What salary must be to get a mortgage?

The salary size suitable for the bank will directly depend on the cost of the home

. The bank specialist takes the loan amount and, based on this amount, calculates monthly payments.

If the resulting payment is less than fifty percent of the salary indicated in the certificate, then the bank will approve the application. If the percentage is less, then the borrower will be offered a reduced amount of money, or the loan will be refused altogether.

In addition to the RFP, a financial company can also check the credit history of a potential client. If at one time a citizen could no longer cope with payments due to low income, then, naturally, he would be denied a loan.

By the way, if we take the average statistics for the country, then in order to get an apartment on a mortgage, it is enough to earn 30-40 thousand rubles a month. But this must be net income without other loan obligations or alimony.

Mortgage broker assistance

The assistance of a brokerage company in obtaining a mortgage is invaluable, because not only options with a low salary are considered, but also a bad credit history, the inability to attract guarantors and other negative factors.

A white broker is constantly in the know: evaluates bank offers, knows about the tariffs being set, and understands the real estate market and housing prices.

Signs of a good, conscientious broker:

- works officially;

- has its own website and office;

- does not ask for an advance payment, but requires payment only upon approval of the mortgage;

- does not fool clients about correcting their credit history (supposedly removing negative information);

- does not impose third-party, unnecessary services.

If it is impossible to obtain approval for a mortgage, the broker will notify the client and offer alternative sources of financing or ways out of the current situation.

In addition, a professional broker will help identify the reasons for banks’ refusal to provide financing and advise on the possibility of rectifying the situation (if possible). Well, it is advisable, of course, to check the broker’s license in advance and read reviews about him on the Internet.

Features of “gray” and “black” income

Unfortunately, taxation in the country is such that many employers have to move away from “white” salaries and switch to “gray” ones.

or even “black”. This system allows you to avoid many taxes. Naturally, according to the documents, the company’s employees in this case receive a minimum income (if it is a “gray” salary) or do not receive it at all (in the case of a completely “black” salary), on which tax is paid. As a result, the absence of a white salary negatively affects not only the future size of the pension. Many citizens cannot get a credit loan, and especially a mortgage loan.

If a potential bank client receives the minimum salary and wants to take out a mortgage loan, then there is a high probability that he will be denied funds, since, according to the law, a citizen does not have to give all his income to a mortgage.

Then a potential bank client has only one chance to prove his income - to provide a certificate of income in the bank’s form.

What to do and is it possible to get a mortgage with a small official salary and no guarantors?

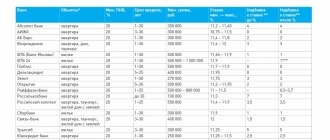

Initially, obtaining a housing loan was fraught with a lot of difficulties - for all programs, lenders established strict requirements in terms of income level and length of service. Today, conditions are softer - banks develop products taking into account the individual capabilities of clients of various categories. Therefore, you can take out a mortgage with a small official salary without guarantors.

Available options:

- Take a certificate from your workplace about your level of earnings in the form of the bank. 2NDFL reflects official income; in the certificate on the form of a banking institution, the employer can indicate the real salary, including the salary.

- Apply for a mortgage as part of a product that does not require the provision of documents on salary and employment. The disadvantage of the programs is the high down payment - from 40-50% of the cost of the purchased housing.

The first option is suitable if the borrower receives most of the salary “in an envelope”. Banks are loyal to such labor relations between individuals and commercial organizations. Sometimes financial institutions accept certificates drawn up according to the employer’s form. The second option will allow you to take out a loan if your unofficial income is high or you have your own savings, for example, from the sale of a previous apartment.

The conclusion is the following: you can take out a loan if the individual actually has sufficient income. If your income is low, both according to documents and in fact, applying for a loan should be called into question. Such obligations can lead to complete bankruptcy.

Probability of mortgage approval with a small salary

There are several options to increase your chances. Let's look at them in more detail.

How to increase your chances of approval?

Let's look at the most current ways to confirm your solvency:

- To start, you can check with your finance company to see what other income is taken into account when calculating your mortgage. For example, this could be a salary at a second job, monthly payments from rental property, deposits, the presence of valuable bills of exchange, and so on. Moreover, the more such papers there are, the higher the likelihood that the loan will be approved.

- If your income is insufficient, it makes sense to find co-borrowers. For example, Sberbank allows you to bring up to three citizens. The income of the co-borrowers is combined with yours, which will lead to an increase in the amount of the possible loan. By the way, in some financial companies, a husband or wife automatically becomes a co-borrower.

- If you have movable or immovable real estate (for example, another apartment, a car, etc.), it can be registered as collateral.

All of the methods described above will help the bank client increase his chance of loan approval.

How to verify income

If you cannot confirm your income, then check with the lender whether it is possible to confirm your income not through a 2-NDFL certificate

, but by providing a certificate in the form of your financial company.

If you do not have official income, you can check with the bank whether it is possible to provide the financial company with an income certificate not in the 2-NDFL form, but in the bank form.

In this case, you will only need to provide a certificate stating your annual income and the accounting department’s stamp.

By the way, not every bank accepts such unofficial certificates, since preference is given to “white” income. In addition, not every organization is ready to admit that it does not fully pay taxes to the state.

How to get a mortgage with a small official salary: 4 ways

Any bank is still interested in the influx of new clients, even with a low level of official income. Still, it is there, so monthly payments can be received stably. But in order not to lose “what is theirs”, the bank offers special conditions to such clients with a small official salary. There are 4 main ways to get a mortgage with a small official salary. Let's look at them in more detail.

How to get a mortgage with a small official salary: 4 ways

Mortgage loan with down payment

The bank can issue a mortgage to a person with a small salary. But he is also interested in making a profit not only in the future, but also in the present. Therefore, the borrower must make a mandatory down payment. But if under a regular mortgage program it is up to 30% of the total loan, then in this case this figure increases to 50%. Sometimes a contribution of up to 60% is required. This is how a credit institution receives at least some guarantees for the return of funds issued in the future.

Mortgage loan with down payment

Should you be afraid of a large down payment? If a client with a small official salary has that kind of money when signing the contract, then it is better to deposit it. This makes his fate easier, because:

- The amount of remaining debt will immediately decrease.

- Monthly payments will be much less.

- Most of the money will already be paid.

- The repayment period may also be shortened. Instead of 10-20 years of debt guarantee, the loan will be repaid much earlier.

Of course, not everyone has such a large amount of money to make a down payment. For this reason, this lending scheme will not be suitable for many. But you need to remember that the contribution is not an overpayment. This money goes towards paying off the principal amount of the debt. This eases the client's obligations. He won't have much left to pay, so future monthly payments won't be such an overwhelming task for him. The larger the contribution, the smaller the subsequent payments.

Mortgage secured by property

A small official salary is not an obstacle to obtaining a mortgage. Many people may have a small income, but at the same time own some property:

- Automobile.

- Other real estate.

- Country cottage, dacha.

- Plot.

Mortgage secured by property

All this property is valuable and can be used as collateral when taking out a mortgage. Bank experts evaluate its value and then draw conclusions. If the property is suitable as collateral, then the mortgage is issued to the client with a small official salary. There are even chances to take out a real estate loan at a high cost. But you need to remember that:

The collateral is immediately seized. But it should not be confused with a judicial seizure, since the property or car remains the property of the owner. It simply cannot be sold or given away until the mortgage is paid off.

Simply put, you need to give the bank copies of property documents (technical, title) and sign a mortgage agreement. In it, this property must be listed as collateral. But you need to remember that the bank does not consider all real estate or cars as collateral. The lender has a number of requirements and conditions for such objects. For example, a dacha or plot of land may not always become collateral. The same applies to emergency housing.

How to get a mortgage with a small official salary without a down payment? It is enough to provide collateral and forget about all the problems with drawing up a mortgage agreement. As soon as the loan is repaid, the seizure of the property is immediately lifted.

Mortgage loan with guarantee

The lender always carefully reviews all clients' mortgage applications. Documents, data, credit history are carefully checked and, of course, solvency is analyzed. It is she who plays a very important role in the approval of the application. It is important for the bank that the borrower can repay the debt. Income level plays a key role in assessing solvency. If the official salary is small, then getting a mortgage is extremely difficult.

The fact is that any mortgage loan is a large loan. It will be difficult for a person with a small salary to pay high monthly payments. What then should you do to get approval?

You need to contact a third party - a guarantor. This could be a person from a circle of relatives or acquaintances who has a stable and high salary. He guarantees for the borrower and takes part in signing the mortgage agreement. The guarantor has the following responsibilities:

- A guarantee for the main borrower who takes out a mortgage with a small official salary.

- Responsible for ensuring that the main borrower pays the debt with interest on time, that is, makes monthly payments.

- If the mortgage debt is not repaid, then this responsibility shifts to the shoulders of the guarantor.

Mortgage loan with guarantee

This is how you can solve the problem of how to get a mortgage with a small official salary. A guarantee is the best solution if someone agrees to take on greater responsibility. Finding such a person is not so easy, but it will be possible to get approval from the bank.

This person must be listed in the contract indicating passport and other data. The guarantor must take part in the conclusion of documents. The bank considers exactly his level of income. If the guarantor's official salary is sufficient to pay off the mortgage loan, then the main borrower receives approval.

Mortgage with approval, but on unfavorable terms

The lender will never go against its interests and will not issue a mortgage to a person with a small official salary. For this to happen, the bank must receive additional guarantees or privileges. He will enter into a mortgage agreement with the borrower, but will offer more stringent requirements:

- Increased interest rate on the loan. It will rise sharply, and the client will have to overpay. But he will receive approval for his application. The rate can be increased by 10, 20 or more percent.

- Inclusion of additional commissions in monthly payments. In this case, the amount of debt also increases, and the creditor receives much more money from the client.

- Mandatory conclusion of an insurance contract. Not only real estate is insured, but also the life and health of the borrower, as well as possible loss of his ability to work. Mortgage insurance is quite expensive, so in this case the client overpays quite a bit.

- An abbreviation of the general loan term during which the entire amount of the debt must be repaid. For example, a mortgage is issued not for 10-20 years, but for 5-7. This way the lender is reinsured and, naturally, gets his money back with interest much earlier.

Mortgage with approval, but on unfavorable terms

The list of conditions may be different. For example, it includes the requirement to provide documents for collateral, attract guarantors, etc. In this case, you can get a mortgage loan even with a small official salary.

At what salary should you not take out a mortgage?

If a citizen actually receives the salary indicated in the certificate, then it is better for him not to take risks and not take out a mortgage loan for his home.

A citizen who wants to receive money from a financial company needs to realize that the income that is needed to repay the loan monthly and the minimum salary are completely different things. A potential bank client must be prepared for the fact that even if a financial crisis occurs in his life, he will still be able to pay off his obligations. That is, if you are confident that even with certain difficulties you will have enough money to repay the loan, then you really have a sufficient level of income.

If a citizen does not have any financial “airbag,” then it is better for him to refuse the loan.

You can learn how to get a mortgage with a “gray” salary from the video.

How to get a mortgage if your official salary is low

Sometimes the employer pays part of the earnings “in an envelope”; these incomes are not reflected in 2NDFL. In 2020, issuing mortgages without 2NDFL is standard practice for banking institutions. To maximize your chances of receiving an approval decision with a “gray” salary, the following will help:

- Salary certificates in the form of a bank or on the official letterhead of the employer.

- Confirm your income with a card statement (salary, debit).

- Contact the bank to whose card the salary is transferred. Financial institutions put forward loyal requirements for existing clients, especially for participants in the salary project.

- Obtain a guarantee from the employer, with his consent.

- Exclude from the list of co-borrowers an official spouse with a damaged credit history.

- Close all small loans and microloans before applying for a mortgage.

- If your credit history has been damaged by delays, then before submitting the application for consideration, take out 2-3 microloans and pay them off on time, apply for a credit card with any limit and pay off the debt in a timely manner.

The bank will pay special attention to the reliability of the employer, credit history and liquidity of the acquired property.

How to confirm income for a loan?

A certificate in form 2NDFL is a mandatory document for the bank. This document was approved by order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] The new form of the 2-NDFL form is a document exclusively for the tax office; for employees, a “Certificate of income and tax amounts of an individual” is drawn up using another form.

For citizens receiving “gray” earnings, you will need to draw up and have a bank certificate certified by management.

To confirm other types of income, you must submit to the credit company:

- Lease contract.

- Tax return (3NDFL).

- Bank account statement.

- Extract from the work book.

- Employment agreement or contract.

When calculating a mortgage, banks take into account benefits received and other similar types of income. They do not need to be documented; it is enough to indicate the information in the application form filled out by the applicant. Employees of the credit institution will double-check the information received by calling the persons responsible for issuing money.

How to get a mortgage if you have no white income

In the absence of even a small official income, with the maximum probability of approval, a mortgage can only be taken out if there is a high down payment - from 50%. If you have a good credit history, you can take out a loan under the “Mortgage on two documents” loan program. Today such products are provided by Sberbank and Rosselkhozbank.

You can reflect your income using a bank certificate. As in the case of “gray” salaries, the reliability of the employer and length of work experience will be one of the determining factors. DeltaCredit is considered one of the most loyal. Tinkoff Bank also provides services for selecting a suitable mortgage program; its partners include more than 10 financial institutions.

If you have your own real estate, deprived of encumbrances and the rights of minors, it can be pledged. This loan program is called “Mortgage secured by your own property”; its main difference is the absence of a down payment. If the property's appraised value is higher than the required amount, your chances of getting a loan increase. The assessment is carried out according to established regulations, and the final price often differs from the market price.