Author of the article: Lina Smirnova Last modified: January 2020 25039

Inheritance today is a complex topic. It is especially difficult to deal with applicants for inheritance when there is no will. This complexity is created due to the complexity of human relationships, leading to a variety of family ties. For example, many are interested in the question of how to enter into an inheritance after the death of a father , since this parent often creates a new family, leaving children with his ex-wife. What rights do his children and their mother, as well as his new legal wife, have regarding inheritance of property in the event of his premature death, we will consider in this material.

Who has the right to inheritance

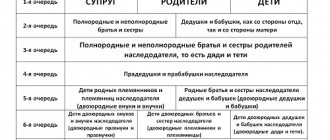

If during his lifetime the father did not order that any of the acquired goods be passed on to his son or daughter, they become heirs by law. The order of succession is indicated in Articles 1142–1145, 1148 of the Civil Code of the Russian Federation. The first priority applicants include: wife, parents, children. The second line of heirs covers the grandparents, brothers and sisters of the deceased. In the third place, uncles and aunts come into inheritance. In the event that there are no applicants of the 1st, 2nd, 3rd stages, the property can go to the heirs of other stages.

If the heirs are in the same line, the inheritance is divided between them in equal shares. Since children belong to representatives of the 1st stage, they will be among the applicants who have advantages over the rest.

Example. Citizen S. has a wife, a sister, two daughters from his first marriage and an adopted son from his second. After S.’s death, the apartment that was claimed by the above-mentioned persons remained. Since the property was acquired before marriage, it is not marital property and the share received by the wife will be equal to the rest. The wife will receive ¼ share of the property, the daughters and son will also receive ¼, and the sister will receive nothing.

Who has the right to inherit property by law after the death of the father? These individuals include:

- Capable children who have reached the age of 18. Persons who got married before the age of 18 are also recognized as having legal capacity (Article 21 of the Civil Code of the Russian Federation).

- Adopted children. They can inherit the property of the adoptive parent, but have no right to claim the property of the biological father.

- Illegitimate children. If the father acknowledged paternity during his lifetime, the child has the same rights of inheritance as children born in a legal marriage. In the case where paternity is not recognized, the child can prove the relationship in court and claim a share of the inheritance on an equal basis with other representatives of the 1st stage.

- Unborn children. A child conceived by the owner of material and intangible wealth can claim a share in the number of heirs of the 1st stage. During pregnancy, the issuance of property inheritance certificates is suspended, and after birth, an application for the right to a share of the property is submitted by the guardian or mother of the baby.

- Children aged 14-18 have inheritance rights with the consent of the responsible persons.

- The rights of children under 14 years of age and incapacitated citizens are represented by their guardians, trustees, and adoptive parents.

Even if the father left a will, minor children (under 18 years of age), as well as children under 23 years of age, receiving full-time education, disabled, dependent on the testator and living with him for at least 1 year, are among the persons entitled to obligatory share in the inheritance.

The following persons will not be able to receive the property:

- Those included in the list of unworthy heirs according to Art. 1117 of the Civil Code of the Russian Federation. These are people who commit illegal actions in relation to the testator or other relatives in order to increase their own or someone else's benefit; parents deprived of parental rights.

- Not included in the will of the deceased (Article 1119 of the Civil Code of the Russian Federation). However, this does not apply to persons entitled to an obligatory share in the inheritance. They receive at least ½ share of the property that would have been due to them in an intestate division.

- Those who have not completed documents to enter into inheritance rights.

- Refused inheritance.

When accepting an inheritance, it is important to understand that refusal of part of the inheritance is impossible, even if it is any debt obligations.

The decision that the heir is unworthy can only be made by the court.

The direct heir may die before the death of the father or at the same time as him. In this case, the right to receive his share of the property is transferred to his descendants. This is called inheritance by right of representation.

Example: If the deceased had a wife and 2 daughters, one of whom died, but had two children (grandchildren for the testator), then 1/3 of the property will go to his wife, 1/3 to his daughter and 1/6 to each of the grandchildren on behalf of the deceased mother.

Father died, how to inherit

Advice from lawyers:

My father died and wanted to inherit an apartment, but his sister and his daughter secretly made a lifelong allowance, what should I do?

3 answers

The father died, the son took over the inheritance, the other children refused, how to transfer the father’s tractor to his daughter. She wrote that she refused the inheritance, but she needed a tractor.

3 answers

Our father died. We entered into inheritance under a will after 6 months. 3 months after entering into inheritance, my sister got married.

3 answers

My father left me a will, I am the youngest daughter, but the eldest is not, can she challenge it, two years have passed since my father died, I entered into the inheritance half a year later?

3 answers

My father died, my mother took over the inheritance, I wrote a waiver in favor of my mother.

3 answers

Tell me, my father died, I need to take over the inheritance, but my grandmother, his mother also takes over, who has priority?

3 answers

If I am the only heir of my deceased father, I did not enter into the inheritance at 6 months. term. What is the current procedure for entering into an inheritance? Thank you!

3 answers

Our father died, our mother took over the inheritance, during his lifetime my father wrote a general power of attorney for his brother on his car,

3 answers

My father died, I entered into an inheritance, now I want to find his deposit in the bank, where to go to get it, the bank said that the notary must make a request to the bank.

3 answers

My father died, I inherited and my second wife filed a lawsuit against me for debts for alimony that my father did not pay. What should I do?

3 answers

My husband’s father died, he inherited his apartment along with his grandmother and brother, received 1/3 of the apartment, can he sell his share and how to do it?

3 answers

My father died, I want to inherit, my mother and father divorced a long time ago, I am my only son (heir)

3 answers

In October 2013, my father died, I took over the inheritance. Certificate of registration of property rights dated June 2014.

3 answers

In 2020, my father died, I took over the inheritance. My sister did not take over the inheritance.

2 answers

In 2008, my father died, I took over the inheritance and his mother. In 2009, there was “some kind of deal” with a notary, after which the entire inheritance was transferred to my father’s mother (my grandmother).

2 answers

My father died, my mother took over the inheritance, and my daughter refused the inheritance in favor of my mother.

2 answers

My father died, I entered into an inheritance when I was a minor, at the age of 11,

2 answers

My father died, I need to inherit the car, but his partner won’t give me the documents for the car, what should I do?

2 answers

My husband's father died. We inherited a house. Only the husband and son are registered in the house.

2 answers

Tell me how to find the deposits of a deceased father? Having entered into the inheritance, the notary assured that the money had not been found! I know for sure that they exist!

2 answers

My father died, my mother inherited a car, should I take it to the traffic police to re-register it in her name or not?

2 answers

I have the following question: my father died, my mother took over the inheritance, but we want to register the car in my (daughter’s) name.

2 answers

My father died, I want to take over the inheritance. At the time of his death, the father was registered in Donetsk, and lived in Nikolaev.

2 answers

My father died at 90. We entered into an inheritance known at that time. To date, it has become clear

2 answers

The father died without inheriting his grandmother’s share, leaving two grandchildren,

2 answers

Tell me please? My father died, I entered into an inheritance, but I didn’t indicate the savings book because I couldn’t find it, a year and a half later I found it and what to do with the money.

2 answers

My father died, I inherited an apartment, I have an illegitimate daughter, the fact of paternity has not yet been established by the court,

2 answers

I want to know the following. When my husband and I were married, my father died and I inherited.

2 answers

If the father died before accepting the inheritance

In the event that the father himself did not manage to inherit the property of a deceased relative, the right to accept the inheritance passes to his descendants (hereditary transmission, Article 1156 of the Civil Code of the Russian Federation). The following may apply for such property:

- father's legal heirs;

- heirs, whose circle is defined in the will, provided that the document bequeaths to them all the property, and not a separate part of it.

Example: Citizen A. executed a will, according to which the apartment went to son V., and the dacha to wife N. At this time, his father I. died, who bequeathed his house to citizen A. Before he could enter into the inheritance, A. died. The wife and son assumed that they would inherit the house. But since only part of the property was bequeathed to them, the hereditary transmission extended only to the daughter of citizen A. from a previous marriage, who entered into inheritance rights by law.

If the father died, who are the first priority heirs?

The first heirs after the death of the father are the children, spouse and parents of the deceased. They have equal rights to the property of the deceased.

The possibility of entering into inheritance together with the first-priority successors of those who claim the obligatory share should not be excluded. These are disabled dependents who lived with the testator. At the same time, the presence of a blood connection with the deceased does not matter.

A claimant for an obligatory share has the right to receive no less than half of the share of property if he were to claim the inheritance on an equal basis with others. If the father made a will during his lifetime, then the inheritance will take place according to its contents.

Expert opinion

Irina Vasilyeva

Civil law expert

If none of the first priority heirs is mentioned in the act of unilateral will, then they will not be able to count on receiving property under the will. However, this does not exclude obtaining the right to inherit a compulsory share.

Inheritance by father's will

Making a will is the best way to prevent conflicts between relatives. The owner of the property has the opportunity during his lifetime to determine who will receive the inheritance and who will not. Moreover, the heir can be an individual or legal entity.

Even if the deceased left a will, there are a number of persons who, regardless of its contents, have rights to the inheritance. These advantages are:

- disabled children, parents or spouse;

- children under the age of majority;

- relatives who were dependent on the deceased for a year or more before the time of death;

- strangers who have lived with the deceased for at least 12 months and are dependent on him.

Example. Citizen K., who is the owner of a house and land, bequeathed it to his second wife. From his first marriage he has 2 daughters, one of whom is over 18 years old, she is capable and graduated from a university, and the other is 5 years old. How to determine what children will get? Since the second daughter is entitled to an obligatory share of the inheritance, it is necessary to calculate what she would have received without a will, that is, according to the law. The shares of daughters and wives would be equal and amount to 1/3. According to paragraph 1 of Art. 1149 of the Civil Code of the Russian Federation, the daughter will receive 1/6 of the property, in other words, half of what would be due to her by law.

To ensure that the father's will is carried out in accordance with his wishes, the contents of the document are interpreted by a notary.

A person can appoint an executor of a will during his or her lifetime. This is a relative or any person who has earned the trust of the testator. The rights of the performer are confirmed by a certificate issued by a notary, and his powers are listed in Art. 1135 of the Civil Code of the Russian Federation. The Contractor performs the following functions:

- creates the necessary conditions for the transfer of property to the heirs in the specified amount;

- can protect property or manage it, acting in the interests of heirs;

- receives funds and other valuables to dispose of them according to the will of the father;

- monitors the execution of the testamentary assignment, drawn up in accordance with Art. 1139 of the Civil Code of the Russian Federation, or testamentary refusal (Article 1137 of the Civil Code of the Russian Federation).

A testamentary legacy can be the right to use property for a certain period or for the entire period of the life of the legatee, and the assignment is of a more generally useful nature. For example, a father may oblige his heirs in his will to dispose of part of his property in favor of a charitable organization.

When can you inherit after the death of your father?

The distribution of property between claimants begins from the moment the inheritance is opened. A period of 6 months is allotted for this. This is enshrined in Art. 1154 of the Civil Code of the Russian Federation. A document confirming the opening of the period is a death certificate. It is issued even if the time of death is established in court. The moment of opening is considered (Article 1114 of the Civil Code of the Russian Federation):

- father's date of death;

- the date of entry into force of the court decision declaring the citizen dead.

However, in some cases the six-month period may be extended:

- If the father dies before accepting the inheritance due to him, his relatives can do this for him. The extension of the term is influenced by how much time is left before the due share is accepted. If the six-month period expires in more than 3 months, the period is not extended, and if less, it is extended by 3 months.

- If one of the heirs does not express a desire to receive the inheritance, the children can claim their rights to its share within 3 months after the expiration of the six-month period.

- If the heir formally renounces his part or is found unworthy, the children have 6 months to file an application from the date of notarization of the refusal or the date of the judicial act.

You cannot miss the deadline for accepting an inheritance due to ignorance or negligence, otherwise, without a good reason, it will not be possible to restore the deadline, and the inheritance will go to other applicants.

What to do if the father did not inherit the inheritance before his death?

If a man died without entering into his rights of inheritance, then the norms of hereditary transmission apply (Article 1156 of the Civil Code of the Russian Federation).

They say that all unaccepted property passes to his heirs by law or by will, if there is one. Attention! The heirs will not be able to claim property that was supposed to go to the deceased as an obligatory share.

If the father died at the same time as the citizen from whom he could have received property, inheritance by right of representation is applied (Article 1146 of the Civil Code of the Russian Federation). in accordance with legal acts, the property is divided in equal shares among the remaining legal successors.

The specifics of entering into an inheritance after the death of the father depend on the presence or absence of a will. The inheritance case is opened at the last place of residence of the deceased or location of the property. Claimants to property are not only children, but also the spouse and living parents of the testator. In the absence of a will, property is divided in equal shares.

How to receive and register an inheritance after the death of a father without a will

Where to start when your father dies? You will need to visit a notary's office. The deadline for this is 6 months. The algorithm of actions is as follows:

Determining the place of opening of inheritance

According to Art. 1115 is the last place of residence of the testator. If this is not determined, then you need to contact a notary at the location of the real estate or the most expensive (by market value) part of the bequeathed property.

Example. Father lived in Vilnius. After his death, he inherited an apartment worth 3 million rubles. and a cash account in St. Petersburg for 1.5 million rubles. The inheritance will be opened at the location of the property.

Documents required for entering into inheritance after the death of the father

You must have with you:

- passport;

- father's death certificate or its notarized copy;

- documents that would confirm relationship with the deceased;

- documents for property that should be inherited: for a car - a registration certificate; for real estate - a certificate of ownership; savings book when inheriting financial assets;

- documents confirming the fact of cohabitation;

- a document indicating the father’s last place of residence: a certificate from the housing office or an extract from the house register.

As a rule, a notary accepts an application if any document from the required package is missing, but it is a prerequisite that it be provided in the future.

Statement

The document is drawn up in writing. You can take it to the notary in person or send it by letter with notification. If the testator is unable to submit an application, the trustee does so. His powers are specified in a document - a power of attorney.

If the heir lives in another city or country, he can send the application to the notary by mail. In this case, the applicant’s signature must be certified by a notary or other authorized persons: a representative of a local government body, a consulate; commander of a military unit; employee of the social security agency.

The application is submitted to the notary. It states:

- Full name of the heir, place of residence;

- information about the owner of the valuables: his full name, place of residence, date of death;

- a desire is expressed to accept a share in the inheritance;

- reasons for obtaining values are given;

- other applicants are indicated by law and will;

- the property to be divided and its location are described;

- The application is submitted with a date and signature.

Expenses, cost

Entering into a father's inheritance is not without costs. The amount will include:

- Costs for legal and technical notary services. At the legislative level, the fixed cost of such services is not defined and may differ in each region.

- Payment of state duty. After the notary’s work is completed, each relative must pay a state fee. Its size is determined by clause 22 of Art. 333.24 Tax Code of the Russian Federation. For representatives of the first stage, it is 0.3% of the value of the inherited share of property, but within 100 thousand rubles; for applicants of other queues – 0.6% within 1 million rubles.

If notarial acts are performed outside the notary’s office, the state duty may be increased by 1.5 times (Article 333.25 of the Tax Code of the Russian Federation).

Cost of property for calculating state duty

For an objective assessment and as confirmation of property rights, the following documents are additionally provided:

- registration certificate for residential or non-residential inherited premises;

- documents reflecting the fact of redevelopment;

- if the object of inheritance is a company, store, enterprise, an extract from the Unified State Register of Legal Entities is provided.

The notary helps to evaluate the property to be transferred. What is it for? Subsequently, based on the cost, the amount of state duty charged for obtaining an inheritance certificate is determined.

The heir has the right to pay the state duty according to the most advantageous option, taking into account:

- Market value - it is formed by an independent expert taking into account the operational characteristics of the object.

- Cadastral value is formed by appraisers on the basis of an agreement concluded with the municipality. Revaluation of objects is carried out up to 5 times a year. You can receive a document on the cost 5 days after submitting an application to Rosreestr.

The inventory value is determined by the BTI appraiser. As a rule, it does not reflect the specific location of the property and can be underestimated, which is beneficial when calculating state duty. However, since 2014 it is allowed to be used only as a starting point for determining the market value.

Example. According to the conclusion of independent experts, the cost of the inherited apartment was estimated at 2.3 million rubles. According to the extract received from Rosreestr, the cadastral value of the property is 1.4 million rubles. The son, who is the heir to the apartment, paid a state fee of 4,200 rubles. (0.3% x 1.4 million rubles).

Benefits when paying state fees

For disabled children of groups 1 or 2, the fee is reduced by 2 times. Incapacitated and minor persons with guardians due to mental disorders are completely exempt from payment.

The following are also exempt from paying state duty when inheriting a father’s property:

- children living with him until death and continuing to use the property;

- children whose parent died while performing a government assignment or was subject to political repression;

- persons receiving bank deposits, copyrights, monetary awards from the deceased;

- WWII participants, heroes of the USSR, Russian Federation, holders of the Order of Glory.

The deadline for paying the state duty is 6 months from the date of opening of the inheritance.

Issuance of a certificate of inheritance of property

The notary checks the received documentation. After 6 months from the date of the father’s death, he issues either one certificate for all heirs, or for each individual. This document is proof of ownership of the deceased's property.

The full package of documents is determined by the notary in each specific case.

Application deadline

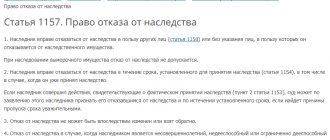

There are situations when, after six months, the heir does not have time to submit an application to the notary. The period may be extended in the event of non-acceptance of the inheritance by another heir, which means that he has formalized a refusal or inaction.

If the heir officially renounces the inheritance, then within 6 months from the date of registration of the refusal, another heir can draw up documents to enter into the inheritance.

The inaction of one of the heirs is the basis for the other heir to extend the deadline for submitting an application to the notary for 3 months.

If a violation of the deadline for filing an application did not occur for the specified reasons, it is necessary that all persons who entered into the inheritance agree to include the late person in the list of heirs. Then the case does not go to court. The algorithm of actions should be as follows:

- verbal agreement with the heirs and their approval of the actions of the latecomer;

- documentation of the fact that the heirs agree to the person’s restoration of inheritance rights; the document must be notarized;

- repeated redistribution of shares in the inheritance;

- cancellation of previously issued certificates of inheritance and registration of new ones;

- changing information in state registers.

What often happens in practice is that the remaining heirs do not consent to changing the will. This inevitably leads to a decrease in their share of the inheritance or deprives the deceased of the right to inherit the property. Therefore, there is a need to go to court.

Before filing a property claim in court, you must pay a state fee, which is calculated as a % of the price of the claim and ranges from 400 rubles. up to 60 thousand rubles. on the basis of clause 1 of Art. 333.19 Tax Code of the Russian Federation. When filing a claim of a non-property nature, an individual pays 300 rubles.

The grounds for filing a claim in court are:

- lack of information about inheritance;

- a valid reason for missing the six-month period: serious illness or other unavoidable life circumstances.

In the event that there was only 1 heir, and the property turned out to be escheated, that is, it became the property of the state, it can only be returned by going to court.

Necessary documents for inheritance

When visiting a notary for the first time, a minimum is required that will allow you to establish the identity of the visitor, the degree of relationship with the deceased and confirm the fact of the death of the testator. Next, we will consider what documents are needed to enter into an inheritance after the death of the father.

Personal documents from relatives

This list includes:

- Personal passport.

- Death certificate.

- Will – if available.

- This includes papers that officially confirm the paternity of the testator - a birth certificate, a court order.

- Certificate of registration of the deceased.

Their legal representative, the mother, acts in the interests of minor children. She must provide her passport and the child's birth certificate. If we are talking about an unborn heir, honey will be required. reference. After giving birth, the mother brings her birth certificate and her passport.

The originals are provided to the notary's office.

In addition to personal details, property details will be required.

Additional documents for property

To provide complete information, you will need :

- Agreements on purchase and sale transactions, barter, donation;

- Certificate of assessment;

- Cadastral passport, if this is real estate;

- Passport for the car;

- Statement of absence of debts for payment of taxes and utilities;

- Bank agreement, if a bank deposit is inherited;

- Technical details.

Expert opinion

Svetlana Samoilenko

Inheritance lawyer

Ask me a question

It is necessary to confirm the deceased's ownership of material assets. The provided papers must display his information as the owner.

If there is no documentary evidence of property rights, then the court will help establish them. This happens if there is a non-privatized apartment left, which the owner did not have time to register. In addition to the listed papers, a receipt for payment of the state fee is attached to the notary application.

Actual acceptance

If the application for the right of inheritance was not filed within the prescribed period, but the person treated the property as his own within six months after the death of his father, we can talk about actual acceptance. A son or daughter can contact a notary to obtain a certificate of inheritance.

Evidence of actual acceptance of the inheritance that a child can use is:

- Use of property for its intended purpose.

- Taking actions aimed at protecting, protecting, and maintaining the integrity of property. This could be installing new windows, doors, changing spare parts in the car.

- Maintenance of the property, which means paying utility bills and taxes.

- Payment of debts of the deceased.

Acceptance of the inheritance must be completed within 6 months. If no action is taken, then after six months, within 3 months, the rights to inheritance can be registered by the heirs by law.

Example. Two sons A. and N. inherited the dacha from their father, but none of them submitted documents to register the inheritance with a notary within 6 months. A year later, A. decided to sell the dacha. To confirm the actual acceptance of the inheritance, he provided the court with receipts for payment of land tax, garden fees, and brought neighbors to testify, who confirmed his constant presence at the dacha and work on the land plot. As a result, the court recognized his rights to this property.

Documentation

In addition to how to properly enter into your rights, it is important to know what documents are needed to enter into an inheritance after the death of your father.

These include the following papers:

- Personal passports of each heir.

- Children must present their birth certificates proving that the deceased person was their father.

- The spouse must provide a marriage certificate, if there is a divorce, about the divorce.

- The parents of the deceased must provide a certificate from the deceased himself, which identifies his official parents.

- Other dependents must provide documentary evidence that they meet all required conditions.

- Certificate of death of the father, or a court decision declaring him dead.

- A list of property with documentary evidence that the deceased was the owner. These may be certificates of registration of rights, extracts from relevant authorities and other supporting documents.

- If any of the legal heirs decides to renounce in favor of someone else, or simply refuse, an appropriate waiver must be provided.

- A document confirming the last place of residence of the deceased. This could be a certificate from the passport office.

- An extract from the house register confirming the deregistration of a deceased citizen.

- Receipt confirming payment of the state duty.

In 2020, the following state duty rates are provided for the use of notary services when entering an inheritance:

- drawing up the entire list of inherited property – 600 rubles;

- opening an envelope in the presence of a will - 300 rubles;

- certificate of will – 100 rubles.

In addition, you will also need to issue a certificate of inherited right, which will become the title document for registering property rights.

The cost of its registration will be as follows:

- For first-priority heirs, the fee cannot exceed 100 thousand rubles, but cannot be less than 0.3% of the value of the inheritance.

- For other heirs, this amount is 0.6%, but cannot exceed 1 million rubles.

The successor can save money if he submits documents assessing the value of the inheritance not at market rates, but at cadastral rates. If two documents on the value of the property are available at the same time, the lower price is taken into account.

It is necessary to make copies of all documents . Notary offices also provide copying services, but they are several times more expensive. Therefore, if you want to save money, you need to prepare copies in advance.

Along with copies, the notary is given the originals of all papers. He checks the authenticity of these documents. It is also important to note that the papers provided should not be expired. All documents must be valid.

In addition, additional documents will be required, depending on the type of inherited property. These include:

- title document for real estate, confirming the legal basis for registration of ownership;

- technical plan of the premises;

- assessment of the value of real estate on the date of death of the testator;

- real estate cadastral passport;

- certificate of absence of debt on taxes on inherited property;

- technical passport of vehicles;

- supporting documents for ownership of various deposits, shares and other securities.

All these documents are necessary for the notary to verify the grounds for the legality of ownership of this property . Such a check will eliminate the misappropriation of rights to someone else's property.

In addition, the notary will provide an application form that will need to be filled out. It can also be found in trusted Internet sources.

Applications and documents must be submitted by heirs within the first 6 months. After the end of this period, the notary sets a time and date for the meeting and division of the inheritance.

Based on all the documents, he makes a division between the legal successors and issues them a certificate of receipt of inheritance rights to certain property.

It is important to know after what time you can assume the rights of an heir . This can only be done after the official registration of property rights on the basis of a certificate obtained from a notary.

If the successor does not register his right in the prescribed manner, he will not be able to fully dispose of this property, including carrying out any transactions with it.

If you have any questions regarding the procedure for entering into an inheritance, you can simply contact a notary’s office and clarify this information.

Similar articles:

- How to sell an apartment with a minor share owner?

- How to arrange an inheritance after the death of a mother?

- How to refuse privatization in favor of parents?

- Can parents' property be confiscated for children's debts?

- Spousal share in inheritance after the death of a spouse

- Previous post How to sell an apartment with a minor share owner?

Comments on the article “How to enter into an inheritance after the death of a father without a will?”

Nobody has written anything yet. Be the first!

What to do if the father disinherits his heirs

There are situations in life when a father deprives his son or daughter of the right to receive part of the property benefits he has acquired. In this case, the failed heir may go to court and file a lawsuit to have the will declared completely or partially invalid. In what cases is a positive decision made?

- If the father is declared incompetent or his legal capacity is limited by a court decision. The reason may be addiction to gambling, abuse of alcoholic beverages, narcotic substances, mental disorders (Article 30 of the Civil Code of the Russian Federation).

- If at the time of signing the will the father did not realize what he was doing.

- In cases where the document was signed under pressure, and threats, deception, and misrepresentation were used against the father.

If the potential heir proves that one of the listed situations occurred, the court may order a posthumous psychological and psychiatric examination.

In this case, the physical condition of the patient during life is assessed. With a high probability, the decision will be positive if the father had diseases: Alzheimer's disease, cerebral hemorrhage, leukomalacia and other pathologies that lead to disruption of brain function.

Evidence that a person could not sign an inheritance document includes evidence of observation by a psychiatrist, recorded facts of mental disorder, and witness testimony. Relatives, neighbors, and acquaintances take part in a survey about the father’s health.

If it is proven that at the time of signing the document the father was mentally healthy, and no one influenced his decision, it is impossible to invalidate the will.

What difficulties arise when taking over your father's inheritance? Many heirs misinterpret the law and believe that if the children were conceived out of wedlock or the parents are divorced, then they do not have the right to receive a share of the inheritance. This is not so, and justice can only be restored using the rules of law. What to do if the father did not consider the heirs unworthy, but did not have time to draw up a will? How to correctly draw up an application for inheritance rights? What should I do if I missed the 6-month deadline for filing an application? How to find out where the inheritance opens? How to correctly calculate the state duty? This is only a small part of the issues that will have to be resolved by the father's heirs.

When solving complex issues of inheritance of property, it is important to be patient, understanding and take the help of a qualified specialist who will help solve problems through legal means. Consultation with lawyers from the ros-nasledstvo.ru portal will simplify the procedure for registering property as an inheritance and eliminate the need to independently understand the legal norms. Each situation is individual and only a specialist can suggest the correct course of action to preserve the right of inheritance.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

16

Statement of claim to establish the fact of acceptance of inheritance in 2020

Actual inheritance from a legal point of view is regarded as a full-fledged method...

74

How to enter into an inheritance after death without a will according to law

A will is an act of unilateral expression of the will of the testator, allowing one to determine the future fate...

7

How to enter into an inheritance after the death of a husband

The rules and procedure for entering into inheritance are regulated by the third part of the Civil...

5

Who is legally a close relative?

In such a concept, obvious at first glance, as “close relatives”...

10

Inheritance by right of representation

The order of inheritance in the absence of a will is regulated by Chapter 63 of the Civil Code...

57

How much does it cost to enter into an inheritance from a notary in 2020?

The amount of expenses for entering into an inheritance after death depends on...