Cancellation of an apartment donation agreement is the donor’s opportunity to return the donated property if certain grounds exist. Conventionally, there are three types of cases in which it is possible to cancel a donation:

- occurred during the life of the donor;

- after his death;

- after the death of the donee.

Civil legislation establishes certain grounds under which cancellation can be made. Most grounds for cancellation of a transaction require a trial , for which you must file a statement of claim and gather evidence to support your claim. At the same time, we should not forget that the law establishes limitation periods (general and specialized).

In some cases, simply filing a lawsuit is not enough. The law provides for the transfer of property in kind after the cancellation of the transaction, but if the property has not been preserved , then an amount equal to the value of the gift is collected. In this case, you will need to contact bailiffs to recover the specified funds.

In general, judicial practice on the type of cases under consideration is positive for those cases when the plaintiff goes to court with grounds for canceling the transaction , as well as in his ability to prove the circumstances of the need for its cancellation.

Is it possible to cancel a deed of gift for an apartment?

The gift agreement is governed by Sec. 32 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation). In addition to general provisions, this chapter also contains provisions on the abolition of donations. Art. 578 of the Civil Code of the Russian Federation provides for specific cases in which it is possible to cancel a deed of gift. Conventionally, such cases can be divided into three types :

- during the life of the donor;

- after the death of the donor;

- after the death of the donee.

The parties to this transaction are the donor (the one who intends to transfer the property free of charge) and the donee (the one to whom the subject of the transaction is transferred into ownership).

It is also necessary to separately indicate the case provided for in paragraph 3 of Art. 578 of the Civil Code of the Russian Federation, which may relate to any of the above conditional types. According to this norm, a donation can be canceled at the request of an interested person if the donation was made by an individual entrepreneur or legal entity in violation of the provisions of the insolvency (bankruptcy) law at the expense of funds that are directly related to his business activities within six months before the declaration of bankruptcy.

During the life of the donor

Civil legislation provides for only two cases of cancellation of a gift during the life of the donor.

- The first case includes a situation in which the donee makes an attempt on the life of the donor or members of his family (including close relatives), or if the donee intentionally caused bodily harm .

- The second case includes such treatment by the donee with the donated property (which has great non-property value for the donor) which creates the threat of its loss .

In this case, the donor has the right to apply to the court to cancel the donation.

After the death of the donor

In the event of the death of the donor, his heirs have only one basis for canceling a previously concluded transaction, which involves the transfer of property as a gift. This includes the intentional taking of the life of the donor by the donee. In such a situation, the heirs have the right to go to court to cancel the previously concluded gift agreement.

Also quite common are cases in which the donor has drawn up both a will and a gift agreement for the same piece of property, for example, an apartment.

In this case, you should focus on whether agreement came into force at the time of opening of the inheritance (after the death of the donor).

If such an agreement has entered into force, then it cancels the will in terms of the transfer of the right to the bequeathed apartment, since such property is no longer the property of the deceased and is not included in the estate.

After the death of the donee

After the death of the donee, there is also one reason for canceling the transaction. Such a basis is the inclusion in the gift agreement of a provision that the donor has the right to cancel the transaction in the event of the death of the donee. If there is no such clause in the text of the agreement, then the property passes directly to the heirs of the donee.

The position of the legislator, the definition of the term and the claim period in 2020

By the term “voidable transaction” the legislator means any invalid transaction, except those that can be classified by him as void. At the same time, such an agreement can still be challenged in 2020 only in court, which distinguishes it from a void agreement, which is invalid in its essence, that is, initially (at the conclusion of the transaction).

Thus, a transaction can be challenged in court only after the donation agreement is signed and the object of the donation is transferred from the donor to the donee. At the same time, the legislator allows filing such a statement of claim not immediately after signing the agreement, but after a fairly long period of time. Simply put, contested gift transactions have their own statute of limitations.

Based on the provisions and information contained in Article 195 of the Civil Code of the Russian Federation, the limitation period is the period within which an interested person can protect his rights that were violated by one of the parties to the donation.

Similar claims regarding the legality of the executed gift agreement may arise:

- At the donee party. Most often, the requirement of the claim is the demand to transfer to him the object promised by the donor or the rights to it.

- On the giving side. As a rule, we are talking about canceling the agreement or refusing to make a donation for any reason.

- Mortgage holders as well as creditors. Some unscrupulous citizens try to donate property that was subject to collection for credit debts and loans.

- The heirs of the donor (by law and will).

According to the legislation in force in Russia in 2020, the statute of limitations for voidable transactions is 1 year. It is during this period that the legislator guarantees the protection of the applicant’s rights.

EVERYONE NEEDS TO KNOW THIS:

State duty for a gift agreement - how much to pay in 2020

However, the end of this period is not always a reason for refusing to consider the claim. Another period is usually applied by the judicial authority in cases where one of the parties makes a corresponding request before the actual court decision on the stated claims or if one of the parties has valid reasons why it could not file a claim earlier.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Simply put, the limitation period is established within the framework of civil law, and any attempt by the parties to change its duration by agreement between themselves (reflecting the duration of the period in an additional agreement or, for example, stipulating it in the body of the agreement itself) will lead to the recognition of the entire transaction as invalid! Only the court can change the term!

Grounds for cancellation of a gift agreement

Each basis for the above types of cases in which the cancellation of a gift becomes possible requires certain evidence . So, for example, if an attempt is made on the donor (or on members of his family, close relatives), bodily harm is caused, then this fact must be proven in criminal proceedings (since these crimes fall under the Criminal Code of the Russian Federation).

The same applies to the case when the donor's heirs have the right to cancel the transaction after his death . There must be a court decision finding the donee guilty of murdering the donor.

If the donor believes that the actions of the donee may lead to the irretrievable loss of the donated property, which is of intangible value to him, then this fact will need to be proven in court proceedings .

The grounds for canceling the gift agreement must be confirmed, and only if they are recognized by the court as valid, the right to cancel the previously concluded transaction on the gratuitous transfer of property arises.

Invalidity of the transaction

Another option for terminating a gift agreement is to declare it invalid.

Conditions

The same requirements apply to a deed of gift as to any other type of transaction. So, it can be considered void in a number of cases:

- The subject of the donation is not specified;

- The donor is an incapacitated or minor citizen;

- If the agreement has not been registered with the Federal Registration Service. Transfer of ownership without state registration of the transaction is impossible;

- If the donee is a civil servant, and the donor is his client.

In addition, the donation can be canceled in some specific situations:

- Behind the gift there is a purchase and sale transaction. To save money and avoid paying taxes, the seller, being a relative of the buyer, transfers ownership of the home to him through a deed of gift, simultaneously issuing a receipt for the money. Such actions are a clear violation of the main principle of donation - gratuitousness.

Having in hand evidence of a violation of the essence of the contract (receipt, eyewitness accounts, etc.), you can easily prove the invalidity of the transaction;

- Behind the gift lies the rent. This case is no less common. Parents (grandparents) transfer housing to their children (grandchildren), but stipulate in the contract an additional condition according to which they have the right to live in the transferred apartment or house while being their dependent. This move also violates the concept of gratuitousness;

- The gift can only be transferred after the death of the donor. In this case, there is a confusion of concepts, because an indication of the transfer of property after death is the destiny of a will. The deed of gift may indicate the period for the transfer of ownership rights, but during the life of the donor;

- The right of third parties to donated property. This happens when, after the death of a spouse, the donor assigns their common property to someone, forgetting that the heirs can claim the share of the deceased.

Procedure

To invalidate a gift transaction, you must go to court.

The claim indicates the names of the plaintiff and defendant, the date of the deed of gift, as well as the reasons why the transaction is void.

Several documents are attached to the application:

- A copy of the claim;

- Receipt of payment of the established fee;

- Deed of gift;

- Evidence of violation of the rules for concluding a transaction.

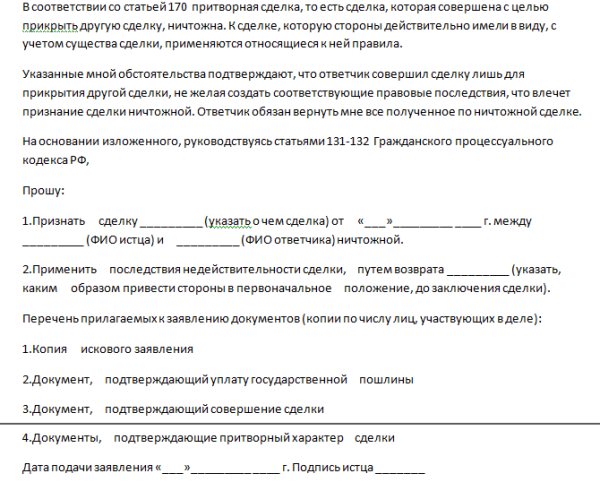

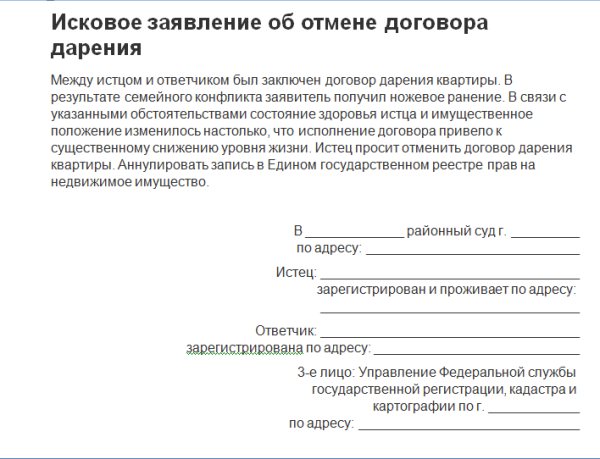

You can see the claim form in the attached file. In this version of the claim, we are talking about recognizing the donation as invalid, since there is another transaction behind it. Depending on the reason for the nullity of the contract, the text of the statement will vary slightly.

Sample statement of claim regarding the invalidity of a gift agreement

Sample statement of claim regarding the invalidity of a gift agreement - 1

Sample statement of claim regarding the invalidity of a gift agreement - 2

A well-known lawyer will tell you about the statute of limitations for invalidating a transaction (for example, a gift) in the following video:

Next, we will talk about whether the agreement for donating a share in an apartment is possible to be invalid.

Real estate share

One of the most common procedures is the recognition of the invalidity of a donation of a share of an apartment. The reason for this lies in the following. To complete a transaction for the purchase and sale of a share of housing, the owner needs to obtain the consent of the neighbors, who in this case have the preemptive right to purchase this part.

It happens that the seller wants to sell a share to friends or does not want to wait until the owners of a neighboring share raise the necessary funds. As a result, he resorts to fraud, transferring his share to the buyer under the guise of a gift, and secretly issuing a receipt for receipt of money. The neighbors, realizing that the deal was a sham, file a lawsuit (see example below) in court, where, if there is evidence, they win the case.

However, there is one caveat here. If the plaintiff (neighbor) wins the case, he must buy out the share of the enterprising seller after the sham transaction is terminated.

Limitation period for cancellation of a gift agreement

Art. 181 of the Civil Code of the Russian Federation establishes a specific limitation period for challenging (or invalidating) a transaction for donating property. This period is three years . However, the beginning of the expiration of such a period is set differently for different cases:

- for the party to the transaction, the period begins to be calculated from the moment the transaction begins to be executed;

- if a transaction is appealed by a person who is not a party to the contract, then the period begins to count from the moment such a person learned or should have learned about the start of execution under the above transaction.

It is worth noting that the limits set for this are no more than ten years from the beginning of the transaction.

The legislation establishes a separate period for declaring a contestable transaction invalid . The period is one year from the date of cessation of violence or threat (or other circumstances) under the influence of which the transaction was concluded. In addition, Art. 202 of the Civil Code of the Russian Federation provides for the possibility of suspending the limitation period in the following cases:

- occurrence of force majeure;

- the plaintiff or defendant is part of the armed forces of the Russian Federation, transferred to martial law;

- establishment of a moratorium (by Decree of the Government of the Russian Federation);

- suspension of the provisions of civil legislation on donations;

- carrying out pre-trial settlement procedures (mediation, mediation, etc.).

Immediately after the termination of the above circumstances, the limitation period continues to apply and is subject to calculation.

In addition, the court, in exceptional cases , may restore the above-mentioned period (due to serious illness, illiteracy, etc.), recognizing its absence as valid .

How to restore the deadline for challenging a gift in 2020

Restoration of the statute of limitations means the fact that the court will protect the violated rights of the applicant, even after the expiration of the period of challenge established by the legislator. However, it's not that simple.

Expert opinion

Lyudmila Kim

Invited expert: author of the “Child Support” blog, practicing family lawyer, 7 years of experience.

To accomplish this, the plaintiff is obliged to provide the court with irrefutable evidence of the valid reasons that became an obstacle to his going to court. In 2020, such evidence may still include travel certificates, medical documents, etc.

Among the main valid reasons, the presence of which allows you to increase the statute of limitations, it is worth highlighting the following:

- military service;

- caring for a seriously ill relative or disabled person;

- illiteracy (in fact, lack of understanding of the Russian language and legislation) - as a rule, applies to foreign citizens;

- a helpless state caused by the use of psychotropic drugs, alcohol or difficult emotional experiences (for example, due to an accident or the loss of a relative);

- a serious illness, or more precisely, its treatment in an outpatient clinic (the very fact of illness, without hospital treatment, is not a valid reason);

- long business trips of the plaintiff;

- serving a sentence in a pre-trial detention center.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement with a notary - cost in 2020

It is worth understanding that we have given only the most common good reasons. You can read the rest yourself or ask our lawyers by writing in the chat.

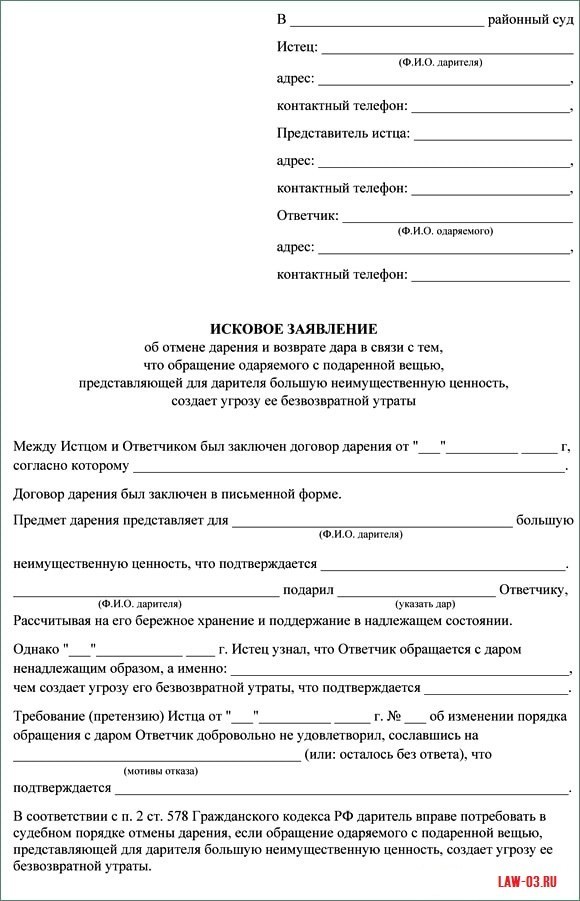

How to cancel a gift agreement for an apartment (judicial procedure)

In most cases, the cancellation of a gift agreement by civil law is provided for in court. This means that in order to cancel the transaction it will be necessary to file a claim in court . In some cases, when filing a statement of claim, it will be necessary to attach a number of supporting documents, without which the said statement will not be considered by the court. In addition, the statement of claim itself must contain all the necessary elements, without which its consideration in court is impossible .

First of all, you need to collect all the documents that justify the need to cancel the transaction. Simply put, an evidentiary basis . Having collected it, you can move on to the next stage - drawing up a statement of claim , which, along with all previously collected documents, will be submitted to the court. In case of a positive decision of the court, the direct instructions of the law established by paragraph 5 of Art. 578 of the Civil Code of the Russian Federation: the donated item must be returned to the donor if it was preserved in kind (which is most likely in the case of an apartment) at the time of cancellation of the donation.

The situation becomes significantly more complicated if the donated apartment has already been sold and cannot be transferred to the donor in kind. In this case monetary compensation equal to the cost of the apartment is collected. If the donee refuses to voluntarily transfer the specified amount, it is necessary to contact the Federal Bailiff Service, providing them with a copy of the court decision that has entered into force (writ of execution) for execution of the decision.

Statement of claim for cancellation of the gift agreement (sample)

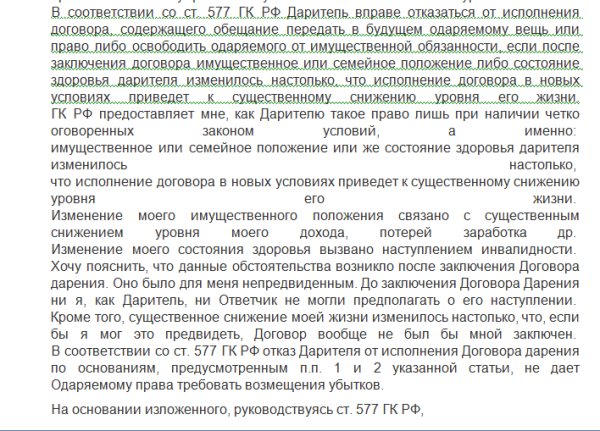

According to general rules, a statement of claim to the court must contain the following information :

- the name of the court in which the claim is filed;

- Full name, place of residence, contact details of the parties to the case (plaintiff and defendant);

- the motivation (which sets out the essence of the request for cancellation) and the pleading part (a request to cancel the contract and return the subject of the transaction);

- list of attachments to the claim;

- signature of the person (or his representative, accompanied by a power of attorney or other document confirming the representation of the interests of the plaintiff in the case).

Taking into account the peculiarity of the cancellation of the donation, the statement of claim must contain information about the reasons for filing the claim . Such grounds must be confirmed , including documentary evidence.

Example

Polyakov V.A. filed a claim in court to cancel the gift agreement in which he acts as the donor. In support of his claims, Polyakov referred to paragraph 1 of Art. 578 of the Civil Code of the Russian Federation, indicating in the claim the justification for canceling the transaction by the fact that the donee caused bodily harm to Polyakov. To prove the above arguments, the plaintiff attached a copy of the court decision recognizing Marchenko S.E. (the recipient) is guilty of intentionally inflicting grievous bodily harm on Polyakov. The court canceled the deal, and the donated item was returned to Polyakov.

Judicial practice of canceling an apartment donation agreement

An analysis of judicial practice indicates that claims are often filed in court without specific grounds for canceling a contract.

In cases where there is a basis, there is evidence of the need to cancel the transaction, the court carries out the cancellation (including in cases related to real estate).

Thus, it is necessary to be careful when drawing up a gift agreement, and if it is necessary to cancel the transaction, carefully collect the evidence base and attach the necessary documents.

In general, in this type of cases, judges more often refuse to satisfy requests for refusal, but this is due to the lack of evidence or the absence of grounds for cancellation.

Canceling a deal

Let us consider in detail the situations in which it is possible to cancel the transaction of donating an apartment (or other real estate) by expressing the will of the donor or through litigation.

When possible

It should be noted that there is a limitation period of three years for canceling a deed of gift. The countdown begins from the moment when the donor or his relatives learn about the occurrence of one of the following circumstances:

- The donee made an attempt on the life of the donor or his relatives, attempted or caused (intentional) bodily harm to them. In the event that the crime has not been completed, the donor may, without going to court, terminate the transaction. For this purpose, his expression of will and the presentation of evidence of criminal acts or inaction are sufficient. If the donee killed the donor, the latter’s relatives are forced to file a lawsuit to cancel the donation in court.

You cannot avoid going to court in other cases:

- The donor may revoke his decision if the recipient mishandles the gift (a collection of books or jewelry, a family heirloom, etc.). However, here it will be important to prove to the court that such actions offend the feelings of the donor and are not based on the financial side of the issue;

- A third party has the right to demand that the court cancel the deed of gift in one case, when we are talking about a transaction made by a legal entity or entrepreneur no earlier than six months before he was declared bankrupt. It is understood that this person resorted to donation in order to conceal his property and make it impossible to transfer it to creditors. Such cases are heard in arbitration court if they fall under three criteria: The transaction violates the law “On Insolvency (Bankruptcy);

- The gift was allocated from funds related to the business activities of the accused person;

- The deed of gift was concluded in the six months preceding the bankruptcy;

The following video will tell you in more detail about the possibility of canceling a deed of gift for real estate:

Statement of claim

If the donor plans to cancel the transaction, he is obliged to send a claim to the donee. This paper will justify the reason for his decision, as well as put forward a proposal to terminate the contract by mutual consent.

In order for the deed of gift to be terminated unilaterally, it is necessary to apply to a court of general jurisdiction (if we are talking about a transaction made by a legal entity, then to an arbitration court) with a corresponding claim. Without a trial, the donor can terminate the transaction only if the recipient makes an attempt on his life.

Claims vary somewhat depending on the type of condition under which the gift is canceled. You can verify this by looking at the samples attached to the article.

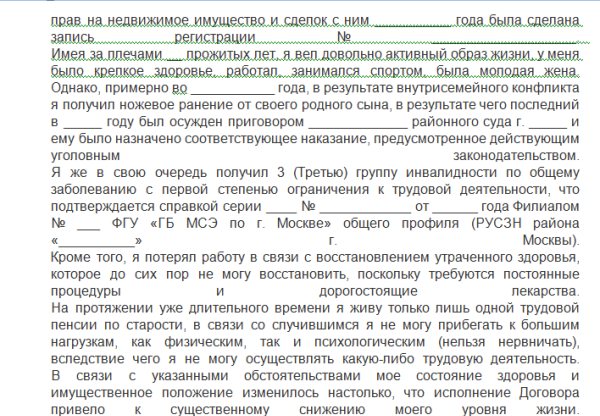

In general, the claim consists of several parts:

- The so-called hat. Indication of the name of the court, information about the plaintiff and defendant, as well as third parties;

- The main part, which describes the circumstances that led to the decision to cancel the transaction;

- Actually the plaintiff's request;

- List of attached documents;

- Date and signature.

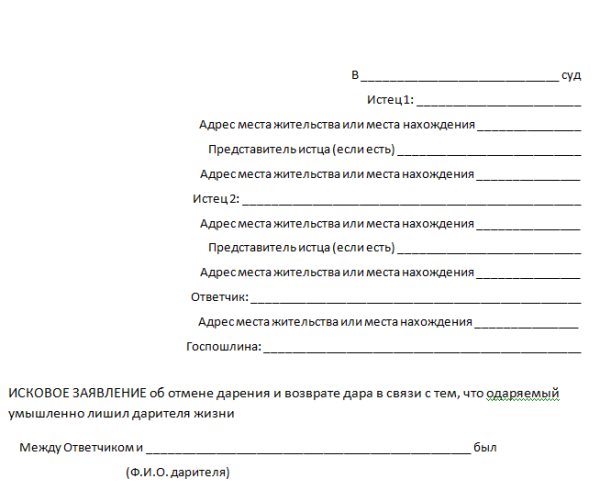

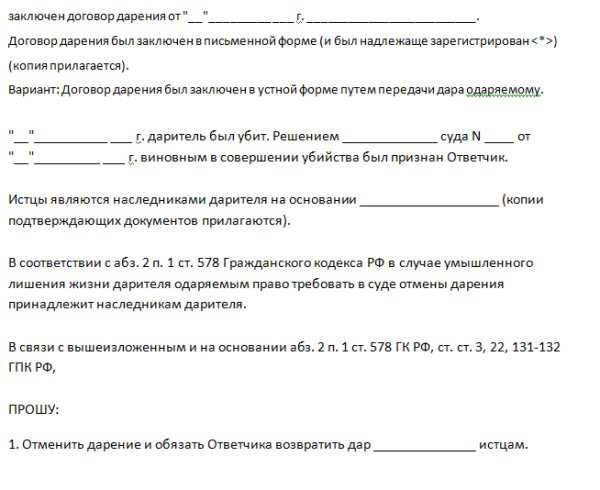

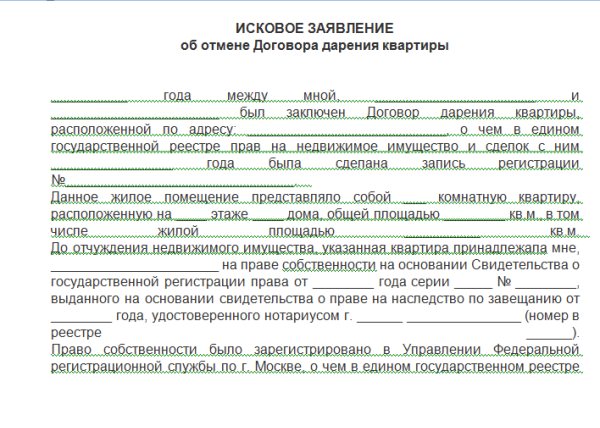

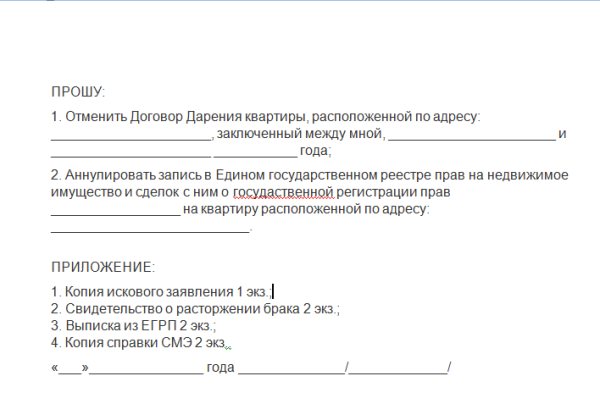

You can view the statement of claim for the cancellation of the gift agreement in the case where the donee intentionally deprived the donor of his life below and can also download it here.

Sample statement of claim for cancellation of a gift agreement (intentional deprivation of life)

Sample statement of claim for cancellation of a gift agreement - 1

Sample statement of claim for cancellation of a gift agreement - 2

Sample statement of claim for cancellation of a gift agreement - 3

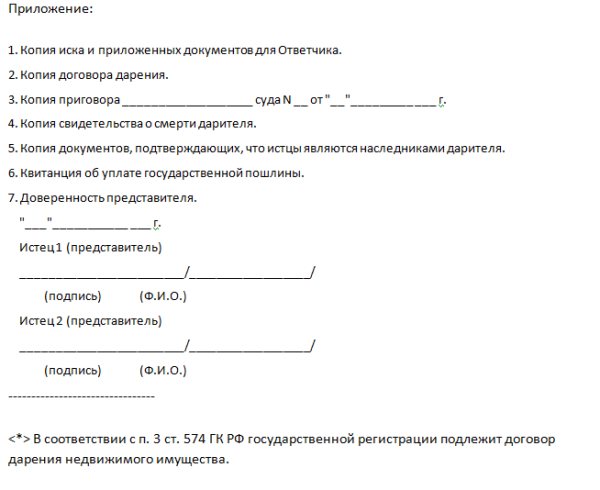

You can view the statement of claim for cancellation of the gift agreement in other cases below and also download it here.

Sample statement of claim for cancellation of a gift agreement

Sample statement of claim for cancellation of a gift agreement - 1

Sample statement of claim for cancellation of a gift agreement - 2

Sample statement of claim for cancellation of a gift agreement - 3

Sample statement of claim for cancellation of a gift agreement - 4

Sample statement of claim for cancellation of a gift agreement - 5

Next, we will talk about how to cancel a donation agreement for a share in an apartment.

Real estate share

The procedure for canceling a donation agreement for a share of an apartment is no different from canceling the donation of other property.

If, at the time of the decision to cancel the donation, the share of the apartment belongs to the donee, he is obliged to return it to the donor. If it was sold or otherwise transferred to a third party, the recipient will be forced to pay the donor material compensation in the amount of the value of the gift.

The following video contains advice from a well-known lawyer on the issue of canceling an apartment donation transaction:

Consequences of canceling the donation of an apartment

The consequences of canceling the donation of an apartment are provided for in paragraph 5 of Art. 578 Civil Code of the Russian Federation. This provision provides for the return of the subject of the transaction (in this case, the apartment) in kind to the donor after cancellation of the contract. This becomes possible only if at the time of cancellation such property is still in the possession of the donee. In the worst case scenario, the apartment may be sold, which means that the recipient will have to reimburse the cost of the apartment in cash. This is the worst-case scenario.

In the best case scenario, the property is still owned by the donee and will be transferred to the donor. However, in this case, it is necessary to register the newly emerged property right with the territorial body of Rosreestr.

Do not forget that when providing this service, a state fee .

Challenging the apartment donation agreement

Perhaps the most common situation among cancellations of deeds of gift in 2020 was cases of invalidation of an apartment donation agreement. Therefore, we invite you to consider all the rules and non-obvious nuances of such a challenge, which will certainly help save you money and time.

So, according to Article 166 of the Civil Code of the Russian Federation, the donation of an apartment can be recognized:

- According to a court decision (the so-called voidable transaction).

- regardless of the court’s determination (a void transaction as a result of a violation of the law even at the stage of drawing up/executing the gift agreement).

In addition, the legislator has defined a list of grounds, the presence of which determines the invalidity of a deed of gift for an apartment:

- The deed of gift was drawn up by a minor, aged 14 to 18 years, without obtaining written consent and participation in the transaction of the child’s legal representatives, whose roles are usually parents, guardians or employees of the guardianship and trusteeship service.

- The transaction was concluded without the written approval of the legal representative of a citizen with limited legal capacity, or a person under the influence of alcohol, medications, etc. participated as one of the parties to the transaction.

- The apartment donation agreement was concluded under pressure, threats or as a result of misleading the participant.

- The donation of an apartment was made by a legally capable person who was not aware of his actions (for example, the donor began to experience severe pain, preventing him from realizing the consequences of his actions, etc.).

At the same time, the filed claim to invalidate the deed of gift will not have the proper legal force in cases of dishonest actions of the applicant. Simply put, if the plaintiff is convicted of fraud or a desire to deceive the court, this will be evidence of the legality of the disputed agreement.

After the court makes a decision on the invalidity of the donation, the property benefits previously transferred by the donor to the donee (in this case, an apartment) must be returned in full to their former owner, and in the event of damage or irretrievable loss of the gift, the donee will have to pay an amount commensurate with the value of what he accepted. gift.

EVERYONE NEEDS TO KNOW THIS:

Is it possible to sell donated property?