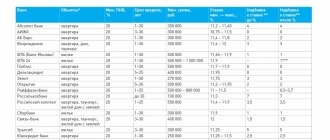

Lowest mortgage rates

Low rates for housing under construction (primary market).

The maximum term is 30 years. In this case, the down payment cannot be less than 15% of the total cost of the property. At the same time, several different government programs are being implemented through the bank to support young families, military personnel, and so on. Under certain conditions, it is possible to reduce interest rates to minimum values and even lower. Sberbank, rates from 10/08/2020

| Program | Rate from % |

| State support 2020, from 0.1% for the first year | 0,1% |

| New buildings (purchase of housing under construction) | 4,1% |

| Finished real estate (on the secondary market) | 7,3% |

| Refinancing mortgages from other banks | 7,9% |

| Mortgage for families with children with state support, from 0.1% for the first year | 4,7% |

| Construction of a residential building | 8,8% |

| country estate | 8% |

| Mortgage + maternity capital | 4,1% |

| Military mortgage | 7,9% |

| Garage loan (parking space) | 8,5% |

Mortgage interest rates at VTB as of 10.10.2020

| Mortgage with state support 2020 | from 6.5% |

| New building | from 7.4% |

| Secondary housing | from 7.4% |

| Mortgage with state support for families with children | from 5% |

| Mortgage refinancing | from 7.4% |

| Far Eastern mortgage | 1% |

| Victory over formalities | from 7.4% |

Alfa-Bank, mortgage rates from 10/10/2020

| Program | Interest rate |

| Secondary housing (finished housing) | from 6.5% |

| Housing under construction (primary market) | from 6.5% |

| Mortgage refinancing | from 7.99% |

| Loan secured by existing housing | from 13.99% |

Gazprombank, mortgage rates from 10/10/2020

| Program | Conditions |

| Preferential mortgage | from 6.1% |

| Mortgage "New settlers" | from 7.5% |

| Family mortgage | from 5% |

| Refinancing | from 8.3% |

| Military mortgage | from 8.1% |

| Parking space | from 9.5% |

| Far Eastern mortgage | from 2% |

Otkritie Bank, mortgage rates from 10.10.2020

| Program | Interest rate |

| Preferential mortgage with state support 2020 | from 5.99% |

| New building | from 7.5% |

| Secondary housing | from 7.6% |

| Family mortgage | from 4.7% |

| Apartments | from 7.8% |

| Military mortgage | from 7.6% |

| Apartment + Maternity capital | from 7.8% |

| New building + Maternity capital | from 7.5% |

| Refinancing | from 7.8% |

| Refinancing a military mortgage | 7,6% |

Minimum transfer of money to the bank in one period

- To make your monthly payment lower, you can increase the loan term to the maximum . Many people take out a mortgage for 20-25 years, which does not mean that they are going to pay it off for the entire term. After all, with a smaller payment amount, you can repay the loan in larger amounts and ahead of schedule.

- Choose a differentiated repayment scheme .

With this type of payment, the amount will become smaller each month due to the repayment of the debt in equal installments and the accrual of mortgage interest only on the balance of the debt. The disadvantages of this payment method are that the first time payments are made, the amount will be greater than with an annuity, and in order to take out a mortgage using this loan method, you must have greater solvency. But over time the amount will become smaller. Such banking offers are quite rare. (the overpayment is significantly less than with an annuity) And if you also choose a low loan rate, you will be able to pay off the mortgage with minimal costs. - You have the right to refuse additional insurance contracts , saving on annual insurance payments. But be careful: some banks put higher mortgage rates without concluding such agreements!

- You can make a large down payment , which will lead to a reduction in the amount of monthly payments.

- If you have the opportunity to use a mat. capital when buying a home - feel free to do it! As a result, when recalculating the schedule, you can reduce the payment amount, leaving the term the same.

How much do you have to pay per month if you take out a mortgage?

- 1.5 million for 20 years .

With a mortgage of 12% per annum in the amount of 1.5 million for a period of 20 years, the amount of monthly payments will be about 16,516 rubles. In this case, the overpayment will be 2,463,910 rubles. But if we make an initial payment of 20% (300 thousand), the overpayment will be significantly less - 1,971,128 rubles, and the monthly contribution will be 13,213 rubles. - 1,000,000 for 20 years .

Let's consider the following option - if you take out a mortgage of 1,000,000 rubles, how much to pay per month on the mortgage? So, with a mortgage for a period of 20 years (240 months) at an interest rate of 12%, the amount of monthly payments is 11,011 rubles. The overpayment for the entire loan term will be RUB 1,642,607. When making a standard down payment of 200 thousand, the overpayment on the loan will be 1,314,085 rubles, the amount of the monthly payment will be 8,809 rubles. - 2 million for 20 years . Under the same conditions, taking out a loan in the amount of 2 million will cost you 22,022 rubles per month with an overpayment of 3,285,213 rubles, but if you make 400 thousand as a down payment, the overpayment will decrease and amount to 2,628,171 rubles. with a monthly payment of 17,617 rubles.

- 600 thousand for 20 years . And if you take a small amount of 600 thousand rubles for 20 years. – it is necessary to pay a monthly amount of 6,607 rubles. Overpayment – 985,564 rubles; Having paid 120 thousand in advance, we receive an overpayment in the amount of 788,451 rubles. with a monthly payment of 5,285 rubles.

- 3 million for 20 years .

If we take 3 million, we will need to pay 33,033 rubles monthly, the overpayment for the entire loan period (20 years at a rate of 12% per annum) will be 4,927,820 rubles. If you deposit 600 thousand rubles, we receive an overpayment of 3,942,256 rubles; you will have to pay 26,426 rubles monthly.

Types of interest rates.

Fixed rate mortgages are the most popular today. The size of this rate is negotiated between the lender and the borrower at the stage of signing the agreement and is not subject to change. The main advantage of this method is that the borrower can plan his expenses for servicing the mortgage loan, knowing that the size of the monthly payments will not change. Another way of calculating interest is the so-called floating interest rate. In this case, it consists of two values: a floating index and a fixed interest rate, while the rates on the interbank lending market (for example, LIBOR) are used as a floating index. Using such a scheme carries the so-called credit risk for the borrower, which may lead to an increase in the size of monthly payments. In addition, it is somewhat more difficult to prepay an adjustable-rate mortgage than a fixed-rate mortgage.

Of course, the interest rate is one of the most important parameters of a mortgage loan. Knowing the main factors that influence its size, the borrower can choose a mortgage for himself whose interest rates will be minimal.

Did you like the content?

+13

Rating of institutions with different rates

50 percent

Taking out a loan with such a large contribution of 50 percent is possible at VTB Bank of Moscow, this program is called “Simple Mortgage” - this means that obtaining a mortgage loan is possible using two documents, without collecting income certificates.

Conditions:

- The loan amount can be any.

- The repayment period of mortgage loan obligations ranges from three to thirty years.

- The rate for using credit funds is 11%.

- Down payment of fifty percent.

- Mandatory signing of insurance.

Important! Typically, in all banks, if the borrower refuses full insurance, the banking institution has the right to increase the annual percentage by one unit!

Requirements for the borrower:

- Age at the time of filing documents is from 25 to 60 years. At the time of expiration of the loan agreement, the age should not exceed: 60 years for women, 65 years for men.

- Total employment experience of at least one year.

- A prerequisite is the presence of citizenship of the Russian Federation.

30%

At RosselkhozBank you need to deposit at least 30 percent of the amount in order to purchase apartments on the primary or secondary real estate markets.

Credit terms:

- The amount issued by the bank is no less than one hundred thousand and no more than twenty million rubles.

- The repayment period of mortgage obligations is not more than thirty years.

- The rate for the use of funds is 10.25 percent, for young families - 10 percent. And also if the borrower is a salary client, the rate will be 10 percent. In the case where a young family is also a recipient of a salary deposited into a bank account, their rate will be reduced from 10 percent to 9.75. Read more about which banks offer mortgages with a down payment of 10 percent and whether there are any disadvantages to such an offer here.

- Down payment from thirty percent.

Important! The rate can be further reduced if you purchase apartments whose value is more than three million rubles.

Requirements for the borrower:

- The borrower's age is from twenty-one years to sixty-five at the date of repayment.

- Work experience must be at least six months at the current place of work and at least one year in the last five years. (For persons running private household plots, receiving pensions and persons who are salary clients, the length of service requirements are slightly different).

- Registration at the place of residence or in the place where the borrower is located.

- Citizenship of the Russian Federation.

20%

Many banks provide programs with such a down payment. Let us list those discussed above.

RosselkhozBank

Issues a mortgage loan with a given down payment for the purchase of an apartment in a new building, the terms of the loan and to the borrower are the same as with a down payment of 30%.

SKB Bank

It offers clients various programs, where a single initial contribution is twenty percent of the amount.

Conditions:

- Amount issued by the bank from 350 tr.

- Duration from three to thirty years.

- Interest rates range from 13.5 to 15.5 percent.

Requirements for the borrower:

- Age from twenty-one to sixty-five years.

- The total experience is at least one year and the current one is from four months.

- Registration and residence - subjects of the Russian Federation where SKB Bank divisions are located.

- Be a citizen of the Russian Federation.

Sberbank

The amount of the initial payment from twenty percent can be under the “ready housing” program.

Lending terms:

- The minimum amount issued is three hundred thousand rubles, the maximum is no more than eighty percent of the amount of the premises being loaned.

- Up to thirty years.

- Mandatory insurance.

The requirements for the borrower are standard.

VTB 24

In the “More meters - lower rate” program, the initial payment is from twenty percent.

Lending terms:

- The rate is equal to ten percent.

- Signing a full insurance package.

- The loan repayment period is up to thirty years.

- The total amount of loan funds is from six hundred thousand to sixty million rubles.

The requirements for the borrower are the same as at RosselkhozBank.

Important! Under this program there is some discount if you buy a home of more than sixty-five square meters. meters, the bank reduces your bet by one unit!

Gazprombank

Under the Military Mortgage mortgage lending program, the down payment is from twenty percent.

Lending terms:

- The annual interest rate is 10.60.

- The repayment period of mortgage obligations is from one year to twenty-five years.

- The amount issued is up to 2.25 million rubles.

- Insurance.

Requirements for the borrower:

- Age from twenty years to forty-five at maturity.

- Registration at the location of the bank or branch.

- Good history of previous loans.

- Be a member of NIS for at least three years.

15%

Here is a list of banks providing loans with a down payment of 15 percent.

Bank VTB 24

“Mortgage for the Military” program, the down payment amount is 15%.

Lending terms:

- Funds are provided for no more than two million rubles.

- The rate is from ten to eleven percent.

- The term of obligations is from fourteen to forty-five years.

The requirements for the borrower are the same as those of Gazprombank.

RosselkhozBank

Provides mortgage loans with a down payment of 15% for secondary housing, and all conditions and requirements in this bank are standard.

3%

Unfortunately, not a single bank provides mortgage loans with a down payment of 3 percent. Perhaps this will appear in the future, but in this case the monthly payment will be very high.

5%

An initial contribution of 5 percent is possible at VTB Bank 24. Mortgage lending with the participation of maternal (family) capital. It is worth noting that the certificate funds can be used both as a down payment and to pay interest on existing mortgage obligations.