The acquisition of their own square meters by young people with the help of a mortgage for students for an apartment in Sberbank on favorable terms is one of the options for resolving the issue. Often, final year students get a permanent job and start a family, which requires further development of an independent life.

Buying real estate with your own funds is not available to everyone. Therefore, a bank loan is often the only chance to get a roof over your head. Rental payments for residential space increase annually depending on inflation. Its amount is not much higher than the monthly mortgage payment. Therefore, more and more young people are turning to the bank for help in purchasing housing.

What are the criteria for approving an application?

Buying real estate involves dealing with large sums. Therefore, the main criterion for a bank to evaluate a potential client is the ability to fully fulfill debt obligations throughout the entire period of the contract. A positive answer is received only by those citizens who were able to document a sufficient level of income that allows them to consistently make monthly payments.

When making a decision to contact a bank, you need to take into account several facts that help increase loyalty:

- The amount of wages or other sources of income. According to the law, loan payments together with other obligatory expenses cannot amount to more than 60% of the amount of income. Based on these data, the maximum amount of credit funds provided by the bank is calculated.

- If there is insufficient cash flow, you can attract guarantors or a co-borrower. In this case, the total level of earnings is taken into account.

- No debts or arrears on loans taken previously. Credit history is contained in a single database and takes into account each concluded agreement with the bank, regardless of the statute of limitations or the name of the institution.

- Ownership of property whose value is comparable to the size of the proposed loan. Real estate is used as collateral, which provides certain guarantees to the financial institution.

It is worth noting separately that there are no special conditions for obtaining a mortgage for an apartment. This means that there is no government support in the form of subsidies or reduced rates. Registration takes place on a general basis; the choice of a lending program is made based on individual preferences and capabilities.

Sberbank sets standard requirements for each potential client that guarantee the fulfillment of debt obligations. These include:

- Age category from 21 to 75 years. Persons under 21 years of age are not issued a loan for the purchase of housing.

- Work experience of at least six months in the last position and at least one year in general.

- Availability of citizenship of the Russian Federation and registration on its territory.

- Repayment period from 1 year to 30 years.

- Presence of a permanent source of funds.

- A down payment of 20% of the value of the purchased property.

Mortgages for students, according to the requirements, are issued only upon reaching 21 years of age. From the age of 18, very few financial institutions issue a loan for a large amount. As a rule, they are characterized by an increased rate and a high down payment.

A reasonable solution would be to involve a third party as a co-borrower. Married couples use this. This not only increases the chances of approval of the application, but also divides the obligation to make monthly payments.

Live, student!

The most expensive cities for students to live in were Yekaterinburg, Moscow and St. Petersburg, according to a study by Domofond.ru prepared for Rossiyskaya Gazeta. The cheapest places for students to live are in Samara, Rostov-on-Don and Novosibirsk.

Housing prices near universities begin to rise in price from mid-summer, they will reach their peak by September. “At this moment, demand will exceed supply,” explains Konstantin Aprelev, vice-president of the Russian Guild of Realtors. The excitement will subside by November. The expert notes that increased demand in the market is provoked not only by students, but also by other tenants. Those who decide to move to big cities are also trying to find housing by the fall - the beginning of the business season.

“Last year, the price of apartments during this peak period increased by 4.7 percent,” notes Irina Filatova, an expert at the real estate portal Domofond.ru.

In Yekaterinburg, a one-room apartment will cost 16.6 thousand rubles per month. In other cities popular for education (Samara, Novosibirsk and Rostov-on-Don), one-room apartments cost an average of 14 thousand rubles. The price per square meter is estimated from 400 to 500 rubles: from 13-14 thousand for one-room apartments and from 16-17 thousand rubles for two-room apartments. In total, the study assessed six cities that ranked first in the ranking by the number of universities. In St. Petersburg, a one-room apartment costs on average 21.5 thousand rubles.

Moscow State University students who want to live in prestigious areas of the capital will have to pay an average of 1,624 rubles per square meter. A little cheaper in the Khamovniki area, then in the Tverskoy and Presnensky districts. The cheapest places are in the Ramenki, Gagarinsky and Fili-Davydkovo districts. Over the year, prices for expensive student housing in the capital have dropped significantly. Thus, apartments in the Tverskoy district became cheaper by an average of 13 percent. The price on Arbat, Khamovniki and Presnensky district decreased by 11 percent.

In general, the buildings of leading universities are located in quite prestigious areas, and there are not many budget offers there. “Students on a limited budget often rent rooms: approximately every sixth room in Moscow is rented by university students, and not less often they rent the entire apartment together,” says Irina Filatova. In the last 5-7 years, there has been a trend for a group of students to rent large apartments in the city center. That is, students are ready to live two or three to a room, but in the historical part of the capital.

When students are looking for apartments, such methods of solving the housing problem as transferring apartments “from hand to hand” or “word of mouth” are still preserved. Students tell each other about vacant apartments and rooms and save on paying a realtor. All other categories of tenants have already switched to searching for apartments only through special websites. True, student word of mouth also works on the Internet; announcements are mainly published on social networks.

There is a myth that property owners do not want to rent out housing to students. They are afraid of noise, guests and complaints from neighbors. But now they often indicate that they are ready to accept students. This status becomes a competitive advantage. Why? Students, as a rule, rent housing for the entire duration of their studies, and when it comes to entertainment at home, they prefer computer games. A noisy holiday is already in the club.

What documents need to be provided?

Before submitting an application, a standard application is filled out, which provides detailed information about the candidate. Here it is necessary to accurately and honestly display the level of income. If there is a co-borrower, full information about him is also indicated.

Official documents will be required to confirm the stated facts. Standard package includes:

- Passport of a citizen of the Russian Federation with a registration mark. If there is temporary registration, additional paperwork will be required.

- You will also need to provide a second document confirming your identity. An international passport or driver's license is used.

- Income certificates. They display official earnings. If additional sources are available, confirmation will be required. Statements of personal accounts, if any, may be an additional evidence.

- Title documents for mortgaged real estate.

- Marriage certificate if the applicant is in an official relationship.

An identical package of documents is collected for the co-borrower. The more evidence a candidate collects of his financial status, the higher the chances of receiving a positive answer.

If a young man has started a family and children, then it is possible to receive preferential conditions when applying for a loan. To do this, you will need to provide a birth certificate of the child or children. Government subsidies will provide preferential repayment terms by paying the difference from budget funds.

Registration procedure

The first step in any business is choice. Sberbank provides a large number of loan products that can facilitate the purchase of real estate. You should study all the nuances of lending programs presented in open sources and choose the most suitable option.

Afterwards, an application form along with a package of documents is submitted to the department. The application is reviewed within five working days. As a rule, the answer comes much earlier.

Once approved, you will need to provide documentation for the property being purchased. Employees will conduct a thorough check of information to avoid unexpected incidents and loss of funds due to fraud. When collaborating with developers who are official partners of the bank, you can get a preferential interest rate on a mortgage loan.

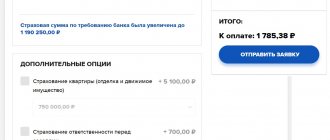

After passing the verification procedure, an agreement is concluded and funds are transferred to the seller’s bank account or transferred in cash. This is followed by the preparation of title documents for the purchased property, as well as insurance.

How to reduce the interest rate on a home loan?

Sberbank conducts periodic promotions, in accordance with which it offers more lenient conditions for certain types of objects. Information about this can be obtained on the website or in consultation with an employee. This service is absolutely free and is available by phone.

Additionally, the bank offers improved conditions for individuals who are clients. If a citizen participates in the salary program, then the interest rate is reduced by 0.5%. Also, additional benefits will be received by a person who has already taken out a loan and closed it without delay.

If you submit an application through the electronic service, a reduction in the remuneration rate of 0.1% is guaranteed. Considering that the loan amount is quite large, even a small reduction can save significant money.

Thus, by keeping your finger on the pulse and having the necessary information, you can achieve a reduction in the standard rate of 9.5% to 8.6%. This result is obtained by participating in the “Young Family” campaign, submitting an application through the electronic registration service and receiving wages through a bank plastic card.

What banks give?

Not all banks agree to lend to young people over 18 years old; many give mortgages only to those who are already 21 or even 23 years old.

Financial organizations providing loans for people over 18 years of age:

- Russian Mortgage Bank;

- Pervobank;

- M Bank;

- VTB Bank.

If the borrower is under 18, then no bank will give a mortgage.

Clients over 21 years of age are eligible for loans from all financial institutions, and the guarantee of individuals is not required.

Sberbank

Sberbank provides housing loans only to persons over 21 years of age. Not a single bank program is designed for an earlier age.

If the borrower has worked for the organization for more than six months, and the total length of service is at least 1 year, then he can count on purchasing his own apartment under any program.

In this case, co-borrowers and guarantors are not required.

VTB 24

VTB 24 provides loans to clients over 18 years of age.

But you definitely need:

- older guarantors or co-borrowers;

- permanent employment and stable income.

What other ways to save are there?

Today's young people, who are at the very beginning of their life's journey, are experiencing financial difficulties. The salary of a specialist without high qualifications is usually very small. Therefore, it is necessary to make the process of acquiring your own square meters as easy as possible.

Loan terms provide several additional savings opportunities:

- Using a maternity capital certificate. Can act as a down payment or for full or partial repayment of debt.

- Property tax deduction. According to the law, the loan size was increased to 2 million rubles. Using deductions, you can save up to 260 thousand rubles by refunding the amount of tax.

The combination of all the possibilities gives a significant relaxation in applying for a mortgage loan. The opportunities provided allow each citizen of the Russian Federation to purchase their own square meters, provided that they have a regular income.

Novorossiysk | Target program “Apartment for a student” - BezFormat.Ru

The association of developers in the south of Russia “VKB-Novostroiki” and the partner bank KB “Kuban Credit” LLC have launched a joint social target program “Apartment for Students”, within the framework of which a student or his family can purchase their own home at any level of solvency.

To implement the program at the 1st stage, 2,500 small-sized apartments with full interior finishing are allocated in houses of the “economy”, “comfort” and “comfort +” classes in the cities of the Krasnodar Territory and the Rostov region (Krasnodar, Rostov-on-Don, Anapa, Novorossiysk, Gelendzhik, Armavir, Krymsk and Sochi). The commissioning period for the houses is 2014-2016. A complete list of them, design documentation, layout, cost, etc. can be found on the website of the VKB-Novostroiki association or in Unified at the address: st. Krasnoarmeyskaya, 36 D. There, as well as on the website of the Kuban Credit CB, you can learn in detail about the “Apartment for Students” program.

The program has four options for participation: - for those who have funds in full or almost in full;

- for those who have a down payment and want to take out a mortgage; - for those who have 30% of the cost, but do not want to take out a mortgage

- and even for those who do not have the funds for a down payment.

During the 2 weeks of the program, 116 people have already applied for a mortgage.

Details can be found at the link: https://www.yuga.ru/news/340633/

Latest news from the Krasnodar region on the topic: Target program “Apartment for students”

The course is for housing construction - Uspenskoe

On the eve of Builder's Day, the Governor of the Krasnodar Territory A.N. Tkachev met at a round table with the heads of fifteen leading enterprises in the industry.09:11 08/11/2014 Newspaper Rassvet

The “Apartment for Students” program has launched in the Krasnodar Territory - Krasnodar

The association "VKB-Novostroiki" and the partner bank CB "Kuban Credit" LLC launched a joint social program "Apartment for a student" in the Krasnodar region.21:44 08/10/2014 News Agency Living Kuban

Residents of Goryachy Klyuch celebrate the 150th anniversary of the city - Krasnodar

Today, August 9, Goryachy Klyuch celebrates its 150th anniversary. Governor of Kuban Alexander Tkachev congratulated the city residents on the holiday.21:03 08/10/2014 News Agency Living Kuban

Goryachy Klyuch celebrates City Day - Krasnodar

On August 9, the city of Goryachy Klyuch celebrates its 150th anniversary. Governor of Kuban Alexander Tkachev congratulated the residents of the city on the holiday, reports the press service of the head of the administration of the Krasnodar region.18:13 08/10/2014 Yuga.Ru

Goryachy Klyuch celebrates its 150th anniversary - Krasnodar

Governor of Kuban Alexander Tkachev congratulated the city residents on the holiday.16:32 08/10/2014 Governor A.N. Tkachev

Builders - the pride of Kuban - Krasnodar

“Alexander Tkachev congratulated the builders of Kuban on their professional holiday.15:55 08/10/2014 Krasnodar News

Target program “Apartment for students” - Novorossiysk

The association of developers of the south of Russia “VKB-Novostroiki” and the partner bank KB “Kuban Credit” LLC launched a joint social target program “Apartment for a student”, 15:36 08/10/2014 Administration of the hero city of Novorossiysk

The regional program “Apartment for Students” has started - Krasnodar

Thanks to the social target program launched in the Krasnodar Territory, Kuban students will be able to purchase their own housing on preferential terms.15:33 08/10/2014 Krasnodar Region Magazine

Tomorrow is Builder's Day - Krasnodar

Dear workers and veterans of the Kuban construction industry! Please accept my warmest congratulations on your professional holiday - Builder's Day! 15:19 08/10/2014 Free Kuban

Kuban students will be provided with preferential housing - Krasnodar

The social target program “Apartment for Students” has started in the Krasnodar Territory. 15:04 08/10/2014 NIA-Kuban

The Governor of Kuban met with representatives of large construction companies in the region - Krasnodar

In the development of the construction industry, the regional authorities intend to rely on Kuban companies.15:23 08/08/2014 Channel Nine

The social target program “Apartment for Students” has started in the Krasnodar Territory - Sochi

Its goal is to enable students and members of their families, as well as parents of high school students, to purchase housing on preferential terms in the city where they are studying.11:15 08/08/2014 Administration of Sochi

The social program “Apartment for Students” started in Krasnodar - Krasnodar

Square meters on preferential terms. Social program for purchasing housing “Apartment for students” started in Krasnodar.20:53 08/07/2014 Channel Nine

The best architects, designers and builders of Kuban were honored in Krasnodar - Krasnodar

Today, August 7, a solemn meeting dedicated to Builder's Day was held in Krasnodar.19:51 08/07/2014 News Agency Living Kuban

A strategy for the development of the construction industry will be developed in Kuban - Krasnodar

In the Krasnodar Territory, they are planning to modernize the construction industry in the next five years; its strategy will be ready by the end of 2014.19:20 08/07/2014 Yuga.Ru

The target program “Apartment for Students” has been launched in the south of Russia - Krasnodar

The association of developers of the south of Russia “VKB-Novostroiki” and the partner bank KB “Kuban Credit” LLC launched a joint social target program “Apartment for a student”, 19:20 08/07/2014 Yuga.Ru

The best builders from all over the region were honored in Krasnodar - Krasnodar

In Krasnodar at the Philharmonic named after. G. F. Ponomarenko held a solemn meeting dedicated to Builder's Day. 19:19 08/07/2014 Yuga.Ru

Kuban authorities expect housing commissioning to increase to 4.5 million square meters. meters per year - Krasnodar

The authorities of the Krasnodar region expect an increase in housing construction in the region. It is planned that 4.5 million square meters will be put into operation. 19:19 08/07/2014 Yuga.Ru

Kuban students can buy housing on preferential terms - Krasnodar

The social target program “Apartment for Students” has started in the region. 17:58 08/07/2014 Krasnodar.Ru

In the next five years, the construction industry of Kuban will undergo modernization - Krasnodar

This was discussed at the meeting of the governor with the heads of leading construction companies in the Krasnodar region.17:58 08/07/2014 Krasnodar.Ru

The authorities promised to take up the master plans of the cities of Kuban to develop a development strategy for 5 years - Krasnodar

First Vice-Governor Dzhambulat Khatuov said that big changes await the Kuban construction industry from September.17:57 08/07/2014 Delovaya Gazeta Yug

VKB-Novostroiki and Kuban-Credit Bank will take on the “Apartment for Students” - Krasnodar

Construction companies included in the association of developers in the South of Russia “VKB-Novostroiki” allocated 2.5 thousand. 17:57 08/07/2014 Delovaya Gazeta Yug

The social program “Apartment for Students” has started in Krasnodar - Krasnodar

The head of the association, Sergei Gerashchenko, announced this on August 7 at a press conference in the press in Krasnodar.17:41 08/07/2014 Yugopolis

Kuban students will be able to purchase subsidized housing - Krasnodar

In 2014, 2.5 thousand one-room and “smart” apartments with full interior decoration will be allocated for students on preferential terms.17:38 08/07/2014 IA Zhivaya Kuban

Congratulations on Builder's Day from the Governor of the Krasnodar Territory and the Chairman of the Legislative Assembly of the Krasnodar Territory - Krasnodar

Dear workers and veterans of the Kuban construction industry! Please accept my warmest congratulations on your professional holiday - Builder's Day! 17:34 08/07/2014 Department of Construction

In the next five years, the construction industry of Kuban will undergo modernization - Krasnodar

This was discussed at the meeting of the governor with the heads of leading construction companies of the Krasnodar region.16:44 08/07/2014 Administration of the Krasnodar region

Kuban students can buy housing on preferential terms - Krasnodar

The social target program “Apartment for Students” has started in the region.16:44 08/07/2014 Administration of the Krasnodar Territory

13 residents of the region received the title “Honored Builder of Kuban” - Krasnodar

In the Krasnodar Philharmonic named after. G.F. Ponomarenko held a solemn meeting dedicated to Builder's Day. 16:43 08/07/2014 Administration of the Krasnodar Territory

The region will develop a five-year strategy for the development of the construction industry - Krasnodar

At a meeting with builders, Alexander Tkachev noted: in order for the construction industry of Kuban to develop successfully, its modernization is necessary.16:34 08/07/2014 Governor A.N. Tkachev

About 4 million square meters of housing are rented out annually in Kuban - Krasnodar

The governor congratulated the builders on the upcoming professional holiday from the stage of the Krasnodar Philharmonic.16:34 08/07/2014 Governor A.N. Tkachev

The governor presented awards for their contribution to the development of the industry to builders at a concert in Krasnodar - Krasnodar

Today Governor Alexander Tkachev congratulated the best representatives of the industry on Builder's Day. 16:30 08/07/2014 Channel Nine

48 thousand economy class apartments will be built in the Kuban capital - Krasnodar

On the eve of Builder's Day, Alexander Tkachev met with the heads of leading enterprises in the industry at a round table.15:29 08/07/2014 Krasnodar.Ru

There will be 48 thousand economy class apartments in Krasnodar - Krasnodar

The authorities of Kuban are actively implementing state support programs for the construction of economy class housing.15:27 08/07/2014 NIA-Kuban

Tkachev said that 48 thousand economy-class apartments will be built in Krasnodar - Krasnodar

The governor said that the Kuban authorities are actively implementing state support programs for the construction of economy class housing.15:26 08/07/2014 Yugopolis

48 thousand economy class apartments will be built in Krasnodar - Krasnodar

Governor of Kuban Alexander Tkachev said that 48 thousand will be built in the regional capital. 15:24 08/07/2014 News Agency Living Kuban

48 thousand economy class apartments will be built in Krasnodar - Krasnodar

In Krasnodar, within the framework of the state program, they plan to build 48 thousand. 14:49 08/07/2014 Yuga.Ru

48 thousand economy class apartments will be built in the Kuban capital - Krasnodar

On the eve of Builder's Day, Alexander Tkachev met with the heads of leading enterprises in the industry at a round table.14:30 08/07/2014 Administration of the Krasnodar Territory

Alexander Tkachev met with the builders of Kuban on the eve of their professional holiday - Krasnodar

During a round table with the heads of large construction companies in the region and public organizations, veterans of the Kuban construction industry, the governor noted, 14:21 08/07/2014 Governor Tkachev A.N.

Krasnodar is waiting for changes. Olympic - Krasnodar

“On the eve of the professional holiday about the problems and prospects of the construction complex of the region, 09:27 08/07/2014 Krasnodar News

novorossiysk.bezformata.ru

Advantages and disadvantages

Summarizing all of the above, we can highlight both negative and positive aspects of concluding a deal. The first includes:

- The need to confirm a sufficient level of official income.

- Penalties for late payment. A penalty is charged for each day of delay.

- Payment for services for opening and maintaining an account.

A small number of shortcomings are present in every case. However, there are much more positive aspects. Here are some of them:

- Availability. Anyone can get approval. Complying with the requirements is not difficult.

- Low interest rate.

- Possibility of receiving preferential conditions.

- Abundance of programs. Choosing the appropriate option will not be difficult.

- Long loan term.

A mortgage loan gives every citizen the opportunity to acquire their own home. Sberbank's activities are focused on meeting the needs of citizens from all segments of the population. It is more profitable to pay off a loan for your own apartment than to pay rent for someone else’s property.

Mortgage terms

Let's take a closer look at the lending conditions for mortgage loans for students in the TOP 30 banks in the country. Sort the table by age and compare the conditions of banks on the secondary market:

| Bank | Base rate, % of | Experience, months | Age, years |

| Sberbank | 8,3 | 6 | 21-75 |

| VTB | 7,9 | 3 | 21-65 |

| Raiffeisenbank | 8,19 | 3 | 21-65 |

| Gazprombank | 7,8 | 6 | 21-60 |

| Rosbank | 8,39 | 2 | 20-65 |

| Rosselkhozbank | 7,95 | 6 | 21-65 |

| Absalut Bank | 9,25 | 3 | 21-65 |

| Promsvyazbank | 8,9 | 4 | 21-65 |

| Dom.RF | 8,6 | 3 | 21-65 |

| Uralsib | 8,19 | 3 | 18-65 |

| AK Bars | 7,99 | 3 | 18-70 |

| Transcapitalbank | 8.49 | 3 | 21-75 |

| FC Otkritie | 8,3 | 3 | 18-65 |

| Svyaz-bank | 9.3 | 4 | 21-65 |

| Zapsibcombank | 9.8 | 6 | 21-65 |

| Metallinvestbank | 8,3 | 4 | 18-65 |

| Bank Zenit | 8,49 | 4 | 21-65 |

| SMP Bank | 9,5 | 6 | 21-65 |

| UniCredit Bank | 8,4 | 6 | 21-65 |

| Alfa Bank | 8,99 | 6 | 20-64 |

| Renaissance | 7,95 | 6 | 18-70 |

| Surgutneftegazbank | 8,49 | 6 | 21-70 |

| MinB | 8,5 | 3 | 22-65 |

| Severgazbank | 8,5 | 6 | 21-70 |

| Bank "Saint-Petersburg | 9 | 4 | 18-70 |

| Sovcombank | 9,39 | 3 | 20-85 |

In this table, mortgages for students for an apartment in a new building:

| Bank | Bid, % | PV, % | Experience, years | Age, years |

| Sberbank | 9,3 | 15 | 6 | 21-75 |

| VTB | 9,8 | 15 | 3 | 21-65 |

| Raiffeisenbank | 8,99 | 15 | 3 | 21-65 |

| Gazprombank | 9,2 | 20 | 6 | 21-65 |

| Rosbank | 10,74 | 15 | 2 | 20-65 |

| Rosselkhozbank | 9 | 20 | 6 | 21-65 |

| Absalut Bank | 10,75 | 15 | 3 | 21-65 |

| Promsvyazbank | 9,15 | 15 | 4 | 21-65 |

| DOM.RF | 8,9 | 15 | 3 | 21-65 |

| Uralsib | 9,49 | 10 | 3 | 18-65 |

| AK Bars | 9,2 | 10 | 3 | 18-70 |

| Transcapitalbank | 9,49 | 20 | 3 | 21-75 |

| FC Otkritie | 8,8 | 15 | 3 | 18-65 |

| Svyaz-bank | 9,2 | 15 | 4 | 21-65 |

| Zapsibcombank | 9,8 | 15 | 6 | 21-65 |

| Metallinvestbank | 9,1 | 10 | 4 | 18-65 |

| Bank Zenit | 9,5 | 20 | 4 | 21-65 |

| SMP Bank | 10,99 | 15 | 6 | 21-65 |

| Alfa Bank | 9,29 | 15 | 6 | 20-64 |

| UniCredit Bank | 9,4 | 20 | 6 | 21-65 |

The table clearly illustrates the general similarity of mortgage conditions for students. However, the most favorable parameters stand out to Sberbank of Russia, where you can get a loan at 7.4% per year if the debt amount is repaid within seven years, but also the age requirement is 21 years.