How to allocate before and after loan repayment?

Conventionally, the procedure can be divided into two stages: before repayment of the mortgage debt and after repayment.

Let's consider how you can allocate a share of a mortgaged apartment to a minor child before or after repayment? The first step is to contact the bank to receive from its employees a letter of request from the bank to provide the minor with a share in the apartment purchased under a mortgage. If employees report that issuing a letter is possible, it is necessary to complete the preliminary procedure for obtaining a mortgage:

- Submit documents for a mortgage to the bank:

- income certificates;

- passport;

- birth certificate;

- spouse's consent to purchase real estate, and so on.

- Get pre-approved for a loan.

- Find the seller and receive from him a package of documents for the property being purchased.

After this, you must contact the guardianship and trusteeship authorities with a letter of petition, as well as the following documents in the list:

- An application containing a request to issue permission to change housing.

- A complete package of documents for the apartment being sold, in which the child is registered as one of the owners, as well as documents for the apartment being purchased:

- technical certificate;

- floor plans and explication from BTI;

- report on the assessment (how the market value of real estate is assessed can be found here);

- preliminary purchase and sale agreement.

- Documents confirming the parents’ ability to repay the loan:

- income certificates in form 2-NDFL;

copies of work books with notes on work experience and/or concluded employment contracts (it is also possible to provide a GPC agreement).

You will also need to provide documents certifying the presence of other valuable property: vehicles, bank deposits, other real estate, and so on.

After submitting the documents, an authorized person from the guardianship and trusteeship authorities conducts a conversation with the parents, finds out the goals they are pursuing, assesses the observance of the child’s rights, and so on. Based on the results of the conversation, the PLO establishes the required amount of the share in the ownership of real estate purchased with a mortgage.

Within 2-3 weeks, maximum within 30 calendar days, the PLO makes a decision - this can be either the issuance of written permission or a refusal with detailed arguments for such a verdict. The further procedure for obtaining a mortgage is not much different from conventional mortgage lending: the documents of the real estate seller, together with the written permission of the OOP, are sent to the bank, after which the bank management makes a decision on signing or not signing the final mortgage agreement.

If the bank categorically did not want to issue a loan with the condition that one of the owners would be a minor, and at the same time, in the old apartment the child was not registered as one of the owners, then allocating a share to the minor is possible after repayment of the debt.

After the encumbrance is removed, you need to draw up a gift agreement, which will indicate the transfer of the share to the child - this agreement must be registered with Rosreestr, after which the child will become one of the owners of the property.

How to allocate a share in a mortgaged apartment to a child

There are two ways to allocate a share in a mortgaged apartment:

- by agreement between the spouses;

- under a gift agreement.

In the case where the parents have not complied with the requirements of the law and have not allocated the children's share, there is a third way - with the help of the court, by forcibly allocating part of the living space into the ownership of the minor. The initiators of the trial are the guardianship and trusteeship authorities or the prosecutor's office. But such precedents are rare, so we will not consider allocating the share of minors through the court.

Voluntary method of allocating a share: procedure, instructions

To allocate a child's share in a mortgaged apartment, parents must do the following:

- Submit an application to a lending institution for a mortgage loan.

- To get approval.

- Find residential premises to buy.

- Obtain permission from the bank to allocate the children's share in the purchased apartment.

- Write a request to OOP.

- Draw up a purchase and sale agreement.

- Highlight the proportion of minors.

- Sign an agreement with a credit institution to issue a loan.

- Start paying off your debt.

Required documents

Obtaining a mortgage loan while allocating a child's share involves preparing a large package of documents and applying to several authorities.

To apply for a mortgage loan you will need:

- Estimation of the cost of housing that the spouses want to purchase with a mortgage.

- A receipt from the seller stating that he agrees to sell the apartment.

- Consent of the second spouse to purchase a home with a mortgage.

- Extract from the Unified State Register for the purchased apartment.

- A photocopy of the passport of the spouse for whom the loan agreement will be drawn up.

- An extract from the work record book, or another document confirming that the mortgage applicant has an official job.

- Certificate in form 2-NDFL confirming the client’s solvency.

- A copy of the marriage certificate.

To register a child’s share, you will have to contact Rosreestr , where you will need to submit:

- Passports or birth certificates of everyone to whom part of the real estate is supposed to be allocated.

- A copy of the marriage certificate.

- Copies of birth (or adoption) certificates of all minor children.

- Contract of purchase and sale of real estate.

- An agreement between parents on the allocation of a child’s share, or a deed of gift for a part of an apartment for a child.

- Receipt for payment of state duty.

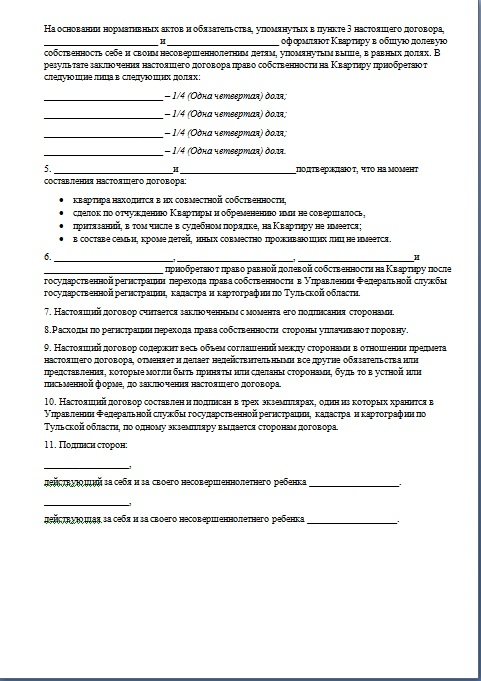

Agreement on the allocation of children's shares

Sample agreement on allocating shares to children in a mortgaged apartment

Before applying for registration of ownership of children, parents must enter into an agreement on the allocation of the children's share in the residential premises, in which they state their obligation to allocate the children's share.

In cases where the parents intend to use MS to purchase an apartment , the Pension Fund will control this agreement, but if the mortgage is issued without using the MS, control is assigned to the PFR.

The document must be certified by a notary; without notarization it has no legal force and will not be accepted by Rosreestr employees.

The text of the document indicates the procedure and terms, as well as the size of the part that the spouses undertake to allocate to the child. The size of the children's share in square meters should not be less than the established standard for the region of residence of the family, usually it is not less than 12 square meters. meters.

The spouses will have 6 months from the date on which they make the last payment on the mortgage loan to fulfill the agreement.

Deadlines

When purchasing an apartment with a mortgage, it is impossible to negotiate any real time period for allocating the children's portion; in each situation it will be purely individual. For example:

- waiting for the bank's decision can last from 10 to 30 working days;

- obtaining permission from the PLO will take up to 14 days;

- fulfillment of the obligation to allocate a child’s share is possible within six months after the conditions for their fulfillment have occurred;

- The process of registering property rights will take from two weeks to a month.

But if the credit institution refuses to allocate the child’s share until the loan is fully repaid, then the parents will not be able to fulfill their obligation until the encumbrance on the collateral apartment is removed. And since a mortgage loan is usually issued for a long time, often for several decades, children will be able to take ownership 20 (or more) years after signing the agreement.

Cost, expenses

The costs of allocating part of the residential premises to the ownership of minors directly depend on the cost of the allocated children's share. The cost of certifying the agreement will be from 300 to 20,000 rubles, depending on the cost of the allocated part.

Useful tips

Before implementing the decision, the child must complete preliminary documents. The feasibility of providing existing housing as collateral is assessed.

Expert opinion Makarov Igor Tarasovich Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

If consent cannot be obtained, you can proceed through the court. Sberbank consultants are ready to provide legal support.

Consultation is available by phone, in person or online.

Young people strive to acquire their own housing as soon as possible and move away from their parents

This is especially important for young families

Given the high cost of housing, most of them have only one option - to buy an apartment with a mortgage. But until the loan is repaid, the property will be pledged to the bank.

During this time, many families have children, and there is a need to allocate a share for the child in the apartment. Is it possible to do this before the mortgage loan is fully repaid? We’ll talk further.

When do you need to formalize the allocation of a share when buying an apartment?

The child's right to own property is prescribed by law. You can arrange for the allocation of a share both before receiving a mortgage and after repaying the loan.

It is standard practice to distribute the share in favor of children after the mortgage is paid off and the lien on the home is removed. However, there are situations when this must be done before the transaction is completed.

Allotment of shares after repayment of mortgage loan

Legal representatives of minors must allocate a share of housing for children within 6 months after repaying the mortgage.

Control over the timely fulfillment of these duties is carried out by authorized bodies. Transactions with maternal capital are regulated in accordance with Federal Law No. 256 of December 29, 2006 “On additional measures of state support for families with children”

If by the time the mortgage is repaid, there has been a new addition to the family, then shares should be allocated to everyone. For example, at the time of buying an apartment there were two children, and then a third was born - each of them should receive their share.

Vesting before mortgage payment

The main nuance in this case is the fact that the mortgaged apartment is pledged to the bank. To register, you will need permission from both the credit institution and the guardianship and trusteeship authorities to pledge children's shares.

Guardianship considers each individual case on an individual basis.

Is it possible to select a part?

Allotment of shares is a more than possible procedure. Moreover, parents are increasingly resorting to this opportunity, since the registered share for the child by the time he reaches adulthood will significantly increase in price. There is a list of requirements and conditions, failure to comply with which threatens parents with non-issuance of a loan, and in some cases even deprivation of parental rights:

- When moving from one apartment to another with the sale of the first home, according to Art. 292 of the Civil Code of the Russian Federation, parents are required to obtain permission from the guardianship authorities if one of the owners of the previous apartment was a minor.

- The area of the purchased property must be greater than or equal to the original area. Moreover, this applies even to those cases when the child is not one of the owners of the original home, but is simply registered there as a member of the family of the home owners. The increase in living space can be confirmed to the guardianship and trusteeship authorities by presenting the main or preliminary purchase and sale agreement.

- New housing must be in a more advanced technical condition than the original - the year of construction must be more modern, the wear and tear of the house, on the contrary, less, and so on. To confirm the improvement of living conditions, the guardianship and trusteeship authorities must provide documents from the BTI.

- If a new property purchased with a mortgage is encumbered, the parents must provide the bank with income certificates or other documents confirming solvency. This is necessary for the PLO to be convinced of the family’s financial ability to pay the loan in full, because otherwise the bank will have the right to unilaterally sell the property as soon as the family’s financial situation deteriorates significantly.

- If an apartment is purchased on a mortgage using public funds (maternity capital, a certificate of improvement of housing conditions for young families, etc.), the property must be registered in the name of all family members, including minors (details on what is preferential mortgage lending and what are the conditions for obtaining such a mortgage loan, read here).

What is a notarial obligation for maternity capital and why draw it up?

Maternity capital refers to state programs to support families raising two or more children. Issues related to the receipt and use of subsidies are covered in Federal Law No. 256 of December 29, 2006. According to the law, the amount issued as state support can be used to improve living conditions. According to Pension Fund reports, most families choose this method of using funds. The rules for allocating maternity capital to improve housing conditions are determined by Decree of the Government of the Russian Federation No. 862 of December 12, 2007. A person can improve their living conditions using maternity capital by doing the following:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call ext. 157 Moscow; ext.953 St. Petersburg; +7 (800) 700-99-56 ext. 402 Free call for all of Russia.

- purchasing an apartment or residential building;

- erecting the building yourself;

- by reconstructing the premises to increase its area.

The above procedures can be carried out on the basis of a direct purchase and sale agreement or carried out using mortgage funds. Moreover, the money can be used to pay off the principal debt on the loan or used as a down payment. Part 4 of Article 10 of Federal Law No. 256 of December 29, 2006 states that property purchased with maternity capital must be registered as the joint property of all family members. Parents and children receive shares. Thus, the law protects the rights of all participants in the transaction. However, often real estate does not immediately become the property of children. A similar situation is possible in the following cases:

- A DDU has been issued, in which registration of ownership occurs after the delivery of the house.

- A house is being reconstructed or built. The right to real estate is issued after receiving a cadastral passport.

- A mortgage was obtained using maternity capital. Title to other family members will be issued only after the loan is closed.

- Membership in any type of cooperative is possible. In this case, ownership is registered after the last payment.

Attention:

If an encumbrance is imposed on the property, it is impossible to allocate shares to children and other family members. A similar situation arises when using a mortgage. In this case, the apartment is registered in the name of the payer, but he cannot dispose of the property until the obligations are completely settled. In all the above cases, the owner of the property is obliged to guarantee the allocation of shares to family members. This will require a written commitment. The document states that the allocation of shares to children will occur within 6 months after the closure of mortgage obligations. If the rule is violated, the person may be forced to surrender part of the property. The obligation to allocate shares after repayment of the mortgage with maternal capital is formalized by a notary.

Difficulties in allocating a child's share

The rights of minors are enshrined in the Family Code. Their protection and monitoring of compliance are monitored by guardianship authorities. A third party, the lender, takes part in the procedure for purchasing real estate using borrowed resources. Thus, the interests of the family, the bank and the supervisory authorities must be taken into account. In this case, you must comply with current legislation. It is this composition of stakeholders that makes such transactions difficult to carry out, requiring increased attention and additional knowledge.

Is it possible to allocate a share to children?

Based on current legislation, parents must ensure the right of minors to own property. In the case of a mortgage, the allocation of a share usually occurs after all obligations have been repaid. If a family certificate was used to make the first payment or early repayment, allocating a share to the child is not only possible, but absolutely necessary.

Let's consider another situation. The family plans to sell the apartment in which the minor is registered, in order to subsequently buy a new one, partially using loan funds. In this case, permission from the guardianship to conduct the transaction will be required. To obtain it, it is necessary to inform the supervisory authority that the child will be granted the right to own real estate, which will be purchased subsequently.

If the child is over 14 years old, his written consent to complete the transaction will be required. Here you can learn more about the nuances of the process.

The transfer of part of the property is formalized in one of these ways:

- Registration of a donation, certified by a notary. Here is more detail about this procedure.

- An agreement to transfer part of an object into the ownership of a minor. This document is also subject to notarization.

To avoid problems with subsequent registration of property rights, you should entrust the preparation of these documents to professional lawyers. You can get a free consultation on our portal. Despite the fact that the minimum size of children's property is not established by law, in order to avoid problems with regulatory authorities, it is best to proceed from the norm - 12 square meters for each of the children.

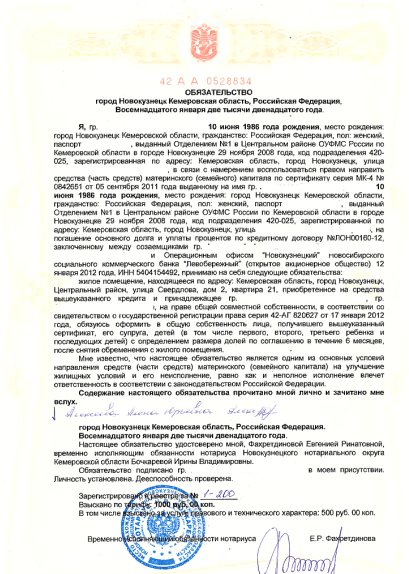

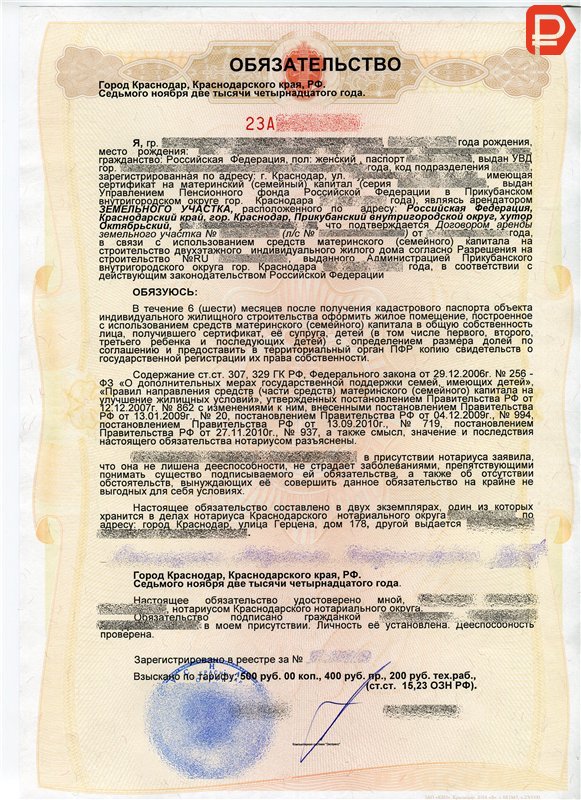

When is an obligation to allocate shares required?

A commitment is a legally certified document. According to it, the future owner of the apartment undertakes to share the right to own housing with children and a second spouse, if any. In simple words, the obligation allows you to delay the moment of allocating children the meters they are entitled to, but obliges them to do this in the future.

This document is required to be drawn up when using the par value of maternity capital to pay part of the cost of purchasing an apartment, including a mortgage. Without it, the pension fund will not direct the money to its intended purpose. If housing is purchased in a new building under a shared participation agreement, then it is necessary to allocate shares to children after signing the act of receiving housing, before registering the property.

All cases when it is necessary to formalize an obligation:

- The property was purchased using borrowed funds; it is possible to allocate shares to children after the mortgage is paid off.

- Parents are the owners of the apartment, while the size of the property of minors has not yet been determined.

- Contributions to the cooperative continue.

- Construction of a private house is underway.

How to draw up a commitment correctly

This document is drawn up by a notary. It must contain the following data:

- Full names of parents and children, their date of birth and passport details (for children under 14 years of age, birth certificate number);

- full address of the object indicating the region and locality;

- certificate number for receiving family capital;

- grounds for allocating shares;

- a clause providing for the allocation of part of the property to children after repaying the mortgage within 6 months;

- indication of the size of the property.

The document is drawn up on a special form, which is certified by a notary. It is important to understand that today there are no structures that monitor the fulfillment of obligations. So, if someone begins to carry out actions to allocate part of the property to minors after the expiration of this period, then the risk of liability is minimal.

This document is drawn up at the time of use of maternity capital funds. It is attached to the rest of the papers that are submitted to the Pension Fund for the management of money. The maternity capital account should not be equal to zero.

It looks something like this:

Today, citizens are given the following options:

- making a down payment on a loan;

- payment of accrued interest;

- repayment of the main body of the loan

The financial products market today offers a huge number of programs involving maternity capital. As part of such offers, you can purchase housing in a new home or on the secondary market.

Some families decide to use government support funds to subsidize the construction of their own home or improve their living conditions, but in practice it can be quite difficult to obtain borrowed funds and permission to use a certificate for such purposes.

One of the main features of attracting maternity capital is that after fulfilling loan obligations, the borrower is required to go through the procedure of registering the apartment as shared ownership. Each active family member must ultimately receive a certain share of ownership of the premises.

Allocating a share to children after paying off the mortgage

As mentioned above, not all banks are ready to go through this procedure. However, large credit organizations are trying to comply with the instructions of the guardianship authorities and take the client’s side in this matter. The shares of minor family members must be determined before receiving a housing loan. Let's consider step by step how to allocate parts of property in this situation.

Peculiarities

The nuances of this procedure include:

- The need to obtain approval from the bank and guardianship authorities.

- If the funds from the maternal certificate were used for the construction of a residential building, then the share should include part of the land on which this construction is being carried out.

- When the property being purchased is under construction, registration of part of the ownership in the name of children is possible only after its completion. This occurs after the house is put into operation and the act of receiving the property is signed, but before the borrower’s ownership rights are registered.

- The need to separate the children's part must be stated in the purchase and sale agreement.

Documentation

You will need to prepare:

- Identity documents.

- Apartment assessment report.

- Title documents (extract from the unified register).

- Consent of the other spouse.

- A written application to the bank about the possibility of distributing property to minors.

Procedure

The process consists of the following steps:

- Obtain a bank decision on the possibility of issuing a mortgage. At this stage, it is worth verbally discussing the possibility of allocating a child’s share and using a family certificate.

- Find an apartment.

- Obtain consent from the bank for the transaction with the allocation of a share.

- Submit a request to the guardianship authorities for approval of the transaction.

- Sign the apartment purchase agreement. The text must contain a clause on granting minors shares in the acquired property.

- Submit all documents for registration.

- Wait until state registration is completed, get a mortgage, and finally pay the seller.

Allocating shares to children after paying off the mortgage is much easier, because this procedure does not require additional approvals from the bank. Let's take a closer look at this process.

Peculiarities

This procedure also has a number of nuances:

- If during the term of the loan agreement another child appears in the family, he must be given a share on an equal basis with the older children.

- 6 months are allotted for collecting all documents and carrying out the transfer procedure after settlement of the loan. If the family does not have time to complete the process during this period, the supervisory authorities have the right to legally recover the nominal value of the capital back.

- To transfer ownership rights, you can draw up a gift agreement or an agreement on the transfer of part of the apartment. Both of these documents are notarized. They imply the transfer of ownership without making additional payments.

- If both spouses are owners, but the share of each of them is not determined, first it is necessary to allocate their parts, then the children's parts. It will not be possible to allocate everyone’s shares at the same time due to different reasons for receiving. Parts of the spouses are allocated on the basis of an agreement on the division of marital property, while the children are transferred by gift or agreement on the allocation of shares.

Documentation

The following kit will be required. To remove the encumbrance after paying off the mortgage:

- Mortgage from a bank.

- An application for withdrawal will be drawn up by an MFC employee. There is no need to prepare anything in advance; there is also no state duty.

Procedure

Consists of the following steps:

- Receipt of a mortgage from the bank after full repayment of the mortgage loan. The bank has two weeks from the date of the last payment to issue it.

- Registration of removal of encumbrance. The set is transferred to the MFC, then the owner receives a new paper from the unified register without information about the mortgage. We wrote in detail about this procedure earlier. You will need a certificate confirming the closure of the mortgage and the absence of debt to the bank.

- Drawing up and notarization of the basis for the division of property (agreement on the voluntary transfer of part of the property, gift agreement).

- Transfer of documentation to the registration authority. The application is submitted by each participant on his own behalf (parents act for minors), the form is filled out by MFC employees.

Let us summarize based on all the above information. It is possible to differentiate children's shares before and after repayment of the mortgage. To avoid disagreements with supervisory authorities, shares that are comparable to the nominal value of the capital should be transferred. You should carefully select a lender; preference should be given to those banks that do not interfere with the transfer of the part of property due to minors. It is best to prepare documents for the transfer of shares from a specialist in this field.

How to allocate a share of maternity capital to children after paying off the mortgage

Theoretically, two options are allowed for allocating a share to children after repaying a housing loan:

- written agreement of the spouses (mother and father);

- gift agreement in relation to children.

These methods are completely legal - the choice in favor of a particular one depends on several factors:

- parents' wishes;

- notary fees;

- goals;

- complexity of design.

Where to begin?

The first thing you need to do to start allocating children’s shares is to notify the Pension Fund of the Russian Federation about the intended use of maternity capital funds.

The holder of the certificate (mother of the child) must write an application to the Pension Fund indicating the purpose - to use maternity capital to pay off the mortgage.

Then the spouses will have to visit a notary and formalize an obligation to allocate shares to the children - a document without which the Pension Fund of the Russian Federation will not approve the issuance of a state subsidy for the birth of a second child.

The notary himself is responsible for drawing up the obligation. Participation of spouses is almost not required. All they need to do is provide documents and put their signatures on the completed commitment. Next, the paper must be taken to the Pension Fund, after which the state transfers maternity capital to the account of the certificate holder (mother).

Procedure

The next stage begins - the distribution of shares after repayment of the mortgage, including with funds from maternal capital.

Here is the action plan for allocating shares in 2020:

- Pay off your mortgage

Making the last mortgage payment is considered the end of payments for the apartment. Legal removal of the encumbrance on housing is one of the conditions on the way to allocating shares to children and the second spouse.

- Take out a mortgage

Borrowers contact the bank to issue a mortgage. Together with her, you need to visit Rosreestr and write an application to remove the encumbrance from the residential premises. Employees of the Registration Chamber will issue an extract from the Unified State Register of Real Estate, giving the right to freely dispose of the property.

- Contact a notary

Parents visit a notary's office and choose a convenient way to allocate a share to their children in the apartment.

The choice consists of the following options:

- certification of the gift agreement - shares are allocated from the parts of the mother and father;

- notarial agreement - conditions at the discretion of the parents.

- Register ownership of shares

The final stage will be to re-apply to the MFC “My Documents” or Rosreestr with an application, deed of gift and/or agreement and documents for the apartment. The agreed shares will become the property of parents and children. Participants in the procedure will receive documents confirming the right to property - extracts from the Unified State Register of Real Estate of a new sample.

You can learn more about the allocation procedure from the article “Allocation of shares to children in a mortgaged apartment.”

Documentation

The redistribution of shares is associated with the registration of ownership. The spouses will have to pay a visit to several authorities: the notary and the Cadastral Chamber of the city (district).

The notary will ask you to show:

- passports of adult family members;

- marriage certificate - issued by the civil registry office;

- certificates for children;

- documents of title nature (purchase and sale agreement, mortgage agreement);

- registering - an extract from the Unified State Register of Real Estate;

- a copy of the obligation to allocate a share to children (notarized);

- other documents.

When contacting Rosreestr, parents must submit:

- statements on behalf of future co-owners - are drawn up by an employee of the MFC or Rosreestr, and the parents sign below;

- one of the selected methods and a document for it - a gift agreement and/or an agreement on allocating a share to children;

- personal documents - passports of spouses, certificates for children, information about the conclusion of a marriage union;

- documents for the property: mortgage agreement, purchase and sale agreement, extract from the Unified State Register or certificate of living space;

- receipt of payment of state duty.

Analysis of documents and registration of shares takes several weeks, after which applicants will be given title documents - extracts from the Unified State Register of Real Estate, where all co-owners will be indicated.

This is important to know: Re-registration of a house after the death of the owner

Registration deadlines

It is also important to know about the timing of allocating shares to children and the second spouse. They vary depending on the stage of the procedure:

- the deadline for fulfilling the obligation is within six months after payment of the mortgage ;

- execution of an agreement or deed of gift – from one day to several days;

- registration with Rosreestr – from 10 to 14 working days .

The deadlines may increase due to shifts in the work schedule of government agencies. The MFC and Rosreestr are closed on weekends and holidays.

Price

The costs of allocating children's shares in an apartment are associated with the services of a notary and registration authorities.

Another cost item is the state duty for registering property rights (Clause 22, Article 333.33 of the Tax Code of the Russian Federation). The amount is the same for everyone - 2,000 rubles for entering information into the real estate register.

Legislative norms

When the loan goes along with the use of maternal capital, there are no questions about providing shares to children. These issues are resolved immediately after the loan is repaid, that is, the division occurs automatically.

This strict requirement of the state is aimed at supporting the property rights of the younger generation. First, a collateral agreement is signed, then a home is purchased, and only then married couples are faced with the need to fulfill the conditions of the capital.

But children are not yet indicated as future owners in a deal to buy an apartment, although parents sign a statement (promise) that they will carry out all the necessary manipulations later. Namely, after removing all encumbrances and closing the credit account.

All transactions with property with the participation of children, when the property must be pledged, are carried out in the Russian Federation with the consent of the guardianship authorities. So, when selling an apartment in order to buy more comfortable housing using bank money, managers should tell them about this in advance.

Afterwards, they must take consent from the board of trustees, first that the existing meters will be sold, and then on the fact that the new property will then be pledged to the department. There may be nuances with this, because there is a risk of non-return, when a minor, like the parents, will simply be left without a corner.

When using such a scheme, the living conditions of children should not become worse. The government agency looks at the quality of construction of the “old” and “new” apartments, and the actual size of the share in these premises. When the child is already 14 years old, all operations at the notary must be carried out with his written approval.

Allocating a share to children before repaying the mortgage

As mentioned above, not all banks are ready to go through this procedure. However, large credit organizations are trying to comply with the instructions of the guardianship authorities and take the client’s side in this matter. The shares of minor family members must be determined before receiving a housing loan. Let's consider step by step how to allocate parts of property in this situation.

Peculiarities

The nuances of this procedure include:

- The need to obtain approval from the bank and guardianship authorities.

- If the funds from the maternal certificate were used for the construction of a residential building, then the share should include part of the land on which this construction is being carried out.

- When the property being purchased is under construction, registration of part of the ownership in the name of children is possible only after its completion. This occurs after the house is put into operation and the act of receiving the property is signed, but before the borrower’s ownership rights are registered.

- The need to separate the children's part must be stated in the purchase and sale agreement.

Documentation

You will need to prepare:

- Identity documents.

- Apartment assessment report.

- Title documents (extract from the unified register).

- Consent of the other spouse.

- A written application to the bank about the possibility of distributing property to minors.

Procedure

The process consists of the following steps:

- Obtain a bank decision on the possibility of issuing a mortgage. At this stage, it is worth verbally discussing the possibility of allocating a child’s share and using a family certificate.

- Find an apartment.

- Obtain consent from the bank for the transaction with the allocation of a share.

- Submit a request to the guardianship authorities for approval of the transaction.

- Sign the apartment purchase agreement. The text must contain a clause on granting minors shares in the acquired property.

- Submit all documents for registration.

- Wait until state registration is completed, get a mortgage, and finally pay the seller.

Agreement on the allocation of shares in maternity capital

A voluntary agreement is the best option when allocating shares to all family members. Spouses can indicate the size of the share after the occurrence of any events.

The agreement is drawn up in writing and certified by a notary. A notary can tell you how to draw up an agreement and advise which points are best included in the document.

Sample agreement

Main points of the agreement:

- Date and place of signing the contract

- Spouses' full names, address and passport details

- Full name of children, their data from birth certificate (up to 14 years old) or passport (from 14 years old)

- Location of the property and its characteristics

- Type of ownership – joint (spouses) or shared (entire family)

- Information about the legal document (number and name of the document)

- Size of shares of parents and children

- Conditions for distribution of shares

- Indicate whether to take into account the redistribution of shares in the event of the birth of a child

- Signatures of the spouses

- Signature and seal of a notary.

The procedure for registering the transfer of part of the property to a child

The procedure is a gratuitous transfer of a share in residential real estate.

The deed of gift or transfer agreement shall contain the following information:

- about the parties to the transaction (full name, passport details, date of birth), - information about the property, - the size of the allocated share/shares, - with the participation of minors under 14 years of age, their legal representatives are indicated.

Registration takes place at the notary (Article 42 218-FZ “On State Registration of Real Estate”).

State duty

You will need to pay to have the agreement certified. The size of the state duty will depend on the value of the property - 0.5% (Article 333.24 of the Tax Code), but not less than 300 rubles and not more than 20 thousand rubles. Additional payments for the technical part of the work vary from region to region.

An additional 2,000 rubles will be required for registration with Rosreestr. Please note that the amount must be divided by the number of future owners, for example, if there are four of them, you should bring four separate receipts, each for 500 rubles.

Documents required for registration

The allocation of shares is certified by Rosreestr. To do this, you must provide the following documents in original with copies:

- parents’ passports, - children’s birth certificates, - agreement on the allocation of shares (3 copies), - marriage or divorce certificate, - document confirming property rights, - checks/receipts for payment of state duties.

Successful registration is the final step in the procedure for allocating a share.

Rules for distribution of shares

When allocating a share, the following points are taken into account:

Number of family members

One of the options for distributing shares could be an equal share for each family member. For a family of 4 people, the share of each family member will be 25%.

Sanitary standards for housing

The minimum standard, according to the Housing Code, per person is:

- 6 sq. meters - in the hostel

- 10-18 (depending on the region) sq. meters - in the apartment

Percentage of maternity capital in the cost of housing

The cost of residential premises usually exceeds the amount of maternity capital, so when allocating a share, you need to take into account what part of the costs falls on maternity capital.

Determining children's shares does not take into account their age or majority.

Minimum share

Minor children are entitled to a mandatory share in an apartment purchased using maternity capital. The normative standard is determined by the municipal authorities (Article 50 of the Housing Code). If there are 3 people living in a family, then the area for one of them should not be less than 18 square meters.