Features of registration of a mortgaged apartment in ownership

Content

By purchasing an apartment using the funds from a mortgage loan, the borrower immediately becomes its owner (Article 1 of Federal Law No. 102), but still cannot fully dispose of his housing. Until all borrowed funds are returned to the bank, the apartment is pledged and the borrower is limited in his actions (Article 11 of Federal Law No. 102).

Limitations of the borrower's rights

The mortgage loan payer has the right to live in the purchased apartment, repair it and use it for the needs of his family. However, there are a number of restrictions on some actions that the owner cannot perform without the permission of the mortgagee:

- registration in the apartment of persons who are not co-borrowers or co-owners;

- alienation of residential premises;

- apartment redevelopment;

- concluding a rental agreement;

- assignment of rights under a mortgage agreement (Article 38 of Federal Law No. 102).

All these restrictions apply until the mortgage loan is fully repaid and the encumbrance on the pledged property is removed.

To whom can property rights be registered?

The owner of an apartment purchased with a mortgage may be one or more persons:

- The borrower can register ownership solely. If he is married, then the apartment will be considered joint property of the spouses.

- Co-borrowers have the right to become homeowners. Co-borrowers are usually the spouse, parents or other relatives of the borrower.

- Minor children must be included among the co-owners if, in order to purchase an apartment, residential premises of which they were the owners were sold.

Co-borrowers, by agreement among themselves, may decide to register ownership of only one of them and not exercise the right to become co-owners of the residential premises.

Ownership of a resale apartment

Registration of ownership of an apartment purchased on the secondary market is carried out immediately after signing the purchase and sale agreement according to standard documents, as well as confirming the pledge of property. At the same time, the ownership of the new owner of the apartment is registered and a note is made about the encumbrance in the form of a pledge from the bank.

Information about the encumbrance will be contained in the extract from the Unified State Register until the mortgage is repaid.

Ownership of an apartment in a new building

The borrower can register ownership of an apartment in a house under construction only after it has been put into operation (Article 16 of Federal Law No. 214). Several years may pass between the execution of a share participation agreement in construction, a mortgage agreement and the registration of property rights.

After transferring a real estate property to a participant in shared construction under a transfer and acceptance certificate, he can deal with the registration of ownership rights independently or entrust the solution of this issue to the developer.

When an apartment becomes a property with a mortgage

According to the law, real estate can be registered as shared ownership with the definition of shares between the parties, regardless of whether it will be purchased for cash or with a mortgage, or whether the parties are in an official or civil marriage. In the loan agreement, the parties will have the status of co-borrowers, obligated to share mortgage payments.

Obstacles can only arise from banks that do not want to take on risks in the event of a breakup of a couple that has not officially legalized their relationship, where one of the parties is insolvent and unemployed. It is not recommended to register property and a mortgage loan only in the name of an unofficial spouse. Since in the future he may challenge the rights of the second spouse, who does not officially make contributions to repay the mortgage loan and does not have a common budget with him.

At the moment, the issue of equalizing the rights and obligations of spouses in a civil marriage with officially registered ones is being resolved at the legislative level, but this issue has not yet been fully resolved.

In such relationships, there are no rights and obligations of the spouses, and there is no regime for joint property of the spouses. Banks do consider the income of borrowers and their spouses, but it is worth considering that an apartment purchased during an official marriage will a priori be considered joint property. It is worth noting that many banks ask to remove insolvent spouses from the list of legal holders through a prenuptial agreement.

Shared ownership in your case is possible only by signing an agreement on the division of property or another way of determining shares. The purchased apartment will be pledged to the bank, therefore various types of actions related to the property require obtaining consent from the mortgage institution. In essence, the solution to the issue goes into the framework of a trust relationship - the common-law husband can be given shares in the apartment after the mortgage is repaid.

Personally, in my experience, the first option is better: you buy an apartment in common joint ownership, and in case of unpleasant circumstances, half is definitely yours.

Everything is more transparent here: we took out a mortgage together, became owners together, and pay it off together. There is also a backup option - take one of your parents’ relatives as a co-borrower, for example, and register some part of the apartment in his name. As a rule, when purchasing an apartment with a mortgage, the property is registered as the property of the person who is the borrower of the funds.

To register an apartment as the property of several persons, it is necessary that all these persons be co-borrowers. The possibility of including you as a co-borrower must be discussed with the bank where you plan to take out a loan.

When registering an apartment only in the name of your common-law husband, the apartment will become his personal property, and if the relationship between you ends, the possibility of allocating you a share of the apartment will depend only on his desire. Provided that the second spouse acts as a co-borrower or guarantor for the loan, it is possible to register it as joint ownership without defining the shares or as shared ownership with the shares defined.

It is also possible to register the borrower as the sole owner; the title owner will be one spouse. In a situation where the title owner is one of the spouses, the apartment will be jointly owned by force of law. To understand which registration option is possible, you need to familiarize yourself with the bank’s position, since each bank has its own requirements for real estate registration and borrowers.

If it is necessary to take into account the contribution of the personal funds of one of the spouses to the purchased apartment, you can use the option of concluding a marriage contract, which is subject to mandatory notarization.

Accordingly, the parties can foresee the legal consequences of a particular transaction in advance, before acquiring property. If you and your husband are married, then regardless of who the apartment is registered to, it is your joint property.

Since usually the title borrower of the person in whose name the apartment is registered is the spouse who officially works. I would also like to note that if the amount of the down payment is your personal, then in case of divorce it is worth insuring yourself and drawing up a donation agreement for this money specifically for you, for example, from your parents.

Then, in the event of a divorce, you will have proof that a third of the apartment was purchased with your personal savings, which means that only the remaining part will be divided in half. When a borrower buys an apartment using a classic mortgage scheme, it immediately becomes his property, remaining pledged to the bank.

Accordingly, the apartment owner acquires three rights: use, ownership and disposal of his property. Registration and moving in of third parties As for the right of use, the borrower can freely live in the apartment and move in third parties into it, however, notifying the bank of all persons whom he wants to move into the apartment.

Because both the borrower and all the persons moving in with him will be responsible to the bank for the safety of the apartment, which means the bank should know about everyone living in it. This procedure is purely for information purposes; the bank will not check the moral character or law-abiding behavior of your residents.

A number of banks, in order to once again remind borrowers of this obligation, offer the borrower to sign a separate agreement when concluding a mortgage transaction, in which the borrower undertakes to agree with the bank on the circle of people whom he intends to accommodate in the apartment. Occasionally, banks impose restrictions on borrowers, allowing, for example, only family members to move into an apartment purchased with a mortgage.

By the way, if among the bank’s conditions there is a ban on people who are not your relatives moving into the apartment, this does not mean a simultaneous ban on registering third parties in it. According to the new housing legislation, registration in an apartment, temporary or permanent, does not give rise to the right to use it.

But you will also have to notify the bank that you are going to register someone in your living space. Sale, will and donation But the right to dispose of the apartment of the borrower who has taken out a mortgage loan is limited due to the fact that the apartment is pledged to the bank until the loan is fully repaid.

This is important to know: How to register a municipal apartment after the death of the tenant

More precisely, there are no legislative restrictions for this, but until a procedure for selling apartments purchased with a mortgage has been developed, banks usually do not agree to this. This will be a secondary pledge, since the apartment is already pledged to the bank that issued the mortgage loan. But, firstly, the consent of the creditor bank that issued the mortgage loan will be required, and secondly, the big question is whether another bank or other institution will agree to become the second lender in line if the borrower is unable to pay off its obligations.

You need to register ownership of a mortgaged home in the same way as in relation to other purchased real estate. This is how mortgage loans differ from other ways of resolving the housing problem, in particular from housing and savings cooperatives. Participation in the latter implies that the housing remains the property of the enterprise until the cost of the property is fully paid.

The bank's permission will be required to register registration of unauthorized persons who are not co-borrowers or co-owners. Most often, the purchased object becomes collateral, but existing real estate can also be used for collateral. What do you think about it? How to sell a share in a mortgaged apartment after a divorce. Obtaining ownership of a mortgaged apartment - Legal advice.

The right of ownership in a housing cooperative to an apartment, grounds for emergence and. Comments To register an apartment as the property of several persons, it is necessary that all these persons be co-borrowers.

Leave a review X What do you think about this?

Where to go to register property rights?

The body that registers the transfer of ownership of real estate is Rosreestr. However, you can submit documents for registration in different ways:

- You can register ownership of the purchased residential premises by contacting the Rosreestr branch. To avoid problems with queues and save your time, you can register on the State Services portal and select the date and time of your appointment in advance in your personal account on the Rosreestr website.

- You can also submit registration documents through any MFC office. You will have to wait a few days longer for the documents to be processed. The exact time of receipt of completed documents can be found on the MFC website by the number of the issued receipt or by calling the regional MFC hotline.

- If the purchase and sale agreement is subject to notarization by force of law, or the parties to the transaction have made such a decision, then after completing all the necessary actions, the notary himself can send the documents for registration to Rosreestr.

Required documents

To register ownership of an apartment purchased on the secondary housing market, the following documents will be required:

- passports of participants in the purchase and sale transaction;

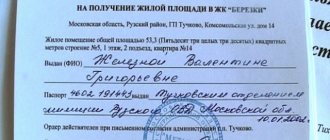

- application for registration of property rights;

- contract of sale;

- title documents for the purchased housing;

- extract from the Unified State Register of Real Estate;

- technical certificate;

- notarized consent of the spouse to complete the transaction;

- preliminary permission from the guardianship and trusteeship authorities (if minors were among the owners of the apartment being sold);

- mortgage agreement and pledge agreement;

- receipt of payment of state duty.

To register ownership of an apartment in a new building after putting the house into operation you will need:

- passports of participants in shared construction;

- agreement of shared participation in construction;

- deed of transfer;

- technical and cadastral passport of the house;

- permission to put the house into operation;

- a document confirming the assignment of a zip code and postal address to the property.

If the developer violates the terms of the DDU (for example, evading the signing of an apartment acceptance certificate), ownership can be registered on the basis of an appropriate court decision confirming the fulfillment of obligations by the participant in shared construction and his actual right to the acquired property.

How to register ownership of an apartment after a mortgage

There are some conditions for obtaining a state certificate of ownership of square meters in new buildings and secondary real estate. Initially, the developer who presented the property for sale is also responsible for providing this opportunity.

Registration is possible if the developer:

- Has a drawn up protocol that distributes residential space and commercial zones on the territory of the building.

- I have already received a technical passport for this building from the BTI (Bureau of Technical Inventory).

- Has documentary permission from the municipal administration to put the premises into operation.

- I signed the transfer deed from the GAO (state architectural and construction organization).

- I have already registered the house in the cadastral register of Rosreestr.

- I took care of assigning a specific postal address and zip code to the house.

The home buyer must ensure that the developer has this set of documents:

- Request this package of documents at the head office of the construction company.

- Pay attention to the address of the developer indicated in the purchase agreement in the details section.

- Have with you a concluded agreement - either an agreement of equity participation, investment, or co-investment. It can also be any type of contract.

In some cases, the conclusion of the contract is delayed for a year or more. Sometimes the signing of documents is artificially delayed, so it would be useful to go to court. In addition, developers can initiate a lawsuit themselves and encourage apartment buyers to do so - this will help save time on drawing up an agreement and speed up its conclusion.

The procedure for registering ownership of an apartment with a mortgage

The procedure for registering property rights in a mortgage transaction does not differ much from the standard one. The only difference is the need to interact with the bank to obtain the necessary documents at some stages of registration of the right.

Step-by-step algorithm of actions

When the purchase and sale agreement for an apartment has already been signed by the parties, a full package of documents has been prepared, the following actions must be taken:

- Decide which method is more convenient to submit documents for registration.

- Make an appointment and submit documents at the appointed time.

- Receive a receipt for documents acceptance.

- On the appointed day, receive a registered agreement and an extract from the Unified State Register of Real Estate.

- Provide a bank statement to transfer funds to the seller.

The document confirming the transfer of ownership will be an extract from the Unified State Register of Real Estate. It indicates the new owner of the residential premises, as well as a mark on the encumbrance of the property.

After registering ownership of an apartment in a new building, the documents received from Rosreestr must be submitted by the participant in shared construction to the bank to register it as collateral. It will also be necessary to evaluate the apartment to determine the market value and insure the home in accordance with the requirements of the mortgage agreement.

Deadlines and costs

The timing of registration of an apartment directly depends on the chosen method of transferring documents for state registration:

| Through the Rosreestr branch | 7 days |

| - if there is a notarized agreement | 3 days |

| - if there is a court decision | 5 days |

| Through the MFC branch | 9 days |

| - if there is a notarized agreement | 5 days |

| Through a notary | 3 days |

Please note that deadlines are indicated in working days. The period for reviewing documents may be extended if additional documents are required.

The state fee for performing actions to register property rights is 2,000 rubles.

When does an apartment become a property with a mortgage?

Registration of ownership of an apartment through the MFC For the convenience of citizens, you can submit documents for registration of mortgage housing not only through Rosreestr, but also through the MFC. By submitting documents to this authority, the applicant saves time because he does not have to stand in line. True, the process of decision-making and preparation of documents here is delayed, since at the MFC employees only accept documents and then send them to Rosreestr. The MFC performs intermediary services. How many days does it take to register ownership of an apartment under a mortgage per year? Dear readers!

According to the law, real estate can be registered as shared ownership with the definition of shares between the parties, regardless of whether it will be purchased for cash or with a mortgage, or whether the parties are in an official or civil marriage. In the loan agreement, the parties will have the status of co-borrowers, obligated to share mortgage payments. Obstacles can only arise from banks that do not want to take on risks in the event of a breakup of a couple that has not officially legalized their relationship, where one of the parties is insolvent and unemployed. It is not recommended to register property and a mortgage loan only in the name of an unofficial spouse. Since in the future he may challenge the rights of the second spouse, who does not officially make contributions to repay the mortgage loan and does not have a common budget with him.

How to remove the encumbrance after paying off the mortgage?

Once the mortgage loan is fully repaid, the encumbrance on the collateral property is not automatically removed. To do this, the owner of the residential premises must take the following actions:

- obtain from the bank a certificate of payment of the mortgage loan and a mortgage note with the appropriate mark ();

- submit to Rosreestr the documents received from the bank, the mortgage agreement and a joint application with the mortgagee bank to remove the encumbrance ();

- after the encumbrance record is cleared, receive an extract from the Unified State Register of Real Estate.

The application must be written by all owners, or by one of them if there is a notarized power of attorney from the other owners. The procedure for removing the encumbrance takes on average up to 3 working days.

With a military mortgage

When removing the encumbrance from an apartment purchased with a military mortgage, it is necessary to take into account that its mortgagee is not only a credit institution, but also the state represented by the Ministry of Defense of the Russian Federation (Article 15 of Federal Law No. 117). Restrictions on the disposal of such property will be the same as with a regular mortgage.

The borrower acquires ownership rights at the time of registration of the transaction in Rosreestr. However, it can only be registered in the name of a borrower who is a participant in the savings mortgage system, since state funds are earmarked. The borrower's spouse will have no right to this property in the event of divorce.

The bank's encumbrance is removed after the mortgage loan is fully repaid. But if the borrower is dismissed from service early, then, depending on the circumstances of the dismissal, he has the opportunity to repay the mortgage with his own funds, while removing the encumbrance imposed by the state.