Can a foreign citizen take out a mortgage?

The Law “On Mortgage” does not impose a ban on mortgage lending to foreigners, but practice shows that the borrower will have to comply with a number of stricter requirements put forward by the bank.

Credit and financial institutions are insured against losses in the event of violations of the terms of the transaction by a borrower with foreign citizenship. A foreigner can stop payments and leave Russia. Then the bank will suffer serious losses.

Financial organizations include such losses as the unpaid amount of the principal debt, interest, fines and penalties, as well as costs associated with lawsuits in court to collect money on the loan. A small number of banks may be willing to risk money and time.

Of course, a foreigner will not be able to take the purchased property with him, but the bank will need to go to court, put the apartment up for auction and sell it below market value. This will lead to additional losses.

However, some banks, seeking to increase income by expanding lending volumes, are ready to enter into transactions with foreign citizens, even those who have a permanent job in the Russian Federation. In this case, all risks are included in the contract through an increase in interest or other additional fees.

The documents of the borrower from another state will be carefully analyzed. The financial institution will check your credit history, place of work, connections, and only if it is completely trustworthy will the bank agree to sign the deal.

A foreigner can take out a mortgage loan, but he should study certain intricacies of the procedure. Typically, banks are more willing to issue loans to citizens of the CIS, although Raiffeisenbank also works with representatives of other foreign countries if they are reliable borrowers.

The nuances of obtaining a mortgage for foreigners

Mortgage Law No. 102, adopted at the end of the 20th century, does not prohibit foreigners from taking out a loan for residential real estate. But this is on paper, but in practice it is not so simple.

Banks are reluctant to work with people without Russian citizenship or even refuse to provide them with loans. This is also not prohibited by law. Financial institutions explain this by increased risks. After all, a foreigner can leave the country at any time. And then banks will suffer losses in the form of:

- Unpaid interest

- Remaining debt

- Fines and penalties

Of course, the apartment/house will remain in the Russian Federation and will be transferred to the bank. However, it will be necessary to obtain permission from the court, put the property up for auction and sell it there. These are additional costs plus the price will be lower than the market price.

And those banks that provide mortgages to foreigners increase the interest rate, the down payment, introduce additional fees, etc. In general, the conditions for issuing mortgages on real estate for foreigners living in Russia are becoming more stringent.

Note that for representatives of neighboring countries (CIS) mortgages are more likely than for citizens of more distant countries. However, there are banks (for example, Raiffeisenbank) that work with all non-residents of the Russian Federation.

So, how can a foreigner get a mortgage? There are two options.

Mortgage for citizens with a residence permit in Russia

In the Russian Federation, citizens with a residence permit have almost equal rights with Russian citizens. This is enshrined in legislation. They, just like indigenous people, pay taxes, have the opportunity to enjoy benefits and receive social benefits. Mortgage lending is no exception.

Mortgages for those who have a residence permit in Russia are carried out according to the usual algorithm. This category of citizens usually includes those who have a permanent job and, accordingly, income. And this is the most basic condition for issuing a loan.

Required documents

The bank provides mortgages to foreign citizens, subject to the provision of the following documents:

- passport, photocopy of all its pages, notarized translation;

- documentary support for legal stay on the territory of the Russian Federation, for example, a residence permit;

- certificates from the employer: employment contract, certificate 2-NFDL or according to the bank form, work permit.

This is a sample list. You can find out the exact list of documents by calling the hotline or using the help of specialists in the office.

Mortgage for CIS citizens

For persons with citizenship of one of the CIS countries, getting a mortgage is much easier. An international agreement between Russia and Tajikistan, as well as Belarus, makes it possible for citizens to obtain a residence permit without a temporary residence permit.

This makes the process of getting a mortgage much easier. The conditions for issuing a mortgage have been especially simplified for Belarusians who do not need to obtain a migration card. You just need to provide information about your permanent employment and income. The loyalty program in mortgage lending has been developed for all CIS countries.

Previously, citizens of Ukraine also enjoyed the right to obtain a mortgage under a simplified option. However, conditions have tightened significantly since 2014. In 2020, the procedure for Ukrainians to obtain mortgage loans has become significantly more complicated. Borrowers from Ukraine are required to confirm permanent employment, income, and payment of taxes.

Immigrants from the CIS countries and foreigners with a residence permit in Russia are a priority category for banks when issuing loans. For them, all procedures will be a little simpler than for citizens from foreign countries.

Attitude of local banks towards lending to residence permit holders

Lending services for customer purchases is always a risky undertaking, so credit experts spend a long time assessing the situation of each applicant. Banks are even more cautious about foreign clients, because the borrower can leave the country at any time without repaying the debt.

Given the risks, not all Russian credit institutions are ready to lend funds for the purchase of expensive property. In matters of real estate lending, some banks prefer to cooperate only with citizens of the Russian Federation. Others “insure themselves” by tightening requirements and increasing interest rates, so they have few clients among nationals of other states.

However, there are financial institutions that see not only risks, but also profits in relationships with foreign clients. They believe that the chance to buy their own “corner” strongly motivates the borrower to be responsible about their obligations.

In their opinion, a mortgage with a residence permit is no different from a housing loan for a Russian citizen, you just need to work out special programs for lending to migrant clients.

Mortgage for those who do not have a residence permit

When making a decision on lending, the following requirements are imposed on citizens who do not have a residence permit:

- Permanent residence in Russia or the decision to move to the country for permanent residence.

- Solvency, and the amount of payments cannot be higher than 40% of family income.

- Employment with an employer from the Russian Federation for at least six months.

- A significant down payment for the purchased property (from 20%).

- Consistent timely payment of all fees and taxes.

- Reliable credit history, absence of any debt.

Compliance with these conditions will allow the bank to decide in favor of issuing a mortgage to a foreigner. In the absence of a credit history, that is, if a foreign citizen has not received loans, the possibility of refusal to obtain a mortgage increases, since it will be difficult to determine the reliability of the borrower.

On the topic: 10 banks that provide mortgages without a down payment.

Banks often consider borrowers from abroad a high-risk category, so they impose additional stringent requirements:

- Attracting guarantors;

- Increase in interest rate (by 1-1.5 points);

- Reducing loan terms;

- Compulsory insurance, not only of real estate, but also of the life and health of the borrower;

- Increasing the minimum period of employment from six months to 2-3 years.

Credit institutions consider it logical that such measures can reduce the risks of financial losses.

Which banks provide mortgages to foreign citizens?

Mortgage programs for foreigners are available in the following Russian banks:

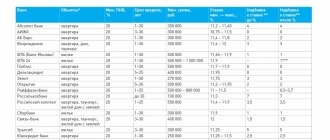

Mortgage loans to foreign citizens in Russian banks

| Name | Citizenship | Bid | Term | Sum | Contribution |

| VTB | no restrictions | from 7.9% per annum | up to 30 years old | up to 30-60 million rubles | from 20% |

| Alfa Bank | Russia, Ukraine, Republic of Belarus | from 8.79% per annum | up to 30 years old | up to 20 million rubles | from 20% |

| Rosbank | doesn't matter | from 6.39% per annum | up to 25 years | from 3-5 million rubles | from 15% |

| Raiffeisenbank | any state | from 8.39% per annum | up to 30 years old | up to 26 million rubles | from 20% |

| Fora-Bank | doesn't matter | from 9.89% per annum | up to 25 years | from 0.6-1 million rubles | from 15% |

| Investtorgbank | any state | from 7.99% per annum | up to 25 years | up to 12 million rubles | from 30% |

Please note that today at Sberbank, one of the largest financial institutions in the country, foreign citizens can only obtain a consumer loan.

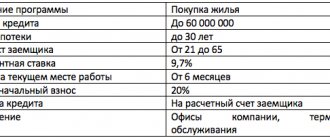

VTB terms

To obtain a mortgage loan, a foreign borrower must provide

- application form;

- passport;

- a certificate of income of an individual or a tax return for 12 months (salary clients of VTB do not require certificates of income);

- a copy of the work book certified by the employer;

- a document confirming the legality of stay and work in Russia.

When considering an application, VTB may request additional documents.

Standard mortgage conditions for a new building:

- loan size – from 600 thousand to 60 million rubles;

- term – up to 30 years;

- rate – from 7.9% per annum with a down payment of 50%;

- minimum down payment – 20%;

- compulsory condition – comprehensive insurance.

Mortgage Secured by existing housing from Alfa Bank - 13.69%

Apply now

Alfa-Bank terms and conditions

Not only citizens of Russia, but also residents of Ukraine and the Republic of Belarus can obtain a mortgage loan from Alfa-Bank. Registration of the borrower at the place of residence or stay is not required. The client can attract up to 3 people as co-borrowers.

General conditions of mortgage programs:

- loan amount – from 600 thousand to 20 million rubles;

- loan term – 3-30 years;

- interest rate – from 8.79% per annum;

- down payment – from 20% when purchasing finished and under construction housing;

- a mandatory requirement is insurance against the risks of loss/damage to the purchased property.

Mortgage VTB 24 for foreigners

Non-residents can get a mortgage from VTB 24 and the Bank of Moscow, and they may not even live in Russia and do not have a permanent income. Financial organizations have developed a special program “Victory over formalities”, which allows you to obtain a mortgage using two documents.

Under the program, a foreign citizen who has the opportunity to pay 40% of the required amount at once receives a loan under a simplified scheme. You must present a passport with a translation certified by a notary, and some other document, for example, a license. It is not necessary to provide employment information.

However, the borrower must be employed in Russia, so the application must indicate the address of the employing organization, length of service there, and contact information. The transfer of information is previously agreed upon with the employer.

Often the role of employer is played by realtors or acquaintances. Usually, positive decisions are made according to a simplified scheme. Promsvyazbank has also adopted a similar program, but they offer mortgages at higher interest rates.

Mortgage without a residence permit

A non-resident of the Russian Federation will be able to obtain a mortgage for the purchase of residential real estate only if the following conditions are met:

- he permanently resides in Russia or has intentions to move to permanent residence (the period of stay in the Russian Federation cannot be less than 183 days);

- has stable employment with a Russian employer for at least six months;

- regularly pays all taxes and fees;

- has sufficient payment and creditworthiness (the sum of all the borrower’s obligations cannot exceed 40% of family income);

- will pay an impressive share of the down payment for the purchased housing (usually at least 20%);

- has no third-party debts or damaged credit history.

If these conditions are met, the bank will be able to meet the client halfway and issue the required amount of money for the purchase of real estate.

IMPORTANT! If a foreign citizen does not have any credit history, that is, he has never taken out any loans or credits, then the likelihood of being denied a mortgage will increase significantly, since it will be difficult for a credit institution to form a correct idea of his reliability and solvency.

Some banks, recognizing the category of foreign borrowers as high-risk, establish additional, increased requirements for them.

Among these requirements and restrictions are:

- increasing the minimum length of work experience for a Russian employer company (for example, from 6 months to 2-3 years);

- requirement to attract guarantors or co-borrowers;

- increase in interest rate (usually no more than 1-1.5 percentage points);

- increase in the amount of the down payment (up to 50-70% of the price of the property);

- reduction of the loan term;

- obligatory conclusion of a comprehensive insurance contract (in addition to real estate insurance, you will need to buy life and health insurance for the client).

Using the listed restrictions, the bank tries in any way to reduce possible risks in the future.

Bank conditions for mortgage lending to foreigners

There are few financial institutions left that offer mortgage lending to foreign citizens. But there is still a choice. For example, such large banks with international capital as Raiffeisenbank and Rosbank provide a mortgage with a down payment of 15%, but the work experience of a foreign citizen must be 6 years.

The conditions for issuing mortgages from the mentioned banks are quite favorable for foreigners; they offer solid repayment terms and low interest rates. Raiffeisenbank is ready to issue a loan for 25 years at a rate of 9.5%.

TransCapital reduces the length of service requirements to 3 years, and Eurasian Bank – to 1 year.

Requirements for a facility under construction

The legislation of the Russian Federation regarding mortgages for housing under construction is at the stage of serious changes. Bank requirements are also changing.

The best option for the client is to have the facility accredited by the bank. In this case, you do not have to delve into the intricacies of the law. If you are buying an apartment in a multi-storey building, it is advisable to ask the developer which banks the building is accredited with. There may be a financial institution on the list that suits you.

If the building is not accredited by the bank from which you want to get a loan, you will have to collect a package of documents for approval (licenses, permits, etc.). Check with your lender for current requirements.

Requirements for the borrower

Depending on the bank you choose, requirements may vary. Each financial organization has its own conditions for issuing a mortgage loan to citizens applying for a mortgage. However, the list of basic requirements includes:

- Employment and permanent income;

- Positive credit history;

- Age limit – 21-65 years;

- Availability of a landline or mobile phone;

- Permanent residence in the area where the bank branch is located;

- Financial activity – from 3 years (for business owners in Russia);

- Citizenship – any.

Financial organizations impose the same requirements on guarantors.

Requirements for premises on the secondary market

The main characteristics that the finished object must meet:

- connected to communications;

- if the room is finished, plumbing, doors, and windows are required;

- condition - not dilapidated, not in emergency condition, not subject to resettlement;

- reinforced concrete foundation, stone or brick;

- there are no encumbrances or interests of third parties.

Raiffeisenbank is the most demanding in terms of real estate. In order to lend, the following conditions must additionally be met:

- the seller is not a legal entity whose work does not comply with the legislation of the Russian Federation, or a close relative of such;

- the premises must have its own kitchen and bathroom;

- there are requirements for the number of storeys of a building depending on its age and region.

Recommended article: How to get a second mortgage

Required documents

The bank will be able to make a positive decision on issuing a mortgage loan only if all the necessary documents are provided:

- Application with personal data in the form established by the bank;

- A passport of a citizen of a foreign state translated and certified by a notary;

- Information about employment and permanent income;

- Information about your stay in Russia (visa, residence permit, migration card);

- Work permit in the Russian Federation;

- Documentation for the purchased property (purchase and sale agreement, cadastral passport, housing assessment, etc.).

However, banks may additionally require other documents:

- About education;

- About temporary registration;

- About the property owned;

- Bank statements about the applicant’s personal accounts.

It is mandatory to provide references from the place of employment. A positive solution to the issue of a mortgage will also be affected by the presence of liquid property owned by a spouse who is a citizen of the Russian Federation.

Legislative basis

According to Federal Law No. 102 “On Mortgages,” the issuance of loans for the purchase of real estate to foreign citizens is permitted without meeting any special conditions. If a resident of another country or a stateless person legally resides and works in Russia, he can purchase an apartment, house, land, cottage and other property by taking out a mortgage from a bank.

For persons who have a residence permit, the procedure for purchasing housing in the Russian Federation is almost no different from that for its domestic citizens. All taxes, duties and benefits paid and received in this process will be similar.

People without a residence permit can also purchase real estate and even take out a mortgage from Russian banks, but, as a rule, this will require a substantial down payment and the fulfillment of some additional conditions.

Registration process

For foreigners, the rules for obtaining a mortgage loan are similar to the scheme under which Russian citizens receive mortgages. The process is carried out in a certain sequence:

- Studying offers on the banking services market, which will allow a foreigner to choose the most profitable option.

- Selecting a specific mortgage program.

- Preparation of the necessary package of documents (given that many certificates need to be waited for a long time, you need to take care of this in advance).

- Visiting the bank and submitting an application.

- Waiting for a decision (more careful consideration of documents from foreigners entails an increase in the processing time - up to a month from the date of writing the application).

- If the bank's decision is positive, the necessary documents are signed (the financial institution provides an agreement with an established detailed payment schedule).

- Making a down payment from your own funds (at least 15% of the cost of the purchased home).

- Registration of the transaction (the purchased object must be registered with the Registration Chamber or MFC, with the further imposition of an encumbrance from the bank).

- Transfer of the remaining amount to the person selling the property.

After all operations are completed, the borrower becomes the owner of the home, which, according to the documents, is pledged to the bank.

Scheme of purchase and sale transaction and mortgage insurance

Let us highlight the main stages of buying real estate with a mortgage.

Contacting one or more banks to approve the amount

The client submits documents confirming his creditworthiness, as well as preliminary information about the purchased property (primary/secondary housing, estimated cost). The bank reviews the application, informs about the possibility of providing a loan, the approved amount, and the interest rate.

Recommended article: What will happen to the mortgage if the bank goes bankrupt, do I have to pay

Collection of documents for the object

The client (or his realtor, representative) collects documents for the premises, the seller, and documents that are missing for himself (for example, the consent of the spouse). The exact list depends on the bank - the client receives it as a separate list.

At this stage, the parties enter into a preliminary agreement in which they state their intentions. Based on this, the buyer usually transfers the deposit to the seller against receipt.

Approval of the object by the bank

When the documents for the transaction are collected, the buyer gives the package to the bank. If all information is complete and correct, without violating applicable laws, the object receives approval.

Making a deal

The parties meet at the bank to sign a loan agreement. A purchase and sale agreement or share participation in construction/assignment agreement can also be concluded here.

If the transaction requires notarization (for example, shared ownership), the parties, together with the creditor, draw up a draft agreement and send it to the notary. Or the contract is drawn up by a notary and its terms are agreed upon with the bank.

Based on the signed purchase and sale/equity/assignment agreement, the buyer transfers (or transfers) the amount of the down payment minus the deposit. The seller writes a receipt for the money received. This document is usually drawn up by the bank taking into account all the requirements.

How to confirm the down payment on a mortgage - read in another publication.

Registration of a transaction

The buyer carries signed contracts, a receipt (or receipts) for the amount of the first payment, an extract from the Unified State Register from the seller for registration in Rosreestr. You can submit documents through the MFC. The maximum period for issuing documents is 2 weeks. Usually it takes significantly less time. The applicant picks up the contract with a registration mark.

Crediting money to the seller

The buyer provides the bank with a registered agreement. Based on this, the money is transferred to the seller.

Risk insurance

The loan agreement provides for mandatory insurance of the purchased object. A residential mortgage may also include additional insurance.

Read the loan agreement carefully. Insure the specified risks within the agreed period and provide copies of the policies to the bank. There are usually high fines for violating the conditions.

Call several insurers. The cost of the policy may vary significantly. When applying, provide a loan agreement so that the insurance agent accurately indicates all the data.

Mortgage insurance – what is required?

Mortgage repayment methods

When applying for a mortgage loan, you will receive account details into which you need to deposit money for repayment. You can top up in any convenient way:

- at the bank's cash desk;

- via bank transfer;

- Most credit institutions offer a bank card (often free) for replenishing via an ATM.

Ask your bank about existing commissions, free replenishment methods, as well as the timing of crediting funds to your account using different methods.

It is often recommended to deposit money at least 2-3 banking days before the scheduled payment.

Refusal and increasing the chance of getting a mortgage

Bank employees have the right not to approve the issuance of a loan to any borrower without giving reasons. But the main motivation for negative decisions is usually this:

- the individual has arrears or debts in other financial organizations of the Russian Federation;

- a guest from abroad lives in Russia for a short time;

- the migrant does not have one or more documents required to be submitted.

The likelihood of receiving a loan can be increased by a large down payment, but if the applicant has a decent income and has no other credit obligations, he may be given consent without overpayment.

When considering an application for a mortgage from a representative of another country, bank employees evaluate his further possibility of staying and operating in the Russian Federation.

Mortgage with a specific example

VTB 24 is one of the most popular banks in Moscow, St. Petersburg and other Russian cities, lending to foreigners. The following must be attached to the mortgage application to this organization:

- a clear photocopy of the passport with a translation certified by a law office;

- paper confirming income (on a bank letterhead or form 2-NDFL);

- a copy of a residence permit and work permit (the latter does not apply to citizens of Belarus);

- TIN, pension certificate or driver’s license, at the discretion of the applicant;

- marriage certificate;

- a photocopy of the work book, certified by the administration of the enterprise.

A sample salary certificate in the established format can be found on this website. Interest on a loan at VTB 24 can range from 12.5 to 17% and is calculated on an individual basis. The bank issues mortgages to both migrants and residents of the Russian Federation for a maximum period of 30 years. The institution charges an additional commission for a number of services.