VTB Bank offers clients favorable mortgage terms, but always requires an insurance policy. Clients often do not want to spend money on additional services due to the accrual of considerable payments under the loan agreement.

How to calculate the cost of mortgage insurance premiums? For this, there is a special online calculator in which you can choose what will be insured:

- Risk of property damage (property insurance);

- Life and disability insurance;

- The risk of losing property rights to housing.

VTB 24: online calculator for calculating mortgage insurance

Many Internet users prefer to calculate the cost of insurance before concluding a contract. When taking out a loan for an apartment, the question of the cost of insurance at VTB Insurance Insurance immediately arises. But on the official VTB Insurance website there is no calculator for calculating the price of a mortgage policy.

On the websites of other large insurance companies you can use a calculator for calculating insurance premiums at VTB. For example, on the Ingosstrakh or UralsibStrakhovanie page, there is a section with a calculator for calculating the price for an insurance contract at VTB.

1. To calculate the cost, go to the website : ingos.ru/mortgage/calc .

2. To get the cost in the online calculator, you must provide the following information:

- City where insurance will be taken out;

- Bank name – VTB 24;

- Insurance conditions;

- Enter the loan amount;

- What will be insured;

- Decipher the borrower's date of birth, gender;

- Establish risks.

It is worth remembering that the calculator gives a preliminary calculation of the cost of a VTB insurance policy, because when concluding an agreement to issue credit funds, the bank may oblige you to take out insurance against all risks. Therefore, the exact amount will be determined after clarifying the nuances of the loan.

For a more accurate cost calculation, we recommend calling the hotline 8-800-100-44-40.

What affects the cost of mortgage insurance?

When calculating the cost of mortgage insurance in the VTB calculator, many factors are taken into account. They can be divided into two groups:

- Characteristics of the premises - price of the apartment, list of possible risks, amount of the down payment on the mortgage, territorial location of the property, technical condition of the premises;

- Features of the borrower - age, weight, gender, presence of serious diseases, lifestyle, area of employment.

Examples of reducing the cost of insurance include the location of the house in an elite area, the borrower is a woman, whose life expectancy, according to statistics, is longer.

And an increase in insurance premium is associated with confirmation of a chronic disease. When a person engages in mountaineering or other sports in extreme conditions, the cost of the policy increases.

Calculator for calculating mortgage insurance for an apartment

Today, purchasing a policy is carried out not through the website https://vtbins.ru, but through the portal of JSC SOGAZ https://shop.sogaz.ru/. The corresponding notice (shown below) is seen by everyone who wants to take out a policy for real estate, life or compulsory motor liability insurance, CASCO and other programs.

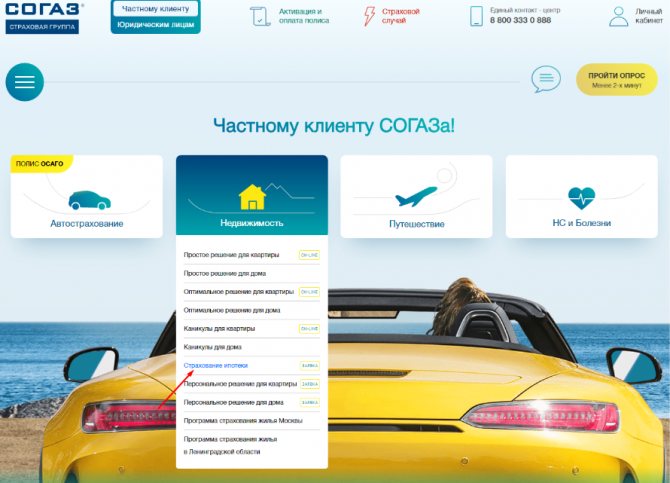

Mortgage insurance programs

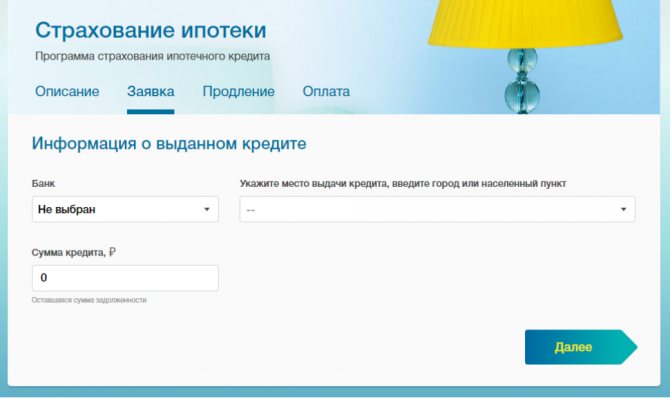

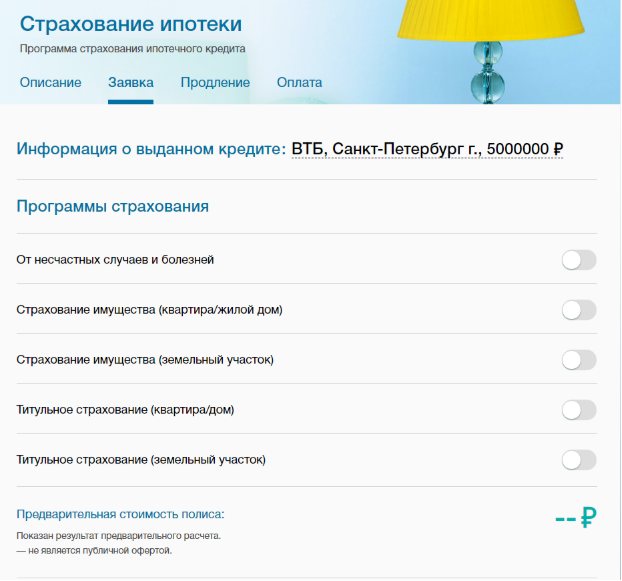

The website provides a calculator that allows you to calculate how much it will cost to purchase a policy. To find out the cost, you need to take a few simple steps:

- Select the appropriate program.

- Fill in the required data on the page that opens. Here you can choose not only VTB, but also Sberbank, Raiffeisenbank, and some other financial institutions that issue mortgages.

Insurance step 2

- Select which risks the insurance package will include by activating the corresponding sliders.

On the portal it is possible to calculate the approximate amount to pay for the policy, submit an application, and also extend existing insurance, since the minimum period is a year, but many decide to expand and increase the duration of the agreement.

Another one is often chosen as a mortgage insurer from VTB. The website provides a very convenient calculator that allows you to calculate and issue a partial or full policy. Calculations can be made on the page https://www.ingos.ru/mortgage/calc/.

What risks does VTB 24 mortgage insurance cover?

In accordance with the implemented strategy, the company provides protection for the subjects and objects of the contract:

- Loss of life and ability to work of the borrower, which implies death or loss of legal capacity (disability). As a result, the borrower’s relatives or he himself gets the opportunity to close the mortgage loan thanks to the insurance policy.

- Loss or damage to real estate that is the subject of a loan agreement. The risk package includes protection from natural disasters, fire, flooding, and illegal actions of third parties. If you purchase housing in a new home, you can insure it after registering ownership of the property.

- Termination or restriction of ownership rights after the purchase of premises. This risk is insured subject to the execution of an agreement with refinancing or payment for real estate on the secondary market, when there is a danger of challenging the right of ownership.

VTB 24 Bank reduces the loan rate when the borrower takes out comprehensive insurance and pays for protection against all risks. But it is possible to conclude an agreement with insurance of one risk - loss or damage to real estate.

The rate under the contract when canceling a comprehensive insurance policy increases by 1%. This condition is mandatory when concluding a mortgage agreement.

If you take out a mortgage with a higher interest rate but no insurance, you will pay less than if you take out a lower interest rate but pay insurance.

Rules for mortgage insurance at VTB in 2020

Before taking out mortgage insurance, the borrower must familiarize himself with the rules for providing it:

- he has the right to insure the property both for the entire period of validity of the mortgage agreement and for half of this period. However, the minimum period for which the borrower must take out insurance with VTB is at least 12 months;

- The borrower independently chooses which insurance company to use. VTB Bank does not insist that the client use only;

- If something happens to the property that was insured, the borrower is obliged to notify the insurance company about the occurrence of an insured event.

Advantages of taking out insurance when opening a mortgage at VTB

It is always useful for a borrower to evaluate the merits of signing an insurance agreement if there is a mortgage with VTB Bank. These include:

- After purchasing insurance for the borrower, the financial risk in the situation of loss of work or legal capacity is reduced;

- It is possible to select a suitable insurer from the proposed list or submit information on another company for consideration;

- The object of insurance can be either a property on the new buildings market or on the secondary market;

- After one year of insurance, you are allowed to change companies.

When applying for a policy, the client receives complete information on the terms and conditions of apartment insurance, which eliminates the possibility of questions arising in the future.

Necessary documents for purchasing insurance at VTB

requests the following documents:

- Documents for identification of borrowers and their copies;

- A medical certificate indicating the absence of serious chronic diseases;

- Reference papers characterizing the balance of the debt for mandatory payments (taxes, alimony);

- Papers characterizing the property (extracts, certificate);

- Loan agreement.

The option of providing other securities is not excluded when the number of borrowers increases or their age is not within standard limits.

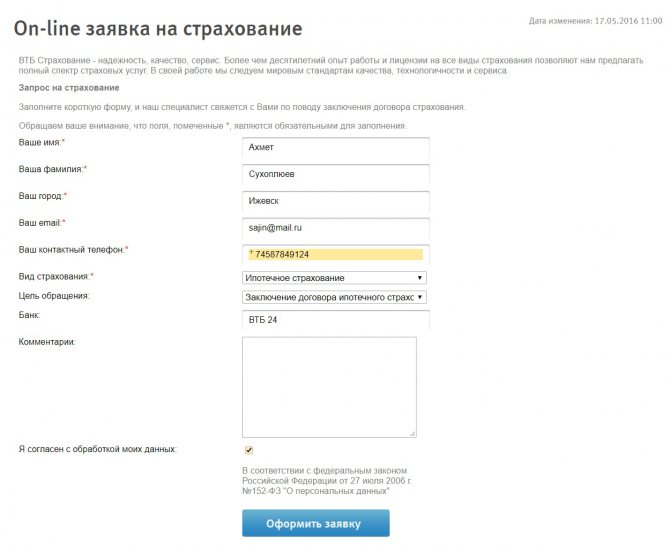

Online application for mortgage insurance

On the official website you can leave an online application to obtain mortgage insurance from VTB, follow the steps:

1. Go to the official website using the link;

2. In the window that opens, you need to fill in: first name, last name, city, email, phone number, type and purpose of insurance, bank (VTB 24).

An operator will contact you within 30-90 minutes (depending on operating hours) and tell you the details of applying for mortgage insurance at VTB.

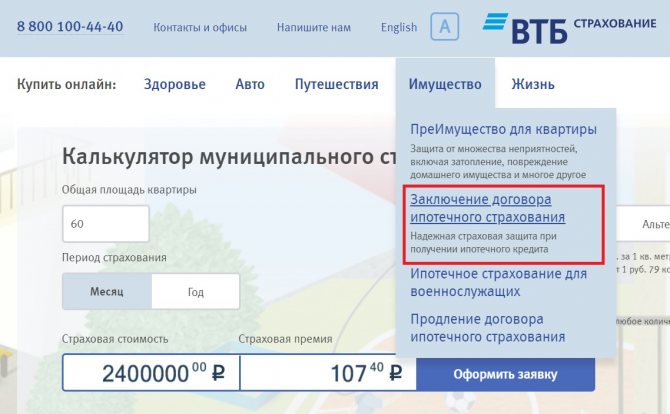

Step-by-step process of purchasing an insurance policy

The primary step towards purchasing an insurance document is to review the application, which is submitted electronically or during a personal visit to the branch. To send via the Internet, follow the steps:

1. On the VTB insurance website, find the “ Conclusion of a mortgage insurance agreement ” section in the “Property” block;

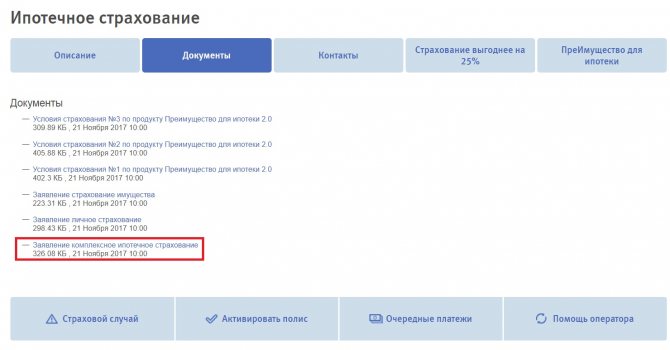

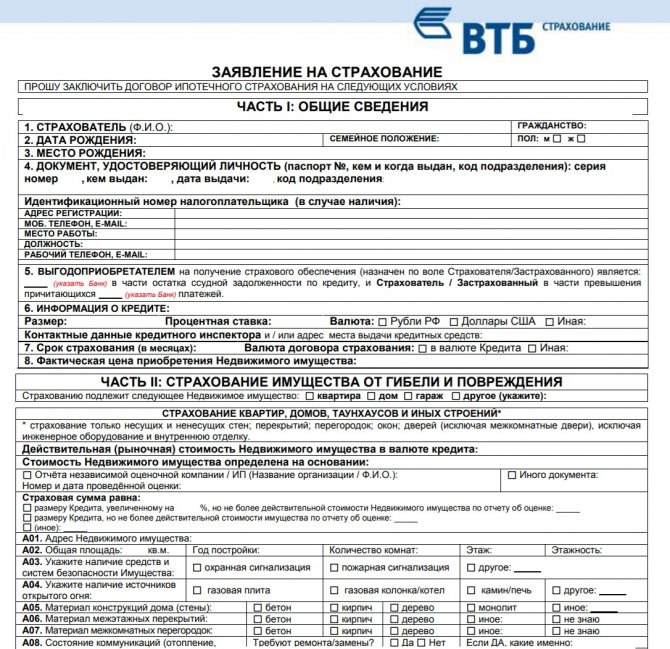

2. Click on the “Application” item and download the document “Comprehensive Mortgage Insurance Application”;

3. Download the papers to your PC (or print) and enter (print) personal data;

4. Send the form to a VTB employee, whose email address can be found via the “Employee” link in the same paragraph (Block for concluding contracts).

During the review process, the insurer’s employee will contact the client and make an appointment, notifying him of the package of necessary documents. First, he will request information about the property in order to carry out the procedure for confirming the veracity of the transaction when purchasing real estate. Subsequently, payment for the policy is made.

Is it possible to refuse insurance when applying for a mortgage at VTB?

When purchasing real estate through a VTB mortgage loan, the borrower assumes obligations for compulsory insurance of the apartment. This is stated in one of the provisions of the Federal Law “On Mortgage” .

The client has the right to refuse to purchase a policy that refers to life and health insurance. In this case, VTB Bank will set the maximum annual rate. The financial institution also has the right to completely refuse the mortgage transaction, which makes the purchase of an insurance policy a mandatory condition.

Formally, the borrower is not required to purchase an insurance policy when concluding a mortgage agreement. This information will be confirmed by VTB hotline employees. But specialists working in the office of a banking organization will insist on drawing up an agreement, arguing that without it they will not approve a mortgage.

However, the client can refuse insurance after receiving a mortgage from VTB. To do this, you need to write a corresponding application, attach a policy and identification card to it and hand it over to the employees of the insurance company. When signing documents, make sure that the contract stipulates the conditions for the return of funds, including the presence of penalties.

Note! VTB insurance refusal is not reflected in the credit history. The borrower's rating will not be reduced.

Is it possible to refuse VTB mortgage insurance?

The Federal Mortgage Law prohibits borrowers from refusing to purchase an insurance policy that protects the risks of their mortgaged property. It is necessary to follow the mandatory principles for issuing a policy. A prerequisite is the procedure for concluding an agreement between the citizen and the insurance company, providing protection in the event of loss of property or damage to the object of the loan agreement.

It is allowed not to pay for life insurance for a mortgage from VTB and protection for situations of loss, restriction of the right of ownership (title). In the absence of this extension in the policy, responsibility is transferred to the shoulders of the borrower. Title protection is considered valid for the first three years of ownership. The statute of limitations subsequently expires.

When a life insurance contract is not concluded, the mortgage interest rate increases. This action is related to risk compensation.

If a person has already taken out insurance, then in accordance with the law, you can terminate the contract in the future:

- Automatic cancellation if there are no payments for the first month (30 days) of the mortgage agreement;

- When applying in the first two weeks (14 days “cooling off period”) after signing the insurance.

All details about refusal of insurance for a VTB 24 loan - refund, sample application.

But first, it is worth assessing the possibility of risks to the borrower’s life or property rights.

Please note: When you sign an insurance policy that includes comprehensive protection, you cannot cancel the contract. This procedure is feasible only for policies that provide protection for a subject or property.

There is no need to sign a policy to protect life and health, as many credit inspectors assure when reviewing applications. The refusal does not affect the quality of the credit history, since the situation described is not indicated in the data submitted to the bureau.

The nuances of refusing insurance

When submitting documents for loan approval, the bank will necessarily offer the borrower to issue a life insurance agreement. Refusal is possible both at the stage of agreeing on the essential terms of the mortgage agreement and after its signing. The consequence of a negative decision will be an increase in the interest rate on the loan.

After paying for the policy, the borrower has a certain time during which he can refuse the services of an insurance agent. This possibility is provided for by law, but requires compliance with a certain procedure. Today, the owner is given 14 days to complete it, and the countdown begins from the moment the contract is signed.

To cancel an insurance policy, you must contact the organization with which the contract was concluded.

The procedure involves the following sequence:

- filling out an application of the established form for the return of the insurance amount;

- submission of a package of documents to the insurance organization;

- waiting for a decision on the return.

The borrower has the right to submit an application for repayment in person, use the service of sending a registered letter or the service of electronic interaction with an insurance agent. Within 10 days from the date of receipt of the documents, the organization must give the applicant a response.

VTB 24 mortgage insurance: where is it cheaper to get it?

To assess the cheapness, it is worth considering many options by contacting the offices of different companies directly. After all, sometimes insurers carry out temporary promotions to reduce the price of popular contracts that must be executed when taking out a loan for real estate. Popular organizations offering flexible terms are:

- VTB - insurance that allows you to save due to the summed up payment for 3-5 years when purchasing the policy for the first time;

- VSK is a loyal system for calculating premiums based on the age and gender of the borrower.

And also, many clients note the Alliance company, where it is possible to purchase a policy at a cost of 0.34% of the price of the mortgage agreement.

Current VTB mortgage insurance offers

Today, at VTB Insurance you can purchase a contract under a special program. It implies a reduction in annual payment by 25% if paid at one time.

So, if the client decides to take out a mortgage for 15 years, when the price of the apartment is 3,000,000 rubles, then he will have to pay 91,824.48 rubles. in 5 years. If you agree to a special program, a discount of 18,744.48 rubles is given. All that remains is to pay 73,080 rubles. at one time.

How not to make a mistake with your choice?

When choosing a company, you should pay attention to the following points:

- There are no pitfalls, for example, the document states that the applicant will not be able to terminate the insurance contract or will have to pay a high commission;

- Elimination of some risk situations;

- Compare the pricing policy for calculations and protection conditions in several companies.

When weighing the safety, reliability and availability of an insurance company, in most cases a person makes the right choice for himself. You can always purchase a policy on favorable terms, but first you should familiarize yourself with the offers of several insurers.

What happens when the insurance is not paid by the borrower

While the policy is in effect, the person stops making payments. What happens then? The insurance company begins sending notifications about the need for payment.

If the citizen continues to refuse to pay the fees, information about this is sent to the banking organization, which will also begin to harass the client in various ways - SMS messages, letters, calls. In the worst case scenario, the case goes to court.

Required documents

Mortgage insurance at VTB requires a certain package of documents that must be provided when receiving a loan for real estate.

Among them:

- a valid passport of a Russian citizen (copies, originals with a registration mark);

- statements of mandatory administrative payments (alimony, taxes, other monthly payments);

- medical report indicating the absence of severe chronic diseases;

- original and copy of the mortgage loan agreement;

- documents for the purchased property (purchase and sale agreement, appraisal report for the secondary market, etc.).

Depending on the selected mortgage program, VTB may require additional certificates and papers if co-borrowers are involved, the applicant is officially married, or wants to purchase living space under a special program with government subsidies.

Important! A mortgage loan from VTB provides for cooperation with accredited companies that have a positive reputation for indemnifying damages in the event of insured events. The cost of the policy is a certain percentage of the mortgage loan amount.

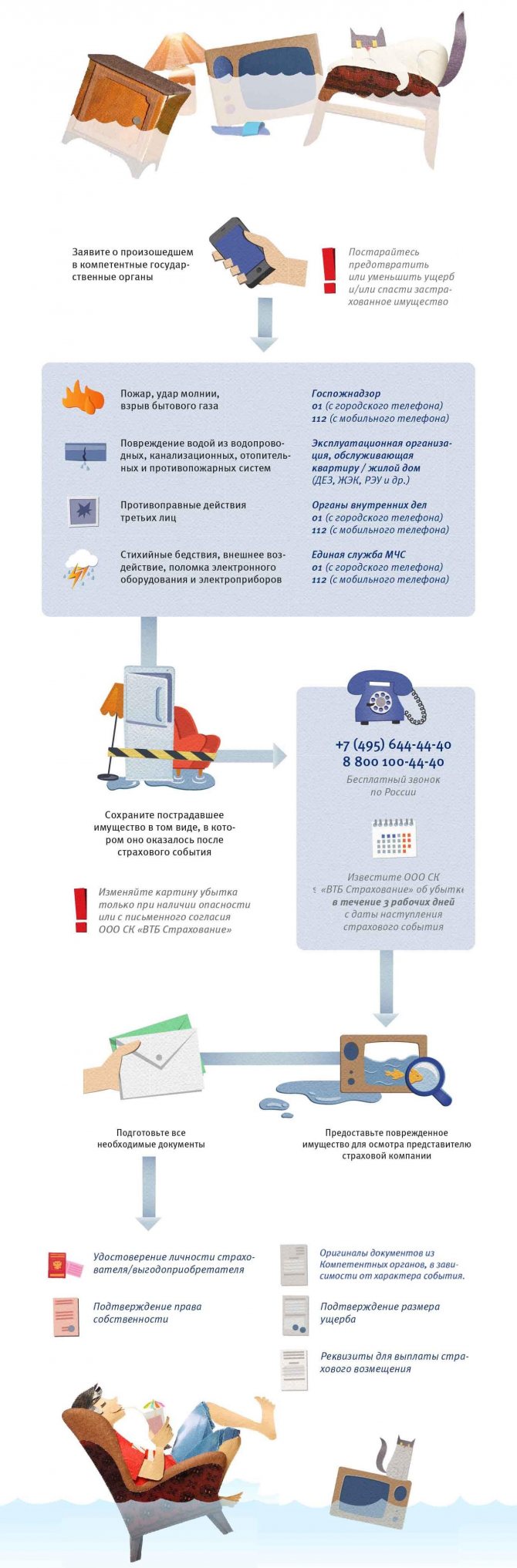

Insured event on mortgage property, what to do?

An insured event occurred, the neighbors were flooded, there was a fire, and so on, first you need:

1. First of all, try to minimize the damage and report it to the relevant government authorities.

2. Next, call the hotline +7 (495) 644-44-40 (payment according to tariff) or (toll-free call).

The insurance company must be notified within 3 working days from the date of the insured event.

3. They will set up a meeting with a representative over the phone and allow them to inspect the damaged property to assess insurance payments.

Before inspection, you should not touch the damaged property, except to prevent further damage.

4. Prepare a number of all necessary documents for an application for insurance payment:

- Identity cards (passport);

- Confirmation of ownership;

- Originals from the competent authorities (fire department, Ministry of Emergency Situations, police);

- Confirmation of the amount of damage;

- Details for payment of insurance compensation;

- Application form, which can be downloaded on the official website in the “Documents” section.

Customer reviews about mortgage insurance at VTB Insurance

Mortgage insurance reviews vary, as many people do not write positive reviews, the majority are negative:

But there are also positive reviews about mortgage insurance at VTB Insurance:

Everyone decides for themselves whether to take out insurance or not. We recommend making a list of top companies and choosing the best option.

Reviews about mortgage insurance at VSK-Dom

Customer reviews about cooperation with VSK insurance are contradictory. There is also a positive opinion about fast and high-quality service.

But there are enough negative reviews, the main reasons for which are:

- Delaying the return of the insurance premium in case of early repayment of the mortgage.

- Loss of documents for insurance payment.

- Disloyalty to clients.

- Delay in payment of the insurance amount in the event of an accident.

I would like to hope that with the introduction of electronic policy issuance and remote dispute resolution, shortcomings in the insurance company’s system will be eliminated.

All reviews can be viewed on the portal: banki.ru/insurance/vsk .

Accredited mortgage insurance companies VTB 24

You can obtain mortgage insurance from any of the following institutions. The list approved by the bank includes 19 insurance companies:

- VTB insurance,

- Alfa insurance;

- Sogaz;

- MAX;

- Reso-Garantiya;

- Ingosstrakh;

- VSK;

- Energy guarantor;

- Alliance;

- Surgutneftgaz;

- ERGO;

- Yugoria;

- Zetta insurance;

- Renaissance Insurance;

- BET;

- Liberty;

- Absolute;

- Rosgosstrakh;

- Agreement.

When operating, these insurance companies comply with the requirements of VTB, which has maintained a partnership with them for several years. But this list has been expanded by other insurers, whose policies are accepted by the bank when concluding a mortgage agreement.

Additionally, borrowers can use the services of RSHB-Insurance, Cardiff, Adonis, Chulpan, Tinkoff.