What does the law say?

Mortgage lending is regulated by 2 regulatory documents - Federal Law No. 102 and the Civil Code of the Russian Federation . Having studied these sources, we can come to the conclusion that the bank cannot refuse a client to receive a loan to purchase a home only for the reason that he is already paying off a similar loan.

If a citizen has a high income and meets the basic requirements of a financial institution, obtaining a second mortgage is possible. However, in this case, the borrower may face rather strict conditions and restrictions.

What else does the bank want to see?

When a client applies for a second mortgage loan, the bank also imposes additional requirements. They are standard - no different from the first application for a mortgage:

- citizenship of the Russian Federation;

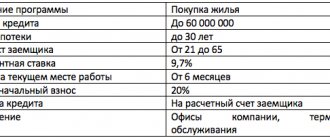

- age ranging from 21 to 65 years;

- stable income;

- permanent residence in a given city;

- Work experience in the last place for at least six months.

Sberbank considers Russian citizenship and permanent residence registration to be the most important conditions for approving an application. Correct age assessment is also important. It is important for the bank that the client is able to pay off the debt, and for this it is important that he must be of working age during the entire payment period.

Conditions for obtaining a second loan

If you don’t know whether you can take out 2 mortgages from Sberbank or any other financial institution in Russia, check out the basic requirements for obtaining a second loan:

- Client's solvency . The lender evaluates both the main and additional income of the family. The main thing is that they have documentary evidence. In addition, experts calculate exactly what share of the total profit will be taken up by payments in two payments (no more than 60% of the total amount);

- Clean credit history . For each request for a housing loan, a thorough check is carried out to identify the presence of arrears and debts;

- Number of dependents and minors . Each of them is given a certain subsistence minimum, deducted from the applicant’s income. That is why the number of dependents directly affects the maximum amount that the borrower can allocate to repay the loan;

- The remaining balance on a first mortgage . Is it possible to get two mortgages for one person? It is possible, however, at the time of applying for the second loan, the first one must be repaid by 70%;

- Down payment amount . As a rule, it ranges from 10 to 30% of the cost of housing;

- Providing collateral . It can be either the property being purchased or other assets offered by the borrower;

- Statute of limitations for the first mortgage (not valid at all banks) . A sufficient amount of time must have passed since the first housing loan was issued (for example, if it was taken out for 15 years, then at least 5).

On a note! Another important factor is having a credit card. It is considered to reduce the client's solvency ratio, so some institutions may require its closure.

The applicant himself is subject to no less strict assessment. It must meet several criteria at once:

- Citizenship – Russian Federation;

- Age – from 21 to 65 years (at the time of mortgage repayment);

- Permanent registration in a given city;

- Official employment;

- Work experience in the last place is at least 6 months.

Requirements for the borrower

To obtain a second mortgage, the client must meet the following requirements:

- Russian citizenship;

- age – 21-65 years;

- official work and stable salary;

- availability of permanent residence in the region where the application is submitted;

- Work experience in the last place is more than 6 months.

To take out a second mortgage, the borrower must also:

- confirm your sufficient solvency;

- have a positive credit history;

- have minimal or no dependents;

- the first mortgage must be repaid at least 70%;

- make a down payment on the second mortgage of 15%;

- provide collateral to the bank.

Sberbank pays attention to these factors when a client wants to take out a second home loan. It should be noted that getting your first loan is much easier.

How to Increase Your Likelihood of Approval

Are you satisfied with the mortgage conditions at Sberbank, but are you worried that you won’t be able to get it because you haven’t closed the first one? Dont be upset. There are several ways to increase the likelihood of your application being approved, and we will tell you about them now:

- provide the bank with solvent guarantors;

- confirm your long-term work with documents;

- confirm the presence of additional property;

- draw up an insurance contract with Sberbank;

- Pay off your first mortgage in full if possible;

- document your additional income.

Documents for obtaining a second mortgage

According to the legislation in force in Russia in 2020, a potential borrower must provide the bank with the following package of documents:

- Internal passport (original and copy);

- IIN certificate (copy);

- Technical papers for purchased housing;

- Marriage certificate (if available);

- Documentation for co-borrowers and guarantors;

- Certificate of income;

- First mortgage agreement;

- SNILS;

- An extract from the bank where the first loan was taken out (allows you to judge the amount of the remaining debt);

- Application for a new loan;

- Child's birth certificate (if available);

- Work book (copy).

On a note! All transactions are considered individually, so the lender has the right to require additional certificates confirming the cleanliness and reliability of the client.

We also note that when contacting several financial institutions, the client needs to collect one package of documents for each of them. This also applies to obtaining a loan for 2 apartments at once, and to those banks from which the first housing loan was received.

How to increase your chances?

Many people wonder if it is possible to take out two mortgages at the same time and is there a way to increase their chances of success? The law does not prohibit taking out 2 or even 3 housing loans at once. The main thing is that the client has enough money to cover them.

As for the approval of a repeated loan agreement, several steps must be taken to obtain it:

- Provide documentary evidence of additional income (for example, an agreement to lease your own real estate that is not pledged);

- Attract the maximum number of guarantors and co-borrowers. In this case, the bank will evaluate the total income, but remember that co-borrowers must be solvent and meet age criteria;

- Have extensive work experience (preferably continuous). As for unofficial employment, it will not help the matter, since any financial source must have appropriate confirmation;

- Be at a financially stable age – 25-35 years;

- Have additional property (cars, agricultural equipment, dacha, house, etc.);

- Have maternity capital - using it as a down payment, you can significantly reduce the interest rate;

- Pay off existing debts as much as possible;

- Take out health, life and purchased property insurance;

- Pay a larger down payment.

Advice! Experts recommend concluding a mortgage agreement for the longest possible term.

This will reduce your monthly payments and increase your likelihood of approval. In addition, you can always close the loan early. The main thing is that this is stated in the contract.

TOP 6 ways: Increase your chances of getting a second mortgage approved

You have to prepare for the transaction in advance. It is important to follow the following recommendations:

- Apply to the bank before reaching the age of 35. Typically, citizens between 25 and 35 years old have the highest permanent income.

- The selection of guarantors and co-borrowers must be approached carefully, since their age and financial situation are taken into account during the application review process.

- Sberbank is more willing to cooperate with payroll clients. Let's assume that income is transferred to an organization. To do this, you need to contact your employer. The law allows a citizen to independently choose the institution through which funds are transferred.

- When filling out the application, it is important to mention the presence of additional property. This could be cars, a plot of land, a dacha.

- The property and life must be insured.

- Provide as much money as possible as a down payment. It is acceptable to use maternity capital, housing certificates and other means of state support.

List of recommendations for a positive decision

What to do in case of refusal?

Having received a refusal to issue a second mortgage agreement, a potential borrower can act as follows:

- Submit a new application after some time (no earlier than 2 months);

- Contact other financial institutions. If you fail to obtain a loan from one bank, feel free to contact others;

- Sell the first property (if it is no longer needed - for example, there is a need to expand the living space). Since the mortgaged apartment is pledged to the bank, the borrower will need written consent to sell it;

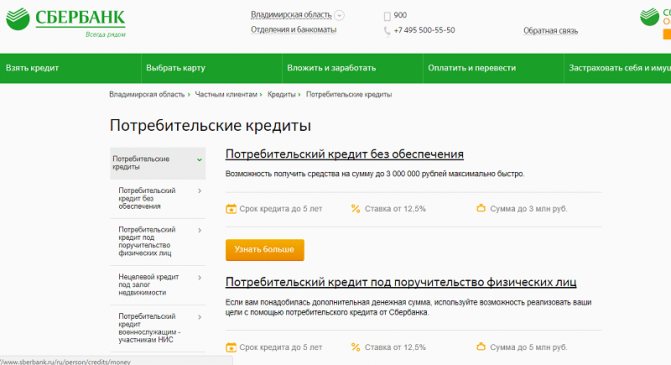

- Take out a consumer loan to pay off existing debt. This method is one of the riskiest, because consumer loans carry higher interest rates.

Features of obtaining a second mortgage

The country's largest financial institution always goes the extra mile for its clients, so issuing two mortgage loans by one individual. face at Sberbank is not uncommon. The main condition for issuing several loans is a high level of solvency of the borrower. When calculating this indicator, not only the citizen’s income is taken into account, but also his existing debt load. If more than 50% of your monthly earnings are spent on fulfilling obligations on current loans, in most cases you don’t even have to think about approving a new loan. It should be borne in mind that to assess risks, all existing loans, credit cards, overdraft cards, future mortgage expenses, as well as the share of individuals are taken into account. persons in loans as a co-borrower.

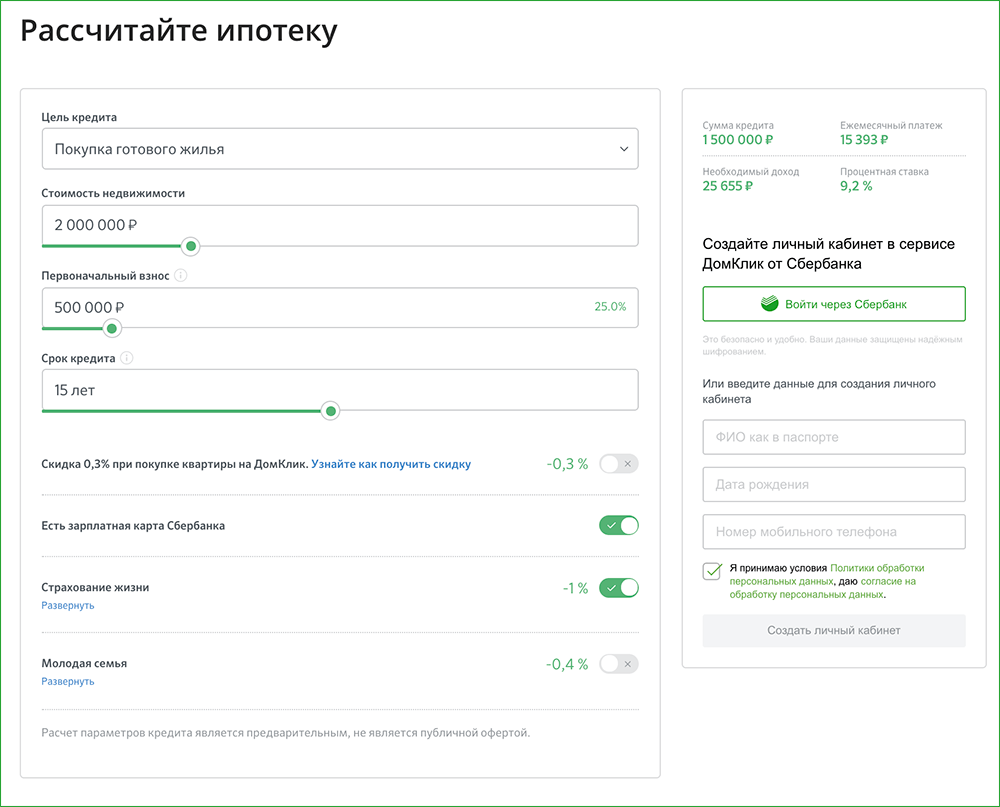

Before contacting Sberbank for re-lending, individuals. a person should analyze his financial capabilities. Using the online calculator presented on the official website of the institution, you can easily calculate the amount of monthly expenses and the income required to cover them.

Often, the need for a second mortgage arises among young families in which, after the birth of children, the problem of increasing living space requires an urgent solution. If there is no money for a down payment, such clients have the right to take out a loan secured by real estate, however, such lending programs are characterized by high interest rates. In addition, under certain circumstances, a financial institution may not accept an encumbered home as collateral. In such situations, it is advisable to obtain a new mortgage on preferential terms, sell the old apartment, make partial early repayment of the debt and gradually pay off the creditor with annuity payments.

To increase the chances of re-approval of a mortgage application, an individual must:

- Prove your solvency. Not only stable income, but also the presence of a car, a garage, or a summer cottage have a positive effect on the lender’s decision.

- Attract reliable co-borrowers . Their age and wealth level will be taken into account when calculating the maximum loan amount.

- Become a salary client of Sberbank. This measure helps to reduce the interest rate and reduce the list of required documents.

- Use the state support (if applicable). Maternity capital and housing certificates are accepted as a down payment.

- Select a property using the DomClick service. Interacting with a financial institution online eliminates paperwork and tedious trips to a bank branch, and the service often offers an additional discount.

- Insure your life. The measure helps to obtain an additional discount on the rate (savings of 1%).

Note: Completing all of the above steps does not guarantee the issuance of a large targeted loan. A credit institution has the right to refuse to issue a second mortgage without giving reasons.

Which bank to choose for a new mortgage?

To obtain a second loan to purchase a home, the client has the right to contact any financial institution. It can be:

- Servicing bank . If you are satisfied with working with your old lender, do not be afraid to use their services again. If there are no debts and the borrower has a high level of income, there are no reasons for refusal. Moreover, in this case the likelihood of approval will be higher;

- Salary bank . Financial institutions offer their salary clients not only the most favorable lending conditions, but also a simplified process for obtaining a mortgage (smaller package of documents, quick consideration of the case, etc.);

- New bank . If you decide to apply for two mortgages in different banks, be prepared to thoroughly check your identity, solvency and credit history. In this case, the likelihood of approval is very ambiguous. On the one hand, many banks treat such borrowers with caution and distrust. On the other hand, submitting mortgage applications to two institutions at once significantly increases your chances of success, because one of them may refuse, and the second may give the go-ahead. If both agree, you can choose the one that offers more favorable conditions. True, this scheme only works when applying for two completely new loans.

Advice! You should not hide the presence of a mortgage or debts on it. During the check, the truth will still come out, and the client caught in a lie will definitely receive a refusal.

Now you know how to take out a second mortgage without paying off the first . It only remains to note that having loans is always a big risk, so before signing another agreement, assess your financial condition and think about whether you really need to urgently purchase additional real estate.

Conditions for obtaining a second mortgage

Only those clients who have a high level of income can count on receiving a second home loan. Also, there will be no special problems if you have an excellent credit history, but only if you make the required amount as a down payment. All previously available loans should not have even the slightest criticism .

When issuing a second mortgage, Sberbank will take into account not only the income of the client himself, but also the total inclusion in the budget of the cash receipts of other family members, as well as all invited co-borrowers.

Requirements for borrowers

But, although issuing a second home loan to a client for banks is theoretically considered profitable, as providing good profits for many years, Sberbank treats borrowers of this level very strictly. Only those clients who fully meet the following requirements can be allowed to issue a loan:

- excellent credit history;

- the previous debt has been repaid by at least 70%;

- work experience of at least six months at the last place of duty;

- officially confirmed high level of income;

- it was possible to make a down payment in an amount of no less than 10-30% of the loan received.

The chances increase significantly if the borrower invites not only co-borrowers, but also offers the bank collateral. When issuing a second housing loan, both the presence of dependents and the number of young children will be taken into account.

If you refuse to receive a second mortgage loan, you can take out a consumer loan and use the funds to purchase a home

Required documents

If a client is interested in how to take out a second mortgage without paying off the first one from Sberbank, then, in addition to fully meeting all the requirements, he will have to prepare a package of documentation . They are identical to those provided when receiving the first loan and consist of the following papers:

- TIN;

- passport;

- first existing mortgage agreement;

- documentation from guarantors/co-borrowers;

- certificates confirming the level of profitability;

- prepared documents for a second apartment/house;

- bank statement indicating the balance of debt.

If necessary, Sberbank may require the provision of other documents that must be brought and submitted as soon as possible.

Other existing conditions

Having Russian citizenship becomes a necessary and important condition. Also, the age of the borrower must not exceed 65 years (at the time of repayment of the second loan) and have permanent registration and registration in the region where the mortgage is issued.