Home / Family law / Inheritance

Back

Published: 09/06/2018

Reading time: 12 min

0

319

A certificate of inheritance is a document that certifies the heir’s right to the property mass or to a certain share that he received from the deceased. The Civil Code, which regulates the procedure for entering into an inheritance, does not oblige the heir to draw up this document (under Part 2, Clause 1, Article 1162 of the Civil Code of the Russian Federation), but in some cases it is necessary.

- How to obtain a certificate of inheritance

- Who receives the certificate

- Dates of issue

- Registration procedure

- Procedure for assessing the market value of property

- What does a certificate of inheritance provide?

- Is it possible to cancel a certificate?

The notary who conducts the inheritance case is responsible for the registration and issuance of the certificate. The certificate is not issued for the heir by default, but only on the basis of an application received from him and after payment of the state fee. By submitting an official application, the heir notifies the notary of his desire to enter into inheritance rights.

A certificate of inheritance rights is drawn up by a notary on a special secure form. It contains an indication of the following information:

- Full name of the testator;

- moment (time) of opening of inheritance;

- list of inherited property;

- Full name of the heir;

- share in property (it is taken from the will, or property is distributed in equal shares among all heirs);

- date of issue;

- responsible notary.

Heirs can issue one certificate for everyone or request their own copy for each.

If the issued certificate did not list all the property, then an additional copy is issued.

How to obtain a certificate of inheritance

The procedure for issuing a certificate of inheritance is carried out on the basis of clause 1 of Art. 1162 of the Civil Code of the Russian Federation. Such a document is issued at the place of opening of the inheritance case (the last place of residence of the deceased or temporary registration).

To open an inheritance case, the heirs should contact the notary assigned to the desired address. Typically, each notary is responsible for a specific area, and if the service area is large enough, then several specialists work there who distribute inheritance cases according to the first letter of the deceased’s surname.

In the application submitted to the notary for the issuance of a certificate of inheritance and entry into inheritance rights, the following information must be specified:

- Information about the location of the notary office to which the application is being submitted.

- Information about the applicant: his full name, registration address and contact telephone number).

- Information about the deceased (relative to, full name, address of last place of residence and date of death of the testator).

- Information about the property that is part of the inheritance mass and the basis for its ownership.

- Date and signature of the applicant.

A sample application for accession to inheritance rights can be found here.

In addition to the application, the heirs must provide the notary with the following documents:

- Confirmation of the fact and time of death of the testator (usually a death certificate or a court order).

- Grounds for entering into inheritance rights: documents confirming kinship (birth certificate, marriage certificate, court decision recognizing paternity, etc.) or a will.

- Title documents that can confirm the heir’s ownership rights to the property (extract from Rosreestr, PTS, etc.).

- Official confirmation of the value of the inherited property: a report on the assessment of the market value of the property or a certificate of the cadastral value of the property from Rosreestr.

- Documents that prove the identity of the heir (passport, birth certificate).

If necessary, the notary may request additional information.

Is it necessary to register a certificate of inheritance?

Do not forget that obtaining a certificate is the right of the heir, but not his obligation. In order to obtain a certificate of inheritance it is necessary to perform a certain sequence of actions.

Step one. Contacting a notary to write an application

Recognition of the right to inheritance occurs after filing an application with a notary at the last place of residence of the deceased. There are two types of application:

- Application for acceptance of inheritance.

- Application for issuance of a certificate of inheritance.

The heir can choose the application form at his own discretion. As a rule, in an application for acceptance of an inheritance, it is necessary to indicate a request for the issuance of a certificate of inheritance. In this case, a separate application is not required for the issuance of a certificate of inheritance. That is, a certificate of inheritance rights gives you the right to accept an inheritance even without an application for acceptance of the inheritance.

If you write an application for acceptance of an inheritance separately, then the document must indicate the surname, name, patronymic of the heir and testator, as well as the date of death of the latter and his place of residence at the time of his death. Recognition of acceptance of an inheritance occurs according to the will of the testator, which is reflected in the will. In addition, the application for acceptance of the inheritance may indicate information about other heirs, as well as the composition and location of the inheritance mass.

Who receives the certificate

The heirs receive a certificate of the right to inheritance according to the law or by will. To obtain a certificate legally, the following grounds are required:

- Lack of a will from the deceased regarding the disposition of property in favor of a specific heir.

- Refusal of heirs under a will to enter into inheritance.

- The will was declared invalid in accordance with the established procedure and annulled.

- The heirs from the will were recognized in accordance with the established procedure as unworthy.

- The heir has documents confirming the presence of family ties or being a dependent.

- The will was not written for all the property included in the estate.

In the will, the testator may indicate any person or persons (with or without specific shares) to whom he would like to assign the property. In order for a will to acquire legal force, it must be certified by a notary during the testator’s lifetime.

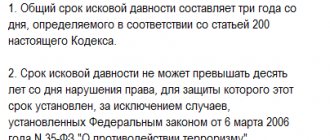

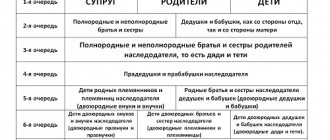

Thus, inheritance of property according to the rules of a will takes precedence over the legal scheme. The legal order of inheritance extends its effect to persons who are related by family or marital ties to the deceased. Its basic principle is priority - the rights to property are transferred to the heirs of the second priority only in the absence of priority applicants (spouses, children and parents of the deceased).

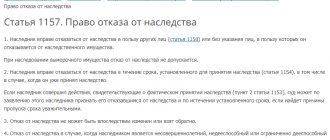

Is it possible to invalidate a certificate of inheritance?

In order to invalidate a certificate of inheritance, there are a number of grounds. The following reasons may be used to invalidate a document:

- it is impossible to issue a certificate to unworthy heirs;

- the certificate is invalid if the rights and legitimate interests of the remaining heirs are not taken into account;

- the document will be declared invalid if the will was declared invalid during the trial.

In all cases, in order to invalidate a certificate, it is necessary to apply to the court with a statement of claim. The algorithm of actions will depend on the requirements that you present, so before applying, it is better to consult with the specialists of our law center in a face-to-face consultation. The cost of making an appointment is minimal and is available to the public.

If we consider the question in a general sense, the procedure is as follows:

As a rule, a claim on this issue is considered by the district court at the place of residence or location of the defendant. The defendant must be the citizen in respect of whom the certificate is being disputed.

However, if we consider judicial practice, if a certificate is declared invalid in relation to the disposal of real estate, the case is considered at the location of the property.

Dates of issue

According to paragraph 1 of Art. 1163 of the Civil Code of the Russian Federation, a certificate is issued to heirs after the six-month period for entering into inheritance rights has expired. The heir will be able to receive it at any time, but only in the absence of legal disputes within the framework of the inheritance case.

The certificate can also be issued ahead of schedule, but under exceptional circumstances. For example, if there is a court decision on early entry into an inheritance, or the inheritance is carried out according to a will, and the list of persons indicated there has already declared their rights.

According to statistics, in most inheritance cases, a certificate is issued only six months after the death of the testator. This period is necessary so that all heirs have time to declare their inheritance rights.

In some cases, the issuance of a certificate is delayed for some period of time:

- If one of the heirs was not born within the established period.

- If there is a court decision to suspend the issuance of a certificate for certain reasons.

- Litigation is ongoing within the framework of an inheritance case.

This list of reasons, which is prescribed in Art. 1163 of the Civil Code of the Russian Federation is exhaustive and is not subject to an expansive interpretation.

If the six-month deadline for filing an application has expired, the heir loses the right to submit a petition for the issuance of a certificate to a notary. Even if he declares his desire to enter into an inheritance, the notary will legally refuse him.

The heir will have to go to court to restore the missed deadlines. But this will require a valid reason: illness, being outside the Russian Federation, etc.

Certificate of right to inheritance under a will (sample)

There are no certificate forms with watermarks. Each notary draws up a document in accordance with the approved form on a notary form.

Form of certificate of right to inheritance under a will

approved by Order of the Ministry of Justice of the Russian Federation dated December 27, 2016 N 313. This form of certificate has number N 3.2 and officially began to be used on January 10, 2020.

The certificate is issued in two copies. One copy is issued to the heir and confirmed by his receipt in the notary register. The second copy is filed in the inheritance file.

Registration procedure

A certificate of the right to inheritance is issued only at the request of the heirs.

Before issuing a certificate of inheritance, the notary must take a number of sequential actions:

- Verification of the death of the testator.

- Establishing the place of opening of the inheritance.

- Establishing the time of opening of inheritance.

- Checking the composition of property in the inheritance mass.

- Checking the status of the heirs and whether they have grounds to lay claim to the testator’s property.

- Determining the list of heirs.

- Verification of other information.

- Checking the existence of a will and its authenticity.

- Establishing the circle of persons who have legal rights to an obligatory share in the inheritance according to the law (if there is a will).

During verification activities, the notary makes requests to government agencies, banks and institutions, as well as other authorities that provide him with information under the law.

After the verification has been successful, notifications are sent to all heirs of the first priority (or another order if there are no applicants from the previous one) and heirs under the will.

Preparing a package of papers for a certificate of inheritance

These should include the following documents:

- copies of the statement of claim according to the number of defendants and other third parties;

- receipt of payment of state duty (check the cost with our specialists);

- power of attorney for your legal representative in court (if you have one).

If you go to court, our lawyer can represent your interests in court. Since we have extensive experience in successfully resolving inheritance cases, you can be confident in a positive outcome of the court verdict.

Author of the article: Petr Romanovsky, lawyer Work experience 15 years, specialization - housing, family, inheritance, land, criminal cases.

Useful information on inheritance

- Entry into inheritance

- What documents are needed to enter into an inheritance?

- Inheriting an apartment

- Inheritance after the death of a relative

- Mandatory share in inheritance

- How to register an inheritance

- Certificate of right to inheritance

- Establishment of the fact of inheritance and recognition of property rights

- Restoring deadlines

- Opening time and place

- List of documents for opening an inheritance case

- Refusal of inheritance

- Application for acceptance of inheritance

- Selling an inherited car

- Opening an inheritance case

- Inheritance after wife's death

- Joint inheritance

- Escheated inheritance

- Documents for registration of inheritance

- Inheritance after mother's death

- Inheritance after the death of a husband

- Inheritance after the death of parents

- Registration of inheritance for an apartment

- Inheritance after father's death

- Protection of inherited property

- Division of inherited property

- Documents for inheriting an apartment

- The procedure for inheriting an apartment by law after death

- Inheritance of a non-privatized apartment

- Inheritance of a privatized apartment

- Application to establish the fact of acceptance of inheritance

- Inheritance without a will

- Limitation period for inheritance cases

- Application for inheritance

- Valuation of a plot for inheritance

- Disinheritance

- Car valuation for inheritance

- Inheritance by adopted children and adoptive parents

- Inheritance by right of representation

- Inheritance after the death of a son

- The procedure for inheriting cash deposits

- Inheritance of land plots

- Inheritance of loan debts

- Inheritance of unpaid amounts

- Actual acceptance of inheritance

Procedure for assessing the market value of property

In the process of obtaining a certificate of inheritance, it is necessary to undergo a procedure for assessing the market value of the property. This is required to calculate the amount of state duty for issuing this document. The state duty is determined in accordance with the tariffs and rules contained in Art. 333.24 of the Internal Revenue Code.

Depending on the degree of relationship, the following rates are established for calculating state duty:

- for heirs of 1-2 stages , who are among the closest relatives (with the exception of grandparents), the state duty is calculated as 0.3% of the value of the inherited property (the maximum amount of the state duty is 100 thousand rubles);

- for other relatives - 0.6% of the value of the inherited property in the part that is due to this heir (but not more than 1 million rubles).

You can get an assessment of the value of property by contacting a specialized organization that is part of the SRO of appraisers. Payment for their services is made at the expense of the heirs or a specific heir by agreement between them.

In some cases, heirs will have to go to court to determine the fair distribution of costs for appraisal activities.

The assessment is made as of the date of death of the testator (based on clause 1 of Article 333.25 of the Tax Code of the Russian Federation). In relation to an inheritance such as real estate, the cadastral value indicated in the extract from the Unified State Register, or the market value, can be used as an assessment. The heirs have the right to determine for themselves on the basis of what value the state duty will be calculated: at the cadastral or market value.

If the heir has several documents assessing the value of the property, then the smallest value will be included in the calculations.

According to Art. 333.38 of the Tax Code, when inheriting certain property, heirs may be exempted from the obligation to pay state duty or provided with benefits.

Preferential status is granted to citizens with disabilities of groups 1 and 2 in the amount of at least 50% of the calculated state duty. When entering into an inheritance of citizens who lived together with the testator in the same living space, if they enter into an inheritance in relation to real estate, the heirs do not pay the state duty.

Also, state duty is not payable if deposits, insurance amounts, or royalties are inherited; property of a person killed in execution; when the heirs are minors, incapacitated and minor citizens.

In addition to the state fee, the heirs must pay a fee for the technical and legal work of the notary. This cost item is not regulated by law and is established by notary offices at their own discretion (subject to the limit established by the regional notary chamber). Therefore, fees for technical and legal work vary depending on the region and the tariffs of a particular notary.

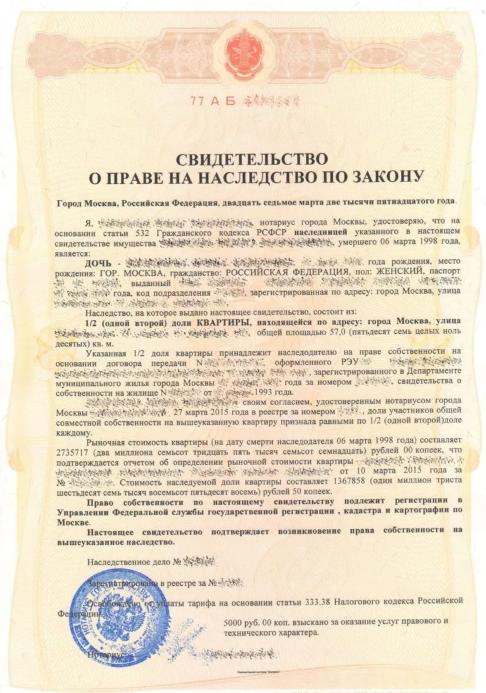

Sample certificate of inheritance right

The certificate is drawn up according to established standards and contains the following information:

- Address of the notary office and full name. the employee who prepared and certified the document.

- Date and exact time of drawing up the paper.

- Full details of the heir who received the certificate.

- Details of the deceased owner of the inherited property.

- The date when the inheritance case was opened.

- Complete information about the entire inherited mass, and about the share in it of the citizen receiving this certificate. The list must contain information about all property subject to state registration, as well as rights to financial assets (deposits, shares, lease agreements, promissory notes, copyrights and patents).

- The value of the inherited share in monetary terms. Determined based on the cadastral value of real estate and data from expert appraisers of movable property.

The document itself is printed on stamp paper with watermarks to avoid forgery by fraudsters.

What does a certificate of inheritance provide?

A certificate of the right to inheritance has a law-confirming character, but does not serve as a legal-forming fact. So, for example, the rights of claim against the debtors of the testator, the obligation to pay debts for him within the limits of the value of the inheritance mass are transferred to the heir not on the basis of a certificate, but within the framework of succession.

The heir has the right to issue a certificate at his own discretion. The absence of the need to obtain a certificate of inheritance in the example of real estate literally means the following. The heir has the right to continue to live in the apartment of the deceased. But if necessary, he will not be able to sell it, donate it, or dispose of it in any other way at his own discretion, since the transfer of ownership from a legal point of view has not taken place.

Without a certificate of inheritance, the heir can safely dispose of the testator’s small property of small value: household items, clothing, dishes, jewelry, etc. But it will not be possible to re-register ownership of property that is subject to mandatory state registration with the State Traffic Safety Inspectorate, Rosreestr or other organizations without a certificate. .

The certificate is an important proof of the existence of the right to inheritance, which is necessary to re-register property with a special regime of use. Such property may include:

- real estate;

- motor transport;

- weapon;

- shares in business;

- stock;

- bank deposits.

After the certificate is issued, the heir must take actions aimed at registering ownership of the property:

- According to Art. 1128 of the Civil Code of the Russian Federation, funds in respect of which a testamentary disposition has been made are issued to the heirs on the basis of a certificate.

- According to the norms of the Federal Law on state registration, ownership rights to an apartment, land plot, house, garage are transferred to the heir on the basis of a certificate and application from the heir. Today, the notary himself can submit an application for the transfer of property rights through electronic channels of interdepartmental exchange with Rosreestr.

- In the securities market under Art. 8 of the Federal Law “On Securities”, the holder of the register can make changes to it only on the basis of the provided certificate.

- Re-registration of civilian weapons is carried out on the basis of the Federal Law “On Weapons” on the basis of a certificate and permit from the Ministry of Internal Affairs.

- According to 21-FZ on LLC, a share in a business is also inherited on the basis of a certificate, unless otherwise established by the company's charter (sometimes there is a ban on the transfer of shares).

A certificate of right to inheritance is also necessary for the heirs of a deceased member of a limited liability company, since it confirms the person’s status as an heir.

The status of an heir serves as the basis by which the share of a deceased member of the company can pass to his heirs in accordance with Art. 21 of the Law on Limited Liability Companies.

Methods of applying for a certificate of inheritance

The application is submitted to the notary at the last place of residence of the deceased in person, through an official representative, or sent by mail. When submitting in person, you must present a general passport. To complete an application through a legal representative, you must have a notarized power of attorney. If you send a document by mail, your signature must be notarized.

A certificate of right to inheritance gives the right to accept an inheritance within 6 months from the date of death of the testator. If this deadline is missed, there are other options for entering into inheritance. It is possible to restore the missed deadline or to recognize the right to inherited property through the court. In addition to the court decision, the remaining heirs can submit a corresponding application to the notary to recognize the right to enter into the inheritance of an heir who missed the deadline. However, the latter procedure is possible only if the issue is resolved peacefully between the heirs.

It is worth noting that if you accept an inheritance, you can submit a separate application for a certificate of right to inheritance to be issued at any time after the expiration of the period for accepting the inheritance.

Step two. Preparation of a list of necessary papers to submit to the notary

In order to enter into an inheritance, the necessary documents and information should be provided to a notary. The kit includes the following papers:

- documents that confirm the date and fact of death of the testator (death certificate, which was issued by the civil registry office);

- documents that will be recognized as the basis for recognition of the inheritance: a will (if there is one) or documents that prove the fact of establishing kinship, marriage or other close relationships with the testator (marriage certificate, birth certificate) in the case of inheritance by law;

- documents that confirm that the testator has rights to the inherited property at the time of his death (real estate certificate, extract from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities, vehicle registration certificate);

- documents that confirm the estimated value of the property, issued by an independent expert organization.

In addition to the evidence base, it is necessary to pay the cost of the state fee and provide the notary with a receipt. The state fee for a certificate of the right to inheritance by law or by will for natural and adopted children, parents, full brothers and sisters of the deceased is 0.3% (take the total value of the inherited property). However, the cost should not exceed 100,000 rubles. As for the remaining heirs, the amount of the state duty should be equal to 0.6% (take the total value of the inherited property). However, the cost should not exceed an amount equal to 1,000,000 rubles.

Do not forget that in each specific case the notary has the right to demand any additional document, since a complete exhaustive list of the evidence base is not spelled out in the texts of legislative regulations.

Step three. We collect a certificate of inheritance from a notary

You can receive a certificate of the right to inheritance after 6 months from the date of death of the testator. In addition, if the notary is confident in the number of heirs who have approached him, a certificate of inheritance rights can be issued earlier than this period. However, in practice, such cases are rare, and on the contrary, the notary may postpone or suspend the issuance of an official document until any circumstances in the inheritance case are clarified.

It is worth noting that in the presence of a will, the notary issues a certificate of the right to inheritance under a will, and in the case of inheritance according to the rules of priority, a certificate of the right to inherit by law. You can pick up an official document by visiting a notary in person or through a legal representative. At the request of the heirs, the certificate can be issued to all heirs at once or to each of them separately; for all property as a whole or for its separate parts.

It is not necessary to register a certificate of the right to receive an inheritance. The heir only needs to put his signature in the register of actions maintained by the notary, observing the rules of notarial document flow.

It is worth noting that in order to own, use and dispose of certain types of property, such as real estate, vehicles, deposit accounts in banking institutions, you must first register your rights to them. In this case, obtaining a certificate of inheritance is a mandatory procedure.

Contents of the certificate of inheritance

The form of the certificate was approved by Order of the Ministry of Justice No. 99 of April 10, 2002. The document is drawn up in two copies : one is issued to the heir (he signs receipt in the notary register), the second is attached to the inheritance file.

Among other information, the certificate must contain : date/place of issue, information about the notary, full name and date of death of the testator, information about the heirs and details of their identity cards, grounds for inheritance, family relationships. The share distribution of the inheritance is indicated with the name of the property, its location and estimated value; numbers of the inheritance file and the certificate itself; the amount of state duty paid; notarial signature and seal.

The legislation of the Russian Federation provides for the issuance of both one document for all heirs and the provision of a separate certificate to each of them. This is confirmed by paragraph 1 of Art. 1162 of the Civil Code of the Russian Federation. At the request of the applicants, if this simplifies the registration, a certificate can be issued only for part of the inheritance , and not for all.

If certificates are issued to all heirs, each one indicates the name of the recipient, but also the names and shares of other co-owners of this property.

Persons authorized to issue a certificate of inheritance

According to Art. 1162 of the Civil Code of the Russian Federation, a document confirming the heir’s rights to inherited property can be issued by a notary conducting an inheritance case , or another person authorized by the state to perform notarial actions.

It will not be possible to choose any notary employee to open an inheritance case. You need to contact a specialist who is tied to the address of the opened inheritance, even if this place is located on the other side of the city or country.

In some regions there is a program called " Inheritance Without Borders ". It provides that within one locality or region you can contact any notary who has a single electronic database installed.

If a citizen of the Russian Federation permanently lives abroad, he can obtain a certificate of the right to inheritance at a consulate or diplomatic mission .