Most often, a mortgage is issued against the property being purchased. That is, the bank issues funds, they buy housing, and it is this housing that becomes the object of collateral - the bank’s encumbrance is placed on it. However, such a mortgage is not relevant in all cases. Then, the solution is considered to be a mortgage secured by real estate that the client already owns.

Mortgage secured by existing real estate

The main difference from a regular mortgage is the collateral. In this case, you can get money by providing the bank with an already owned property. The money can be spent on completely different purposes if the loan is not targeted, and on purchases specified in the loan agreement if the mortgage is targeted.

Who is interested in a mortgage secured by an apartment or house?

Most often, a mortgage secured by existing real estate is chosen if:

- the desired apartment, room, house or land is not approved under a standard mortgage due to various circumstances (for example, the room is not the last in the communal apartment, the apartment has an illegal redevelopment or there is no water supply in the house);

- you need to make major home repairs, which requires a large amount of money;

- business requires investment, and taking out business loans is expensive;

- You need credit money in a large amount to realize consumer goals not related to the purchase of a home.

Basically, a mortgage secured by existing real estate is considered as an alternative to some other loan - a mortgage, consumer or business loan.

Advantages and disadvantages

A mortgage secured by real estate has its pros and cons that need to be taken into account when obtaining a loan.

| Advantages | Flaws |

| You can buy any home, even if it doesn’t meet the bank’s requirements. The property of not only the main borrower, but also of third parties - for example, parents or other close relatives - is accepted as collateral. No down payment is required to obtain a mortgage. It is possible to agree on individual mortgage terms (for example, deferment of interest/principal payments). | The bank will focus on the price of the mortgaged property when determining the loan amount, and not on the price of the apartment being purchased. Strict requirements for the collateral (year of construction, technical condition, etc.). Insurance is more expensive compared to a conventional mortgage. |

It’s difficult to say unequivocally about interest rates - in some places they are higher compared to a regular mortgage, in others they are lower. Each borrower decides for himself which option is more profitable for him.

Down payment for a mortgage secured by real estate

A down payment is not required when applying for a mortgage secured by existing real estate, especially if we are talking about non-targeted loans. The borrower has the right to add his own funds for the purchase if credit is not enough, but there is no need to report this to the bank, as with a classic mortgage.

However, for some targeted programs, banks have the right to establish down payment requirements. With a mortgage secured by real estate, this contribution is usually higher - from 25 to 40%. In addition, the loan itself is issued based on the amount of available real estate. This may be disadvantageous compared to the classic home loan option.

Read in detail:

Mortgage without down payment: Interest rates of different banks; Requirements for the borrower; Real estate requirements; and other nuances.

Targeted or non-targeted loan

A targeted loan is issued for the purchase of real estate, a non-targeted loan is issued for any other purposes that the borrower sets for himself. Interest rate difference. For targeted loans the rate is lower, for non-targeted loans the rate is higher, because the bank’s risks increase.

Do I need an intermediary for a transaction with a mortgaged apartment?

The role of an intermediary - a real estate company or a private realtor - comes down to meeting several needs of the buyer and seller. This means searching for a suitable offer, checking the purity of the transaction, as well as the correct execution of all necessary documents. In normal sales transactions, priorities shift towards finding a suitable offer, as well as towards achieving the optimal price - both of which, in principle, the client can do independently. As a rule, information about all offers is available on the relevant media resources, and the price, in fact, is dictated by the market, and if it is possible to “bring down” the price somewhat, the savings will be minimal.

Checking that there are no obstacles to completing a transaction is also included in the standard set of real estate services, but the hired realtor, in fact, has no incentive to conduct a thorough check, and no one will give guarantees in this case. Therefore, to carry out such an operation, it is more reasonable to engage a competent lawyer.

This is important to know: Maternity capital for the purchase of an apartment: conditions in 2020

The purchase of a collateralized apartment is a more complex transaction, since the participation of a third party is assumed - the bank that imposed the collateral encumbrance, and the apartment can only be sold with its consent. It is necessary to select the optimal payment scheme and, therefore, correctly place emphasis when preparing documents, taking into account the interests of all parties to the transaction. Therefore, attracting an experienced realtor (or company) who would take on the development of a sales scheme would be very helpful.

Review of interest rates on loans

We have collected the main interest rates for mortgages secured by real estate in Russian banks.

| Sberbank (for any purpose) | From 11.3% |

| VTB (non-targeted) | From 10.4% |

| Alfa-Bank (for any purpose) | From 13.69% |

| Rosselkhozbank (targeted for real estate) | From 9.1% |

| Rosselkhozbank (non-targeted) | From 9.7% |

| Opening (target – for the purchase of housing) | From 9.9% |

| Opening (target - for apartment renovation) | From 10.9% |

| Rosbank (target mortgage) | From 6.89% to 10.14% |

| Bank "Saint-Petersburg" | From 10.7% |

| Tinkoff Bank | From 8% |

The final interest rate depends on many factors. For example, salaried clients are usually provided with privileges, and if they refuse life insurance, the rate will increase by 1-2%.

Some banks ask for title insurance, the availability of which also determines the rate. If it fails, it can grow by 1-2%.

If the loan is targeted, then the bank will need to submit documents confirming the corresponding expenses, for example, an extract from the Unified State Register of Real Estate on the registration of ownership rights for the purchased apartment in the name of the borrower.

Schemes for purchasing a mortgaged apartment

Today, the following schemes for the sale of collateral real estate have become widespread:

- Sale through loan repayment by the apartment buyer

The buyer deposits the entire amount into the seller’s bank account, thereby fully repaying the borrower’s obligations to the bank. The bank removes the deposit, and the apartment can be re-registered to the buyer. This type of transaction is quite risky for the buyer, since the seller, after removing the deposit, may “change his mind” about selling the apartment, and forcing him to do so will be very problematic.

- Sale with bank participation

This is important to know: Buying an apartment at auction from the Moscow government

Settlements are carried out using bank cells (letter of credit accounts), the buyer places his money in deposit cells - one cell contains funds intended to pay the bank the remainder of the debt, and the other cell contains the balance of the amount specified in the purchase and sale agreement. In the meantime, the purchase and sale agreement is sent to the Federal Registration Service for registration simultaneously with the bank’s application. After the apartment is re-registered, the bank gets access to the funds in its safe deposit box, and the seller takes the money from his safe deposit box.

There is a technical nuance here, which causes an increased risk for the buyer and for the bank - the collateral is withdrawn within 5 days, and for re-registration, employees of the Federal Registration Service need 10 days. During the period when the mortgage has already been removed and the title has not yet been re-registered, the current owner may, upon application, cancel the registration of the purchase and sale agreement.

- Sale through change of mortgagor

The transaction also provides for the placement of the buyer’s money in safe deposit boxes, but in this case the purchase and sale agreement is not drawn up, but the collateral (and debt obligations to the bank) are transferred to the buyer. After the buyer receives a certificate of ownership of the apartment (still encumbered by a bank lien), the seller receives his balance, and the bank receives part of the amount necessary to pay off the debt obligations. Only after this the deposit is removed and the apartment is completely at the disposal of the buyer. This is the safest scheme for purchasing an apartment with collateral for all parties to the transaction.

What kind of real estate is accepted as collateral: apartment, house, room, land

Each bank has its own rules. Typically the following is accepted as collateral:

- housing: apartment, town house, residential building;

- apartments are considered individually;

- residential buildings are accepted as collateral with the land located underneath them;

- separate land plot;

- permanent garage;

- a permanent garage with a plot of land underneath it.

The bank may establish special requirements for real estate. Most often this means suitability for year-round living, provision of water supply, and good technical condition. The apartment should not be located in a building for demolition, dilapidated or in disrepair. The land plot must have convenient access roads.

The maximum loan amount will depend on the value of the collateral. As a rule, up to 70-80% of the property price is issued. You will definitely need to make an independent appraisal of the property from a professional appraiser accredited by the bank.

Mortgage conditions in the largest Russian banks

The basic conditions for mortgages secured by real estate in Russian banks are approximately the same. Somewhere the rate is lower, but there are more requirements for the borrower, in other banks it’s the opposite. Below we will compare the conditions by category in different banks regarding mortgages secured by real estate in banks: Sberbank, VTB, Alfa-Bank, Rosselkhozbank, Otkritie, Rosbank, Bank St. Petersburg.

![Tinkoff loan secured by real estate [credits][status_lead]](https://agentstvo-prava.ru/wp-content/uploads/tinkoff-kredit-pod-zalog-nedvizhimosti-credits-status_lead2.jpg)

Requirements for the borrower

The main things to pay attention to are:

- citizenship;

- requirements for place of residence;

- borrower's age;

- client's work experience.

Sberbank, VTB, Rosselkhozbank and Otkritie issue mortgages only to Russian citizens. Bank St. Petersburg also serves only Russians, but the co-borrower can have any citizenship (spouse). Alfa-Bank considers applications from Russians, citizens of Ukraine and Belarus. Rosbank does not have citizenship requirements.

Permanent or temporary registration on the territory of the Russian Federation is required by Rosselkhozbank, Otkritie and Bank St. Petersburg. For other creditors, this factor does not matter.

On average, loans are provided to borrowers from 21 to 65 years old. The youngest age (18 years) is allowed at Otkritie, a bank in St. Petersburg. You can extend loan repayment up to 75 years at Sberbank and, in some cases, at Rosselkhozbank.

Regarding employment, the requirements are very different:

- Sberbank refuses to issue mortgages secured by real estate to individual entrepreneurs and business owners; other banks have no such restrictions;

- The opening does not work with gaming industry employees, bodyguards, realtors, unemployed citizens;

- For citizens running private household plots, it makes sense to first contact Rosselkhozbank - they know how to read household books;

- The average total work experience is 1 year and from six months at the last place of work.

For a mortgage secured by real estate, banks do not set a minimum income.

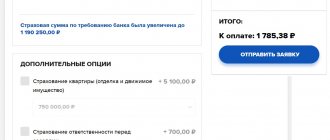

Amount of credit

The amount always directly depends on the market price of the collateral property. After preliminary approval of the application, you will need to order an assessment from a specialist recommended by the bank (otherwise the result may not be accepted). The price of the report starts from 5,000 rubles. Based on the opinion of a specialist, the bank will set the maximum mortgage amount secured by real estate.

| Bank | Amount of credit | As a % of the property price |

| Tinkoff Bank | Up to 15 million rubles. | Individually |

| Sberbank (for any purpose) | Up to 10 million rubles. | 60% |

| VTB (non-targeted) | Up to 15 million rubles. | 50% |

| Alfa-Bank (for any purpose) | From 600 thousand rubles. | Individually |

| Rosselkhozbank (targeted for real estate) | Up to 10 million rubles. | 50% |

| Opening (target – for the purchase of housing) | Up to 15 million rubles. | 70% |

| Rosbank (target mortgage) | Up to 10 million rubles. | Individually |

| Bank "Saint-Petersburg" | Up to 10 million rubles. | 70% |

Mortgage terms secured by real estate

The longer the term, the lower the monthly payment.

| Rosselkhozbank | 10 years |

| Opening | 15 years |

| Tinkoff Bank | 15 years |

| Sberbank, VTB | 20 years |

| Rosbank | 25 years |

| Bank "St. Petersburg", Alfa-Bank | 30 years |

Mortgage without proof of income

Some banks offer this option subject to a rate increase. For example, VTB is ready to provide the “Victory over formalities” option and approve an application based on two documents. The rate will be assigned individually.

Registration of a mortgage secured by real estate

Issuing a loan secured by real estate is practically no different from taking out a regular mortgage, with the exception of the stage associated with signing the contract and transferring money to the seller.

How to take out a mortgage secured by real estate step by step:

- Apply for a mortgage. This can be done online on the bank's website or in person at the nearest office or mortgage center.

- Collect the necessary documents that your personal manager will ask for. Conduct a real estate appraisal.

- Provide documents for verification to the bank.

- Come to the office on the appointed date to sign documents. Sberbank offers completely remote servicing through its electronic services.

- Register an encumbrance on real estate in favor of the bank - through the MFC in person or through a manager (an additional paid service).

- Receive loan funds.

The sequence of points may vary depending on the internal policy of the bank. Until the encumbrance is registered, an increased interest rate will be charged to the bank.

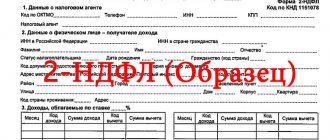

List of documents

To apply for a mortgage secured by real estate you will need:

- passport of the borrower and co-borrowers, SNILS, INN;

- documents on marital status (marriage and children);

- income documents: 2-NDFL certificate or bank form, bank account statement (salary clients may not provide);

- for collateralized real estate: USRN extract, consent of the mortgagor (according to the bank form), appraiser’s report, technical documents.

At its discretion, the bank may ask for additional documents, for example, the consent of the mortgagor’s spouse to encumber the property.

![Tinkoff loan secured by real estate [credits][status_lead]](https://agentstvo-prava.ru/wp-content/uploads/tinkoff-kredit-pod-zalog-nedvizhimosti-credits-status_lead3.jpg)

How to apply for a secured mortgage without proof of income

To apply for a mortgage without proof of income, the borrower needs to select a bank and submit an application online or come to the office. Documents you will need are a passport and a second identity card.

Various banks accept:

- international passport;

- military ID;

- seaman's passport;

- certificate of a federal government employee;

- pensioner's ID;

- SNILS;

- driver license.

For approval, you will need to prove that you have funds for a down payment of 30-50% of the cost of housing. The minimum threshold depends on the bank: Sberbank asks for at least 50%, VTB at least 30%.

On a note! A decision on a mortgage without proof of income is made quickly – within 24 hours.

As proof, you can submit a bank account statement or provide another document.

Features of a loan without income certificate:

- There is no need to submit income documents or employment certificates.

- Higher interest rate.

- The maximum loan term is shorter – up to 20 years in many companies.

- A high down payment is required.

- You cannot use maternity capital.

Otherwise, the registration procedure is similar to standard mortgage conditions. You need to submit documents for initial consideration, wait for the bank’s decision and select a property. After this, collect a package of papers for the property and wait for the final decision on the mortgage.