In what cases should shares be allocated to children?

If maternity capital is used to improve conditions, then parts of the acquired property are always allocated to each child and spouse. The funds can be used, for example, to purchase an apartment or build a house.

A real estate property that is acquired in whole or in part with the help of the state cannot be registered as the property of one person. The allocation of parts is mandatory - they must be received by:

- spouse;

- all natural children (including adults);

- all adopted children.

If other relatives live together, allocating a share to them is prohibited. Allocation to a spouse is not made if he:

- died;

- declared dead by court decision;

- deprived of parental rights by court decision.

Note! If capital funds are used to compensate for the costs of building/renovating your own home, it must be introduced after December 31, 2006. If the building was commissioned earlier, compensation from the state is not expected.

How to allocate shares to children based on maternity capital

to fulfill the legal requirement and allocate shares to children without having the agreement certified by a notary if the capital funds are used as the missing amount for the purchase of housing. The right to conclude such a transaction arises for parents when the child turns 3 years old (after whose birth the right to receive a maternal certificate arose).

there is no need to draw up an obligation and subsequently contact a notary to allocate shares , since it is possible to register ownership rights for all family members at once . To do this, the parties draw up a purchase and sale agreement , under the terms of which parents and children will act as home buyers (the law does not prohibit minors from purchasing real estate). In this agreement, it is necessary to indicate the size of the shares in the property of each family member, for example, each person has 1/4 of an apartment.

When completing this transaction, the purchase and sale agreement specifies a condition according to which part of the amount will be paid to the seller from maternal capital funds . After signing the contract, the parties register ownership, but the property will be pledged to the seller until the contract is paid in full.

After registration of ownership rights, buyers must apply for the release of capital funds to the Pension Fund. If everything is properly completed, the Pension Fund transfers the funds to the seller’s account, after which the parties to the transaction must remove the encumbrance from the housing in Rosreestr.

Distribution of shares when using maternity capital

Clause 1 Art. 42 Federal Law No. 218 of July 13, 2015 “On State Registration of Real Estate” states that a transaction for the allocation of shares must be certified by a notary. Regarding this rule of law, there is no explanation as to whether the transaction is subject to certification if the owner is a sole or the property is jointly owned by the parents.

Practice regarding this issue is ambiguous . When alienating property under joint ownership, the law obliges such a transaction to be completed with the notarial consent of the spouse , but does not indicate whether the agreement itself is subject to certification . In this case, the consent of the spouse is required only so that the second owner cannot subsequently challenge such an agreement. Based on this, we can conclude that there is no need to notarize the transaction of alienation of shares from the right of joint ownership.

The Rosreestr office for the Republic of Tatarstan also adheres to this rule. In its clarification dated August 12, 2016, the Department reports that the transaction for the allocation of shares, in accordance with Art. 7 Federal Law No. 172, is not subject to notarization if the property is alienated from individual or joint ownership.

From July 1, 2020, by order of the Ministry of Economic Development No. 187 dated April 10, 2018, it is allowed to make an entry in Rosreestr about the joint property of spouses . Accordingly, upon fulfillment of the obligation, the parents allocate property to the children as shared ownership, and the remaining part remains in their joint ownership and is considered equal by force of law.

However, in practice, Rosreestr does not always take these facts into account and does not register a transaction for the allocation of shares from joint ownership without notarization. Moreover, in the case of alienation of property from individual ownership, practice shows that the transfer of ownership rights is registered without notarization.

Notarial obligation

It is not always possible to legally register parts of the premises immediately upon purchase. Then the PF will require a notarial obligation from the mother, which reflects the fact of allocating shares to the children.

A sample text of the commitment can be found here.

When is it required and where to go

This document will be needed for 2 cases:

- The housing is not registered as private property (on the day the capital is received).

- The property is registered to 1 owner, i.e. is not the common possession of all relatives.

In practice, this is associated with the following situations:

- The object was previously purchased with mortgage funds, and formally its owner is one or both parents. However, at that time they did not have children or only 1 son/daughter, so they did not receive maternity capital at the time of purchase.

- The property was purchased with mortgage funds, but it is still under encumbrance. Children will be able to become owners only after full payment to the bank.

- The apartment is located in a building under construction, which has not yet been put into operation.

- Parents or 1 parent are members of a housing cooperative.

- The family lives in a house built before the capital was received. The owner of the property is 1 parent or both spouses, but children do not formally have ownership rights.

The allocation of shares is impossible for legal reasons. Therefore, the Pension Fund undertakes that the owner will divide the property into parts at the first opportunity.

What is stated in the obligation

The following data is indicated:

- Date, place of signing.

- Full name, passport details, registration address of 1 or both parents.

- Description of the use of capital: for example, to repay principal and interest on a mortgage.

- Description of the object (address, document details).

- Allocation obligation.

- Date, signature, surname, initials.

- A note on certification of paper by a notary: date, signature, surname, initials, seal.

6 month execution period

It is important for parents to pay attention to how exactly to allocate shares to their children, as well as when to do this. The deadline is 6 months. from the moment when the legal possibility of separation arises. For example, 6 months. from the date of termination of the mortgage encumbrance or putting the house into use (in the case of a new building).

List of documents

The obligation to allocate a share is made by the owner of the apartment or house, who may be:

- the owner of the certificate;

- his husband/wife;

- both spouses, if they received a mortgage (co-borrowers) or both participate in a housing cooperative, are shareholders under the DDU.

The paper is drawn up in the personal presence of the person giving the obligation and signed personally by him. If the obligation must be given by both spouses, they sign it together.

Before contacting a notary to draw up a notarized obligation to allocate shares, applicants collect the following papers:

- passports of all parties;

- marriage document;

- certificate;

- birth certificates of sons, daughters (also adults);

- documents for the apartment.

In some situations, other papers will be needed:

- about adoption (if there is an adopted child);

- mortgage agreement.

Important! It is unacceptable to compose the paper yourself. If it is not signed by a notary, the PF representative will not accept it, since such a document has no legal force.

Price

The allocation of shares to children is documented only with the help of a notary. The tariff for the service depends on the specific region and on average is about 1000-1500 rubles. A fee is charged for drawing up the obligation and consumption of materials. The paper is drawn up on the day of application and issued to the applicant.

How are shares allocated to children when buying a home using maternity capital?

The transfer of shares in an apartment or house occurs by concluding an agreement on the alienation of shares of real estate, which are subject to notarization. There is also the practice of transferring shares under a gift agreement. It is used much less frequently compared to the application of the agreement. Parents themselves choose which design method to use.

To allocate shares, the following conditions must be met:

- the housing is not encumbered (not under a mortgage);

- the apartment, house has been put into operation and ownership is registered in the name of one or two spouses.

The option when the owners are two spouses, and each of them has an allocated share, can be formalized both through an agreement and through a gift deed for allocating shares to children. This practice exists when a family first takes out a mortgage on an apartment, then gives birth to a child and pays contributions using maternity capital. As for residential premises purchased only using maternity capital, the shares of all family members are the same, both parents and children.

It is impossible to divide residential property acquired only with maternity capital exclusively between spouses; shares must be allocated to children.

According to Art. 245 of the Civil Code of the Russian Federation, the owners (the parent for whom the cash certificate is issued) independently decide how many square meters will belong to each of the children. When allocating shares, it should be remembered that on average in Russia the minimum housing standard per person should be 9–12 sq. m. meters.

Property purchased with maternity capital is divided among all family members with the exception of children who are not related by blood to the parent for whom the cash certificate is issued (stepdaughter, stepson).

Deadline for fulfilling the obligation

Be sure to indicate the deadline during which the allocation of shares must occur, i.e. Documentation of part of the property for relatives. This should happen within a maximum of 6 months. from the moment this opportunity became available.

When buying an apartment with a mortgage

The beginning of the term is counted differently. If it was purchased with a mortgage, registration must take place within 6 months. from the date of termination of the encumbrance. In practice, the procedure looks like this:

- The owner makes the final payment on the loan, repays the principal, interest and fines, commissions (if any).

- Receives a certificate from the bank confirming full repayment of the mortgage (closing the account where the loan was).

- Provides this certificate, papers for the apartment and his passport to the Rosreestr branch (through the MFC) in order to remove the encumbrance.

- Within 5-10 working days, the MFC receives a new extract from the Unified State Register of Real Estate, which indicates that the property does not have an encumbrance. There is no fee for this action.

- Within 6 months from this date, the owner must legally formalize the allocation of shares to the children.

- The last action is a second application to Rosreestr through the MFC in order to document the division of the premises into shares. Usually these are ideal parts, without physical separation, for example: 1/5 or 1/20.

When purchasing an apartment under construction under DDU or through a housing cooperative

If the spouses are members of a housing cooperative or have entered into a DDU agreement with the developer, they receive ownership of the apartment only after the building is put into use. The moment of transfer of the premises is the date of signing the acceptance certificate after a visual inspection of the property. The allocation of the children's share must occur within six months from this moment (for children and spouse). The further procedure is exactly the same.

During reconstruction/construction of a house

The period is counted from the day when permission to use the building was received. It is formalized by local authorities.

Methods of fulfilling an obligation

Another important issue relates to how to allocate shares to children in practice, i.e. how exactly to fulfill your obligation. This can be done in 2 ways at the choice of the homeowner himself, by making:

- Agreement.

- Donation agreement.

Each of these methods has its pros and cons. Both documents must be drawn up by a notary, so the applicant bears additional costs, and the text is drawn up by a legally competent person, making the likelihood of documents being accepted by Rosreestr very high.

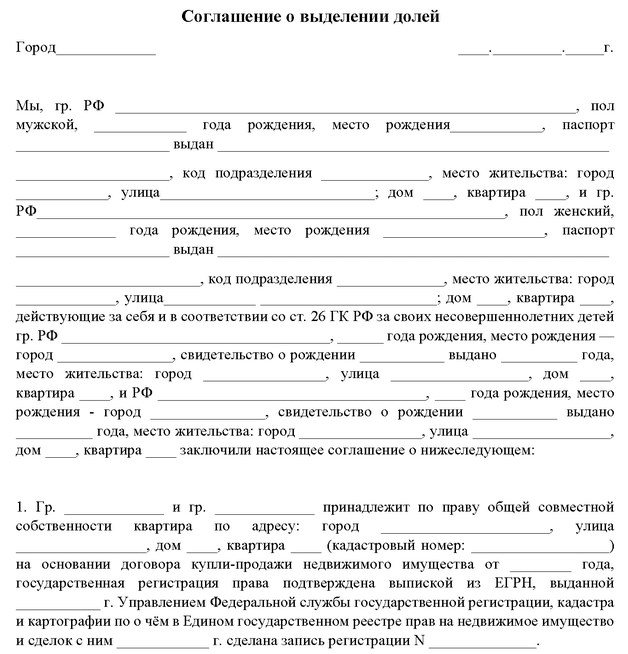

Agreement on allocation of shares

Any operations with parts of a real estate, including the allocation of shares to children, can only be performed with the participation of a notary.

A sample agreement can be downloaded from this link.

Who compiles and is it possible to do it ourselves?

To document the provision of shares to relatives, they contact a notary, who draws up a document and checks the legal capacity of all people signing it. There is no need to draw up an agreement on shares yourself - a paper without a notary’s signature and seal is not valid, so representatives of Rosreestr will not reasonably accept it. The notary's fee is 0.5% of the cost of housing, minimum 300, maximum 20 thousand rubles.

How to determine the share

The law does not contain specific requirements for determining shares, so the size can be specified at your discretion. The most common options:

- In equal quantities for all people - for example, ¼ for 4 family members.

- Shares according to sanitary standards - these are different indicators by region: in Moscow 18 m2.

What to include in the agreement

There is no generally accepted sample agreement, however, to document the allocation of shares, the following information must be reflected in the text:

- Date, place of drawing up the paper.

- Full name, passport information of all parties.

- Full name, date of birth, children’s passport information.

- Description of the property and the documents on the basis of which it was purchased - address, area, contract details.

- A statement that the property was acquired with the capital received (name, date of receipt of the certificate and the name of the issuing branch of the Pension Fund).

- Indication of the size of the share that goes to each owner. They are prescribed in simple fractions: 1/5, 1/10, etc.

- Statement about a possible redistribution of shares, i.e. allocation of new parts in case of birth/adoption of new children.

- Signatures of each participant: both spouses and all adult children.

Registration in Rosreestr

The last step to register shares is to contact Rosreestr. This can be done through the center for the provision of public services to citizens - MFC. You can go there through a live queue or make an appointment in advance.

This can be done online on the website or by phone. There is no single number for Russia - it differs depending on the region. For example, Moscow, St. Petersburg +7 (812) 417 34 94. The applicant names a convenient date and time and receives a PIN code (a combination of 4 digits). On the day of treatment, these numbers must be entered into the terminal no earlier than 15 minutes before the start of the appointment. The user then receives a paper ticket and waits for the appointed time.

To apply, you must take the following documents with you:

- agreement;

- passports of all parties specified in the agreement (they appear in person);

- birth certificates of sons, daughters;

- documents for the apartment;

- marriage document;

- certificate;

- a receipt confirming that the fee has been paid.

Its size is part of the amount of 2000 rubles. The proportion is determined by the size of the share. For example, if a family registers 4 shares of ¼ for each person, then each of them must pay 500 rubles. Therefore, the total duty will still be 2,000 rubles.

The processing time takes from 5 to 10 working days; you can find out about the readiness of documents by calling a representative of the MFC. Based on the result, applicants receive an original extract from the Unified State Register of Real Estate, which indicates the full name and size of shares of each new owner.

Note! Today, ownership certificates are no longer issued. An extract from the USRN completely replaces this document and has the same legal force.

Allocation of shares to children without a notary

Any civil contract can provide ownership of real estate. The owner only needs to indicate in it that he is ready to separate part of the property to the other party. The main document here is the agreement on the determination of shares.

The law states that the division of property between spouses must be carried out in the presence of a notary. But if the property is individually owned or jointly acquired, and the shares will be distributed exclusively to children, then certification of the action by a notary is not required.

If a trip to a notary is necessary, you can draw up a free-form application yourself. All you have to do is reassure him.

Items that must be indicated in the document:

- All personal information of the participants in the transaction.

- Address, cadastral number and other documents for real estate.

- Full value of the property.

- Shares and their sizes.

- Rights and obligations of the parties.

- Information about the notary.

Sample

Donation agreement

This method of allocating a share in an apartment also involves drawing up a document that is signed by a notary.

A sample gift agreement can be viewed here.

Who compiles and is it possible to do it ourselves?

The document is drawn up by a notary, without whose signature and seal the contract will not be valid. Therefore, citizens can immediately contact a notary’s office, pay the fee and receive the original document. The notary's fee is exactly the same: 0.5% of the cost of housing, minimum 300, maximum 20 thousand rubles.

How to determine the share

The size of the share is determined in a similar way - parents can register them at their own discretion. Theoretically, it is possible that the size will be negligible, for example, 1/20 per person. However, children can object to this value and go to court. The judge distributes the shares equally to each person.

The parts are allocated mathematically, since the premises have a small area, and the allocation of a physical share is impossible. However, if the apartment or house is quite large, each owner can demand a real allocation - he receives an isolated room and the right to use common areas (kitchen, toilet, etc.).

What to include in the contract

The form of the document is arbitrary, but it is necessary to reflect 2 essential conditions:

- Subject, i.e. description of the apartment in which the share is transferred as a gift.

- Statement that the allocation of the share is free of charge.

The agreement on the allocation of shares must include the following data:

- Place and date of signing.

- The name and information from the passport of each participant (they are called the donor and recipients).

- The subject of the agreement is the transfer of a share free of charge.

- Description of the property, reference to the agreement on the basis of which it was acquired.

- Full name of all persons registered at this address.

- Reference to the norms of civil legislation on the procedure for registering a gift agreement.

- Distribution of registration costs between the parties.

- Signatures of all parties, transcripts of signatures (surnames, initials).

Registration in Rosreestr

In this case, the applicant also applies to Rosreestr through the MFC. Take the same documents with you. The amount of the fee, the waiting period and the results of the application are exactly the same.

Agreement on allocation of shares to children lawyer

It is not possible to sign an agreement on the allocation of shares in kind. When going to court, who will be the defendant? After considering the application and making a positive decision, the parent is issued a Certificate, and the MK funds are transferred by the Pension Fund to the current account without the right of unauthorized cash withdrawal by the parents.

In fact, it is from the moment they receive this document that parents have obligations to manage funds, but legally, they must be enshrined in the appropriate agreement.

If the home was purchased on credit, after making the last installment on the mortgage loan, you need to obtain a mortgage document from the bank. You need to contact the Rosreestr authority with this document to remove the encumbrance from residential real estate.

In addition, preparing a written agreement in a notary’s office is the key to a legally competent approach to document preparation and a way to avoid annoying mistakes.

When notarizing a document, the direct presence and personal signature of all owners of the residential premises is required. Sample agreement on the distribution of shares to children based on maternity capital Below you can see a sample agreement on the distribution of shares in residential premises acquired at the expense of MK.

How much does it cost to allocate shares to children based on maternity capital? The costs that will have to be incurred in connection with the distribution of shares between parents and children include a fee to a notary for certifying a written agreement on the allocation of shares and payment of the state fee for registering the right of shared ownership of real estate.

So the owners become: the mother who received the certificate, the father, the children - indicating the size of the shares of each family member. Compliance with this rule of law guarantees not only the child’s rights to a share in the ownership of an apartment or house, but also the rights of each parent to a share of the living space, even if they divorced.

Agreement on the allocation of shares in maternity capital, sample Documents are registered as common joint property of the husband and wife read answers 1 Topic: Individual residential building Form of agreement on the allocation of 5 shares in three individual residential buildings, standard sample.

We don't want to go to court. Is this possible and where should I go to start the process? Important And the contract for the sale and purchase of these shares to children, read answers 2 Topic: How to sell an apartment with a share of a minor child We have two rooms in a three-room apartment in our property, the rooms were privatized and there were three people in the privatization, a mother, father and a minor child.

The husband agrees to renounce his share in my favor, for this it is necessary to agreeread answers 2 Topic: Agreement on the allocation of shares in a house We, while married to my husband, purchased a house at the expense of mat.

In the certificate of owner I am the wife, the husband is not listed read answers 1 Topic: Dilapidated housing I live in a communal apartment. Three rooms are privatized and one is not. Until recently, a written agreement on the allocation of shares of children did not require mandatory notarization.

The legal peculiarity of this document is that the father and mother act simultaneously in several roles: If the son or daughter is not yet 14 years old, the document indicates that the legal representative, the parent, is acting on behalf of the minor child.

If the age is years, the document must indicate that the son or daughter is acting with the consent of the parents. The written agreement must be drawn up in accordance with standard business practices.

The final stage is the submission of a completed document of a written agreement on the allocation of shares to the Rosreestr body:. Documents can be submitted through the MFC, or you can directly visit the regional body of Rosreestr. MK, since this is one of the most common cases.

How to prepare documents and allocate shares to children after purchasing housing using maternity capital? Terms of use of MK for the purchase of housing The direction of MK for the purchase of housing can be done by....

Sometimes purchased housing is immediately registered in the name of all family members, including children, with the shares indicated. Your email will not be published.

Skip to content Copyright Consumer rights. Agreement on the allocation of shares to children lawyer An agreement on the allocation of shares in kind cannot be signed. Contents: Agreement on allocating shares to children sample Agreement on allocating shares in an apartment Agreement on determining shares in maternity capital How to draw up an agreement on allocating shares to children in an apartment?

Agreement on the allocation of shares in maternity capital, sample How to allocate a share to children in an apartment, agreement template, algorithm of actions. Agreement on the allocation of shares Agreement on the allocation of a share to children lawyer Agreement on the allocation of a share to children lawyer.

This is done by concluding an agreement on giving children shares in an apartment or house in accordance with an article of the Civil Code of the Russian Federation and entering the corresponding registration data in Rosreestr.

The obligation involves the allocation of a share to the following family members: children and the second parent, if only one parent is the owner of the mortgaged property; only for children if the co-owners of the home are two spouses-parents. And the agreement for the sale and purchase of these shares to children, read answers 2 Topic: How to sell an apartment with a share of a minor child We have two rooms in a three-room apartment in our property, the rooms were privatized and there were three people in the privatization, a mother, father and a minor child.

Related posts. In turn, to find out his obligations under the old version of the law, the individual entrepreneur must read the provisions of paragraphs 3 and 4 of Art. A unified form has been developed, which should be used when filling out an official assignment.

It is usually filled out immediately. How long can you delay? According to the law, management should not delay payment of due amounts to employees even for 1 day. But due to the fact that responsibility is Important Quote Help restore justice Disability is established not on the basis of the concept of justice or injustice that everyone can Add a comment Cancel reply Your e-mail will not be published.

Free consultation, call now: 8

Responsibility for failure to fulfill an obligation

In practice, it is important to know exactly how to allocate shares to your children. As for liability, today the law does not provide for the application of any sanctions for failure to provide shares to children, i.e. parents will not be fined. The prosecutor's office conducts only separate, random checks. If, as a result, she discovers a violation, she will oblige the owner to eliminate them within a specified period.

If there is a disagreement between parents and children, the latter can go to court to demand their share of the premises. It is known from practice that the court determines the size of the parts:

- in proportion to the contribution of each family member to the purchase of housing;

- in equal shares if it is impossible to determine this contribution.

If the spouses illegally cashed out the capital and then used it for illegal purposes, they may be subject to criminal liability. The court will demand the return of funds, and will also fine violators (up to 120 thousand rubles) or sentence them to imprisonment for up to 24 months.

Mechanism for allocating shares to children when purchasing housing using maternity capital

If a family has exercised its right and purchased housing using maternity capital, then all family members must be allocated a share of the area of the purchased property.

Acquired housing using maternity capital is divided into shares for all family members

To do this you need to do the following:

- Draw up a notarial undertaking stating that parents distribute the shares of their children.

- After documenting the shares, sign documents confirming their transfer into ownership for each family member.

- Certify the rights to individual parts (shares) of real estate by contacting the organization involved in real estate registration.

In short, the distribution mechanism looks like this. Now let’s dive deeper and tell you what parents need to do in accordance with the “letter of the law” in order to correctly divide and register the housing purchased with maternity capital.

Is it possible to do without a notary?

The allocation of shares to children is carried out only with the participation of a notary. Even if the document is drawn up by a professional lawyer, it must be notarized. Therefore, the family will incur inevitable expenses - in the amount of about 5,000-10,000 rubles, depending on the region and the tariffs of a particular notary.

However, in practice there are often ambiguous situations that require additional professional help; Here are some common examples:

- Rosreestr employees do not accept the document and refuse to register the transaction, citing the fact that it was executed incorrectly.

- The developer does not put the house into operation and violates the deadlines specified in the contract, which is why the purchase and allocation of shares are postponed.

- The bank does not issue a certificate of full repayment of the mortgage, citing unpaid interest, commissions, overdue debt, non-payment of insurance, etc.

- Representatives of the PF do not agree with the size of the shares that the owner will determine in the future for each person, citing the fact that they are significantly less than the sanitary norm.

- The spouses are formally married, but do not actually live together; the second parent does not support children, so allocating a share for him is inappropriate.

If you do not have sufficient experience, it is advisable to contact a lawyer so as not to waste extra time. You can get a free consultation right now by asking your question in the chat window located in the lower right corner.

If the presented material was useful to you, you can share the article with your loved ones, friends and colleagues who also have questions about allocating shares to children. You can also rate the article by liking and reposting.

Read more about how to sell an apartment with minor children.