What does debt for utilities lead to?

The main regulatory document regulating the legal relations between citizens and management companies is the Housing Code of the Russian Federation. An entire section (VII) is devoted to the issue of payment for residential premises and utilities, which states that the obligation to pay payment arises for the following categories of citizens:

- employers under a social tenancy agreement;

- tenants of state or municipal housing stock;

- members of a housing cooperative;

- home owners;

- developers or persons who accepted the premises under the transfer deed.

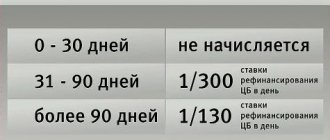

According to Art. 155, payment is due by the 10th day of the month following the billing month: for January - before February 10, for February - before March 10, and so on. It also provides that in case of late/incomplete payment for services, owners and tenants are required to pay the management company (MC) a penalty in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay, starting from 31 days. This leads to an increase in the amount of debt and even collection of it in court.

If there is a debt of 500,000 rubles or more, the company has the right to demand foreclosure on the debtor’s property: a car, an apartment, etc.

What does debt restructuring mean for citizens?

The concept of restructuring is enshrined in Art. 105. It implies an agreement-based change of debt obligations to other terms and payment terms, as well as the possibility of their partial write-off.

This agreement establishes more acceptable terms for the payer, giving him the opportunity to pay off his bills in full with:

- reduction of monthly payments when the payment term increases;

- writing off part of the debt that arose for a good reason;

- providing temporary holidays on payment of bills with mandatory repayment of current accruals.

For management companies, it is important to regularly pay for the services consumed, which is stipulated in the concluded contracts. If payment deadlines are not met, a debt arises. It entails negative consequences not only for citizens, but also for the resource supplying organization, because a balanced budget and high-quality provision of services are possible only with proper payment of bills.

So, restructuring the utility debt is beneficial to both parties. The contract will allow the potential consumer to settle payments in stages, without accruing penalties, and the management company will save time and money on legal proceedings, working with bailiffs and collecting payments under enforcement documents.

The reasons for the debt and the amount may vary, but the most common are:

- dissatisfaction with the quality of services provided and the belief that tariffs are greatly inflated;

- deterioration in the financial situation of a family or a citizen living alone;

- personal reasons: illness, living in a remote area, etc.

In this regard, when establishing the terms for repayment of rent payments, an individual approach to each tenant is practiced: family composition, employment and average monthly income are taken into account. This allows you to choose an installment plan that will allow you to make current payments on time and repay the debt.

Benefits from debt restructuring

Debt restructuring benefits both parties. For utility workers, this is an opportunity to receive their money, albeit in parts, later than the deadline.

The consumer benefits are as follows:

- the amount does not have to be found in full immediately, since the money is paid gradually and in parts;

- the debtor eliminates the risk of accrual of penalties and penalties, since the utility company voluntarily provides a deferment;

- the owner of the property is protected by the terms of the contract signed by the parties.

We recommend: Who seals water, electricity and gas meters and why

By agreeing on a restructuring, the consumer has the opportunity to continue making current payments without further increasing the amount of debt.

The legislative framework

Since the collection of utility bills almost always occurs in an indisputable manner, home owners and tenants need to know what laws govern the calculation and procedure for paying utility bills.

Having studied the relevant regulatory documents, it is easy to figure out in which cases the conclusion of a restructuring agreement is beneficial to the payer, and in which it is not.

Since the contract is the main regulator in any area of relations, including housing, the main legal act regulating obligations and the procedure for their fulfillment is (Articles 420-453).

The issues of providing utility services and their payment are discussed in more detail in Section VII of the Housing Code of the Russian Federation.

The relationship between providers and consumers of utility services, the procedure for quality control and determining the amount of payment is regulated.

Controversial relations between consumers of utility services and management companies, as well as resource supplying organizations, are regulated. An example is the illegal shutdown of electricity or other housing and communal services.

JUST CHOOSE

If a citizen of the Russian Federation does not have the opportunity to pay the debt to housing and communal services, then he or the housing and communal services have the right to launch a debt restructuring procedure. Moreover, this procedure can be carried out both through the court and in the form of a private agreement between the tenant and the housing service.

Since a mortgage loan has a number of features, the restructuring of mortgage debt, as a rule, takes place according to slightly different rules than for short- or medium-term lending, which are spelled out in Law No. 373 of April 20, 2015 “On the basic conditions for the implementation of the assistance program... for mortgage housing loans "

This is interesting: Can Bailiffs Seize a Savings Deposit?

Who can apply for debt restructuring

Revision of the terms of the contract for the provision of utility services or settlements is possible only under certain circumstances. The main reason is the financial situation, which does not allow timely payments for gas, water and heat supply. It is for this reason that most consumers are interested in whether it is possible to pay off the debt for light in installments.

The owner or tenant of an apartment has the right to initiate the conclusion of an installment agreement if the following circumstances arise:

- long-term illness or disability;

- loss of a breadwinner and lack of sources of income for other residents;

- job loss and long-term inability to find work;

- maternity leave or family problems;

- a large number of loans and the inability to pay them.

All circumstances require documentary confirmation. Evidence may include income certificates, work records, birth/death certificates, extracts from an outpatient card and other documents.

Conditions for restructuring housing and communal services debts

Although the payment schedule under the restructuring agreement is drawn up taking into account the capabilities of a particular debtor, management companies try to comply with the principle specified in Art. 138. According to this article, monthly deductions from wages should not exceed 20% of the amount remaining after taxes. Under these conditions, the consumer will be able to easily repay debt and pay current bills.

There are often cases when, when concluding an agreement to revise payments, the previously accrued penalty is written off:

- taking into account the proportionality of the principal debt and the penalty, established by Art. 333 Civil Code of the Russian Federation;

- when applying the limitation period, according to Art. 196 of the said act.

As a rule, when determining the conditions for debt restructuring, management companies take into account the following circumstances:

- the period of non-fulfillment of obligations;

- dishonesty of consumer actions;

- ratio of the amount of debt and penalty;

- the financial ability of the debtor to pay the amounts under the contract and current payments.

It is worth noting that restructuring the debt for housing and communal services for a dysfunctional family is impossible, because in an atmosphere of conflicts, parasitism, abuse of alcohol and drugs, or addiction to gambling, compliance with any agreements is doubtful.

In this case, the debt is collected in court. Consideration of claims for the collection of debts on utility bills up to 500,000 rubles takes place by order, without calling the parties, in accordance with Ch. eleven .

In this regard, before submitting an application for concluding an agreement, it is worth checking the information on the collection of the amount provided by the official website in the Russian Federation. If enforcement proceedings have not been initiated, you can contact the resource supply organization and apply for an installment plan.

Restructuring of debt on utility bills

Conclusion

- Application of psychological influence on the residents of the house by placing the amount of debt on a special stand. All citizens passing by will see the initials of the owner, as well as the amount of debt.

- Application of penalties - penalties, penalties. They have the right to accrue for each day of late payment. In a few months, this may become an unsustainable figure for a Russian.

- Complete refusal to provide services (if possible). Management company employees have the right to turn off the valves. Thus, the citizen finds himself in a difficult situation.

- The management company has the right to transfer, by agreement, the obligation to collect the debt to a collection agency. Today there are a lot of such companies, and their employees are afraid of exceeding their powers. Russians often complain about the illegal use of force or other measures of pressure by debt collectors.

- The most severe method (rarely used in practice) is eviction from the living space. Instead, they may be given housing of a smaller area or nothing at all.

- the calculation of the limitation period is based on the decision of the court - this is why utility companies are in no hurry to go to court with a demand for debt payment;

- if the debtor pays some part of the amount, recognizing the existence of the debt, the countdown resumes from the date of payment;

- Housing and communal services structures do not have the right to enter the amount of debt into current accounts.

According to government decree No. 354, adopted in May 2011 and defining the relationship between the population and organizations providing public services, the latter must be paid no later than the tenth day of the following month after the reporting month. Read resolution No. 354 .

We recommend reading: How to obtain a certificate stating that during the Chernobyl accident you lived in an area recognized as the Chernobyl zone

Who can apply for restructuring?

Considering that the solvency of the population does not always allow for timely payment of debts, utility companies are forced to agree to deferred payments in order to receive their money later and in parts, rather than being left with nothing at all.

Since relations between suppliers and consumers of housing and communal services are regulated by agreement, they are no different from a legal point of view from other types of interaction between market participants. This also applies to the limitation period, which, according to Article 196 of the Civil Code of the Russian Federation, is three years. This means that the utility debt is not payable if 36 months have passed since its formation.

- cases of deliberate failure to make payments due to the low quality of services provided or disagreement with current tariffs;

- a sharp decrease in income due to job loss or other problems;

- personal factors: serious illness, shift work, etc.

Is it possible to appeal a refusal to restructure utility debts?

Article 155 of the Housing Code of the Russian Federation establishes deadlines for making payments. The money must arrive no later than the 10th day of the next month: for August - before September 10, for March - before April 10, and so on. The same article provides for the right of the management company to charge penalties if payment is not received within 30 days after the due date. The amount of penalties is 1/300 of the refinancing rate of the Central Bank of the Russian Federation, penalties are added to the amount of the debt and make it even larger.

In order for restructuring to be carried out, it is necessary to prove that there is a serious problem in the family or the payer. Such evidence can be certificates from the hospital, a work record book with a record of dismissal, or a death certificate of a close relative. The reasons may be different, but they must be compelling.

The difficult economic situation in the country, unemployment, the difficult financial and material situation of individuals and legal entities leads to the loss of the payment function, and, as a result, an increase in debts on mandatory payments. The most pressing and frequently discussed issue in society is the issue of repaying utility debts. An option to resolve this issue is to restructure the housing and communal services debt, which has its own advantages and disadvantages.

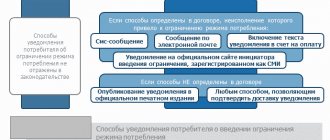

The procedure for drawing up an agreement to revise the terms of debt payment

It is advisable to clarify all the details of how to properly restructure the housing and communal services debt with the management company or resource supplying organization. But in most cases, after considering the application and making a decision on installment payments, the tenant is offered to enter into an agreement containing a new payment schedule, installment period and payment method.

Documents for obtaining installments

The main document for making a decision on debt restructuring is a statement, to which should be attached:

- identification;

- certificate of family composition;

- a certificate of the amount of debt or readings of measuring instruments;

- document on official employment or work book confirming dismissal;

- family income certificate;

- in case of illness - a certificate of the need for treatment;

- confirmation of the right to reside in a residential premises: rental agreement, social lease or certificate of ownership.

Typically, all documents, except certificates of family composition, income and employment, are provided in the form of copies.

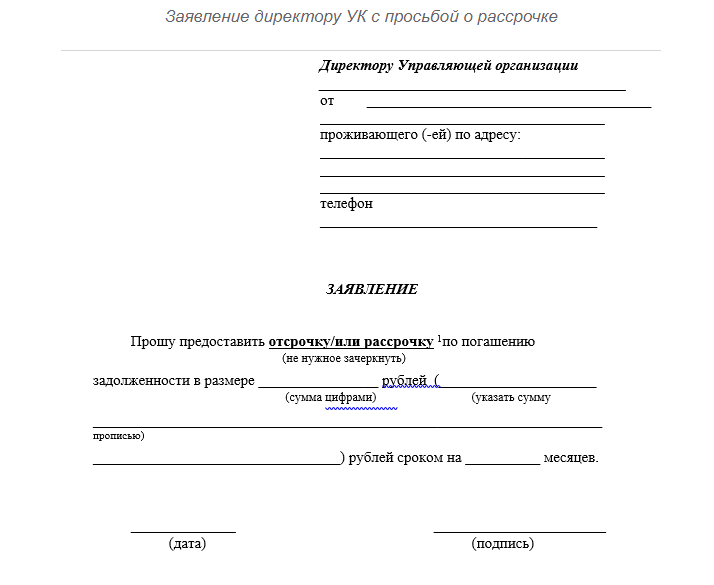

Application for concluding an installment agreement

There is no established application form for applying to the management company with a request for installment payment of the debt amount. But any written appeal must comply with the requirements of Art. 7 and contain the following data:

- name of company;

- Full name, address and telephone number of the applicant;

- reason for contacting and a brief description of the situation;

- proposal of terms and conditions for installment plans;

- signature and date of the application.

The specified documents are attached to the application, after which it remains to wait for the decision of the Criminal Code and the invitation to sign the contract.

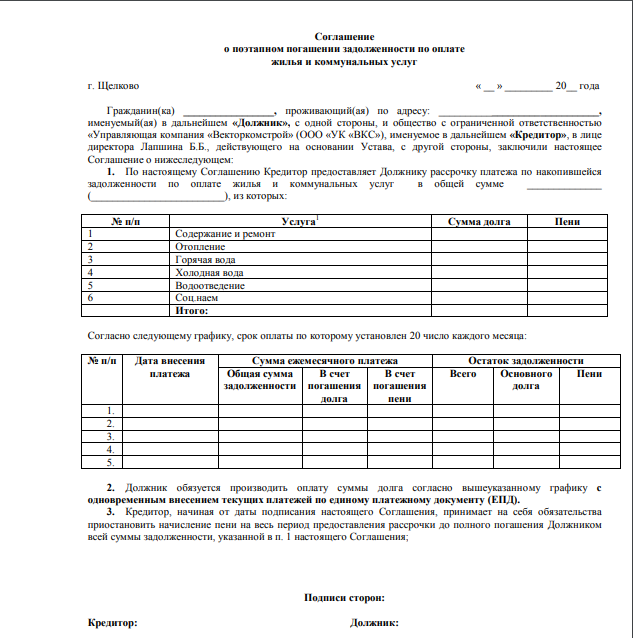

Debt restructuring agreement

If both parties are satisfied with the terms of the installment plan, they sign an agreement that contains:

- details of the company and the debtor;

- detailed information about the occurrence of debt, amounts written off and planned repayment of the balance;

- new payment schedule;

- liability of the parties in case of violation of obligations under the contract;

- duration of the agreement.

The main obligation of the resource supplying organization is to provide utilities in full, and the tenant’s is to timely pay current payments.

The document is drawn up in two copies having equal legal force. One is received by the debtor, the other by the service provider. From the moment the contract is concluded, the debt is no longer such and the accrual of penalties for the specified amount ceases.

Restructuring of debt for payment for electricity

Debts for utilities can grow like a snowball, especially during the heating season. In order not to be included in the lists of malicious defaulters, to prevent litigation and not to lose your property, you need to take measures. EtCetera will tell you how you can pay utility providers gradually and relatively painlessly for the family budget. Ukrainians are accumulating huge debts.

We recommend reading: Benefits Single Father of Many Children

How to apply for an installment plan for a debt to pay for electricity in Kyiv in 2020

According to the National Encyclopedia of Construction ProfiDom. As the Domik portal learned. This norm is prescribed in the Rules for the Use of Electrical Energy for the Population. The company reported that when applying, the consumer must present the following documents:.

Write-off of debts for housing and communal services after bankruptcy occurs at the request of the owner with the attachment of a bankruptcy court ruling. Documents must be submitted to all organizations to which there is a debt for housing and communal services.

- You can also find out the debt for housing and communal services by visiting the State Services website gosuslugi.ru. After logging into your personal account on the website, you need to type “Payment for housing and communal services” and select a service provider. Then you enter your personal account number and you can see the accruals. After the first payment or repayment occurs on the site, this personal account will be linked to the profile of the owner of the personal account.

- It is impossible to find out debts in the housing and communal services sector by last name and address, since this information is personalized and related to the owner.

Debt write-off options

To be sure that there is no debt, you need to make a list (register) of all services provided and contact each of the organizations. The exception is for services included in the general receipt.

- passport;

- certificate of family composition;

- certificate of debt on utility bills;

- work book confirming the fact of dismissal;

- family income certificate;

- certificate of ownership or social tenancy agreement;

- a medical certificate in the presence of any disease that prevents work.

The application for restructuring is written in the official name of the management company. Next, you need to provide your personal data and information about the amount of debt. It is necessary to explain in detail the reasons for delays and the dates of their occurrence.

Debt restructuring procedure in 2020

An agreement is drawn up in 2 copies . Among other things, it may contain provisions protecting the rights of the management company. For example, if the debtor sells the home, the management company will have the right to demand the full amount of the debt from him.

A one-time and small delay in housing and communal services will not entail serious consequences. However, if the debt accumulated over several months or years amounts to tens or hundreds of thousands of rubles, owners and tenants will have serious problems. One of the options for protecting rights is restructuring, i.e. redistribution of debt payments for a certain period.

Positive aspects of debt restructuring

The main advantage of concluding an installment agreement is the opportunity, even if there is debt, to apply for benefits or a subsidy to pay for housing and communal services. This rule is established in Art. 160 of the Housing Code of the Russian Federation and states that compensation for expenses for payment of residential premises and utilities is provided in the absence of debts or the conclusion and implementation of agreements for its repayment.

Other benefits of restructuring include:

- uninterrupted provision of energy supply, heat supply and other services;

- settlement of the dispute peacefully;

- the ability to minimize the amount of debt and write off penalties.

The agreement also has negative sides: confirmation of the amount of debt and the inability to challenge it, as well as an extension of the statute of limitations.