- home

- Useful articles

- Fee for providing information from the Unified State Register of Real Estate - State Duty

30.05.2018

Today, a certificate from the Unified State Register of Real Estate can tell a lot about real estate and even confirm ownership of an object, so many Russians are interested in the question of what the state duty is for an extract from the Unified State Register of Real Estate. Since it is impossible to obtain the information of interest without payment, it is worth understanding what the amount of the payment depends on and whether it is possible to save money.

Fees for providing information contained in the Unified State Register of Real Estate

The state duty is the fee for providing information from the Unified State Register of Real Estate. The obligatory payment is paid by the person who requests the necessary information. The amount of state duty is the same for different regions and is established by law. Benefits and discounts are not provided during the deposit process.

The amount of the state fee for an extract from the Unified State Register depends on a number of criteria, including:

- status of the user who sent the request (legal entity, individual);

- complexity of the information that interests the applicant;

- the form in which the document will be issued.

Without going into details, it is worth noting that the cost of an extract from the Unified State Register for individuals will be cheaper than for an enterprise, and the price of a paper certificate will be higher than an electronic one.

Many users are interested in information about when the fee must be paid for providing information from the Unified State Register; the state duty is paid before submitting the request or after receiving the information. Although there is no clear information in the legislation, in practice the following procedure has developed:

- When an extract is issued through the MFC, a regional division of the Unified Register, it is recommended to make payment in advance. Failure to pay according to Rosreestr details may result in denial of service during a personal visit to a government agency.

- When ordering government services through online services, the request is generated automatically. One of the stages of the procedure is payment of the state duty, without which the operation cannot be completed.

Thus, planning to personally go to the state. institution, it is worth paying the fee for an extract from the Unified State Register in advance, and presenting the receipt of payment to the employee. When choosing online cooperation, money will need to be transferred during the process of forming a request.

As stated, the tariff for obtaining information from the register is established by law. The cost of services depends on various factors. Below is a range of state duty

for providing information from the Unified State Register of Real Estate 2020 for individuals:

- A certificate with a description of the property will cost about 400 rubles.

- The extended version will cost up to 750 rubles.

- Receive a record with a note about the legal capacity of the owner - up to 950 rubles.

- Providing information about title documents will cost up to 600 rubles.

If you need to obtain information from the Unified State Register for legal entities, you will need to pay an order of magnitude more:

- extract with a description of the property - up to 1100 rubles;

- extended form - up to 2200 rubles.

As noted above, when paying the state fee for issuing an extract from the Unified State Register, no benefits are applied. You can obtain information from the State Register for free only when preparing title documents. In all other situations you will have to pay.

Details for Paying the State Duty for Extract from the Unified State Register of Legal Entities 2020 Moscow Region

As always, we will try to answer the question “Details for Paying the State Duty for an Extract from the Unified State Register 2020 Moscow Region”. You can also consult with lawyers for free online directly on the website without leaving your home.

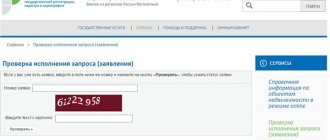

On our website we now have the ability to generate a receipt for payment of state duty.

Now you don’t need to delve into various KBK codes, check the correctness and relevance of the details, because in case of an error, it will be very difficult to return an incorrectly made payment.

As a rule, payers find out that they made a payment using incorrect details only at the tax office when the tax inspector does not accept your documents.

Attention state duty payers!

You just need to select the type of payment required and fill in the details of the payer who pays the state duty. The system itself will generate a receipt for you and all that remains for you is to make the payment in a convenient way.

New KBK codes - Budget classification codes

KBK - 182 11300 130 - fee for extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs - Recipient's bank - Branch 1 Moscow, Moscow 705 - account 40101810800000010041 - BIC 044583001

— INN and KPP of the recipient of funds — MIFTS of Russia No. 46 for Moscow

KBK – 182 10800 110 – state duty for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions;

State duty details

Information contained in the state register about a specific legal entity or individual entrepreneur is provided upon request, drawn up in any form, indicating the necessary information in accordance with the “Rules for maintaining the unified state register of legal entities and providing the information contained therein”, in the form of an extract from the state register in the established form these Rules.

How to get an extract

KBK – 182 10800 110 – state duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities;

The cost of the extract is established by the Decree of the Government of the Russian Federation “On the amount...” of May 19, 2014 No. 462. By force of habit, we call any fee in favor of the state a state duty. However, according to the above Resolution No. 462, for issuing an extract from the Unified State Register of Legal Entities, not a fee, but a fee is charged.

Extract from the Unified State Register details for payment of state duty Podolsk

On our website we now have the ability to generate a receipt for payment of state duty.

Now you don’t need to delve into various KBK codes, check the correctness and relevance of the details, because in case of an error, it will be very difficult to return an incorrectly made payment.

As a rule, payers find out that they made a payment using incorrect details only at the tax office when the tax inspector does not accept your documents.

State duty for extract from the Unified State Register of Legal Entities 2020

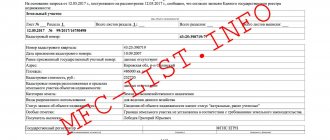

Details for paying the cost of the extract can be found by entering the phrase “Federal Tax Service payment of state duty” into any search engine. The first link will show you the page of the official website of the Federal Tax Service, on which you should click on the item “Fee for providing information from the Unified State Register of Legal Entities”, and then select the type of extract you are interested in (urgent or not).

When printing and paying a receipt, check that the details from official sources are filled out correctly. Recipient of the payment: Department of the Federal Tax Service for the Moscow Region (inspectorate of the Federal Tax Service of Russia for the city of

Sergiev Posad, Moscow region INN: 5042105043 KPP: 504201001 Account number: 40101810845250010102 in the bank: GU Bank of Russia for the Central Federal District BIC: 044525000 KBK: 18211301020016000130 OKTMO: 466 15101 state fee for an extract from the Unified State Register of Legal Entities of the Federal Tax Service for the Moscow Region (inspectorate of the Federal Tax Service of Russia for the city of

State duty for urgent extract from the Unified State Register in Moscow details

Sergiev Posad, Moscow Region) Payment by: Fee for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs (federal government bodies, Bank of Russia, management bodies of state extra-budgetary funds of the Russian Federation) Municipalities of the Moscow Region → Municipal districts of the Moscow region → Sergiev Posad municipal district → Urban settlements of the Sergiev Posad municipal district → The city of Sergiev Posad

Details of the Federal Tax Service for the Moscow Region (inspectorate of the Federal Tax Service of Russia for the city of Sergiev Posad, Moscow Region, payment of the state fee for an extract from the Unified State Register of Legal Entities

Moscow 7726062105/772601001 - recipient of the Federal Tax Code for Moscow (Inspectorate of the Federal Tax Service of Russia No. 26 for the city).

Moscow) - OKATO code of the municipal territorial entity 45296575000 Details of the state fee for state registration of KBK - 182 10800 110 - state fee for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity

An extract from the Unified State Register of Legal Entities can be issued either to the Federal Tax Service, which is responsible for maintaining the register, or to the MFC, which act as an intermediary between the applicant and the tax office.

The cost of the extract is established by the Decree of the Government of the Russian Federation “On the amount...” dated May 19, 2014 No. 462.

For enterprises registered outside the capital, the rule applies: the details for paying the state fee for the Unified State Register of Legal Entities are indicated exactly by the Federal Tax Service inspectorate to which the request was submitted.

In addition to the Federal Tax Service, an extract from the Unified State Register of Legal Entities can be obtained through the MFC. This is a body that acts as an intermediary between the taxpayer and the tax authority.

The cost of the state duty for obtaining an extract is established by Decree of the Government of the Russian Federation No. 462 of May 19, 2014.

Despite the fact that we are talking about paying the state duty for an extract from the Unified State Register of Legal Entities, according to Resolution 462, it is not the duty that is transferred to the state, but the payment.

State duty for obtaining an extract from the Unified State Register of Legal Entities

The state fee for an extract from the Unified State Register of Legal Entities must be paid only if the document is required to be received in paper form. The fee is identical for individuals, individual entrepreneurs, and organizations. We will tell you more about the procedure for paying the state fee for obtaining an extract from the Unified Register of Legal Entities in the article.

- Directly at any bank. When paying a state fee, no commission is charged (but not in all cases, so it’s better to check).

- Through a payment terminal of any bank. There may be a commission here.

- Through the mobile application of any bank. True, in the Sberbank application there is no special option for state tax duties, but you can enter the details and pay:

From October 1, 2020, a one-time re-use of the state fee is possible in case of refusal of the initial registration of a company, if the reason for the refusal was incorrect completion or failure to submit documents.

Refund of state duty

Again, there are no exact regulations on the expiration dates of the state duty, but we tried to submit for initial registration a month after payment - everything was registered. In any case, there is no need to delay it for more than a year.

By force of habit, we call any fee in favor of the state a state duty. However, according to the above Resolution No. 462, for issuing an extract from the Unified State Register of Legal Entities, not a fee, but a fee is charged. The state duty is fixed exclusively in Chapter 25.3 of the Tax Code of the Russian Federation, and the fee for issuing extracts from the Unified State Register of Legal Entities is not given in this chapter. For simplicity, in this article we equate these concepts.

Details for paying the cost of the extract can be found by entering the phrase “Federal Tax Service payment of state duty” into any search engine. The first link will show you the page of the official website of the Federal Tax Service, on which you should click on the item “Fee for providing information from the Unified State Register of Legal Entities”, and then select the type of extract you are interested in (urgent or not).

State duty extract from the Unified State Register of Individual Entrepreneurs

The state fee for an extract from the Unified State Register of Legal Entities must be paid only if the document is required to be received in paper form. The fee is identical for individuals, individual entrepreneurs, and organizations. We will tell you more about the procedure for paying the state fee for obtaining an extract from the Unified Register of Legal Entities in the article.

An extract can be obtained from any Federal Tax Service. Typically, such a document is required to complete any transaction, open a bank account, notarize documents, or obtain a permit for a certain type of activity. That is, the need for an extract arises if the company needs to obtain important, and what is also very important, up-to-date information.

How is the statement issued?

A payment document for payment of the duty can be generated on the Federal Tax Service website using the “Fill out payment order” service. In this case, a receipt for payment will be generated, in which all the details will be automatically entered according to the address specified by the taxpayer. After this, the receipt can be printed and paid at any bank.

Payment of duties through the terminal

Important! When transferring the statement fee, special attention should be paid to KBC. This indicator will be responsible for what type of procedure the payment will be sent to. If the code is specified incorrectly, this will lead to refusal to provide an extract.

- State duty for state registration of a legal entity, with the exception of state registration of liquidation of legal entities and (or) state registration of political parties and regional branches of political parties. (KBK 182 1 0800 110) - Amount 4000 rubles;

- State duty for state registration of changes made to the constituent documents of a legal entity, as well as for state registration of liquidation of a legal entity, except for cases when the liquidation of a legal entity is carried out in accordance with the procedure for applying bankruptcy (KBK 182 1 08 07010 01 1000 110) - Amount 800 rubles ;

- State duty for re-issuance of a certificate of state registration of a legal entity (KBK 182 1 08 07010 01 1000 110) - Amount - 400 rubles;

- Payment by individuals or legal entities for information about a specific legal entity when contacting the registration authority for information about it, with the exception of information about the number and date of issue of an identity document of an individual, about the body that issued the specified document, as well as information about bank accounts ( KBK 182 11300 130) - Amount of 200 rubles for each document (for urgent provision - 400 rubles for each document.

- Payment by individuals for a certificate of compliance or non-compliance of the information about the personal data of an individual stated in the request with the information contained in the Unified State Register of Legal Entities (KBK 182 11300 130) - Amount of 200 rubles for each document (for urgent provision - 400 rubles for each document );

- State duty for state registration of an individual as an individual entrepreneur (KBK 182 1 0800 110) - the amount of 800 rubles;

- State duty for state registration of termination by an individual of activities as an individual entrepreneur (KBK 182 1 0800 110) - Amount of 160 rubles;

- State duty for the re-issuance of a certificate of state registration of an individual as an individual entrepreneur (KBK 182 1 0800 110) - Amount of 400 rubles;

- Payment by an individual entrepreneur for information about him when applying to the registration authority for the re-issuance of a document confirming an entry in the Unified State Register of Individual Entrepreneurs, as well as when applying for urgent provision of information about him in the form of an extract from the Unified State Register of Individual Entrepreneurs (KBK 182 11300 130) - Amount of 200 rubles for each document (for urgent provision - 400 rubles for each document;

- Payment by individuals for a certificate confirming the compliance of the personal data of an individual entrepreneur contained in the request with the information contained in the Unified State Register of Individual Entrepreneurs (KBK 182 11300 130) - Amount of 200 rubles for each document (for urgent provision - 400 rubles for each document;

- Payment by individuals for information about the place of residence of an individual entrepreneur (KBK 182 11300 130) - Amount of 200 rubles for each document (for urgent provision - 400 rubles for each document.

Unified State Register is a database where information about real estate is collected, data about owners is systematized, etc. After the property is registered in the state register, they are included in the Unified State Register database. If you need to get an extract from this database, you should also write an application and send it to the tax office. Most often, such information is needed when:

State duty for obtaining an extract from the Unified State Register

KBK – 182 10800 110 – state duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities;

MIFTS No. 46 You are on the official website of the Interdistrict Inspectorate of the Federal Tax Service No. 46 for the city of Moscow. The Interdistrict Inspectorate of the Federal Tax Service for the city of Moscow, the registration authority of the city of Moscow MIFTS No. 46 for the city of Moscow, maintains the registers of the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, and issues extracts from the register.

The state duty for an extract from the unified state register is paid before sending a request for its receipt to the relevant authorities. Regardless of who exactly applies for the extract - a legal entity or an entrepreneur, the fee will be the same and amount to 200 rubles.

Kbk for state duty for extract from the Unified State Register of Legal Entities 2020

Moscow (Inspectorate of the Federal Tax Service of Russia No. 26 for the city.

Moscow) - OKATO code of the municipal territorial entity 45296575000 Details of the state fee for state registration of KBK - 182 10800 110 - state fee for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity,

You may also like

Source: https://legcons.ru/neobhodimye-dokumenty/rekvizity-dlya-uplaty-gosposhliny-za-vypisku-iz-egryul-2019-moskovskaya-oblast

How to make a payment

When studying information on how to pay the state fee for an extract from the Unified State Register, you can use any convenient option from the following:

- payment of state fees via Internet banking;

- use of ATMs, terminals;

- by using the online service to obtain information (during the process of completing the request);

- using electronic payment systems;

- by visiting a branch of any bank;

- using the terminals located in the MFC.

Having specified how much you will have to pay, it is worth checking the recipient’s details in advance. It is important to determine which division of Rosreestr will issue information. When an applicant applies to the State Register in person, he receives a receipt containing all the necessary information. Using a terminal or ATM, the user can quickly deposit money and continue solving urgent problems.

Is it possible to save money when receiving an extract?

All kinds of actions of citizens are subject to taxes and state duties. It is logical that everyone wants to pay less but get the full range of services. Although there are no statutory benefits or discounts, you can save money without resorting to illegal options.

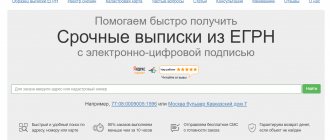

difficult to overestimate:

- available around the clock;

- do not rest during holidays and weekends;

- you don’t need to devote a lot of time to visiting them or stand in huge queues.

The main difference between their work and real departments is the issuance of documents in electronic form, and less often, the sending of a paper statement via Russian Post. However, data on such a resource is processed for a maximum of two to three days, and in most cases the user receives the necessary information within a few hours after payment.

As noted, the cost of an electronic statement is slightly cheaper than its paper counterpart:

- a regular, detailed certificate costs about 250 rubles;

- data on the history of transfer of ownership rights - 250 rubles.

The received document is not just for reference purposes, but has all the legally significant powers of a paper extract. Despite the fact that there are no wet stamps on the printed copy, any authorized person will be able to follow the link provided by Rosreestr to verify the compliance of the information. The electronic statement is certified by an enhanced electronic signature, which is sufficient protection of the document from forgery.

When planning to obtain information from the Unified Register, it is worth noting that the task is quite complex. There are constant queues in departments of government agencies, and not everyone can afford to take time off from their boss to resolve personal matters. In the process of independently requesting information via the Internet, you should be extremely careful, since inaccuracies and errors when filling out the form can lead to the fact that the statement comes empty, and you will have to pay for a new request again. By turning to professionals, you can avoid such risks and obtain information promptly, without unnecessary problems.

And do not forget that the stingy pays twice.

Obtaining information about real estate

In some cases, it is simply necessary to obtain information about a particular property.

They are presented to everyone who has formally submitted a request to the relevant government agency.

The extract is a list of the main parameters of the property. It is issued by the Rosreestr authorities.

You can get information about any real estate property:

- About the land plot.

- About the apartment.

- About a country house.

To obtain information, you must specify the minimum object parameters:

- the address where the property is located;

- its cadastral number.

The statement will contain the following information about the property.

This:

| Its full name | and the address where this object is located |

| Object characteristics | and its purpose |

| Date of registration of ownership | owner details |

| Cadastral number of the object | details of the extract itself |

Place of appeal

In order to obtain an extract from the Unified State Register, you must contact the appropriate government agency.

This is the territorial branch of Rosreestr at the location of the property.

You can do this in several ways:

| Visit in person | territorial office of Rosreestr and make a request |

| Contact the nearest MFC | or through the official website of Rosreestr |

| By using | a single portal of public services and via mail |

You can also receive an extract in several ways:

| In person, presenting your passport | or through a representative, but he must have a notarized power of attorney |

| By registered mail with notification | and through the nearest MFC |

| By email | in this case the document is submitted online |

| Having visited that branch of Rosreestr | to which the request was made |

Algorithm of actions

To obtain an extract from the Unified State Register, you must follow the following algorithm of actions:

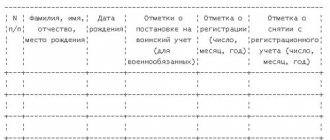

| Visit the territorial office of Rosreestr | or the nearest MFC, and write a request. The request must be submitted only in writing, oral form is not provided |

| Then the applicant pays the state fee | and the receipt is presented to the Rosreestr employee. This is not necessary, since the “arrival” of funds should be reflected in the computer program. But in practice this is not always the case! And if the Rosreestr specialist does not see the payment, he will not issue an extract to the applicant |

| A copy of the applicant’s passport must be attached to the application. | if the extract is prepared by a representative, then a copy of his passport, as well as a copy of the power of attorney |

| After submitting the documents | the official who accepted them (this can be either an MFC employee or an employee of Rosreestr) issues a receipt to the applicant. It indicates the data of this employee, a list of documents and their quantity, as well as the date of acceptance |

| Within the period specified in the receipt | the applicant or his representative must receive an extract in the manner specified by him |