It happens in life that people express a desire to give their property to another person, but such an expensive gift requires the execution of a number of documents so that the recipient can become the full owner of movable or immovable property.

Most often, the object of donation is an apartment, house, car, garage or land. You can also donate family and other valuables, rights and various types of property. It is worth knowing that donation does not provide for any obligations on the part of the recipient; under the gift agreement, the object passes to the recipient free of charge. You should not draw up a deed of gift if there is a verbal agreement on the future obligations of the offender, since he has the right not to fulfill them. Chapter 32 of the Civil Code of the Russian Federation regulates legal relations that arise in the process of donation, and the Donation Agreement itself is considered a unilateral transaction.

The list of documents that will be needed for a gift agreement must comply with the requirements of the Federal Registration Service; it may vary depending on the object of the gift. The documents for preparing a deed of gift for an apartment differ from the package of documents required for donating a car.

Documents for deed of real estate

Let's look at what documents are needed for a deed of gift for an apartment or house.

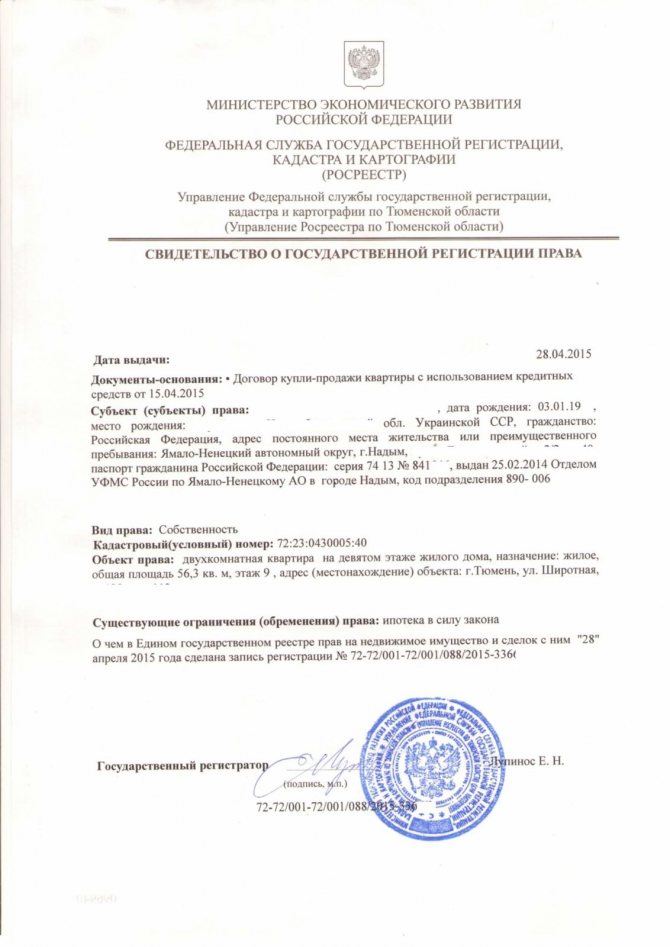

- Documents confirming the donor's ownership (sale and purchase agreement, inheritance document, etc.);

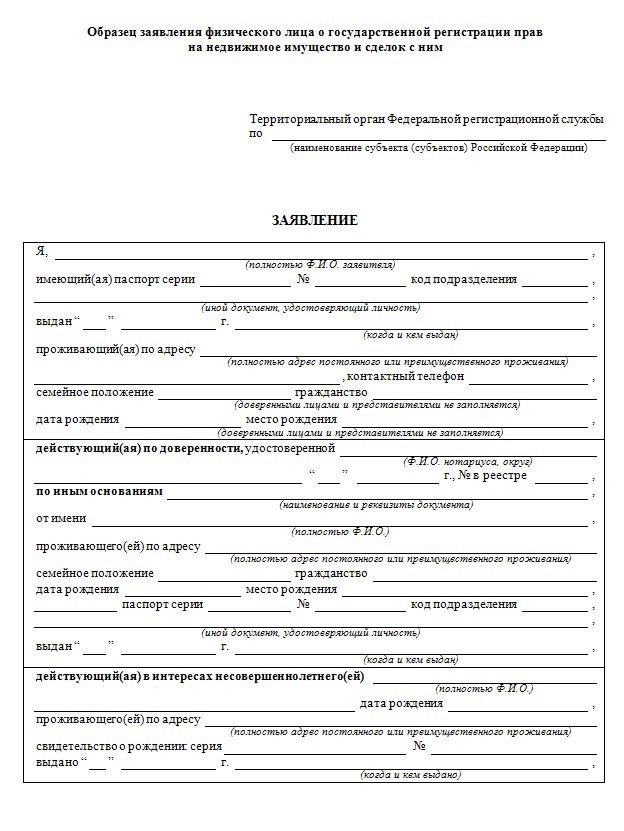

- Donor's application for transfer of ownership;

- Application of the donee for registration of property rights;

- Passports of the donor and recipient;

- An extract from the house register about the composition of residents in the alienated premises;

- Cadastral passport (issued by the BTI);

- Certificate from the BTI on the inventory assessment of housing;

- Receipt of payment of the state fee for registration;

- Donation agreement with a description of the subject of the donation (can be drawn up in writing with or without the participation of a notary);

- For married persons, the consent of the second spouse, certified by a notary, is required if the house or apartment was purchased during the marriage;

- If the house or apartment was purchased by the donor during the period when he was not married, then a corresponding notarial application is submitted;

- If children live in the house or apartment that is the subject of the donation, then it is necessary to obtain the consent of the guardianship and trusteeship authorities for the alienation;

- If one of the parties is under 18 years of age or incapacitated, then a guardian’s permission is required to complete the transaction.

- If a person is executing the agreement under a power of attorney, then an agreement on the fiduciary execution of the deed of gift (power of attorney) is required.

- All these documents must be submitted to the Office of the Federal Registration Service, where the transaction will be registered, and from the moment of registration the gift agreement comes into force.

- The donee will receive a certificate of ownership approximately one month from the date of submission of documents.

How to draw up a gift agreement in 2020

Regarding the rules for drawing up a gift agreement for its acceptance by Rosreestr, it is worth noting that today there is more than one form established by law, the most current of which you can download below. At the same time, each of them contains only basic points, without which specialists of the registration authority will not accept documents for registration of ownership rights.

In order to find out what other information needs to be included in the deed of gift so that it matches your specific situation, you can contact a notary or get a free consultation from experienced lawyers on our website by calling us or filling out one of the forms in the article!

Important : Although concluding a deed of gift in writing with the participation of a specialist is not in most cases a prerequisite in 2020, we note several cases when the agreement must be drawn up in this way.

Thus, when donating property to the donee, the value of which exceeds 3,000, or drawing up a preliminary agreement with a promise to transfer this property in the future, the parties must only draw up a written agreement. Moreover, if the object of the transaction is real estate, the deed of gift must not only be drawn up by hand, but also certified by a notary, who, after completing the transaction, will independently register the gift agreement in Rosreestr, or more precisely, register not the document itself, but the ownership rights of the new owner.

The list of mandatory requirements for a deed of gift today when drawing it up includes:

- Data from the passports of the donor and the donee;

- technical characteristics of the object of donation, as well as the description and address of the object (if real estate is being donated);

- the exact date and place of conclusion of the donation agreement;

- information about the owner of the property - on what grounds he acquired it (you must immediately refer to the title document attached to the package of documents);

- a note that the property being donated has not been seized, and it does not act as collateral for a loan, or the opposite if, for example, the donated apartment has a mortgage;

- confirmation of the fact that both parties are fully aware of their actions and accept the consequences of the transaction;

- if the role of the donee is a minor, a note is needed stating that his interests when signing the agreement are represented by a legal representative, who, as a rule, is one of the parents or guardian of the child;

- an indication of the exact time after signing the agreement that the agreement will come into force;

- signatures of each party or their representatives, if any.

EVERYONE NEEDS TO KNOW THIS:

Real gift agreement - what do you need to know about the transaction?

If, when drawing up a deed of gift, at least one of these points is ignored or omitted, the agreement will not have legal force!

Documents for registration of a deed of gift for a share of residential premises

You can also donate part of the housing that belongs to you as the owner or co-owner. When donating part of the joint property, you will need to obtain the consent of the other co-owners, which must be notarized. However, if part of a house or apartment is given to someone who is already a co-owner, then the consent of the other co-owners is not required in this case.

For example, if a spouse and their child live in an apartment, if the mother or father wants to give their share to the child, then the consent of the second spouse will not be required .

If the co-owner of the property is a minor, then without the consent of his parents or guardians, even part of such housing cannot be donated to another person.

Documents for deed of land

To issue a deed of gift for a land plot, the following documents will be required:

- Certificate of ownership of land;

- If the land plot was inherited, then a Certificate of inheritance rights to the land plot;

- If the land plot was purchased, then the purchase and sale agreement;

- If the land plot was received under a rent or lifelong maintenance agreement, then provide such an agreement;

- If the land plot was previously received by the donor under a gift agreement, provide this document;

- An agreement confirming the indefinite use of the land;

- An extract from the Unified State Register of Rights (USRP), providing information about the absence of arrest or prohibition on the transfer of a land plot;

- If a house is donated along with a plot of land, then an extract from the house register is needed;

- Extract from the technical passport issued by the technical inventory bureau;

- If the donor is married, then the consent of the second spouse is required, but only if the land plot was acquired by the owner of the property during marriage. The spouse gives consent in person (his presence or a document of his consent certified by a notary is required. In the event of the death of the second spouse at the time of registration of the transaction, a Death Certificate is provided;

- If children live on the plot that is being donated, then you need to obtain permission from the guardianship and trusteeship department to donate it;

- Receive a regulatory assessment of the land and a certificate of payment of all taxes and the absence of debt on them.

After signing and notarization of the gift agreement, it is registered at the Registration Chamber and the agreement on the transfer of possessions from the donor to the donee is registered.

Making a deal

Thus, in order for the contract to comply with the norms of current legislation, it must be drawn up in accordance with the established rules. However, while pointing out the mandatory requirements when drawing up a deed, the law does not indicate that the deed of gift must be drawn up exactly this way and not have additional clauses, the absence of which in certain situations, in itself, may become grounds for breaking the agreement. That's why it's better for the parties to contact a notary or get free legal assistance provided by our website!

At the same time, specialists can deal with both the execution of the contract and the support of the transaction in general. In any case, for this you will need to provide them with a package of documents required for the transaction and some other certificates, which we will consider below. Required on this list are:

- passports of the parties;

- title papers for the object of donation;

- cadastral and technical passports;

- extracts from the BTI, as well as house books and registers.

Simply put, the parties must have all the documentation in their hands that allows them to describe the condition of the object and the parties, as well as the situation in general.

Donation expenses - how much to pay in Rosreestr

An important part of the deed of gift are the costs of its registration. So, in addition to the fact that the parties will have to pay for notary services, the tariffs for which today are approximately the same for offices located in the same region, they will need to pay the established income tax, the amount of which is 13% of the estimated price of the donated object .

You can read about how much individuals and legal entities will need to pay when paying the state duty for a gift agreement in Rosreestr by clicking on the link. Please note that today, in most cases, you need to pay:

- 2,000 Russian rubles if the transaction was concluded between individuals;

- and 22,000 Russian rubles – for deeds of gift between legal entities.

Algorithm for completing a transaction

Lawyers consider the process of drawing up a gift agreement and its subsequent registration in Rosreestr in the form of the following step-by-step algorithm of actions:

- Obtaining the donor's consent to accept the gift from the recipient, as well as collecting the necessary documents, some of which require quite a lot of time to obtain.

- Drawing up the contents of a deed of gift, which is best entrusted to a professional notary who knows the specifics of this branch of law.

- Signing of an agreement by the participants (that is, parties) to the transaction, during which the donee, donor and notary must be present, confirming with their signature that the agreement was concluded in accordance with the standards established in the current legislation.

- Submitting documents to the relevant registration authority and waiting for a change in ownership of the donated object.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement for shares of an OJSC or CJSC between individuals and legal entities

Only after all the described stages have been completed will the donation be considered completed, and the object of the transaction will become the legal property of the donee.

Important : Perhaps it is worth recalling once again that the deed of gift itself is not registered in Rosreestr, and therefore, when drawing it up, the recipient only needs to check the accuracy of the information contained in it and certify it.

Notarial support of the transaction greatly simplifies the procedure. Starting in 2020, these specialists were allowed to register property rights obtained through the conclusion of deeds of gift. This means that the parties will only have to collect documents, formulate their terms and sign the agreement - everything else will be the responsibility of the notary.

Documents for registration

According to the current legislative framework of the Russian Federation, registration must take place based on the documentation provided by the applicant to the relevant government agency. For this reason, the collection of documents must be approached with all responsibility.

Remember that the absence of at least one of the certificates or extracts listed below may cause refusal to register property rights after the conclusion of the contract!

The list of documents that are mandatory for transmission to specialists of the registration authority in 2020 includes:

- Photocopies of all completed pages of the donor’s and recipient’s passports;

- a gift agreement, initially drawn up in at least 3 copies (one for each party and one for the registration authority);

- a corresponding application filled out in a form that can be obtained from a specialist of the registration authority;

- a notarized power of attorney for a person participating in the transaction instead of one of the parties (optional);

- papers confirming the legal ownership of the donor to the object of the transaction;

- diagrams, plans, passports, as well as other technical documents for the gift;

- an extract from the house register (it is recommended to receive this document at the very end - since it has a validity period of 30 days from the date of receipt);

- written consent of the second spouse, if the object being donated is part of the jointly acquired property;

- consent of a minor or his legal representatives, in cases where children act as the donee;

- written consent of persons who act as guardians of incapacitated citizen-donees;

- documentation confirming that there are no utility or other debts in the apartment;

- documents confirming the absence of restrictions and the fact that the object of the transaction does not act as collateral;

- receipts confirming successful payment of the state duty, the amount of which for individuals in 2020 is 2,000 Russian rubles.

In addition, in some cases, employees of the registration authority may request additional documents if they consider that the attached documentation is not enough to fully disclose the general situation.

Documents for deed of gift for a car

It is worth noting that the car that will act as a gift must be deregistered with the State Traffic Inspectorate.

The car donation agreement must be notarized.

If the cost of the car does not exceed an amount equal to ten minimum wages, then a donation agreement can be drawn up without notarization in the presence of witnesses who sign such an agreement. Of course, such an agreement will not be valid if a ban is imposed on the car due to the fact that it has not yet been paid off on the loan or for other reasons.

The donor must have ownership of the car he is going to donate.

After the deed of gift for the car is issued, it must be registered with the traffic police.

Registration procedure

When carrying out state registration, lawyers recommend that the donor and recipient take into account 3 main points:

- methods of submitting documents to the registration authority, of which there are many today;

- time to prepare the requested documents, some of which cannot be obtained quickly, and some of which have an expiration date (for example, an extract from the house register);

- order of registration.

EVERYONE NEEDS TO KNOW THIS:

Contents of a donation agreement to a temple or church

So, in 2020, each applicant for registration of ownership of an object of donation has the right to transfer documents in one of the following ways:

- Personal application to the MFC or registration authority. In this case, the party acting as the applicant independently delivers and transfers all the necessary documentation, after which it receives from an employee of the organization the corresponding receipt indicating the date of receipt of the certificate of registration of ownership.

- By email. Today there are many special websites, as well as the official portal of government services, where every citizen of the Russian Federation has the opportunity to enter the information necessary for registration by filling out forms and submitting an application. However, in order to maintain the legality of the actions, the applicant will need an electronic signature confirming the user’s application. This method is usually used by notaries, as it allows not only to save time, but also the client’s money due to the special price on this portal.

- Outdoor event. In addition to the methods described, citizens who want to register property rights in Rosreest have the opportunity to invite a specialist to their place, which requires additional payment, the amount of which, as a rule, depends on the region. Also, not every region offers such a service.

Each applicant has the legal right to use any of the listed methods, choosing his preferred method of registration.

Important : Also, the parties have the opportunity to make an appointment with Rosreestr by telephone or by visiting the authority in person.

As for the registration procedure, it is extremely simple and will not require much time or action from the applicant. After preparing the documents, you just need to submit them to the register in any convenient way, after which you will receive an extract (if you apply in person) and the date when you can pick up the corresponding certificate.

After submitting the documents to the registration authority employee, the decision to approve or reject the application must be made within 2 to 10 days, depending on the method of application of the applicant. You can learn more about all this from this video:

Cases when it is impossible to issue a deed of gift

According to the Civil Code of the Russian Federation, it is prohibited to issue a deed of gift for property whose value exceeds 5 minimum wages in cases where:

- the donor is incapacitated;

- the donor has not reached the age of majority;

- the gift is issued by a representative of the incapacitated person;

- a gift addressed to an employee of a medical or educational institution, as well as a social protection institution;

- a gift in the name of a government employee;

- a gift addressed to an employee of the municipal education authority;

- donation between commercial organizations.