article 1168 of the Civil Code of the Russian Federation. The owners of such rights can be heirs who permanently lived with the testator in the living space, which is part of the inherited property, until the opening of the inheritance and do not have other housing. The emergence of a preemptive right does not depend on whether the inherited property was in joint ownership or not.

In addition to living space, the priority of their priority claims also applies to things that were items of common use. The same inheritance procedure is established for cars.

An heir who has expressed a desire to exercise his preemptive right is obliged to pay compensation to the other participants in the inheritance process in an amount exceeding his share in the total inherited property. Without payment of compensation, he cannot exercise his rights. Cash and property can be used as compensation. The period during which the preemptive right can be exercised is determined by current legislation at three years. After this time, the distribution of property between the heirs will be made in accordance with the general use of the property.

Having declared his rights to real estate, the heir must draw up a contract or agreement with other parties in writing, defining in it the amount and form of compensation payments and the timing of its execution. Such an agreement may also contain the refusal of other heirs to receive compensation payments from the heir who exercised his preemptive right.

The value of the inherited property is assessed by the heirs themselves or by professional appraisers. If the value of the property claimed by the heir, using his preemptive right, is less than the size of his share in the total inheritance, compensation is not paid to other parties to the process. Participants in the inheritance process who disagree with the assessment and division of property can challenge the decision of the other parties. All disputes related to inheritance are resolved in court.

The exercise of pre-emptive rights is not mandatory. The heir who has the priority right may refuse them.

If none of the heirs has a priority right

The distribution of inherited property between heirs who do not have preferential rights occurs in accordance with the procedure determined by the current legislation. Shares are distributed among heirs according to law. The heirs of the first line of inheritance become the owners of the majority of the inheritance.

The division of inherited property, which includes real estate, can be made only after the heirs receive a certificate of the right to inherit. Such a document is issued by a notary at the location of the inheritance. It has no expiration date.

In case of disagreement with the size of the share of the inheritance, each of the heirs has the right to defend their interests in court by filing a claim to review their inherited share in the total amount of property. Registration of ownership rights of heirs to real estate received as an inheritance can be carried out at any time convenient for him.

Example of division of housing between heirs

Citizen P. inherited an apartment along with other heirs. The woman wanted to take advantage of the preferential right that she had, since she lived with the testator in this residential area. But citizen P. does not have the means to pay the remaining heirs compensation for using her right. Therefore, in this case, she cannot use it and inherits the housing in the manner prescribed by law.

Conclusion

Those who enter into inheritance rights to real estate must know and remember the basic rules for registering an inheritance:

- In order not to lose your right to inheritance, you must declare it within six months from the date of death of the testator. You must declare your rights as an heir to the notary who opened the inheritance case.

Living together in the same living space with the testator before his death and the opening of the inheritance gives the heir a preferential right to receive this housing. The indivisibility of a part of the inheritance can be determined in relation to property and vehicles that were in joint use.

The most popular questions and answers regarding the division of housing between heirs

Question: Hello, my mother died and did not leave a will, and by law I have the right to receive ownership of her apartment. But there is a problem. My mother lived with her niece for a long time and even registered her in the apartment. And I wouldn't want her to live there. Will my actions to evict her be legal? Larisa

Answer: Hello, Larisa. In your case, according to the law, you are, of course, the heir of the first priority. But there is one limitation, which is specified in Article 292 of the Civil Code of the Russian Federation. It says that the transfer of ownership of an apartment to another person is not grounds for termination of the right to use residential premises by family members of the previous owner. And your mother’s niece is one of those, since she lived with her and ran a common household with her. Therefore, you cannot evict her.

List of laws

Sources: alljus.ru, studopedia.ru, pravonanasledstvo.ru, nam-pokursu.ru, www.bequest-expert.ru

Next

No comments yet!

Share your opinion

You might be interested in

Pension savings are included in the inheritance

Restore the deadline for accepting an inheritance state duty

Limitation period for inheritance after death

Inheritance loan: how not to pay

Popular

How a car is divided by inheritance (Read 22)

Can bailiffs take away an inheritance (Read 21)

Inheritance after the death of a divorced spouse (Read 20)

Address certificate of the Federal Migration Service for inheritance (Read 20)