Special loan programs for the purchase of secondary housing

The loan size under the “Victory over formalities” program can reach a maximum of 30 million rubles. The minimum down payment when purchasing a secondary property is 40% of the total payments. The rate is 7.9%. Using this program, you can get a mortgage by providing only two documents - a passport and SNILS. No income certificate is required. SNILS have the right not to be provided to persons who are not required to possess this document according to Russian law (in particular, military personnel). This type of contribution does not provide for the use of maternity capital. Documents for this program are processed in an expedited manner, within 24 hours after submitting the application.

Requirements

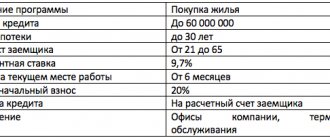

Requirements for the borrower. A citizen of the Russian Federation or a foreign country can take out a mortgage. The borrower must be officially employed in Russia. The total work experience is at least 1 year, in the last position - at least a month. Age - from 21 years at the time of conclusion of the contract to 75 years at the time of repayment of the debt.

Real estate requirements. You can buy a finished apartment or residential building (townhouse) with a mortgage. It is necessary that there are no encumbrances against the apartment, and that all owners are not against the sale.

The market value will be determined by an independent appraiser. The service is ordered and paid for by the bank client from his own funds. To conduct an assessment, the bank recommends contacting organizations that have received the bank’s approval. You can find a list of organizations on the official website.

Required documents. To submit an application you need to provide the following package of documents:

- A completed application form;

- passport of the Russian Federation or a foreign country;

- a document confirming the right to stay and confirming employment in Russia - for borrowers without Russian citizenship;

- insurance certificate (SNILS);

- proof of income;

- a copy of the work record or an extract from it;

- military ID - for men under 27 years of age.

As proof of income, a 2-NDFL certificate, a bank certificate or a tax return for 12 months can be provided. Clients whose salaries are credited to a VTB card do not need to confirm income. You can indicate income from two jobs.

Sample certificate 2-NDFL.

If the loan is approved, you need to prepare copies of documents for the selected apartment or house:

- confirmation of ownership;

- cadastral passport;

- extracts from the house register;

- characteristics of the premises (financial and personal account);

- passports of all owners (all pages, even blank ones).

In addition, provide the bank with an appraiser's report. If one of the owners is under 18 years of age, you must obtain permission from the guardianship authority. The bank may request additional information, so before submitting documents it is better to consult with an employee of the VTB Mortgage Center.

If you are purchasing an apartment on the secondary market from a legal entity, you will need copies of the following documents:

- Constituent documentation of the organization.

- Certificates of state registration.

- Certificates from the tax office, which confirms that the legal entity is registered. The certificate must be issued no earlier than 60 days before the date of conclusion of the real estate purchase and sale agreement.

- A copy of the certificate of entry into the register.

- A document that confirms the authority of a representative of the organization.

You can apply for a mortgage by presenting only a passport of the Russian Federation and a pension certificate SNILS or INN. Such conditions are offered by the “Victory over formalities” program.

The decision will be made only on the basis of these two documents; proof of income is not required. The down payment must be more than 40% of the cost of the apartment. Maternity capital cannot be used in calculations.

Mortgage conditions for secondary housing at VTB

Anyone whose permanent place of work is located in the Russian Federation can become a client of the mortgage program. There are no requirements for the borrower’s citizenship and place of registration - they can be anything.

To increase the desired loan amount, the borrower has the right to attract a guarantor. Close relatives of the borrower, as well as spouses (both civil and legal) can act as guarantors. The package of documents provided by the guarantor is identical to the package of documents provided by the borrower.

If the borrower, for whatever reason, does not repay the loan on time, the guarantor undertakes to repay his overdue debt. It is possible to register the purchased property as the common property of the borrower and the guarantor, or as the individual property of the borrower.

To obtain a mortgage outside of a special program, both the borrower and the guarantor are required to provide:

- Passport;

- Application form;

- A certificate in the form of a bank or a 2-NDFL certificate plus a tax return;

- An extract or certificate from the work book, or a copy of the work book with the certification of the employer;

- SNILS (only for citizens of the Russian Federation);

- Military ID (only for men under 27 years of age);

- For citizens of foreign countries - a document that would confirm the legality of their employment and stay on Russian territory.

How to get a mortgage at VTB

Requirements that are not specified in the description of each individual home loan program are standard and are set by default, based on the general mortgage conditions for VTB 24 Bank.

These conditions are publicly available and can be obtained both through the official website and by contacting the office of a credit institution.

Requirements for the mortgaged property

The fundamental requirement of any lender for collateralized real estate is the absence of encumbrances on it from third parties.

As well as unsatisfied claims of legitimate applicants for a share of property, which could arise from the unlawful removal from the apartment of minors, incapacitated persons or subjects serving imprisonment by decision of a judicial authority.

You can find out the presence of encumbrances (in the form of collateral, rent or lease) at the registration chamber of Rosreestr, and the absence of possible claims from persons with legal rights can be clarified by receiving a copy from the house register, which indicates the reason for the discharge of everyone who previously lived in the apartment.

Another significant factor affecting the liquidity of the collateral is the condition of the property, which can be considered satisfactory if the building or part of it is not included in the list of objects subject to demolition, reconstruction or major repairs.

What else is important to know: Mortgage loan for building a house - methods of obtaining funds, terms of issuance, benefits, preferential programs

You can obtain the information you are looking for from the relevant department or the department of the local municipality that oversees the housing stock.

After choosing an apartment, the possibility of its mortgage, that is, collateral with a credit institution, must be confirmed by the consent of the insurance company to accept the object for insurance of the risks associated with it, as well as the approval of the credit expert of the VTB 24 bank branch.

Benefit from insurance

When concluding a loan agreement with a mortgage on the apartment being purchased, it is necessary to conclude an insurance agreement, which must necessarily compensate for the occurrence of risks associated with the condition of the apartment, as well as the liability of its owner to third parties.

Such insurance is provided for by the Mortgage Law and is not subject to discussion, unlike the borrower’s liability to the bank in the event of non-repayment of the debt, which does not necessarily have to be guaranteed by insurance.

However, credit institutions use a trick and increase the interest rate by a percentage point or more for those who refuse voluntary insurance.

By not concluding additional voluntary insurance of his liability, the borrower agrees to an annual loss of an amount at least twice as large as the cost of the policy, and also does not acquire additional protection against force majeure circumstances, the occurrence of which can never be excluded.

The choice of insurance organization is nominally under the control of the borrower, who can give his preference to any company.

However, if the insurer is not included by the credit institution in the list of accredited ones, then it will have to undergo additional verification of the bank’s requirements, which should not be accompanied by an extension of the time period for making a decision on issuing a loan.

If the loan officer determines that the insurance company does not meet all applicable requirements, the mortgage will be denied.

Among other things, when agreeing to additional personal insurance, you should remember the legality of the insurer’s requirements to undergo a medical examination, without which it is difficult to obtain a policy.

Cost estimate

In each branch of VTB 24 Bank you can find a list of expert organizations that the credit institution trusts in assessing the market value of residential real estate.

Having chosen one of the experts, you should agree with him on the assessment of the selected apartment, the cost of which may turn out to be too high and then the bank will not agree to the deal.

The way out in this situation is to reach an agreement with the seller to reduce the price to the maximum level specified in the expert’s report, which can be free of charge or compensated by the buyer from his own funds if he is really interested in the apartment.

If you cannot reach a compromise with the seller regarding the price, you will have to abandon the purchase and start looking for another apartment, and write off the costs of the examination as unnecessary. The expert's opinion should be left, but for no more than six months, in case the seller changes his mind and cannot find another suitable option.

Requirements for borrowers

Requirements for borrowers:

- Citizenship and registration of the borrower: no restrictions.

- Place of work: on the territory of the Russian Federation or (only for citizens of the Russian Federation) in branches of transnational companies abroad.

Guarantors. To increase the loan amount, you can attract Guarantors - the Bank will take into account the total income of the Borrower and the Guarantor to calculate the maximum loan amount.

In this case, legal or common-law spouses, as well as close relatives of the Borrower - parents, children, brothers and sisters (including half-siblings) can act as guarantors in this case. All Guarantors participating in the Borrower's total income provide a package of documents similar to the Borrower's documents.

The Bank engages the Borrower's spouses as obligatory guarantors, unless a marriage contract has been concluded between the spouses.

In this case, when applying for a mortgage, the Guarantor provides only a passport and SNILS.

The ownership of the purchased property can be registered both as the individual property of the Borrower, and as the common joint property of the Borrower and the Guarantor - legal spouse.

Guarantee means the obligation to repay the overdue loan debt in cases where the Borrower, for one reason or another, does not repay the mortgage loan.

Procedure

Submit your application. Make a preliminary calculation and apply for a mortgage. Our employee will contact you, advise you and make an appointment at one of the mortgage centers at a time convenient for you.

Bring your documents to the mortgage center and receive approval in 1-5 days (or within 24 hours under the “Victory over formalities” program).

The approval is valid for 4 months from the date of receipt. You can look for an apartment on your own or with the help of our partners, by selecting an object from among those offered on the site or by contacting our partners.

Select a property. The manager will advise you on what documents you need to collect for the selected property and help you make an assessment. Provide a package of documents, and the bank will check the legal cleanliness of the apartment.

In addition, the apartment will be inspected by the insurance company in order to agree to compulsory home insurance. Insurance against the risk of loss and damage to the purchased apartment is mandatory.

To avoid a 1% interest rate increase, we recommend that you take out life and disability insurance.

Complete the deal. Sign a purchase and sale agreement and a loan agreement with the bank, as well as an insurance agreement. The bank will transfer the money to the property seller.

The purchased property is immediately registered as your property. Simultaneously with the registration of property rights, a mortgage will be registered in favor of the bank until the loan debt is fully repaid.

Registration of the contract

Another possible stumbling block may be the execution of the transaction if the seller or realtor does not show prudence and does not accept a form of agreement acceptable to VTB 24.

The agreement is standardized, takes into account the interests of all parties to the transaction and was signed by more than one hundred mortgage borrowers, however, if it does not suit one of the parties, it has the right to submit its own version of the document for consideration by the bank before the advance payment is made.

With a non-standard agreement, disagreements are likely to arise, the elimination of which will inevitably lengthen the approval procedure and execution of the transaction.

To prevent this from happening, it is better to immediately download the mortgage purchase and sale agreement form on the official VTB 24 website and submit it to the realtor and the seller for study in order to minimize the period of reconciliation of disagreements.

Additional expenses

If you carefully read the terms of mortgage lending, you will find that VTB 24 warns in advance about additional costs that await a potential borrower, namely:

- Down payment depending on the chosen loan program and the cost of the apartment.

- The realtor's commission, which is optional, since the seller usually pays him.

- Payment for expert services of a home appraiser.

- Insurance payments, including medical examination fees.

- Notary's fee for certification of the purchase and sale agreement and other documents.

- State duty for registering a transaction in Rosreestr.

- Reimbursement to the bank for settlement and cash services not included in the mortgage offer.

What else is important to know: Alfa Bank (St. Petersburg) - mortgage, programs, conditions, reviews

Documentary preparation

You can also apply for a mortgage loan at VTB 24 online if you go to the official website and receive a conclusion on the possibility of lending by email, but you will still have to formalize the relationship with the lender in the office, having prepared the following documents:

- a copy of all pages of the Russian citizen’s passport (including blank pages);

- military ID - for men, if under 27 years of age;

- a copy of the work book with the employer’s confirmation stamp on each page and a certification that the employee “continues to work to the present”, confirming at least six months of continuous work experience;

- certificate 2-NDFL or in any form (agreed by the bank), allowing you to reflect monthly earnings during the last year or the actual period of employment;

- a copy of the income statement from the Federal Tax Service, if available;

- employment contract or certified copy of the document;

- SNILS, and in its absence, the individual taxpayer number, which must be indicated in the application form;

- for non-working pensioners – a copy of the pension document and an extract from the pension fund account;

- if the borrower is the person who signed the income certificate, then an extract from the Unified State Register of Legal Entities will be required;

- additional documents.

Documents "on demand"

The credit expert may request additional documents that will influence a positive decision:

- Copies of diplomas, certificates and other documents on obtaining education, training in a profession or advanced training.

- Agreements and certified information on current and fulfilled debt obligations in other credit institutions.

- Data on assets in the form of copies of title documents for movable property and real estate.

- Bank account statements and data on non-cash means of payment (stocks, bonds, etc.).

Having collected all the necessary documents or taking advantage of the “Victory over formalities” offer and providing a passport and SNILS, any citizen of the Russian Federation aged 21 to 60 years with an appropriate income can choose one of the presented loan products and buy an apartment on the secondary market.

The offers from VTB 24 are varied, and the purchase of mortgaged apartments is especially special, since it is comparable to a mortgage with state support, which is currently the most optimal investment in residential real estate.

Repayment methods

To repay a personal mortgage loan, it is not necessary to be personally present at the VTB Bank office. The loan can be repaid either in full or in part (including ahead of schedule) in one of the following ways:

- through branches of the Russian Post;

- using the all-Russian VTB ATM network;

- transferring funds through another bank;

- through the VTB website, when logging into the client’s personal account.

In addition, it is possible to repay the loan at the cash desk of any VTB branch.

You will need to show your passport. However, the payer of the loan does not have to be the person in whose name the loan is issued - if you provide the loan agreement number, any authorized person can make the payment. Official website of the bank: vtb.ru

Requirements for the borrower and necessary documents

The bank does not impose special conditions on borrowers applying for a mortgage loan. The exception is for military personnel using a special benefit program. For persons over 45 years of age, “Mortgage for the military” is not issued.

The main requirements include:

- permanent registration in the region where the application is submitted;

- place of work in the Russian Federation;

- confirmed income from 1 or 2 official sources.

Additional opportunities for the borrower:

- the right to attract up to 4 guarantors or co-borrowers, which allows you to qualify for a larger credit limit;

- summing up income at the main place of work and part-time work;

- the right to distribute shares of ownership of the acquired property between co-borrowers;

A basic list of documents, the same for all proposals, except for “Victory over formalities”:

- Questionnaire in the form of a credit and financial institution.

- Valid passport, nationality does not matter.

- Original SNILS from citizens of the Russian Federation.

- Confirmation of the amount and source of income (2-NDFL, tax return for individual entrepreneurs and self-employed persons, certificate in bank form).

- An extract (copy) from the work book, certified by the employer, or information from the tax service.

- Military ID for persons liable for military service up to 27 years of age inclusive.

- Valid residence permit and proof of employment documents for foreign applicants.

Depending on the initial conditions, the bank has the right to request additional packages of documents. When applying for a loan within the framework of the “Victory over formalities” offer, a valid passport and the original SNILS are sufficient, and for military personnel, foreign citizens and other categories of persons - an identity card and TIN.

Important! If a marriage agreement (agreement) has not been concluded between the spouses, then when obtaining a mortgage loan it is necessary to involve the husband or wife of the applicant as a co-borrower.