When constructing a residential building, citizens often need to take out a loan. It is possible to get a mortgage for building a house from Rosselkhozbank; you just need to know some of the nuances of lending. The construction of country houses requires significant investment. With a sufficient material base, things speed up significantly. Since the process, which involves not the purchase, but the construction of a private residential suburban building, is associated with all sorts of risks, banks are not very willing to issue loans for it.

Rosselkhozbank is one of the Russian banks that approves mortgages for construction work under fairly acceptable conditions. But the applicant has to try a lot to get approval for such a mortgage. Since the bank is reliable, getting a loan from it becomes an excellent opportunity to significantly bring your housewarming closer.

Do they now provide a mortgage for the construction of a private house?

There are extremely few bank offers providing loans under the terms of construction of a private house in Russia. Such a mortgage remains the most risky step for the bank, which is why the lending requirements are extremely stringent.

The main risk for a financial institution is that with unfinished construction, the liquidity of the building is minimized. To compensate for its own risks, the institution certainly requires that the applicant be provided with a maximum of reliable collateral obligations.

To be able to obtain a mortgage for the construction of a residential building, you will need to have official rights to other property, a land plot. At the same time, you cannot do without a confirmed, permanent job that provides a sufficient source of stable income.

Many citizens at a certain time come to the idea of the need to purchase their own home. To do this, you have to solve various issues - buy a new building or secondary housing, which is better, a house or an apartment.

For the majority of the population, the advantages of a private house are noticeable: individual layout, large area of premises. When a decision is made to take out a mortgage to build a house, a lot of problems immediately arise - where to apply for it and what conditions exist for such lending?

It’s worth taking a closer look at how a home construction loan differs from a traditional mortgage:

- The very first difference is that with a regular mortgage, the citizen first determines the apartment option he is looking for, and then rushes to the financial institution. But if you decide to receive money for the construction of a private house, you first need to determine the required amount in order to then plan construction costs for it.

- The second difference is the very high interest rates for lending for the construction of a private house. This is easily explained, since the liquidity of a finished apartment is significantly higher.

- The third difference is that a mortgage for private housing construction forces the applicant to submit a project and approve it. Then you will need reporting documents indicating the completion of construction. But the positive thing is that you end up with a finished home that is designed specifically according to your wishes.

- The fourth difference is that there are certain requirements regarding the land plot. You can't build a house just anywhere. New construction must begin on land that has an appropriate purpose, which is permitted for private construction and further permanent residence.

- The fifth difference is that for the entire construction period the bank has the right to receive additional security from the applicant, expressed as a guarantee or pledge of other real estate.

- The sixth difference is the ability to receive finance in tranches, which depend on the completion of certain stages of construction.

Features of lending for housing construction at the Russian Agricultural Bank

Rosselkhozbank does not have any special programs for the construction of a private house.

There are no special lending programs for the construction of real estate at Rosselkhozbank.

But this option for using borrowed funds is provided for by standard (including materiel capital) and “Rural Mortgage”. If the borrower needs a small amount, then it is easier to apply for a consumer non-targeted loan.

Differences between a mortgage for building a house and a regular one

Despite the advantages of the house (individual layout, large area of rooms), it is more difficult to get a loan for construction than for a finished apartment.

This mortgage differs from the standard one:

- strict requirements for the land plot (the new building must be located on land intended for individual construction and permanent residence);

- the need to submit a project for approval, then - documents confirming the completion of construction;

- higher interest rates (the liquidity of an apartment is much higher than a house that is just planned to be built);

- the need to provide additional security (guarantee, pledge of another property) for the period of work;

- the opportunity to receive money in installments as successive stages of construction are completed.

Mortgage conditions of Rosselkhozbank in 2019

Already in 2020, applicants received a chance to have a mortgage approved by the Russian Agricultural Bank, and for a fairly long period. When the terms of an executed mortgage agreement are changed by the consumer, the bank has the right to take adequate measures to protect its risks, while simultaneously increasing the client's liability.

It is also allowed to take out a consumer loan for construction, but only on the condition that it is issued for a non-targeted purpose. But mortgage lending opens up more favorable prospects for the borrower:

- Significant lending period;

- Comfortable annual interest rate;

- Approval of a significant amount that can help successfully implement the construction.

Currently, Rosselkhozbank has opened a mortgage program called “Housing Lending”. According to this proposal, the applicant is able to organize the construction of real estate. It is available on both your own and rented land.

It is also allowed to purchase any unfinished object that requires completion. According to the terms of this program, it is possible to obtain approval for the following parameters:

- Minimum amount - from 100,000 rubles;

- Maximum loan - 20,000,000 rubles;

- Mortgage duration - 30 years;

- Initial contribution - minimum 15%.

There are absolutely no commissions or other hidden payments when issuing a loan for construction work. An already built or later completed structure acts as a guaranteed collateral. A maximum of three individuals are allowed to act as co-borrowers, the condition being that they are not even relatives.

The official partner of the applicant must become a co-borrower. Consideration of a loan, the purpose of which is the construction of an individual building, is carried out within a week.

Stages of registration

It is not necessary to take out a mortgage for the construction of a residential building yourself. Some organizational issues are taken care of by credit brokers. But a potential borrower can figure everything out without the help of intermediaries.

Stages of registration of a mortgage agreement:

- Submit your application for consideration.

- Prepare a design and construction estimate.

- Conduct an assessment of the land or real estate that is pledged to the bank.

- Get pre-approval from a lender.

- Insure the collateral and (if desired) the life and health of the borrower.

- Draw up a loan agreement establishing the relationship between the parties.

- Receive funds in cashless form. The bank can transfer them directly to the contractors if the construction is carried out by a company.

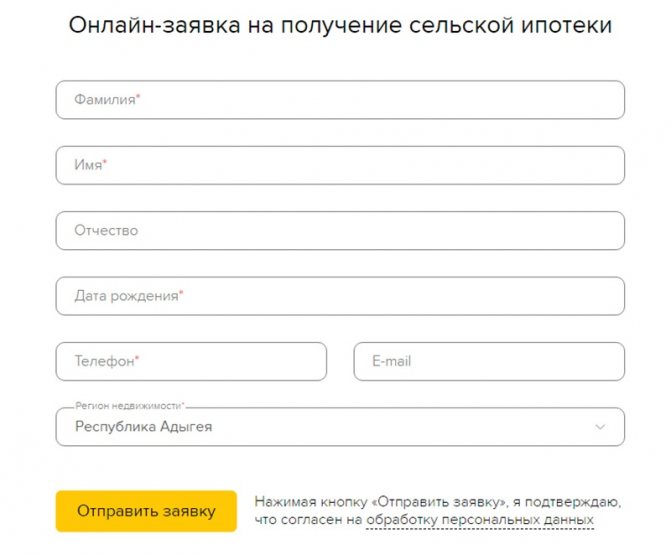

Application for a mortgage.

It is necessary to make timely monthly payments and provide the bank with documents on the progress of construction, if this is specified in the terms of the loan agreement.

Documents required for approval

Standard package of documents:

- application form for receiving credit funds;

- passports of the borrower and co-borrowers;

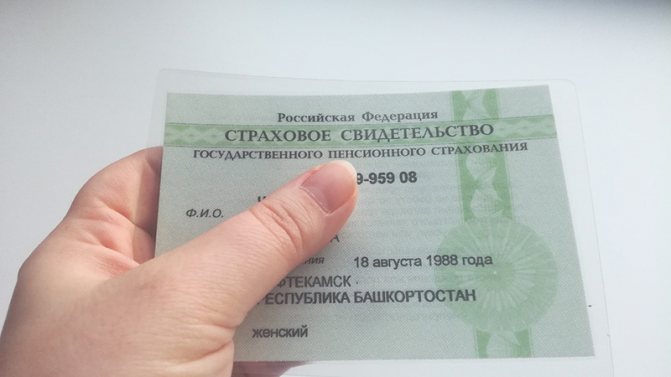

- SNILS;

- a copy of the work book and the original for verification;

- employment contract;

- proof of income;

- military ID (for men of military age);

- driver's license (if available);

- certificates of marriage/divorce, birth of children (if available).

If the information provided is not enough to make a decision on applying for a mortgage, the bank may request additional documents confirming the client’s personal data or financial situation.

Additionally, a package of papers is provided for the site and the planned individual housing construction project (IHC).

All documents must be completed properly.

You will need:

- certificate of registration of ownership of a land plot;

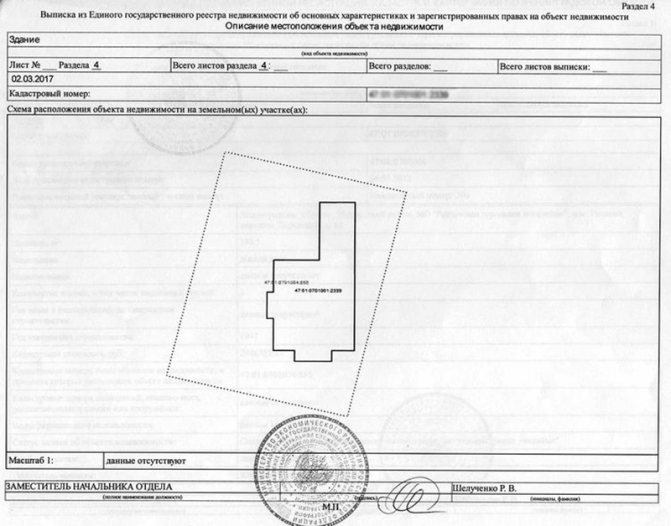

- cadastral passport;

- extract from Rosreestr;

- official permission to carry out construction work;

- contract agreement (if you plan to involve a contractor);

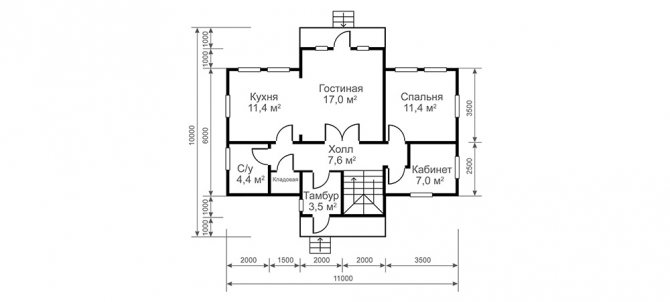

- house design, estimate (RSHB can provide an amount not exceeding 80% of the estimated cost of a private house).

Additionally, you may need a house project.

Features of insurance

According to the Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 No. 102-FZ, it is mandatory to insure only the collateral. Depending on the terms of the loan, this may be a plot of land, land and a house that is planned to be built, or other real estate of the borrower. Life and health insurance is not mandatory, but it does affect the rate reduction.

Interest rates

For each situation of a mortgage loan for the construction of a house, Rosselkhozbank independently calculates its own risks, then setting the rate within 8.9–12%. It increases as the degree of risk increases.

See the same topic: What is a “children’s mortgage”? Conditions for issuing preferential children's mortgages at 6 percent

At the same time, certain categories of citizens have the right to count on special mortgage lending conditions:

| Conditions | Preferential rate | Standard rate |

| Up to 3,000,000 rubles | 9,15 | 9,3 |

| More than 3,000,000 rubles | 9,05 | 9,2 |

| Home construction | 11,45 | 12 |

Who can be counted among the “beneficiaries”? According to information published on the bank’s official website, the following are recognized:

- Bank clients who have payroll cards;

- Employees of budgetary organizations;

- All military personnel;

- Agricultural workers.

Calculating a mortgage loan using a calculator

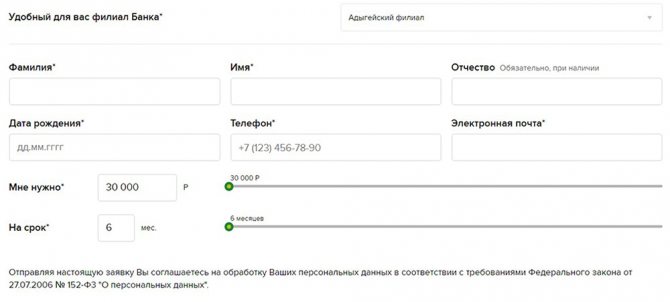

To pre-calculate the planned mortgage loan for the construction of a residential building, which will show the entire amount of the upcoming overpayment along with the size of the monthly payments, it is convenient to use an online calculator.

It is necessary to enter into its columns:

- Mortgage size;

- Her term;

- Your salary;

- The amount of the down payment.

An electronic calculator will only give a preliminary result, which may differ significantly from the final bank offer.

Mortgage for the construction of a private house in Rosselkhozbank: calculation calculator

RSHB provides its clients with fairly favorable mortgage insurance with the lowest possible interest rates. Proper management of them depends on the possible full refund guarantees that have been provided to the client. Another important advantage is the possibility of earlier repayment of mortgage funds. If a decision was made to repay the loan early, this will not be the basis for the accrual of fines and commissions.

Another advantage is that the client can use the calculator on the official website before signing the contract. This is an ideal opportunity to calculate your strengths and potential interest rates, which directly depend on the loan term, income level and the size of the down payment. To get approximate indicators, you just need to fill out all the necessary columns of the calculator.

It is worth noting that Rosselkhozbank issues a mortgage for the construction of a residential building with a higher interest rate, approximately 0.5%. It is valid until the time of receipt of a certificate confirming ownership of an already fully completed construction project.

A feature of this form of lending is that each construction stage is characterized by the mandatory preparation of estimates. The mortgage itself, like a loan, is issued in the form of opening a line of credit, where a selection of the main parts of the project and estimates is carried out. The mortgagee has the right to use the assistance of selected contractors and has the ability to carry out basic work processes on its own.

The invitation to work from professionals must be reflected in the estimate plan. RSHB is able to provide an amount of no more than 80% of that indicated in the estimated calculation scheme. To obtain the most favorable conditions for a mortgage for the construction of a private country house, the borrower should make a down payment of 15% of the total estimated cost.

Possible mortgage options for building a house

Although the bank offers all the programs described below, consumer loans along with the collateral system are the most popular among them. But the borrower’s use of maternity capital to repay an already open mortgage is guaranteed by law, so Rosselkhozbank does not refuse when a woman asks to formalize such a repayment procedure.

Consumer loan

There are situations when the upcoming construction of a house does not require significant lending. The citizen only lacks a certain amount to add to his own savings. Then the best solution is to apply for a consumer loan from a bank. The advantage of such a mortgage for the construction of an individual house is the minimum interest rate with a simplified registration procedure. Disadvantage - money is issued only for a short period (1-5 years), but usually it is not difficult for the borrower to repay the debt on time.

Banks are more willing to issue consumer loans, as opposed to targeted programs. Clients have the opportunity to independently calculate the amount of monthly payments and submit an application via the Internet to save their time.

The main difference between a consumer loan is that it does not require property to be pledged as collateral, so most of the risks are absent. No guarantors are needed, which is why such a mortgage is issued almost immediately.

Secured mortgage

The current practice of drawing up a loan agreement secured by a real estate pledge becomes more complicated when the subject of the pledge is a land plot where the construction of a building is expected. For the bank in such a situation, both the land and the future house built on it will become guarantees. An indispensable condition is that the site must be the private property of the applicant, confirmed by relevant documents.

This mortgage option remains attractive to citizens, but banks are very reluctant to agree to this method of obtaining a loan. The procedure is complicated by the fact that it is necessary to carry out an assessment of the value of the land plot, which certainly takes into account its localization and the possibility of connecting communications. It is also checked that the site does not belong to legally protected areas where any buildings are prohibited.

The loan period for such a program is usually short - a maximum of 3 years. It is calculated based on the final price of finished housing. Then it will take some more time to fully repay the debt.

The chance of obtaining a mortgage on land is very small, but when the assessed value of the land is significant, it increases. Rosselkhozbank willingly approves a loan only in situations where the land is located in prestigious areas and an increase in its liquidity is expected, which is capable of fully covering the loan amount.

Standard mortgage

Standard conditions imply that the applicant already owns a plot of land. He just needs capital to finance the construction work. The only collateral in the contract and the guarantee for the bank is the future home.

Rosselkhozbank offers this lending option; the borrower only needs to determine the conditions under which he wishes to obtain a mortgage. As a result of concluding an agreement, the bank has additional guarantees that the development will be completed properly and the loan debt will be closed.

Maternal capital

This state program, called maternity capital, was adopted in 2007. Its basis is that financial proceeds are deposited into the mother’s account after the birth of her child. They cannot be used until the baby reaches the age of 3 years. It is also an indispensable condition that you are allowed to spend money only on specific needs.

The main option for a family to invest maternity capital is to use it to open or pay off a mortgage approved for the construction of a country house. Many young parents dream of having their own home, built according to their design.

Such a program provides additional guarantees for the child, since part of the real estate is certainly registered in his name.

Required documents

When purchasing a property that is ready to move in, they check whether the seller has rights to dispose of the relevant property.

A private individual provides a DCT, a privatization agreement or another supporting document.

The absence of encumbrances and compliance with technical parameters are controlled using an extract from Rosreestr. The market value is determined by an independent assessment. Additional requirements are specified taking into account the specifics of the subject of lending.

For an apartment

A certificate from the regional unit of the Ministry of Internal Affairs confirms the number (age) of registered residents. It is necessary to provide written consent of the spouse (other owners, guardianship authorities) to the sale transaction.

To a house in the countryside

In addition to the listed documents, the bank is provided with information about ownership of the land plot or long-term lease. The house must meet the requirements for a facility intended for year-round use.

For construction

When making a purchase under a shared participation agreement in construction, the following is transferred to the bank:

- title documents for the building (site);

- developer's project declaration;

- approved permit for the construction of the facility;

- a copy of the DDU.

When building a house, in addition to title documents for the land plot (lease agreement), you must provide for verification:

- a complete extract from the USRN database with a topographic plan;

- estimate and agreement with the contractor;

- permission to carry out construction work;

- coordination of the project with supplying and controlling organizations.

You should remember that the building must be put into operation no later than 24 months after receiving the loan.

Topographic plan.

To the site

In addition to a purchase and sale agreement or other scheme for transferring ownership rights, the use of a long-term lease is acceptable. Along with these documents, you need to prepare an extract from Rosreestr with the plan.

To submit an application to the bank

The list of documents that must be provided for mortgage approval is as follows:

- an application filled out in the prescribed form with personal data;

- civil passport with marks of registration of permanent (temporary) place of residence;

- SNILS;

- military ID or registration certificate, if the applicant (male) is under 27 years of age;

- a copy of the work record book certified by the employer or a certificate from the human resources department;

- information on official income (2-NDFL);

- marriage certificates, birth certificates of children.

Additionally, the documents discussed above regarding the loan facility are transferred.

Application for a rural mortgage.

Requirements for the borrower

The main requirements of Rosselkhozbank for approving a mortgage loan for the construction of private housing are the presence of a regular income and the ability to fully pay monthly installments. At the same time, the bank takes into account:

- The volume of the estimated estimate.

- The desire to use the services of contractors at the construction site who will be involved in the construction process.

- Mortgage payments are made only by non-cash credit to the client’s account, so the contractor must be a registered entrepreneur or legal entity.

Look at the same topic: Are social mortgages given to low-income families in [y] year?

Property requirements

At the same time, Rosselkhozbank puts forward certain requirements for the future property that is the subject of the agreement (land plot):

- The land for individual housing construction must be owned by the applicant at the time of execution of the contract.

- Any document provided to the site must have a special state certification carried out in accordance with current legislation.

- If the land is leased, then its term must completely exceed the term of the mortgage.

Also, when the bank confirms the application, it always independently rechecks the construction estimate. This service is paid separately by the client, along with insurance.

Procedure for obtaining a loan

A consumer or mortgage loan is issued according to a single scheme. First, the potential client submits an application, after its approval - all the requested documents (papers and certificates can be immediately submitted to the bank branch). Then, within 5 banking days, the application is reviewed and the decision is announced.

A consumer loan is issued immediately after the application is approved. For a mortgage, the next stage is collecting documents about the property being pledged as collateral. After checking the papers, property insurance and, if desired, personal insurance are issued.

The bank transfers the money to a separate account, to which a card can be issued. They can then be withdrawn in cash or directly transferred to the seller of the land, the contractor carrying out the construction.

What documents are required

Rosselkhozbank requires the applicant to provide the following documents:

- A correctly completed application according to the sample provided on the website;

- Passport of a citizen of the Russian Federation;

- Military ID for men of military age;

- All documents confirming family composition;

- When there are minor children in the family, their birth certificates are required;

- A copy (certified by the employer) of the work book;

- A completed bank form confirming a regular source of income.

For the construction project, it is necessary to have a certificate of state registration for the land plot, a cadastral passport, an extract from the Unified State Register, a construction estimate, and an official permit to carry out construction work.

If you plan to involve a contractor in the construction, a contract is also required. After providing the bank with the entire package of documents, the applicant will have to wait approximately 5 days until the financial institution approves the loan program.

Documents for obtaining a mortgage for construction at Rosselkhozbank

In the list of documents that need to be submitted to Rosselkhozbank to obtain a mortgage in 2020, you can see:

- application in the form of a questionnaire;

- Russian passport (a document that replaces it);

- for men under the age of 27 (inclusive) - military ID or registration certificate;

- certificates of state registration of marriage, birth of children (if available);

- work book, form 2-NDFL (to confirm employment and income);

- documents for real estate.

The last point should be examined in more detail. The list of documents includes:

- certificate of registration of ownership of the land plot where construction is taking place;

- extract from the Unified State Register of Real Estate (Unified State Register of Real Estate - a resource containing information about all real estate objects on the territory of our country);

- cadastral passport of the land plot (extract with information about the object);

- construction estimate, which is drawn up by the borrower himself or the construction organization;

- building permit.

Registration procedure

Before receiving approval for a mortgage to build a country house, the applicant must fulfill a certain list of conditions. Initially, you need to clarify all the required parameters of the proposed loan, then study all banking requirements and prepare a complete package of necessary documentation. Only such a scrupulous approach can ensure a positive response from a financial institution.

Then you need to prepare documentation related to the construction project. A mortgage agreement is concluded, and payment for construction work is made from the funds credited to the account. When the building construction process is completed, the borrower should obtain state registration for the house. Then the mortgage interest rate will decrease slightly - by 0.5%.

The mortgage program implemented by Rosselkhozbank is an excellent option for ensuring the successful construction of a country family home. Loyalty to young families allows them to build a reliable foundation for their descendants. It is only important to ensure unconditional repayment of monthly payments in order to guarantee compliance with the concluded agreement.

Procedure for obtaining a mortgage

To obtain a loan for secondary housing (apartment), follow the following algorithm:

- choose a locality that complies with the rules of the program;

- enter into a preliminary agreement with the seller;

- to secure the obligations of the parties to the transaction, a deposit is transferred (receipt of money is confirmed by a written receipt);

- submit an application and accompanying documents to the RSHB;

- after the loan is approved, they sign a mortgage agreement and take out property insurance;

- carry out a purchase and sale transaction with registration of the new owner and collateral in the Unified State Register of Real Estate database.

To pay in cash, you can use a standard scheme with a depository box. The seller gains access to the vault after providing the bank employee with a passport and Rosreestr extract.

Payment options

When a client wishes to repay a mortgage early, many banks charge a certain percentage for this action. Sometimes they completely refuse to issue a loan for the construction of a country house. Early repayment is the ability to pay off the mortgage debt simultaneously with all accrued interest in advance, without waiting for the end of the contract.

For Rosselkhozbank, the standard terms of the transaction are monthly payments. When drawing up an agreement, it sets out a clear procedure for repaying a loan for the construction of a house, and indicates the interest on the use of the mortgage (separate payment or a single accrual amount).

The types of repayment are cash payments through a bank cash desk, bank transfers, or debits every month from the client’s bank card. The latter option is available if the borrower has a Russian Agricultural Bank salary card, which significantly saves time and simplifies payments.

Reviews

Svetlana, Novorossiysk, 36 years old, Moscow: “We purchased a plot of land a long time ago. There was no way I could allocate the funds required for the development from my family budget. We decided to take out a mortgage for the construction of the building so that we could relax there in the summer with our children. The missing amount was not that big, so I ordered a consumer loan from Rosselkhozbank. Construction has begun, and now we are just watching how our dream home is being built.”

Alexander, Volgograd, 30 years old: “A man’s responsibilities include planting a tree, raising a son, and also building a house. It was the latter that became possible for me recently, when I managed to obtain a mortgage for construction at Rosselkhozbank. The process of concluding a loan agreement is quite simple, so now I’m waiting for the developers to turn my project into reality.”

Rosselkhozbank offers to issue a mortgage loan in 2020, the purpose of which is the construction of a country house. It is convenient to obtain it for a period of as much as 30 years; you will have to pay 8.9–12 percent per annum. The final amount of debt is quite high, although the terms of the agreement are still very favorable.

Although it is worth considering that Rosselkhozbank is a state institution, so this factor becomes an indirect guarantee of the reliability of the loan. Citizens who earn money from agriculture have access to preferential terms for providing such a mortgage.