After submitting an application for a mortgage at VTB 24, the most exciting period begins - waiting for the bank’s decision. The time it takes to make a decision depends on many factors, but if the borrower has a positive credit history and stable income, there should be no problems. Experts recommend contacting the bank with a pre-selected property. This will make it possible not only to speed up the procedure, but also to receive preliminary consultation regarding the compliance of the selected housing with the bank’s requirements.

What can affect the bank's consent?

Content

When issuing loans, banks carefully select applicants and approve loans only to solvent citizens. The goal of a financial institution is not just to get your money back, but also to make money.

The period for consideration of the application by VTB 24 and the final decision of the bank is affected by:

- the type of real estate chosen for purchase - the bank is not interested in the value indicated in the purchase and sale agreement, but in the real market price of the property. The more liquid the property (the one that can be sold quickly and profitably), the higher the likelihood of getting “real” money for it;

- The age of the borrower must not exceed the threshold at the time of repayment of the mortgage; as a rule, it is equal to the pension age and is equal to 55 years for women and 60 years for men (in 2018). The exception is military pensioners. The minimum age at VTB is 24 – 21 years;

- work experience - the bank must be confident in the stability of the borrower;

- marital status - borrowers with children can count on government support and use it to partially repay the debt;

- the use of maternity capital or other government support measures as a guarantee of solvency;

- the amount of the down payment - the larger this amount, the more likely it is to get approval;

- The region of residence of the borrower is taken into account to calculate the amount that should remain in the family after paying off the loan obligation (at least one subsistence minimum for each family member). Each region has its own cost of living for different categories of the population.

To increase the likelihood of receiving a mortgage loan, a potential borrower, in addition to the main package of documents, can provide other documents.

Required documents

The main package of documents includes an application, a questionnaire, as well as originals and certified copies:

- Russian Federation passports;

- work book;

- 2-NDFL certificates.

If salary certificates and employment contracts are drawn up in free form, it may take more time to verify them.

An additional package of documents may include:

- education diplomas;

- information about additional sources of income, for example, deposits or rental housing;

The process of purchasing a home using loans from VTB 24 Bank may also depend on the chosen mortgage program:

- housing in a new building or on the secondary market;

- lending for the purchase of a large apartment;

- secured by other real estate;

- mortgage loan refinancing;

- preferential mortgage lending with government support;

- housing for military personnel;

- acquisition of collateral real estate owned by the bank.

Each program has its own nuances that need to be considered together with the loan officer.

Important to remember!

All documents and certificates have a validity period, so Form No. 9 (certificate of registration in residential premises) is valid for 10 days, a certificate of income is valid from 10 to 30 days, a document from the Pension Fund is valid for 30 days.

Required documents

To apply for a mortgage at VTB, you must provide a standard package of primary documents. It includes the following papers:

- application for a mortgage loan;

- Russian passport;

- marriage registration certificate;

- children's birth certificate;

- education document;

- another document that confirms the identity of the borrower;

- employment contract;

- employment history;

- certificate from the place of work about the amount of income;

- a certificate indicating the presence of additional sources of income.

As mentioned above, this is a standard set of papers. But you need to be prepared for the fact that the bank may request other documentation. For example, a certificate of ownership of real estate or an extract from the borrower’s account.

After purchasing a mortgaged home, you need to provide a secondary package of documents to the VTB branch. It includes title documents (transfer and acceptance certificate, contract, checks), technical documents, insurance letter, photocopy of the seller’s passport (if we are talking about housing from the secondary market). In this case, the title documentation is subject to mandatory notarization.

How long does it take to get approved for a mortgage at VTB 24?

The timing of consideration of an application for a mortgage loan is very important for the borrower, since delays in processing time may cause refusal by the seller of the property.

The maximum period for which applications for a mortgage are considered can be up to 10 working days; usually VTB 24 Bank makes a decision in 1-5 days (except weekends and holidays). It depends on the following factors:

- whether the borrower has been serviced by this bank before;

- whether there are open accounts in a financial institution, participation in a salary project;

- borrower's credit history;

- the nature of the documents provided to the bank;

- attracted co-borrowers and guarantors.

When choosing a financial institution, clients take into account the following facts:

- interest rate;

- lending terms;

- How long does VTB 24 bank consider an application for a mortgage?

To ensure that the period during which a mortgage application is considered is minimal, care must be taken to ensure that all documents are as correct and truthful as possible. Bank employees conduct a thorough check of all data, make calls to the place of work and guarantors. All received data is analyzed by a credit inspector, who makes a conclusion about the client’s reliability.

Stage 2. Final approval

Here, a personal visit to the bank is mandatory; a specialist will accept your package of documents and check their authenticity and relevance. How long does it take to process a mortgage application at VTB at the stage of studying all the documents?

Recommended article: Conditions for refinancing a mortgage at VTB

The bank will do a full check and analysis of your data. The final decision takes 3-5 days - this is what the bank promises. But how long does it actually take to get a mortgage approved at VTB? Often the period can be seriously delayed if some problems arise. Let's understand the nuances of the process.

What does the bank check?

The bank checks the borrower in several areas. The bank's credit and legal services and security services participate in the verification. What's important:

- An important point in the VTB mortgage approval status is the state of the applicant’s credit history (CI). If the CI check during scoring was successful, then the bank specialist will additionally check the presence and nature of delinquencies and other parameters of previous loans;

- information about the applicant’s income for the last six months (), as well as the existence of obligations to confirm income and expenses, are very carefully checked;

- the bank can make requests to the Pension Fund, the Migration Service, the Tax Service, the Bailiff Service (data on writs of execution and unpaid fines);

- The bank's security service uses special customer databases to check the borrower's data, the accuracy of income certificates (), information about the employer, the borrower's criminal record, information about the seizure of accounts, and others.

A thorough check may take up to 10 days, and if errors or inaccurate data occur, the period may be significantly delayed. Therefore, there is no clear answer to the question - how long does VTB Bank consider an application for a mortgage?

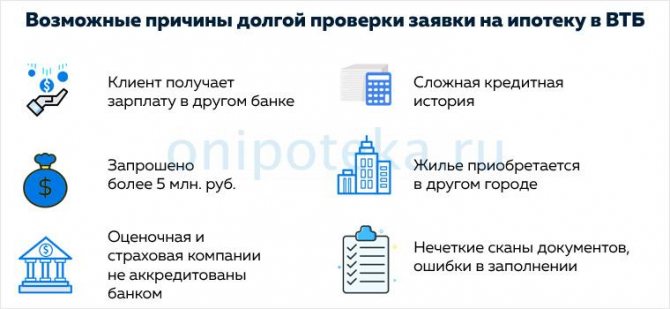

Why is a long review possible?

The bank assures that the decision will be ready in 3-5 working days, but most often this period is longer and can take 3-4 weeks.

Why does VTB take a long time to consider a mortgage application:

- depends on the client's status. It takes literally one or two days for a salary client to be approved, since the bank knows his income and reliability. For other clients, the scope of the review can significantly increase the time required to prepare a solution;

- The approval period may be extended for clients wishing to receive a loan of more than 500,000 rubles. There will be additional checks here;

- the deadline may also be delayed for applicants who use the services of appraisers or insurers not accredited by the bank;

- The type and quality of the documents submitted are important. If there are expired certificates, incorrect data, errors or typos in documents, this can lead not only to an increase in the decision period, but even to a refusal (the validity period of mortgage certificates is in another article);

- the already mentioned credit history of the borrower will also seriously affect the approval period;

- The purchase of real estate in another locality may also affect the approval period.

The difference in approval times also depends on the chosen mortgage program.

The borrower can receive approval within 24 hours if he chooses an exclusive program based on two documents Victory over formalities.

How to find out the status of an application for a VTB mortgage

The standard response option from the bank is an SMS message to the phone number you specified when filling out the application form. If the solution is ready, the client will know about it immediately.

But if within a week you have not received a decision on your application from the bank, it’s time to act and find out the status of your VTB mortgage application yourself. What options exist here:

- you can call the bank's phone number 8-800-700-24-10;

- leave a request to customer support. The application form can be found on the website;

- you can call the manager who helped you fill out the form (if you have his phone number);

- Log in to VTB Online Internet banking. You can enter your login and password, go to your personal account and there you can see if the solution has come to the specialists.

The answers to the question - how long does VTB consider an application for a mortgage - are interesting in customer reviews on social networks and forums. Opinions, of course, are different, but many are dissatisfied with the long wait.

Deadlines for re-submitting a mortgage application (if your application is rejected)

If you receive a refusal from VTB on your mortgage application, do not despair. The attempt can be repeated, but when? And how many days does VTB review the mortgage application again? This usually takes about the same time or a little less (if there are fewer checks).

The bank has set a deadline for re-application. After refusal, the client has the right to re-apply for a VTB mortgage after 90 calendar days.

Do I need to reapply?

You may be lucky and the bank will change its credit policy during this period.

Let's give an example . The bank refused you a mortgage because you were in arrears on your previous loan. A little later, the bank changes its credit policy, and a small delay in the previous loan becomes acceptable. And when you resubmit your application after 90 days (even without changing or improving anything), it may be approved, since your slight delay is already acceptable. But this is a happy accident.

How to increase your chances of approval

In general, banks are not obliged to explain the reasons for refusal and usually do not try to do so (). The borrower can only try to understand what exactly led to the refusal.

The following actions are usually recommended to increase the likelihood of mortgage approval at VTB:

- improve your credit history. For example, take out small microloans several times and carefully pay them off;

- attract guarantors, co-borrowers with a high stable income;

- provide documents confirming the client’s additional income;

- increase income (basic salary or additional income).

If you have not found the reasons, you do not understand why you received a refusal, you can turn to the services of credit brokers.

If you are refused again, you can contact another bank, since banks have different credit policies.

How will the institution communicate its decision?

When the consideration of the possibility of issuing a mortgage is completed and a decision on a specific application is made, a bank employee makes a personal telephone call to the applicant. If the client indicated in the questionnaire another method of notification: an SMS message or an e-mail, then the bank’s decision will be reported in this way.

After receiving the notification, the borrower must come to the bank branch to obtain more detailed information about:

- loan term;

- interest rate:

- loan size.

If a citizen is a client of VTB-24 bank, then he must have a personal account on the VTB24 online website. It will not be difficult to obtain information about the bank’s decision in your account.

If the bank does not get in touch for a long time and is delaying deadlines, you can call the hotline back or visit the branch yourself. A possible reason for the delay may be the high workload of bank employees.

How to speed up mortgage approval at VTB 24 Bank

To speed up VTB approval, use these tips:

- In the form, please provide more information about yourself.

- Provide complete and accurate information in your application.

- Confirm your income: main and additional income.

- Collect a complete package of documentation.

- Meet the mandatory requirements of VTB Bank.

- If the review is delayed, remind yourself.

- Provide collateral whenever possible.

If you follow several recommendations at once, the bank will give a preliminary answer faster.

How long does mortgage approval last?

Many clients are interested in how long a mortgage approval received from VTB 24 is valid. This information is important for borrowers, since they need to have time to select a suitable property and determine their financial capabilities. In various financial institutions operating in the Russian Federation, this period ranges from 60 to 120 calendar days.

The validity period of a mortgage decision at VTB 24 is 120 days. During this period, the borrower must decide whether he will use borrowed funds from a specific bank to purchase square meters. The decision to issue a loan at VTB is made within 3-4 days, and to refer a credit expert to a consultation, you need to fill out a form on the financial institution’s website.

If the borrower changes his decision regarding raising mortgage funds, or finds more favorable lending conditions in another bank, he can cancel his application.

Decision notification

When submitting an application on the website (and when visiting a bank office too), the client provides a valid cell phone number, as well as an email. This number will receive a call from the credit manager as soon as VTB makes a decision to issue a loan or refuse it.

Moreover, if the form is filled out on the website, the manager calls back almost immediately to clarify the details. For information about the paper version of the application, read the article “Sample application form for a mortgage at VTB and instructions for filling it out.”

There is no way for a borrower to find out about VTB’s decision on a mortgage application via the Internet, since the bank does not maintain a unified database of applications. All that remains is to wait for information by phone. If a positive decision is made, the client will need to go to the mortgage branch of the bank with all the documents and sign an agreement.

Steps after a positive mortgage decision

Consider the steps of a client who received a positive response:

- Look for real estate.

- When you have found a suitable property, wait for it to be verified by the bank.

- Once the property is approved, conduct an appraisal.

- Submit all documents: your own and for the real estate.

- Insure real estate (if desired, health and life), draw up collateral (mortgage), mortgage and sale agreements.

- Make your first payment.

- Register the transaction in Rosreestr.

After receiving a mortgage from VTB 24, repay it in good faith.

I don’t even know how I can influence this situation... On August 1, 2017, I contacted the bank to get advice on mortgage lending, I’ll immediately note that I am a salary client of this bank , upon receiving the consultation they told me the deadline for reviewing the application and gave me a memo with a list documents and all necessary information about the terms of consideration and conditions of mortgage lending. The period for consideration of the application , both according to the employee and the one indicated in the memo, ranged from 5 to 15 working days. On August 07, 2020, I had already submitted a complete package of documents for consideration of an application for a mortgage at VTB 24 Bank (office in Magadan, Lenin St., 30), the application was accepted, they checked whether the complete package of documents was submitted, whether the forms and necessary certificates and were told to wait.

On August 23, 2020, this was the 13th working day of consideration of my application , I decided to call the VTB 24 bank hotline to clarify the progress of consideration of the application, since by that time there were no calls at all either to me personally or to my work, no one checked my documents. When talking with a female operator, it turned out that she did not see my application in the system at all, that is, my application “seems to not exist.” She suggested calling the local branch office and gave me a contact phone number.

On August 23, 2020, I called the local branch office with the same question about the progress of the application, to which I was told, I quote, “How long were you told for the processing time of the application? 15 working days? Is the 15th working day Friday? wait, the deadline hasn't expired yet"

Having called our local office again on Friday, August 25, 2020, at around 5:00 p.m. Magadan time, they told me “So what, today is the 15th working day, our working day ends at 7:00 p.m., so wait until at the end of the working day, they will call you.” Naturally, I didn’t expect any answer that day.

On Monday, August 28, 2020, when I called the bank office again, I was given the answer that today they would certainly tell me what was going on with my application. But no one ever called me.

On the morning of August 29, 2020, I called the bank office again, this time I asked for the phone number of the head of the lending department, since the issue was not resolved by ordinary employees. They simply forgot about me. Having called the head of the department, I received an answer that she would personally figure everything out and let me know. On the same day, after lunch, a young man from the audit department called me and the chief accountant from my work in order to clarify the information on the questionnaire and income certificate. He also clarified that today he will hand over the documents for further consideration. On the same day, a girl called me and said that at the local level they reviewed my application and pre-approved it, now all documents will be considered by the central office in Moscow, and also clarified that an additional certificate from work may be needed.

On September 05, 2020, I sent an additional certificate from work to the email of the credit manager who is handling my application. Calling the manager a week later, I was told that they were still waiting for a decision from Moscow. However, the manager found it difficult to answer how long we would have to wait.

On September 15, 2020, after fruitless calls on September 13 and 14 to my manager’s personal phone, I finally got through and heard the answer that there was still no decision on the application from the head office in Moscow and it was also unknown when I would be given an answer. In addition, she clarified that the additional document was registered as a new application; why it was a new application is completely unclear to me. Also, I received a suggestion from my manager that maybe you should simply refuse the application, since it has been under consideration for so long.

As of September 21, 2020, my application has been considered for 34 working days and to this day I have not received any response. Based on the above, I cannot rate the work of this bank higher than one.