Author of the article: Yulia Kaysina Last modified: January 2020 3726

In accordance with the rules applicable to inheritance legal relations, after the death of the owner of the property, the concept of liability of the heirs for the debts of the testator is applied. Article 1175 of the Civil Code of the Russian Federation establishes that, regardless of the basis on which the inheritance is received, all obligations of the deceased are transferred to the legal successors.

General provisions

The limits of liability of legal successors for the debts of the deceased are determined based on the value of the inheritance they received.

The responsibility of the testator passes to the successors at the moment when they receive legal rights in relation to the estate and the property is transferred to them in fact. All heirs bear proportionate shares of responsibility for the payment of debt obligations.

The type of liability under consideration is called joint and several. It is imposed for the purpose of ensuring that the heirs fulfill the obligations of the deceased. The distribution of obligations between legal successors depends on the limits of the shares of property that they received. A person with whom the deceased was in a debt relationship has the right to demand compensation for the debt from any of the legal successors.

In a situation where the creditor is a person included in the circle of legal successors, the remaining heirs are not subject to responsibility for paying this debt.

Expert commentary

Potapova Svetlana

Lawyer

It should be noted that in 2020 there is a rule according to which the lender has the right to make claims regarding the payment of the debt within a certain period of time. The period during which the legal successors must be obliged to repay the debt is three years. The limitation period for credit legal relations cannot be delayed or interrupted. This rule applies to creditors and legal successors.

Liability of guarantors for the obligations of the deceased

The liability of guarantors for the obligations of a person ceases with the death of the latter. There are two exceptions:

- the contract establishes the liability of the guarantor even after the death of the borrower;

- with the consent of the guarantor, to be responsible for the successors of the deceased person.

Also on the topic: Do pensioners have the right to a compulsory share in the inheritance?

If the borrower has no heirs, then the inheritance mass is considered escheat - transfer to the state treasury. Consequently, the state fulfills the obligation to repay the loan. An exception is the consent of the guarantor to answer for the obligations.

As for the limits of liability, the guarantor is liable for obligations within the limits of the total loan amount. Often this provision becomes the cause of a conflict between a banking organization making claims within the limitation period and an individual acting as a guarantor.

Inheritance of debt

Debt obligations that cannot be transferred to legal successors include:

- alimony payments;

- surety agreement;

- other obligations that terminate due to the death of the testator.

Based on the above, we can conclude that obligations that are not classified in the considered category are transferred as succession:

- loan payments;

- penalties associated with delay;

- interest;

- fines;

- debts associated with non-payment of utility bills or taxes.

Legal successors can assume only those tax debts that accrued while the testator was still alive. After the death of a citizen, the accrual of liabilities must cease.

Deadlines for debt collection

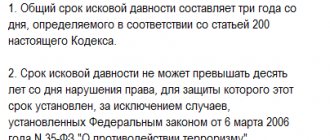

Obligations that were received by the heirs from the testator have a limited period of fulfillment. Such a period cannot be interrupted, restored or stopped.

In 2020, creditors can present their claims against heirs for debts within 3 years.

This is the general limitation period, and in the case of inheritance, it begins to be calculated from the moment of death of the testator.

After the expiration of this period, creditors cannot present their claims on the obligations. In such a situation, debts are simply written off as their own losses.

Peculiarities

The successor to whom part of the inheritance has passed, together with the property, assumes obligations related to the payment of the debts of the testator. In the event that several legal successors are provided for in the will or on legal grounds, liability is subject to joint and several distribution between them. As already mentioned, lenders have the right to contact any of them or all of them together.

The responsibility of the heirs regarding the debt will be distributed in proportion to the shares that they inherited. If a situation arises in which the claims put forward by the creditor are greater than the value of the property received as an inheritance, the successor should not be responsible for the debt of the testator with his property. This means that obligations will be terminated regardless of how much of the debt remains outstanding.

Expert commentary

Kireev Maxim

Lawyer

Debt arising as a result of the conclusion of a loan agreement also passes to the legal successors. Before starting to make payments, heirs should familiarize themselves with the drawn up agreement and study the existing nuances. One of them may be material support.

Article 1175 of the Civil Code of the Russian Federation on the liability of heirs for the debts of the testator

The first part of the article mentions the joint liability of heirs. This type of liability arises from debtors to the creditor.

Joint and several liability of heirs

Joint liability of heirs arises when inheriting by any means (by law, will, inheritance contract), if property and property obligations are inherited by several persons.

- Even if the will specifies one heir who refuses the inheritance, joint and several liability will arise when other heirs are called upon by law.

- The creditor has the right to demand the fulfillment of obligations under the agreement from all heirs and from any of them in full or in part.

- Failure of one heir to fully fulfill all the creditor's demands shifts the balance of the debt onto the shoulders of the other heirs.

If the debts are greater than the value of the property

The heirs divide among themselves both the property of the deceased and his debts. In this case, each heir pays his share of the debt, which cannot go beyond the limits of the inherited share (paragraph 2, paragraph 1 of Article 1175 of the Civil Code of the Russian Federation).

This literally means the following:

If the value of the testator's debts exceeds the value of the property included in the inheritance, the heirs simply will not receive anything. They do not have to pay anything extra from their own pocket. .

Responsibility of heirs of a mortgaged apartment

As a rule, the borrower's total debt to the bank always exceeds the value of the collateral. This is due to bank interest, which the bank includes in advance in the amount of the debt. Upon the death of the debtor, ownership of the mortgaged apartment will pass to his heirs. But only if the loan is repaid in full.

If the heirs refuse to transfer the loan to themselves, the testator’s debt will remain part of the inheritance. It can be paid for using inherited property, including the mortgaged apartment itself.

If the entire property of the debtor (together with the collateral) is not enough to cover the debt to the creditor, the heirs lose it completely. They will be required to return the mortgaged apartment to the bank, which will sell it at auction to repay the loan. But to pay interest to the bank for a loan taken by the testator, in accordance with the rules of Art. 1175 of the Civil Code of the Russian Federation, heirs are not obliged.

- Unlike the heirs, the debtor's co-borrowers, who are also jointly and severally liable, are obliged, at the request of the creditor, which can be presented at any time, to pay the debt in full along with interest.

- The guarantor has the right to enter into an agreement with a credit institution on subsidiary liability, which occurs upon confirmation of the borrower's insolvency.

Inheritance of duties during hereditary transmission

The debts of the testator, transferred to the deceased successor after the opening of the inheritance, are transferred to the latter's heirs by the right of hereditary transmission and are paid within the value of the testator's property. At the same time, the debts of the deceased successor cannot be paid at the expense of this property (Part 2 of Article 1175 of the Civil Code of the Russian Federation).

How are the claims of the testator's creditors to the heirs fulfilled?

The testator's creditors have the right to file a claim against the heirs in court if the statute of limitations has not expired (Part 3 of Article 1175 of the Civil Code of the Russian Federation).

A break, suspension or restoration of a missed limitation period is not permitted.

It is also allowed to present property claims of creditors even before the opening of the inheritance:

- to ensure the safety of the property, an executor of the will or a notary will be involved;

- the legal process will be suspended until the inheritance is accepted, and if there are no heirs, until the property is transferred to the state as escheat.

Hereditary transmission

In judicial practice there is a phenomenon called hereditary transmission. This refers to a situation where the estate, including property and debt obligations, passed to the successor, but he did not have time to accept the inheritance because he died. Then this property, as well as the property of the deceased legal successor, passes to the subsequent heir - this will constitute a transmission. The ultimate successor will be liable for the debt obligations of the first testator.

It is worth noting that material liability will extend only within the limits of the value of the property inherited from the first testator. If there is not enough property to cover the debt, liability cannot pass to the property of the second testator. The obligations will cease.

Satisfaction of creditors' demands

The legislation does not provide for a separate procedure for satisfying claims put forward by creditors.

According to existing practice, the following procedure is used to fulfill obligations:

- Initially, expenses associated with the funeral of the testator are paid. This also includes costs associated with burial and memorial events. If it is required to pay for the treatment of the testator before death, then these obligations are also subject to fulfillment.

- Notary services and state fees are subject to payment.

- The will is being fulfilled. Execution occurs in accordance with the contents of the document.

- The requirements of creditors are fulfilled.

The legal successor has the opportunity, within six months after the death of the owner of the property, to withdraw funds from an account opened with a banking organization and pay expenses associated with the funeral. Such expenses include the funeral itself, the installation of monuments, etc.

Procedure for satisfying creditors' claims

In the legislation of the Russian Federation there is no strict list according to which all claims of creditors during inheritance are satisfied. procedure for satisfying creditors' claims can be distinguished :

- First of all, the expenses associated with the burial of a deceased citizen are satisfied (payment for medicines, payment for pre-mortem treatment, payment for funerals, memorial services, payment of expenses associated with burial).

- Next, expenses associated with the protection of the inherited mass of property are reimbursed (state fee to a notary).

- Next on the list are the costs of executing the will (costs for the executor, etc.)

- Other requirements of creditors.

Information

The heir has the right to withdraw money within 6 months, if it is available in bank accounts, and use it for various expenses related to the burial of the deceased (costs for a decent funeral, installation of a monument, etc.).

The procedure for submitting claims by creditors

Creditors have the right to demand payment of debts from the moment of death of an individual. Before accepting the inheritance, the creditor has the right to make a claim against the property. The requirement is presented in writing to the notary. The notary is required to register this claim.

The submitted document means that the heir has unfulfilled obligations, and the heirs are obliged to pay them after accepting the inheritance. The claim must be submitted taking into account the following features :

- The claim must be made no later than 6 months from the date of opening of the inheritance.

- The claim is filed regardless of whether the obligation has become due or not.

- The total period for filing claims by creditors is equal to the general limitation period (3 years).

Attention

After filing a claim, the notary must notify the heirs of the debts they have. The notary is also obliged to explain the procedure for paying debts to creditors.

When do creditors make demands?

The power to repay the testator's existing debt obligations arises at the time of his death. Until the successors have accepted the estate, creditors have the opportunity to make claims related to the repayment of the debt. To do this, the claim must be made in writing and sent to the notary's office. Accordingly, the successor begins to bear responsibility for the debt obligations of the testator when he accepts the inheritance.

Features of the claim:

- the document must be submitted within six months from the moment the estate was opened;

- submitted regardless of when the deadlines for fulfillment of obligations are established;

- The time during which a claim can be filed is equal to the limitation period and is three years.

When the document in question has arrived at the notary’s office, the notary has the obligation to notify all legal successors about the debt. The notary will also have to explain the order in which the debt is paid.

The concept of liability of heirs for the debts of the testator

It is a mistake to believe that inheritance includes only property rights, since it implies a set of not only rights, but also obligations.

By accepting the estate, the heir receives not only the asset, but also the liability transferred by the testator. It follows that the successor is liable for the debts of the deceased person.

When considering the institution of liability of an heir for the debts of the testator, one cannot help but pay attention to difficult questions - about the limits of liability, the composition of the debt, the requirements of creditors, etc.

Also on the topic: Application for restoration of the period for accepting an inheritance: how to draw up, who the defendant is, state duty, jurisdiction

Inheritance regarding loan debts

Inheritance of debts under loan obligations is carried out in the same way as other contractual obligations. It is worth noting the features of this procedure:

- in the case where there are several legal successors, the banking organization makes claims against all or one;

- if the property that was inherited by one successor is not enough to pay the debt, the bank turns to another heir;

- when a banking organization has filed claims against only one legal successor, it has the opportunity to file recourse claims against the remaining heirs;

- if the inherited property is not enough to cover the debt, it is considered repaid, and the obligations are considered fulfilled.

Expert commentary

Kolesnikova Anna

Lawyer

The banking organization has the right to present to the legal successors only such demands as are specified in the loan agreement signed by the testator. Changing the terms of the agreement cannot be made with the participation of one party. When the property secured a loan agreement during the life of the owner, after the death of the encumbrance, the encumbrances also pass to the legal successors.

Special cases of inheritance of debts

The debts of the deceased pass to the heirs in cases where they are not recognized as inextricably linked with the personality of the deceased testator.

Each specific type of debt obligation has its own characteristics of inheritance and debt collection from heirs.

Debts on mortgages and car loans

Successors are liable only to the extent of the shares of the property they inherited. For such an assessment, it is necessary to take into account the market value of the inherited property. The price is determined on the date of opening of the inheritance case; it cannot change.

In addition to heirs by law and by will, such debts can be transferred to other entities, in particular:

- Guarantors;

- Co-borrowers;

- Insurance companies with a loan insurance agreement.

The heir, if he has entered into an inheritance, must independently notify the bank of the death of the testator as early as possible.

After this, he can act in two ways:

- Re-register the property in your name, use it and repay debts on a schedule approved by the credit institution;

- Sell the property and thus pay off part of the debt.

Child support debts

As a general rule, alimony payments are classified as a category of debts that are inextricably linked with the deceased debtor. However, alimony has its own inheritance characteristics.

The alimony debts of the deceased are canceled only for a future period of time.

However, if during his lifetime the testator accumulated a large amount of alimony debt to his children or spouse and did not have time to repay it before his death, such debts are recognized as ordinary obligations. Therefore, they must be repaid by the heirs.

Debts for utilities

Having inherited an apartment, house, room or other living space, the heir also receives a bunch of debts for utility bills, which formed during the time of non-payment by the testator. This obligation will have to be repaid.

You can find out in advance information about their availability from the management company that services the house.

Surety

In the case where the guarantor has assumed obligations for one borrower, after his death the guarantor obligations will be terminated. If the contract stipulates that the guarantor is obligated to repay the debt in any way, then he must fulfill the obligations until full repayment occurs. When the legal successors do not have enough funds to pay the testator’s loan, the guarantor must reimburse the remaining amount.

Successors should carefully review the loan agreement, as it may contain a clause regarding life insurance. If the incident that happened to the testator is covered by insurance, then the debt will be covered by the insurance payment.

Payment of penalties and fines

Not in all cases, when the heirs enter into their rights, they immediately learn about the existence of credit obligations of the deceased. In this case, during this period of time the bank will charge fines and penalties for the amount of overdue payments.

In accordance with legislative acts, a banking organization cannot charge interest from the moment when the testator died. However, according to practice, it is better to resolve this issue with the bank rather than through the court, since the judge may take the side of the creditor.

Waiver of debt

In all situations, legal successors do not know that the testator has a debt. Creditors do not always immediately make demands for compensation. During this time, the debt increases several times. Until the heir has accepted the property, he needs to make sure that there are no debts. It is also worth keeping in mind that debt payment is made within the value of the inherited property.

To cancel your debt you will need:

- Draw up a refusal in relation to the inheritance mass. A period of six months has been established for the acceptance of property. The refusal is written in favor of the other heir. It is impossible to return property after refusal.

- Do not accept inheritance. To do this, you must not take any action regarding the property for six months. In this case, the rights are subject to restoration.

Limitation period for claims of creditors against heirs

In accordance with the current Civil Code of the Russian Federation, the limitation period for claims of creditors against the successor is established - it is 6 months from the moment he accepted the inheritance. The exceptions to this rule are the following requirements:

- on the need to recognize ownership of property by third parties;

- on reimbursement of expenses incurred while caring for a deceased person during his illness or funeral;

- on reimbursement of expenses for the protection of property passed on by inheritance.

These claims are subject to a different statute of limitations – 3 years.

It is important to take into account several features related to the procedure for submitting demands for the fulfillment of obligations:

- claims can only be made against successors who accepted the inheritance, and it is important to comply with the statute of limitations;

- limitation period is a period that cannot be stopped or interrupted;

- Art. 1284 of the Civil Code of the Russian Federation prohibits foreclosure of copyright within the boundaries of its validity period.

Also on the topic: How to get a death certificate?

If the heir and the creditor are the same person, then he does not lose his right. Referring to the Civil Code of the Russian Federation, the heir is not released from liability for debts, and the creditor does not lose the right to fulfill the obligation.

Articles of the Civil Code of the Russian Federation establish a certain order of satisfaction of creditors' claims:

- Initially, costs incurred due to the need to care for a deceased person during illness or when organizing a funeral are subject to reimbursement;

- then the funds spent on the protection of the inherited property and its management are paid;

- costs of executing the will of the testator;

- other claims made by creditors in accordance with the established procedure in compliance with the limitation periods;

- fulfillment of the refusals provided for by the will.

For a certain period of time, the inheritance may be “lying”. In this case, it is allowed to use fiction - to file claims against the property, which does not turn it into a subject of legal relations.