Which banks give mortgages even with low earnings?

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Sovcombank

from 5.9% rate per year

Go

- Amount: from 300 thousand to 30 million rubles.

- Rate: 5.9%.

- Duration: from one year to 30 years.

- Age: from 20 to 85 years.

- You can confirm your income with a bank certificate.

More details

Alfa-Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Opening

from 8.7% rate per year

Go

- Amount: from 500 thousand to 30 million rubles.

- Rate: 8.7 - 14.45%.

- Duration: from 5 to 30 years.

- Age: 18 - 65 years.

- Down payment: from 10%.

- They accept income certificates in the bank form.

More details

Gazprombank

from 7.5% rate per year

Go

- Amount: from 500 thousand to 60 million rubles.

- Rate: 7.5%.

- Duration: from one year to 30 years.

- Age: 20 - 65 years.

- Down payment: from 10%.

- Review of the application from 1 working day.

More details

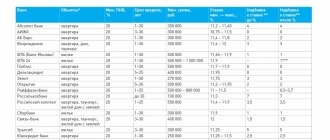

What income does the institution need?

Lenders look at two main earnings. This is white profit (based on their official earnings) and gray profit - the amount that is not shown in the 2-NDFL certificate. These are so-called non-taxable income funds.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

It often turns out in the CIS countries that gray profits exceed official accruals. If we add the news of the arrival, then the bankers consider:

- Figures from the salary certificate at the place of work.

- Amount from part-time work.

- Unofficial accruals.

- Passive income from renting out a car or apartment (house, office).

It is worth noting that most large government organizations, such as Sberbank of Russia and VTB 24, take into account only official cash receipts, which you can document. Income certificates can be taken into account, including bank forms, bank account statements, official lease agreements, income from intellectual property, etc.

Later in this article:

How does the mortgage amount depend on income?

When applying for a mortgage, the loan officer will request documents confirming your solvency. The bank wants to be sure that your income will be enough to pay your monthly payments. The higher your official earnings, the greater the likelihood of receiving approval for the required amount.

After you submit all the necessary documents, the bank will conduct a verification. If your credit history is good, your income is sufficient and there are no debts, then most likely the mortgage will be approved, and the interest rate will not be excessively high.

The bank has its own strict requirements regarding the amount of income. The loan burden should not exceed half of your earnings. For example, if you receive 20,000 rubles a month, then the loan payment cannot be more than 10,000 rubles.

What borrower income is taken into account?

The question arises: what salary is needed for a mortgage? Most banks take into account all types of citizens' profits, which can be confirmed by certificates, statements or other documents. And this is understandable: it happens that in the 2-NDFL certificate, a person’s official salary is indicated in the amount of 12,000 rubles, while the total income is 150,000 rubles. In Russia, almost all banks take into account the unofficial profits of citizens. Thus, even such large banks as VTB 24 or Sberbank take into account unofficial income.

...So, the following income is taken into account when obtaining a mortgage:

- - basic salary at the place of work (certificate 2-NDFL or according to the bank form);

- — salary from part-time work;

- — passive income from renting out real estate.

What should the salary be?

Each bank is guided by its own settlement system. No one discloses the full formulas, but an approximate calculation method looks like this (you need to add up all the indicators):

- 1 subsistence minimum (LM) per borrower;

- 1 PM for dependents (children);

- the amount of monthly loan payments;

- a mortgage payment that is no more than 40% of income.

The cost of living may vary depending on the region of residence. For example, in Moscow it is about 16 thousand rubles, and in Belgorod - 9000 rubles.

10% of the limit of all open credit cards counts towards this ratio, whether you use them or not. If you don't need them, close those accounts before applying.

Let's look at the situation using an example. Let's say the salary is 25,000 rubles per month. There are no credit cards or unpaid loans. The borrower is not married and has no children. Lives in Belgorod in an apartment with his parents.

25,000 rubles - 9,000 (living wage for yourself) = 16,000 rubles. We remember that the payment should not exceed 40% of the salary. 40% of 25,000 = 10,000 rubles.

This borrower will be given a mortgage only if the monthly payment does not exceed 10,000 rubles. Usually this amount is not enough, so it is desirable that the minimum salary be no lower than 30,000 rubles.

With a monthly income of 30,000 rubles, you can count on a maximum mortgage amount of 1,500,000 rubles for 20 years.

Let's consider at what salary it is possible to approve a mortgage for 3,000,000 rubles with an initial payment of 1,000,000:

The amount of bank funds will be 2,000,000 rubles. If you take out a mortgage for this amount at 10% per annum for 15 years, the monthly payment will be 21,493 rubles. In this case, regular income is needed at least 53,732.5 rubles.

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Sovcombank

from 5.9% rate per year

Go

- Amount: from 300 thousand to 30 million rubles.

- Rate: 5.9%.

- Duration: from one year to 30 years.

- Age: from 20 to 85 years.

- You can confirm your income with a bank certificate.

More details

Alfa-Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Opening

from 8.7% rate per year

Go

- Amount: from 500 thousand to 30 million rubles.

- Rate: 8.7 - 14.45%.

- Duration: from 5 to 30 years.

- Age: 18 - 65 years.

- Down payment: from 10%.

- They accept income certificates in the bank form.

More details

Gazprombank

from 7.5% rate per year

Go

- Amount: from 500 thousand to 60 million rubles.

- Rate: 7.5%.

- Duration: from one year to 30 years.

- Age: 20 - 65 years.

- Down payment: from 10%.

- Review of the application from 1 working day.

More details

What income do you need to have to get a mortgage?

There is no minimum or maximum indicator at which a client is guaranteed to be approved for a mortgage. This is calculated on an individual basis, but the minimum salary is unlikely to be suitable. How much must a potential borrower earn to be issued a mortgage loan?

It's simple: the higher your earnings, the greater your chances of getting a housing loan. There are 2 factors to note here.

When calculating the mortgage, a percentage of the salary is taken into account, in proportion to which the maximum allowable amount is determined. There are no specific figures - a lot depends on the location in which you plan to purchase real estate. Apartments in Moscow, Sochi and St. Petersburg are expensive, so the income level must be high

Housing in the region or on the outskirts of the city is cheaper, which means a lower salary is suitable for obtaining a mortgage. The final ratio of income and expenses is also taken into account. The norm according to which banks are ready to approve a loan is when the client will spend no more than 40-50% of his income to repay it

If a person has other debt obligations (for example, a previously issued car loan), then the amount to repay them is added to the expenses.

Examples:

- If, with a salary of 40,000, 15,000 rubles, you spend on a car loan, you can’t even dream about a mortgage.

- When a citizen earns 30,000 rubles, but has no other debts, the loan is more likely to be approved - provided that the monthly payment does not exceed 15,000 rubles.

- And if a client receives a monthly income of 20,000 rubles, and at the same time he has a child who needs to be supported, then the bank will refuse a mortgage.

When a family takes out a mortgage, the total income is taken into account, and debt obligations (like all property) are divided equally. Then, after deducting the repayment amount and other debt payments, the remaining funds should be enough to live on - that is, there should be a subsistence level for each family member. But there are a number of nuances here:

- if you have children, expenses for them are deducted;

- if there is a benefit, it is added to income;

- if the spouse is dependent on the husband, this will lead to a reduction in the amount of the mortgage issued.

In any case, the solvency of clients will be assessed by the bank individually.

How to calculate the required income to get a mortgage

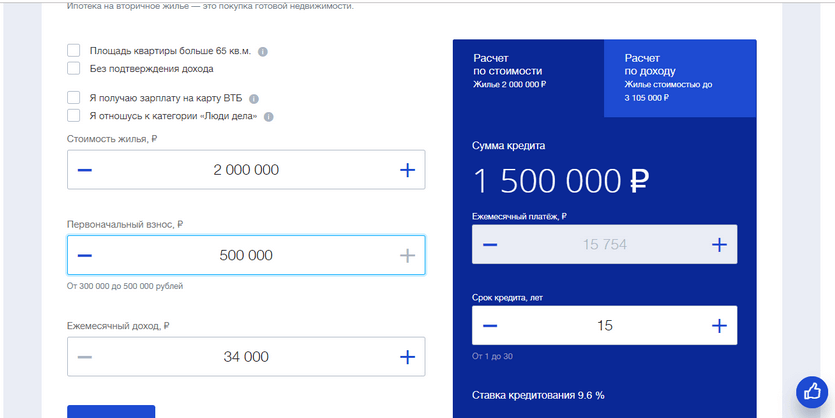

Each bank sets its own requirements for the borrower, including income. You can use a mortgage calculator on almost every official bank website. When you enter the desired parameters, the system will automatically calculate the minimum monthly income.

This calculation is approximate, so it is advisable that your income is above the minimum. On the Sberbank website you can find out the amount of the minimum income using the mortgage calculator:

On the left you need to enter the desired loan data, and at the top right you will see a mortgage calculator based on your income.

What should your salary be to get a mortgage?

Let's move on to the main question: what should be the minimum salary for a mortgage? It is clear that there are no legally established restrictions. Each bank has the right to decide for itself who to lend and who not. In any case, the borrower's income must be adequate in comparison with the size of the loan.

Most home equity loans have a down payment that can be substantially more than the monthly payment. An important issue that a bank must decide in relation to a client is determining his creditworthiness.

Let's consider a real example showing what the salary should be to take out a mortgage of 1,000,000 rubles. Let's say a young family needs a mortgage, which amounts to 1,000,000 rubles. On average, the interest rate on a real estate loan in Russia is about 12% per annum. Let this family take out a mortgage for a period of 5 years. Using a mortgage calculator, you can calculate that payments in this case will be about 17,000 rubles per month. Let's find out what income is needed for such a mortgage. To do this, we divide the monthly payment by 0.4: 17,000 / 0.4 = 42,500. Therefore, the family must receive at least 42,500 rubles per month for the bank to issue a loan to it.

Thus, to the question at what income they give a mortgage of 1 million rubles. for 5 years?, you can answer this way: from about 40,000 rubles per month.

How to submit an online application to the bank

If you are convinced that your monthly income is sufficient, you can apply online. This can be done on the official website of the bank. Let's look at the example of VTB.

To submit an online application you must:

- Go to its website and select the “Mortgage” section.

- Select the required program: new building, secondary housing, military mortgage, etc.

- Enter your loan information and view the calculation.

- Click “Submit an application”.

- The system will prompt you to fill in personal data, information about employment and purchased housing.

- After filling out, you need to click “Submit Application”.

During business hours, a bank employee will call you back, check the information received and clarify any missing information. The application is checked within 1-2 days, and the decision comes in the form of an SMS to the specified phone number.

Get a profitable mortgage:

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Sovcombank

from 5.9% rate per year

Go

- Amount: from 300 thousand to 30 million rubles.

- Rate: 5.9%.

- Duration: from one year to 30 years.

- Age: from 20 to 85 years.

- You can confirm your income with a bank certificate.

More details

Alfa-Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Opening

from 8.7% rate per year

Go

- Amount: from 500 thousand to 30 million rubles.

- Rate: 8.7 - 14.45%.

- Duration: from 5 to 30 years.

- Age: 18 - 65 years.

- Down payment: from 10%.

- They accept income certificates in the bank form.

More details

Gazprombank

from 7.5% rate per year

Go

- Amount: from 500 thousand to 60 million rubles.

- Rate: 7.5%.

- Duration: from one year to 30 years.

- Age: 20 - 65 years.

- Down payment: from 10%.

- Review of the application from 1 working day.

More details

What income is needed for a mortgage?

If the salary is low

Other income or other possibilities for securing a loan

Some time ago, a documented official salary of the borrower was a mandatory requirement for obtaining a mortgage in almost all banks.

Now the situation has changed to a large extent. In particular, Sberbank provides the opportunity to obtain a mortgage loan without proof of income and employment. VTB also declares this possibility: it has a program for accelerated receipt of a loan using two documents - “Simple Mortgage” without proof of income (according to two documents: a Russian passport and SNILS - a pension insurance certificate). Of course, this does not mean that banks will unreasonably risk their money. It’s just that in these cases they will ask you to provide a different package of documents and put forward other requirements for the borrower to secure the loan. Thus, a replacement for a certificate in form 2-NDFL from the last place of work and a certificate of income in the form of a bank can be:

— Registration of another property as collateral to secure a loan

— Providing guarantees for co-borrowers or guarantors

— Documents confirming other income, for example, from the rental of residential premises or other real estate, business activities, receipt of dividends from existing shares or other securities...

The client’s credit history, which the mortgage bank will study without fail, is also a factor that will contribute or, conversely, hinder a positive decision.

What other options

If the borrower’s official income is lower than that established by the bank for its mortgage offers, there are still opportunities to negotiate a change in the terms of the loan:

— You can propose to the bank to increase the down payment and, thereby, reduce the amount of monthly payments.

It is the increased down payment of 40% and above that must be made by VTB “Simple Mortgage” applicants without proof of income.

To pay the down payment, mortgage seekers often take out a consumer loan from another bank.

— You can contact the bank with a request to increase the mortgage term - since in this case the monthly payments will be lower, and the salary requirements may also be eased.

— Often in such cases, the option of purchasing a cheaper apartment is considered.

— The possibility of participating in any state-subsidized preferential mortgage program should be explored (young families, military pensioners, “mortgage with state support”...)

— You also need to monitor the promotions of banks and development companies, their special offers. For example, Sberbank may provide better conditions to clients participating in its salary project.

What to do for those who have a small official salary

If you receive a dull salary, and your official income is clearly not enough to get a mortgage, then you can apply for a mortgage without salary certificates. Banks call this program “two-document mortgage.” It implies that to approve the application you will need a passport and another document confirming your identity (driver’s license).

If your salary is low, this is the most likely way to get a loan. However, for the bank, such a program is associated with great risk, so it may have other conditions: a higher interest rate, an increased down payment or a shorter mortgage term.

Is it possible to get a mortgage with unofficial income?

If you have no official income at all, it will be difficult to get approval for a mortgage. In such a situation, you can ask the employer to issue a certificate in the bank’s form. True, only a small number of organizations will agree to this.

A bank may be more lenient towards a client whose income is deposited into an account at the same institution. Sometimes the bank may accept the statement as proof of regular income.

Try to bring as many documents as possible confirming your income. They may be:

- interest on deposits;

- money from rental property;

- help from relatives if proceeds go to the bank;

- profit from farming.

To increase the likelihood of mortgage approval, you can ask relatives to act as guarantors or borrowers.

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Sovcombank

from 5.9% rate per year

Go

- Amount: from 300 thousand to 30 million rubles.

- Rate: 5.9%.

- Duration: from one year to 30 years.

- Age: from 20 to 85 years.

- You can confirm your income with a bank certificate.

More details

Alfa-Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Opening

from 8.7% rate per year

Go

- Amount: from 500 thousand to 30 million rubles.

- Rate: 8.7 - 14.45%.

- Duration: from 5 to 30 years.

- Age: 18 - 65 years.

- Down payment: from 10%.

- They accept income certificates in the bank form.

More details

Gazprombank

from 7.5% rate per year

Go

- Amount: from 500 thousand to 60 million rubles.

- Rate: 7.5%.

- Duration: from one year to 30 years.

- Age: 20 - 65 years.

- Down payment: from 10%.

- Review of the application from 1 working day.

More details

Where can I get a mortgage with a minimum experience?

What should people do if their total experience is less than a year, but they want to purchase an apartment with a mortgage? There are many options for them to solve this problem. For example, they can become participants in a salary project (this is a service provided by banks for companies, in which the bank transfers salaries to employees onto debit cards issued by it).

Another option may be the bank’s loyal attitude towards the borrower. Let’s say a person has worked for 10 or 11 months, but the bank’s conditions are at least a year of work, in this case the bank agrees to a meeting when issuing a mortgage and can make a positive decision regarding the borrower.

A borrower, even at the beginning of his career, has a good chance of getting a mortgage. In this case, he will need to issue it using two documents, that is, provide a civil passport and some other personal document (IIN, SNILS, international passport or driver’s license).

This is done for the purpose of concluding a comprehensive insurance contract. This type of insurance is issued to help the borrower fulfill his obligations in the event of unforeseen circumstances (for example, a person loses his job).

If a person has always worked under a civil contract, then in order to obtain a mortgage he will need to provide a copy of it, and if the client’s income level is acceptable to the bank, then he can count on a positive decision. Such an agreement is considered as an auxiliary source of income. These applications are handled by the banking organization Globex. This bank has many profitable programs for mortgage lending.

Entrepreneurs and freelancers have a real opportunity to take out a mortgage secured by existing property. To do this, they submit a document for real estate. The loan issued by the banking organization will be used to purchase a new home. If people do not have real estate, then they can take out a mortgage with a significant down payment to prove to the bank their solvency.

After you have received the answer to the question of how long you need to work to get a mortgage, you should not forget about other points that influence the bank’s decision. In addition to their work experience, bank employees take into account the borrower’s marital status, level of education, citizenship and registration, and features of the credit history.

Mortgage loan from Otkritie Bank with a rate of 9.3% →

A mortgage is one of the fastest and most realistic ways to get personal square meters in Russia. The amount of income in this case plays an important role. The salary should be enough to cover the monthly payment and provide the person with all the essentials.